Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s take it back. What’s the first thing you did for money?

From JSS 3 to SS 2, I wrote notes for my classmates who didn’t want to do it themselves and charged ₦500 to ₦1k for it. On average, I made ₦4k-₦5k per month.

What were you doing with 5k in JSS?

I paid a school prefect ₦2k, so they’d tell the other senior students to leave me alone.

But the rest was still a lot of money. My favourite meal was ₦50 bread and ₦40 akara. Imagine how many I could buy from what I made.

A lot. Was there a reason you stopped writing the notes in SS 2?

I had an easier way to make extra money — my friends paid me to sit beside them during exams or do their assignments or projects for them.

Was bread and akara the only reason you were hustling for money?

I don’t know why I started, but I suspect the state of my parent’s finances was a key factor. My dad repaired and sold computers and my mum worked in the civil service. My dad’s business had its on-and-off seasons, so we had to rely on my mum’s civil service and occasional loans during the off months.

So, while they sent me ₦1500 to ₦2000/month, I could tell it was a struggle to do it. And I had three siblings they needed to worry about, too.

Nothing much else happened until I got into university in 2014 to study systems engineering — I always knew I wanted to do something related to computers.

Where did the interest in computers come from?

My dad. I grew up watching him repair and sell computers, and I started playing with them when I was about four years old. However, I wanted to do higher-level stuff than my dad ever, and studying a computer course was the first step toward that.

But one thing temporarily stood in the way.

What was it?

Again, my dad. He had a stint in the military and wanted me to go to the Nigerian Defence Academy to study engineering. Luckily, I knew something he didn’t about the application process and used it to my advantage.

If you wanted to go to the NDA, you needed to buy a JAMB form and a separate NDA application form. My dad thought I only needed the JAMB form, and I didn’t correct his assumption. Of course, I couldn’t proceed with my application or write the NDA entrance exam.

With that out of the way, I changed my institution of choice on the JAMB form and chose systems engineering.

Bruh. Did he ever find out?

Yes. But it didn’t matter because only had to pay my school fees for the first year.

Because I was on a first class at the end of my first year, I got a few scholarships that ran into ₦400k/year. The only term was that I had to maintain my first-class grades. I knew I wouldn’t have to worry about money until I left uni.

What else happened in uni?

