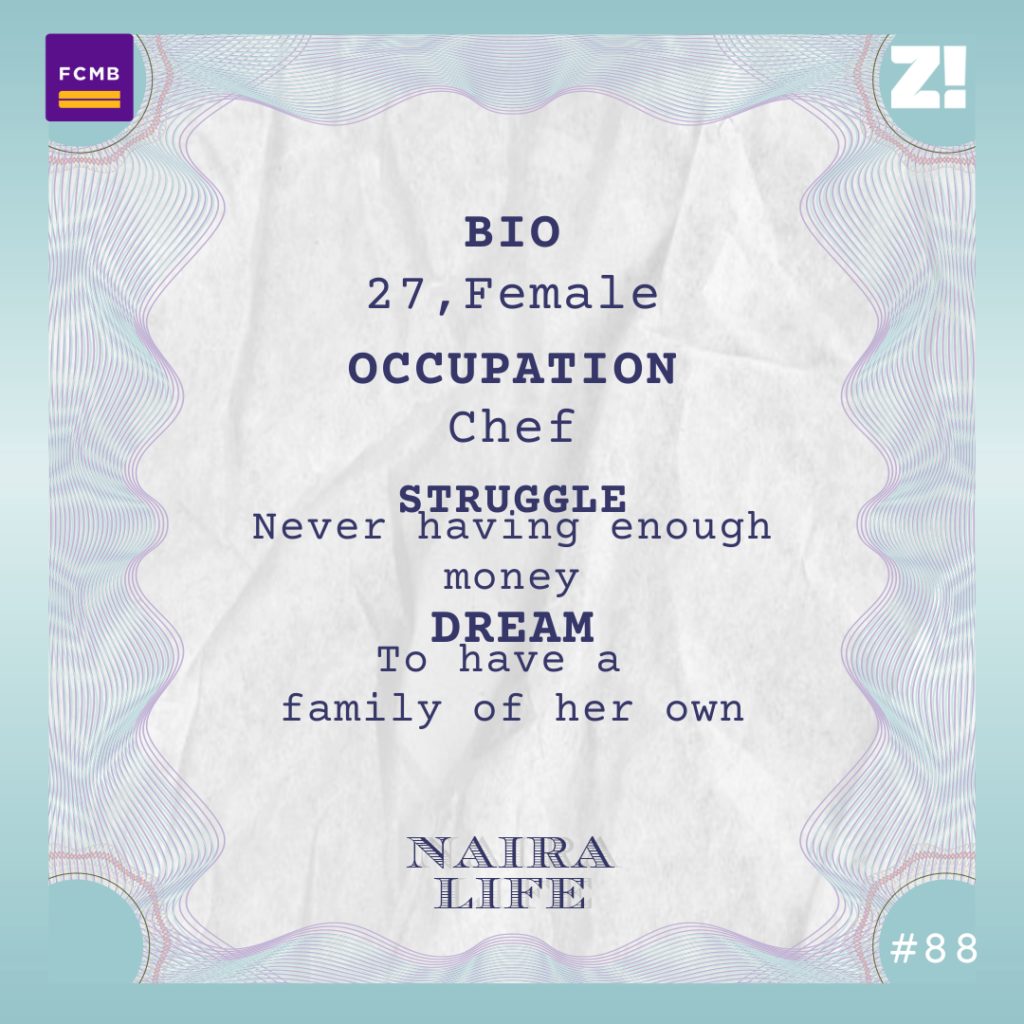

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When you think about money, what is the oldest memory that comes to your mind?

Growing up with a struggling single mother. She couldn’t finish school when she got pregnant and had to drop out.

What was she studying?

Accounting. She was also working part-time at a cosmetics store, where she met my dad. They fell in love, and she got pregnant.

Ah.

He was there for three months after I was born, paying bills, buying baby food. Then he disappeared for a month, so she went looking for him. She got to the house and saw plenty of slippers by his door.

My father was getting married to someone else.

Ah.

Anyway, my mum struggled to raise me by herself. At a point, I lived with my grandma and her sister because she couldn’t cope.

Did she pay for your schooling?

For secondary school and university, I was on a scholarship. My grand-aunt funded it. My uni school fees, for example, was around ₦500k per year — it was a private school.

I imagine you still had to worry about taking care of yourself.

