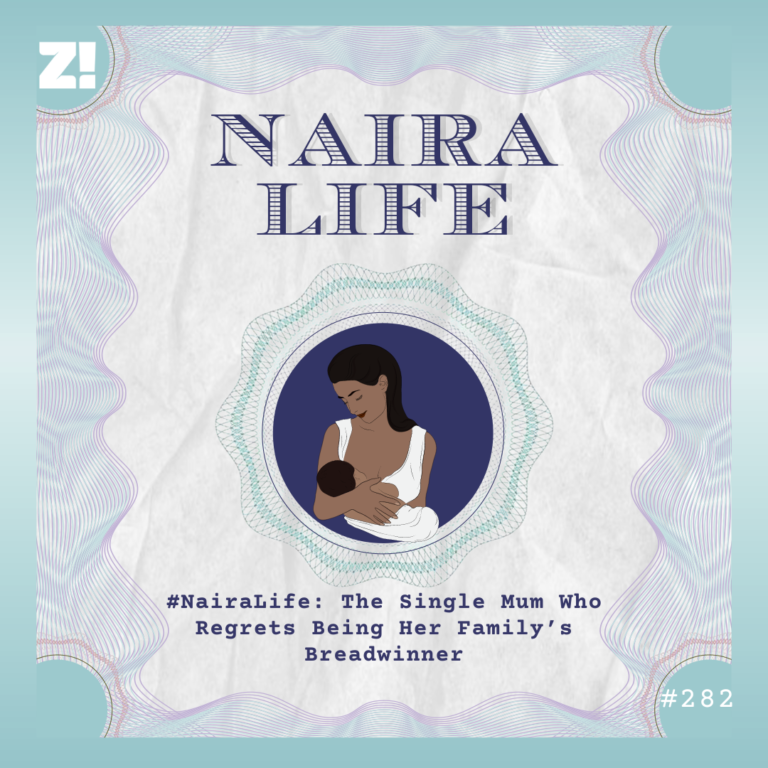

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

As a child, I always thought money was just available. My dad was very generous, so all I had to do was ask. My mum, on the other hand, was the complete opposite. You had to beg, lie and cry to get anything from her.

What did your parents do for money?

My dad imported and exported cash crops, and was hardly home. My mum was a stay-at-home wife till I was about 14 years old. She basically took care of me and my younger siblings.

What was growing up like, financially?

It was very up and down. Since my dad dealt with seasonal crops, he made most of his money around harvest time, which was once a year. Other times, there’d be no money, and things would get really bad.

Our life was like that: Money today, no money tomorrow. But when there was money, there was really money. Like flying to meet your dad on vacation money.

When there was no money, there was really no money. I remember returning to boarding secondary school one time, and my mum couldn’t afford the transport fare. We had to take soólè — a cheaper, but more dangerous alternative.

How did that shape your opinions about money growing up?

I had a fear of financial insecurity and instability, and it’s stayed with me till adulthood. I became very money-conscious early. It’s the reason I started working at 14 years old.

Your first job. Tell me about it

During the three-month break between SS 2 and SS 3, I worked as an attendant at a betting shop beside my mum’s provision store. My pay was ₦10k in the first month, then it increased to ₦12k.

What were you spending money on?

Data, snacks and those ₦50 Lantern storybooks. I also had a bank account my dad had created so he could send me money without my mum intercepting it, but I hardly saved.

Ushering was the next job I did. I started immediately after I entered the university in 2013, but my first gig was a scam.

What happened?

I applied to an ushering agency via WhatsApp and sent my pictures. They said I’d been accepted but needed to pay a ₦5k application fee.

Bank transfers weren’t popular then, so I made the deposit at the bank and sent the picture of the deposit slip together with my picture, name and details to an email address they provided. They sha blocked me, and I never heard back from them again.

Omo. Did you try another agency after that?

Yes. Thankfully, the next one was legit. I started working most weekends, earning between ₦5k to ₦8k per event. I did approximately three events a month and could make anything between ₦20k to ₦30k. The highest I ever got from ushering was ₦20k for a politician’s one-day event.