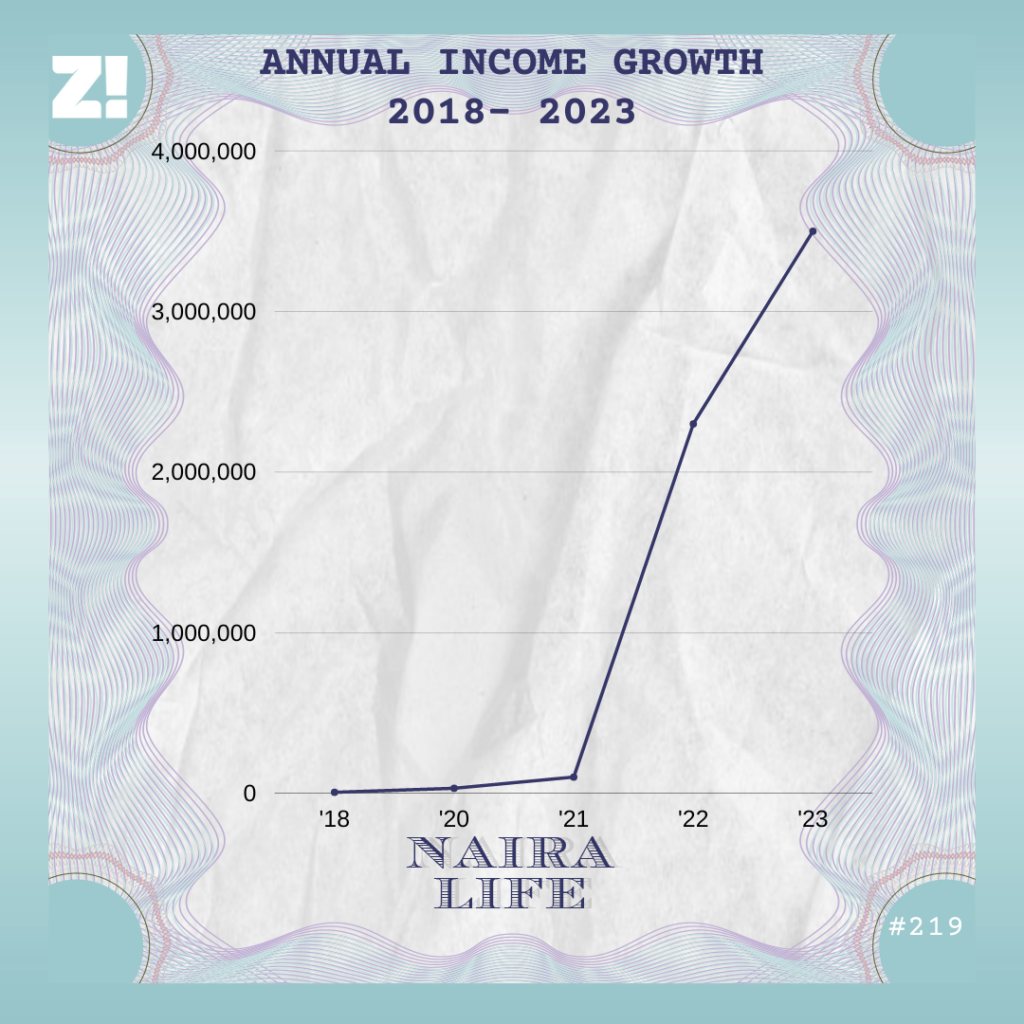

In 2016, I learned C-sharp as part of my school work and Java, thanks to a government-funded program. Before I got to my third year, I’d gotten good at it and a learning organisation hired me as a training instructor. My salary was ₦50k.

I worked there for a year before I left for my IT in 2018 where I worked as an Android developer.

Was it a paid gig?

A ₦5k/month stipend. It’s interesting because it was a cool startup and everyone thought they paid well. I had the scholarship money, so I didn’t mind.

I was more concerned about not enjoying Android development the way I thought I would. I needed to find and explore other options.

About three months into my IT, a friend dragged me to a conference organised by a non-profit organisation. To be honest, I went for the food. But I heard about data science for the first time, and I was curious. Something about using data to drive value and artificial intelligence sounded interesting.

What steps did you take after that?

I went to a few boot camps and participated in hackathons. In December 2018, my team of four won a hackathon organised by a bank and the NGO that introduced me to data science. The prize money was ₦1m. Also, I got ₦150k in monetary rewards for winning in some other categories.

Best in everything

The hackathon lasted for three days, and I made ₦400k at the end of it. From that moment up until I graduated, I was balancing side jobs with school and living on the random ₦50k-₦100k that came by and my scholarship money.

How were you moving money?

I wasn’t spending money on myself: I was squatting with a friend and using the school internet. But I was big on sending money home. For the most part, half of what I made in a month went home. I was also heavily involved in the tech communities I was in. If there was a community event, the organisers could count on me to drop ₦30k – ₦50k.

I went for another edition of the hackathon at the end of 2019, and my team won the ₦1m prize money again. When I graduated a few months later in 2020, I had ₦756k in my savings — my share of the hackathon’s prize money and the projects I worked on during the previous months. The most interesting thing, however, was that three companies were interested in hiring me.

A flex

Haha. After praying about it, I had this conviction to go for whatever offer I got first. When the first offer came, I saw that I’d be a graduate intern and get paid ₦30k/month if I accepted it. My first reaction was, “Which one is this again?”

But I decided to trust my gut and accepted the role. However, my plan was to leave if the other companies reached out with better offers.

Did they?

They reached out but they also offered me internships and salaries of ₦50k. I decided to stay for the experience and optimise for growth.

What did growth look like for you?

The company had the most interesting clients and projects. Because of this, data engineering entered the mix and became something I was interested in.

Why?

I wanted something that was close to software engineering and wasn’t as popular in Nigeria at the time. Besides, data engineers are big players and their job is to provide the right data for the data scientists.

So I started figuring out how to transition into data engineering.

The best path forward was to enrol in a data engineering certification course. The one I wanted cost ₦350k, which I couldn’t afford on my salary, even though it’d been increased to ₦40k. So I spoke to the company to pay for the course and deduct ₦15k from my salary every month.

