Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

One morning, when I was five years old, my family and I returned home from church, and there was no money or food to eat. I asked my mum what we’d eat, and she said, “Jesus will provide”.

Then, she told my siblings and I to dance and praise God. We did that, and she went out and came back with food. I really thought an angel dropped the money for the food on our doorstep, and I was so excited that my prayers worked. Money was a frequent topic in our house, and situations like this food incident were regular.

Why was money a frequent topic?

We didn’t always have the money we needed, so we used a scale of preference approach to spending. Whatever wasn’t important had to wait until there was money to spare. My late dad was a lecturer, my mum was an accountant — she built a school later on — and with five children, money was never enough.

Inevitably, I grew up believing that money could never be enough, which manifested as a constant urge to make money.

When was the first time you acted on this urge?

2009. I was in my second year in uni when I started taking ushering gigs. The first one I ever did paid ₦5k instead of the ₦10k I was promised. I didn’t even mind. The organisers had covered our transportation, so I had nothing to lose.

I also did some market promotion gigs for a beer brand trying to re-enter the market. I’d never been in a bar before because of my background, but the ₦30k/month was pay I couldn’t pass up.

I should mention that I had a monthly allowance of ₦10k, and I augmented this with the ushering and market promotion gigs. In my third year in uni, I decided I could take a break from pursuing money.

What happened?

Three of my siblings graduated from uni, easing the financial pressure at home. It was just my younger brother and I in school. Plus, my eldest sister got a job at a bank immediately. She also started helping out with the occasional pocket money.

The improved financial situation gave me time to pursue other interests. I’d realised I didn’t want to practise my engineering course. I only studied it because my family decided I’d be an engineer since I was good at maths. But I didn’t like it and couldn’t drop out.

Thankfully, I found a lifeline when I discovered AIESEC on campus. I finally found something I was interested in, and I focused on the activities: conference planning, talent management and marketing. It wasn’t bringing me money, though, at least not while I was still in school.

What about after school?

I landed a three-month AIESEC internship with an entertainment company in Nairobi in 2014 — a year after I left uni. The salary was 140,000 Kenyan shillings, which was about ₦70k then.

I returned to Nigeria after the internship and got another six-month internship through AIESEC at a logistics company. This time, it was a ₦90k/month role. At that point, I wasn’t sure what I wanted with my career. I was just working to earn money. Then, I got married four months into the internship. I was 24 years old.

How did that happen?

I still ask myself the same question. My mum regularly sent my sisters and me broadcast messages about the qualities of a good wife, and I subconsciously felt I had to get married. It felt like the next logical step.

So, when I started hanging out with a long-time friend who returned to Nigeria from the UK and he brought up marriage, I went with it too. We got married in 2014.

What did that mean for your career?

I got pregnant almost immediately, and I quit my job because it seemed too stressful to juggle with a pregnancy. Also, I married into a rich family that didn’t shy away from spending money, and I thought I didn’t have to bother about making money anymore.

Before we go on, is being married to a man from a rich family anything like Nollywood depicts?

We lived in my husband’s family home with his mother and siblings. Let me explain how the house worked: my husband and his siblings all dropped an amount with their mother for our monthly needs: from food to toiletries and my child’s diapers. I didn’t even know how much a cup of rice cost. It meant I never had cash for anything.

Some months into my marriage, I became uncomfortable with depending on someone else for money. I felt strange having to ask for small things like money to do my hair or get toiletries. So, immediately after I had my child in 2015, I started job-hunting and got a ₦30k/month teaching job the following year. My child was barely a year old.

What was that like? Juggling childcare with a job?

My mother-in-law helped look after my child. My husband and in-laws didn’t understand why I had to work, though. They thought I just wanted to stress myself. But I wanted to have control of my finances.

My ₦30k salary was only enough for transporting myself to work. I even trekked sometimes so the salary would last a month. I didn’t get any financial support, but I didn’t care.

How long did this go on for?

I taught at the school for two years before I left to help my mother-in-law manage her new school. That was a mistake; I never should’ve done that.

