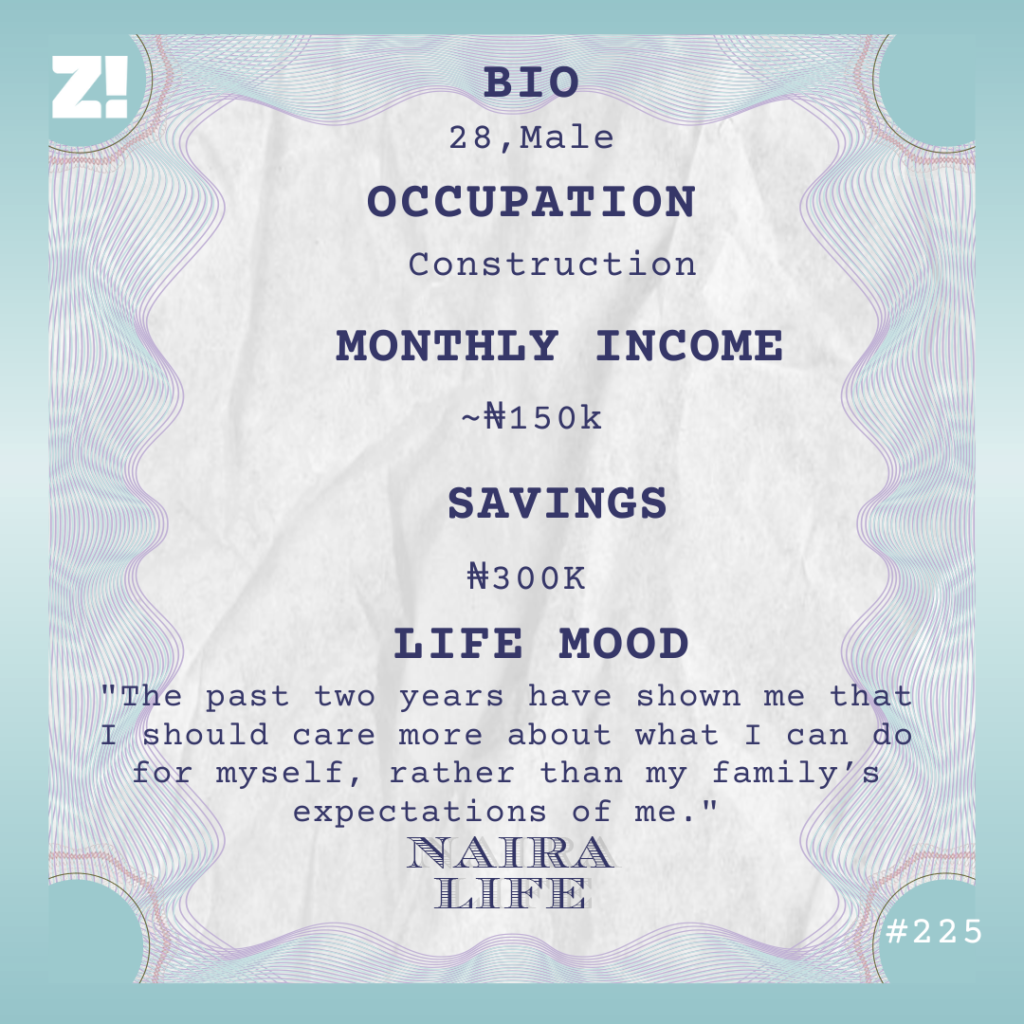

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Do you remember your oldest memory of money?

It was in 2006. I asked my mum to buy me a T-shirt, expecting a yes or a no from her. But she asked me what I’d been doing with my daily allowance, which was ₦50 at the time. When I told her that I spent everything, she offered me a deal: she’d take ₦5 from my allowance every day and keep it with her.

After saving up to ₦50, she added the balance and bought the shirt I wanted for me. I was 12 years old at the time, but the lesson stayed with me for many years after that — if you wanted something, you had to save up for it.

That’s wholesome

For the most part, growing up with my parents was a lesson in putting money to good use. My mum sold pepper and groceries in a market and my dad was a small-time car dealer. So we weren’t rich. But you see my dad? He was very intentional about how he wanted his kids to be raised.

We lived in a ghetto in Mushin and his primary priority was shielding us from the streets. Because of that, he ensured that we went to private schools. All 11 of us.

