Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This subject of this week’s #NairaLife is an investment manager. He is in the business of helping people make money, and he has learned how to do the same thing for himself. What is most interesting about him? His motivations.

What’s your oldest memory of money?

Growing up, my dad did this thing where he would give me money and say:” Put this money in an envelope and keep it. I’ll ask for it later.” It may be weeks before he’d ask, but he usually did to confirm I still had it. Then he would give it back to me and ask me to keep it again. The lesson was, you don’t touch the money that’s not yours. After he died a few years ago, my mum found an envelope labelled “Daddy’s money” in a drawer at home. It’d been there for years.

I’m sorry about your dad. It must have been a profound moment when your mum told you about that envelope.

It was. My parents taught me how to respect money at an early age. When I got money gifts, they made sure I spent half and saved half. I grew up interested in how money works.

What was the first thing you did for money then?

After I graduated from university in 2001, I offered to work at a stockbroking firm for free. I studied psychology and had no major prior experience in the financial markets. However, the firm I worked at didn’t have much business to do at the time. After three or four days, I quit. A friend of a friend had a forex exchange company in the same building as the stockbroking firm, and he offered me a job at his.

What was the job about?

He sourced forex and sold to his clients, who were mostly merchants. He was like the average Bureau De Change guy, but he did more volume. When I started working for him, I was earning ₦5,000. I was his runner, doing administrative work and helping him facilitate transactions. He increased it to ₦8,000 during my service year. In the two years I worked for him, he gave me a few raises. When I left in 2003, I was earning ₦30,000.

Where did this interest to have a job in the financial markets come from?

It was something that built up over the years. My parents were big on saving, and I got a sense that investing was a thing too. I spent a lot of my mornings watching Lou Dobb’s “MoneyLine” show on CNN, and everything I saw looked interesting. Also, my mum worked in a bank, so I appreciated financial services. After uni, I decided to go for it.

Interesting.

While I was working for the forex guy, I enrolled in a part time postgraduate diploma management course at a university in the south-west. My parents paid for it. I’m not sure how much it cost anymore, but it was less than ₦100,000. I got my first well-paying job towards the end of the programme.

Where?

A telecommunications company. I worked in the customer service department. My salary was ₦80,000, which I thought was fair at the time. But looking back now, it could have been better.

How?

It was the first time I realised that bonuses and other benefits can make a difference. I had a friend who worked in another telecom company and was earning half my salary. However, when I added up his bonuses and other allowances, he was earning more than I was.

After about three years at the company, I quit and travelled to the UK for my Master’s Degree in Financial Management. This was 2006.

How much did it cost?

About £10,000 pounds. At the time, a pound was, maybe, ₦250. My parents sold some of the shares they had to raise the money.

Interesting. How did it go in the UK?

My parents were only interested in taking care of the tuition. They expected me to figure out the rest. While I was in school, I got a customer service job. It paid minimum wage — £5 pounds per hour. I also picked some extra minimum wage jobs. At the end of each week, I was making over £200. A lot of it went into buying clothes.

Haha. Why?

The thing is, when I was in Nigeria, it was difficult to get shirts my size. But in the UK, I saw shirts that fit, so I just started buying as many as I could in preparation for my return to Nigeria. Four shirts cost £100.

That makes sense. How long did you spend in the UK?

I finished my programme in 2007 and graduated in 2008. But I stayed back a while because I was trying to find a job in their financial markets.

I moved to another town in the UK and lived with a friend. I did some manual labour at a hospital for about two weeks before I got a stable job. Again, it was in customer service, and they offered me a 10-month contract. It paid well above minimum wage. I was going home with over £1,200 every month.

Lit.

In 2009, I was close to getting my dream job at an international investment company in the UK. They had given me papers to sign and everything. But a financial crisis hit the UK and the markets crashed. I lost out on the job.

Damn.

I moved back to Nigeria in the same year and did a few interviews that led nowhere. In 2010, I got a job with the state government’s Internal Revenue Service as a tax administrator, with an offer of about ₦100,000 per month.

At the time, was the plan to build a career in the civil service?

I actually wanted to give this a try, but after some time on the job, I realised that it wasn’t for me. I wasn’t bad at it. It wasn’t just what I wanted to do. I spent less than two years before I resigned. I did a bit of consulting after that, helping small businesses set up PAYE systems, file their taxes, and other related stuff.

How long did you do this for?