Hmm. Why?

I served as the school’s administrator for four years and didn’t get paid once. The funny thing is, people thought I was living my best life. Like, “Wow, she married a rich man. They set up a school for her, and she even has a driver.”

But I was truly broke. I couldn’t buy anything for myself or my mum during those four years. I gave my mum excuses about how we were still trying to get the school functional. In reality, I was being used, and I couldn’t leave without causing family issues, so I took it as an opportunity to gain work experience and build myself.

Did you try to do other things to earn money?

I tried my hands at tailoring when I noticed I wasn’t going to get paid. I’d learnt the craft during my first school job. I took some savings I’d gathered when I had a salary and used it to buy tailoring materials. I had two sewing machines — my wedding gifts — and I set them up in an abandoned store belonging to my in-law’s family.

Since I didn’t pay rent, they made it look as if it was their way of paying me for my work at the school. But I was barely making anything from the shop because I didn’t have a steady clientele due to my spending long hours at the school.

In 2019, I finally found an opportunity to leave the school. I was pregnant, and we’d moved out of the family house because we wanted space — my mother-in-law had issues with my husband spending late nights, and it led to a few arguments. The school was far from our new place, so I took the opportunity to leave.

What did you do next?

After I had my second child, I began paying more attention to my business. Leaving the family house opened my eyes to the fact that we didn’t really have money, and I couldn’t afford to be financially dependent.

I also registered for NYSC that year because I thought no one would employ me without a certificate. The government started paying corps members ₦33k in my second month of service. It was like heaven to me. I’d worked for so long and didn’t even know what it was like to have ₦33k.

Damn. What was running a business while serving like?

I served in the state I lived in, so it worked. I got two commission-based assistants and included fabric sales and home-based tailoring classes in my list of services. The latter was a hit. Most people interested in my classes were middle-aged housewives who didn’t want to attend fashion schools. I made ₦50k monthly from the business on average, but most of it went back to the business.

I should mention I still didn’t have my husband’s support. He wanted to keep the illusion of us being wealthy, and my working meant he didn’t have money to take care of his home. He actually didn’t have money but didn’t want people to know. I was supposed to get glammed and look the role of an “odogwu’s wife” when, in reality, I was taking care of most of the home’s expenses.

That must have been tough

It was. I kept hustling because my kids had to eat. While I was still serving, I applied for a social media manager role at an NGO. I was a 30-year-old dragging social media work with 22-year-olds. But I got the job.

The salary was ₦90k/month. My job also included scheduling therapy appointments, and I enjoyed what I did. It didn’t mean I wasn’t applying for other jobs and looking for money, sha.

LOL. Did the job search yield results?

It did. I got another school administrator role for ₦45k/month towards the end of 2020. I juggled this with the social media job and my business.

My marriage began to nosedive during this period. My husband started leaving home for days. I told him plainly that I couldn’t leave my work to be chasing him around because I had children to feed.

I knew the whole thing would crash soon, and I focused on becoming financially independent.

How were you managing three jobs?

I had been without money for too long, and I couldn’t return to that. It was a swim-or-sink situation. I’d return from school and stay up at night to do my social media job. My assistants mostly handled my tailoring business.

It was a stressful period, but I was looking ahead. If I left my husband, I’d have to sort out rent and school fees myself, and I needed something sustainable. I mean, I was already suffering, but this time, I had a goal.

Did you leave?

I left in 2021 when he became violent. I moved back with my children to my family house, and we stayed there for six months.

In 2022, I left the school and got an office admin job, which also paid ₦45k. The plan was to gather admin experience to work in a standard organisation.

To sort out accommodation, I took a housing loan from work to rent a ₦300k/year one-bedroom apartment and moved in with my kids. Then, I quit my social media role to focus on the admin job. It paid more, but it wasn’t my desired career path. I also closed down my business because my ex kept going there to cause a scene. It was too much.

Sorry about that. You went from three income sources to one. What did that mean for you?

