Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

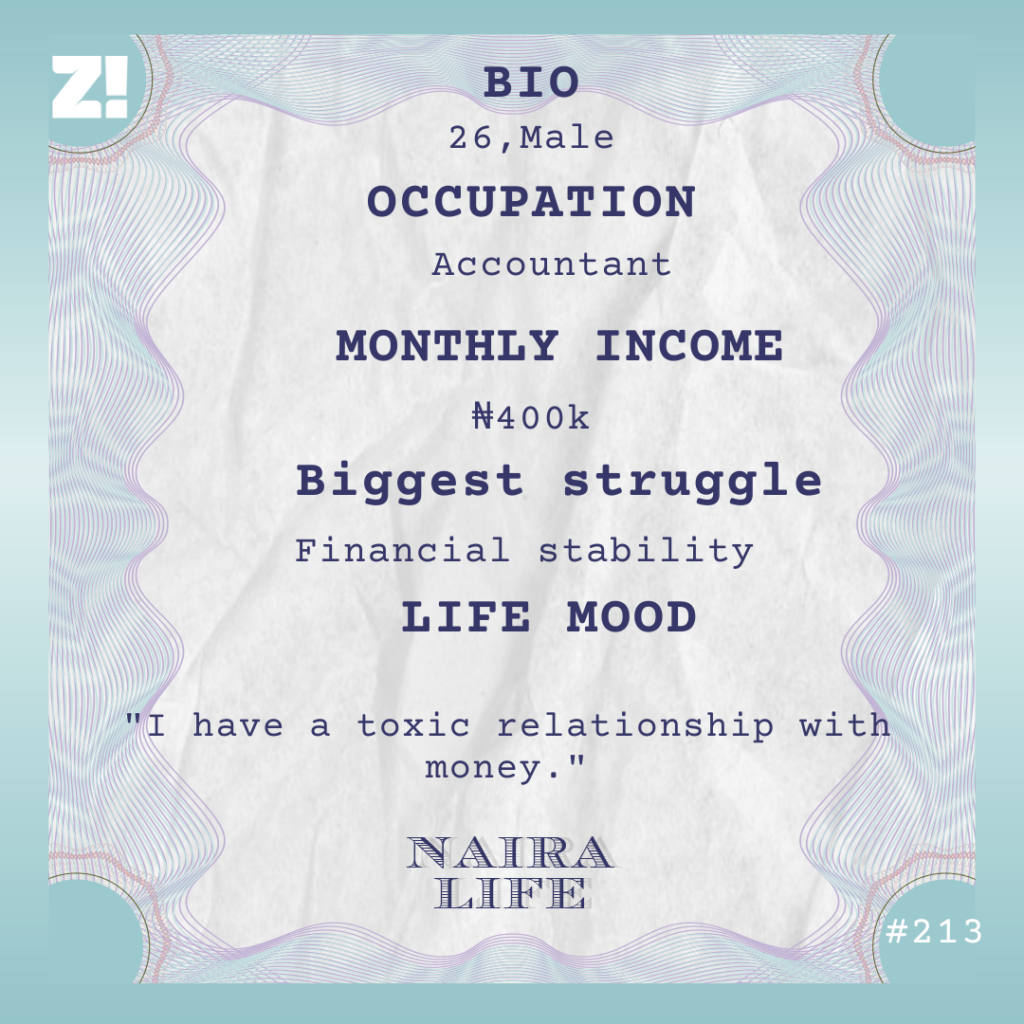

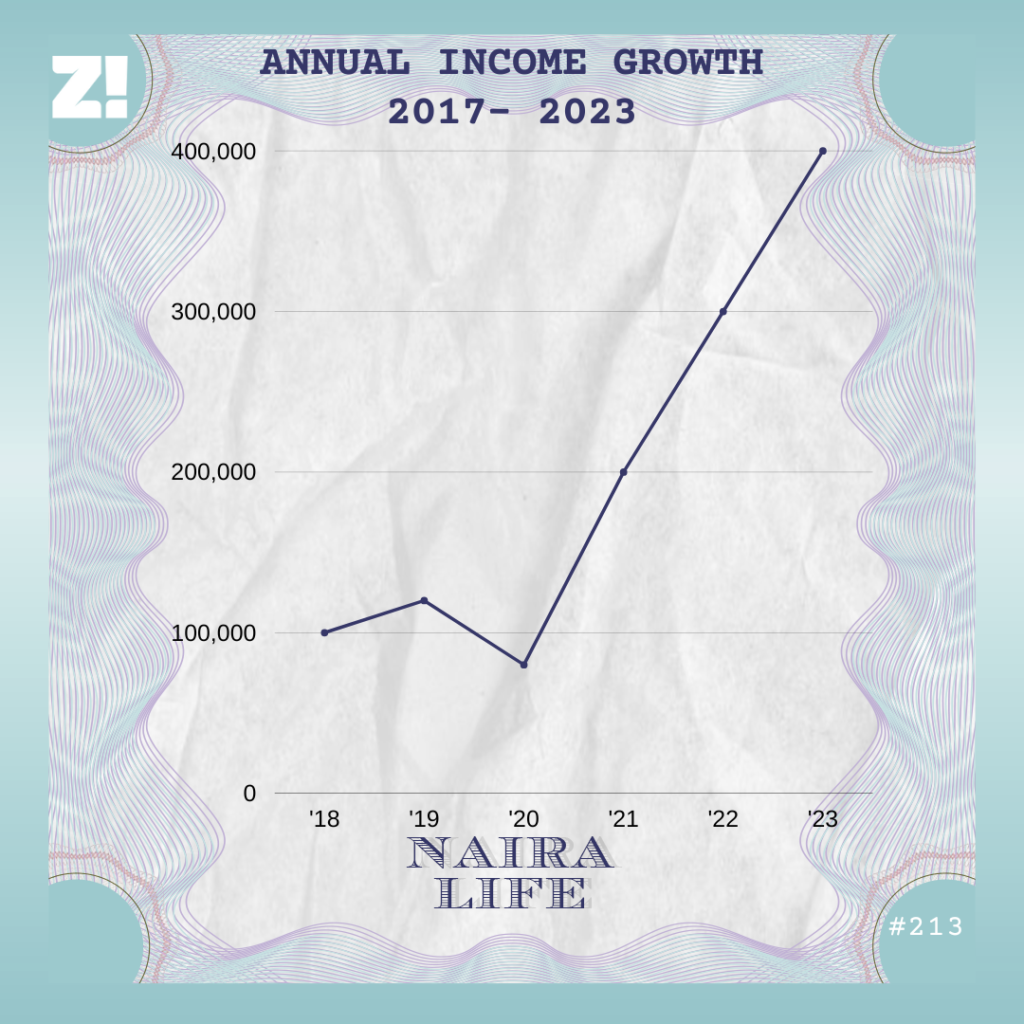

Since getting his first job in 2018, the 25-year-old accountant on this week’s Naira Life has been on an upward income trajectory. Is he close to financial stability? He doesn’t think so. His biggest struggles? toxic financial decisions and his inability to manage lifestyle creep.

What’s your earliest memory of money?

In 2002, I was five years old, and it was the first time I was sent home for unpaid school fees. I remember my sister — who was in a senior class at the same school — and I had to go back home around 9 or 10 a.m. It’d be the first of many times I was sent home for that reason.

Can you paint a picture of what things were like at home?

We were good until my dad lost his accounting job at an oil company and couldn’t find something else. Then my parents decided to invest everything they had into starting a school, which wasn’t profitable for years. They struggled to raise six kids – I’m the fourth – and we had to make lots of adjustments. We had to share resources — from pieces of meat during meals to clothes — because that was the only way they’d go around.

Thankfully, the money situation started to get better around 2009.

What changed?

