Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When would you say you first “knew money”?

I have always wanted to be rich since I was 10. I started reading newspapers at an early age, and I learnt about MKO Abiola’s money and generosity. I would write on my school notes the number of houses I wanted to build, the number and names of companies I wanted to start, the number of chieftaincy titles I wanted to have.

My mum came from a poor family somewhere in the South West. She always prayed (and sang when doing chores) to have children that would change her fortune. Even at that age, I was gingered.

Since you remember being so driven, what was the first thing you ever did for money?

I was not really a business person. I was a book worm focused on my studies, so I could get good grades and land a good corporate job after school.

My first job didn’t come until after I graduated.

Tell me about your first job.

It was more like an internship at an investment management firm. I got it a few weeks after I graduated. My CV was submitted at the company by a brother. I was invited for a test, I passed, did the interview, got the job. This was 2007, and it paid ₦50k.

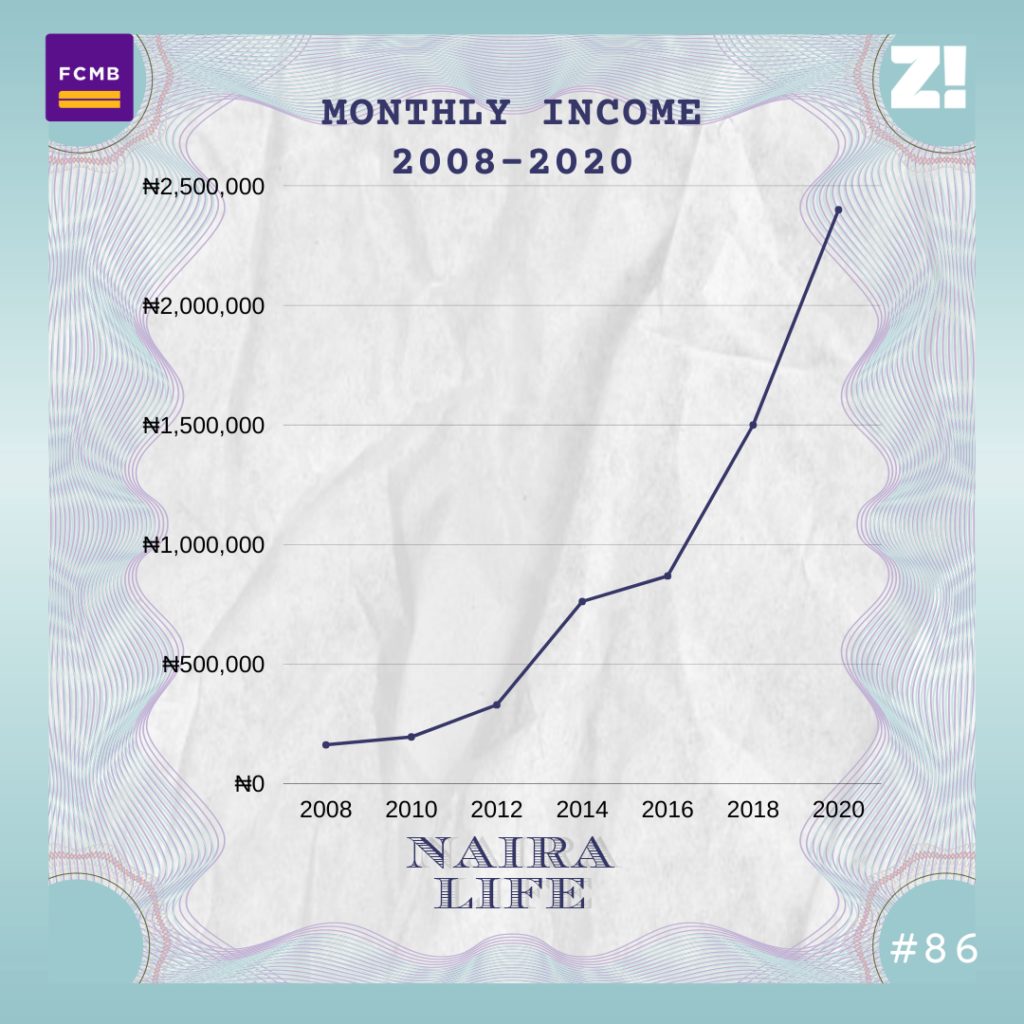

I got the real job after NYSC in 2008. Oil and gas. This one first paid ₦163k, then ₦196k after a few months.

What did it mean to get into an oil company in 2008?

Let me take you back to when I graduated in 2006. The economy was booming. Banks were recruiting en masse, absorbing people. Any second class upper graduate could get a bank job as long as they passed the job tests and interviews.

The capital markets operators, including the firm I worked for, were also doing well. So it was a period of boom.

Now, I must admit I was lucky. Oil and gas was not an easy industry to get into. It was and still is fiercely competitive. I remember ExxonMobil would invite entry-level candidates, and you’d see a sea of heads at a test centre. The test would hold in at least three centres. All for less than 20 slots.

