Every week, we ask anonymous people to give us a window into their relationship with the Naira – some will be struggle-ish, others boujee–but all the time, it’ll be revealing.

If you’re looking for a person who’s genuinely enthusiastic about work, the subject of this Naira Life story speaks to this.

This particular episode was pulled off in partnership with Fairmoney. They’re promising that you can get up to ₦150k in 10 minutes. Mad ting.

Age: 25

Occupation: Product Marketing

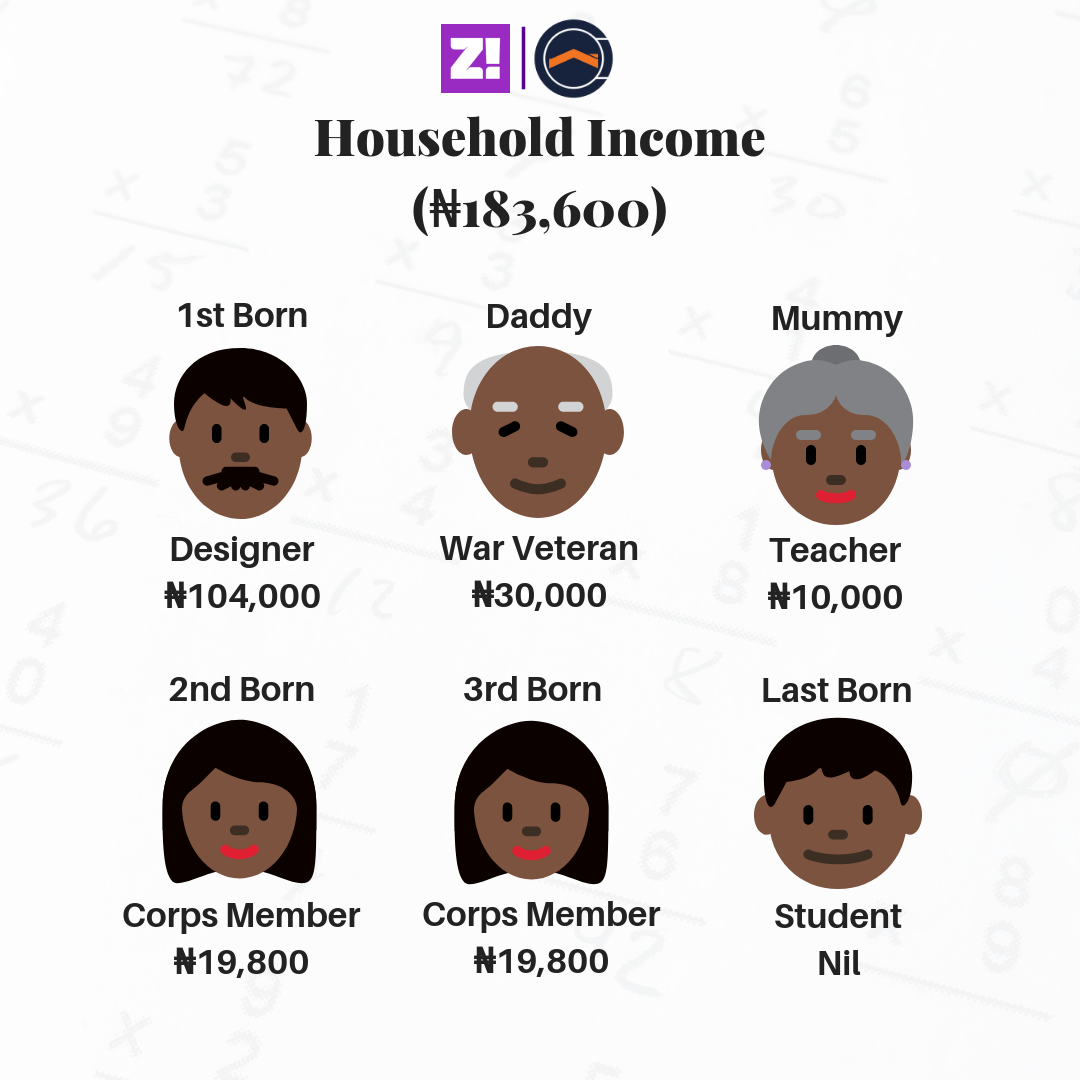

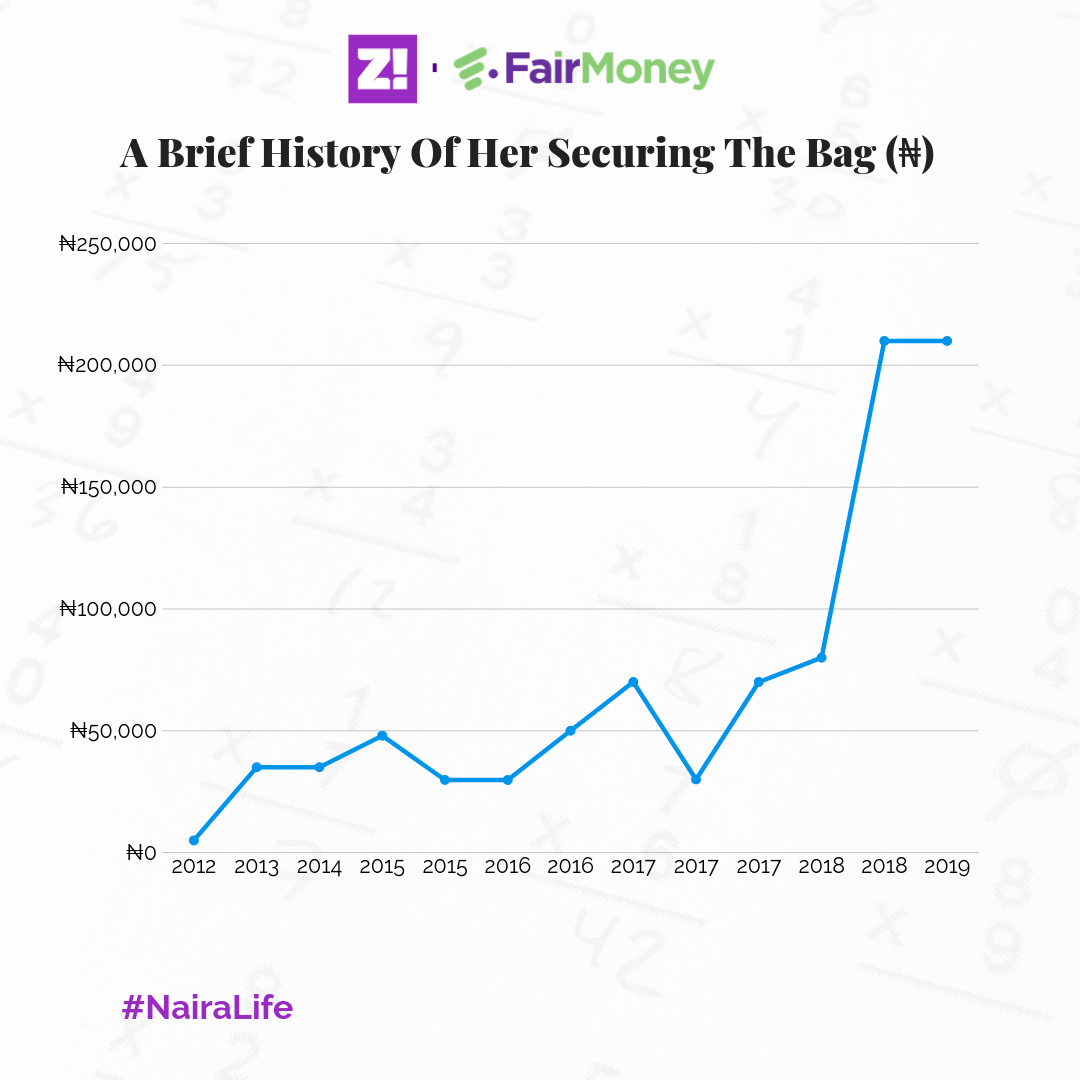

Current Income: ₦210,000/month (net)

Rent: Nil

Tell me about the very first money you made.

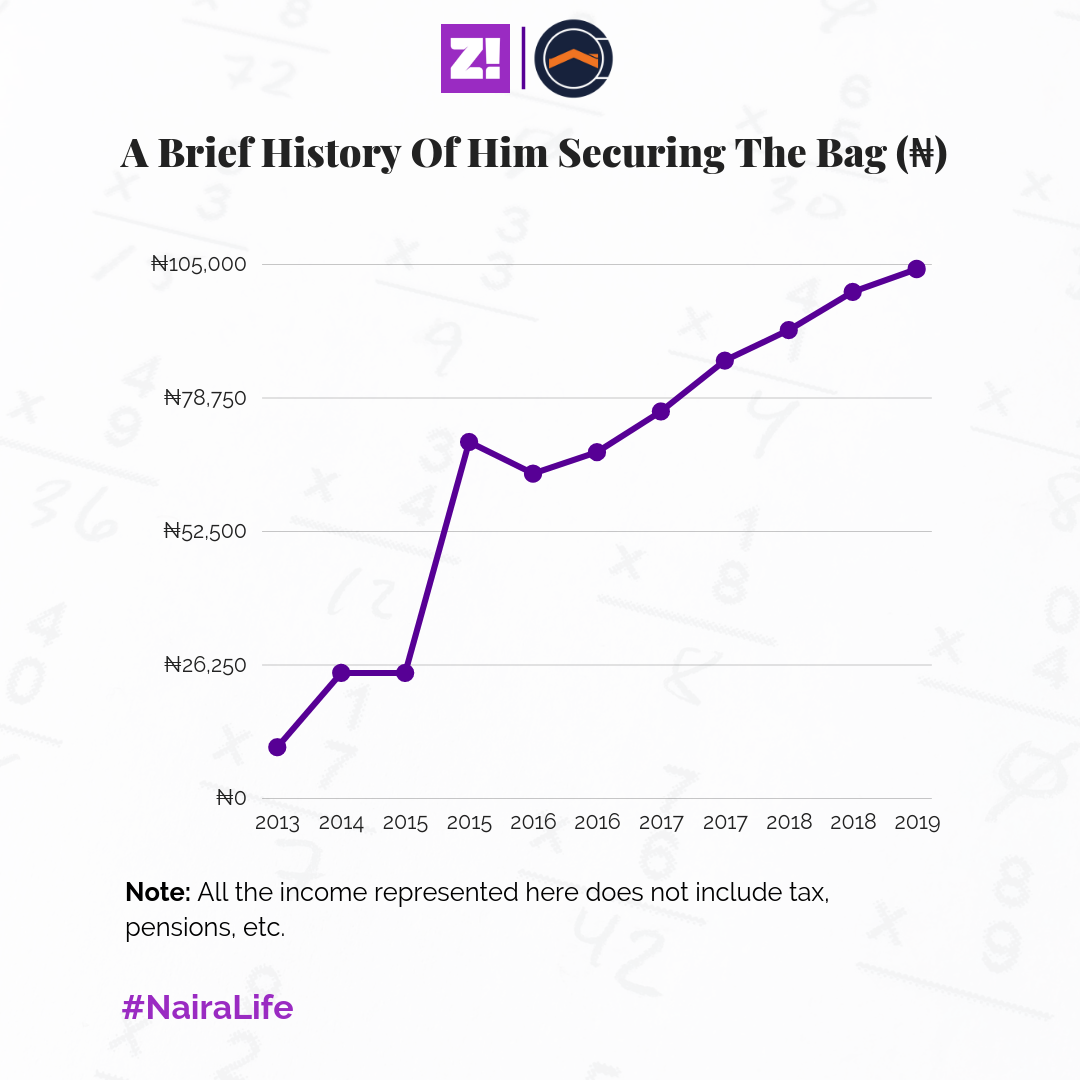

Let me think–it was at my Church’s Media Team. I was a P.A. to the Director of Productions.

Oh no! Wait, I also made money in school–I sold Cheese Balls and biscuits.

The first time I tracked my profit, I realised I actually made ₦5-₦7k. I went to a private University where leaving school was a problem, so I ended up having to send school workers to help me buy more goods. This was my 2nd year and I guess that counts as my true first hustle. I did this for at least 2 years.

The Church money was in my 3rd year, and that was ₦30k.

Were you getting pocket money?

I didn’t exactly grow up in a proper mummy-daddy family. So for some reason, there wasn’t any structure around pocket money. Money just came when it came. Whenever I was broke, I just go, “can I call my aunty to tell her I’m broke again?”

What other hustles did you have?

Before I served, I worked at an Ad agency as a front desk officer–₦50k, plus tax. I remember when 40-something thousand naira entered my account, and I was like, what is this tax thing for sef?

Omo, I was a big girl that time o. It was close to work, so I never spent money on transport. There was this guy who was toasting me, so he was always giving me free rides.

That period was actually the first time I bought stuff online–one rubbish skirt that cost ₦6k.

Then NYSC?

