Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Put your money to work with as little as ₦5,000. Invest Naija’s SEC-registered Money Market Fund delivers quarterly income, liquidity, capital preservation, and returns that beat savings and fixed deposits. Start here.

What’s your earliest memory of money?

In Primary 5, I was sent home for not paying school fees and was only allowed to return after my dad begged. I think he settled with the school authorities to pay half first and the rest later. That was the first time I realised how important money was.

That incident wasn’t a one-off. Throughout secondary school, I continued to experience cases of delayed fee payments.

What was the financial situation like at home?

Things were somewhat stable when my dad had a 9-5 job at a newspaper. Then, he left to start his own business around the time I started to get sent out of school. I know he tried several businesses — textiles, fashion, tiles and making art pieces — but the money wasn’t great, so we lived off my mum’s nursing income.

We went from three meals a day to two, and then one. Sometimes, I wouldn’t get money to buy food at school. That’s when it clicked that “Omo, e don dey red.” I mean, we were surviving, but barely.

When was the first time you worked for money?

That’s after secondary school. I graduated in 2011 and spent almost five years trying to get admission into the university.

In my first year at home, I started going to a prevarsity programme. Someone introduced it to my mum, and it was supposed to prepare students for A-levels, which we could use to study abroad or gain direct entry into a Nigerian university. I met people richer than me in that institution, and I started thinking about making money.

At that point, my mum sold female hair accessories, so I offered to sell some of them at school to make small profit here and there. For instance, if one hair clip was ₦800, I’d sell it at ₦1k and keep the ₦200 difference. Sometimes, I kept the full ₦1k and didn’t return my mum’s capital. It was wrong, but I was a stubborn child. I wanted to use the money to show off in school.

Was the business lucrative?

It was fairly lucrative. At first, I felt a little weird selling female stuff. People also looked at me weird. However, I decided I couldn’t be ashamed of whatever I put my hands into. If I didn’t sell, I wouldn’t make money. So, I just did it, and with time, people warmed up to me. They saw I was just being industrious. Also, I sold what they needed.

I sold the hair accessories for a few months until my mum stopped selling them. Then, I decided to sell jewellery. I bought necklaces and other pieces from the Hausa sellers in the market and resold them in school for a small profit. I can’t remember how much I was making, but I know it wasn’t serious money. It was just enough to buy food for myself and my friends, watch football at viewing centres, cut my hair, and cover other small expenses.

I did that for about a year and stopped when I realised I wasn’t doing well in school. At this point, I had failed twice in the prevarsity. It was supposed to be a nine-month to one-year program, but I’d already spent two years. Most people I knew had gotten their A-levels and gone on to Russia, Ukraine, and other countries for their studies. I was ashamed, so I left the school to try a pre-degree somewhere else. This was in 2013.

I guess this attempt wasn’t successful

It wasn’t. In 2014, I abandoned pre-degree and A-levels and started taking JAMB lessons. I wasn’t trying anything for money at this point because I just wanted to enter uni.

Also, the financial toll of trying different programs to get into uni started telling on my mum. She had to pay my fees and those of my siblings who were still in secondary school. On top of that, she had to return to school herself for added certification to get promoted. So, everywhere was tight.

I passed JAMB that year, but didn’t get into uni. I tried again in 2015, and my efforts were finally successful.

Phew. Finally

Finally o. In my first year, I met a fashion designer in school. He didn’t actually make clothes; he’d design the outfit, measure the person, buy the materials, then give it to a tailor to sew. He essentially made money from the designs and from buying the materials.

I sort of “interned” with him to learn how he ran the business. He told me I needed to start by making designs for myself, and potential clients would reach out when they saw what they liked. So, out of the ₦5k – ₦10k allowance I received from home and the occasional urgent ₦2k from my aunt, I’d squeeze out money to design two or three shirts for myself.

It worked. People started asking about my shirts, and I told them I could make some for them too. That’s how it became a business. I’d mix different materials like jeans, ankara and plain shirts and sell between ₦8k – ₦15k. I typically made ₦1k – ₦2k profit on each.

How long did this business last?

