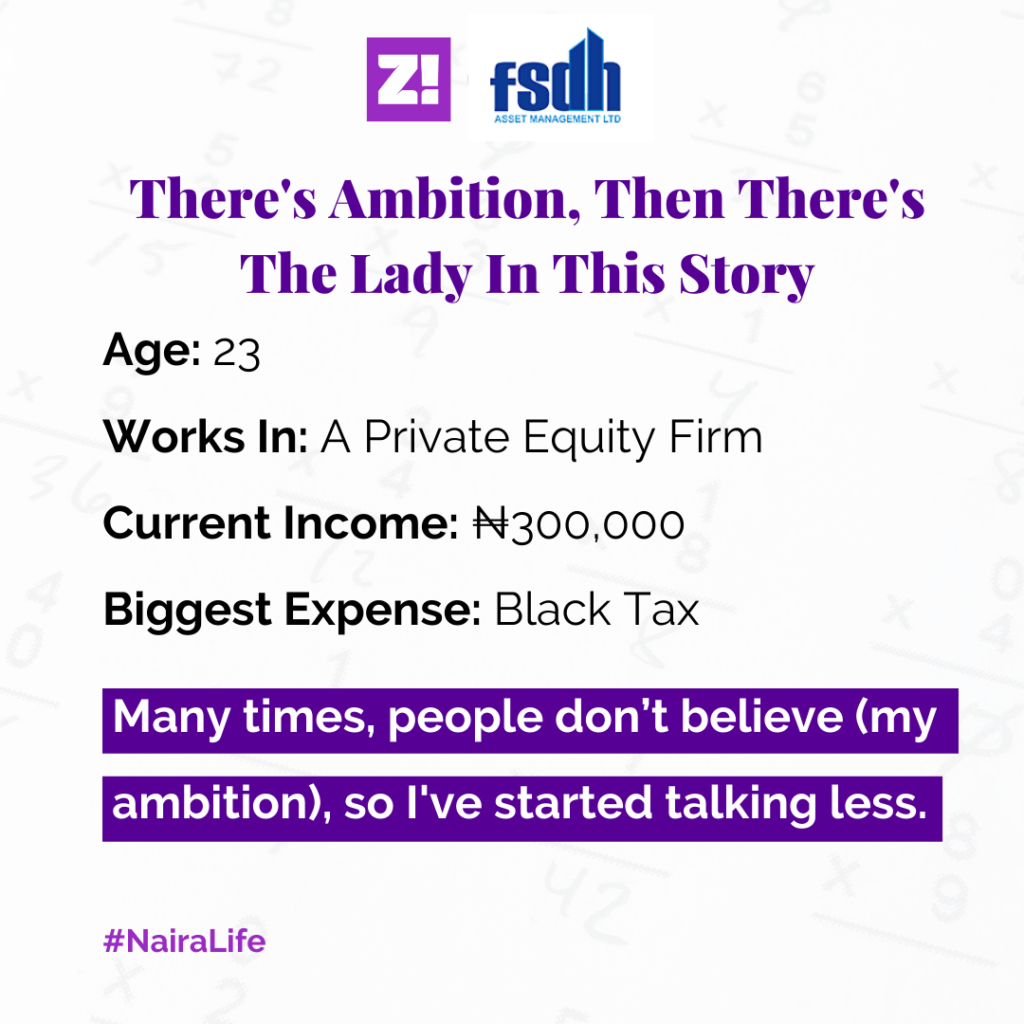

Working in Private Equity is quite the dream for many young people in Nigeria who have the kind of qualifications they’re looking for.

The subject of this story didn’t get in by chance. She’s 23, recently finished NYSC and has been working since the first week she completed her final year project in school.

She studied accounting but decided to pursue an investment banking career. She hasn’t looked back since.

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s go all the way back, like way, way back – you know, to your childhood.

I wanted to be a doctor – finding the cure for HIV was supposed to be my life’s purpose. Then, one day in SS1, my Accountant uncle was like “why don’t you study accounting. You can work anywhere,”

And that’s how I ended up in commercial class.

I pretty much knew that I could survive in any career path but I particularly liked accounting because it had a sprinkle of maths here and there

So, it wasn’t money, but in fact maths.

While it was a spur of the moment decision, it wasn’t a path that was uninteresting for me because there was math involved so I had fun with it.

Speaking of money, I love, love money.

Hahaha. About money, when did you first clock the importance of money, ever?

