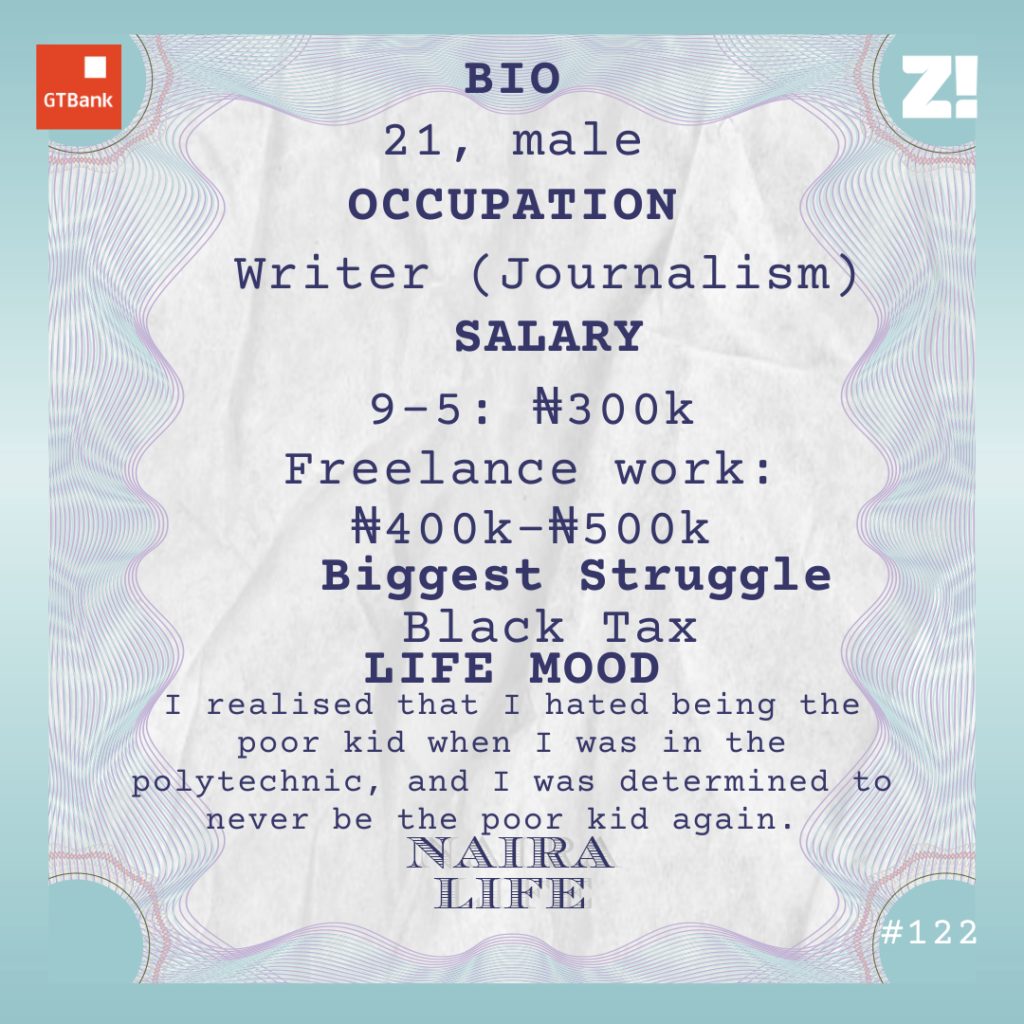

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by Quick credit. With Quick credit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

What’s your oldest memory of money?

One evening in 2012, my dad returned from work and gathered the family around. He opened his bag and there were bundles of ₦1000 notes inside. The money inside the bag was ₦1m, and he called us so we could see what that kind of money looked like.

Oh wow. Did he say where the money came from?

My dad is a civil servant who dabbled in politics. Around this time, he was making bank because of his political affiliations. So the money came from that.

Unfortunately, he spent all the money he made on women, and when it dried up, we went back to square one.

Can you paint a picture of what square one looked like?

I grew up in a face-me-I-face-you house that belongs to my mum’s father, and we lived there for years. At first, our financial situation wasn’t totally bad because we weren’t dying of hunger.

When my dad’s political money started coming in, we started living a little better. We moved to a proper apartment and finally had DSTV. It was an opportunity for my father to get us out of the lower class. But he took mismanagement of funds to a different level, got a new wife and new girlfriends. Eventually, he set us back to a point where we were worse than before.