My parents’ school became more popular, so more kids enrolled. And we gradually moved from the struggling middle class to the comfortable middle class. When I got into university in 2012, my parents could conveniently send me ₦5k/month, and they increased my allowance every year. My final year monthly allowance was between ₦20k – ₦30k.

So how did uni go?

The financial struggles I grew up with did a number on my confidence, so I had a lot of insecurities about money. In uni, all I wanted was to be one of the cool kids, and my allowance took care of that. It started with the small things. In my first year, Blackberry was the popular phone, and almost everyone was on BBM. I made it a mission to get one, so I saved from my allowance for a semester to raise ₦12k, which was enough to buy a used Curve 2 from a classmate who wanted to buy a newer model.

As my allowance increased, so did my compulsion to do the seemingly cool things everyone was doing. Things took a turn in my second year.

How?

I made new friends who introduced me to the nightlife. The rest of my time in uni was fueled by food, parties and alcohol. I was living above my means; my allowance couldn’t match the lifestyle. So, on a regular month, my allowance only lasted a week or two.

It only worked because of my community of friends. Everyone chipped in, so when someone in the group was broke, the rest of the group covered them.

The downside to this was that I couldn’t build a savings culture, and I didn’t even realise it until I graduated in 2017. I left uni with zero naira to my name.

Inside life

The next step was NYSC. I served in the south-south. My parents cut me off, but the federal government paid ₦19800, and my PPA paid ₦10k and an additional ₦10k welfare allowance. All this brought my monthly income to ₦39,800.

In addition, my PPA provided accommodation and feeding for corps members. 2018 was the most comfortable year of my life. I was balling, man.

By the end of my service year, I had saved about ₦100k and even bought a laptop. I returned home in October 2018 and started job hunting.

How did that go?

I got a job within three weeks. I was hired as an account officer in a hospital, and my salary was ₦100k.

Sweet

In the first few months, I saved ₦30k out of my salary and lived on the rest. Then my employers started acting up.

What did they do?

The salary stopped coming on time. And when it came, it was never paid in full — they could pay 60% first and the remaining 40% days later.

I found it difficult to plan around their payment schedule and had to dip into my savings to survive each month. In the end, I figured that I had two options: find a way to live with the new arrangement or find a new job.

I’m guessing you started looking for a new job

I did. After 11 months at the hospital, I found another job as an accountant in an entertainment company. In my excitement, I didn’t think to negotiate my salary. I accepted their first offer.

How much was it?

₦120k. I could have gotten up to ₦150k.

Anyway, I started the job in December 2019. My short-term goal was to rebuild my savings, so I put ₦40k aside each month. I lived with a member of my extended family and only had to worry about feeding and transportation expenses, which were about ₦1k every day.

Three months later, my plans hit another obstacle.

COVID?

Yes. When COVID hit in March 2020, the company said everyone would have to take a 33% pay cut. This brought my salary down to ₦80k, so I had to return home to my parents.

By August 2020, I had about ₦140k saved up and decided that it was time to invest in something.

What?

Forex trading. I had friends who put money in it and cashed it out. So I started thinking, “What could it hurt?” The entire point of saving was to make it work for you anyway.

₦360k was the minimum capital I could invest, and I had ₦140k. To raise the balance, I took a ₦220k loan from my bank and dumped all the money into the investment.

What were the terms of the investment?

15% Return on Investment (ROI) every month. I was expecting ₦54k from the scheme every month. But this happened once before the whole thing crashed, and the people in charge disappeared. I lost my capital, my entire savings, and I was in debt. I was paying the bank about ₦23k/month out of my ₦80k salary. I’m not sure how I’d have survived if I wasn’t living with my parents.

Did the company return to paying full salaries?

They did in January 2021. I got two raises in quick succession — one in February and another in April — which put my earnings at ₦200k.

In a few months, I’d done a complete turnaround. I was out of debt and earning twice as much as I did in 2020. I left the company in June 2021.

