Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

My parents would give me ₦20 or ₦50 for food in primary school, and I’d spend everything before I got to school.

Wait… how?

I walked to school with my siblings and neighbours, and we bought anything we saw on the road — puff puff, popcorn, sweets, you name it. The money never followed me to school, and I’d power through the day and trek home after school.

Would you say there was money at home growing up?

We were a basic middle-class family. School fees were paid on time, at least. My mum’s a banker, and my dad did everything he could for money. When I was younger, he sold cars. He’d bring in cars from Benin Republic and Cotonou and sell them to buyers in Nigeria. It wasn’t fayawo [illegal importation], sha. He also did some construction and cleaning gigs at different points in time.

I had a comfortable childhood, so making money wasn’t top of mind for me as a child.

So, when was the first time you made your own money?

It would’ve been during my fourth year in the university, around 2016. My ₦20k monthly allowance always finished within two weeks. So, I decided to start a business to make extra income and worked on a whole plan. But I told my mum, and she refused to give me money for it.

Why? What was the business idea?

I was going to buy shirts at ₦300 each and sell them to law students at ₦500 so I could use the profit to hold body and soul together. I think I asked her to give me ₦20k – ₦50k to start.

She insisted I focus on school instead.

Did you?

Sort of. At least, I didn’t try anything for money again till after university in 2018. That was the actual first time I made my own money, and I made it by grooming a dog.

How did dogs get in the picture?

Well, I grew an interest in dogs in uni. A schoolmate and I became friends because he had a dog I grew fond of. I tried to convince my parents to get a dog too, but my dad said, “In my family, we don’t keep dogs because the dogs always die.”

Ah

But after my dad passed in 2017, we were robbed. I was away at school, so I only heard that my mum eventually decided to get a security dog.

After I left university, my mum and siblings stopped giving me free money. I noticed many of our neighbours had dogs too, so I approached one of them and offered to groom their dog.

I bathed the dog, cleaned its space, and took it for a walk. When I returned, the owner gave me about ₦3k.

Interesting. Did that happen often?

I did a few other grooming gigs here and there. Then I convinced my mum to sell the dog she’d gotten — a German Shepherd and Boerboel mix that was more fearful than protective — for a fiercer purebred Rottweiler. I’d take the dog for walks regularly and meet other dog owners. People soon knew me as the guy who was always with one dog or the other.

I’d also get fellow dog people’s numbers, with the intention of contacting them when my dog had puppies. Sadly, I never really had a successful litter myself — most of the puppies died — but I became a middleman for people who wanted to sell puppies and those who wanted to buy.

How much did this usually bring you?

At first, I made ₦5k – ₦10k on each purchase I helped facilitate. The buyer or seller would give me something small, or I’d add something on top. I got like two or three of these deals monthly. My mum was so supportive; she’d occasionally pitch in with money to buy dog food.

2020 was my big break — the lockdown, specifically. That was when I got my first major payout. Over the years, I’d made myself something of a dog breeding expert on Twitter by researching and sharing long Twitter threads about caring for different dog breeds and all that stuff.

So, this person reached out to me for help. He wanted to buy a purebred Boerboel. I mentioned one random price, and he didn’t even negotiate. I also said he’d need feed and a cage, and he sent me the money for it. The guy hadn’t even seen me before, but he sent me over ₦400k. I made ₦80k profit on that one deal alone.

If 2020 was your big break, it means you got other profitable gigs, yeah?

I did. I’m not sure why, but people bought so many dogs during the lockdown.

I became friends with a vet who had a medical pass to move around because of his job, so we’d go together to different people to groom, treat and sell dogs. I made about ₦100k/month in 2020 from clients I mostly met on Twitter. There’s a huge community of dog owners online o.

Did you know anything about this community before you started?

I didn’t. All I did was come online to talk about dogs, and they found me. Whenever I shared health and wellness tips for different breeds, random people would DM and be like, “Oh, my dog isn’t eating. What should I do?” or “My dog isn’t barking well. What do you advise?”

Those questions pushed me to research more on YouTube and Google search, so I could help them. In return, they recommended me to other dog owners. Others would come and ask me to recommend dog breeds they could buy.

I didn’t highly mark up my prices on dog sales at first. Someone could say they wanted to sell a puppy for ₦180k, and I’d just add ₦20k. The price would end up being more reasonable and sell faster than others who’d put up the same puppy for sale at ₦300k. So, people trusted me.

