Citizen is a column that explains how the government’s policies fucks citizens and how we can unfuck ourselves.

Access bank is no stranger to court cases relating to “Post No Debit” (PND) orders, and we will explain so in this article.

On November 4, 2020, the Central Bank of Nigeria (CBN) obtained an order from a Federal High Court in Abuja that empowered it to freeze the bank accounts of 20 individuals and organisations linked to the #EndSARS protests, stating that the court that the bank accounts might be operated by terrorists.

But, while the order and the subsequent action by the commercial banks, including Access Bank, to freeze the respective bank accounts has stirred a lot of controversies, including a boycott of the “Lagos Judicial Panel on Inquiry and Restitution For Victims of SARS Related Abuses and Lekki Toll Gate Incident” that held last Saturday, 7th November 2020, there are newer cases brewing.

What Should Have Happened?

The ideal story should be that the CBN obtained an ex-parte order from a Federal High Court in Abuja to “freeze” the accounts of 20 individuals and organizations linked to the #EndSARS protests, after which it showed this order to the commercial banks – Access Bank, Fidelity Bank, First Bank, Guaranty Trust Bank, United Bank for Africa and Zenith Bank, who then proceeded to block financial transactions on the respective bank accounts.

Think of it like an SS3 school prefect getting a written order from the school principal to punish all SS2 students. The school prefect then goes ahead to present this order to the class captains of all the SS2 classes. This is because the school prefect must derive her authority from somewhere, in this case, the school principal.

But what if the school prefect did not get an order from the principal before telling class prefects to punish SS2 students? Or, what if the CBN did not get a court order before telling commercial banks to freeze the accounts of these #EndSARS protesters?

Read: What Is An Ex Parte Order?

Blaid Construction Ltd v. Access Bank

In Blaid Construction Ltd v. Access Bank, a 2017 case, Access Bank, placed a “post-no-debit” order on the accounts of Blaid Construction Limited and Blaid Properties Limited, after a letter from the Independent Corrupt Practices Commission (ICPC) directed it to. Also, the EFCC obtained an order before a Federal High Court in which the bank was also instructed to place a post-no-debit alert on accounts held by the Blaid Construction. Both orders were meant to last for three months: from 1st July 2016 to 30th September 2016.

However, after three months, the post-no-debit order continued. So, in 2017, Blaid Construction took Access Bank to court, arguing that Access Bank’s denial of their right to operate their bank account was illegal and unlawful, and that access bank should pay them ₦500 million as damages for violating bank and customer relationship, among other things.

In its own defence, Access Bank argued that the post-no-debit alert was placed on the Blaid Construction’s accounts because it was complying with the ICPC’s letter.

Delivering a judgement that favoured Blaid Construction Ltd, the court stated that ICPC lacked the power to place a post-no-debit alert on bank accounts without first obtaining an order from the court and that the conduct of Access ban to “unilaterally” freeze the account of Blaid Construction Ltd is illegal.

The court then ordered Access Bank to pay ₦5 million as damages to Blaid Construction Limited.

What Is Going On In This Present Case?

A post-no-debit order is an order that prevents all transactions from taking place on a bank account, either through ATMs, credit cards, cheques, or any other means. And from the case, we have seen, a court order must be gotten before a post-no-debit can be placed on bank accounts, or an account can be “freezed”.

But new facts now show that the CBN did not obtain a post-no-debit order before directing banks to freeze the bank accounts of #EndSARS protesters.

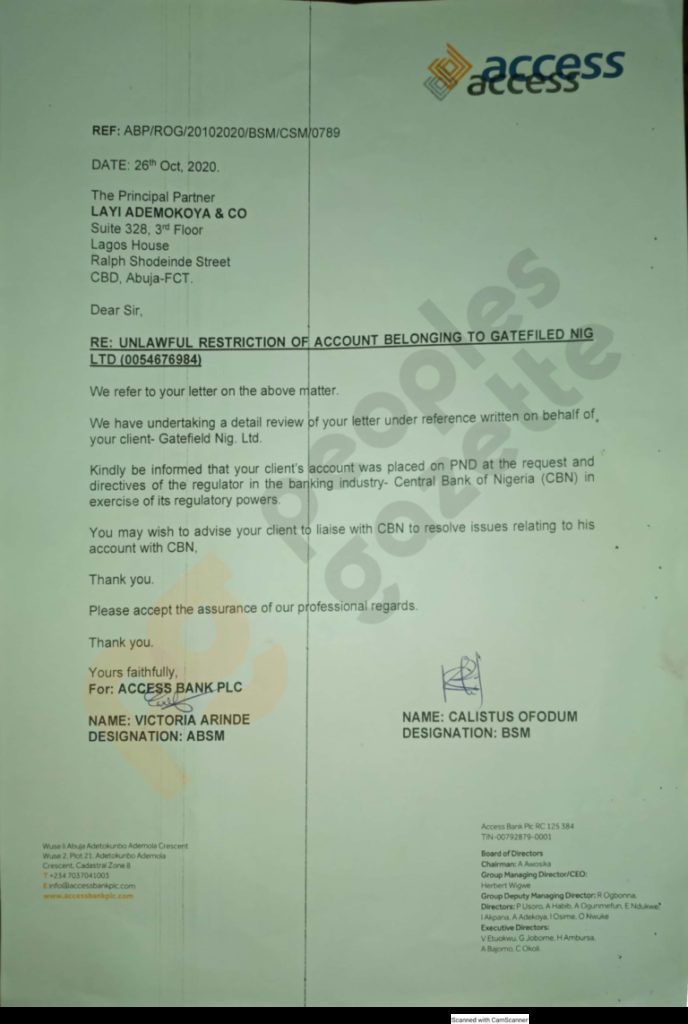

In a letter obtained by People’s Gazette, a news website, details show that Access Bank was communicating with Gatefield Nigeria Limited, one of the companies who were affected by the CBN’s post-no-debit order, since as far back as 26th October, more than a week before the post-no-debit order was approved the court.

And Access Bank have also explained on Twitter that they are “compelled” to comply with regulatory directives.

But we have explained that all post-no-debit orders must be approved by the court, Gatefield Limited is having none of this. The company has gone ahead to sue Access Bank to court for “unilaterally” freezing its bank account, and it all really looks like the 2017 case, all over again.

Read: 17 Things Only People Who Have Been To A Nigerian Bank Will Understand

We hope you’ve learned a thing or two about how to unfuck yourself when the Nigerian government moves mad. Check back every weekday for more Zikoko Citizen explainers.

COMPONENT NOT FOUND: donation