My good grades really helped me. I got invited to five major international oil companies in Nigeria — Exxon, Shell, Chevron and Total Upstream. I had a shot at downstream too. The first offer I got was from one of the downstream companies a month after my NYSC. I took it and settled there. That was my launch pad into the industry.

Tell me about how your income grew from ₦163k.

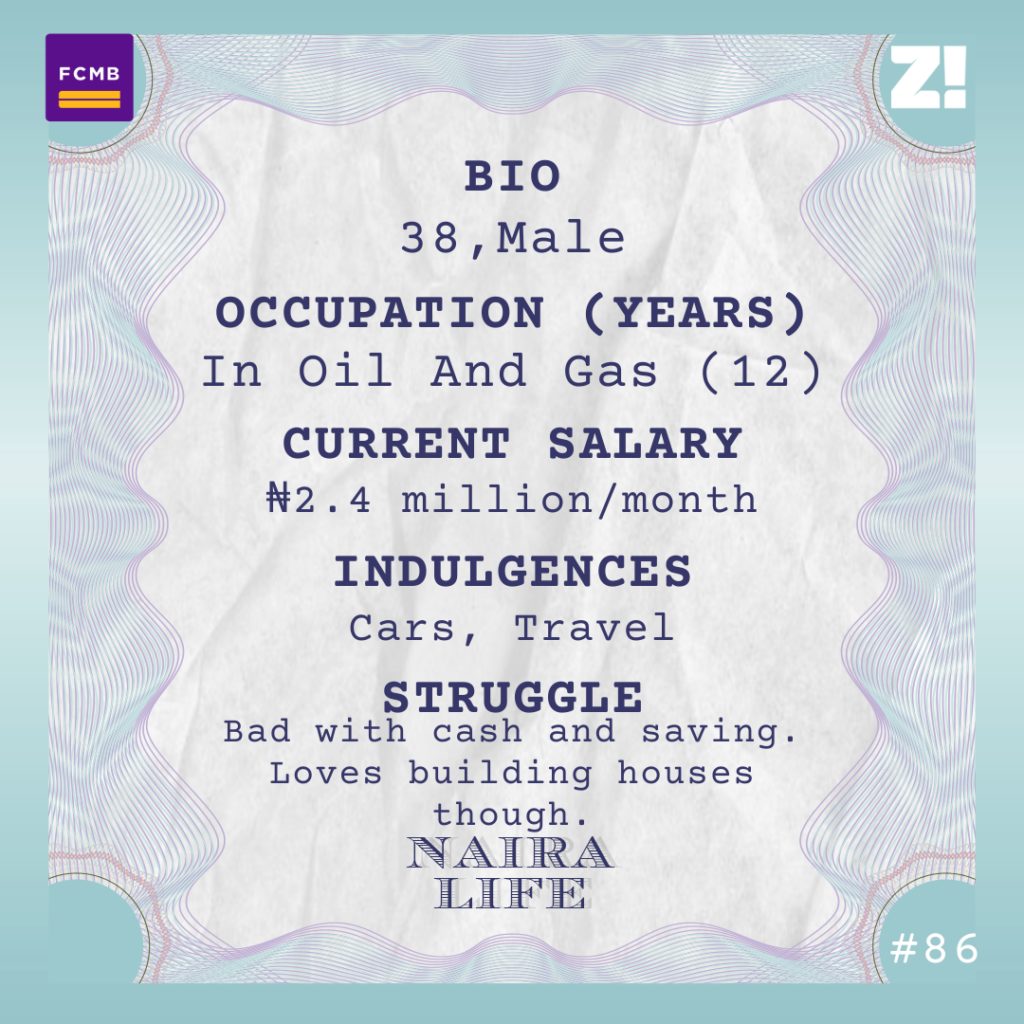

By the time I left the downstream industry after four years, I was on ₦330k per month. An upstream company offered me ₦500k per month and I grabbed it. A year later, my role was upgraded and my salary rose to ₦762k. The next year, I was on ₦869k due to inflation adjustments. A couple of promotions and cost of living adjustments later, I now earn ₦2.4m after tax and pension.

Love it. Between your first salary and now, what important life events have happened?

I got married almost 10 years ago and now we have three kids. My initial plan was to celebrate my 10th wedding anniversary with my wife in Paris, but God had another plan with Corona.

Another thing, I enjoy building houses, so I would say I have never stopped building houses.

This is interesting.

I started my first housing project in 2009, and now, I have completed five houses — four bungalows and a duplex.

As soon as I finish one, I move to the next. I’m very bad at keeping cash, so I prefer to spend my money on these projects. I love decent cars too.

What’s a decent car?

Well, I’ve used a Range Rover, Land Rover and Chrysler at different points. That’s my personal indulgence. I also travel for fun.

Tell me what an average trip looks like.

