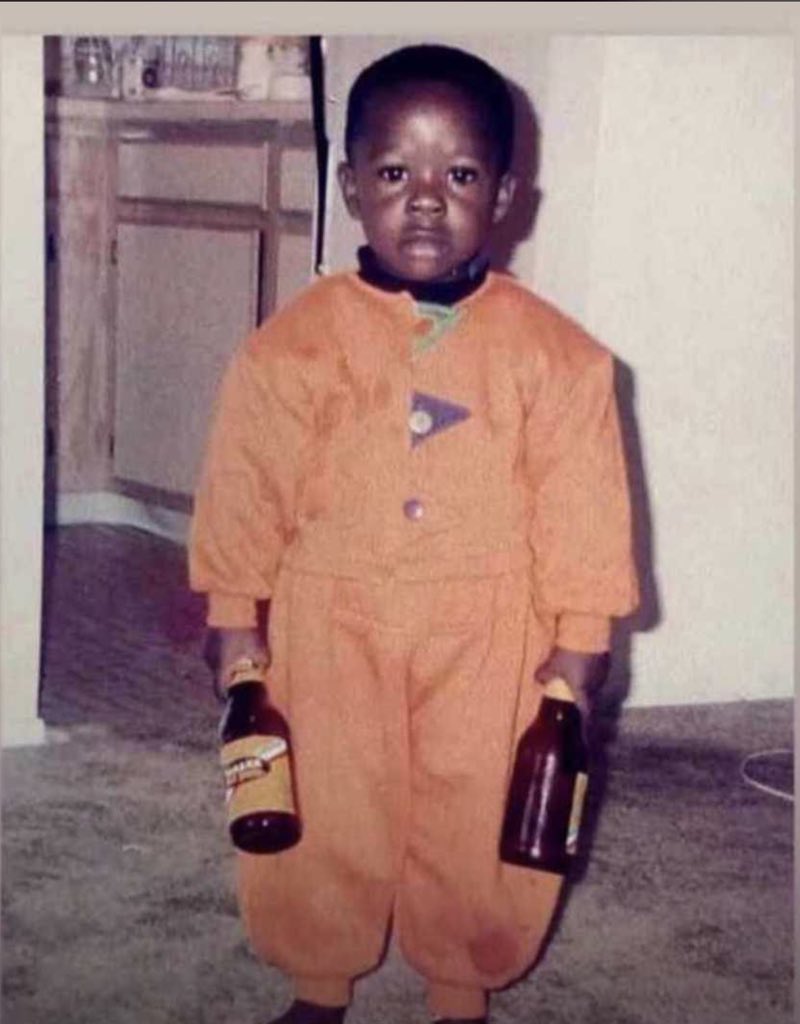

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When did you first realise the importance of money?

That has to be when I was in JSS 3. I stole ₦500 from my dad’s bedroom drawer and used the money to show off at school. I bought ₦50 yoghurt drinks for my two seat mates, and everyone in class suddenly wanted to be my friend.

I already knew money was necessary to buy things, but I didn’t realise it could change how people saw you until this incident. The by-force friendship was short-lived because my dad noticed the missing money and made sure I was punished in front of the entire school. It destroyed my hard-earned street credibility.

I’m wheezing. Speaking of, what was money like growing up?

We didn’t have a lot of money. My dad was a civil servant and my mum was a teacher at a private school. I have three siblings, and we all lived in my dad’s uncompleted one-bedroom house. My dad had gathered money to build the house and once it was slightly livable, he bundled us all there so he wouldn’t have to pay rent anymore.

That house remained unfinished until I entered the university. I never brought my friends home because I was ashamed of the muddy floor and rusted iron roof. Now that I’m older, I know my dad was just making do with what he had.

I also didn’t like how I couldn’t get the things my friends had. I schooled at the private secondary school my mum taught at, and I always compared myself to the students who wore new uniforms and bought snacks at school. My own school uniform was what we called “Bo n’ fo” — my trousers were always smaller and rested above my ankles.