When I called my mum for stuff, she’d say she doesn’t have money, so I didn’t like asking her. She sent ₦5k every month, but it was never enough. The first job I ever did was an ushering job in university — I was 19 and in 200 level. I’ll never forget that job.

They told us to bring stilettos. We were on our feet for like nine hours on stilettos. The pay was ₦5k, and I got stranded after. See, I couldn’t have survived uni without my friends.

Tell me about that.

First of all, I went to a university where cooking wasn’t allowed. Some periods, my feeding was covered by my friends and my boyfriend. So many times they’d say, “Let’s go and eat. I’ll pay for the food.” Sometimes, my boyfriend would buy me dinner, but there were days when I’d go without food.

When was your most difficult financial stretch in school?

400 level, while I was working on my final year project. I started calling family members till it got to the point where they were saying, “Ah ahn, what about your mum?”

What about your mum?

She used to work at a filling station. It was my sponsor’s filling station. My mum had to endure harsh working conditions just because of the scholarship I was on. You get? Her salary was ₦20k without a pension, healthcare. Like, when my mum retired from that job, her salary was still ₦20k.

Ah.

She worked there for over 15 years. She retired in 2019. She fell really sick and just never went back to work. Diabetes. She suffered a partial stroke too. She’s 52 now. It’s funny because her first real health crisis started on my last day at school.

Tell me about it.

I think it was the anxiety or excitement of it. She gets very anxious whenever I’m travelling, for example, so I never tell her till I reach where I’m going. Anyway, telling her I was coming home the next day, coupled with my graduation, landed her in the hospital for two months.

How did you pay for that?

My grand-aunt. She paid for it; I just did the caring. I’m very grateful to her for my schooling and for my mom’s hospital bills. This was in 2015. The next year, I went for NYSC.

Where did you work?

I worked at a government ministry in Ogun State. There, I started selling jewellery to sustain myself beyond NYSC’s ₦19,800.

Before NYSC, I fell in love with a guy because of his fingernails. When I started serving, and he didn’t want me squatting, he paid for my rent, a ₦50k per year room.

After NYSC?

I started applying to jobs, but nothing was forthcoming.

What kind of jobs were you looking for?

You know now, after NYSC, you’ll be applying to office jobs. I thought I would work in an office, buy my mum a car.

Aha. How did that go?

Nothing happened. I was just sitting at home, getting fat. I spent almost a year at home. My boyfriend used to send me money as the spirit led. I gathered all the money and started selling noodles. Because most people knew I was a graduate, they used to come to my stand and say, “I like your courage”, and then they’d buy.

How many cartons were you selling?

I started with half a carton of noodles, bought sardines, bought two spaghetti, bought takeaway packs. I started with about ₦20k. Then I started delivering to people, and it was legit cool, till I got a job interview at a bank one month after. I was soo happy, until I went there.

What happened?

The role was a contract role as Direct Sales Agent. I didn’t want to take the job, but they said if you do well, you could become a full-time staff of the bank.

How much was the job?

₦48k before commission. Basically, you’re going to look for new people to open bank accounts on your own dime.

Out of frustration one day, I just walked up to a man outside the bank and started pitching to him. I had no clue he was the state’s zonal head of the bank.

I left the job after a month. If I’d stayed there, I would have expanded a whole lot more.

Why did you leave?

Someone paid for my culinary school. My zonal head asked in the office if anyone knew a caterer for a small event. I told him I could do it. This was in 2017.

I got paid ₦150k to cater for 30 people.

How much did you make in profit?

Maybe ₦10k, because I didn’t have my own equipment and spent a lot on renting. Through that gig, I met a man.

Heh.

You know those Yoruba men that say, don’t call me chief, call me Ade?

Ohooo.

Yes. He asked me what I wanted, and I told him: culinary school. I just said the first thing that came to my head. I didn’t even know there were culinary schools in Nigeria, but he told me to go and do some research. I found one, and it cost ₦500k. When I called him, he said: “When do you want to start?”

Energy.

He sent ₦300k for me to make a deposit. But that was when I started asking myself, what does this man want from me gan gan?

Great timing.

I went to meet my office confidante, and he was like, why are you doing as if you don’t know what he wants? You better return the money if you can’t do it. But I couldn’t return the money.

Because you’d made a deposit.

