Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When did you realise the importance of money?

In the university. I attended a boarding secondary school and didn’t handle much money as a child. I think that’s why, the first time my dad gave me a ₦40k allowance in uni, I went wild and finished the money in one week. And this was in 2007.

The whole thing?

Yes. It was the first time I realised that money could come easily but go just as quickly. My dad was surprised when I called to ask for more money after a week.

He was like, “You know what? I’ll only give you ₦20k for the whole month from now on.” So I had to learn to manage. It wasn’t difficult to adjust; I just knew what I had and managed my expectations accordingly. That was the only option after my dad made it clear I’d only get money from home once a month.

Speaking of, what was the financial situation at home?

We were middle class. My parents are divorced, so I grew up with my dad. I’m not sure if my mum contributed financially, but my siblings and I lived with my engineer dad.

There were occasional periods of lack growing up, but my dad took care of the bills and gave us a comfortable life. I didn’t need to do anything extra for money, though I tried once in my final year at uni.

Tell me about it

I had a printer in school because of my final year project. So, I thought of charging people for printing services.

I had plenty of customers because students always need to print something. I might have charged ₦50 per page and made about ₦10k/month. The business only lasted two months because I didn’t know I was supposed to keep business money aside; I spent it all. When it was time to replace the printer ink, I had no money left. That was the end of my money-making attempt in uni.

I graduated in 2011 and moved to the UK for my master’s degree.

How did you handle your day-to-day expenses in the UK?

My dad gave me a £150/month allowance, which covered all my expenses. In fact, I lived a pretty comfortable life. Food was cheap in the UK. I’d buy foodstuff in bulk for £30 at the beginning of the month and cook when I needed. The rest of my money went into occasionally eating out and using the train.

I returned to Nigeria after my degree in 2013, and NYSC was the next step. I served in the army because they wanted people who could teach them a language I studied. My NYSC allawee, plus the stipend I received from the army, brought my monthly income to ₦60k.

Was ₦60k good money?

This was 2013, so it was good money. The ₦60k took me the whole month and then some. I wasn’t partying so much, but I hung out with friends regularly. My dad had bought me a car at this point, and fuel wasn’t expensive, so things were great.

After NYSC, my dad helped me get an interview with a bank. I got the role and interned for three months, earning ₦100k/month. Training school came after, and I was there for two months, also earning ₦100k. It was a lot of money back then.

2014 was my most active year; I spent most of it outside. There was no restaurant in Lagos I didn’t visit. I met up with friends for drinks, went to the beach, and just generally was everywhere. I had zero savings.

Then, just before the end of training school, I decided I didn’t want to work in a bank and quit. If I’d stayed, my salary would’ve been increased to ₦250k, but I had to leave.

Why?

I couldn’t deal with the stress. I was undiagnosed at the time, but I’d developed bipolar disorder. I’d been manic for most of the year, and at that point, I just felt like I’d die if I didn’t leave. I could tell something was off.

My dad was understandably upset and tried hard to convince me to stay. When I insisted, he took my car and said, “You want to be an adult? Be an adult. Do things how you want to do them, but know there will be consequences.”

He later forgave me, but he thought I threw an opportunity away.

When did you get diagnosed?

A few months later, in 2015. I also started taking medication, so I became more stable. I wasn’t sure what I wanted to do with my career, but I thought marketing would be a good fit because I consider myself creative.

I told my dad, and he supported me. He paid for the online marketing courses I took, and after I got my certificates, he linked me up with a marketing agency. I got the job as an assistant manager for client services, and my salary was ₦100k/month.

Did you prefer the job to banking?

Yes, in many ways. There was a better work-life balance, and my workplace was five minutes away from my house, which was great.

The only downside was that there wasn’t much prospect for income growth, and they often delayed salaries. Some months after I got in, I found out my supervisor earned less than I did; she’d been there for five years.

You say?

They had a thing where the salary you negotiated at the beginning is what you get, and the salary only increases by like ₦3k or ₦4k as the years go by. Even my ₦100k was the gross pay; my actual pay was about ₦80k+ after deductions.