I was always aware we didn’t have much money, and I wanted money so much.

What did you do about this “want”?

As a child, I mostly satisfied my wants by stealing. I’m not proud of it, though. I was a regular customer of my dad’s belt, his favourite discipline tool. But it was no match for my desire to just be like other kids.

After I graduated from secondary school in 2010, I taught at a primary school for ₦6k/month and was there for almost two years. I’d already mentally accepted that I wouldn’t go to the university anytime soon. My elder brother was at university then, and my parents couldn’t afford to put both of us through school at the same time. So, I figured uni would only happen if I gathered enough money.

Fortunately, an elder in church took an interest in me and offered to pay my tuition for the first two years of university. That’s how I got into the university in 2013.

How did you survive in uni?

For the first two years, it was a mix of relying on my benefactor’s kindness and whatever allowance I could get from home. My benefactor gave me ₦10k – ₦15k every two months, and my mum assisted me with foodstuff.

When I got into 300 level in 2016, my benefactor told me he couldn’t pay my tuition anymore. Although he’d made it clear he’d only pay for two years from the beginning, I was still shocked. I didn’t think he’d just leave me like that. How was I supposed to sponsor myself without help?

I met with another big man in church and told him my situation, hoping he’d help me too. But the man told me to come and work in his plastic company.

What was the job?

The supervisor just put me in the factory and tasked me with packing the raw materials and loading the products into buses. My salary was ₦15k/week.

I worked there for two months.

Oh. Why?

It was stressful, and I couldn’t keep up with showing up at the factory every day after classes. I had no source of income for the rest of 300 level, so I started serial borrowing. I was taking loans from people to pay off other loans.

I mostly asked for loans from church members. I was the church drummer, so people knew me. I’d ask a fellow church worker or the mothers. I had more luck with the mothers.

My loan requests were often school-related, like handout needs. Others were urgent ₦2k asks for food. I didn’t pay back all the loans because it was really hard to keep track. Some of my creditors didn’t even bother to ask for their money back. I only repaid people who disturbed me for their money.

I see. Didn’t this affect your relationship with those who didn’t get their money back?

Some acted somehow when I reached out for help again while I still owed them. Others said they didn’t have money after the second time I borrowed money from them. But I always tried to explain my situation and plead for patience.

To be honest, there wasn’t much I could’ve done. If I’d known my benefactor was serious about not supporting me beyond the first two years, I’d have rejected the admission. But I was already in school and had already invested too much energy to drop out.

Did you try any other way to make money?

Yes. During my final year, I started taking brand activation gigs during the weekends. I’d follow FMCG distribution buses to market their products to retailers and set up market shows to drive visibility and sales. I made between ₦5k and ₦8k per gig.

I also took on a few drumming gigs at other churches’ events on Saturdays. The churches sorted out my transport fare and a plate of food. I’d have made good money if I drummed on Sundays, but I couldn’t leave my church.

In August 2017, one of the women in church whom I’d told about my financial situation suggested starting a business. She gave me ₦50k, and I started selling polo t-shirts in school.

How did that go?

It went well at first. I made a ₦1500 profit on each t-shirt and sold up to six weekly. The money from the business came in handy when I was writing my project. But customers started owing me, so I took out loans to restock.

I borrowed ₦30k from one guy. When it was time to pay back, I started avoiding him because I didn’t have money. One day, the guy broke into my hostel room, packed my t-shirts, and texted me to inform me he’d taken them as I hadn’t paid him back.

The goods he took were worth ₦40k, but I didn’t drag it with him. Some guys told me he was friends with cultists, so I left him for God. Thankfully, this happened around the time I graduated from uni in 2018.

What did you do after uni?

I spent my service year teaching at a private secondary school. My monthly income was ₦29,800: The school principal paid me ₦10k/month and my NYSC stipend was ₦19,800. Service year was good, actually.