Then he invited me over one day. When I got to the house, I just knew this wasn’t his real house. So I drank a lot of Vodka from his bar and…

And?

And that’s how I collected my balance that day.

Noted.

The next month, I enrolled in culinary school. It felt like I wasted money because my tutor was Youtubing our classes, and I started to wonder why I didn’t go to Youtube and use the money to start my own business. Anyway, I got a certificate there.

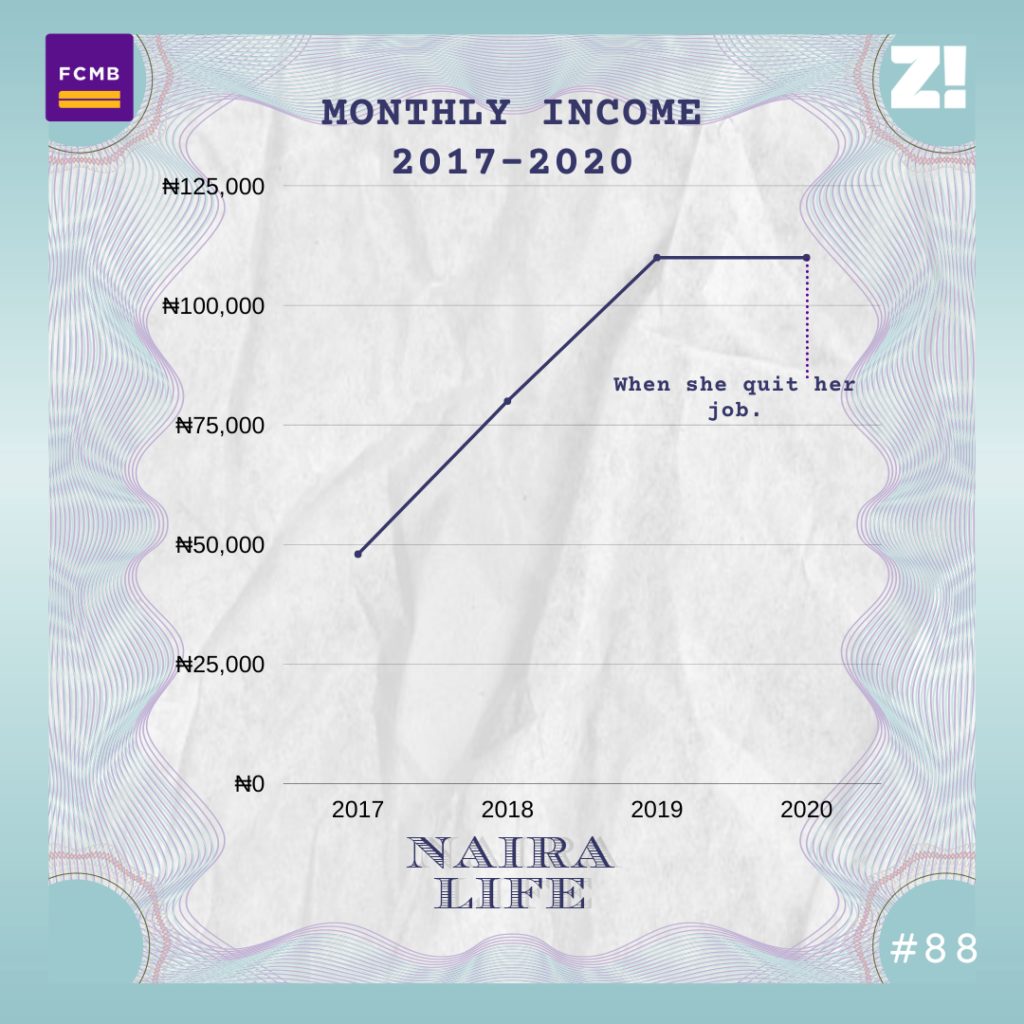

After culinary school, I was at home again. My friend helped me secure an interview at a coffee shop, as a manager. I got that job because of my culinary certificate. The pay was ₦80k, and it was on that ₦80k that I made recipes and grew out the menu.

Culinary school finesse. How long did you work there for?

Eight months. She hired someone else to come and work on my team and started paying her ₦180k.

Interesting.

I was like, why is there so much difference between our salaries when I’m doing way more? I found out that the girl went to school abroad. I was mad.

Someone else who had gotten another job at a restaurant asked me to apply there. So I did.