Not long. I finally got a job in the financial services sector in 2012. It was a core investment firm, and I’ve been there since that time.

You’ve been there for more than 8 years. How has your role evolved over time?

The company works with pension funds. This is how it works: a lot of employers deduct a portion of their employee’s salaries, match it and put it in a pension savings account. What we do is to invest that money on their behalf.

When I started, I was in the research department. My job was to look into the companies we wanted to invest in and analyse their finances and market trends before making recommendations. I’m not sure what my starting salary was anymore, but it was about ₦300,000.

What happened after that?

I moved from being a stock broker to an investment manager. In 2014, I was promoted to a junior portfolio manager role, and it changed my life. I had to specialise in something, and I chose the bonds market rather than the stock market. My job now was to look into the businesses we lent money to and confirm that they were credit-worthy.

Ah, I see.

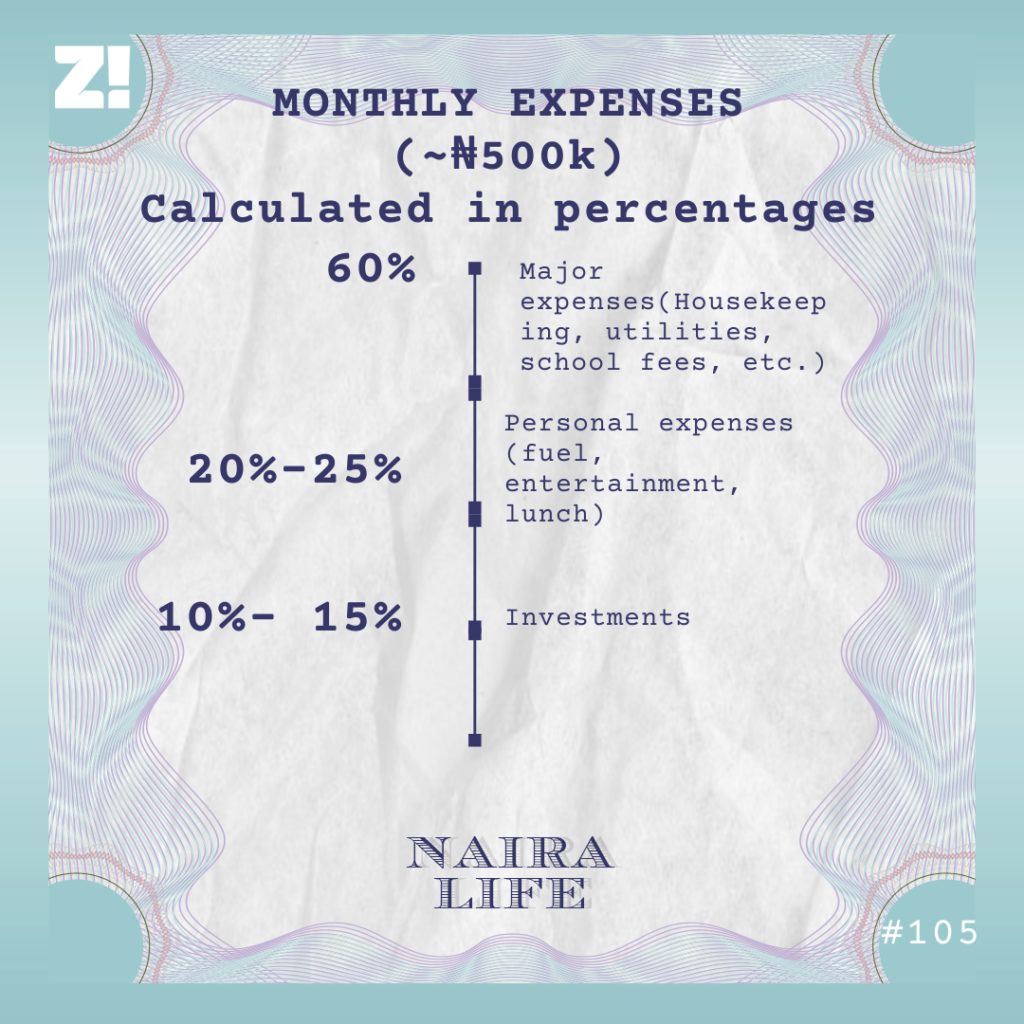

As I grew in the business, I got more responsibilities. I’m a Portfolio Manager now. I take care of different funds and portfolios and come up with strategies to help the investors grow their money. For the most part, this is dependent on their preferences and how much risk they can take. My salary has also grown over the years. Right now, my monthly pay is about ₦500,000, minus bonuses.