The school accommodated me, so I spent money only on food and going out. Sometimes, I sent money home to my mum. I even finished my service year with ₦80k in my savings. This was 2019.

But COVID lockdown happened. I didn’t have any income source, so I finished my savings in months. Then, I moved to the loan apps.

That doesn’t sound good

Those loan apps showed me shege. Maybe it’s even my fault. I knew I had nowhere to get money from, but I kept borrowing money from the apps. Of course, I defaulted a lot. The loan agents would call and call, and send threats when I refused to pick up.

One time, they sent my obituary announcement to my mum and told her she’d bury her son if he didn’t pay his debt.

Ah

My mum called me in a panic but I convinced her they were scammers. My biggest learning here was to stop dropping my mum’s number when applying for loans. I even deleted her number from my phone because I heard the loan companies can access your contact list.

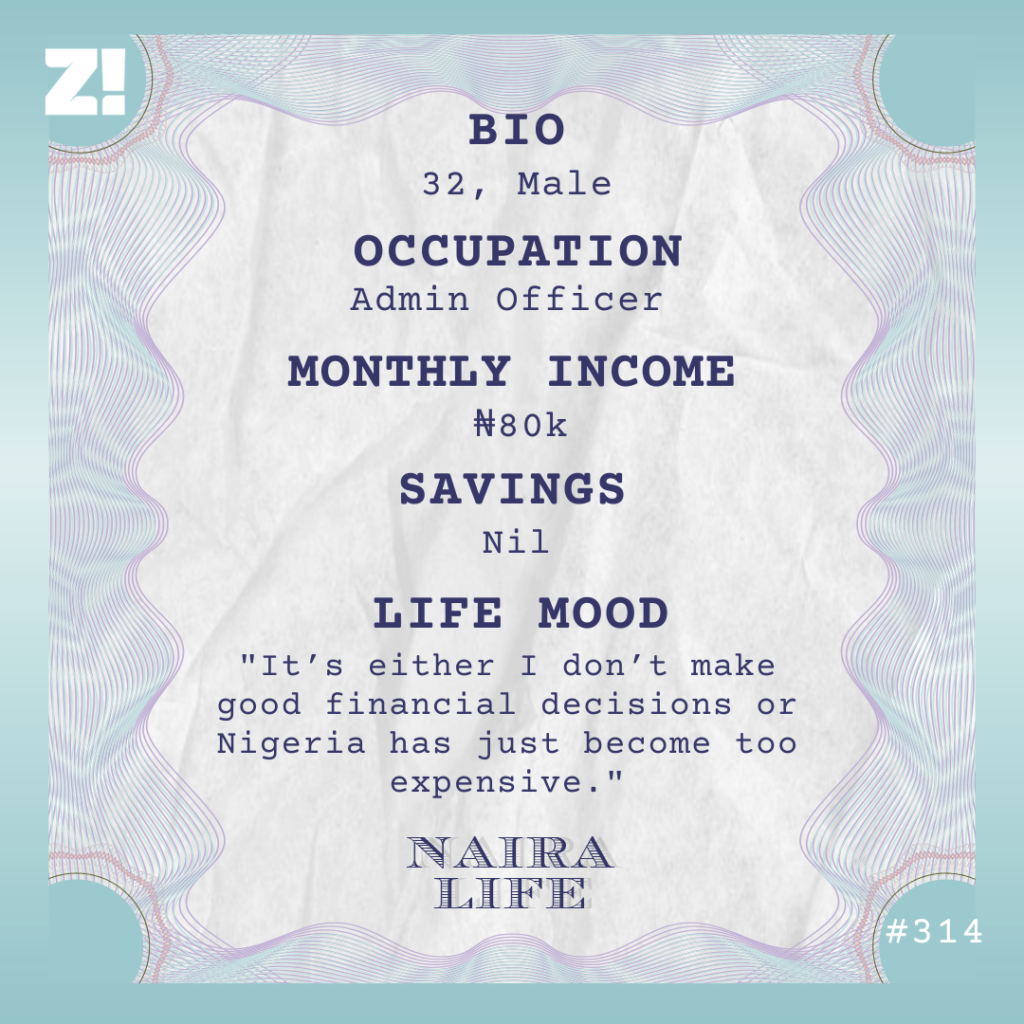

Looking back, I’m not sure how I survived 2020. I just survived. When church resumed in 2021, I returned to asking people for help and money. Some sent me job vacancies, which I applied for, but nothing came out of them. Finally, my pastor offered me a role as an admin officer at the church. That’s still my job today.

What’s the pay like?

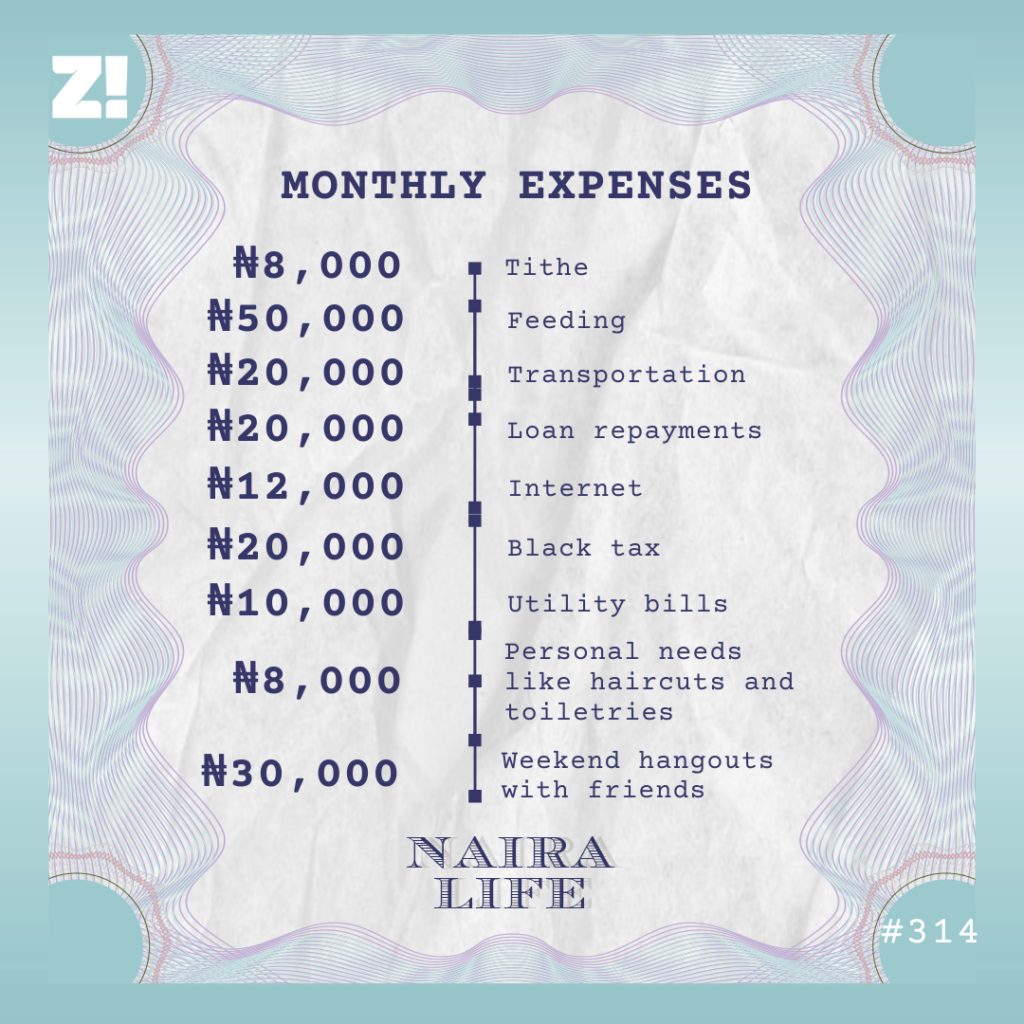

It was ₦50k/month when I joined in 2021, then it increased to ₦80k in 2023. I haven’t gotten a raise since. My rent is ₦240k/year but the church pays half.