Can I tell you something?

Please do

Dog money is one of the easiest money you can make. Someone can just wake up and say they want a ₦500k puppy, and the seller agrees to sell at ₦300k. You easily make ₦200k on one single transaction.

Why did you increase your markup?

Omo. I got tired of making ₦5ks and ₦10ks in late 2020 and decided I only wanted to serve people who could pay premium prices. Plus, my low prices started to drive high-paying customers away. When we discussed prices, they always thought the dogs were too cheap to be purebred. No one told me before I gradually started charging well.

Nigerians spend good money on dogs o. In 2022, I facilitated my most expensive single sale yet. It was an adult female Boerboel which I helped transport from Ghana. It cost ₦1.5m, and I didn’t add anything to the price because I wanted to build a relationship with that client. He gave me ₦50k for my stress, though. The dog’s owner also gave me ₦20k.

₦1.5m…

Around Christmas 2020, I added dog boarding to my services. Money from dog sales was good, but it was also unpredictable. So, I told people they could bring their dogs to stay with mine whenever they travelled and just drop money for food. The first client brought his three dogs for the holidays and dropped ₦100k for food.

At first, I didn’t have a fixed price. I charged based on the dog’s size — to determine how much they needed for food — and how long they intended to stay. Now, I charge ₦3k per day. I board dogs all year round, in addition to helping to facilitate dog sales.

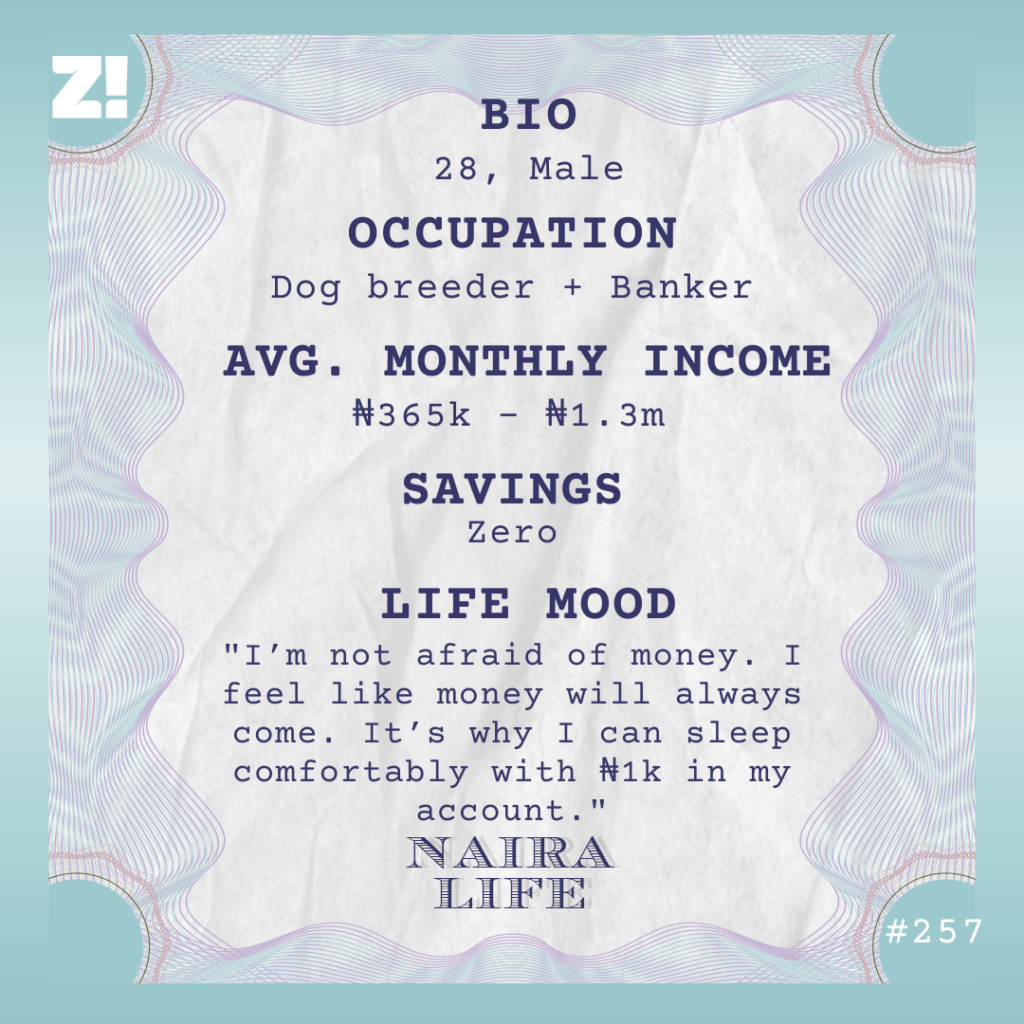

How much does this typically bring you in a month?