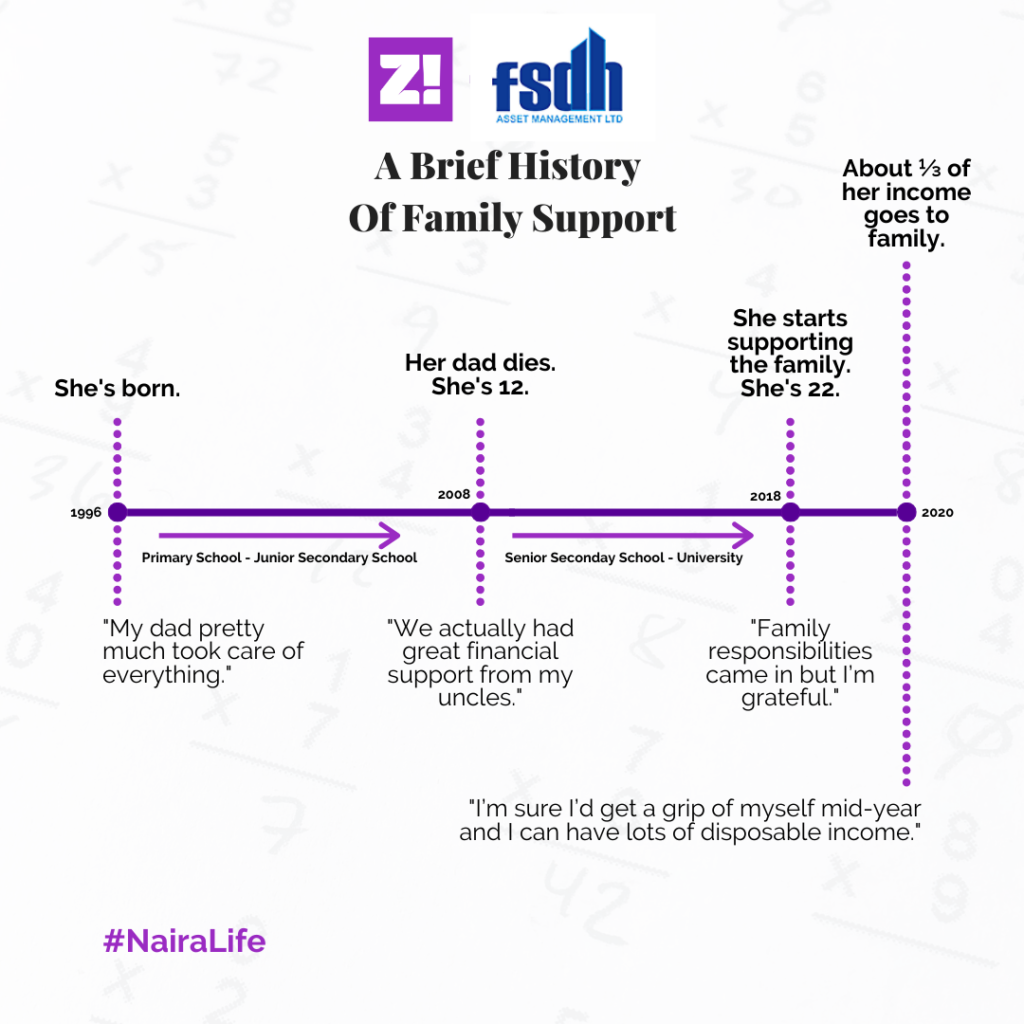

Look, I grew up in a low-income family. Three siblings and my mum – my dad is late.

I’ve always known that money is the koko. My sister and I have always dreamed of ways to get rich from a very young age.

Considering the fact that my dad died when I was 12, the hustle sort of intensified. Immediately we could navigate how to board buses properly we were on our way to building our Dynasty – that’s what we called it hahaha.

We pretty much have the ‘driven’ gene. It’s overwhelming.

And intense. Sorry about your dad.

Thanks. I was 12, about to write my Junior WAEC.

Must have been tough for you mum.

We actually had great financial support from my uncles on both sides of the family. One of them was the main sponsor – the person that pays for tuition and major bills.

That’s amazing. What’s the first thing you ever did for money?

I needed to go to prom in SS3 but we didn’t have enough money. My sister was a budding fashion designer and I was her model, so we made a sample prom dress. I took pictures and we wanted to show people the sample, so they can make their prom dresses with us.

We tried to go to one of the fancy schools – they didn’t make it past the gate, hahaha.

Hahaha. This is hardcore. Do you remember the first money you made though?