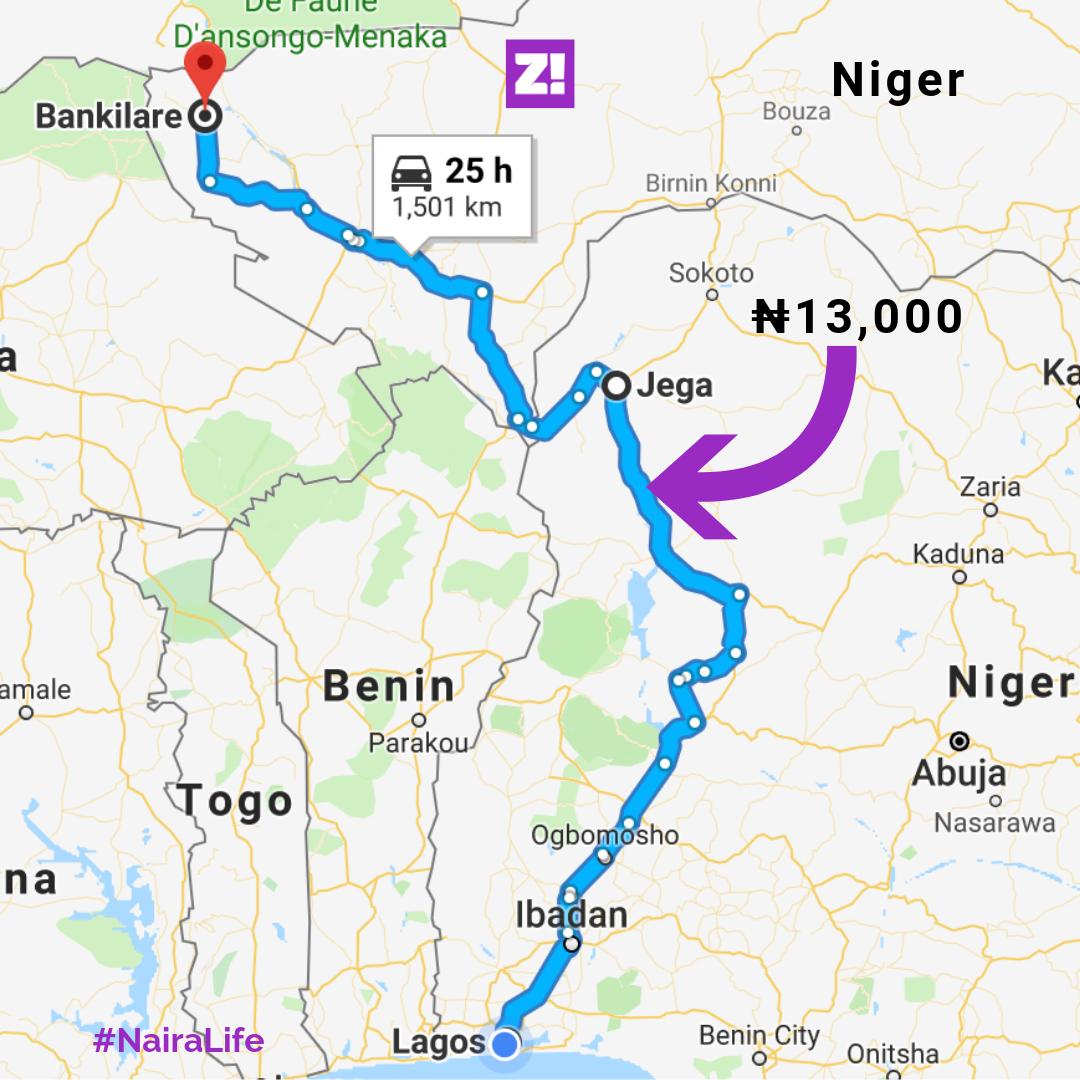

I was tired of being at home in Lagos with my folks–too much control and curfews–so I was glad I got out of Lagos. My allowee was ₦19,800, then ₦10k from my Place Of Primary Assignment (PPA).

But I had one extra hustle there: My PPA was at the Government House Church, so there was an extra gig–as a church greeter. I kid you not.

“You’re welcome to Church!” every time the governor was arriving. Different colourful clothes and all that, every Sunday.

Then I took another weekend gig that had very little to do with money. I always had this dream that I’d have some form of impact wherever I serve. And because I like kids too, I started teaching some children on weekends. I asked for ₦2k. Do you know their father still owed me? Nonsense.

When did NYSC finish?

2016. Then I started working at a small media company. I got paid ₦50k. Ah, my mum insulted me sha. Plus my uncle too. They didn’t understand how they’d spend almost 4 million on my education and then I’d settle for ₦50k for a first job.

It wasn’t even funny at all.

But to me ehn, it wasn’t really about money at the time, so I was willing to take it.

I left after three months. The structure, or more accurately, the lack of it, was a problem. I did Social Media management there.

Then I joined another media company. I was working on digital strategy and content management. This was actually where I started taking all the online courses I could find because I realised how much I liked marketing. I studied something completely different by the way.

How much did this new company pay?

I asked for ₦120k, and they basically just said: “you’ll see your salary.” That’s how my salary came and I saw ₦70k. Rookie mistake.

It was a disaster.

Then they stopped paying consistently. Then one day, in the second half of the year, we got laid off. Bruh, I cried all the way home. I didn’t even know where to start. Keep in mind I still had responsibilities with family. So I started job hunting again.

While I was looking for a job, someone told me about a woman who had a blog and needed someone to handle social media.

I was like, oya let’s do this. Why I especially liked this gig was that I had enough room to grab new skills. ₦35k.

I started at another media company in October. But how I ended up as an intern there despite having some decent experience is even more epic.

When I first applied for the gig, I got an email that said stuff like, “Oh apologies, we don’t have full-time positions, because we’ve hired for these positions. But we have internship positions.”

I was willing to take it to be honest, but my mum was like “what exactly is your problem? What internship are you doing with all your past experience again?” She wasn’t having any of it.

But I really felt like this company was pretty much one of the biggest in the media game.

When I resumed, there were no ‘filled out full-time positions’. In fact, no fulltime hires had been made recently. They just wanted someone who could do all the work for less money. The learnings ended up becoming valuable, but I can’t forget that.

I got paid ₦40k at first, then later ₦50k after 3 months.

Crazy.

Also, I still had the side hustle–that woman with her blog–that gave me ₦30k.

My internship was supposed to last 6 months, but by the sixth month, there was no word of the way forward. So when I sent in a notice that I was going to quit, I got a “Oh you’re going to get a raise. We’re going to confirm you, full-staff.” In my head, I was like ohhhh, so you had to wait for me to try to quit first.

I quit anyway.

Something I told my mum before I took the job was that, when I begin to apply for other jobs, it won’t matter much that I interned. What will matter is the work I did, and bruh, did not I not do a lot of work? It stretched me intensely.