How long did you do the ushering jobs for?

Till 300 level. It was my major source of income because things were bad again at home, and my parents still had to look out for my siblings. While my parents handled my school fees and sent a ₦30k monthly allowance, I took responsibility for all my other needs.

Why did you stop ushering?

I started dating a generous man.

Now I need the details

We met in 2015. He was a doctor who worked not too far from my uni, and I typically spent my weekends with him. Since my ushering gigs were during weekends, the work just died a natural death.

He gave me money for the first time after we spent a weekend together. I got home and found an envelope with ₦50k inside in my bag. Subsequently, he just started giving me random money and buying me food. It made my life easier; I didn’t have to ask for money.

One time, I was with his debit card when I saw a ₦10k bag I liked and just paid for it. I remember asking myself why I thought it was okay to spend his money without his permission, but he didn’t even flinch when I told him. We dated for a year before our relationship ended in epic breakfast. But I don’t want to get into that.

Ouch

After I finished uni in 2017, I went for youth service and lived on the ₦19,800 allowance plus other small money I made for writing short articles for a German-based LMS.

How did you get into writing?

Heartbreak brought out my creative side. I wrote dark pieces about unrequited love, depression, family and all that jazz. I even had three journals at a point. My friend saw it and was like, “Why not make money with this thing?”

So, she linked me up with the LMS. She also worked there, and they sent my payments to her account as well. Payment was per word, and we had targets — usually 3k to 5k words. The amount I got at the end of the month depended on how well I met my targets. My very first salary was ₦73k. Subsequent months ranged between ₦20k to ₦70k.

₦20k?

It was a very unstable place. If you didn’t meet your targets, you could wake up to find that you’ve been logged out, and you have to beg for another account. When that happens, you lose any progress you’ve made up till that point, and your hours start counting again. I worked there till service ended in 2018. I think my last salary was ₦48k.

What did you do next?

I studied a medical course at uni, so I decided to try out a hospital internship. I got a year-long internship at a general hospital in early 2019. My monthly stipend was ₦91k/month, which was a relief coming from the unstable LMS job. However, the hospital was really the ghetto. It was the experience that helped me realise I didn’t want a medical career.

What made you come to that decision?

While interning, I happened to be part of a general meeting with senior medical professionals from all over. I remember looking down at all their worn-out shoes and deciding I didn’t want to wear those kinds of shoes. These were seasoned professionals who had been at it for over 10 years. That couldn’t be my life.

I feel you. Was it just the shoes, though?

It was mostly that. Then, I had a friend who joined the hospital’s human resources department. I’d hang out with her in the HR department and admire the work they did. I liked mathematics in school, and they handled a lot of data, which I loved.

Then, another friend introduced me to an HR/admin officer, and I started unofficially helping him with data entry and documentation. Around that time, the departmental secretary went on maternity leave, so I helped with documentation while she was away. At that point, I just liked the work and knew I didn’t want to do the course I studied. I didn’t have a clear career plan.

What did you do after the internship ended?

I’d started dating the friend who introduced me to the HR officer before my internship ended in June 2020. He was also generous, so when my salary stopped, he put me on a ₦50k monthly allowance. Sometimes, it was ₦150k, and after we’d been together for a year, it went up to ₦200k.

I spent most of my time with him, so I didn’t look for a job. However, I started a bedsheet business in November 2020.

What inspired that?

I loved buying bedsheets for my space. One day, I went sourcing fabrics for a new one. I put a poll up on WhatsApp to see which fabrics worked best for men and women, and my friends began to show interest. So, I just decided to start selling.

My boyfriend gave me ₦300k as initial capital, but I started with ₦150k and kept the rest. I bought 16 bedsheets for a start and sold the whole thing in eight days. I made a ₦2k profit on each. I also sold some duvets for a ₦3k profit.

But December was when I really made money. Someone contacted me to supply sheets and duvets for his mansion. The contract was worth ₦200k, and I made an ₦80k profit.

Love to hear it. So, the business was a hit?

