Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When did you first realise what money was?

I realised my family was rich when, as a five-year-old inquisitive child, I snooped through my dad’s briefcase in his room one day and found bank statements and letters from Barclays Bank. This was 1996, and the bank was offering my dad a £100k loan.

Now I want to know what he did for money

He was a major supplier for Michelin before the company left Nigeria, so he was a pretty big deal. But I never would’ve guessed it because he had a lot of financial discipline and was very low-key.

On a family vacation abroad when I was around 10 or 12 years old, I asked my dad to get me video games because all my friends had one. Instead, he bought an educational VTech computer game, even though he could afford a PlayStation, Xbox or Sega. He’d always say, “Getting money isn’t as easy as it seems.”

He taught me so many money lessons.

Do share

He made me understand the importance of working hard to get the kind of money I want. He also taught me that there’s a “wrong” way to spend money. His position was partly the reason why the first thing I did for money was washing our neighbours’ cars for money when I was 10 years old.

How did that work?

We lived in an estate, and it wasn’t strange to find young kids washing their neighbours’ cars for the random ₦10 or ₦20. My friends and I started with my dad’s car before moving on to pretty much the entire estate. I saved all I made in a kolo and had up to ₦1k at a point. I later spent it all on Enid Blyton books and Mama Put sha.

I didn’t try another money-making move till my second year in uni in 2008. I attended a private university and noticed students didn’t have many food options at night when the cafeteria had closed. So, I made arrangements with someone who made snacks close to my school to buy in bulk at discounted rates and sell in the hostel at a markup.

What kind of snacks?

Scotch eggs, sausages and meat pies. I brought in the snacks twice per week, and I typically made about ₦8k- ₦10k in profits weekly. I stopped after two months, though.

Why?

It was time-consuming and was already affecting my studies. Plus, other students in the hostel decided to copy the business when they saw how successful it was. There was a lot of competition.

I didn’t mind stopping because I got a regular allowance from my parents — about ₦40k/month, which later increased to ₦50k/month. I only started the business in the first place because I wanted to see if I had an entrepreneurial muscle.

Did you flex that muscle again while in uni?

I couldn’t. I changed departments in my second year, which eventually led to some result issues. The school didn’t update the change, and I had no academic records for the first two years. I had to have an extra year.