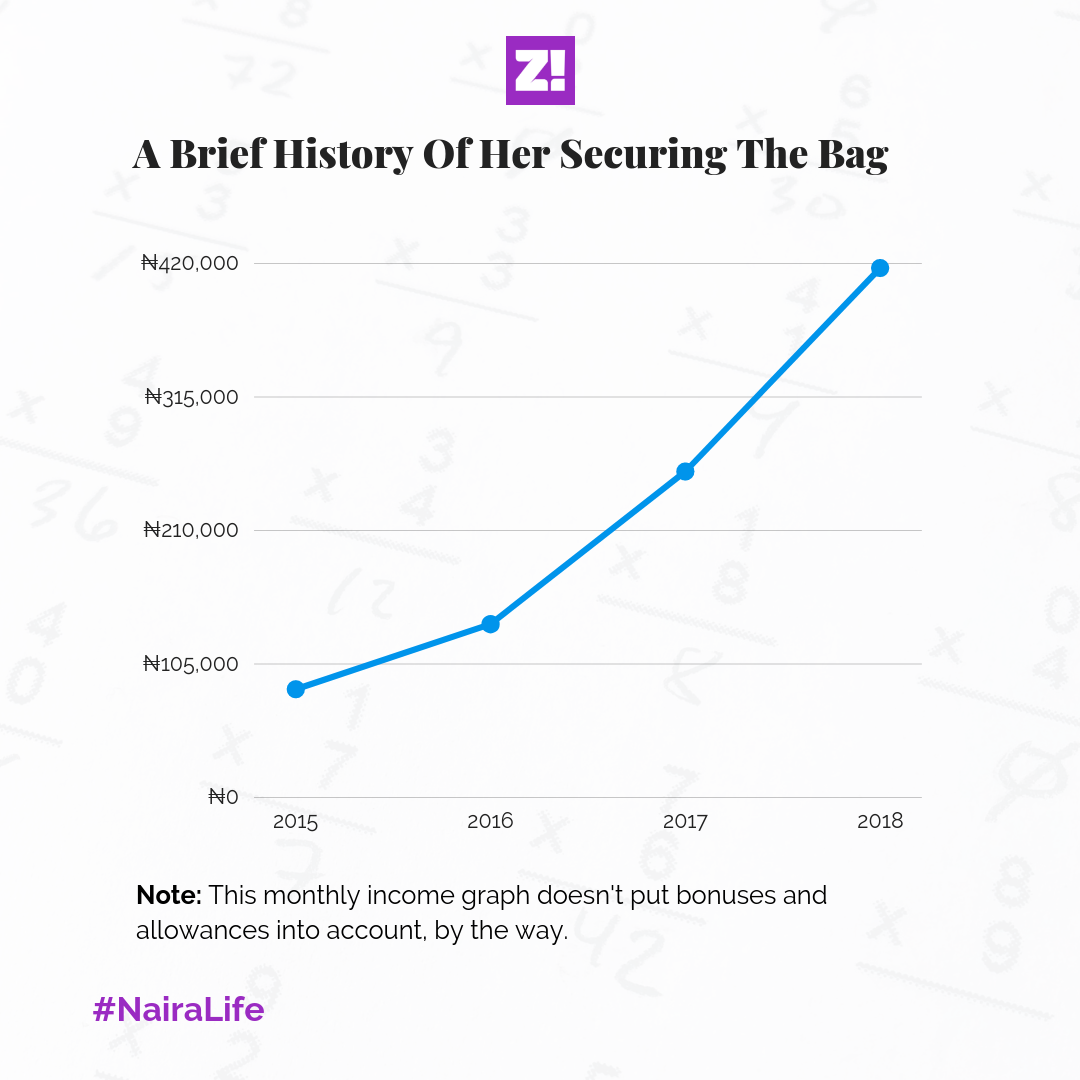

Then I joined another company and my net was ₦210k. Even better is that it was also close to home. The thing about this new gig is that it required all my attention when I joined, so I quit my side hustle.

What has changed about your perspective, in all this time?

As much as I say money is not everything, it’s still a major key. Being broke makes me cranky. Even in my relationships, when I tell you I have a problem, I don’t even need to ask you to give me money. You’re just supposed to use your head.

Okay, let’s talk about the money you currently earn.