I should mention that my dad married two wives. I have five siblings from his first marriage, and I’m the first of my mum’s four kids.

Fascinating. What was it like growing up in a polygamous home?

The one thing I still remember is the pressure to compete. It started with how well you did in school compared to how your half-siblings did. We were family, but someone had to be the best.

I couldn’t escape this because one of my half-brothers was the same age as me. As the years progressed, this competition and the pressure that came with it extended to things like money and finances.

What do you mean?

In 2012, I got admitted into the polytechnic to study civil engineering, but my half-brother didn’t. He tried the following year, and the same thing happened. In between writing these exams, he started working. Once that happened, he didn’t need money from home anymore.

After writing JAMB for three years without getting into the university, he ditched his plans for school and got a job instead. Like that, he was 100% independent and I wasn’t, even though we were almost the same age.

But you were in school, weren’t you?

I don’t think my dad thought about it that way. From my second year at the polytechnic, I started hearing things like, “You should be able to do some things by yourself now. Look at your brother.”

Man, the pressure that came with that was something. The best thing to do was to get a job, but there weren’t a lot of opportunities in the town where my school was. I didn’t get my first job until my IT in 2016.

Tell me more about that

I worked at a construction company in Lagos, and I was an assistant site manager. The pay was ₦20k. However, I spent 80% of my monthly stipend on transportation. I lived on the mainland and the site I worked on was on the island — it took three bus rides to get there.

The money was barely enough, so I had to get some help from home. My dad gave me ₦500 every day to support what I had. I hated that.

Phew

But I loved one thing about IT. Although I was an intern, I had a degree of ownership and my site manager encouraged and trusted me to make critical decisions. Before I returned to school, the site manager left the project and the company put me in charge. We were in the finishing stages, but the confidence boost was everything I needed.

Energy

It didn’t come with a pay increase, though. But sometimes I’d get some tips from clients or contractors — about ₦2k – ₦5k.

In 2017, I returned to the polytechnic for my HND.

And you had to return to collecting an allowance?

Something like that. But my chances of getting money from home even got way slimmer. All I kept hearing was to think about what my brother could do by himself already.

So whenever I got money from home, I’d save something from it because I wasn’t sure if I’d get anything the next time I asked. Also, I returned to working with the construction company during semester breaks. I wasn’t paid a salary, but I got tips on the sites I worked at.

I graduated from the polytechnic in 2018.

Where were you, financially?

I barely had anything in savings. I stopped asking my dad for money in my final year because it’d become embarrassing, so I lived on what I had saved up for the whole year. But now that I was out of school, I was determined to set myself up and earn some respect from home.

Did you have a plan?

The only plan was to go all in on construction jobs. I had about two years of construction experience, and I was certain it’d get me something. That said, I knew I couldn’t go back to the construction company I interned at.

Why not?

I’d worked with them for long enough to know that they’d always lowball me because I used to be an intern there. I couldn’t afford to go back there and earn ₦20k/month. I had a point to prove at home.

Luckily, one of the engineers I worked with in 2016 had started his own company and brought me in on one of his projects. I got paid based on the volume of work available on the site, but my average income was about ₦50k. There were also the additional tips that came from time to time — ₦2k here, ₦5k there.

Within three months, I managed to save ₦100k. Then I was mobilised to a state in the northwest for NYSC. There was nothing for me there, so I paid ₦30k to redeploy back to Lagos.

I imagine you continued working with the engineer

I did. His construction site was my PPA. At some point, he left the site for me to manage and my monthly earnings doubled to about ₦100k. The federal government also paid me ₦19800.

How did the rest of the year go?

The pressure I felt to make money eased a bit. But now, I couldn’t bear the thought of losing this income source without a plan B. I was like, “If this person I’m working for can have a company, maybe I can, too.” So I went ahead and registered a construction company. This was in 2019.

What happened after?

After I finished NYSC in 2019, I’d saved close to ₦300k from the projects I worked on with my former boss. Nothing major happened for the rest of the year — I was thinking about how to get my clients but nothing came through. Then 2020 came and Covid happened, which slowed things down. But it gave me a bit of time to figure things out.

I’m curious, how did you hope to get projects?

To be honest, I didn’t think about it too much. But after trying and failing to get jobs for more than three months, I started looking at my contacts. A friend from school came through and offered me an opportunity to partner with him on a hotel construction project he was looking at. We pitched ourselves to the client and got the contract.