In a bad month, I make approximately ₦200k from everything dog-related. January, June, July and December are my best months. I think it’s due to a combination of people travelling and 9-5ers getting mid-year bonuses. In those months, I can make up to ₦1m. That’s minus my bank job.

I was coming to that. When did a bank job enter the picture?

In 2022. You know how I said dog money can be unpredictable? Add that to the fact that I’m not a saver — seeing money in my account is reason enough to spend it — so I can be really broke if nothing comes from dog sales in a while. There was a month I didn’t make any sales, and only earned ₦10k from a dog I boarded. I had to sell my TV to supplement my income.

I first tried to get a bank job in 2021 through my uncle, but I failed the interview. Then, I took up a small marketing job at an e-commerce company. My salary was ₦80k/month. In 2022, I applied to the bank again, passed and got the job. It pays ₦165k/month, and an additional ₦165k every quarter. But I like to tell people I’m not a banker. I’m a dog dealer and breeder who happens to work in a bank.

LOL

I do love my bank job, though. I’m a marketer, but it isn’t stressful because I have a chill boss. However, I can easily double my salary with just a few dog transactions.

I feel you. Let’s talk about your relationship with money

I’m not afraid of money. I feel like money will always come. It’s why I can sleep comfortably with ₦1k in my account. I can wake up the following day, and something will bring ₦100k to me.

However, I know I spend a lot. So, I’ve resorted to writing down every single thing I spend on so I know where my money is going, at least. I’ve done this for a few years now, and it’s helped me keep track of my expenses. That way, I know I spent 10% of my income this month on airtime, for example. Or that I spent 50% of it giving it away to people.

Speaking of, dashing people money is a big problem. In 2023, I gave out a total of ₦1m to people, and I made ₦9.3m that year. That’s about 11% of my income, and I don’t even pay tithe in church. I want to learn how to say “no” to people in 2024.