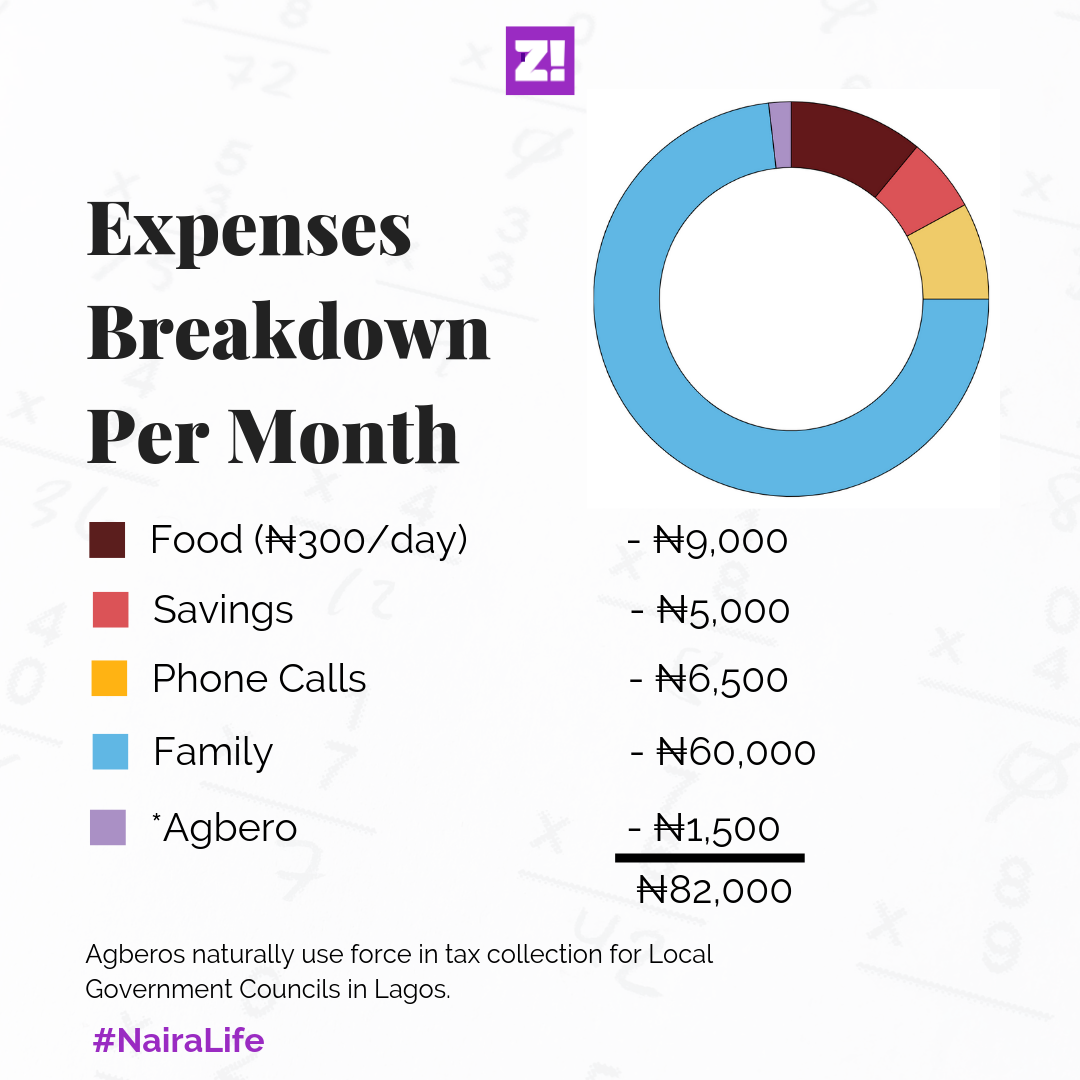

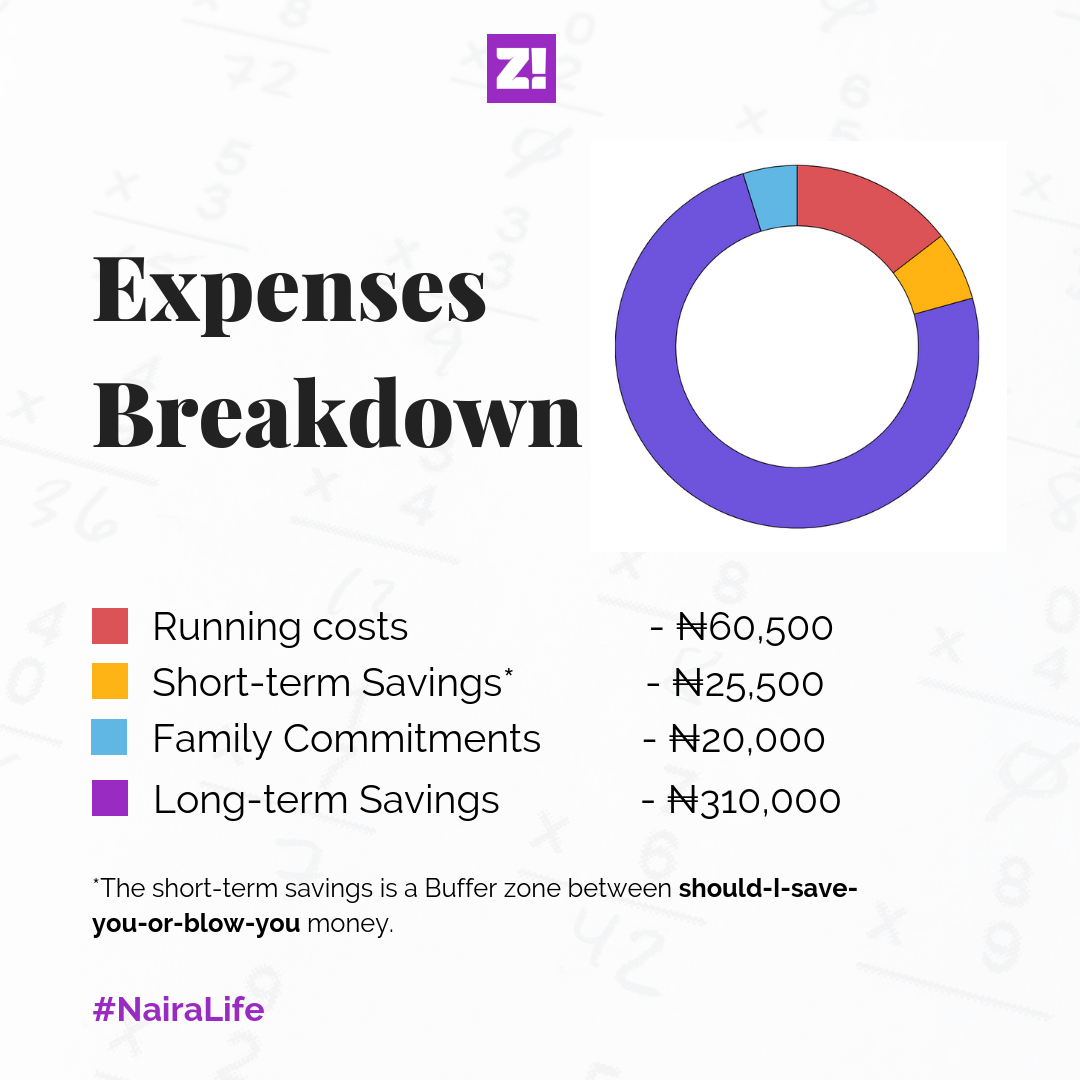

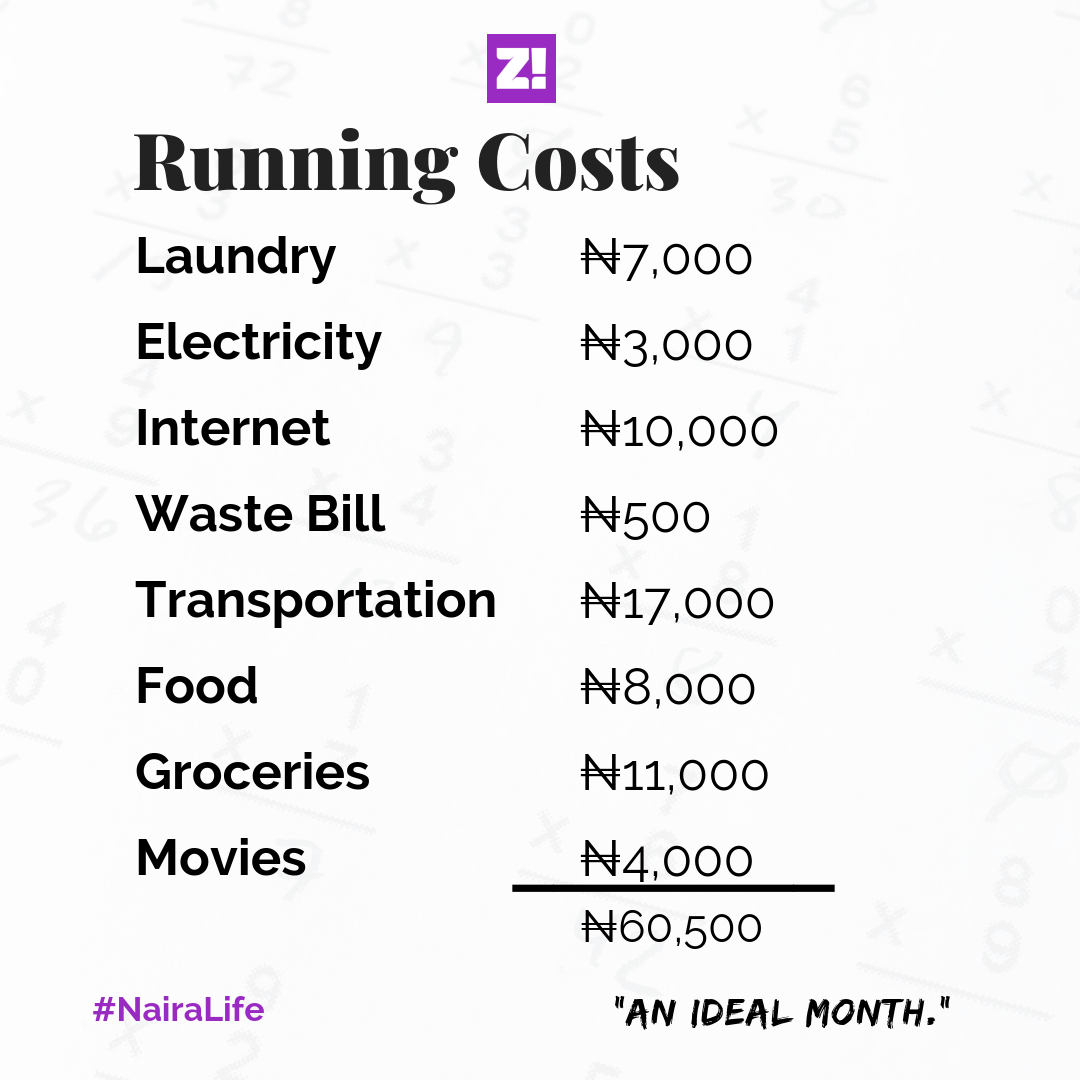

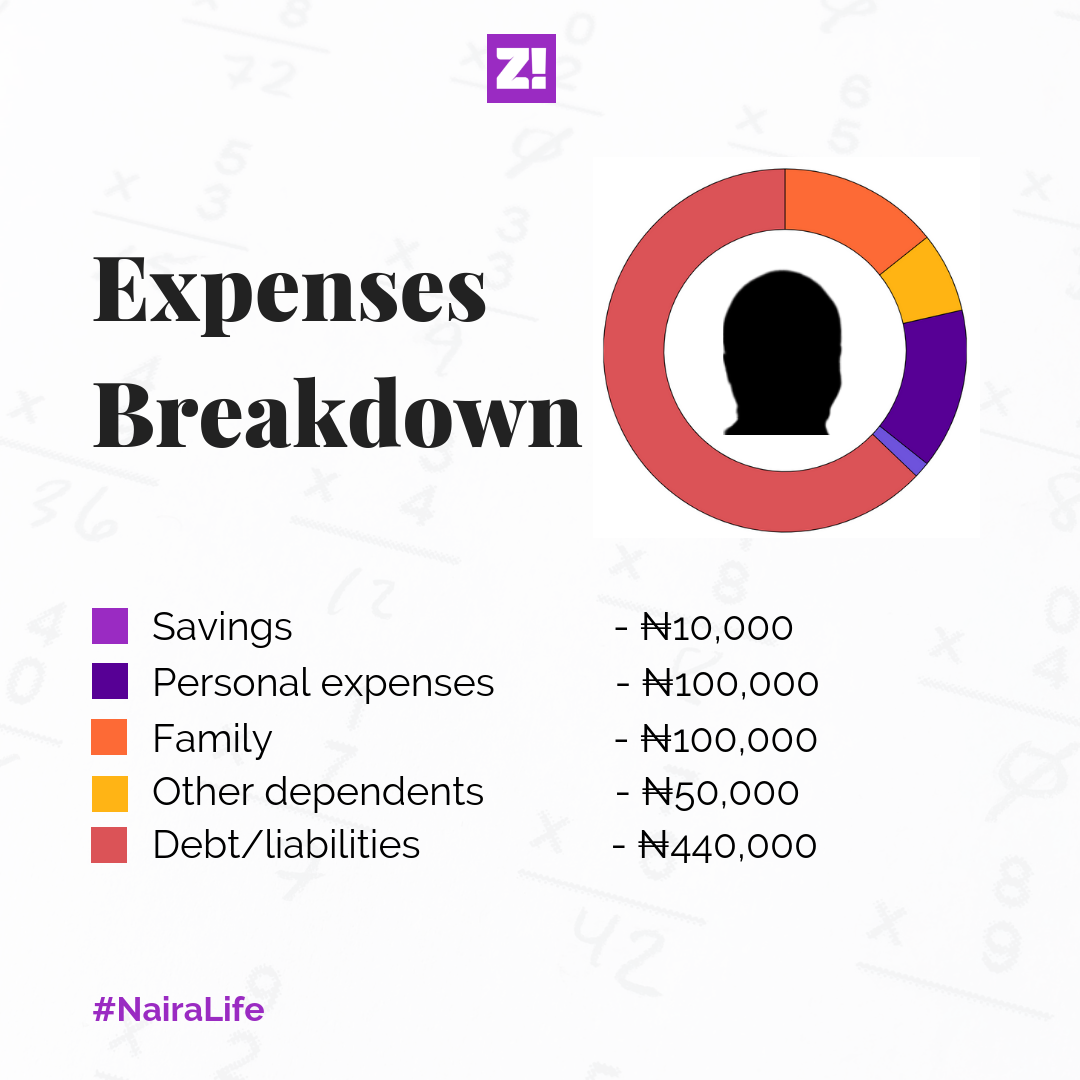

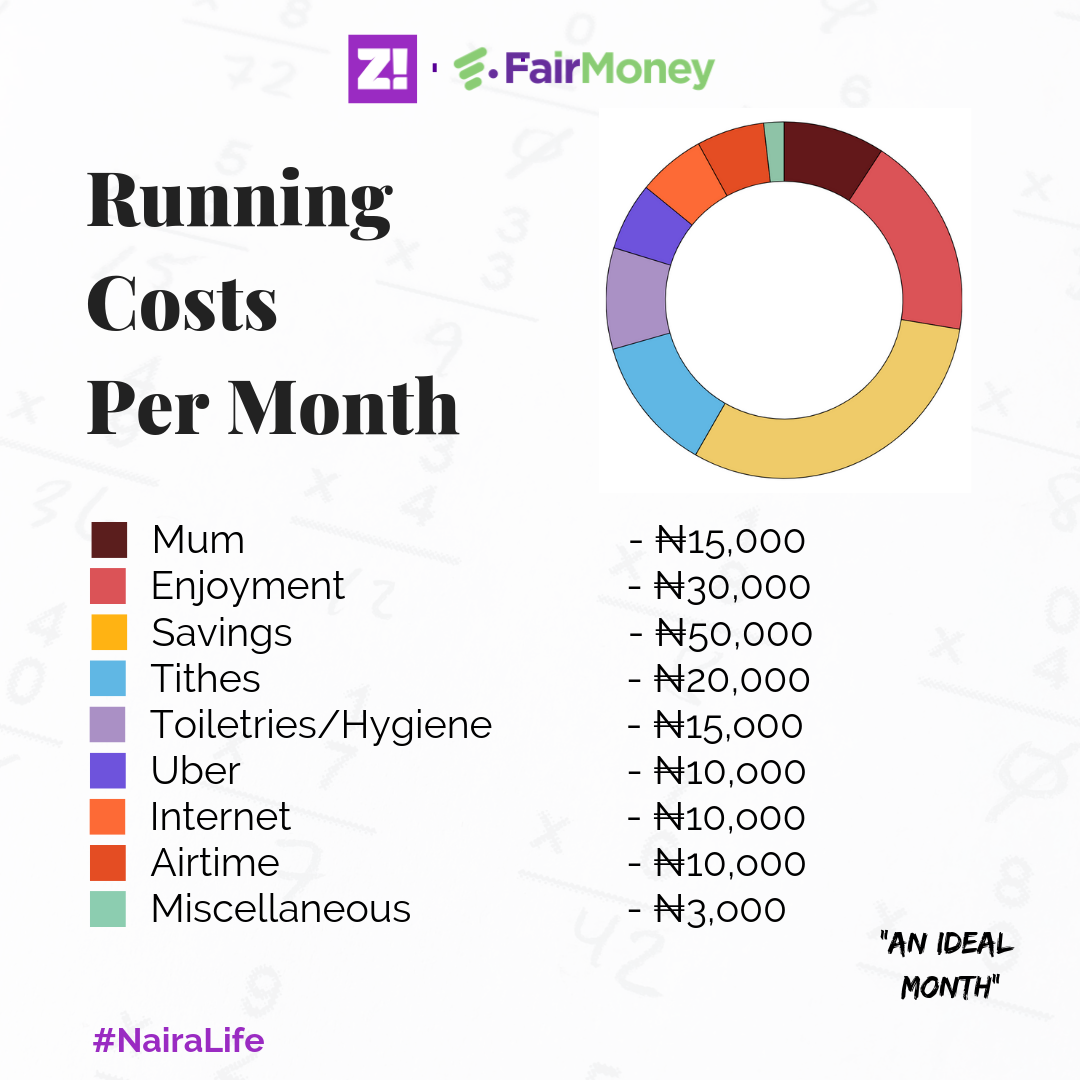

First of all, I budget a lot. I know where my next salary is going.

I tend to feel bad about it, but I spend a significant amount of my money on hair. My monthly spending tends to change a lot too. For example, my ideal savings should be ₦100k. But then I spend on hair, and that one just disappears. Also, makeup. Usually, each time I’m shopping for makeup, the budget is ₦10k, but I just bought a crazy new brand that’s more expensive–₦26k.