Yay

We spent about seven months on the project before the client suspended work — the project was gulping more than his budget. But I made about ₦600k from supervising the project.

The next thing I did was to buy a car.

Oh yeah?

I’d been driving my dad’s car, and I didn’t want to wait until he asked me if I ever planned on getting my car. Also, I was pretty sure we got the contract for that project because I pulled up in my dad’s Lexus. So I thought it was a business decision to get a car. My thinking was that it would help me land deals, so I bought a Nigerian-used 1997 Mercedes C200 car. It cost me ₦650k.

A part of me bought the car because I thought the jobs would keep coming. But a dry spell followed, and I didn’t have any project to work on for three months.

When did the next project come?

January 2021. This one was a duplex and took seven months to complete. I think I made about ₦1.2m from this one. After completing the project, I moved out of my parent’s house into my apartment. It was the next step for me. The whole thing cost me ₦650k.

I turned my sights on getting another project, but nothing came for a few months. I had to do a little pivot here.

What?

I started working as a contractor, maintaining existing structures. My recurring client was a hotelier I knew from my internship. He put me in charge of one of his hotels and my job was to do routine maintenance on the property — from fixing leakages and cracks to supervising renovations. Every time I was called, I made between ₦60k – ₦100k. But it was once every few weeks. That said, it made sure I continued earning some money.

Was that your only income source during that period?

No. I’d realised that work wasn’t going to be as regular as I’d have liked and my savings wouldn’t help me if they just laid idle in a bank account. So I bought a used keke Napep for ₦400k and gave it to someone to drive. The agreement was that they’d deliver ₦9k to me every week. This came in consistently for about five months before the driver started giving me excuses. When I realised that I couldn’t trust him anymore, I took the Keke back and sold it for ₦350k.

Wiun

The funny thing about 2021 was that I was mostly broke, but I gathered a bit of respect from home. They thought I had everything together because I had a car and an apartment. But I knew how broke I was. What that meant was that I couldn’t ask for help.

Between 2021 and now, I’ve worked on two more projects. The first one started in November 2021 and lasted for a year. I was put on a monthly salary of ₦100k, so I made about ₦1.2m. The next one came in January this year, and I’ve only made about ₦200k from that project. I expect to make ₦500k more before the project ends in a few months.

Fascinating. But what do you do to make money during the off seasons?

Omo. I sold my first car sometime last year for ₦400k and raised ₦500k extra to buy a 2005 Honda Civic. When I didn’t have construction jobs to do, I registered the car on a ride-hailing app and started working for them. I was making about ₦20k/week from this. It was only enough to keep the lights on.

That’s how I navigate my income now — when I have projects to do, I can expect to make roughly ₦150k – ₦200k/month. But when I don’t and I’m running low on savings, I hit the road and drive for the ride-hailing company.

Can you tell me what your finances look like at the moment?

I’m not going to lie; I’m down a bit. I have about ₦300k in savings now and I’m hoping I won’t have to dip into it. My financial goal last year was to save enough money to leave the country, but that didn’t happen. I’ll like to try again this year. All it might take is one or two big projects.

If it’s up to you, how much will you like to make per month?

I’ve interviewed at construction companies looking for full-time engineers, but their offers weren’t great. The best one I’ve seen so far is ₦140k. Unfortunately, it doesn’t work for me.

If I’m going to drop my work for someone else’s, I won’t do it for anything less than ₦200k. And the only reason I’m considering a 9-5 in this industry is that I’ll like to have a constant flow of income. The bills don’t care if I make money in a month or not — they keep coming.