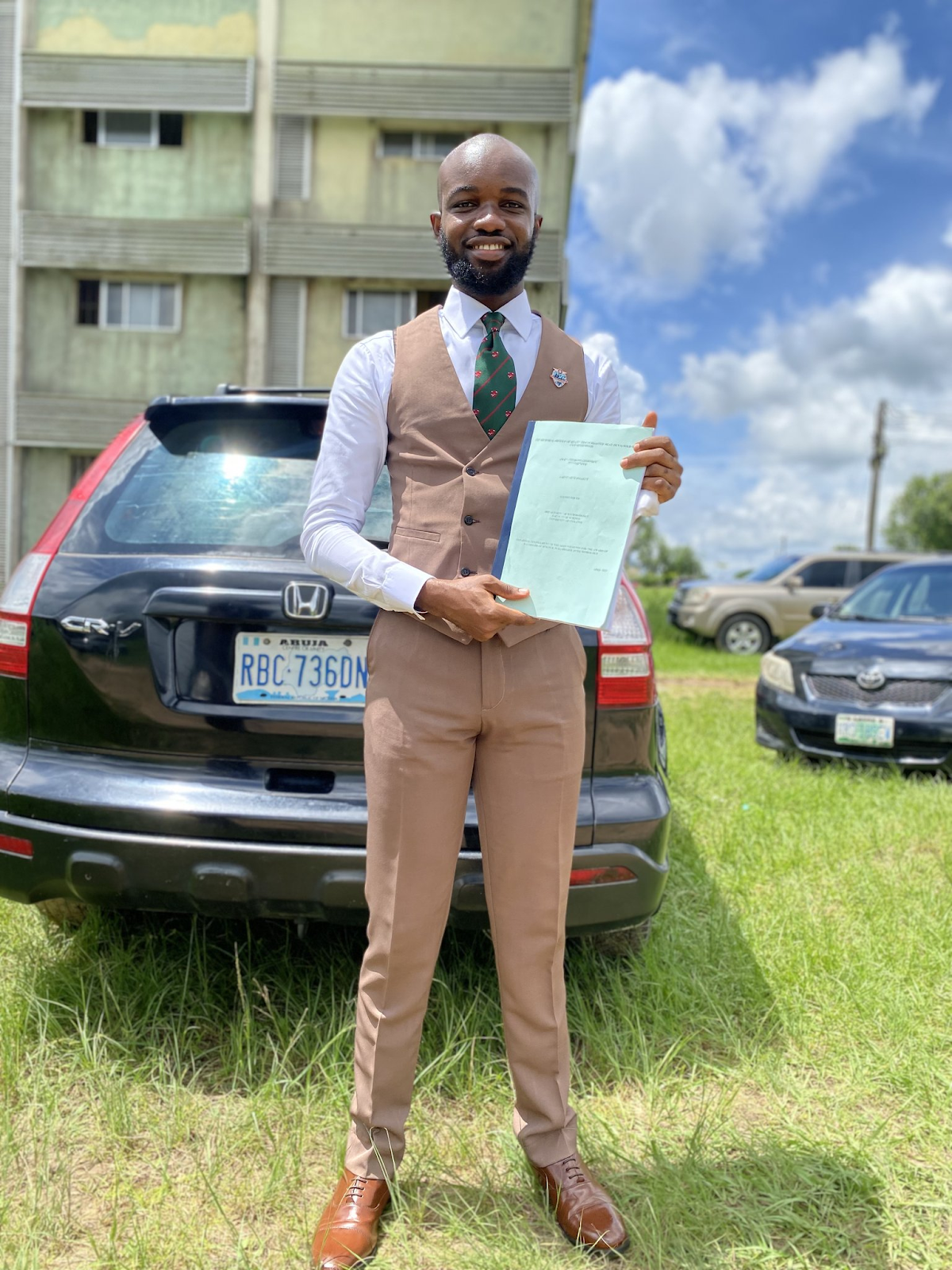

I finally graduated in 2013 and decided to take a job with a network company someone in church introduced me to while I was waiting for NYSC call-up.

What was the job like?

I was a project manager, but I did most of the CCTV and IP telephone installations and other network configurations for our hotel clients. I was paid per project, and it depended on how much work I had done during the month. For example, if I helped install about 50 CCTV cameras and Wi-Fi points, I could make ₦30k in commissions at the end of the month.

Was that the average amount you made monthly?

Yes. When NYSC came and posted me out of the state, I redeployed so I could keep working there. My commissions grew to about ₦50k- ₦100k/month after a couple of months. I worked there for about three years.

Were you still getting an allowance from home?

That stopped immediately after uni. In fact, the period I started earning money was when my family’s finances hit a bit of a downturn.

What happened?

My dad tried to get into politics and lost everything. My mum even had to start teaching at a school to make money. Of course, I had to help out with the bills, so that’s where most of my earnings went, apart from the occasional personal expense and love “sturvs” — I had a girlfriend.

What did you do after leaving the network company?

I took another job as the personal assistant to an oil company’s director.

Oshey, oil money

The salary was ₦100k/month, which wasn’t bad in 2017. I wasn’t really spending the salary because other perks came with the job. I was given a car, and they reimbursed every amount I spent on it. My boss also gave me many random ₦5ks for “transport”, but I was using the company’s car, so I didn’t have to spend anything.

So, what were you actually spending on?

I saved a lot because I was planning to get married and needed to get a new apartment. I was co-renting with someone at the time, and my part of the rent was ₦190k.