You know what is funny? Through the years we lived in a face-me-I-face-you compound, I didn’t think we were poor.

Why?

I don’t know. I was surrounded by poor people, but for some reason I thought I was a rich kid. I always believed I was an exception.

It wasn’t until I went off to a polytechnic in 2014 that I realised I was indeed poor. When other kids were going to restaurants for lunch, I could only afford to buy a packet of Cabin biscuits.

Ah.

I left the polytechnic after a year. No reason. I just dipped.

At home, things spiralled out of control when my father ran out of money again. He became physically abusive towards me and my mum. They eventually separated in 2015.

I’m sorry. What was it like with your dad out of the picture?

Things were okay for a while. My mum is also a civil servant, so there was a regular stream of income even if it wasn’t great. The year we left my dad was probably the best year of our lives. But it lasted for only a short time.

What happened?

The government didn’t pay my mum her salary for several months, and when they did, they paid only half of one month’s salary.

By the way, I was back in school, in a university in Benin Republic. I wasn’t getting an allowance from my mother. I’m not sure my father even knew where I was. I had to borrow money to pay tuition. But there was hardly enough money left for rent or feeding. Sometimes, I would eat only once in two days. On the good weeks, I would boil rice and beans together just so I could have something close to a balanced diet. I dropped out of school again in 2016 because there was no money.

Omo.

It was soul crushing. I was forced to move from my childlike mentality of “We’re not rich but we’re also not poor.” to “Oh shit. We’re POOR poor.” I realised there were limits to what I could do because of my family’s financial situation. I was on my own. For a long time, I couldn’t buy new clothes and couldn’t participate in other activities regular kids my age could. Poverty closed me off.

When I returned to Nigeria, I had nothing to do, so I opened a blog. From there, I started learning how to use social media. A few months later, I met someone who worked in marketing online, and they helped me get a job as a social media manager for a lingerie brand. My salary was ₦10k per month.

That must have been a huge relief.

It definitely was. I didn’t have a bank account, so the money was going into my mum’s account. The job ended after two months because the person handling the brand’s marketing left.

Later that year, I got a one-off project and wrote a blog post for a company in the US, and it paid $50. I didn’t even withdraw the money — I just used it to purchase a proper domain name for my blog.

Lit. When did you find another job?

Three months after the last one ended. Someone I follow on Instagram used to write for this publication and always shared the content she created for them on her Instagram story. One day, I went from her account and landed on the publication’s website, then their contact page where I found the editor’s email. I was like, “You know what, I’m not a bad writer.” So I sent an email to the editor and attached a copy of my badly done resume. She reached out, we had a conversation, and I got the role. Guess how much they offered to pay?

How much?

₦1k for an article and I had to write at least three articles every week. I didn’t mind. I had just started at a university in Nigeria, and my mother wasn’t sending me an allowance because she couldn’t afford to. I was writing up to five articles and making between ₦15k and ₦20k per month. The money was doing a lot for me because I needed money to pay for food in school, transportation and things in between.

A couple of months after I started the job, I got an email from another person who owned a fashion publication and she offered me a job. That one was ₦25k per month. However, I left after two or three months because I realised that the person didn’t really have a structure or direction.

By this time, I had gotten bored with the one that paid ₦1k per article. My earnings at the job weren’t consistent — the amount of work I did in a day determined how much I got paid at the end of the month. I wanted to leave, but I didn’t know what else to do. Or if I had options to do anything else.

Out of the blue, a bigger media company reached out to me. The editor of the publication had seen my work and asked if I would like to be a contributor for their website. It wasn’t going to be a paid gig.

Oh?

I’d realised that as much as money is important, clout is almost as important in some situations. This job was going to give me some level of clout, so I was hyped about it and determined to make the best of it. I started writing for them in October 2018.

I’m guessing you remained at the ₦1k per article job.

I did. But the editor of the publication I’d just started working with had a PR agency she was running on the side and asked me to come on board for a copywriting project. I got ₦45k from that.

After two months on the job, we had another conversation, and I told her that I would like to join the team as a full staff. They were concerned that I didn’t have a degree, but I gave her a whole ass speech about why they needed me. She promised to do something about it but nothing was guaranteed.

