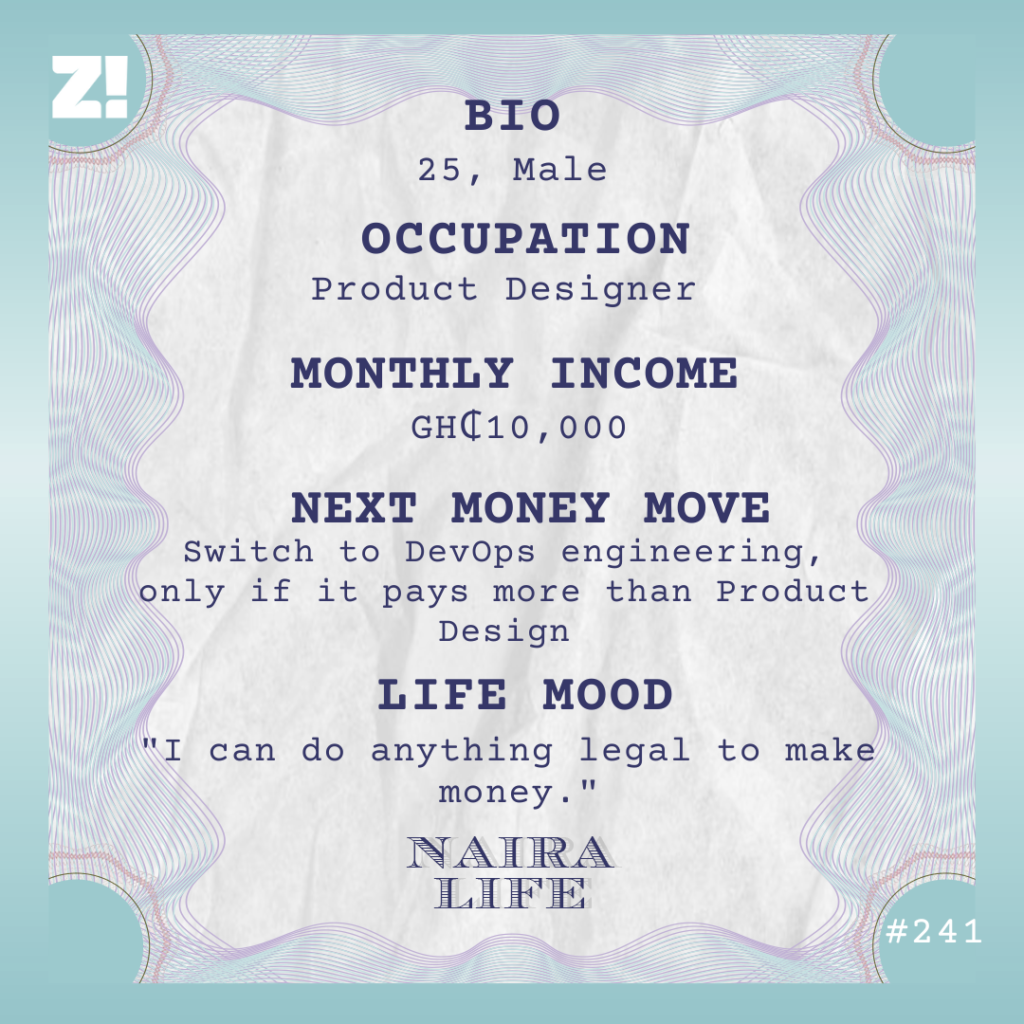

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I made my younger brother and I trek home for a week in primary school because I was saving money to buy a football.

Ah. What was his offence?

He was just a victim of my ambition, really.

Our parents gave us ₦20 daily for transportation and an additional ₦20-₦30 for lunch. I can’t recall how much the football was, but the plan was to save in my kolo for a week to raise the money.

I was responsible for my brother, so he couldn’t go home before or without me, hence the trekking. It turned out to be a wasted effort though.

What happened?

On the Thursday of that week, my mum saw us walking home while returning from her shop. Of course, I had to explain, and she was angry I made my brother go through that.

For context, the walking distance between school and home was about an hour and thirty minutes.

She revealed I wouldn’t even find any money in my kolo. It turned out she’d been using it to give her customers change at the shop.

Screaming. Was there money growing up?

There was. My mum was a trader, and my dad owned a petroleum tanker for African Petroleum before it became Forte Oil. He was also an executive in their petroleum tanker drivers association, so he was hardly home during the week. We looked forward to the weekends because he always returned with goodies. But everything changed when I got to SS 1.

How so?