The wedding plans eventually didn’t work out, but I went ahead and rented my own place in 2018. The total package was ₦690k, but the rent was ₦450k per year. Interestingly, I hit a financial roadblock just after getting my place.

Oh no. What happened?

Someone from church scammed me into leaving my job to work for him. He convinced me he’d done business with the company I worked for and found out they were in a bad financial situation.

Coincidentally, the company was also in a court case at the time, so it looked like he was telling the truth. I left and started working with him as a project manager for offshore platforms. My salary was supposed to be ₦250k/month, but I only got paid once in the four months I worked there.

He couldn’t afford to pay?

He was using me as a front to defraud people. He told investors he had an oil block, and if they invested money with us, he’d refund it after six months with interest. But he used the money for himself and kept lying to me. I started to suspect things weren’t fine when some coworkers I met there left mysteriously. I reached out to some of them and heard things. I decided it wasn’t worth fighting for my unpaid salaries, so I just packed up and left.

I was unemployed for about two months after, and then my dad had a partial stroke. I had about ₦800k saved, which went down the drain quickly trying to settle his health bills and other expenses at home. I also went into about ₦400k debt.

Omo

Thankfully, in September 2013, I got a business development job at a medical sales company. It was ₦80k/month —a drop from my previous income, but beggars can’t be choosers.

Thankfully, through serious budgeting and miracle funds from two family members I never expected, I was about 80% debt-free by December. In January 2019, I got promoted to project manager, and it came with a ₦40k raise.

Nice

I left them in 2021 for a sales representative job at a bigger medical sales company, and my salary was ₦150k/month. It later increased to ₦200k in May 2022. I also got commissions of between 1.5% to 2% on every sale I made. It was a low percentage considering I brought in about ₦110m to the company in the one year I spent there.

Was it the same level of commissions they gave everyone?

Yes. At one point, we even fought them to increase it to at least 5%, but they refused to budge.