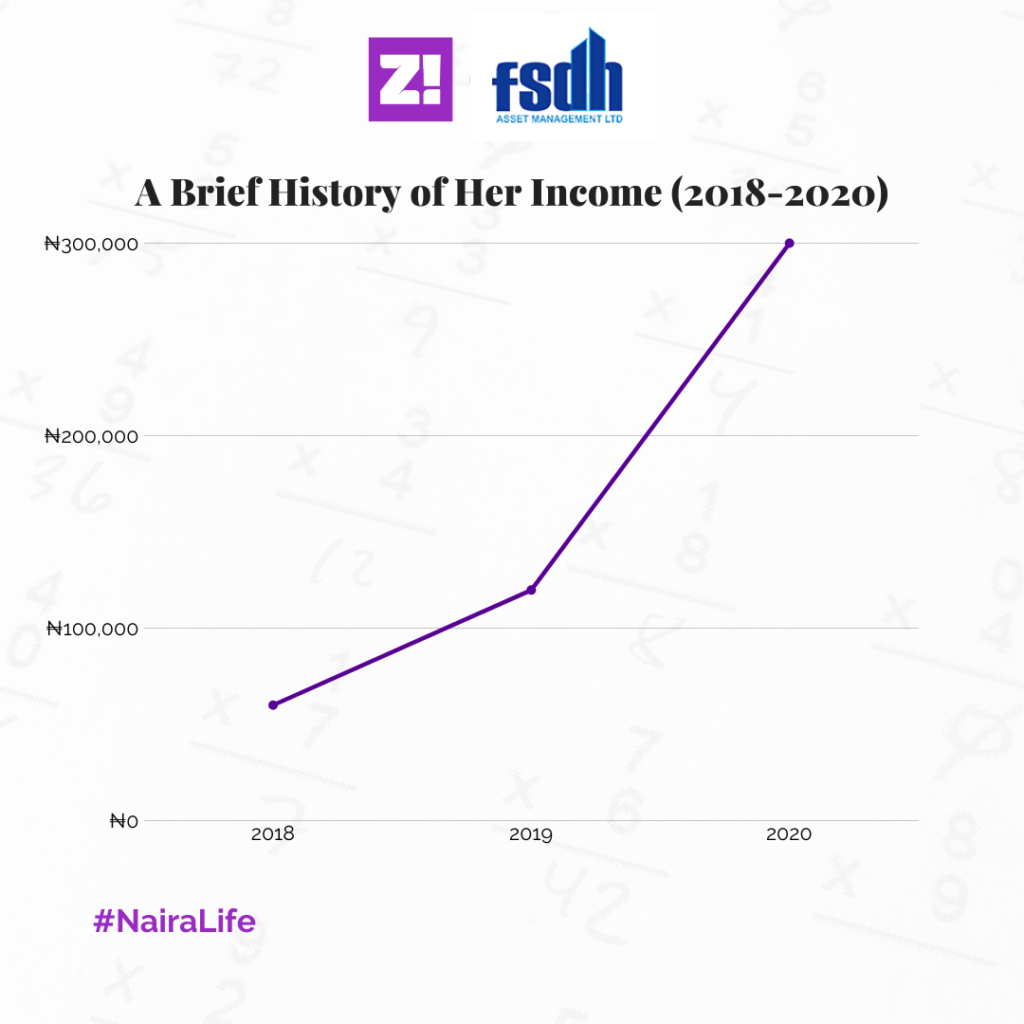

That’d be my first salary as a research intern at my pre-NYSC job. 2018. 60k.

Ah ahn, enjoyment.

Hahaha, not really. Family responsibilities sort of come in but I’m grateful. Anyway, I went on to serve at an investment bank in Lagos, and they paid me 100k a month.

I imagine these guys retained you.

They wanted to but I needed to work with a bigger company.

This energy, which market can I buy it?

Hahaha. I got a job working in Private Equity. I don’t know how long I’d be here but my little time here has exposed me to different businesses. In the near future, it’d be easier to run my business, if the time comes.

Interesting. What are your biggest WOAHs since you started working in Private Equity?

Considering that I’ve been here for a little over two months, the biggest WOAH has really been working for a company that not operating in only Nigeria. It’s strange but interesting understanding of other Anglophone African economies. For example, I never really cared about how the Ghanaian economy worked until I started working here so it’s quite challenging and interesting.

Unlike Nigeria, Ghana actually has an oversupply of power in its economy. Can you beat that?

You had to bring in electricity.

Haha! While the demand for electricity overshadows that of supply in Nigeria, the reverse is the case in Ghana. Now they have long term power contracts that they have to renegotiate so that the government doesn’t continue to pay for unused power.