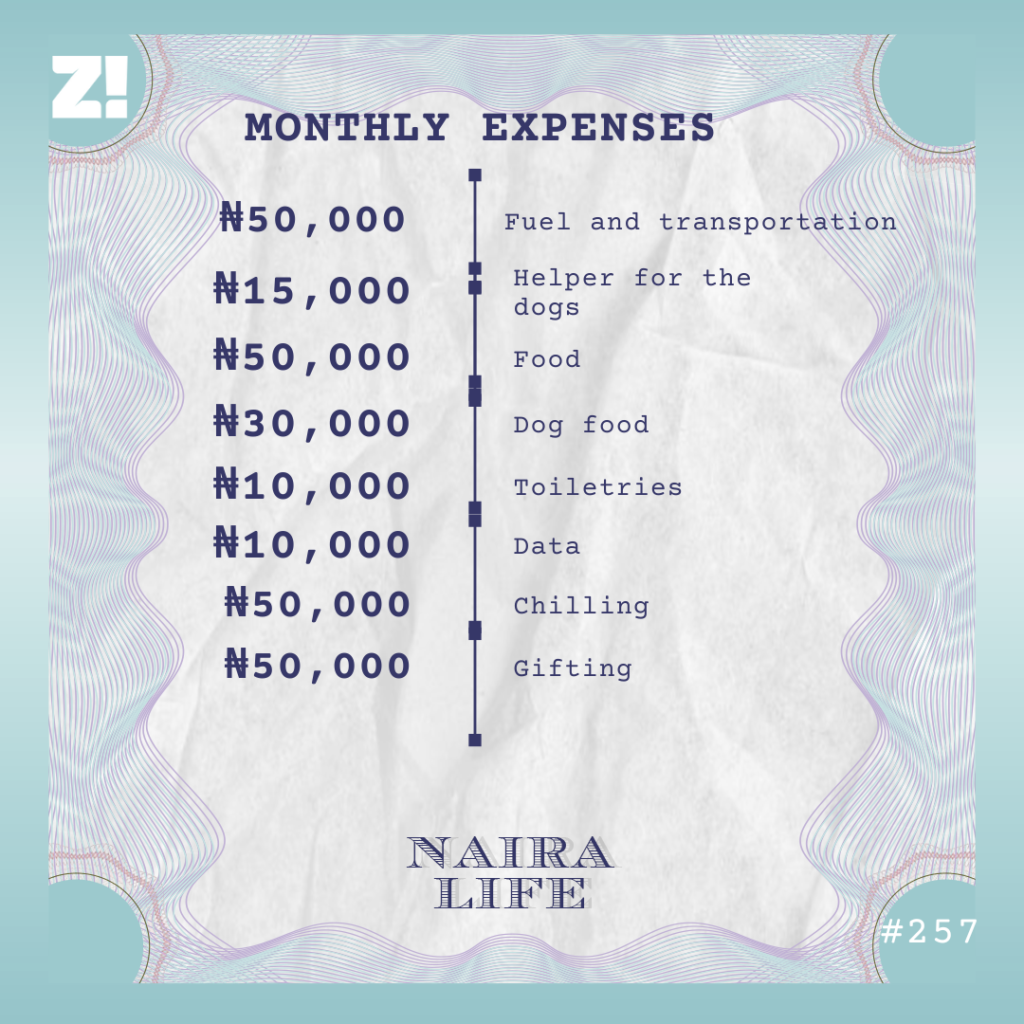

What else takes your money? Let’s break it down for a typical month

I live with my parents, so I don’t have to pay rent. What I spend on dog food depends on how many dogs I have in my house that month. Sometimes, I spend up to ₦50k.

Up until December 2023, I was in a ₦100k/month ajo contribution to save for my car. I started in January, but it hadn’t amounted to much in August when I bought the car. The car cost ₦2m, and I took a ₦400k loan from a neighbour to complete it. Even the loan, I had to sell one of my dogs to repay it because some money I was expecting didn’t come through.

Out of interest, what do your finances look like at the moment?

I currently have zero savings, but I plan to save ₦1m this year. That means I’ll need to take out ₦80k every month and leave it in a savings app.

What’s something you bought recently that improved the quality of your life?

I was going to say the car, but it didn’t improve anything. I’m always fixing one thing or the other. I recently had to pay ₦90k to fix something. Yesterday, the mechanic said I should bring another ₦140k.

But I plan to do something for myself this year. Before the end of the first quarter, I intend to use my leave allowance, which is ₦100k, for a staycation weekend. I’m considering a neighbouring state, so I can spend about ₦75k on transportation and hotel fees. Then, I can use the remaining ₦25k for food.

Is there something you want right now but can’t afford?

I’d like to own a house. It feels like the next sensible step after buying a car. I’ve made some enquiries about a mortgage arrangement in an estate in my city. Buyers need to pay ₦3m upfront for a two or three-bedroom bungalow, and you can spread the payment annually over 15 – 20 years. The houses are worth ₦15m – ₦25m on outright payment. I can’t start the mortgage this year, though. Maybe next year.

How would you rate your financial happiness on a scale of 1 – 10?

7. Apart from the house, I don’t think there’s anything I want that I can’t get. It may just take a while. But I want to be rich-rich so I can buy a ₦30k shirt without thinking too much about it or feeling like I’m spending too much on myself. My dogs even enjoy my money more than I do.

What do the next few years look like for you? Will you stay in banking?

I should. I see myself getting promoted this year, and that could bring my salary to ₦400k.

Honestly, I don’t think I will ever be broke again. If I lose my job today, I can go into cab driving. If that doesn’t work, I can become a POS agent or go and be bathing someone’s dog every week. I just know I can’t go back to urgent ₦2k levels of broke with the amount of things I can do.

Plus, like I said, I’m not afraid of money. I have less than ₦5k in my account right now, but I know there will always be something. Things can be bad for one week, but it can never be bad for one month.

Is there something else you’d like to share that I didn’t ask?

There’s plenty of money in this dog business, but I’ve also lost a lot too. I once brought in a dog from Ukraine that cost about ₦1m, and it died after it got to Nigeria. I’m still not sure what killed it because there was no money for an autopsy. Obviously, I didn’t get anything from that sale.

There was another one from Serbia that accidentally got hit by a keke while I took it for a walk. I paid ₦70k for surgery and treatment, but it still died. Or is it when I’d just wake up and find one of my dogs dead? Now, I try not to put myself under undue pressure. Dog wey go die go die.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.