Now you had ₦25k/month

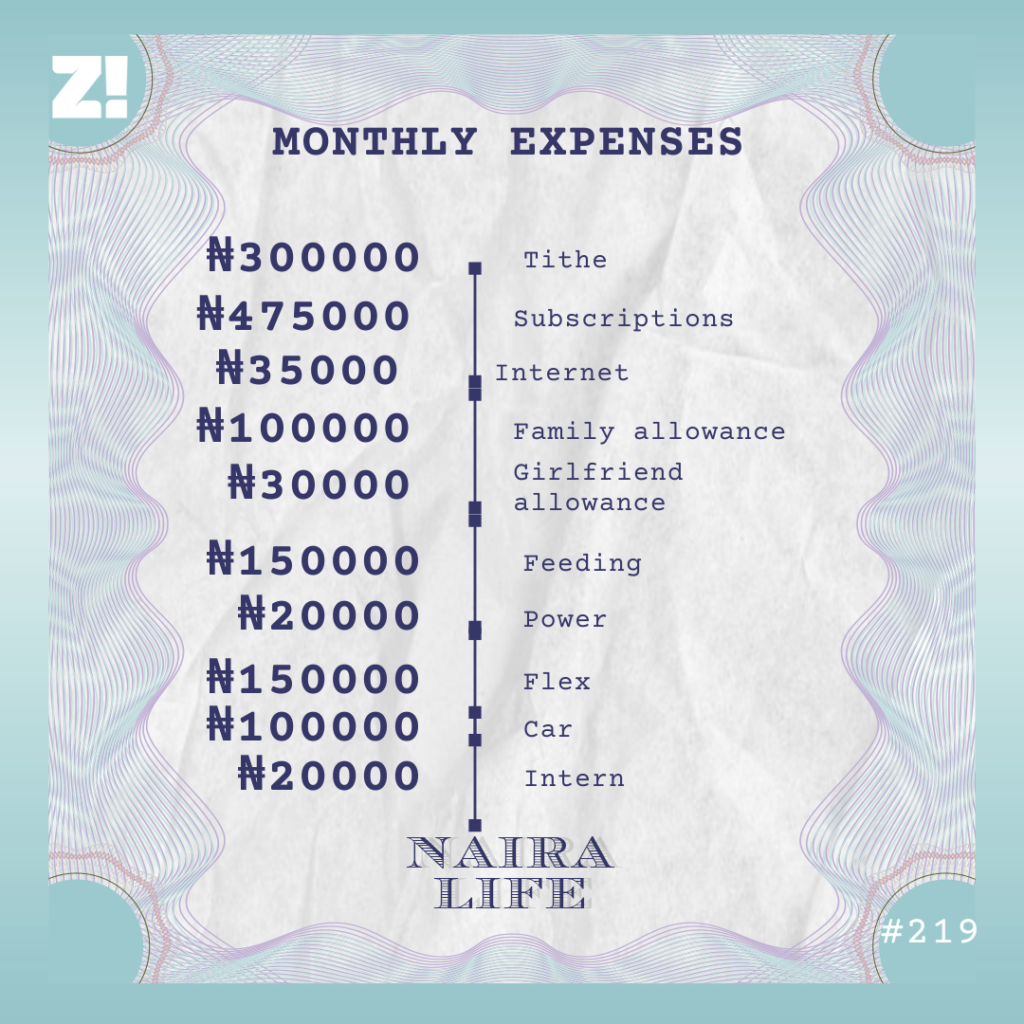

My internet was ₦20k and my tithe was ₦4k, so I was left with ₦1k. I lived on my savings from school, which was running out fast because I gave my parents ₦20k/month and also supported them with ₦400k to pay the rent.

I’m curious. Were you applying for other jobs?

I was. My salary expectation was ₦250k-₦300k, but no employer wanted to pay up because I hadn’t done NYSC.

In the short term, I started working on side projects again, which brought in between ₦50k-₦100k/month.

When did you go for NYSC?

I couldn’t go until December 2020 because of Covid. After returning from camp, I didn’t get a chance to speak to my boss about a possible raise until January 2021 — I’d written and passed my data engineering course, so I thought it’d give me more bargaining power.

How did that go?

The company offered me ₦50k, and my boss asked me to take it because the federal government was going to pay me ₦33k. I walked out of his office and never returned.

Man, what was the plan now?

I interviewed with a new company almost every day in January 2021. The highest offer I got was ₦50k, and they all gave the same reason for lowballing me.

Let me guess: NYSC?

Yes! I finally found a company willing to do ₦100k in February, and I worked with them for six months.

What happened after?

In July 2021, a company I applied to in 2020 reached out. After the conversations, they made me an offer.

How much?

₦500k. But I didn’t accept it immediately — I was hoping that the company I was working for would make me a better offer because I was due for confirmation. Also, I was working on a major project.

When I saw my new offer of ₦125k, I bounced and accepted the job offer waiting for me.

One month into the job, the management of the company switched to paying in dollars because of the price fluctuations between both currencies, and my salary was adjusted to $1200. After converting to naira on the black market, my net salary was between ₦650k – ₦680.

Nothing major happened until November 2021. A client sent me a link to apply to a freelance platform, which I did and got a consulting gig there. I was charging them $20/hour and making about $3200 a month.

