Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

The She Tank and BellaNaija are set to release a groundbreaking film as part of their 2024 Women’s Economic Power Campaign titled #HerMoneyHerPower. The film showcases real stories of women who have used their economic power to lift themselves and those around them, inspiring a younger generation to follow suit. Click here to find out more about the #HerMoneyHerPower campaign.

Let’s start with your earliest memory of money. Do you remember that?

I remember looking forward to every Eid celebration because my mum made me take food to our neighbours, who always gave me money in return. One neighbour always dropped at least ₦500. That was serious money to an 8-year-old. My siblings knew about his generosity, and we used to fight to deliver food to him. I often made at least ₦1k at the end of the day from these food runs.

I saved my money to buy bangers in December, sneaking out of the house to light them with my siblings. Fun times.

Your mum never asked to “keep the money for you”?

She tried once, but my dad changed it for her. My mum was the frugal parent who always tried to manage money, but my dad was the jaiye jaiye type. The only arguments they had around us were on minor money matters.

My dad didn’t understand how he could be a major car dealer, and his wife would make a case for Nigerian cornflakes over a foreign brand to reduce costs. So when she tried to take the money my siblings and I made, he said, “Haba. Let these children be.”

Thank God for daddy

Haha, thank God. My dad tried his best to spoil us as much as my mum allowed. My mum was a stay-at-home mum, so she often “intercepted” any gift from my dad that she considered extravagant.

For example, my dad gifted me an iPad after I passed JAMB in 2009. He thought it’d be great for uni, but my mum saw it as the weapon that’d push me into waywardness and a desire for expensive things. She seized that iPad and made me use a small Android phone instead. I was so angry. If I made my own money, would anyone stop me from getting nice things?

Speaking of money, when was the first time you worked for it?

2011. I started selling panty liners to my coursemates and hostel mates when I was in second year in uni. I got the idea from my cousin, who’d signed up to a business networking company that manufactured health and lifestyle products.

As a member, she had access to the products and sold them in her university. She told me about it because she wanted me to sign up under her, but I didn’t have the strength to convince people to join anything. We just settled on her sending some of the products my way.

I can’t remember every detail, but I made ₦800 in profit on every sale. The panty liners were a hit, and it was the first time I realised I knew how to convince people they needed something.

I sold the products for almost two years and made at least ₦30k in profit monthly. Add that to the ₦20k I got from home as a monthly allowance, and I was a pretty comfortable student.

Nice. What were your expenses like?

The only thing I remember using the money for was an iPhone. I saved heavily through the year and bought the iPhone 5 in 2013. I think it had just come out and cost around ₦150k. Looking back now, spending all my money on one phone may have been foolish, but it was a reward for all my hard work.

That same year, I did a three-month undergraduate internship at a production company. They only paid a ₦5k stipend, and I’d already zeroed my mind that I wouldn’t show up every day. ₦5k didn’t even cover my transportation for two weeks, not to talk for a month. But I changed my mind after my first two weeks at the company.

Why?

My supervisor was part of the sales team, and she intrigued me. She was so well-spoken and self-assured, it was like looking at a vision of what I wanted to be in the future. I decided there that I wanted to work in sales.

It’s dumb, but I somehow equated being confident with working in sales, and I wanted that. My supervisor also talked about meeting targets, but I figured selling wasn’t an issue for me. I mean, didn’t I sell out panty liners in school? Plus, she also got commissions for meeting targets, and the idea of extra money outside salary sounded good to me.

I didn’t get into sales immediately after I finished uni, though. I taught for a while when NYSC posted me to a secondary school in 2015.

Did you like teaching?

Oddly, I did. I taught basic science, and I really vibed with my students.

The school paid me ₦10k monthly in addition to the ₦19,800 NYSC stipend. The job also came with free accommodation at the school’s sick bay, so I was pretty much chilling with my income. I also saved a bit. I finished the service year in 2016 with ₦120k in my savings. I didn’t have any plan for it; I just thought it was nice to keep money aside.

What happened next?