I did it throughout my time in uni. It was a regular source of income and it really helped me survive in school. In fact, in my final year, the business earned me first ₦100k after I got a mini-contract to design varsity jackets for final-year celebrations. That money went towards settling my final year project.

After I finished uni in 2019, I had two options: go full-on into fashion or attend a media school. I chose fashion and tried to learn how to sew with some fashion designers in my area, but they didn’t take me seriously. I didn’t learn much, so I decided to just go to media school instead.

Why was media school the alternative?

I had seen the poster somewhere, and participants were supposed to learn about radio and TV presentation. Growing up, I loved listening to the radio and watching football. One time, in 300 level, I heard a presenter talking about sports on the radio, and I remember thinking, “I can learn this thing.” So, the interest kinda grew from there.

Also, I’ve always been quite creative. I wrote poetry in school and attended all the poetry events in the city. Media school felt like the right next step. Also, I’d prayed about it and felt God leading me in that direction.

That said, I still needed money to enrol. The school charged ₦80k for the five-six month-long training, and I didn’t have that.

So, how did you go about it?

I approached someone I’d met from my poetry days and told him I wanted to work with him. He had a tech business, where he taught children how to code with Scratch. He agreed to take me on, showed me the ropes, and I started teaching the kids for ₦20k/month.

I agreed with the media school to pay the training fee in installments and only attend classes on the weekends or during my off days. Four months into the training, COVID hit and everywhere closed down. I had to stop working at the tech business, but my media training continued online.

The owner of the media school had an online radio station, and as part of my training, he got me to come on board as the sports presenter. Every day, I recorded a 10-minute sports show and sent it to him, then he edited it and put it online. I wasn’t getting paid for this, but it was an opportunity to perfect my craft.

How did you survive this period without an income then?

I’d returned to live with my parents after graduating from uni, so I was just eating at home. I also got small ₦10k or data gifts here and there from participating in poetry and short story competitions on WhatsApp groups.

Instagram Lives were also pretty popular during COVID, and since I was active in these WhatsApp groups and they knew I was a radio presenter, they often asked me to host the live sessions. This typically came with some payment too. That’s how I survived that period.

In June 2020, I saw a job advert for a sports presenter for a radio station. I applied and got the job.

Whoosh! What was the pay?

At first, my employer said ₦50k/month. But after the first month, they reduced it to ₦25k.

Ah. Why?

Radio stations typically make money from adverts. My employer was an online radio station, and they struggled with landing adverts, so no money.

The ₦25k was small, but I didn’t mind. I was doing what I loved. I worked there until January 2021, when I went for NYSC. For my service year, my dad connected me with someone who got me a teller job at a bank. I made ₦50k/month from that, plus the ₦33k from NYSC.

A few months into my service year, the owner of the media school I trained at called and told me about a brand that wanted to do an entertainment show on the radio. The show was to be on an indigenous radio station in the state I served in, and was to last for six months. They were willing to pay ₦80k/month. Of course, I jumped at it.

My broadcast schedule was mostly Wednesday evenings, so I was able to juggle the show with my job at the bank. I even started volunteering at another radio station, hosting their sports show thrice a week. They didn’t pay me; I just did it for the love of the game.

Let’s not forget the three income sources

Haha yes. The money coming from those made it possible to explore the sports journalism thing. I lived on the income from NYSC and the entertainment show, while I saved my salary from the bank. Sometimes I touched the savings sha.

At the end of service year in 2022, I had about ₦300k in savings. I used ₦100k to buy a phone and invested the rest in crypto because a friend convinced me to do it. I didn’t understand anything about crypto, but I went ahead to put my money in Cardano and Shiba Inu. Instead of the money to be “going up”, it was just going down.

Yikes

I wanted to remove my money, but my friend told me to wait for the crypto to bounce back. He even told me my crypto could be worth $100k in two months if I just played the long-term game. In summary, I lost everything in six months.

Sorry about that

Thanks. I returned to my home state and started living with my cousin. From there, I applied to another radio station and got a job as a sports presenter for ₦50k/month.