Meanwhile, you are here, worrying about electricity and Okada bans. How has that affected you, by the way?

HORRIBLE. It makes me rant on my WhatsApp status every morning. One of my friends told me he fell ill and landed in the hospital.

Woah. I hope he’s okay.

Yes. The doctor just prescribed a drug called “Less Lagos Madness”

Hahaha. This is the funniest, not-funny thing ever.

It’s like I go to work with an open mind every day.

Questions like “would I get a bus?”, “how long am I going to wait for one?”, “how many people would I successfully shove trying to get into a bus?” My work colleagues can’t relate, I look like the crazy one

What’s your monthly income like now, and how does it disappear monthly?

300k net. One would think I’d have lots of Investments considering I’m a finance person but it’s not so. I have to write exams – ACCA and co. I also have to settle the school fees of my younger siblings. Currently saving up for rent. I’m sure I’d get a grip of myself mid-year and I can have lots of disposable income. Also hoping for a full-time role, from intern to an analyst.

Wait, are you an intern currently?

Yes. The way these multinationals work, they need to sort of see you work for a period before you transition into full time. It’s basically budgeted in dollars.

How much will you earn when you go full time?

I’m not sure. Wild guess? 800-1 million. It’s a year’s internship, but you can get a bump up earlier being a high performer.

I’m rooting for you.

Thanks.

It’s time to get our hands a little dirty in the nitty-gritty of your monthly expenses.

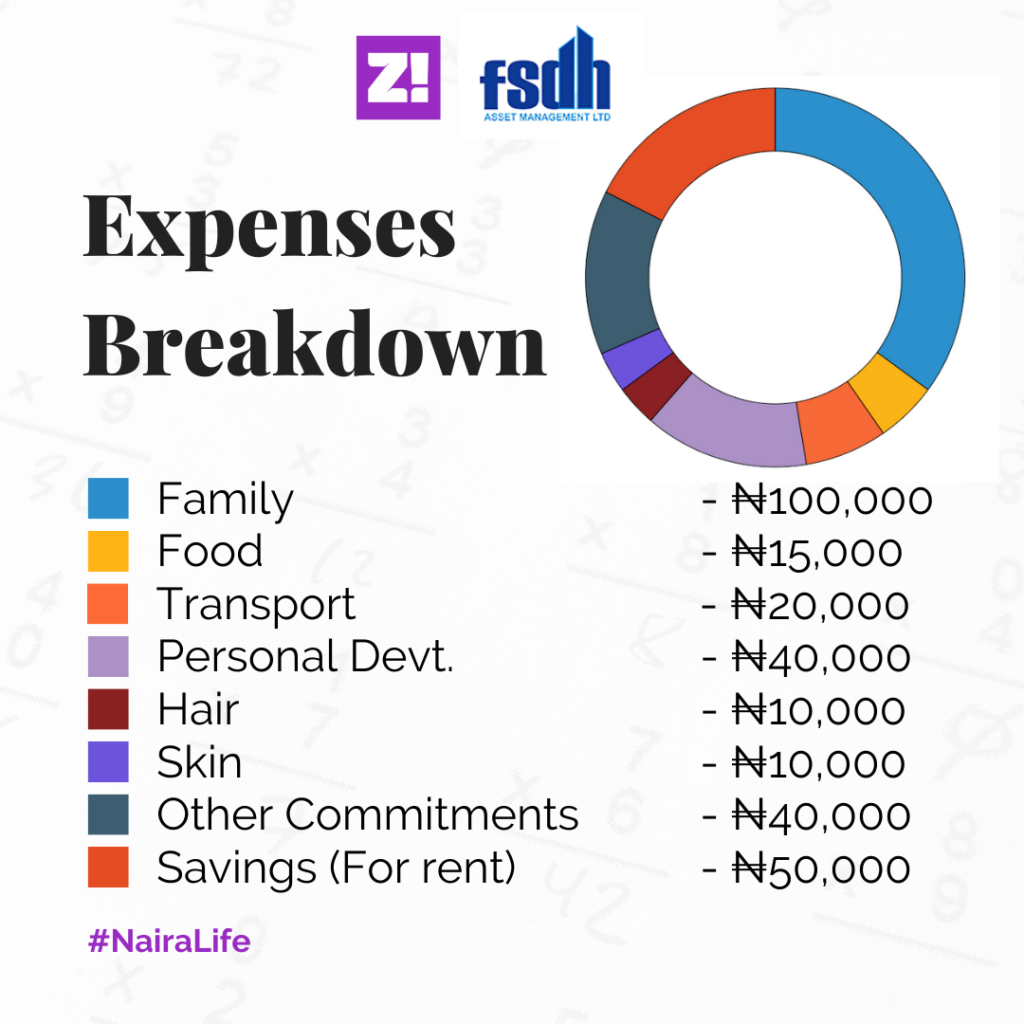

Let me explain the numbers. The family part includes monthly upkeep, part-payment for my sister’s school fees and brother’s school expenses.