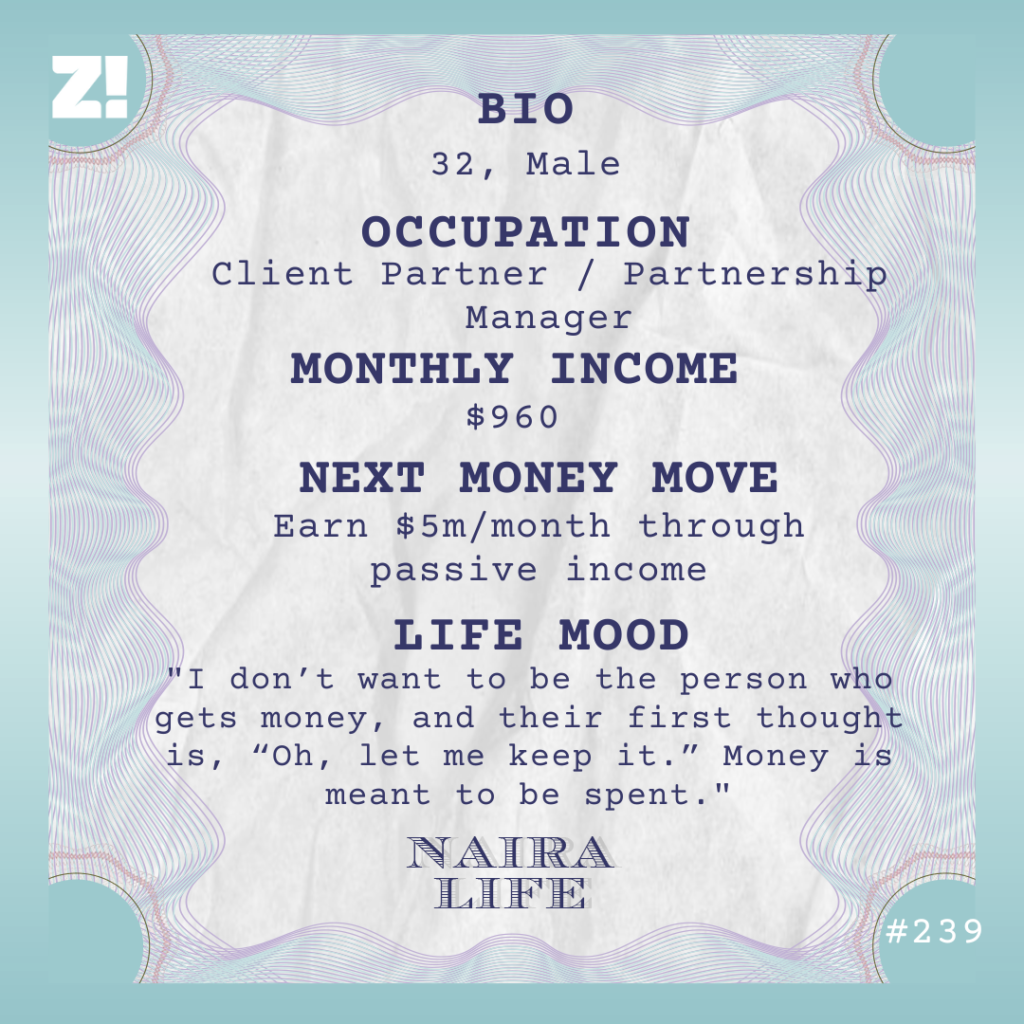

Anyway, I got a remote job with an international health technology company in September 2022 and started earning in dollars, so I’ve left naira wahala alone.

God, when? How much was the salary?

$960. I’m still earning that, but the naira equivalent has increased over time due to the naira devaluation. When I first started, I got about ₦780k/month, but now it shuffles between ₦870k to ₦920k.

Wiun. So, it’s sort of increased your purchasing power

In a way. But if you really look at it, purchasing value has pretty much stayed the same. For instance, I buy my groceries monthly, and I’ve constantly watched the prices increase, and I still buy the same things. The same things that used to cost me ₦50k now cost ₦60k.

So, while I can afford to buy these things, I’m not getting maximum value for the amount I have. It’s crazy because you can’t plan your expenses. It’s not about earning dollars; what can your dollars do?

But has your spending increased with your earnings?

Definitely. I can now afford to do small instant gratification here and there, but in an organised way. I’ve come to a point where money doesn’t control or get me unnecessarily excited.

If my financial situation had been like this in 2014/2015, it might’ve been a different story. But I’ve seen what money, or the lack of it, can do to people. I mean, I’ve seen my dad with and without money. So, let’s just say earning more has given me some wiggle room to afford my wants and needs.

How has your income growth over time impacted your perspective on money?

I think saving money is fine, but it shouldn’t be key. You want to save for the rainy day, but when it comes, you’ll still spend the money. Right now, I see myself as a conduit for money; money flows through me to reach others. I don’t want to be the person who gets money, and their first thought is, “Oh, let me keep it.” Money is meant to be spent, and spending it helps the economy grow.

I’ve also realised that, by improving my skills, I’ve increased my earnings and made myself a larger channel through which money flows. I’m holding foreign currency now, like my dad did many years ago, but I don’t see it as a big deal. It’s still money, and it will be used to purchase stuff. So why not use it?