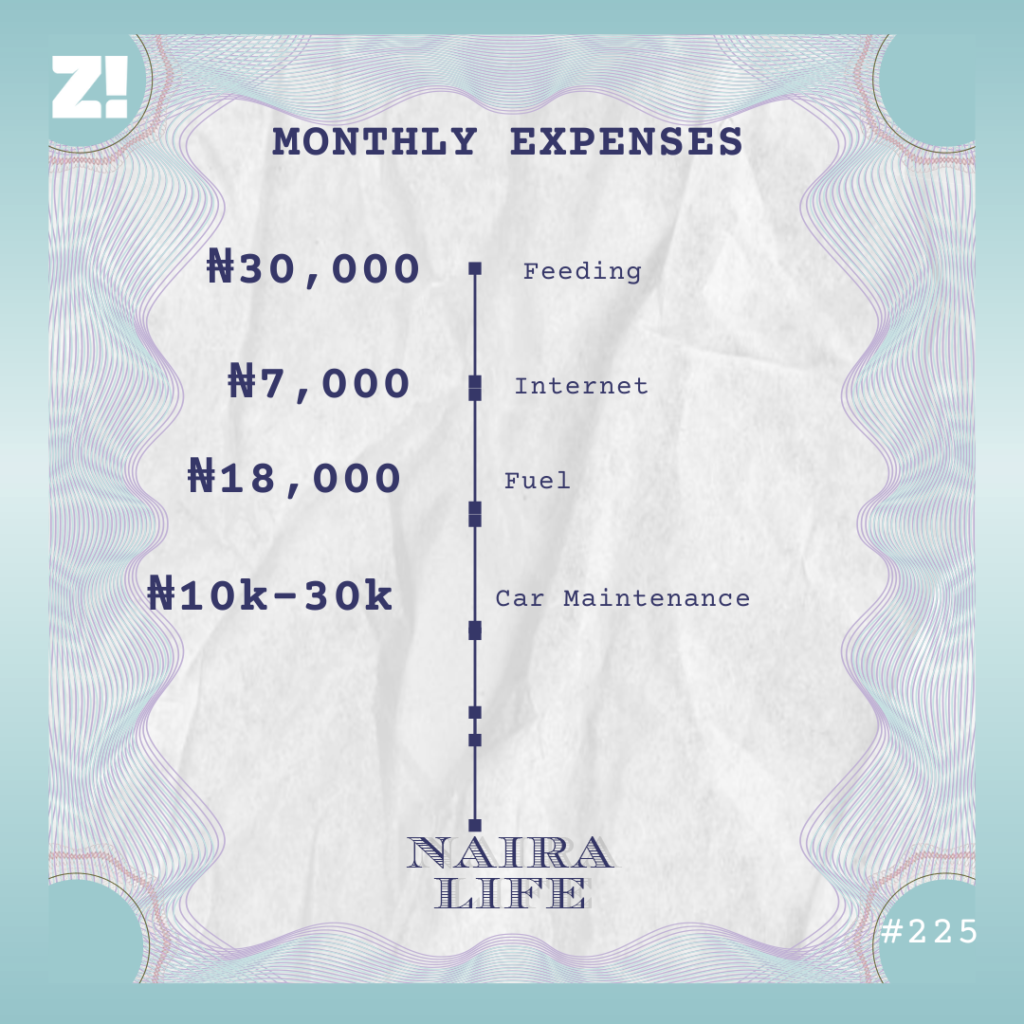

Speaking of bills, what do your recurring monthly expenses look like?

How have your experiences shaped your perspective about money?

Money will always come and go, and it’s best to see it as the scarce commodity it is. It doesn’t matter if you have a long run when it keeps coming in, there’ll ultimately be a down moment. I’m not sure how to prevent it, but the best thing to do is to position yourself to deal with the down periods and have a plan B. That has worked in my case — When I don’t have projects to work on, I put my car to use.

Do you still feel the need to get validation from home?

See, I’m tired of the pressure that comes with it. I don’t care anymore. The past two years have shown me that I should care more about what I can do for myself, rather than my family’s expectations of me. So it doesn’t matter if someone in the family is doing better. As long as I keep trying to do better for myself and keep my income sources open, I’ll be fine. I’m working with my own time now and trusting the process now.

Is there anything you spent money on recently that made you happy?

This happened in 2021, but it still makes me happy. The government demolished my mum’s stall in the market. So I rented a shop for her, which cost ₦250k. I loved that I could do that for her.

Love it for you. What do you want now but can’t afford?

A piece of land. I’m tempted to invest my entire savings in one right now, but it won’t get me what I want. I’m looking at buying something in a good location, so I can flip it for a profit in the next 3-4 years. I might need close to a million naira for that.

Whew. On a scale of 1-10, how would you rate your financial happiness?

It’s a 6.5. I’m not quite where I’d like to be, but I also know that I’ve grown a lot in the past few years. I just need a constant flow of money and higher-paying projects, and I’ll be great. Like, if I have ₦10m in my savings right now, I’ll be the happiest man on earth.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Yes, I want to do a Naira Life

Find all the past Naira Life stories here.