I think I walked everywhere I went in 2022. I lost so much weight that my mum had to intervene. She took my kids for three months to give me time and space to get a grip on myself. I struggled with that because I used my children as a shield to grieve the end of my marriage. You can’t cry with kids around. They don’t give you room to be depressed.

Being alone meant I had to confront my emotions and go through all the phases of grief. After I was done with that, I took pen to paper to map out my career. I’d gotten admin experience already. The next thing to do was get a better-paying job.

How did that go?

I enrolled in a bunch of free online admin and Excel courses to upskill, and I applied to jobs like someone was pursuing me. I must have applied to 500 jobs in two months. I’d also been “promoted” to admin team lead at my workplace by this time. There was no salary increase — just the fancy name change.

In September 2022, I eventually landed my current job as an admin officer in an oil company. The funny thing is, I didn’t exactly apply for it. A recruitment agency contacted me on LinkedIn to ask if I was interested in the role. I shared my CV and did the interviews. In my head, if they asked about salary expectations, I’d say ₦150k, so I could afford to save ₦50k monthly.

I got the offer via a phone call, and the recruiter said my salary would be about ₦700k — ₦500k basic salary plus allowances.

Wow. Paint me a picture of how you reacted to this

I was speechless for a full minute. The recruiter kept asking if I was there. I thought, “How is this possible? Will I have to kill people at this company to earn that much?”

A colleague was with me at the office when the call came in, and I put the phone on speaker so they could confirm I wasn’t hearing things. Who goes from ₦45k to ₦700k just like that?

My mum thought I was being scammed and couldn’t be convinced otherwise till I received my first salary. I cried the day I got that alert. I was so overwhelmed. It was just God.

That kind of income jump probably came with some lifestyle changes as well

Not immediately. I stayed in my one-bedroom apartment for another full year, but I renovated my family house and gave my mum ₦1m to expand her school. She was there for me through my marriage wahala, and it felt so good to finally be able to give back to her.

I wasn’t in a hurry to make major lifestyle changes. I didn’t change my children’s school until I noticed I could pay two terms’ fees at once. I moved to a ₦500k/year two-bedroom apartment in September 2023 and got a car for ₦2.7m in December because the new apartment is quite a distance from my workplace.

How’s your savings goal going?

I can definitely save more than ₦50k monthly now. Specifically, I save ₦200k/month now. I’ve also built a ₦3m emergency fund. Owning land is another future investment option I’m considering.