Now, I was earning about ₦2.3m/month from my main and side gigs.

Sweet. That must mean a lot.

Man, it did. It gave me the freedom to start something I’d always wanted to do — clear my parents’ debt, which was about ₦2m. I started paying it off in December.

It was in the same month I started interviewing with a big tech company. I was big on working with this company and even had a job alert created for them. The moment I saw a role I was suited for, I applied for it immediately.

Fast forward to May 2022, I got the job.

The salary was ₦1.6m/month after tax. But the company had a policy: their employees couldn’t work on consulting or freelancing gigs that’d affect their jobs. My side gig at the time demanded that I worked eight hours a day — it was almost like another full-time job.

It sounds like you had a decision to make

I did. I was torn between taking the offer for the big name and making do with the pay cut. Or sticking with my current job and making extra money with my side job, even though it was costing me my mental health.

Ultimately, I went for the big tech job. Besides, there were additional perks that came with the job.

Tell me

$50k worth of stock with a vesting period of four years, housing and car allowances, and my signing bonus—

One question. What’s a vesting period?

When you join a company that gives you stock options, you will receive a percentage of your options every year over a period of time. When your stock options vest, it means that it’s available for you to buy.

Gotcha

My signing bonus was about ₦4m, and I took ₦3m from my savings to buy my car. The company also pays my rent — ₦2m/year.

I was happy with this, but something else happened. At my former workplace, I worked with a client that was sad to see me leave. Three months after I started my new job, they reached out to me about a consulting deal. The term was pretty much like “Give us two hours of your time every day, and we’ll pay you $2500/month.”

Get out!

The good thing is that the job is mostly a breeze, except for the very few times I’ve had to work all weekends. It’s not free money, but it almost feels like it sometimes.

Omo. How much do you make from both jobs?

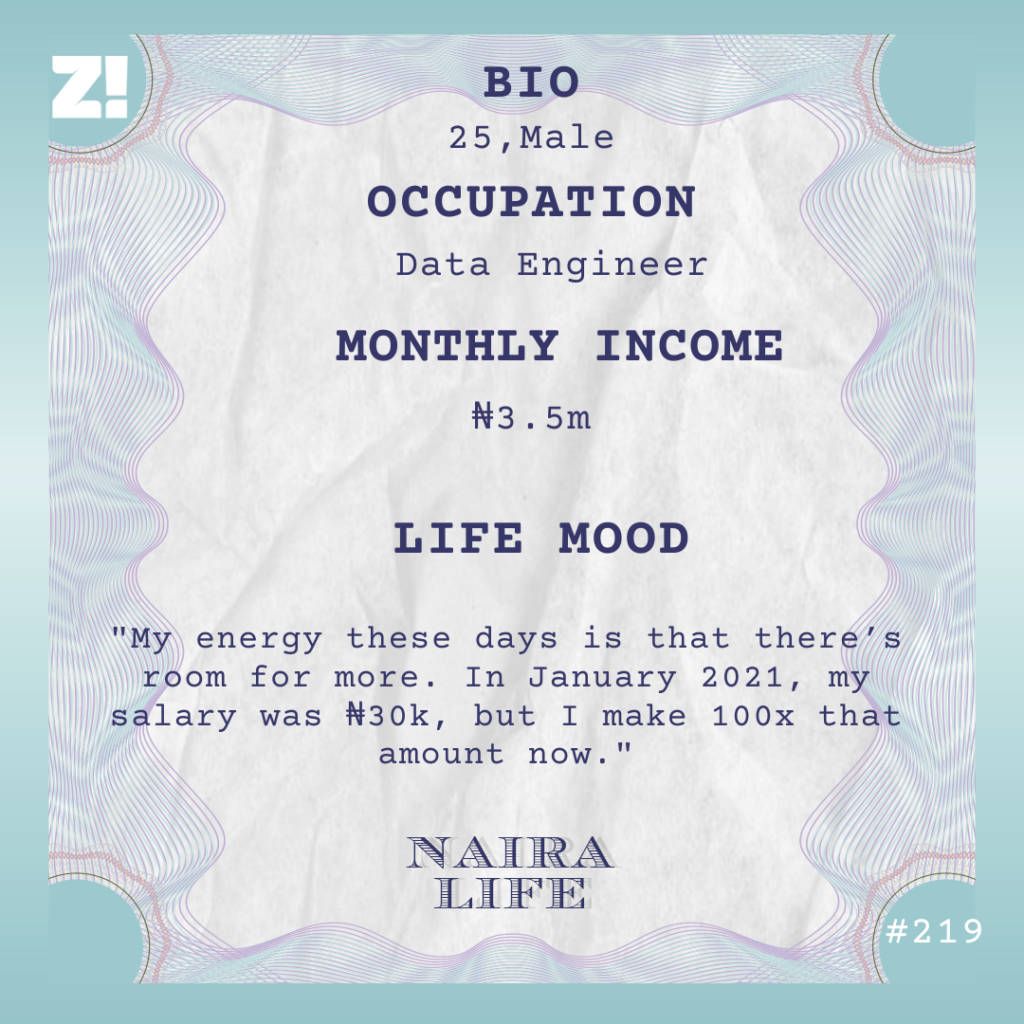

₦3.5m/month.