I had minimal responsibilities — I only had to contribute for food expenses and pay for cable TV because of my job — but I was always broke by the middle of the month. To save transport costs, I’d sometimes sleep at the office or trek for a bit before taking public transport. I wasn’t able to save at all.

Things started to look up in 2023 when I got two recurring gigs to write sports articles. The first one paid ₦90k/month, and the other paid ₦4k per article, which I later negotiated to ₦7k. I typically did three articles weekly for the latter. In a month, I was making around ₦180k from the writing gigs.

Not bad at all

The pay was good, but towards the end of 2023, it became difficult to juggle all of the jobs. I also took on occasional football commentary gigs where I’d travel to work at live football games. Those gigs came at least twice a month and brought me ₦50k per game.

I was doing a whole lot. So, I decided to let go of my job at the radio. They’d refused to increase my salary and the job took almost all my time. I focused my energy on the commentary and writing gigs. At least, those ones brought me about ₦280k/month.

What were your expenses like at this time?

I was definitely spending more money. As my income increased, I started sending money home to my parents and siblings. I had a girlfriend — who’s now my fiancée — and it wasn’t difficult to get her stuff anymore. I also started saving ₦50k monthly for my own apartment and another ₦50k for my wedding fund.

In January 2024, I landed a sports producer role at a TV channel and had to move to Lagos. I stayed with a family friend for four months before I gathered enough money to rent an apartment. I got my place for ₦650k/year (₦1m when you include the initial agent fees) and spent an extra ₦500k for a fridge, bed frame, kitchen cabinet, fan and a few other things. I still don’t have all the furniture I need.

How much did the new job pay?

₦250k/month. I still kept my two content writing gigs and occasional football commentary gigs, so those typically brought my monthly income to around ₦600k.

Towards the end of 2024, the multiple jobs started to take a toll on me again. One of the writing jobs started a daily meeting thing, and my TV job also required my full attention. I couldn’t make mistakes because it’d show on TV and be really obvious. Travelling for football matches across the country for the commentary also took so much time.

So, I left the commentary gigs first, and in February this year, I left the ₦90k writing job to reduce my workload. Funny enough, the second writing job just told me in July that they needed to restructure, so they wouldn’t need my services anymore after this August.

Ah. So you’re down to one job?

Yes o. It’s just my 9-5 now; my only income is my ₦250k salary. Well, I’m expecting my last ₦90k – ₦100k from the writing job at the end of the month, but that’s it. In case you have a job, I’m seriously looking.

Phew. How does it feel to go from multiple income sources to one?

Honestly, it’s scary. I’m getting married in a few weeks. You feel like you have what it takes for the next phase, or at least something to manage, and suddenly everything just changes.

I’m scared, but I can’t afford to process my emotions or drop the ball. I’m already sending out CVs everywhere and searching for the next opportunity.

I’ve also made many lifestyle changes. I used to eat out a lot, but I cook more now and only eat once a day. My food expenses have dropped from ₦70k to ₦40k. I now calculate everything I spend on transportation to the last kobo. I’ve also stopped going out for no reason.

Let’s break down these expenses for a typical month

This is based on my current strict budgeting

You mentioned a wedding fund. How’s that looking?

My fiancée and I both save jointly for the fund. We estimated we’d need ₦3m for the wedding, and we’ve reached that amount. We’re already spending out of it to pay the wedding bills, too. I think we’ve spent about ₦1.5m.

Out of curiosity, do you think you’d still spend the full ₦3m on the wedding? Considering your new financial situation

That’s an interesting question. I don’t think I have much of a choice, really. My fiancée’s family lives in a much farther state and we’ll need to travel there. Just one person’s round-trip flight costs ₦200k.

The wedding is already happening. We already planned to spend this amount, and we have to go on. Instead of dwelling on the wedding expenses, I’d rather dwell on how to make more money legally.

How much do you think you should ideally be earning right now?

Considering my experience in radio, digital content and TV, I should ideally earn around ₦700k – ₦1m. But if you have a job paying ₦250k or ₦400k, I’ll collect.

How would you describe your relationship with money?

I really don’t know. I just know I get scared when my account drops to ₦50k, which usually happens before the 17th of the month. Now, I don’t even have up to ₦30k, but I don’t have time to be scared. I’m just leaving everything to God.