Somewhat. Sales were mostly from my family and friends, so it wasn’t that regular. But the business was just so I could have something to do — my boyfriend regularly sent me money. Because of that, I could save most of the salary plus ₦198k COVID allowance I received from the hospital towards the end of my internship. By the end of 2020, I had almost ₦700k in savings. But then, I went to invest it.

It’s already sounding like it didn’t end well

Before then, I had made a smaller ₦200k investment with an agribusiness platform in October 2020. It was a year-long investment, and I was supposed to cash out ₦240k after maturity. There was no issue with that one.

But then, in 2021, I invested ₦800k in one popular forex company and was supposed to cash out ₦1.2m after nine months. They even had an app where you could see your money grow. But the time to cash out came, and I couldn’t click the “withdraw money” button. At one point, the app stopped working. I sent emails and tried customer support with no luck. It was when I went to social media and saw other people wailing that I knew it was gone. I cried ehn.

Omo. I’m so sorry

It was extra painful because I didn’t tell my boyfriend. I wanted my “financial wisdom” to be a surprise to him. It felt like I had nothing to show for the business capital he’d given me.

Also, I wasn’t sure of the future of the business. My boyfriend cheated earlier in April 2021, and while we were still together, things were going downhill. It made me start rethinking the business. He was my primary source of income, and I realised I needed something more sustainable. I was ready to leave, but I was also scared of not having money and being unable to feed— the age-long fear of financial insecurity. It prompted me to look for a job.

How —

Wait. Did I mention I made another stupid investment in 2021?

OMG

This one was with a family friend. He was the accountant and also quite religious, and I believed him when he assured me it was legit. So, I put in close to ₦600k. It was supposed to last six months, but the site crashed after the third month. 2021 was essentially my year of fake investments. I lost ₦1.4 million in total.

Yikes. How was the job search going, though?

I was applying for random jobs and living on online hiring platforms. I used the time to brush up on my CV and LinkedIn with stuff I learned from free recruitment and interview training sessions online.

I also read a lot about customer success, human resources, and even data analysis; practically anything that’d make the transition into related fields easy. I also did some HR courses on Coursera — it was free because I applied for financial aid. After taking the courses, I’d add them to my LinkedIn profile. But I was also depressed and was crying all the time.

Finally, in March 2022, I landed two offers: an HR data analyst role in Ibadan and a Talent acquisition specialist role in Lagos.

Which one did you go for?

I lived in Ibadan, and the HR data analyst role was going to pay ₦150k. The Lagos role was ₦50k. The Ibadan job was more reasonable, but I thought I needed a change of environment to beat the depression, so I took the Lagos job. It’s definitely one of the craziest things I’ve ever done in my life. By this time, I’d broken up with my boyfriend, but we remained friends.

I moved in with a friend at Gbagada — the office was at Surulere. I still had about ₦500k in savings (including the ₦240k cash-out from the agribusiness investment). So, as a soft babe, I used a cab from one of these ride-hailing apps on my first day. It cost ₦3,700. That’s when I knew Lagos wasn’t for the fainthearted. I saw people hustling for buses while returning home that day, and one lady’s skirt even tore. The ghetto.

Not you slandering Lagos

I couldn’t keep up with cabs or hustle for buses, so I moved out of that friend’s house after two days and went to live with another friend in Surulere. The plan was to stay for two weeks while I looked for a house.

But within a week, the friend started asking about my plans to get a place. I was aggressively house hunting, but it was difficult doing that while doing a very stressful full-time job, coupled with Lagos agent’s wahala.

One week and five days into staying with her, the friend sent me a text on a Thursday evening, saying her mum was visiting over the weekend and I needed to leave.

Darn. What did you do?

I just started crying. I was at work, and my boss saw me and gave me the rest of the week off to sort out my house situation and resume work on Tuesday. Luckily, I found a mini flat in Surulere the very next day. It was supposed to cost ₦800k, and I only had ₦500k. So, I called my ex, and he sent me ₦500k.

I ended up paying just ₦500k — the landlord decided not to collect the agent and agreement fees. I then spent about ₦300k to furnish it. I was settling in pretty well until I lost my job in May 2022.

How come?