Big energy! What couldn’t you do before this jump that you currently do?

Once I got used to the money, I started looking at investment opportunities. Fortunately, my current company makes it easy. As a staff, I get to buy the company’s stock at 90% of the market price. Also, while other people would have to buy in dollars, using the black market rate, the company charges me for it with the CBN rate of ₦420/dollar. So I get more stock units for less the price.

Since October last year, I’ve been buying $200 to $250 worth of company stock every month. At the moment, I have $14k worth of stock in my account, including the vested $12500 worth of stock.

Mad. What’s something you invested in that didn’t work out?

I tried some Agri-tech investment last year and lost the ₦400k I put in it. I guess you can’t win everything.

Now, if I don’t trust that an investment will build wealth for me, I won’t touch it. I now know it’s best to save your money in dollars than put them in high-risk investments.

Back to your income. How do you stay on track of things these days?

Everything that leaves my account is recorded in a spreadsheet. But I split my main income into two — I buy stocks with $200-$250 and live on the rest. From the $2500 I earn from consulting, I put $1k in my emergency fund and set aside the remaining $1500 for projects. At the moment, I’m saving up capital for a business opportunity I’m pursuing soon.

What’s it about?

I know a lot about cars. Also, my mechanic is my best friend. We’ve been doing some research into buying high-end accidented cars, fixing them and reselling them in Nigeria, and the numbers look good. For example, you’ll spend around ₦6m – ₦9m to bring a 2013 RX 350 car into Nigeria, do some minor repairs and sell at the retail price of about ₦13m.

I hope it works out. This sounds like a good place to talk about your running costs

My feeding budget is high because it also includes my family. I buy a bag of rice every month, which costs ₦40k and send another ₦50k for groceries. I spend about ₦60k to fuel my car and ₦40k on radiator coolant.

Also, I’m currently working on a personal project and paying the intern that assists me ₦20k/month.

What else has your income jump meant in the months that have passed?

A lot. My energy these days is that there’s room for more. In January 2021, my salary was ₦30k, but I make 100x that amount now. I’ve also worked for five companies in that time, and I think that says something, too.

That said, I’m now more scared than ever to be broke. It’s a flex when you want something and know you can afford it.

The fear of being broke makes me think that I’m probably not earning as well as I should sometimes.

Oh? How much would cancel out that fear?

$8k/month.

When do you think you might hit that number?

I’m not sure. But I kinda have a five-year plan that should translate to a monthly income of $20k, and it requires me to go for an MBA and take leadership roles at my workplace. I plan to follow through with that.

Back to the present, what do you want right now but can’t afford?

My dream car is a Mercedes GLE 350, and it costs about ₦24m. It doesn’t make any financial sense to attempt buying it now, but I should feel doable by December. The car business will fund it.

I’d like to know what you think about money these days

I think money is a spirit. When you do basic things to make your family happy and touch the lives of people around you, they’ll pray for you and ask for two things: good health and growth in whatever you do, so the money flow doesn’t stop. I believe very strongly that this works.

Also, I’ve learned that everything in life is about time and season. What you don’t have now will come later. The key is prioritising the resources and other key things that’ll get you there.

A segue, is there a moment that you think could have changed everything and sent you on a different path?

Going to the NDA like my dad wanted would have changed things. Up until today, I believe sabotaging that plan and not applying to the academy is one of the best decisions I’ve ever made. I’d have figured something out but I don’t think I’d be this happy.

Since you mentioned it, what’s your financial happiness on a scale of 1-10?

It’s a 7. I like very much that I can afford the basic things and certain luxuries, and make my family and girlfriend happy.

I’m in my soft life era, which means that I’m looking to invest in the right businesses and cash out on them. I’ve seen that the best way to build wealth is to consistently put something in what looks like nothing but has the right propensity for growth, and then blows up over time. So that’s what I’m interested in now. If I’m successful at it, this number goes to an 8 or a 9.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.