Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When was the first time you made money?

2005, my first year in the university. A coursemate and I worked on a construction site during a brief ASUU strike. I was supposed to go home, but I couldn’t call home for transport money to travel back home.

I was squatting with this coursemate, and we were “soaking-garri-once-a-day” levels of broke, which was why we looked for the job.

We were paid ₦600 each daily to carry blocks, cement and stones. I only did it for four days before I fell sick.

Why couldn’t you call home, though?

My dad passed away just before I got into uni, and things became hard at home. Before his death, he worked as a car dealer and was the sole breadwinner. We lived in our own house and were really comfortable.

After he died, his family started fighting over his properties. My mum had to leave it all to them when the fight became spiritual, and she started having strange illnesses. Afterwards, she did all sorts of petty trading and sent me and my younger sibling to school from the little she made. Of course, I had to adjust my perspective on money and expectations and learn to survive.

What were some of these perspective changes?

I always thought money just came to honest and good people. It’s what I’d seen and learned from my dad. He was the definition of good and honest. My dad had regular clients because people knew him to be honest and trusted him with referrals.

But was the family that took all his properties after death honest? They didn’t work for what they took, but they still had money.

With everything that happened after my dad’s death, I knew I had to hustle, but I also learned that honesty and hard work weren’t a guarantee for success. So, I did several things for money, even some I’m not proud of.

Can you share?

In 2006, I had a six-month stint at a pure water factory. I was in charge of packing and loading bags of water for ₦5k weekly. But I usually made an extra ₦1k – ₦2k by diverting some sachets of water before packing and selling them on my own.

I also used to write GCE exams for students for a fee. It wasn’t regular, but I made ₦2k on every exam I did. I got caught once by an invigilator, but I settled them with a bottle of coke.

That was all it took?

That was all it took. GCE was once a year, so I had other hustles. In 2007, I was a sales boy for a catfish business for ₦10k per month. But I used to make extra money by doing a little addition and subtraction with the records.

What were your expenses like?

My mum still paid my school fees and sent ₦5k at least once a month, but I sorted other costs like hostel accommodation, feeding and course materials on my own. Plus, the odd spending on girlfriends.

I wasn’t even serious about school like that — I had largely abandoned classes because of work. The fish pond was close to my uni, so I could rush to school if there was urgent school business. I managed to graduate with a second-class lower in 2010, though.

Did you work at the fish pond till graduation?

I worked there until 2009, when the owner decided to stop the business. By then, my salary had been slightly increased to ₦12k, but I made about ₦25k in total from the several adjustments I made.

Without a stable salary, I survived the rest of my time in school by taking server gigs at weekend owambes for around ₦5k weekly. I also used to drum at one church on Sundays for the ₦1k they’d give me after every service.

For a while too, I joined market activation campaigns for popular brands. Those gigs are the reason I still equate marketing with standing under the hot sun with a branded polo, and hundreds of flyers in your hand while everyone else tries their best to ignore you. I suffered o. And how much were they paying? ₦5k per campaign.

Anyway, I survived and graduated.

What did you do after graduation?

I went for NYSC in 2011. I only went because I was sure of ₦19,800 monthly, and I wasn’t sure what else to do with my life at that point.

The school I was posted to had an additional building in the compound that was under construction. I studied building technology in uni, and even though I wasn’t a serious student, I could tell the workers were doing rubbish.

One day, I asked the principal if I could help him supervise the workers. He agreed, and I supervised the project until it was completed right before I finished my service year. It took that long because the man was gathering the money and dropping it small small.

Did he pay you for the supervision?

For where? He didn’t. Strangely, I didn’t mind. I did my service year in a boring village, and there was nothing else for me to do after classes. But he did connect me to the person who gave me my next job.

How did that happen?

When I finished service in 2012 and told him I was returning to the town I schooled in, he told me he had a friend there who was into construction. I met with the friend, and he employed me as a site manager. I worked there for three years.

How much was the pay?

There wasn’t a standard monthly payment; my pay depended on the volume of work and the number of sites we had to manage in a month. But on average, I made between ₦60k – ₦70k monthly.

Did you think it was good money?

I thought I was a big boy. I could send money home once in a while, and I wasn’t paying rent since I lived in the office. The workers could spend the night in the office, so I took advantage of that. I also had a steady girlfriend who I supported in school.