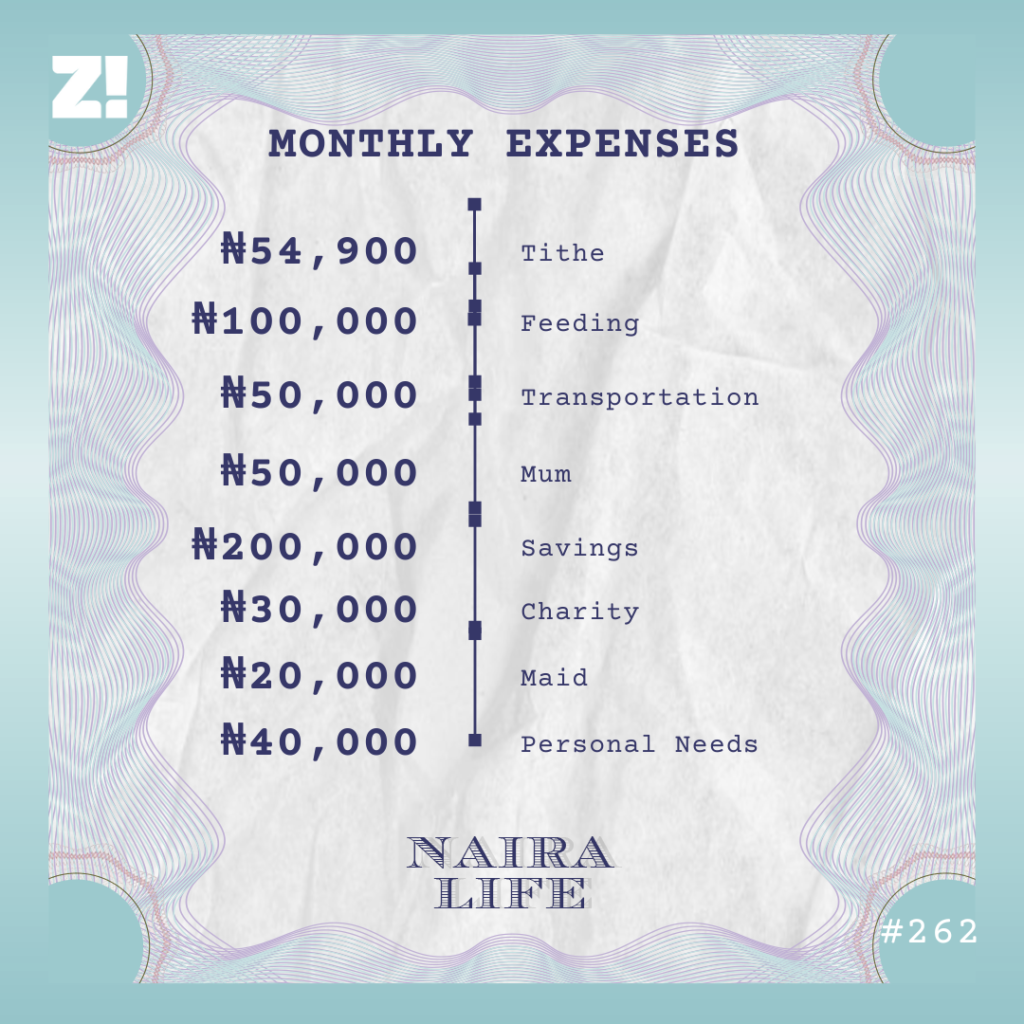

Let’s do a breakdown of your typical monthly expenses

I get sizable allowances from work every two months, which I use for major expenses. For instance, I get a ₦2.4m housing allowance every January, and it sorts my children’s school fees and rent for the year.