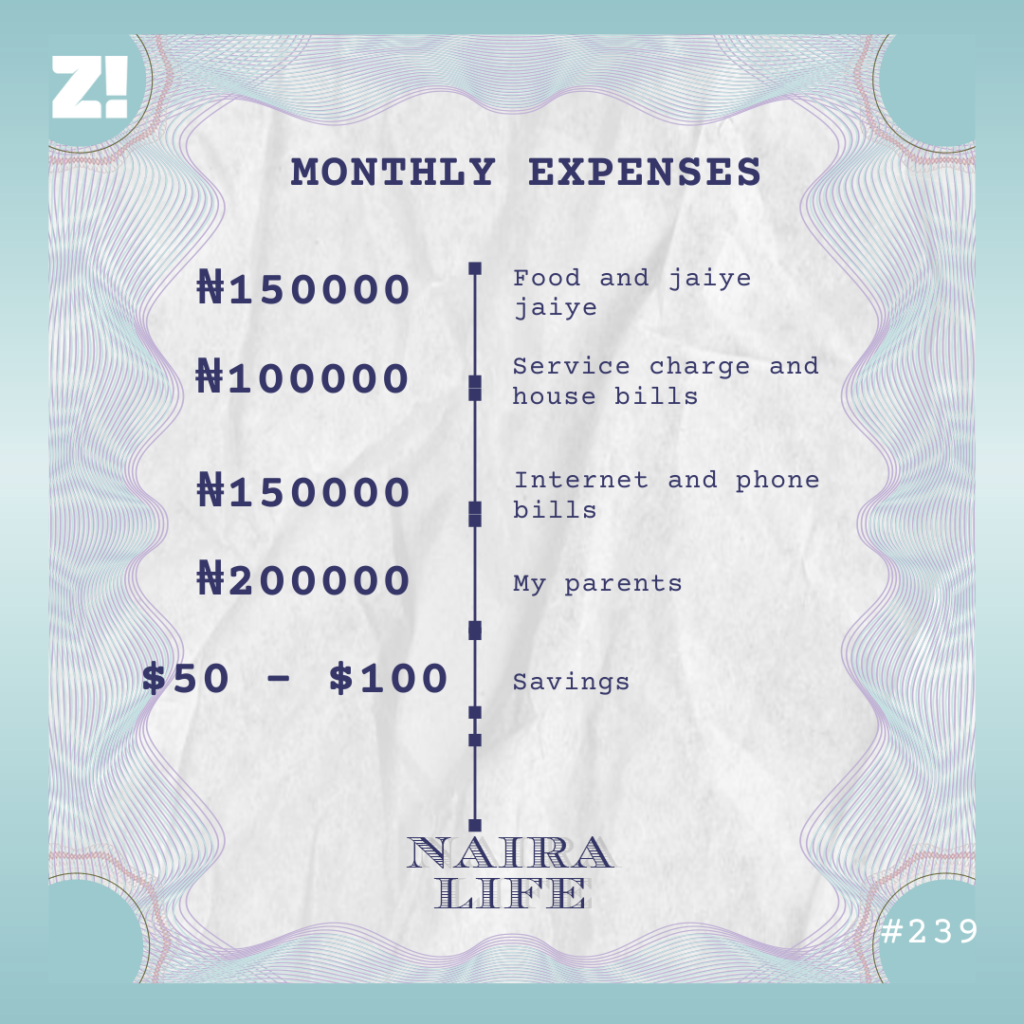

So, what do you use your money for in an average month?

What’s a purchase you made recently that significantly improved the quality of your life?

I bought some land in June for about ₦800k. I plan to develop it much later, though. It’s just an investment for now.

What’s one money lesson hill you’re willing to die on?

Money isn’t everything, and it’d be great if we all started seeing it that way. It’s a tool for getting good things done, but it’s not THE tool that defines you.

Curious, though. Do you think you’d be a quiet-rich person like your dad?

Somewhat. But my eye tear small. When the money balance well, you’d probably find me on a yacht somewhere, enjoying my life quietly without any apology.

What would you classify as “balance well” money?

At least, $5m/month.

Wawu

I’m aiming for more than that. I want to get to the point where I have a lot of assets bringing in passive income. I’m considering investments in agriculture, tech and real estate. Such that I can sleep for one year and be sure that something is coming into my account.

Is there anything you want right now but can’t afford?

A new TV and the newest Xbox console. I can afford it, but they’ll both cost about $1k, and it’s not a priority now.

How would you rate your financial happiness on a scale of 1-10?

4. That doesn’t mean it’s bad; it’s just growing. Plus, I still have the >$5m/month goal to reach.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.