There was also usually free money from balances from buying building materials, so I was good.

But in 2015, I decided to venture out on my own and offer construction services under my own firm — even though I was the only one there.

What inspired that decision?

I realised that my boss could make up to ₦800k profit on one project, and we could have at least two projects running concurrently in one month. But I was only being paid less than ₦100k a month. So, I left.

I had about ₦400k saved up at the time, and I used ₦300k to rent a mini flat and registered a company with what remained.

Did you get clients immediately?

Another reason I had the courage to leave my boss was because I met a potential client through a friend who wanted to build some hostels.

I started the project around the time I registered my company. It lasted for a year, and I made close to ₦2m from it.

Wiun. That definitely qualifies as a big break

It was. It wasn’t a lump-sum payment, though; the amount was stretched out over the one-year period.

Most of it went into my wedding. My girlfriend got pregnant, and her family insisted we got married before she started to show. Of course, I wanted to marry her and was glad this came when I had money. We got married in 2016.

However, she lost the baby after the wedding.

So sorry about that

Thank you. It was as if my business knew I wasn’t in the right frame of mind because I didn’t get a client for the rest of the year.

My wife and I managed the little I had left from the hostel project and the occasional support we got from my wife’s family. My wife herself wasn’t working.

When did the next project come?

2017. An uncle from my mum’s side who lived abroad wanted to return to Nigeria and asked me to help build his house. I made about ₦600k from that project.

Then, in 2018, I partnered with my former boss to work on a project. It was a hotel, and I didn’t have enough manpower, so I got him on board. It lasted about six months, and I made close to ₦700k.

On average, I had one major client every year till I took a break from the business in January 2023.

How were you managing when there were no clients?

I started supplying tiles on the side in 2019. Since I already worked with people who were either building or renovating, it was easy to get clients.

So, I partnered with a supplier at a major tile market. Whenever clients needed tiles, I’d get them from him and sell them at a markup. That usually brought about ₦50k – ₦70k a month.

My wife also got a bank job in 2018, so she also supported the income. But she’s currently the primary breadwinner.

Is this connected to you taking a break from work?

Yes. I had a mini stroke in January, which the doctor attributed to stress and high blood pressure. He emphasised that I needed to take it easy, considering I’m just 35 and already having such health scares.

It was supposed to be a one-month break, but I haven’t returned to work since.

Why?

My wife got pregnant again for the first time since we got married. In February, she was six months gone but started having complications and was placed on bed rest. She had to take maternity leave early, and I stayed back to take care of her.

We had the twins in April, about a month too early, and they had to be in the incubator for three weeks. Soon after we returned home, she had to return to work. There was an option to extend the leave without pay, but we needed the money and had no one to help. My mum would have come through, but she passed away in 2022.

I’m sorry to hear that

Thanks. We decided I’d stay home to care for the children. I was only too happy to do it, and not just because I needed to watch my health; we had waited years for these babies. That’s what I’m doing now. I’m a proud stay-at-home husband.

How long do you imagine you’ll do this?

For as long as it’s necessary. My family is my priority now. My wife has endured the struggle and trauma of unexplained infertility for seven years. It’s only fair I take this burden off her, at least until we can figure out how to balance the twins’ care with work.

Curious. What does being a stay-at-home husband look like?

My wife cooks during the weekend and freezes most of it. She also expresses breast milk daily and stores it in the freezer. So, most of what I do is defrost, warm the milk and feed the babies, keep them entertained, do the laundry and heat up the food she already cooked so she has something to eat when she returns from work.

She also has a cousin who is schooling around and pops in from time to time to help with house cleaning, market runs, and the twins.

How do the home’s finances run?