I supplemented my salary with a side hustle. I got close to my supervisor, and she introduced me to the foreign company she worked for on the side. I got paid in naira, and my job was to provide client services (remotely). My income from that was ₦60k/month.

How long did you juggle both roles?

Two years. I left the marketing agency in July 2017 because they kept owing salaries. I lived on my income from the side hustle until January 2018, when I had a massive manic episode that landed me in the hospital for a few weeks.

Even after I was discharged, I didn’t feel like myself. My dad suggested I visit with my mum in the UK to recover, so I did. I stayed in the UK for six months. I even stopped my medications because I felt they weren’t working. What was the point of taking medication if they couldn’t keep manic episodes at bay?

So, I rawdogged life without medication for about a year. Looking back, I was manic throughout without realising it.

I started job-hunting when I returned to Nigeria in August 2018. Again, my dad helped, and I got interviewed for a project management role with an oil servicing firm in October. I asked for ₦500k, but they could only pay ₦120k, so I took it. I should mention that I’d taken a project management course in the UK, which helped. I worked there for two years, and my salary grew to ₦150k. I left when the place became too toxic.

Did you have another job lined up?

Yes. A job in communications and business development at a startup. It was practically two roles in one, and the salary was ₦200k/month. I tried to negotiate higher, but I think I’m bad at negotiations.

At this point, I was living alone. My family had moved further away, and my dad didn’t want the longer commute to trigger another manic episode. My rent was ₦700k/year for a one-bedroom apartment. Living on my own made it clear my salary wasn’t great. I had to save and manage money to meet my living expenses.