The job had crazy expectations. I was hired to do HR, but I also did customer service, sales and a little of everything. We also did recruitments and would be given extremely short deadlines to submit candidate profiles.

My boss had given me and one other colleague three days to submit some profiles. We couldn’t meet up, and by Monday morning, I opened my mail in the office to find a termination letter. No one said anything to me, and I stayed till 5 p.m. and left. The next morning, the HR had the audacity to call me to ask why I wasn’t at work because I had a “notice period”.

Mad o. So back to job hunting?

It was tougher this time around because my savings were depleting fast. By June, I had just ₦25k and decided to sell my laptop. I told a friend that I wanted to sell it, and she got so upset that things were that bad. The next thing I saw was her post on WhatsApp: “Isn’t there anyone who needs an HR officer in their company?”

Aww

That post landed me a ₦171k/month HR role. I resumed in July.

That must’ve been a relief

It was. I later discovered I was lowballed because I didn’t negotiate, but it was still life-changing money for me.

I’d started sending ₦20k home as black tax since my internship days — even when I was jobless. The needs from home were increasing because my dad was fully out of business, and it felt good to earn money that could take care of needs as they arose.

Were you spending on yourself at all?

I usually sent ₦70k home in a month, so I’d split the remaining ₦100k into two: ₦50k to my savings and ₦50k to take me through the month. It was tough, but I learned to manage.

In December 2022, I started getting HR gigs from someone on LinkedIn. Mostly payroll, CV, employee handbooks and others. The gigs gave me an additional ₦100k monthly, so I decided the whole thing would go straight into my savings account that I didn’t touch.

How was work going?

I resigned in March 2023. It was the period when transportation costs became too much to bear, and the company refused to go hybrid or give me a salary raise. My mental health couldn’t take it, and I could no longer function well. So, I left even though I had nothing else lined up. But I got another job six days after my notice period elapsed in April.

Impressive

It was a real lifesaver. It was an HR manager role for ₦350k/month — a 100% increase from my previous salary.