See ehn, I’m not doing again.

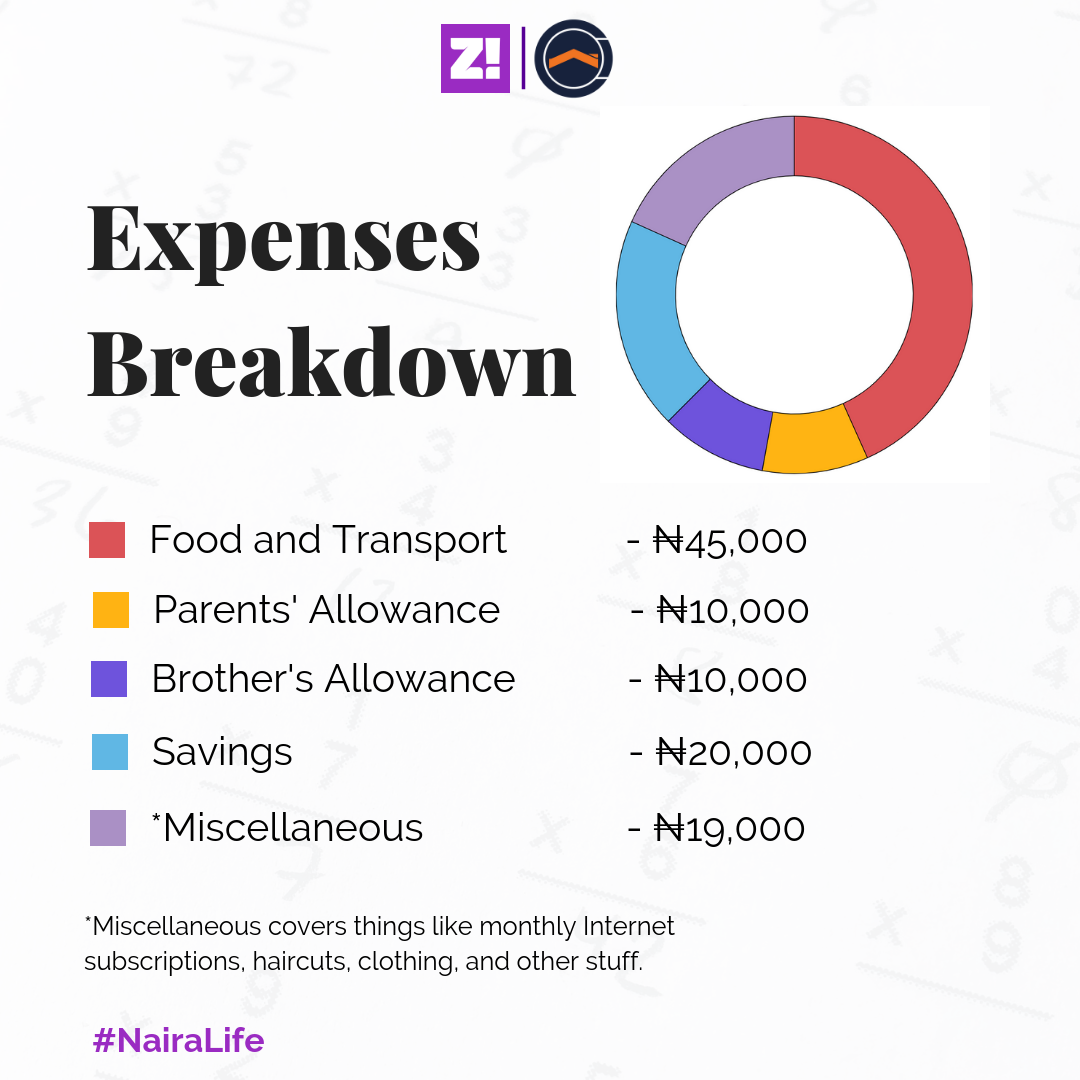

Let’s create a scenario of what an average month looks like

looks like.

I’m also big on kolo or piggybank–anyone you call it. I just throw change in there. I’m not a cash person, so every time I withdraw money, I make sure to keep some of it in. I have no idea how much I have in there to be honest.

There’s also the part where I’m obsessed with clothes.

What’s the highest you’ve spent on clothes at once?

I spent ₦50k once. It might not seem like a lot, but that’s a quarter of my salary. No shopping for another four months after that.

How else do you manage your money?

I sit down at home. What am I looking for about? If you want to take me out, come and carry me, please dear. Last weekend, when I wanted to go out so badly, I slept through it. When I’m craving anything that involves going out, I sleep. Sleep works like magic.

Let’s talk about your airtime spending.

I was in a long distance relationship with someone Abroad, we used to text and do video calls. Then I took a break. Then I started talking to someone back here. That meant that I started buying airtime to talk on the phone because the Internet can’t be trusted. I’ll buy ₦1k airtime, and next thing I’ll hear after talking a little is “your account balance is low.”

Mad ting.

