Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was money like growing up?

It was constant, and I got it with no strings attached. I didn’t understand the concept of working for money because my family had everything covered.

When I was in primary school, my siblings and I found our allowances on the table every day. My dad used to do this thing where he gave us every denomination. So if your allowance was ₦100, he’d give you ₦50, ₦20, ₦10, ₦5 notes and some coins. My allowance when I was in primary five was ₦50, and I got it every morning without fail.

What did your parents do for money?

My mum went from an office job to running her own business. At first, she opened a business centre. Then she opened a small cafeteria, which evolved into a catering business. My dad, on the other hand, was a civil servant. Together, they made enough money to fund the necessities. We ate good food, lived in a decent house and went to quality schools.

It’s fair to say that I was shielded from the need to make money in my early years. But this started to change when I was about eight or nine years old.

How?

My earliest memories of this was watching how hard my parents worked. My mum was building her catering business and it was backbreaking work. My dad was also travelling a lot for work. Slowly, I got the sense that all of this was how we got our money.

The next realisation was finding out that money was a limited resource. Some context: I have two sisters and a brother who are much older than me, and they were in private universities at the same time. My parents had to figure out how to pay for it. Also, two of my sisters had some health challenges, and my parents felt the toll of these financial obligations.

My mum sold her gold jewellery, which she’d bought as a form of investment, to raise money at some point. She also liquidated some of her investments in the Nigerian stock market.

Watching all of this unfold clicked something in my brain: I didn’t have to worry about money only because I had parents who made sure I was provided for.

Fair enough. When was the first time you made money?

During the six-month 2013 ASUU strike, I learned how to bake cakes. When school reopened, I started a small baking business. My earliest customers were church folk, family and friends and the random people they referred to me. In a good month, I had up to four orders and made between ₦10k and ₦12k.

I was 17 years old and in 200 level.

I imagine you didn’t have to depend on this for survival though

No. I had a weekly allowance of ₦5k. One of my older sisters was already working, and she also sent me ₦5k monthly. Then my other siblings also occasionally sent me some money gifts. This was my life until December 2015 when I left university. The last child tax was really strong.

Must be nice

Haha. I stopped asking for money after writing my final exams. Between January and April 2016, I was at home, waiting to be mobilised for NYSC and lived on the money I made from baking. But my focus was on how to put my economics degree to use and launch my career during my service year. The way I saw it, I had to serve in Lagos and get a good placement.

I spoke to my mum, and she did what she had to do to get me posted to Lagos. A family member also helped me get a role as a junior research analyst at a boutique investment bank.

How much did the role pay?

₦35k. Plus as a serving corps member, I got ₦19800 from the government. Luckily, I got a very soft landing when I moved to Lagos — my eldest sister had been living in the city for a few years, and I moved in with her. My office was also on her route to work, so she dropped me off at work on most mornings.

How were you moving money out?

I always drew a monthly budget and stuck to it. The thinking was to figure out a plan that ensured that I had enough money to take me through the month. Ultimately, I spent most of my earnings on food, airtime and data, which were my basic expenses. I wasn’t saving though. I didn’t need to.

Did anything change post-NYSC?

The investment bank retained me and upped my salary to ₦75k. This was in April 2017.

However, I spent five more months before I hopped jobs.

How did this happen?

During my service year, I did this graduate programme with a training academy called Edubridge. It was a six-week course and cost about ₦40k, which my sister paid. Asides from being a training institute, the academy was also a talent pipeline and companies reached out to them to look for entry-level employees.

I was shortlisted for an interview with a new finance company, and I got the job in September 2017. It was a business analyst role, and my salary was ₦100k. Nine months later, I got a raise to ₦120k.

What did this rapid income growth mean for you at the time?

Although my taste and expenses got bigger, I had extra money to save after drawing up my monthly budget. In April 2018, my company piloted a savings product, and I started saving the ₦10k with them.

Fast forward to December 2018, I started thinking about switching jobs again.

Why?

It was a very difficult job, and I worked long hours on weekdays and weekends. But I wasn’t particularly intentional about finding a new job. Not until I helped a friend prepare for a graduate trainee test at a bank and she convinced me to take the test, too. It took some prodding, but I took the test on the deadline day. Interestingly, I passed it and was invited for the first phase of interviews. Then the subsequent phases. In the end, I got a job offer from the bank.

While thinking about whether to accept or reject the role, my dad passed away.

Oh, man. I’m sorry. Do you want to talk about it?