I used to do Dubai every other year but got tired. I like London and Paris. I love Scotland too. I have done the major cities in Scotland — Glasgow, Edinburgh, Aberdeen and Dundee. I have done Turkey. I had fun in Istanbul, but the time spent at Hilton Glasgow was my best ever.

A typical trip lasts between 8 to 14 days. I travel economy class, but I use top hotels just for the experience. I try to use Hilton because I’m building my Hilton membership points so I can get subsidised booking.

I just love seeing the flashy modern cities. I really don’t fancy all these historical sites people talk about.

What’s on your to-do when you enter a new city?

I love football, so if there is a popular football monument in the city I’m holidaying, I try to visit. So I’ve visited the Emirates, Stamford Bridge, Old Trafford, Dundee United stadium, Wembley and Etihad.

I don’t club, so that’s out of it. I do a lot of shopping though. I buy most of my wears when I travel. TM and Zara stores are two of the first places I look for in any city. When I travel with my family, we go out in the evenings for sightseeing. When I travel solo, it’s sports monuments and shopping.

I can spend as low as ₦800k when I travel solo to one country. If I do more than one country and use top hotels, I may do up to ₦2m. With my family, ₦3m. I hardly spend more than ₦3m.

Back home here. I’d like us to break down your monthly expenses now. Let’s use your last income.

I spend about ₦1.1m on loan repayments — about ₦500k from it is actually Ajo. I have some short-term loans, banks throw loans at you when you earn that much. I spend about ₦1.5m on school fees per annum for my children plus that of a family member’s child under my care. In school fees months, I cut other expenses.

I spend about ₦100k on household stuff. I have about 10 people on my payroll, from my mum to family members. I spend about ₦100k on that. I always have an ongoing project, and I throw at least ₦300k on that. I keep about ₦200k for regular expenses — from car maintenance to gifts — during the month. I save a very little portion, less than ₦50k.

That ₦50k, hmm.

I’m very bad at keeping cash. I’ve been working for 12 years, and I can count on my fingers the months in which my salary lasted till another month. It never did when I was earning ₦163k and it still doesn’t do now that I earn over ₦2m. It’s the weirdest part of my personal finance. I used to complain, but I’ve realised there is little I can do.

How do you fund your holidays?

Several ways. But mostly from lump-sum payments, like bonuses and 13th month received towards the end of the year.

Raising ₦800k to ₦3m is not difficult by the way. Most of those expenses up there are not fixed. I may decide to not spend the ₦300k project budget for three months.

And of course, I pay school fees only thrice in a year — January, April and September.

I also stagger my travel costs. If I want to travel in December, for example, I won’t spend all the money then. I can buy flight tickets in July, book hotels in September and by the time I travel in December, all the money I need are my shopping and feeding expenses. With this planning, it’s not difficult.

Let’s talk about projects. What type of projects do you spend on?

Houses.

I’m curious about the unit economics of building houses.

They are usually small houses that cost between ₦15m to ₦30m. Three are personal. Two of the houses are commercial. I only recently finished the ones that will be commercial, so returns have not set in, but I’m hoping to get the returns in 10 years. To be honest, I did not build the houses for immediate economic consideration. I see it more as a store of value. Together, the five houses are worth about ₦100m.

I think you have an interesting relationship with money.

Well, I wish I could be good at saving though, I don’t think I have had ₦5m in my bank accounts for over a month. I realised early in my career that I am bad at keeping cash, so I decided to spend on things I could see: houses.

There’s also me trying to help people within my means because I believe I am lucky to have such a decent job. I try to have fun too, as permissible by faith. Travelling is my main indulgence. Then cars. So these are things I spend money on.

I’m poor at investments too. If I invest in liquid assets, I can easily sell them and spend the cash, hence my reservation about it.

This is not necessarily the best personal finance strategy, but this is what I do.

Has this “lack of cash” ever backfired?

A number of times. I once needed a huge sum for an unforeseen family event, and they expected me to just transfer the money immediately or after a few hours. No one believed me when I said I didn’t have cash. I had to screenshot my account balance to convince a sibling. How much? ₦400k.

What comes to mind when you think about retirement?

Relocating back to my country home in my village and enjoying a stress-free life. Hopefully, I would have built more commercial properties and rent would be a good source of income.

My pension account balance is currently above ₦30m. Hopefully, it would be up to ₦100m at retirement.

I have a small side business too; a small consulting firm that is not yet profitable.

So, I’m banking on rent on my properties, pension and retirement benefit from my employment. One of the good things about the upstream oil and gas industry is its decent retirement package.

You could go home with as much as ₦100m after 25 years of service.

I also hope my saving culture would have become better before retirement, so I should have a decent saving balance.

On a scale of 1 to 10, how would you rate your financial happiness?

I would say 8. I am lucky to have a good job that pays more than ₦2m per month. It hasn’t translated to a heavy financial chest, but I am still happy at the projects I have done. Even more, the number of people that have benefited from it.

You know, I built one of the houses for my mother. Handing it to her remains the most fulfilling day of my life.