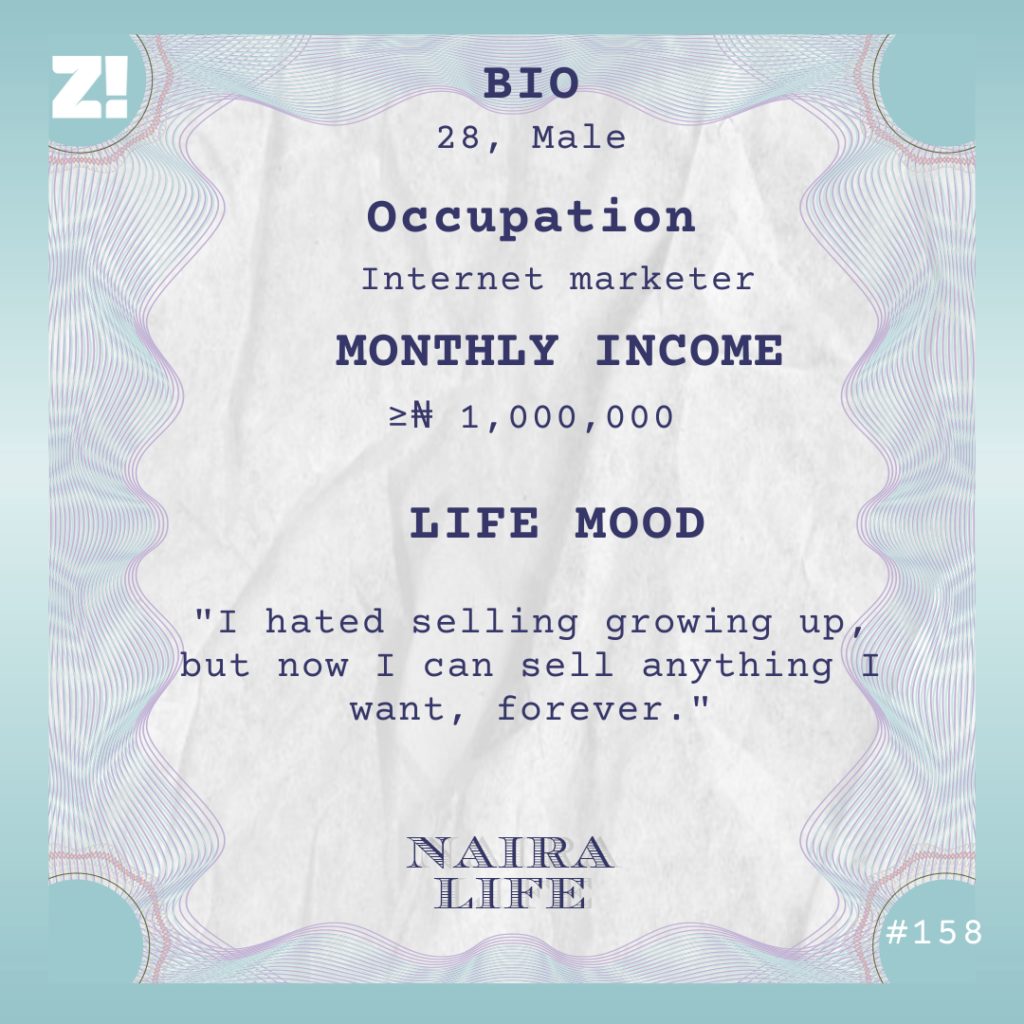

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Today’s subject on Naira Life made one promise to himself since he was young — he would never sell anything to make money. After breaking the promise three times, he’s finally found that selling is his calling, and his monthly income is a testament to this.

Tell me about your first memory of money.

The earliest idea I had revolved around not wanting any efforts I made for money affect my time with my loved ones the way it affected my parents.

My mum worked as a high-ranking officer at a bank. She left home before we woke up and came back after we’d slept. I remember being a frustrated nine-year-old thinking, “When I grow up, I won’t let my job come between me and my family.”

And your dad?

He did anything his hands could find — from producing soap to selling car parts. His businesses weren’t always successful, so my mum was the major breadwinner. My siblings and I quickly learnt that if we needed money, we went to her to because whenever we went to my dad, he would say he didn’t have it or we should go to my mum.

But my mum wasn’t taking care of only my two siblings and me — some extended family also lived with us. So she hardly gave us when we asked. In my teens, her response to my money requests became that I needed to go and make my own. She would tell me to go and look at kids selling things on the streets and emulate them. I absolutely hated it whenever she said that. The idea of selling things was irritating to me.

Why?

In my early teenage years, I was once recruited along with other young people in church by my pastor to sell newspapers. He was going to pay us for our services, but we had to make profits. Omo, that day was hot and nobody bought from me no matter how hard I tried. I didn’t even sell enough to make any profits. That day, I swore I didn’t want to have anything to do with selling again in my life.