I want to know how your job has helped you with your finances.

My job is basically helping people to pick the best investment opportunities and growing it. If I can do that for people, why won’t I do it for myself? When I do research for work, I’m also doing it for myself. If I see an opportunity and I have enough capital, I put money in it. I may not do the same volume as an institution will, but it’s working and I’m building my own wealth too.

Haha. Fair enough. What do your current expenses look like?

My monthly expenses are calculated in percentages.

I don’t pay rent anymore. My dad left me a house.

Flex. Speaking of your investments, what do you invest in?

I invest a lot in shares, mutual funds, and treasury bills. Have I lost money? Yes. But I try to stay in the middle of high risk and low risk. I’m not trying to make all the money I can make at once. Wealth creation is not a sprint, it’s a marathon.

How do you try to avoid losses?

There’s a strategy in the market called averaging down. For example, you buy a unit of shares at ₦50 and the value drops to ₦40. That’s a ₦10 loss already. Some people may decide to sell it immediately to minimise the loss. But I would buy another unit at ₦40. Now, the average price of my investment is ₦45. This way, I’ve managed to keep my loss to ₦5. If the price goes back up, then I can make my profit.

What happens if the price continues to drop?

If I have the money, I hold my position and put more money in it. I continue buying at lower prices. When the trend changes, I start posting a profit, then I sell. I just exited one of such positions I held since last year. I made about 12% profit on that.

That’s intense. So, how much do you have in investments right now?

I’m not sure about the exact amount right now, but it’s over ₦10m, and that’s a conservative number. I don’t like talking about these things.

Phew. I’m curious about something. A lot of your earliest memories about finances were influenced by your parents. What does this now mean for you?

That I have to do the same for my kids. I have two, and they are both below 10. They are still young, but I’m teaching them about these things. My parents taught me how to save. I learned how to invest. The idea now is to pass all the knowledge to my kids. I’m trying to build generational wealth here.

Tell me more about this.

A character in Billions, a show I watch, said something in the lines of “A generation builds wealth, a generation grows it, a generation spends it.” At the moment, I’m building on what my parents gave to me. It will be their job to teach their kids too even if they don’t work in financial services. The way I see it, they need to understand how to put money away and the processes involved in growing it.

That makes sense.

I opened a stock brokerage account for them the moment they were born. If someone gives them a cash gift, I match it and pay it into their accounts. I’m building a small portfolio for them already. When they’re old enough, they will be trained on how to manage it.

Hook it in my veins. Let’s go back to you. What do you think your finances will look like in, say, five years?

I have no idea, but I definitely want more. And it’s not from a place of greed — I’m just testing myself and growing what I have. I’m used to a certain lifestyle, and I want to be able to afford it for as long as I’m here. So, I’m in this for as long as I can do it. At the same time, the long term plan is not totally tied to income but the feeling of self-actualisation, which will be decided by just how much of all this I can teach my kids.

Lit. Now I’d like to know how your experiences have shaped your perspective about money.

Money is a by-product. If I have it, then it means I’ve worked to earn it. And I’m not afraid to earn and put money away. But I’ve also realised that putting it away somewhere is not enough. It needs to grow consistently. Like my dad used to say, work for money when you’re younger so it works for you when you’re older.

I also think that money is an end in itself. Everything is valued in a currency, so it’s really important to have it and hold it. I’m not saying you shouldn’t spend on yourself or have a decent quality of life, but it will be unwise to go overboard.

Speaking of quality of life, what’s the last thing you bought that improved yours?

I installed an internet broadband service at home. Everything took about ₦30,000, but it’s cut my monthly internet costs and made it easier to work from home.

Also, I turned 40 last year and I thought of buying myself a meaningful gift. I decided on a wristwatch I’d wanted to buy for a while. I’m not going to tell you how much I bought it, but I had to save for a few months. Every time I look at it, I see something I strived for, and it’s so fulfilling.

Got it. On a scale of 0-10, how would you rate your financial happiness?

I’ll give it a 7. I’m comfortable, but I’d love to amass more wealth. If it was just about me, I’d probably be okay with where I’m at now. But I’m building this for my kids too, so they have a legacy to stand on when they’re older and can make their own decisions. My parents did their best to do that for me. It’s only natural that I do the same thing for them.