He suffered a stroke in 2016 and never fully recovered until he died. His death triggered a need to start something fresh and since a new job was waiting for me, I decided to go for it. I accepted the role in December 2018 and quit my old job in January 2019. I also took the money I’d been saving with them — about ₦100k — out and gave my mum for my dad’s funeral. She didn’t need it, but I wanted to do something.

I also had about ₦40k in a money market fund, and I took it out to get me through the first month of the bank’s training school.

Were you paid while at the training school?

Yes. The bank paid trainees ₦100k/month. After going through the training school, I started getting a proper salary, which was ₦226k. Between May and November, I worked on rotation at different departments within the bank before I was transferred to the communications department. Subsequently, I worked for another six months before I was confirmed as a full-time employee of the bank in May 2020.

Did anything change in your payment structure after confirmation?

Now I was entitled to allowances. However, these were deducted from my main salary, so my pay went from ₦226k to ₦176k.

Tell me about these allowances

I got two allowances in a business year: housing and education paid in January and June respectively. In 2020, my housing allowance was ₦208k and my education allowance was ₦326k.

Nothing much happened until 2021 when I got promoted, and my salary jumped to ₦279k. By extension, my allowances also increased. In 2021, I got ₦390k in housing allowance and ₦345k in education allowance.

How did promotion work at the bank?

There were two performance cycles twice a year. If you got an A in three consecutive appraisals, you were up for promotion, although it didn’t necessarily mean you’d get it. The rest of the process depended on how much the head of your department was willing to fight for you. I was lucky that my department was small, so it was clear how much work I was doing.

Oh, I missed an important detail.

I’m listening

In 2019, my former manager at my previous job contacted me. He’d started a small company and needed a freelance business analyst at his new business, so he started outsourcing these jobs to me. Now I was making between ₦30k – ₦50k every once in a while.

The frequency of these projects increased during the 2020 pandemic because I was working from home. Also, he started referring me to other clients, and I had something to do on the side every month. My combined income for most of 2020 was ₦310k.

Sweet

Even though my income had been growing since 2019, I was still living with my sister and wasn’t paying rent. The only thing that had changed was that I was now saving 40% of my monthly income.

By the end of 2020, I finally had reason to dip heavily into my savings.

What happened?

My sister was moving out of Lagos. We decided that I’d keep the apartment and continue paying the rent, which was ₦1.2m + ₦120k service charges. She also sold her car to me for ₦800k. A pretty good deal if you ask me.

Since I was now living alone, my expense profile shot up a bit, but my savings goal was still 40% of my monthly income. While I managed to save up about ₦1.5m in 2021, my biggest realisation was that whatever money I made would never be enough. It didn’t matter how much I earned from my job and other projects, I’d always need to figure out new ways to increase my income. If anything, for the fact that the cost of living kept going up.

It was almost like it was from my mouth to God’s ears because my income significantly increased in 2022.