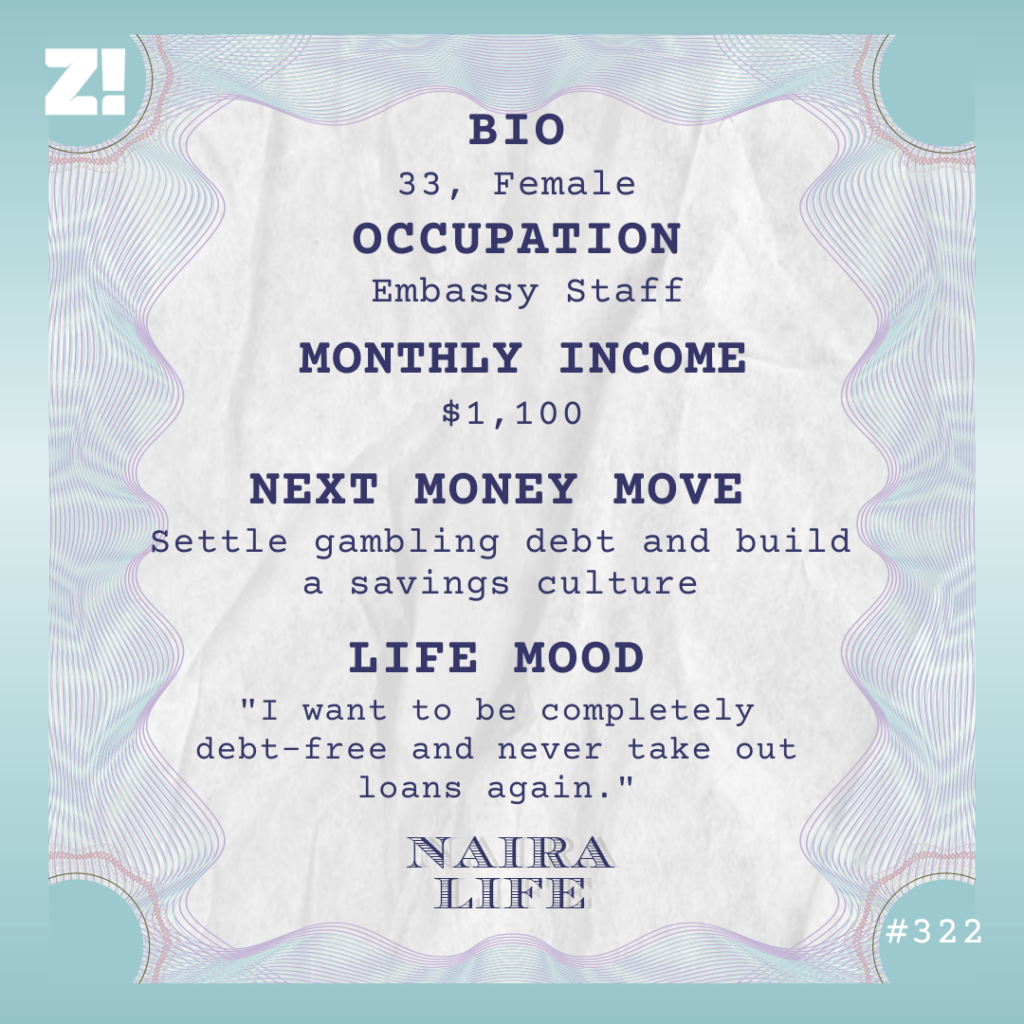

Fortunately, six months into the job, a job I’d applied for at a foreign embassy in Nigeria came through. I applied for the job the previous year, and it took six months before they called me, and another six months to complete the interview process. This was in 2021, and I’m still at the job today. I work in the passports and citizenship office.

I imagine the salary was a big jump from your pay at the startup

It was. When I got in, my salary was ₦770k/month. It has increased several times over the years because of inflation. It went from ₦770k to ₦800k, then ₦1m. After a few more bumps, my employers just decided to pay in dollars, so now I earn $1,100, which is around ₦1.7m after conversion.

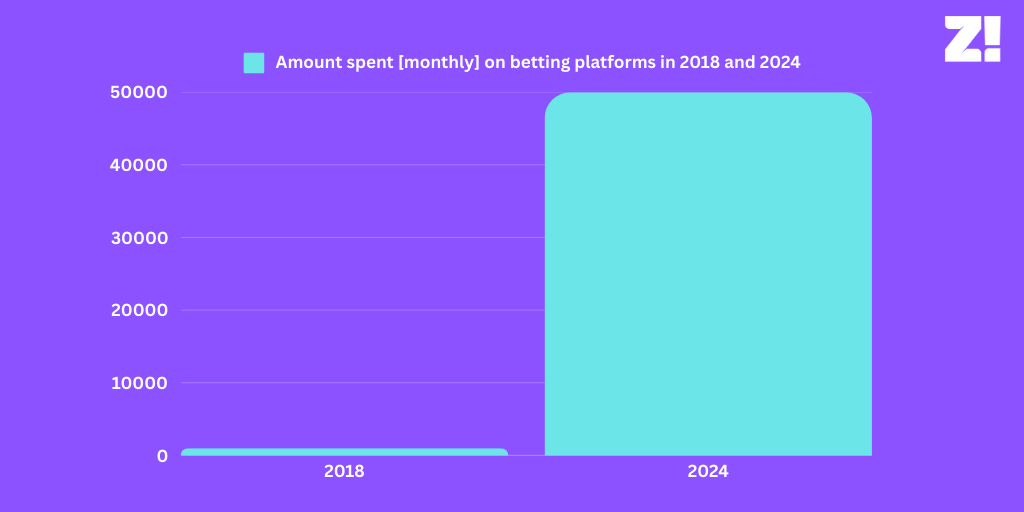

I wouldn’t say I’ve really enjoyed the pay increases because, sometime in 2020, I got into gambling. Right from when I got this job in 2021, I was already repaying gambling loans.

Click here if you’re interested in talking about your Naira Life story

How did you get into gambling?

It was a period when I needed extra money to supplement my salary. I’d dabbled in putting money on horse racing and casinos in the UK, but it was nothing too serious. I also tried once from Nigeria using my UK card details and won £90, but the betting companies got stricter about only allowing UK residents to use their services.