Why did you leave?

I was poached by a holding company, and they offered me ₦300k. For the first time in my life, I had more money than I knew what to do with. So once again, I decided it might be time to invest in something.

What was the plan this time?

Agric investments. The company I was now working for had an investment department. The promise was “Invest a minimum capital of ₦500k for a quarterly ROI of 10%.”

RELATED: The #NairaLife Of A Lawyer Who Is Obsessed With Investment Opportunities

After your last experience with investments, didn’t the ROI seem suspicious to you?

I thought, “I work here, so what could go wrong?” The investment arm of the business had been working smoothly for years. They seemed credible enough. However, I didn’t want to use my savings as capital this time, so I applied for another bank loan of ₦500k.

I got my interest payment twice, then nothing happened after that.

While I was still trying to figure out what was wrong, the cracks started to show. Salaries were delayed in December 2021 and January 2022. At first, the management said this happened because they had some issues with the bank. After that, they stopped talking to us, and I didn’t receive any payment from the company.

The company didn’t officially fire me, and I even did some work for them here and there until May 2022. But I knew I was in trouble by March 2022. I was no longer saving, and I owed the bank quite a bit of money, so I had nothing to fall back on. It was a mess.

Sounds chaotic

As a short-term fix, I took another ₦200k loan from the bank, hoping that the company would pay my outstanding salary at some point.

They didn’t.

After missing my loan payments for three consecutive months, the bank sent me a demand notice. I was in panic mode.

How did you navigate that?

I rang one of my sisters and asked her to loan me ₦200k, buying me three months to figure out how to get a new job.

Luckily, I made it to the final stages of an interview at another firm later that month, and a job offer followed.

How much?

₦330k. When I resumed in June, my biggest priority was clearing my debt. I managed to do that in September 2022.

Phew. What’s happened between then and now?

I got a raise to ₦400k in January 2023, and I have been saving ₦190k/month. My savings goal for the year is ₦2.2m. But I’m afraid I might not hit it.

Why not?

My biggest struggle right now is lifestyle creep and the nightlife. When I first got this job, I stopped trying to save money. For the rest of 2022, I spent between ₦30k – ₦40k going out every weekend. I ended the year with zero savings.

I’ve gotten a hold of myself and saved every month since 2023 started. But I’m not entirely sure how long it’ll last. I’ve reduced the number of times I go out to once or twice a month, and now budget for lau-lau in my monthly expenses. But I don’t trust myself with money, so it doesn’t feel like a lasting solution. My predisposition to making bad financial decisions is unmatched. I guess I’ll have to take it one day at a time.

Sounds like a plan. Speaking of budgeting, do you have an idea what your recurring expenses look like?

Tithe – ₦50k

Black tax – ₦15k

Data – ₦20k

Feeding – ₦60k

Subscriptions – ₦10k

Lau-lau (nightlife) – ₦30k

Shopping – ₦20k

Miscellaneous – ₦5k

Savings – ₦190k

What do you see when you think about your financial future?

I have a toxic relationship with money, so I can’t help the feeling there’s still a lot of financial instability ahead of me. I don’t stick to my plans and I’m just a decision away from reverting to old habits and making questionable financial decisions.

However, I’m done with investments. I just want my money to breathe into my account. What I eventually do with it is another conversation.

Fascinating. Do your family know about your struggles with money?

They have an idea but don’t know how deep it runs. I didn’t open up to them until after I got my new job, and I believe they think I’m good now. I live with a member of my extended family and they don’t know about this either.

To be honest, I feel like I need help. And it’s interesting because I get good financial advice from people in my circle, but I never put it to use. In a way, I know what to do — I just never seem to be able to do it.

On a scale of 1-10, how would you rate your financial happiness?

It’s a six. I still remember how tight things were growing up. In fact, it never occurred to me that I’d be earning this much at 26. While my financial decisions have gotten me into tough situations, I’m glad I’m here and can afford my current lifestyle.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.