Oh yeah? Tell me about this

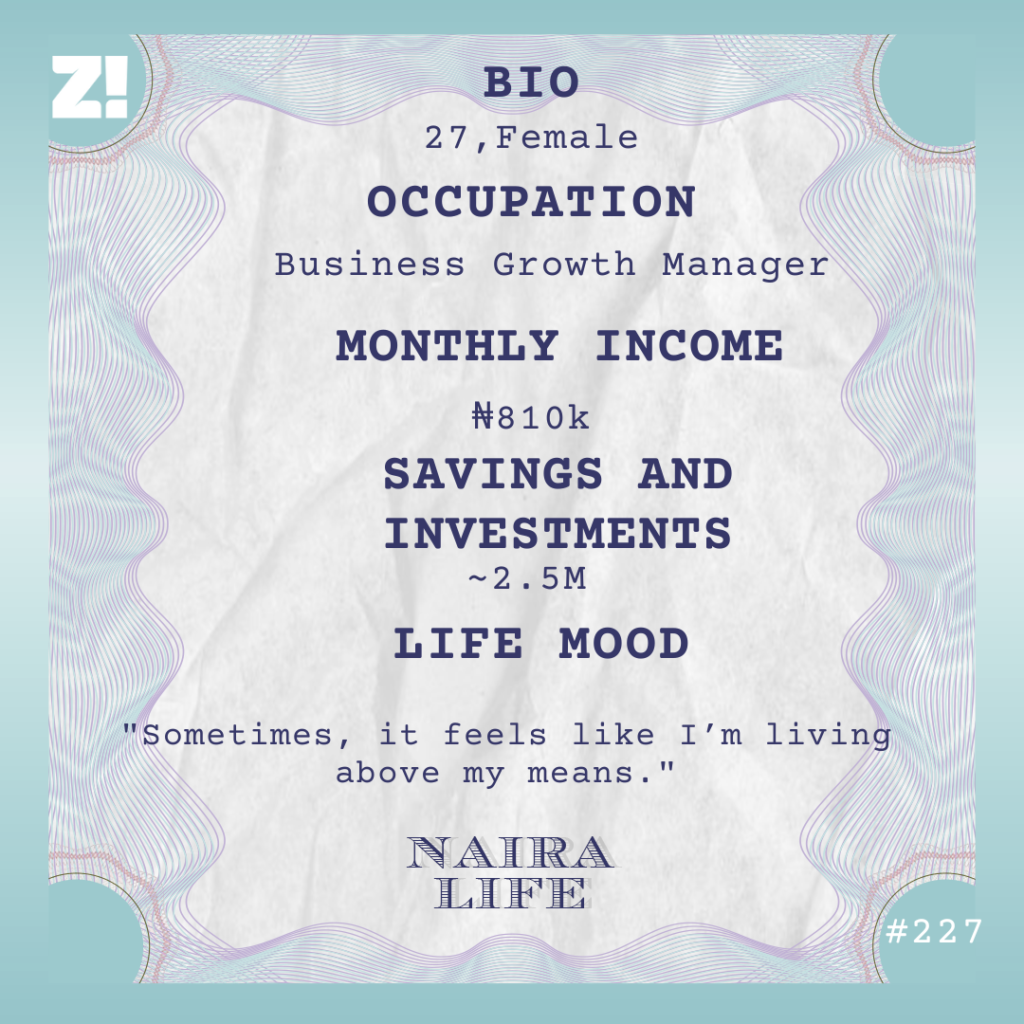

In March, a friend reached out to me to find out if I was interested in a role at the company where she worked. It was a new professional services company, and they were looking for a Business Growth Manager. She thought I was qualified for the role because I’d worked in the investment and traditional banking and had a bit of business knowledge. With nothing to lose, I threw my hat in the ring. I interviewed with the company and got the job.

*Drum roll*

My salary was ₦600k when I started the job in May 2022. In the same month, I got a part-time, remote job through my former manager, and this paid ₦150k/month.

Three months into my main job, I got a raise, increasing my salary to ₦635k. That’s not all.

It’s not?

In August 2022, I got another small job writing content for a website for ₦25k/month. Now I have three constant streams of income, bringing in ₦810k. If I do any extra work in a month, this number goes up to ₦870k – ₦900k.

You were earning between ₦279k – ₦310k up until 2021. What do you think changed in 2022?

The years of work just added up. Interestingly, the two jobs I constantly work on the side came from a single source — my manager from 2018. We had a good working relationship when we worked together full-time, and it continued after I left the business. Most of the one-off side projects I’ve gotten over the years also came from him. Essentially, it’s all come down to having a working relationship with the right person.

What has this income growth meant for you in this little time?