There was a change of management at my dad’s workplace when Forte Oil acquired the company, which brought new rules. For example, they brought new type and model specifications for the tankers, meaning my dad needed to buy a new tanker, but he didn’t because he couldn’t afford it. He also wasn’t part of the association anymore because his tenure ended, and some benefits stopped.

I know all this because he sat us down to explain the situation. Our new financial reality meant I had to leave my school’s boarding facilities, which I’d attended for junior secondary school, for day school in SS one. He still got contracts to transport fuel, but it wasn’t regular anymore.

How did this affect the family’s finances?

It didn’t immediately become obvious that we didn’t have as much money. My dad protected us from it as much as possible. It was only after I failed my JAMB exam in 2013 that I realised we didn’t have much.

What happened?

I scored 166 on the exam, so we explored the A-level route. But when my dad and I inquired about the cost of studying petroleum engineering, they billed us almost ₦600k for the one-year programme. So, the plan changed to attending a polytechnic, though I didn’t like the idea.

I remember my dad saying, “You know this wouldn’t be an issue if things were like they were before,” and I had to be reasonable.

I got into a polytechnic the same year, but I still wanted to go to uni. So, I focused on getting good grades for direct entry. That meant no hustle till I finished ND in 2015.

What was the hustle?

I interned with an electrical company during my IT. The pay was ₦10k/month, but I got paid ₦40k during a two-month period — I was assigned to a special project where I had to work from early morning to late at night.

What were you spending money on?

Mostly on the direct entry application — I had to process transcripts, sort out school clearance, and then buy the forms. I was advised to also apply for HND as a backup plan, but I refused. Guess what?

Direct entry didn’t work out?

It didn’t. I also could no longer apply for HND as the time frame had passed, so I was stuck at home for another year. I’d left the internship because I thought school would work out.

To pass the time, I got a job with a family friend who had a microfinance firm. They collected daily contributions from traders, and I was a marketing officer — a posh name for a money collector.

How much did it pay?

₦15k/month. But my boss — because of her relationship with my family — used to give me random lunch and transport money.

Although I didn’t spend much from my salary, I couldn’t save because I sometimes made mistakes when recording the amount I collected daily. When this happened, I used my money to balance up the difference so there’d be no story.

When it was time to apply for uni again, I took up an additional job at a JAMB tutorial centre where I taught in the mornings. I got paid the odd ₦3k or ₦4k/month for teaching, but the payment wasn’t structured —the centre was new and was owned by someone I considered an area brother. I honestly did it to help myself prepare for JAMB, considering I had to cover the syllabus to teach the students.

You did JAMB again?

I wanted to give myself more options, so I applied for both direct entry and JAMB. I wanted to ignore HND again, but my dad insisted and gave me the money for the form. Thank God he did, because both direct entry and JAMB didn’t work out.

Ah

I dropped my uni dream and faced my HND squarely. Before leaving for school in 2017, the area brother I worked with advised me to do a little bit of everything, so I decided to do anything legally possible to make money.

I started writing and joined a couple of writing communities, where someone introduced me to ghostwriting gigs. He got the clients, and I’d write for him at ₦1 per word. The gigs weren’t regular, but I remember getting two gigs that paid ₦10k and ₦40k at some point. I did that for a semester before I stopped working with the guy. I found out he got paid as much as ₦5/word but only paid me ₦1.

Did you try getting the gigs on your own?

I didn’t have the connections, so I dropped the gigs. I still wrote because I got into campus journalism in 2018. But I didn’t get paid for that.

Interestingly, campus journalism led me to tech.

How did that happen?

In February 2018, someone I exchanged contacts with at a program for journalists posted about a digital skills training for students who were home during the ASUU strike. I was interested in web design, so I paid the ₦6k fee and attended the two-week training, using a friend’s laptop to practise what I learned. A couple of months after the training, I got my first web design gig.

How?

I was part of the press council in school, and I pitched the idea of having a web presence. I charged ₦25k to design and build the website.

Did you get more web design gigs?

The guy I mentioned earlier wanted to bring the training to my school. Let’s call him B — he’ll come up a few more times.

We got closer, and he noticed how committed I was to pushing the startup. So, B made me a campus ambassador, giving me access to learning skills like graphic design, social media management and digital marketing for free.

Also, B regularly referred me for web design gigs for a small cut. A gig could be ₦60k, and I’d pay him ₦10k as a commission. In 2019, I made approximately ₦50k/month from the gigs.

This was enough to get me a ₦53k smartphone when my phone had issues. I also paid my tuition that year. It felt good to be able to do things with my money without having to call home.