Feeding is cheap because I try to cook. That transport part is definitely going up this month with this Okada ban. My skin and body maintenance is really cheap because I generally don’t wear makeup and all.

Being a girl is so expensive by the way, and I’m just doing the barest minimum at the upkeep department. That’s why I’m big on making more money and changing my life.

Tell me more about the upkeep part.

I mean, I don’t go shopping every other month, I don’t buy Vietnamese hair – at least not yet. No manicure or spa treatments. I don’t spend 50k on body oils and an extra 50k on fragrance. It doesn’t mean that I don’t like them but it’s not just time. Soon. I just need to stash good and smart.

The way I grew up has always made me approach things with a unique mindset, and it has worked to a good extent.

I see big things as very achievable. Like, “what’s the worst that could happen?” I have no problem banging on every dream company door if I need a job.

Interesting fact: Before I got this job, I wrote lots of cold emails to different companies’ CEOs. So I’m a big dreamer and intentional about creating generational wealth.

I’m curious, how much do you imagine you’ll be earning in 5 years?

With plan A or B?

Run me through both

This is very optimistic, but I want billions in annual revenue if I become an entrepreneur.

But following my career trajectory, I might be up for up to $250000 per year.

I’m going to leave that entrepreneurship part. $250k per annum? That is wild.

Yes. In my heart of hearts, this is it. The trick to earning well is to ensure you add enough value to account for your high salary. The higher ranked you’re, the easier it is to directly link your performance and remuneration.

Let’s create a scenario of a road to 250k. And what it looks like.

Go for Master’s next year – that should take a year. Start as an investment professional at one of the top Development Finance Institutions – $120k to 150k per year. Work my way through promotion to get to $250k per year.

Do you know what makes it more interesting? Earning that and living in Naij. Your house and utility bills won’t be alarming.

Multinationals also have a way around taxes which makes it less painful. Life is sweet.

What way?

A segue, but there seems to be a history of black tax with you.

It’s suffocating and needs to be handled with a brave heart if not, it’d leave the taxee frustrated and broke.

It is very dicey because I mean, who doesn’t want to help the family? I find myself struggling with it because I’d give an arm and leg for my nuclear family before I remember that I can’t walk.

But for young black professionals to be able to grow sustainable wealth, they must learn not to be guilt-tripped into giving all their money away. This would also prevent them from depending on their children when they grow old – they’d have an attractive retirement fund and viable investments to fall back on.

Word. Black Tax is a short term inconvenience for long term financial freedom. Discuss (20 marks)

I think it all depends on how you handle it. Paying black taxes on things like education of younger ones or buying a property for your old ones (which can serve as rental income) and all that can lead to a long term financial freedom because you’re empowering them.

However, if you use a chunk of your earnings to cover recurrent income (paying the food bills and electricity bills of many families), then there’s no long term freedom.

I always feel broke after I pay for all the important stuff and my account balance starts to dwindle. I literally panic.

Sorry.

What’s the last thing you paid for that required serious planning?

Everything. I plan for everything.

Do you have a safety net of sorts, in case anything goes south?

I know this is irresponsible but I’m trusting on my good genes not to fail me. I haven’t been sick almost all my life. I just need to make it to the middle of the year. No school fees to pay. Would have raised enough for rent.

On a scale of 1-10, how would you rate your financial happiness?

3. I need more money. I need a very nice apartment and to uber my way through life – I don’t want to drive in this traffic. I need money to start investing.

It’s like you didn’t come to this life to suffer at all.

I want it, and I’m going to get it. Many times, people don’t believe me, so I’ve started talking less. Sometimes, I’m scared about how passionate I am of these things.

I never got to ask, was it one of the cold emails that landed you the current job?

Let me tell you. I made a list of 12 companies – I was picky about where I wanted to work – and sent cold emails, LinkedIn requests and all that job stalking stuff.

And that’s how I landed this job.

Funny thing is, I still get interview requests from them but guess who now sends rejection emails to companies?

Energy.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people.

But, if you want to get the next story before everyone else, with extra sauce and ‘deleted scenes’, subscribe below. It only takes a minute.

Every story in this series can be found here.