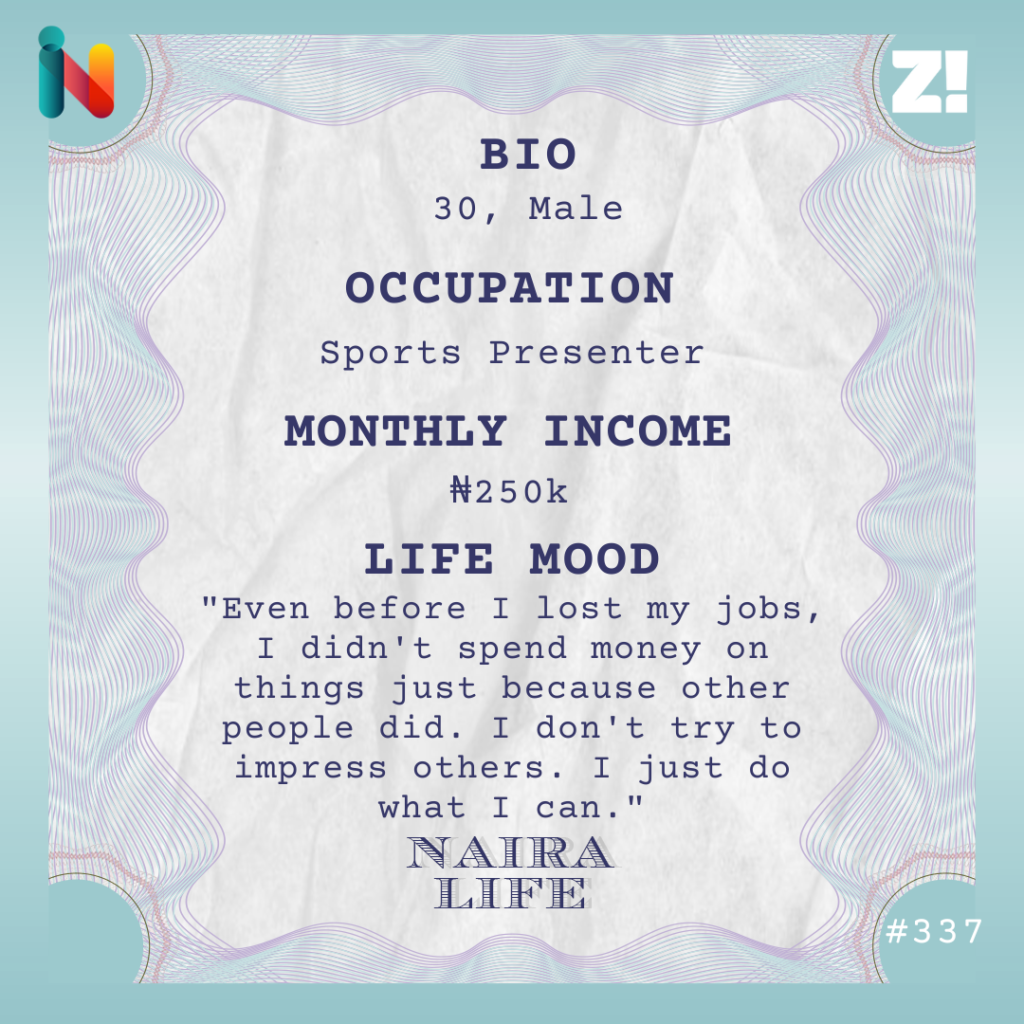

As for my financial lifestyle, I think I live below my means. Even before I lost these jobs, I didn’t spend money on things just because other people did. I don’t try to impress others. I just do what I can.

Is there anything you want right now but can’t afford?

A car. It’ll probably cost me at least ₦12m, and I don’t have that.

Is there anything you’d like to be better at financially?

I want to be better at investing. I’m 30 now, and I want to be financially independent by the time I reach 35 – 40. I don’t want to be fully reliant on a 9-5 job at that age.

How would you rate your financial happiness on a scale of 1-10?

7. I’m grateful for where God has brought me, but I also want more.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.