But I was still using my friend’s laptop, and when I graduated in November 2019, I realised I no longer had something to work with for the gigs.

Yikes. What did you do?

I had about ₦20k in savings, which couldn’t buy a laptop, so I went back to live with my parents. I got bored after one month, so I worked with a tech consulting company for a month-long unpaid internship as part of an entrepreneurship program. I moved in with a friend who lived closer to the company to save money and to get away from home.

What happened when the internship ended?

I got a reality check. I had no source of income and was broke. I considered returning to work as a marketing officer for my family friend, but B came through.

He brought me on as a tutor at his digital skills training startup, and I started teaching there on the weekends. I taught graphic design, web design, digital marketing and social media management. I got paid ₦4k for each session and roughly ₦32k to teach one class per month. And I taught four classes.

Not bad

With this income, I got a laptop for ₦80k in March 2020 to resume my gig hustle. B introduced me to someone in the U.S who needed a social media and web manager, so I took up the role in addition to my tutoring. That paid ₦50k/month, but it lasted only three months.

Why?

Some personal issues led to a mental breakdown, so I quit both jobs and deactivated my social media. My U.S boss tried to persuade me to take a one-month break and offered to pay for therapy, but I was just really tired of the work. I knew accepting the help would make me indebted to her, and I’d have to return. I didn’t want that.

Sorry you went through that. What did you do next?

After I got better, I borrowed ₦40k from my mum and applied to a program to learn product design. Three months later, B introduced me to someone who wanted to build a mobile application. I got the gig and was paid ₦90k. I remember being so shocked that I could earn so much for a one-time thing. The first thing I did was pay off the debt I owed my mum.

So, you added product design to your hustle

Yes. It was also when product design became more popular in the tech space. B decided to add product design classes to his training, and I handled the class for ₦4k per session as usual. That was all I did for a while because I kept getting rejections on job applications. Both junior product design roles and internships –everywhere rejection.

Omo

In 2021, B reached out and pitched the idea of both of us co-founding a fintech startup. My job was to design and manage the product to save us money, while B provided the finances. It was awkward being a broke co-founder, but it was also an avenue for me to build my portfolio. It helped give me a sense of purpose, too — I was building something.

How did that go?

We’re still trying to get funding, so we’re still at it. But I finally got a ₦250k/month junior product design job in September 2021.

That was after over a year of unemployment

Omo, I felt free. I had to relocate to a new city because it was on-site. Fortunately, I found a friend who’d paid for his apartment before leaving for South Africa. So, I lived rent-free for the five months I worked at that company.

You left?

I got into an eight-month-long, fully-funded tech entrepreneur training program in Ghana. While I could’ve kept my job, I wanted to give the program my full attention.

I was paid a ₦40k (GH₵ 600) monthly stipend, which I didn’t really spend because data, transportation, food and accommodation were already paid for. I sent money home periodically, though.

But after the program, I returned to Nigeria and my eyes cleared.

Let me guess. No job?

Back to square one. I’d also run out of my savings and had no income for about five months. Luckily, I got a gig in December 2022 to design a product and mobile application. I was supposed to be paid ₦700k but only got ₦500k. The person still owes me, but that money lifted me out of poverty.

LMAO. How did you survive when you were unemployed, though?

I borrowed a lot from my mum and younger brother. So, the first thing I did was clear my debts and used the rest to do fine boy. I also travelled to see my girlfriend — now my wife — because our relationship had become long-distance when I was in Ghana. It was as if I knew I’d be returning to Ghana.

Why did you return?

I’d applied for a job while I was still running the program, and they offered me the job in January 2023. The salary was GH₵ 10,000 — about ₦600k — but I had to be on-site for three months. Of course, I accepted.

I mean, it’s ₦600k

After three months, they agreed to let me work fully remotely, so I returned to Nigeria. I still work there on the same salary, but the exchange rate in the past two months means my salary now moves between ₦725k and ₦820k.

Has your spending increased with your earnings?

Somewhat. I try to be more intentional with my savings now, but the last six months have been capital-intensive. I had to fund my wedding, rent and furnish my apartment, which cost about ₦2.5m in total. 80% of that went into the apartment, though. We had support from family for the wedding.

But now, I only focus on spending on essential things. I don’t do delayed gratification if the item is important because if I don’t buy it now, the price can change tomorrow. I also take emergency savings seriously. Then there’s the regular savings and investments in fintech apps.