I toyed with the idea of staying back at the school to teach full-time. But they offered me ₦20k/month and the idea disappeared fast. I couldn’t imagine enduring five years of uni to come and be earning ₦20k.

I spoke to my brother about looking for a job and he connected me to a friend who worked at a management consulting firm. I applied, did the interviews and got employed as a business development executive. My starting salary was ₦85k, with the option of commissions if I brought in at least 12 new deals monthly. I usually averaged 6-8 monthly and even that was impressive. I was something like a superstar at work.

After working there for a year, I was promoted to senior bizdev executive, and my salary increased to ₦120k. I’d been living with my parents since I returned home from NYSC, and after my promotion, I decided it was time for adult life. My mum kicked against it, but she calmed down after I pointed out that our house was far from my workplace. It wasn’t that far; I just wanted to leave.

Tired of living at home, eh?

Yes. I just wanted freedom. My mum had started to pocket-watch me, and it didn’t make sense to explain why I bought a new dress or listen to lectures about saving money whenever she saw me with a new shoe. I wasn’t spending frivolously; I just had to constantly update my wardrobe because my job involved meeting people, but my mum thought I was being wasteful. It was tiring.

How did househunting go?

Fortunately, it was pretty stress-free. I paid ₦10k to an agent my friend introduced me to, and we found the perfect apartment within two weeks.

It was a ₦400k/year apartment, but I lied to my parents that it was only ₦250k so they wouldn’t complain about it being too expensive. My dad gave me ₦300k, I made up the balance and moved in around 2018.

Living alone wasn’t as easy as I thought. Suddenly I had to start caring when a light bulb stopped working and thinking about what I’d eat for the week. But I made it work. It just meant I had to budget seriously and cut down on some needs.

For example, I learned to shop thrifted clothes rather than only purchasing overpriced boutique items. And I actually found gems in thrifted clothes o… unique pieces that no one would’ve guessed weren’t new after I washed and properly ironed them.

I’m always up for thrift praise. Tell me more about how you handled budgeting

I created a simple spreadsheet where I tracked my proposed expenditure for a month versus what I actually spent that month.

I still use the same method to track expenses today, and it’s been very helpful. There’s no thinking like, “Ah, how did I spend money this month?” because it’s literally there in black and white. It’s also helped me become more intentional with saving.

I’ve saved at least 40% of my income since I got another raise to ₦200k in 2019. Once I input the salary into the spreadsheet, it automatically calculates the 40%, and I send that amount to a separate account. Over the years, my savings have come in handy for emergencies and major projects. Like when my dad fell ill and passed in 2020, I used my savings to handle my share of the funeral expenses.

I’m sorry about your dad

It’s fine. I often wish he’d stayed alive for at least another year; 2021 was my big break, and I’d have loved to spoil him a little. I landed a sales manager role at a fintech company and went from earning ₦200k to ₦750k from one job change.

That’s more than three times your previous salary. How did that feel?

It felt like I was finally seeing the benefit of all my hard work. I was still going to be pursuing clients up and down like I did at my previous job, but the fintech job came with a 7% commission on every deal I landed in a specific category.