Now, the publication where I was earning ₦1k per piece terminated my contract. Apparently, I was working for a direct competitor, and they didn’t like that. I lost the only paying job I had without any idea if the second publication was going to offer me a full time job. I was pretty much running on vibes.

Did the offer ever come?

Thankfully, it did. I got a call from HR in January 2019 to notify me of my promotion. It was ₦50k per month — the biggest salary I’d earned up until that point. However, I was going to write three articles every day of the week, including Saturdays and Sundays.

The ghetto.

It was mostly 200-300 words newsy stuff and the occasional opinion article, but I was perpetually tired because I was also working on weekends and still had to go to school.

By the way, I didn’t have a laptop. I had been typing with my phone. I barely slept and spent most of the night writing so I could have enough time to spot any errors and fix them. My first laptop came in February 2019. I put out a request on Twitter and people donated about ₦100k in a few hours.

Whoa.

The laptop made the process easier, but I was still working every day of the week. At some point, I started managing two of their social media accounts. I left the job in September 2019.

Why did you leave?

I started making more money.

Whooop. Tell me how that happened.

In March 2019, I got an idea for an article. I was going to write it for the publication I was working with at the time, but their editorial process was too restrictive. So I randomly googled “How to pitch articles when you’re a freelance journalist”. I wrote a pitch and sent it to an editor in the UK. They liked the idea and commissioned me to write the story. 200 pounds, which was about ₦90k at the time.

I was like, “Wait, this is almost 2x of my salary.”

Cue in the existential moment.

Lmao. I got another job off that story. One of the people I interviewed recommended me to the commissioning editor of a consulting company. They asked me to write a report on youth culture in Nigeria and offered me ₦200k for it. That was literally my salary for four months. It picked up from there — I got two more gigs back to back and each paid me more than my full time job.

I knew my time at the publication was over when someone I met on social media who was attracted to me flew me out to Abuja for a week, and I spent the whole week relaxing and spending someone else’s money. That was my first time on a plane. It was also when I realised that I deserved to live a proper baby boy lifestyle. When I returned, I texted my editor and told her I was done working there.

And you went full freelance?

Yup. But I’m not going to lie; it was scary. I was leaving paid employment for something that may not have worked or even be sustainable in the long run. The gig could stop coming at any point. Lucky for me, a publication I’d previously written reached out to me in October or November and wanted me to cover an event for them. They paid me about ₦400k to attend and cover the event. And boy, did it calm me down a bit. I also had another company that paid me ₦200k for another story. I knew I was good for the rest of the year. 2019 was the first time I had a steady source of income for a whole year. And I just carried the energy into 2020.

Love it. Let’s talk about 2020.

I had found a balance and knew I wanted to stick with freelancing for at least most of the year. It’s a bit hard to give an accurate picture of what I was making per month because of the way freelancing is structured. I could get commissioned for a story in January and get paid in March.

Also, the first quarter of each year is usually slow because publications are trying to figure out their plans for the year. But I didn’t do badly. On average, I made about ₦500k monthly in the first quarter of 2020. And I was writing about three stories for different publications per month.

That’s way more than you were making in the quarter of the previous year. Lit.

Yes. By the time the second quarter started, Covid had hit and the media industry was unstable. But I got a lucky break — I landed a gig and started writing for a publication every week. $200 for each article. That meant I was sure of at least $800 at the end of the month, which was about ₦288k. Other than that, I was writing an average of five stories per month for different publications, and was getting paid anywhere between $1300 – $2000 per month.

What was the highest amount you got paid to write a story in 2020?

₦800k. I got a DM on Instagram about the possibility of doing a profile of an artist. This was even in the thick of Covid, but I accepted it. The process was straightforward — I did the interview, wrote the story and got paid.

Interesting. So what were your finances looking like at the end of 2020?

They weren’t bad, but when you are a freelance journalist, you always have anxiety about money. In the last three months of 2020, I was making something around ₦700k per month. It’s a struggle to know if you’re doing good because you’re not sure when the next gig will come. Also, it didn’t help that I was bad at saving.

How so?

I was making enough money in 2020 to afford anything I wanted, and I didn’t hold back. There was a time my phone fell down and the screen cracked. I bought a new phone the following week. Also, I was in a long distance relationship and was flying across states almost every week and spending about ₦200k on flights and accommodation each month. Things like that. I started actively saving around October 2020. By December, I had ₦1m — most of it came from one article I wrote so I don’t think it counts as savings. The money eventually went into renting an apartment in 2021.