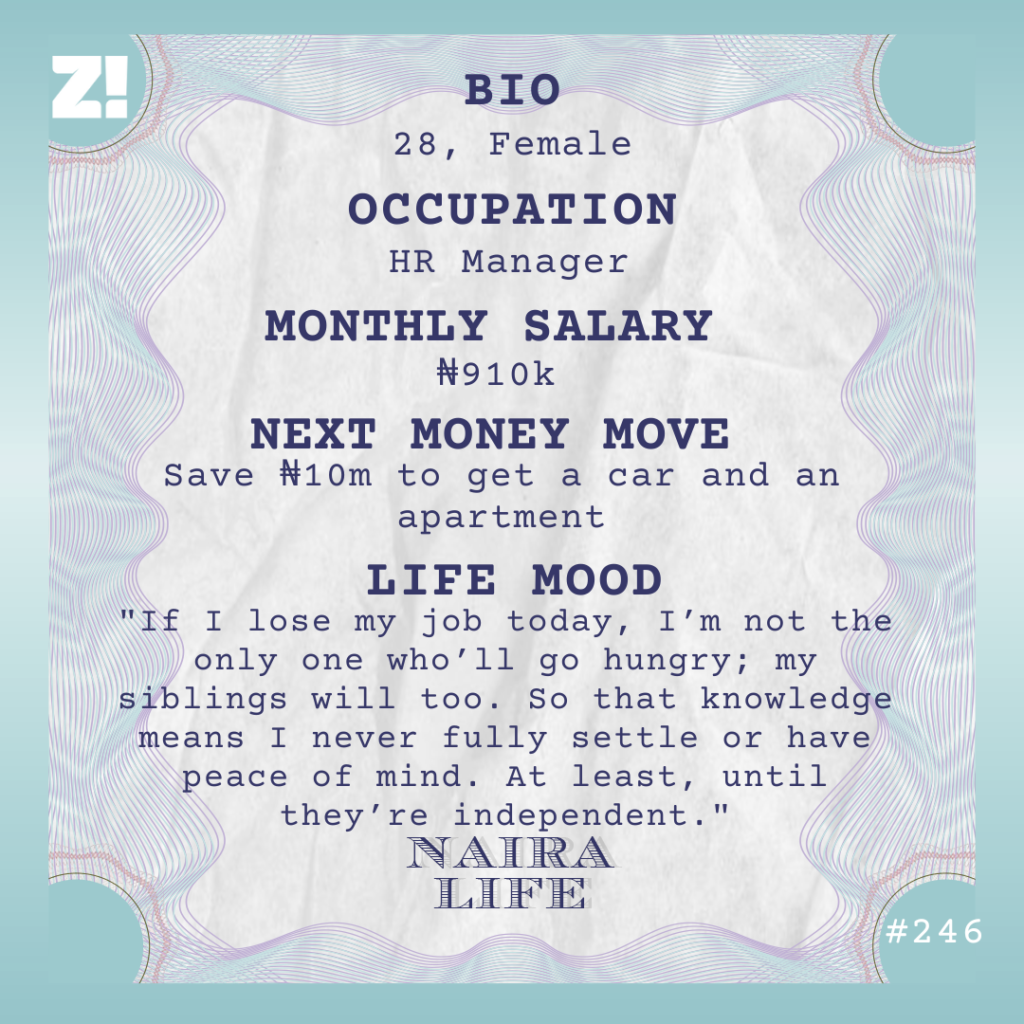

It gets crazier. In July, the company merged with a fintech company, and I got promoted to HR manager for the parent company, and my salary increased to ₦910k.

How did you react to learning about your new salary?

It’s a very dramatic story. When I saw the alert, I checked the payroll. The person whose name was next to mine had the same salary, so I thought it was a sorting mistake and I was paid another person’s salary.

The salary came in at midnight, as it usually does because my boss doesn’t live in Nigeria. When I saw ₦910k, I couldn’t touch the money. I sent a quick WhatsApp text to my boss explaining the error, and she just said, “It’s not an error. You’ll be briefed tomorrow. Goodnight”. Ah. How was I supposed to sleep that night?

LOL

I concluded it was probably a performance bonus, but it turned out to be a pay raise. It felt unreal.

What does this rapid income growth mean for your spending habits?

I still live the same lifestyle. A lot of my income goes into black tax. Two of my younger siblings are now in uni, and they’re sort of my responsibility since my dad went and married another wife.

Earning more has made my life a bit better. Dresses I used to think were too expensive don’t seem that costly now. But I’m being conscious about my spending. I want to sponsor my siblings’ education in a way that they don’t have to depend on me.

While that fear of financial insecurity has reduced, it’s still there. I work for a fintech after all, and anything can happen. But at least now, I can save better.

How much do you currently have saved up?

₦2m. Since I started earning ₦910k, I have saved ₦600k every month. Right now, I have two savings goals: A car to beat my daily cab costs and an apartment on the Island for proximity to work.

But I’m also saving so I can have something to fall back on if I ever get laid off. I’m even still job hunting and wouldn’t mind a remote offer, so I can do both jobs together. I want to move to a job that’s more stable, so I don’t have to worry about being laid off and losing my source of income.

Have you considered how much the car and apartment would cost?

I want a luxury car which will cost about ₦8m. An apartment would likely cost me ₦2m, but it’s a secondary need. The car is more important.

Are you still considering investments these days?

I’ve sworn off them. I’m so scared now that I can’t even put money in these fintech savings and investment apps. I have about ₦40k in Nigerian stocks and $180 in US stocks, but that’s about it. I’ve not gotten to the point where I can put my money somewhere other than traditional banks. I prefer to see it every day.