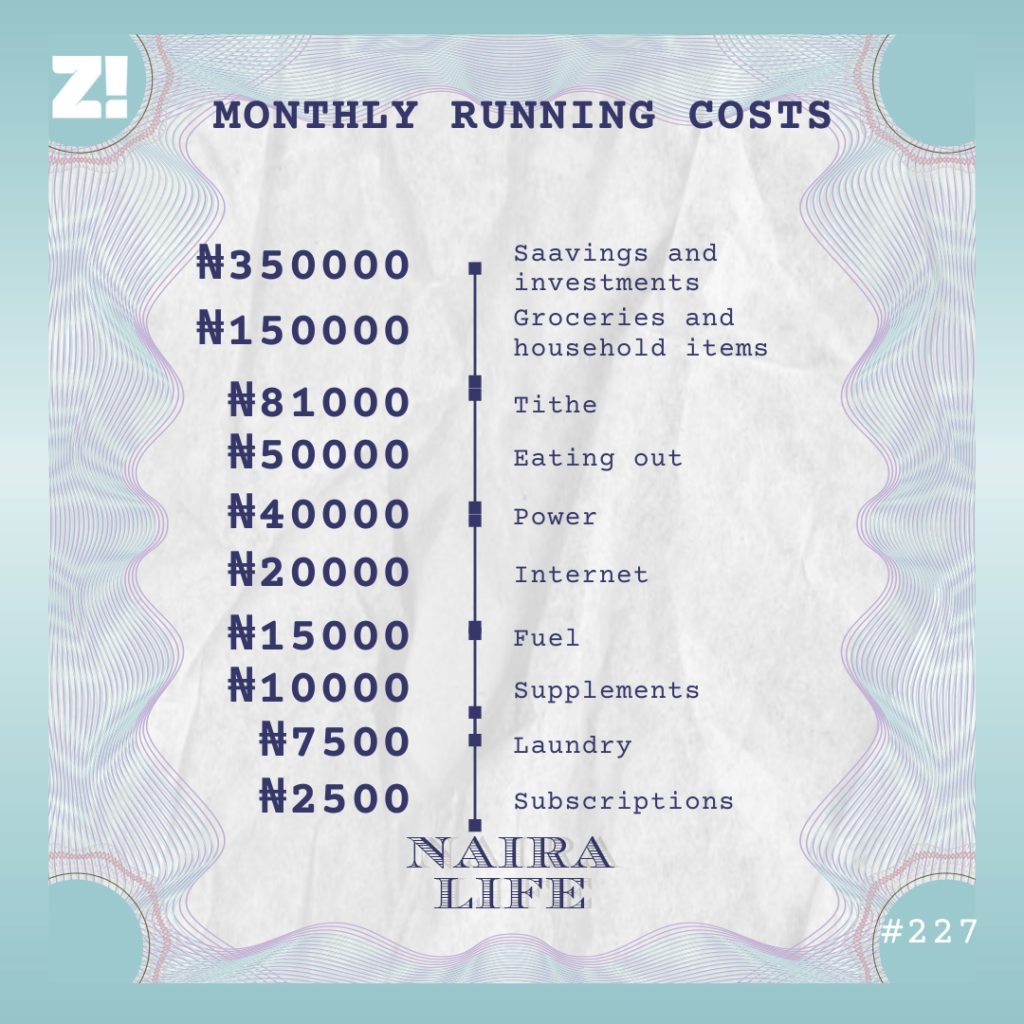

Two things: higher savings and lifestyle inflation. Now I just try to strike a balance between living my life and being financially responsible. In practice, it means optimising to save 45% of my monthly income. Plus I now look out for investment opportunities I can find.

How’s that going?

I got into US stocks last year, but the US economy wasn’t doing great, so I took the money out at some point and funnelled it back into my savings.

My mum started a mushroom business — she had a team that grew the mushrooms, dried and sold them to pharmaceutical companies. I invested ₦450k in it and made ₦150k in profits within three months. The plan was to put everything back in, but the business is currently on hold because of some supply chain problems. I still have the ₦600k with my mum, though.

Then I have another ₦800k in investment opportunities on an online savings platform that I trust.

What about your savings?

I’ve dipped into that recently to pay my rent and do some body work on my car, and both came to ₦1.5m. At the moment, I have ₦750k in my core savings account and ₦350k in flexible savings — this is what covers my emergency expenses.

How would you describe your relationship with money now?

I don’t love it. I feel like I’m constantly thinking about money and what needs to be paid for. Sometimes, it feels like I’m living above my means, especially because I don’t have a lot of family responsibilities. But on the other hand, I’m not a wasteful person, so maybe I just need to earn more.

But do you know where your money goes every month?

I also budget ₦30k for my skincare and ₦25k – ₦30k for requests from family.

Curious. How much do you feel you should be earning now?

An ideal number is ₦1.3m – ₦1.5m. It will eradicate the feeling that I’m living above my means. That said, there’s a lot of upskilling and networking that needs to be done to get here.

What do you want right now but can’t afford?

A lot, man. LASIK eye surgery and that was about ₦1.2m the last time I checked. Also, I want to travel more and see the world. A nicer house will be nice, too — I currently pay ₦1.2m for a BQ.

I feel like if I have to plan intensely for something, then I cannot afford it. Everything on this list is not things I can pay for in a heartbeat.

Have you spent money on anything that required proper planning recently though?

In December, my phone got damaged, and it wasn’t cost-effective to repair it. So I had to shell out ₦520k for a new phone, and it took punching some numbers to get it done. But it’s the phone I wanted, and it improved the quality of my life. I’ll take the win.

On a scale of 1-10, how would you rate your financial happiness?

5.5. I know I can be earning more, and it seems to be the only thing I think about these days. Sometimes, it’s hard to see how far I’ve come in the past few years because of this mindset. I’m looking forward to the point where I think less about money and focus more on experiences. My satisfaction will shoot up when that time comes.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.