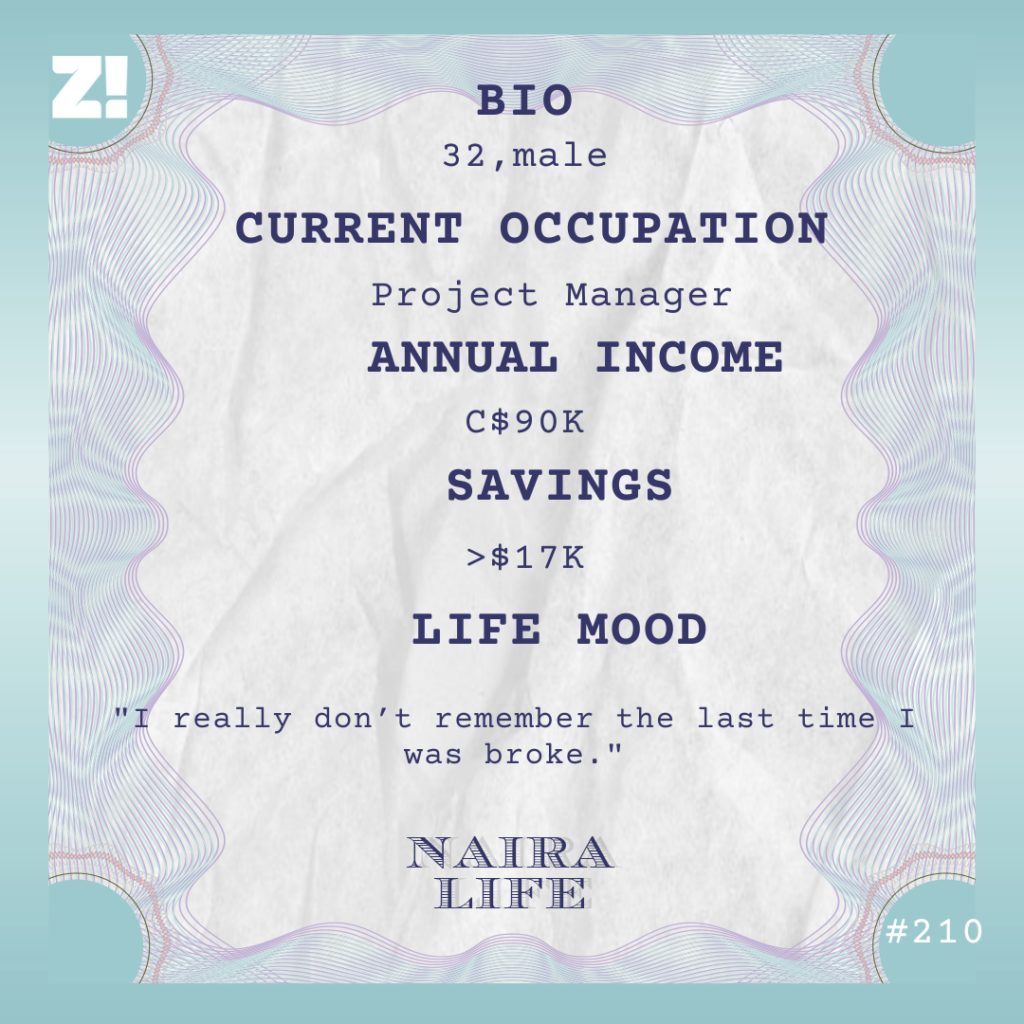

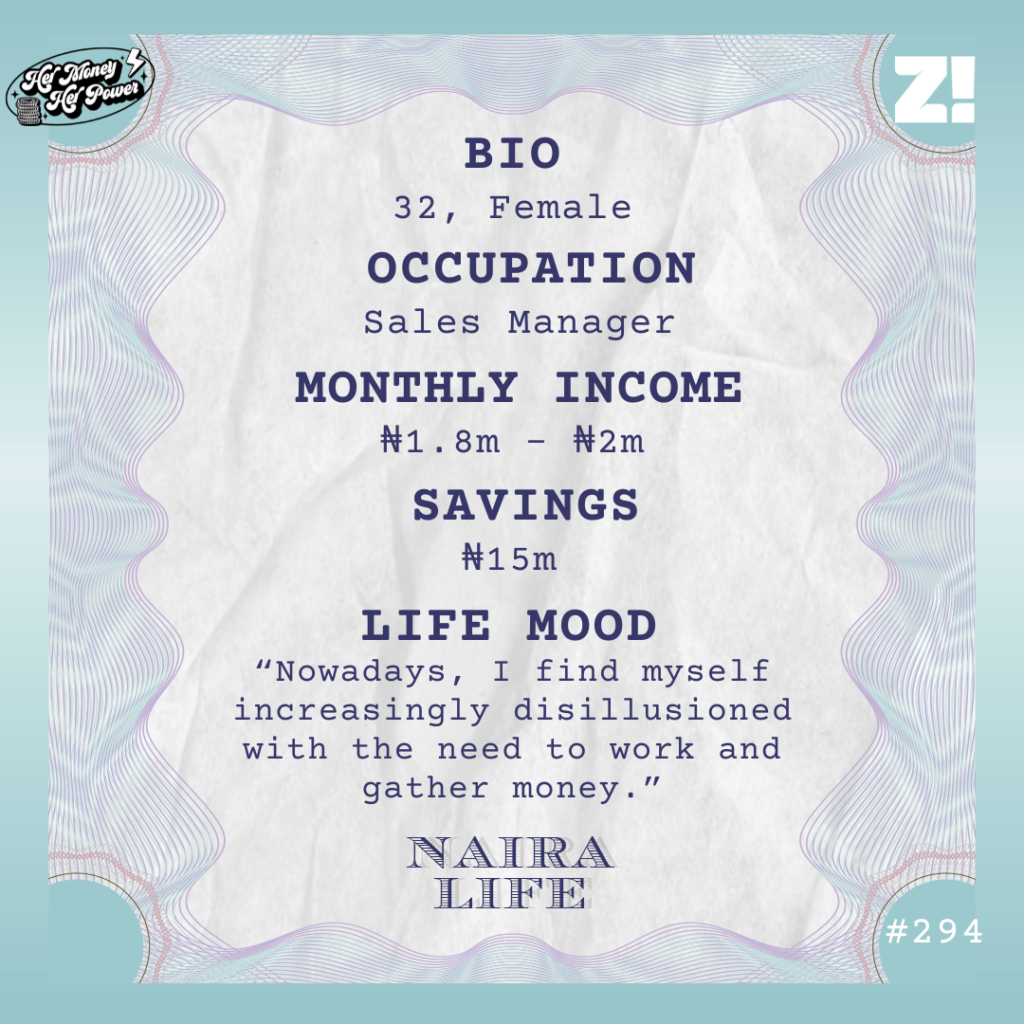

I’m still at the job, and my salary has increased over the years to ₦1.2m. With commissions, that’s often between ₦1.8m and ₦2m.

That’s not bad at all

It’s not. I know I’m more privileged than most, and I’m fortunate enough to afford to live below my means. My mum and siblings don’t bill me, so my primary responsibility is myself. But I’ve been battling a deep sense of tiredness and lack of motivation since late last year.

At first, I thought it was a desire to make more money, so I began applying for other jobs, but when I got invited for interviews, I ghosted them. I’ve also gone on leave at work a couple of times, but I returned even more burnt out than when I left. I have a theory for why I feel this way.

What’s that?

I’ve worked nonstop since 2015, and it’s starting to catch up with me. Nowadays, I find myself increasingly disillusioned with the need to work and gather money. Like, is the point of my life to go from one meeting to the next trying to upsell people and pretend I’m passionate about one fintech product or the other?

To be honest, I’m considering quitting my job and taking an indefinite sabbatical to travel around Africa and see if I can drum up the passion to do anything again. Going on leave didn’t work because leave had an end date, and I found myself becoming increasingly anxious as the time to resume work grew closer. An indefinite sabbatical may be just what I need to get my head in the right place.

Have you considered how you’d survive without a job?

I think about that every day, and it’s the reason I haven’t dropped everything to sleep on a beach somewhere.