My major responsibilities are feeding, rent and occasionally sending small money home to my parents and siblings. The thing is, ₦80k hardly covers that, and I often feel I should earn more. The church has really tried for me, but the work doesn’t match the money.

I handle everything from organising programs and outreaches to working as the pastor’s personal assistant. But I can’t even complain because they’re paying my rent.

Is there an ideal amount you think you should be earning?

₦200k isn’t bad. I’m still single so that should comfortably meet my needs. I know it’s not an impossible thing for God to do. I’ve seen Him do bigger miracles for other people. Maybe if I earned up to ₦200k, I wouldn’t still be taking loans as much as I do.

You still take loans?

I never stopped. However, I’ve tried to reduce my borrowing from loan apps because their interest and wahala are too much. I borrow more from people as I can still explain the cause of any delay in repayment. Also, no one is threatening my life if I cannot pay back. I don’t think it’s possible to survive in Nigeria without borrowing money from people.

How often do you take loans these days?

At least twice a month. Once I receive my salary, at least ₦15k goes into repaying one loan or the other. Then, after removing feeding and transportation costs and a few personal expenses, I’m broke by the second week. That’s when I start borrowing.

I turn to church friends, coworkers, and old school friends for ₦20k – ₦30k loans. Most of the time, I don’t get the full amount from one person — it’s ₦5k here, ₦10k there, and so on. I turn to loan apps only when I can’t find people to loan me money.

Does that happen often? Not finding people willing to lend you money?

It happens quite a lot. I know people in church already call me a chronic onigbese, and some of them avoid me because of that. I don’t mind the name-calling because I know I’m not in the right, but my financial situation is beyond me.

I have a roster of multiple people I’m supposed to pay back, but I can’t remember every single person I owe. I don’t pick calls from strange numbers anymore because it’s most likely someone calling me for their money.

Being in this constant debt cycle is exhausting. I don’t derive pleasure from holding people’s money, but I almost always have to borrow more money to settle a creditor, and the cycle never stops.

A recent example is a chorister I borrowed ₦100k from in October 2024 to meet up with rent. She really disturbed me to pay back and even reported me to the pastor. We eventually settled on a ₦20k/month repayment plan.

I will have to borrow more to meet that. There’s no way I can remove ₦20k from an already insufficient ₦80k salary and not die. I still owe three different loan apps about ₦175k. I can’t pay those ones anytime soon.

Can you break down what your typical month in expenses looks like?

Sometimes, I try to save ₦10k/month for rent, but I spend it by the second or third week. Either I don’t make good financial decisions or Nigeria has just become too expensive.

How would you describe your relationship with money?

It feels like I’m not making progress financially. I constantly need money for something, and the need never ends. I also acknowledge I have a borrowing problem. The people are right; I’m an onigbese and maybe I need to own it so I can focus on solutions.

I need help and advice. I want suggestions on what people think I should do to recover from constant borrowing. I know earning more money will play a big role, but what do I do in the meantime? I may be unable to cancel debts permanently, but at least it can be reduced to once in a few months.

Is there anything you want right now but can’t afford?

A relationship. I’ve not had much luck in love because of my financial situation, but I’m tired of being alone. But I can’t do anything about that for the next few years sha — at least until God sends me a helper to change my story or I find a better-paying job.

How would you rate your financial happiness on a scale of 1-10?

3. As I said, I feel like I’m not making financial progress. I get depressed when I think about it, but I’m trusting God for a positive change soon.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

[ad]