One of the guys I’m currently reviewing said we need to take a break from going out. Because every time we go out, it’s like “let’s go and eat here,” “let’s go and chill there,” and then you end up spending money. One guy took me to this restaurant that’s so damn expensive. When they brought the bill like this–₦40k. And what did I even eat?

Local relationships are expensive. You want to go to nice places but they’re all overpriced. Abroad, good pizza is cheap, but here everything is expensive.

Long distance relationships or just being single saves you money.

Okay back to income: How much do you feel like you should be taking home monthly?

Like ₦400k. Because my work stretches me mentally a lot. I have sleepless nights just trying to crack it. If the things I come up with to add value to the company, I should be paid. My work takes all my time. I have no work/life balance. If I spend so much time on my work, I should be paid more.

How much do you think you should be earning in 5 years?

I see myself being Marketing Director in a top company. Or a marketing consultant. I should be earning like ₦3 million a month when I think of where I’m headed and the amount of knowledge I’ll have by then. This figure is of course based on the current value of the naira.

What is something you want right now but can’t afford?

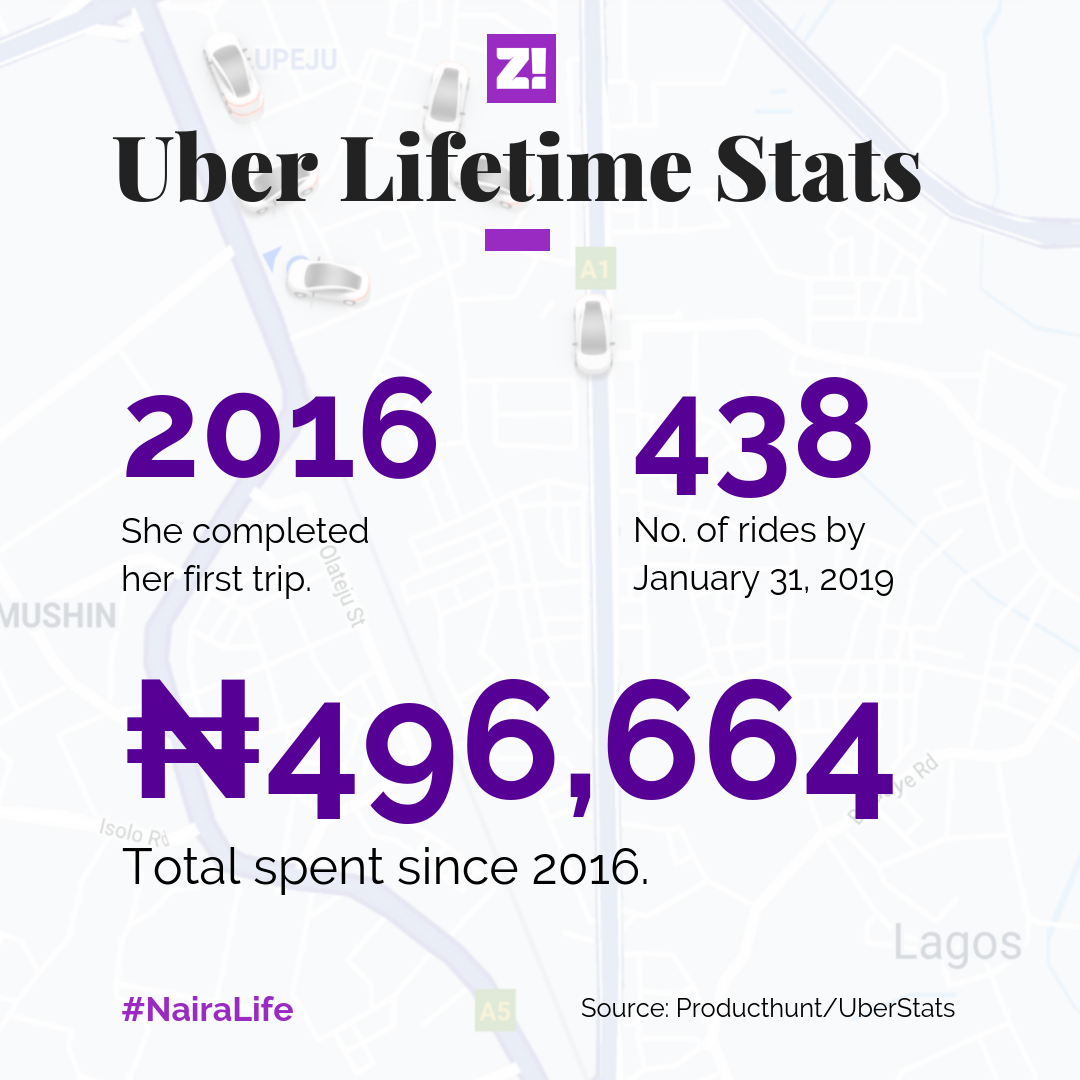

A car. I need it now-now. I’m done with these Uber drivers. I’m tired–the ones that smell, the ones that talk to me one kain, the ones that annoy me.

The car I want is ₦10 million, but the one I’ll manage is ₦2 million. Two separate things.

When do you think you’ll retire?

I intend to run a primary and secondary school in my 50s, when I’m done with the corporate world. But if you’re asking when I’m going to stop working, the answer is never, because I really can’t be idle.

How much do you know about your pension?

13k gets put in my pension account every month? To be honest I’m not sure. It’s just one of those things I do because they said we should do it. But I don’t feel strongly about it, because I feel like if I have my own money, I won’t need it. But they say things might just go wrong and then you suddenly need it.

Last thing you bought that required serious planning?

My phone. It cost ₦306k. My Airpods, on the other hand, didn’t require serious planning because I bought it once–it did require serious thinking.

Most annoying miscellaneous.

As much as I didn’t want to do it and didn’t budget for it, it was school fees for one of my siblings. It was some ridiculous reason that would mean he didn’t resume on time, so I paid ₦40k.

Do you have any investments?

My baby brother’s business. Investment is something you get out right? Uhm, no I don’t. Because it’s more of giving than actual investing. This is why I want to start my own. I also want to invest in someone’s business soon. Someone I know is starting a food business.

Rate your financial happiness over 10?

Something like a 6.5. My current income just gets me the basics, but there are so many things I need that I don’t have. Like my car, I want my car now.

There’s still so much more I want to do, but I can’t do now. I won’t say I’m unhappy, but I need more to be able to do more things than I can do now.

What’s something you’d have loved me to ask you but I didn’t?

I was hoping you’d ask how much I’ve ever earned in my entire life?

That’s interesting, tell me.

Add all the money I’ve earned since then–the 50k gigs, side hustles, the end of year bonuses and returns on small investments here and there. I’ll put the money at maybe ₦15 million?

What’s next?

I’m starting a side hustle soon, it’s more about finding personal purpose than finding money. I feel the need to touch lives to directly and I want to do it with business.

The funding for this? It will have to come from my savings.

It’s time to put all that kolo money to work.