I decided to try casinos again in 2020, and won ₦500k with a ₦20k stake. That’s how I got hooked. The thing about gambling is, one never really makes progress. If you keep gambling, especially at casinos, you’ll certainly win up to a point and then start losing money.

I didn’t know how to stop, so I constantly lost money. When I earned ₦770k, I took out ₦200k for feeding and ₦298k for rent, and spent the rest gambling. When my salary finished, I moved on to loans. At first, I used loan apps, but after they embarrassed me once, I moved on to banks for loans and kept racking up debt.

I initially planned to use a percentage of my salary to repay the loans every month, so I’d still have money for other living expenses. But as my debt increased, my ability to repay decreased.

My dad stepped in twice and paid off all my debt, but I just went back and racked up more debt. It was a full-blown addiction. All my money went into the casinos and settling debt. I barely had anything left for food. I didn’t know it then, but my constant gambling was linked to my mental illness.

How so?

In 2024, I started taking active steps towards recovering from my gambling addiction. I reached out to an NGO for therapy. When the therapist noticed I was on medication for bipolar disorder, they pointed out that my medication wasn’t strong enough.

It turned out that impulsive spending is a symptom of my condition, and my medication wasn’t fully managing it. So, I switched medications and noticed that the urge to gamble went away. But the new medication came with serious side effects: weight gain, constant sleepiness, and my monthly flow disappeared.

I stopped the medication for a while because of the side effects, and the urge to gamble returned with a vengeance. It was so bad that whether I had money or not, I’d find a way to get or borrow money just to gamble it all away. My worst day in gambling ever was when I gambled away ₦2.2m in one day.

Wow

I returned to the stronger medication a few months ago and accepted the side effects like that. I also gave my dad all my money to hold so I wouldn’t have quick access to it.

It’ll take a while for the medication to kick in with full effect, so the urge to gamble still comes once in a while. But it’s nothing compared to before. I’ve blocked gambling websites on my phone, and whenever I manage to find a new website, I set ₦20k wager limits so I can catch myself before I go overboard. Once I realise I’m gambling again, I close the account and practice self-exclusion.

It’s not easy, but I’m managing it well. Right now, I’m focused on settling my debts and learning how to manage my money again. I keep most of my money locked away in fintech apps, so I get minimal access at certain times. Also, I often send my salary to my dad after taking out what I need to repay loans monthly.

I’d like to increase my self-control to the point where I don’t need to send money to my dad; it’s not the best locking-money-away measure. My dad still gives me my money if I ask for it, which isn’t really effective.

You mentioned settling debts. How much do you currently owe?

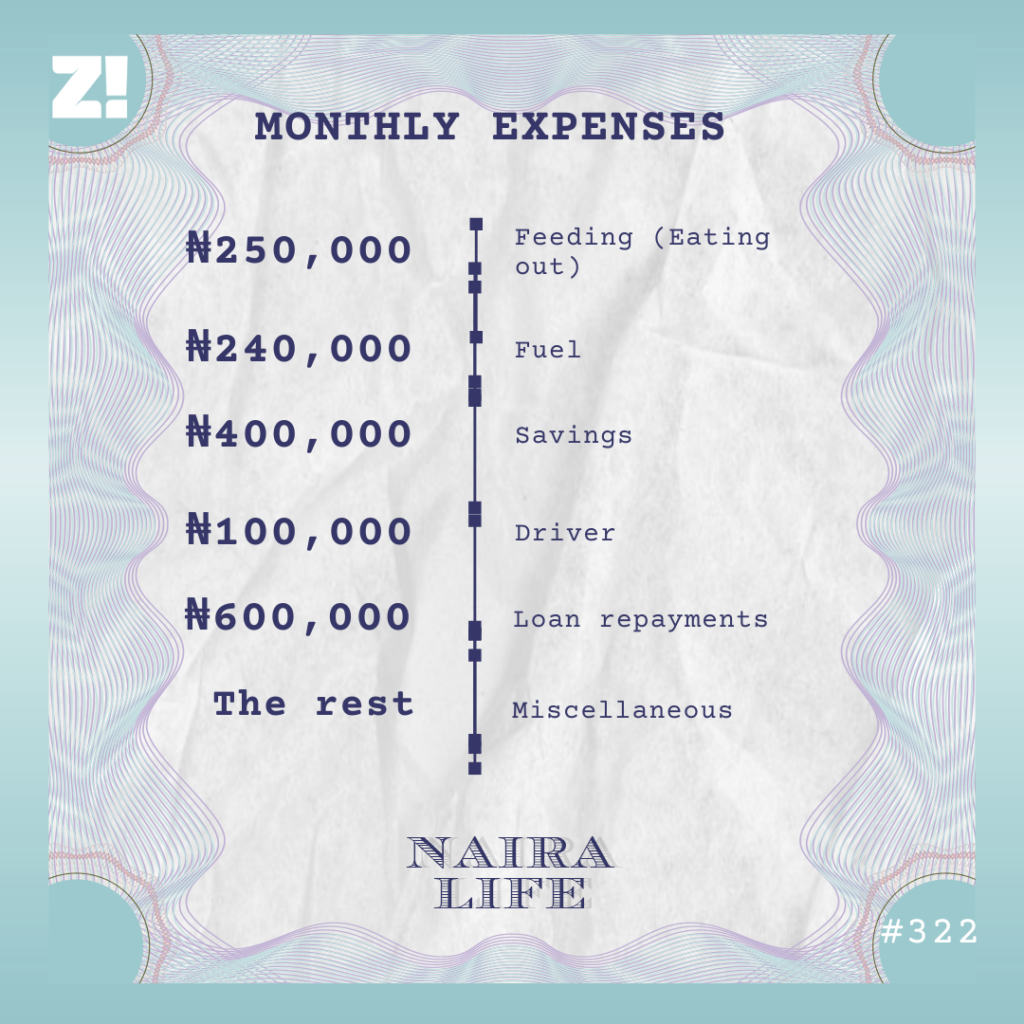

About ₦5m. It used to be around ₦9m across three banks and a UK credit card, but I’ve been actively repaying monthly since last year. I currently pay ₦600k in loan repayments every month. At my current repayment rate, it should take another year to pay everything off.

While we’re on the subject, what do your typical monthly expenses look like?

I no longer pay rent because I moved back home in 2024. I needed to make some lifestyle changes and save money, so instead of paying rent, I pay a driver to take me to work.

I have about ₦500k in my savings account right now, which is puzzling because I save ₦400k monthly. I don’t know if it’s because I’m still gambling or haven’t figured out a good spending habit.

How have your experiences impacted your relationship with money?

At some point, all I thought about was gambling with money. Now, I’m trying really hard to save. I understand that money doesn’t need to come quickly; it can also go quickly. Regardless of how long it takes to make money, it can go fast because there’s always something to spend on.

I’m still learning how to manage money. I think I didn’t learn earlier because of my background, so I’m playing catch-up. I’ve started with savings and hope to build on that and find more ways to accumulate wealth.

I would have tried investments, but I think I’ve expended all my risk in my gambling days. So, I’ll stick to savings plans that allow me to lock up my money for now.

What do you imagine the next few years will look like?

First, I want to be completely debt-free and never take out loans again. I also hope to grow my savings to ₦6m within two years.

I’m considering moving to Canada in the next few years, so I could either do that or stay in my role. By the way, I really enjoy my work, so I wouldn’t mind continuing what I’m currently doing.

That said, I still want to have a side hustle. This might be the only job I’ve had without something else on the side. Some options I’m considering are content writing or something in marketing. I haven’t been able to actively pursue gigs because my medication always makes me tired, but I’m on the lookout.

What was the last thing you spent money on that made you happy?

My phone. I got it in February for ₦570k after the previous one got stolen in traffic. I know having a phone increases the risk of returning to gambling, but I still do other things with my phone, and I was happy I could replace it.

How would you rate your financial happiness on a scale of 1-10?

3. I still have a long way to go. It’ll be a 10 when I’m debt-free and have at least ₦6m savings.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

[ad]