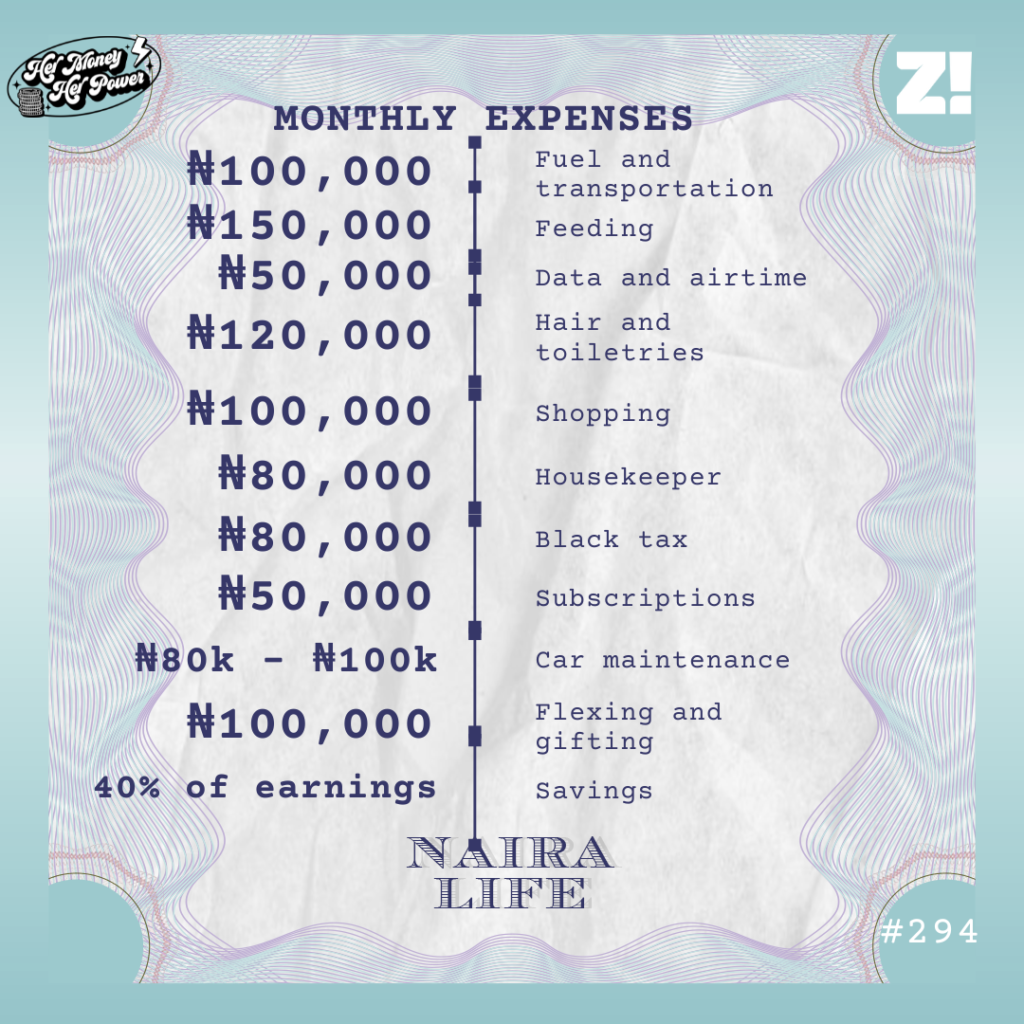

I have about ₦15m in savings right now—spread out across my mutual funds and dollar savings—but I know that’s nowhere close to sufficient to fund my travel dreams or keep me comfortably unemployed for long. My rent alone is ₦1.5m/year. It was ₦800k when I got it in 2022, but my Lagos landlord did what he knows best and increased it this year.

I’ll need a safety net of at least ₦45m to plan an indefinite sabbatical without worrying about getting a job when I’m ready to work again. The way it’s looking now, I may only be able to achieve that by 2027, assuming I have no major expenses and manage to drastically reduce my living expenses or get an impressive pay rise. 2027 is still far away, but it’s the only hope I have right now. Let’s see if I can last that long.