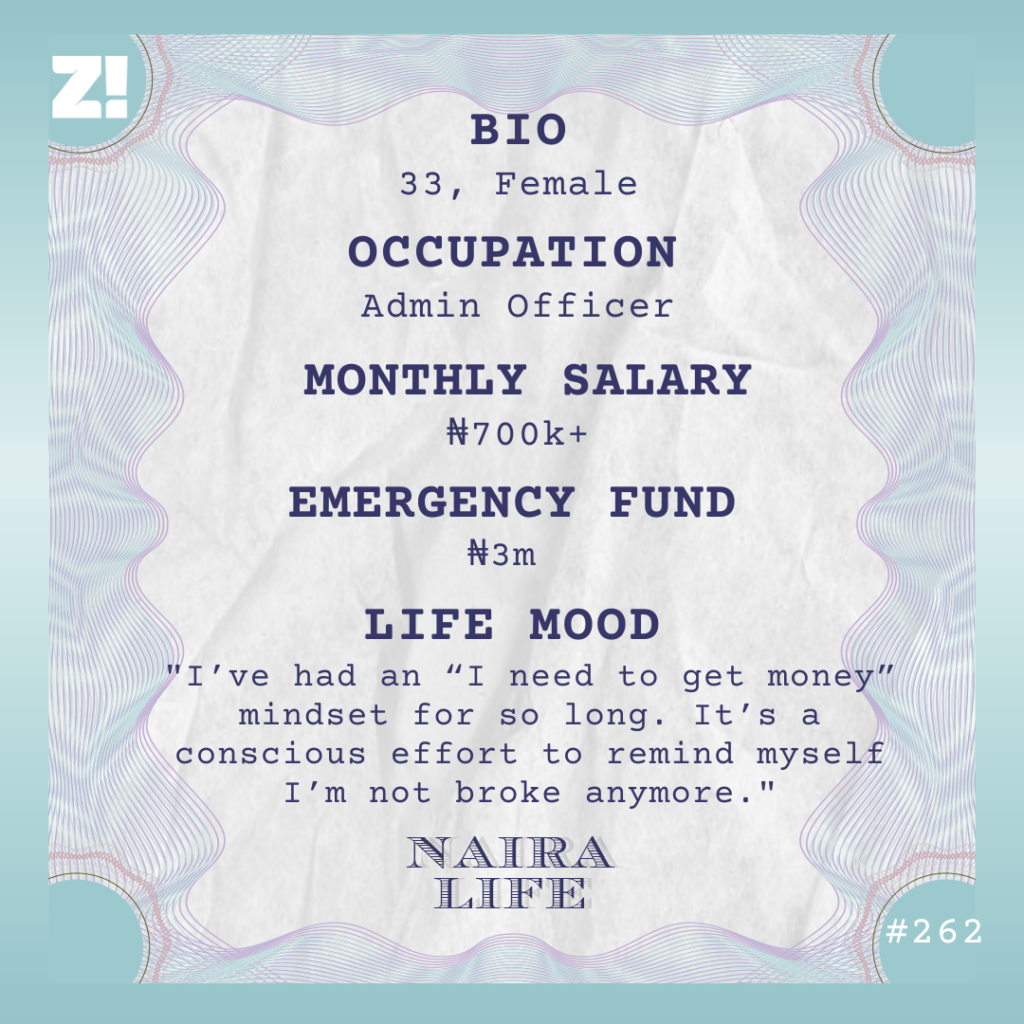

How would you describe your relationship with money now?

I’m learning how to relax. I’ve had an “I need to get money” mindset for so long, and it’s a conscious effort to remind myself I’m not broke anymore. I can afford to buy ₦200k hair, but it still feels like an outrageous expense. Like, ₦200k hair when that kind of money can help ten other people?

I think I also internalised some of the things my ex said. He often accused me of being extravagant because I wanted to have my own money and not depend on him. So, maybe I’ve been subconsciously trying to prove him wrong. I thought if I bought a new bag, people would say, “Oh, no wonder she left. She probably has someone else”. But I’m deliberately moving on from that.

I want to get to a point where I don’t overthink spending on myself. Oh, I’m also finally processing my divorce.

What’s that like?

When I began the divorce proceedings in October 2023, we’d been separated for two years. My lawyer advised me to wait for two years post-separation so the courts wouldn’t delay the process by trying to give us time to sort out our differences. I’m paying ₦200k in legal fees and another ₦15k to my lawyer every time we appear in court. I’ve been in court every month since then, and it’s been quite messy. But hopefully, it’ll be sorted soon.

Rooting for you. What do you think the future looks like for you?

I’m currently studying for an MBA in Human Resources. I’m in my second semester (out of five) and have spent ₦400k on it so far.

I’d also like to take classes to become a licensed therapist in the next four years. It’s why I chose an HR-focused MBA because I’ll need to know how to understand people to help them. I needed therapy during my separation, but I couldn’t afford it. You’d hear therapists charge ₦100k per hour. I want to be able to provide affordable therapy for divorced and abused women and children.

In addition, I hope to build something like a healing shelter in the long term. I keep thinking about what would’ve happened to me if I didn’t have my family house to run to when things went south. Housing is a major reason why people stay in abusive situations.

How would you rate your financial happiness on a scale of 1-10?

8. I’m happy with my finances and even happier with the person I am right now. I know where I’m going, and I’m willing to do the work to get there. I could lose the ₦3m in my account and still be happy. I’m no longer afraid of not having money or starting over. The worst has happened, and I came out of it.

What would make that number a 10?

When I eventually become a therapist and build a shelter. I like my job — it pays my bills — but it’s not what I want to do for the rest of my life.

Is there anything else you’d like to add that I haven’t asked?

I’d just like my fellow women to know that we do ourselves a disservice when we don’t have anything that brings us money. Having your own money is better than being perceived to be rich. It’s good to get free ₦500k, but earning ₦500k will boost your confidence — knowing you can produce value. When the chips are down, that’s what you can call your own.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.