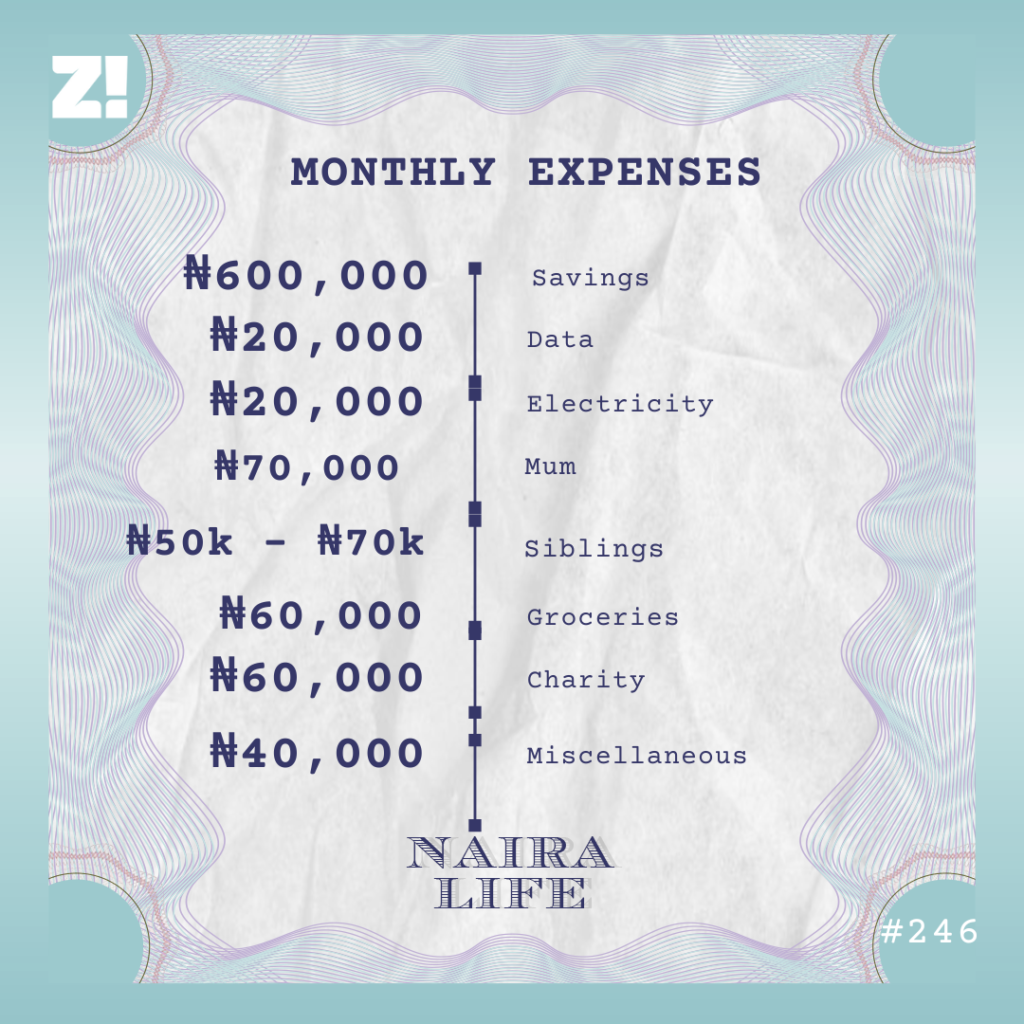

What do your regular monthly expenses look like?

Curious. What amount monthly would cancel the financial instability fear?

My short-term goal is ₦1.5m/monthly. That way, I can save ₦1m monthly and live on ₦500k. I hope to get that by 2024.

Long-term, I’d like to earn in dollars. Preferably $2k/month and above. Of course, I know I need to constantly develop myself to remain relevant if I want to get there.

How would you describe your relationship with money?

It’s been very volatile, but it’s beginning to mature. I’m now very strict with savings. Even when I had my birthday recently, I drew up a budget to outline how much I could use to spoil myself. I still fear financial instability, but I’ve grown more confident in my skills. I know that as long as I have these skills, I can always still make money.

How would you rate your financial happiness on a scale of 1-10?

6. I’m earning good money now, but I haven’t saved enough. I want to get to ₦10m in savings. I also still have a lot of heavy black taxes, and I’ll only be really happy when my siblings are less dependent on me because they have jobs.

If I lose my job today, I’m not the only one who’ll go hungry; my siblings will too. So that knowledge means I never fully settle or have peace of mind. At least, until they’re independent.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.