Ah, I see. What’s 2021 looking like for you?

Well, I got a full time job with publication in January 2021. It happened in the DMs. I indicated interest, and they set an interview up for me the following day, which was a Friday. I got the job offer in my mail on Monday. By Wednesday, I resumed work.

How much?

₦300k. I’m trying to live a nice baby-boy lifestyle, and I thought it was wise to diversify my streams of income. Also, I want to leave the country and the programme I might use as my ticket out requires me to have a paying full-time job.

Man. How much do you make every month these days?

About ₦700k-₦800k. My salary from my full time job is ₦300k. On average, I make between ₦400k-₦500k from freelance work monthly. It’s hard to break it down because it’s not in naira. Also, the money fluctuates because each publication has a different rate.

This is the part where we break down your monthly running costs.

What’s your savings plan now?

I’m trying to be better with savings. My salary pays for my running costs each month now. I started saving ₦200k from what I make from freelancing since February after I sorted my house rent.

Investment scares me because I’m bad with numbers, but in the near future, I’ll explore my investment options and hopefully learn how best to manage and invest my money.

Lit. Looking at your career now, how much do you think you should be earning?

I don’t have a problem with my current earnings. It just would be nice if all of it comes from one source. However, any job that wants my 100% focus at the moment has to pay me between ₦800k and ₦1M. But to be honest, I don’t think I have any interest working with any Nigerian company moving forward.

Energy! How has your experience shaped your perspective about money?

I know that when people tell you that money doesn’t bring you happiness, they are just being liars and dirty bitches. Money definitely does bring happiness. My therapist told me that my self worth is tied to how much I make because of my experiences, and she’s right. I mean, I come from proper poverty and the anxiety of not wanting to go back there is always there. In a way, it powers me because I’m working so hard to ensure that I never experience it again. I realised that I hated being the poor kid when I was in the polytechnic, and I was determined to never be the poor kid again.

My only financial struggle right now is the black tax. It’s the bane of my existence.

When did you start paying black tax?

From the moment I started earning. I’m the oldest son and the first child of my mum. When I started the first job that fetched me money, I didn’t have a bank account, so it was going into my mum’s account. The only thing I took out of the money was what I needed for data.

In 2018, I was funding my schooling but my mum was also “borrowing” money from me. There was a time she called me to ask for ₦60k to pay for my sister’s school fees. That was even more than my salary at the time. There is an expectation that I need to chip in and help regardless of what I make.

At what point did you clock this?

I don’t think there was an exact moment where I realised this. It’s always been a lingering feeling in the air. And I know it’s going to be perpetual. I really don’t know how I feel about that. On one hand, you’re making good money. But on the other hand, you’re taking responsibilities you shouldn’t have to.

When I’m at home, I pay for everything from food to light bills. At the end of each year, I know my bills are about to skyrocket because of Christmas. Someone needs to buy clothes. Or they need to stock the house with food. Now there are things I want to do with money that I can’t because of these responsibilities.

Sounds hectic.

See. Just after I paid my rent in February, my mother started calling me that their rent was also due. I had to pay for that one too.

On some days, I just pretend to not hear what they need. My sister called me the other day to ask for me to buy a phone, I just didn’t say anything till she ended the call.

Do you ever think your black tax expenses will stop at some point?

I really doubt that it will. I’ll feel guilty if I stop giving to my family. Also, my family feels like I owe it to them, so there’s that. I might be in this forever. I really hate it and have a lot of anger about it, but I’m trying to deal with those emotions in a healthy way by seeing a therapist.

Sending you love and light. What was the last thing you spent money on that made you happy?

My TV. I don’t even watch TV like that, but it was a good idea to get one. It cost me ₦150k. Also my Apple Watch. It was a very random buy but I started going to the gym this March and I thought it would be great to have one, so I went out and bought it and I’m really glad I did. It cost about ₦200k and I have no regrets.

When was the last time you felt really broke?

At the beginning of the year. I had less than ₦200k in my account because I had just paid rent. It felt scary, not having money for me means not having options, and I hate that feeling. I was anxious until the next credit alert came in.

On a scale of 1-10, how would you rate your financial happiness?

7. It would have been an eight if I wasn’t dealing with black tax. I’m making money I couldn’t fathom a few years ago. However, with black tax and the anxiety I have about money, I occasionally find it hard to enjoy it. But hey, we move.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld