Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

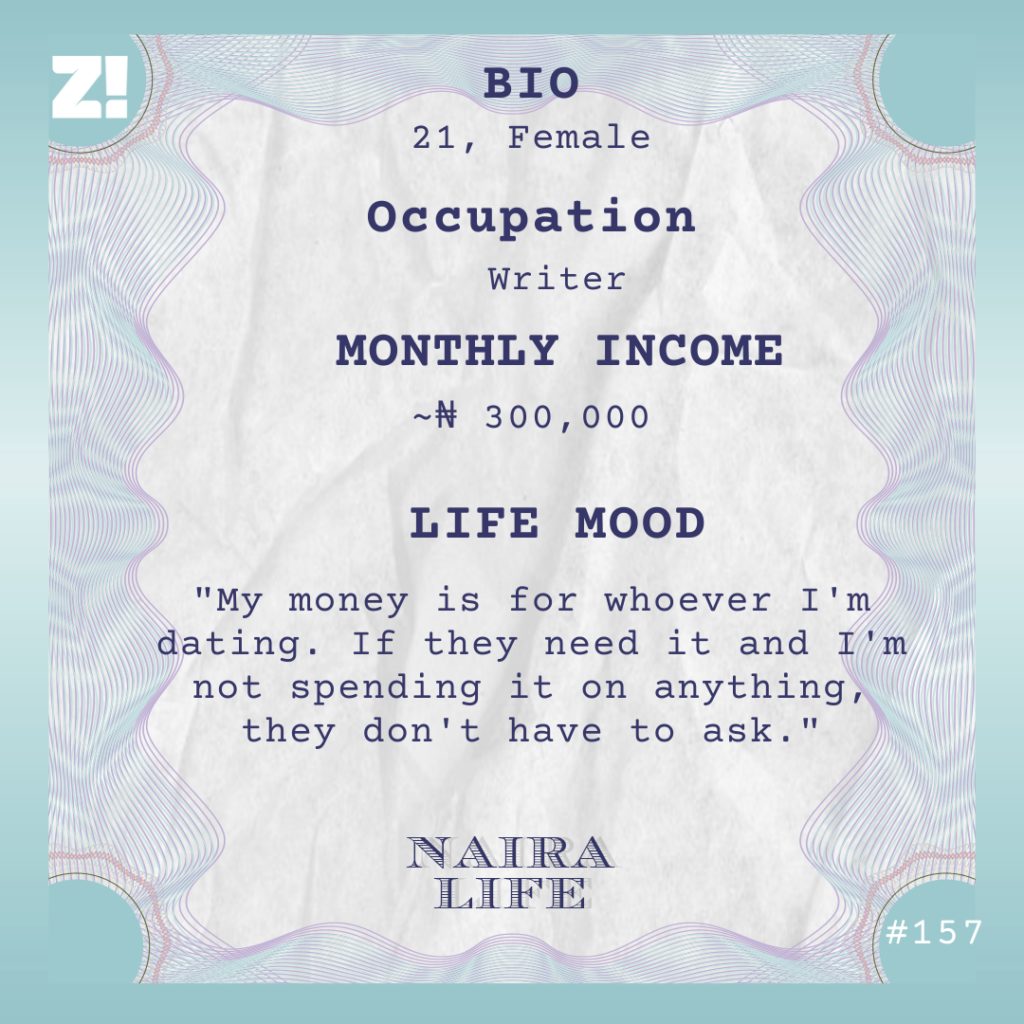

On #NairaLife today, the 21-year-old subject tells us about how her dad’s spending habits affected her relationship with money. To her, money is meant to be spent on people you love without hesitation, and she applies this rule to her romantic relationships — she currently has six partners.

What’s your earliest memory of money?

When I was eight years old, I won a book during a school competition . It was about a rabbit who had to write letters to his family because he got on the wrong flight and was now far away from them. The book had an envelope at the end of each chapter, for whoever reading to put a letter in. Instead of a letter, I put money gifts from my relatives in there.

A few months after I started saving, armed robbers came to our house. They put a gun to my dad’s head, threatening to kill him if he didn’t give them any money. As my mum and I watched him beg that he had no money, I had a bright idea — I would give them the money I’d been saving so they could leave my dad. I spoke up and they asked for the book. They took the money, some jewellery in the house, and left.

Whoa. What were things like at home?

Things were good on some days and terrible on others. My mum was a tailor who mostly made money from bulk school uniform contracts, so she only had a lot of money once a year, and my dad did business. Till today, I don’t know what business it was.

My dad’s business wasn’t always profitable, so he didn’t always have a lot of money. When he did, he spent it badly. Everybody knew when he’d just made money; one time he bought a car on a whim even though we already had one, another time, a plasma TV, or he’d go out drinking and womanising, and then go broke again. But with all his money-related flaws, he made sure he gave me money and got me gifts whenever he had the chance. To me, it became the perfect way of showing love.

How did all of this affect your view of money?

I promised myself I was always going to have a fixed minimum monthly income so I wouldn’t ever be in a situation where I didn’t have money. When you go from poor to rich and back to poor in a matter of days, it messes with your mind.

I hated seeing money go in and out of our lives, but we couldn’t do anything about it. For instance, we ate rice and turkey every Wednesday for years, and I got home from school one day and saw fish instead of turkey. I asked my mum why we were eating fish, and she said turkey was too expensive. On some other weeks, we had boiled eggs. When things got better again, we went back to eating turkey. This was the cycle.

I became obsessed with hoarding money once I got into secondary school. My mates would talk about their trips abroad and the things their parents bought for them, and it made me feel poor. I thought if I hoarded enough, I could afford those trips by the time I was done with school. I specifically wanted to go to Paris.

How did you do it?

Whenever my relatives gave me money, I kept it. From time to time, I bought Barbie CDs, but I mostly kept the money to feel good about myself. When my parents noticed how invested I’d gotten in money, they started using money to make me do things like brushing my teeth or doing house chores.

How many millions did you make?

As you can see, not enough.

I hoarded money until I started making money myself at age 12. I learnt how to make beads in JSS 3 and started selling to people who came to my mum’s store whenever I was on holidays. In a month, I sold about five beads for ₦8,500 each and made ₦30,000 profit.

When I turned 15, I stopped making beads because of some health challenges and school exams. That same year, immediately after school, I got a job.

What was that like?

I worked as a cashier at a family friend’s pharmacy. The pay was ₦15,000 monthly, but I preferred it to selling beads because it was a fixed income.

I stayed at the job for six months and left when I got into university at 16. By the time I was resuming, I had over ₦100,000 in savings from all the salary and business income I’d kept. I spent ₦50,000 on a new phone. The rest of the money was what I took to school.

Your parents didn’t give you money?

Not at all. I moved in with my aunt who lived close to my university, so everything I needed was catered for. Also, my parents knew I had an account with money in it so they expected me to fend for myself. Whenever I needed money for snacks or just to hold, I withdrew from my savings.

Luckily for me, my ATM card went missing sometime in the second semester of my first year, and my bank account was a kids’ account that only my mum had control over, so I couldn’t get a new one. When I asked the bank what I would need to transfer ownership to me, the process was super complicated and my mum didn’t want to be stressed, so I opened a student account in a different bank. Because my parents knew I had no access to my old account and no money in the new one, they put me on a ₦20,000 monthly allowance.

Baller.

LOL. I didn’t ball anything. The money didn’t come at once. It was ₦5,000 weekly, and after spending ₦1,000 on transportation and ₦1,500 on data, I had only ₦2,500 to spend every week. Most of the money went to buying stuff for my friends. Having money plus freedom for the first time made me realise I liked spending money on people I liked.

It didn’t take long for my allowance to become insufficient. I started asking my parents for more money. When my requests were met with resistance, I told them the money I needed was for books. It worked like magic. My parents were big on education, so if their daughter needed money to buy books, they were going to provide.

I smell fraud.

I started small. My dad had gotten a job that seemed to pay well; it became solely his responsibility to pay for my books. I was inflating prices and making as high as ₦20,000 multiple times a semester. Between 2017 and 2019, the scams got bigger. At some point, I was collecting as much as ₦50,000 per semester and my dad didn’t seem to have a problem with it.

What were you using the money for?

I was just balling, taking care of my friends and going out to eat. Until I started dating.

By February 2020, I was dating someone, and because I wanted to be a good partner, I went from Benin where my school is to Ibadan to see them for Valentine’s Day. I had about ₦60,000 before that trip. Three days later, I came back with ₦2,000. We went out multiple times, and I paid for everything. Two days after I got back to Benin, they called me and broke up with me.

Ouch.

By April 2020, I was talking to someone that lived in another state. He was also a student and didn’t have as much money as I did, so I’d buy him meals, send him ₦5k from time to time and pay for his stuff. Seeing him happy made me happy. We got in an open relationship in July, and shortly after, I got a writing internship that paid ₦50,000.

You were making your own money again.

Oh yes. I was getting ₦50,000 salary, ₦20,000 monthly allowance, and anything else I collected from my dad. The money went into my head. My gestures to my partner became even more frequent. Then I started dating someone else and also spending on them.

On your 50k salary?

Not really. In October that year, I was promoted to a full-time staff and my salary increased to ₦100,000. I increased my savings with my mum to ₦20,000. The rest of the money went to food and my partners.

Interesting. Were your partners gifting you as well?

They were. If I needed money or indicated that I liked something online, they got it for me.

Later that year, you could say I got a raise at home too. I didn’t have to scam my dad to collect money from him anymore. He had gotten a few promotions and was willing to give me money.

2021 must have been huge.

Oh yes it was. My average monthly income in 2021 became ₦300,000. On some months, it went as high as ₦500,000.

Ah. How did this happen?

Being my dad’s baby girl became my main hustle. He gave me at least ₦100,000 every month for no reason at all. All I needed to do was call him and ask. I also got another raise at work: ₦200,000.

And your lovers?

They had increased to four by the end of 2021. I started living with one of them. The others, I visited from time to time and sent stuff to.

How many are they now?

Six.

Are you ever concerned about how much you spend?

Never. My rule with my partners is simple: my money is your money. I don’t like it when I’m with them and they ask me for money. Take my card and spend. Spending is my way of showing love, and it’s worth every penny because they get to smile, and I’d do anything to make them smile.

I’m curious about what your savings look like.

When I started earning ₦100,000, my savings with my mum increased to ₦50,000 monthly, and it’s continued ever since. Now, I have about ₦500,000 with her. On my savings app, I have about ₦16,000.

Can you break down your monthly expenses?

I spend whatever’s left on food and outings.

What’s something you want but can’t afford right now?

A new laptop. A Mac. I like the aesthetics of a Mac, and I need a new laptop.

Also, what’s something you want to get your partners but can’t afford?

A house for all of them to live in so I can be with them at the same time. It’s very unrealistic though because apart from houses being expensive, my partners are scattered all over Nigeria.

Rate your financial happiness on a scale of 1-10.

It’s at a 7. I’m not dissatisfied, but I want to earn more money. My end goal in life is to make all my partners stay-at-homes and spoil them all.