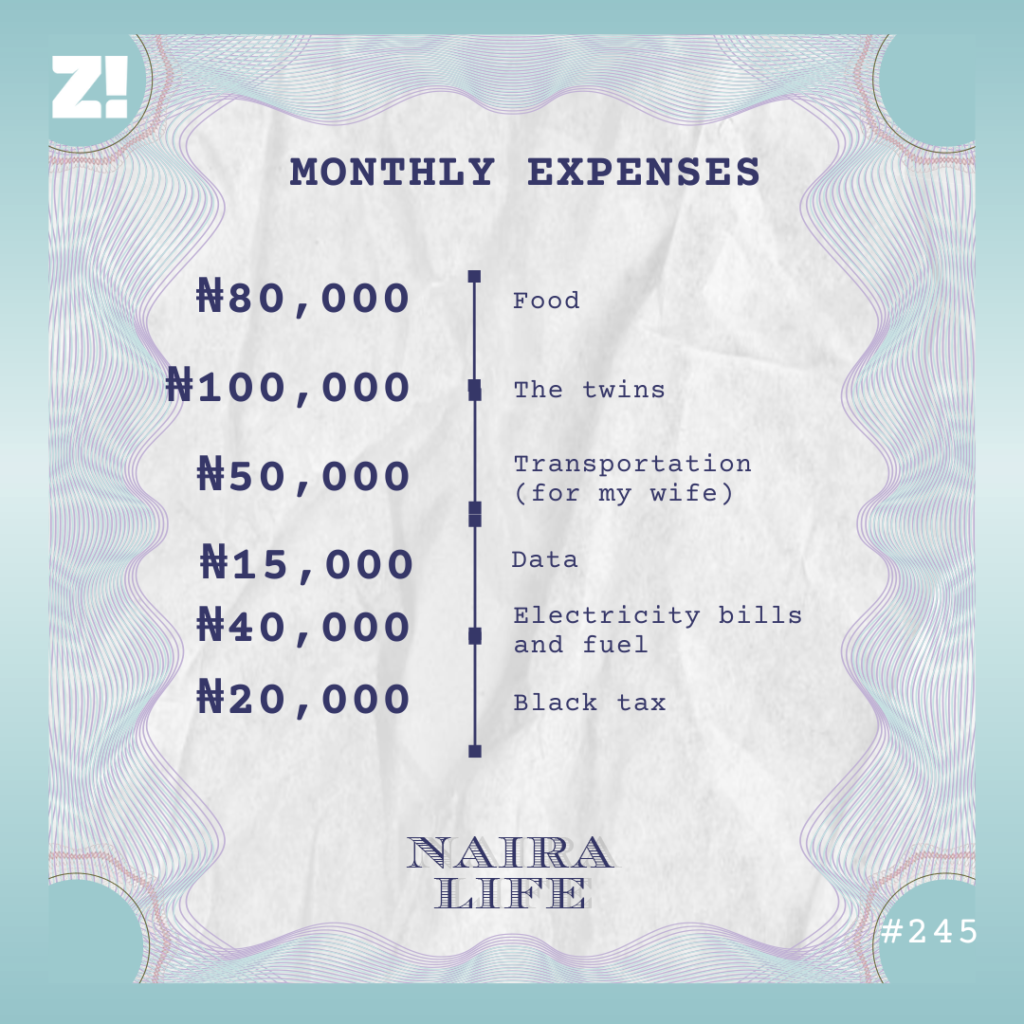

My wife earns about ₦500k per month, and since we’ve had the twins, she sends half of her salary to me and saves the rest. The half with me is what we try to manage for the month, even though we dip into our savings before the month’s end.

We’re saving so much because I have a landed property that we hope to start developing by the end of the year. I also have some money saved up from when I was working. Our combined savings is about ₦2.5m now.

We currently live in a flat my wife inherited from her dad, but we want to build our own and rent to get an added income source.

What do your monthly expenses look like?

The thing about raising kids is, you will spend. They can develop a cough, and the next thing you have to do is change their medicine. Or they poop immediately after you change their diaper, and you have to change it again. But it’s a problem we’re happy to have.

Your story has gone from needing to hustle to doing without it happily. How has this affected your perspective on money?

After my dad died, making money felt like a point to prove. I needed it to survive, but it also felt like an anchor to make sure I didn’t return to that feeling of hopelessness. And when I first got married, it was a way to ensure my wife didn’t have to suffer like my mum did.

But now, money is simply a means to an end. It’s what pays the bills, and that’s it. Maybe it’s knowing that I could easily drop dead if I do too much, or the fact that my wife’s support helps me understand that I’m not alone and don’t need to kill myself to prove a point. I know I still need to make money, and I’m still thinking about how best to work around my business, but this is what works for my family for now.

What’s something you want but can’t afford right now?

Our own house. We’re already working towards it, but getting ₦15m now would definitely fast-track it.

On a scale of 1-10, how would you rate your financial happiness?

6. I’m not actively earning, but I feel somewhat fulfilled right now. I’ll figure it out as it goes.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.