I actually told the owner of the restaurant that I wanted ₦150k, but I settled for ₦110k. This was in 2019.

What was it like working there?

Generally great, except for the one man, a chef, who made my job difficult. He kept trying to sabotage me.

I also got tips and bonuses that pushed my money to like ₦130k monthly.

Nice.

Eventually, I left early in 2020. I feel like I’d have stayed longer if that other chef didn’t make my life difficult. I really wanted to give my food business a shot though. When I left, I didn’t have much beyond my main ₦110k salary.

So, how did it go financially? You had ₦110k and no stable means of income. How did you wing it?

I had a support system. My boyfriend. It’s not like I was on an allowance or something, but any time I asked for money, he gave me. Whenever he noticed I needed money, he gave me.

How did the lockdown affect your business?

It was bad at first, then it became good just before the end of March as people were stocking up. Demand increased in June when the lockdown was lifted a little. June was my best month.

Do you know how much you made?

No. I put whatever money I made back. I know there were days where I made enough to pull out ₦10k in a day.

How was your mum at this time?

I placed her on an allowance. It used to be on impulse before, when she’d call me and say, “I need this or that.” Then I realised that it had gotten to a point where I couldn’t save anymore because I was giving her all my money. So, I put her on a monthly allowance in August this year.

How much?

I told her that I’ll give her ₦20k every month, but not at once. Every week, I’d give her ₦5k as a benchmark.

I’d also been living with my boyfriend for most of the lockdown, but a few months ago, I rented a place. We’d been having issues, so it felt like the right thing to do. Everything cost me like ₦800k.

I’m happy I took that step.

Me too, but why are you happy?

Because I would have gotten stranded. We had a fight, and he kicked me out. Before, I would have had to beg him.

What do you mean, “before”?

He threw my load away six times.

Tell me about the f — wait, are you okay talking about this?

Funny thing is, I don’t know how to feel anything anymore. I tried to cry but I couldn’t.

I don’t even think about it. I can’t remember much, but the first time it happened was probably two years ago. I went back to live with my mum.

The second time?

I sat down there, outside his house, because it was late. I also didn’t have any money on me.

Was this his reaction to every fight?

Not really. First, he’d insult me, insult my family and always remind me that I come from a broken home. Then he would try to hit me or he would scream at me. You know when someone is screaming, and you are trying to get through to the person, you end up having a shouting match with them. Whenever this happened, he would turn the table on me and say I’m the one always screaming the house down.

For five years, I literally held down the relationship.

That’s heavy. So, back in the kitchen?

I never left. I’ve even been sending CVs out for chef roles.

I noticed that you can’t tell how much you’ve made, but what’s an expense that never leaves?

My mum. I legit have to cater for my mom. She has nobody else. Then my house is not yet done.

You and money have an interesting history, you know.

Yes. It stops a lot of nonsense and disrespect. That is why can’t work under people. I always feel humiliated if I have to depend on them.

Another thing I’m curious about, what’s an aspect of your financial life that you struggle with?

I never have enough even when I try to save.

What is something you want right now but can’t afford?

Like I said, setting up my mum and then setting up myself, because I’ve always wanted to own a restaurant. If I’m able to set up a restaurant or a buka, I don’t need to set her up. I’ll just be like, momsy, come and stay here.

Do you ever wonder what a different life will look like for you?

Yeah. A different life would be a complete family with siblings. My mum wouldn’t be as lonely as she is. I feel like I missed out on family bond. You know, that closeness. Sometimes I feel like I have nobody. I think that’s something that made me stay with that guy. He gave me a sense of family.

These days, I feel like I’m floating.

On a scale of 1-10, how would you rate your financial happiness and why?

4. I feel like a steady income will make me more grounded, not worrying about the next day. I feel like I can do better, but why am I not better?

Do you ever feel like this?

Sis.

As flight restrictions are gradually easing up, you can finally go see your loved ones or go for those business trips on a budget.

FCMB’s international travel deals will make your experience even better. Here’s what they have for you:

• Discount on international flight fares.

• Foreign currency debit card for use on ATM, POS, and Online transactions abroad. (capped at $1,000 monthly).

• Free Virgin Atlantic COVID-19 cover.

• VIP access to a global network of airport lounges with Priority Pass card and a Platinum Debit card. Grab a seat here.