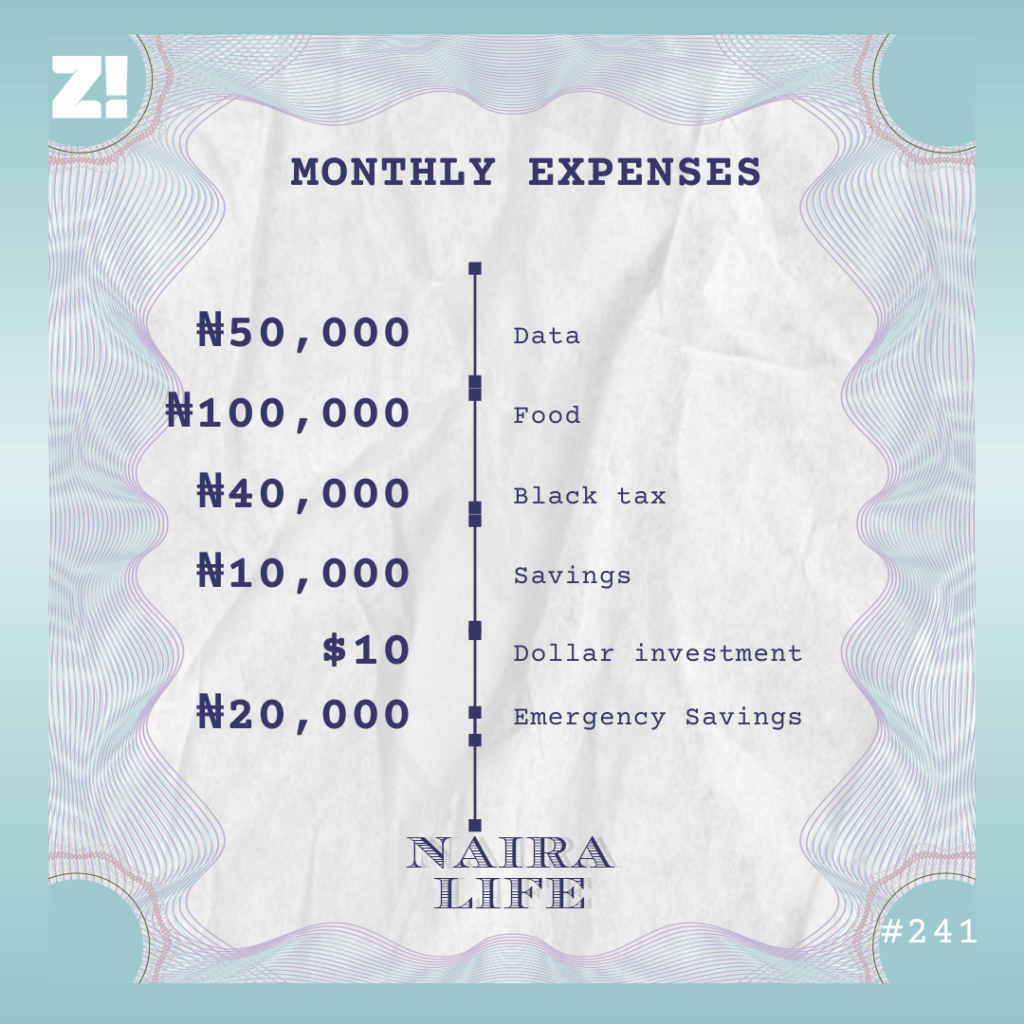

What does this look like in a month?

There are other expenses I can’t account for now because they seem intangible, so I’ll just tag them as miscellaneous. My savings and investments portfolio is currently around ₦300k – ₦400k, but now that I’m off capital-intensive projects, I should be able to grow it more. My target is to finish the year with a portfolio of above ₦1million.

How has your view on money changed over the years, coming from almost no income?

Having money gives you confidence and leverage. It can practically solve almost 90% of the issues people have.

It’s good to have money, and it should be spent. I believe that it’s the money that I spend that’s truly mine. So, I don’t usually have money lying around. Before the money comes in, I already have what I want to use it for.

How are you thinking of long-term career plans?

Honestly, anything that’s paying me handsomely. I like to say I can do anything legal to make money. Product design is still paying me at the moment, so I’m still here. I’m also considering DevOps engineering and have started taking courses. If it pays me more than product design, I’ll switch to it. I’m just pursuing financial stability.

What does financial stability look like to you?

At least, ₦1m – 1.5m/monthly. Or preferably in dollars. $2k/month isn’t bad.

How happy are you financially? The scale is 1-10

4. I’m not in debt, but I’m not liquid enough. I want to get to the point where I have heavy investments and can also become unbelievably liquid.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.