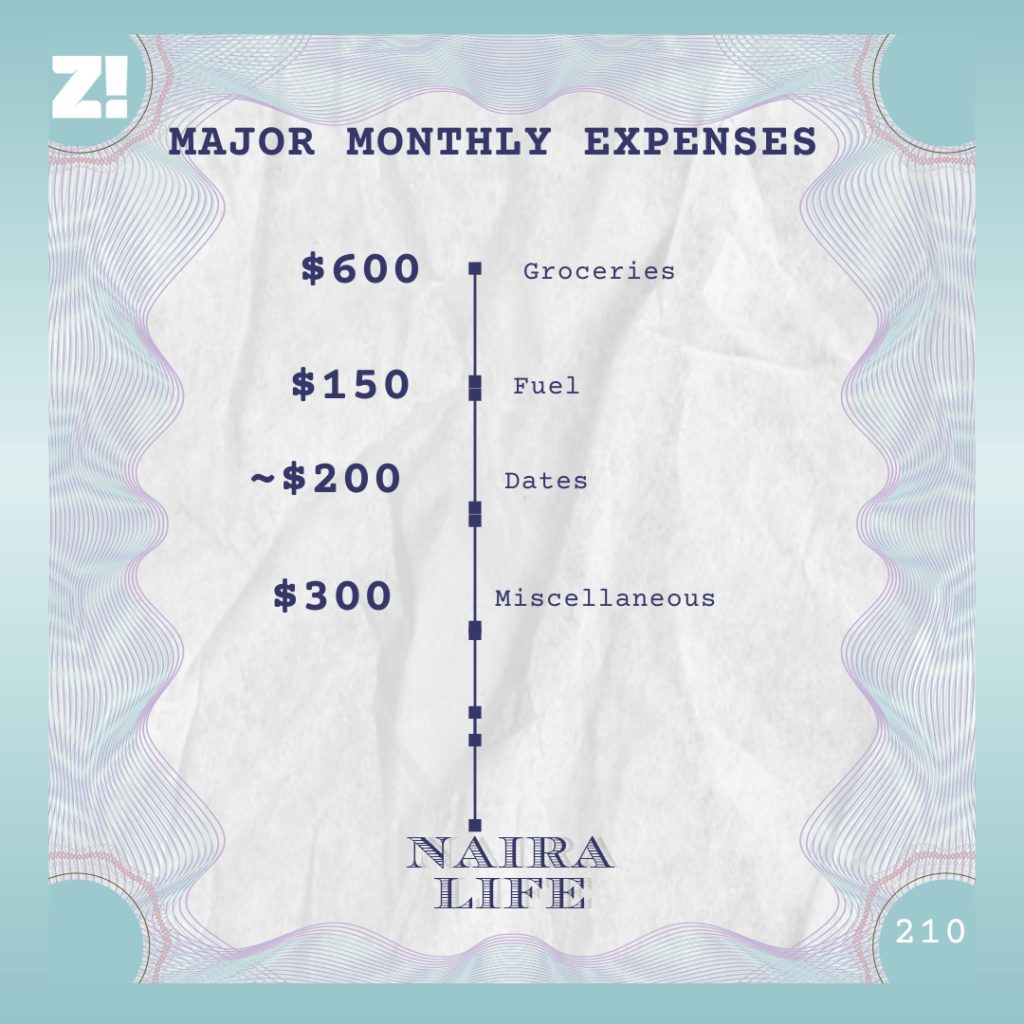

You mentioned living expenses. What does that look like in a typical month?

My dad gifted me a Toyota Camry car in 2020, and that car behaves like an evil spirit. I’m constantly repairing one thing or the other. I can afford to sell it and buy another, but that’ll really eat into my savings and push my sabbatical plans even further. On the days I can’t manage the car, I just take cabs.

How has your income growth over the years impacted your perspective on money?

I used to consider money an all-important thing when I started my career, but now that I make more, I see that it’s essentially just a means to an end.

Don’t get me wrong. I still like money and know how important it is — I wouldn’t be overthinking quitting if I didn’t — but it’s not a yardstick for happiness. It’s good to have money, but it’s not the most important thing. One can have millions of dollars and still not feel fulfilled.

Interesting. Do you think you’d return to sales if you eventually went on a sabbatical?

I honestly don’t know. It’s been a while since I felt the rush of closing a deal that made me love my job. If that returns after my break, I might continue. If not, maybe I’ll just start dancing on TikTok.

Haha. What’s the last thing you bought that made you happy?

A ₦500k wig I bought last week. I still randomly wear the wig around the house just to admire myself, haha. I can’t wait to install it.

How would you rate your financial happiness on a scale of 1-10?

7. I’m in a good place financially. But mentally? That’s most likely a 3.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]