That’s fair.

One time in secondary school after the newspaper event, one of those con artists who scammed people into thinking they could turn money into paper came to our school. They showed us a few demos and then brought a ghana-must-go full of those special papers. My friends and I weren’t convinced to buy, instead one of us swore he knew how the thing worked — the first step was putting paper over a fire so that the smoke darkened it, I can’t remember the next. While I was trying it out, my mum caught me and gave me the scolding of my life. She made it clear that if I wanted to make money, I had to do it legally. After that, I didn’t try to make money again till university.

What did you do?

In the early years of university, I connected students who wanted to sell phones with buyers. I handled the conversation, so I added my own profits. After a few deals, I stopped. It wasn’t easy finding people who wanted to deal that way and handling the conversations was stressful. I didn’t do business again until 2017 when I had an extra year in university. I studied statistics and I didn’t really enjoy it or take it seriously.

What business was it?

I sold popcorn on campus. A friend convinced me that it was the next best thing, and we would make at least ₦2,000 daily. This was in 2017 and I was 23. I got ₦30,000 from my mum and my friend contributed ₦20,000. The business crashed after three months of losses. We bought the wrong corn, expensive milk, didn’t track money, it was terrible.

Now, you’ve sold two things after promising to never sell again.

And both times, I got frustrated by the concept of selling. I only did these because I wanted to have my own money, and not because I wanted to sell.

What happened next?

I started NYSC in late 2018. At first, I didn’t find a job I liked. I was attending to customers at an event planning centre just so they could sign my monthly clearance form. Five months into NYSC, my friend linked me with a job at the front desk of a gym that paid ₦40,000. It was on Lagos Island, and I lived on the mainland, so my transportation to work every day was ₦1,000. I only survived because NYSC was also paying ₦19,800.

By 2020, I turned 25 and my finances were in shambles. The gym job that had retained me after NYSC cut salaries to half when lockdown hit in April, so I only got ₦20,000 from them. On a few occasions, some of my friends abroad reached out to tell me they needed someone to write school essays for them. I wasn’t a writer, but I took the jobs. That paid between ₦18,000 and ₦36,000. My saving grace was that I didn’t have any responsibilities. My mum wasn’t in Nigeria, but she sent money to feed the family regularly, so I was fending for only myself.

Because I was home and doing nothing, by May 2020, I decided to learn Data Science and Data Analysis. Everyone was talking about how it was the next best thing, and I needed skills to be more valuable so I could get a job and make money. I got a few courses online, some free and some paid, and started learning.

How did that go?

It was going smoothly until I was on my way to church one morning in July and someone snatched my phone from the bus window. I was devastated. That was the third time my phone was being stolen in two years. If I was going to buy a new phone, I would need to save my salary for about 10 months without touching it. That couldn’t work, so I started talking to my friends about opportunities for making money fast.

What did you find?

One friend introduced me to internet marketing.

Selling again?

I was too desperate and frustrated to turn down the suggestion. He showed me a course that taught how to sell online, target ads, write powerful copy, put products in front of people who would buy them and all that. The course was ₦40,000. I paid half and another friend paid half. Buying the course also gave me access to a platform where I could become an affiliate marketer — I could sell courses and get commissions from the sales whenever someone purchased with a link I shared. That link was connected to my account.

After my first week, I decided to sell a course on working from home because we were in the middle of a lockdown and people would be interested. I put the link on my WhatsApp story and made two sales. My commission was a total of ₦4,500. It was sweet, easy money. After that, I started talking about the course I was doing to see if people would be interested in wanting to learn how to sell.

How much was the commission on that one?

50%. ₦20,000. In my first month, I sold 50 copies and made ₦1,000,000 in commissions, and I hadn’t even finished taking the course. I was just posting the link everywhere on social media and talking about how that course would help them sell and make millions. I wasn’t using the knowledge from the course to sell products, I was using it to sell the course itself.

Mad.

Luckily for me, I joined the platform when they started a three-month challenge for who would sell the most books. I did similar numbers on my second and third months, and by the end of my third month, I won the challenge. They gave me a car. That’s when it hit me that the past three months hadn’t been a fluke. I was actually selling and making money online. 3 million naira in three months.

What did you use the money for?

It was hard for me to keep track of my finances. I was new to making money, so I spent it anyhow. The only good financially progressive thing I did with the money was buy crypto. The rest, I bought a phone, stopped entering buses from the first month, ate out a lot and gave out money. Whenever people asked, I gave.

Were you still at your gym job?

They gave me a one-month notice in August 2020, and I left. Business was bad because of the pandemic.

My third month doing affiliate marketing coincided with me getting a Data Analysis job at a tech startup that paid ₦100,000. I still had some knowledge from when I started learning, so I applied because somewhere deep down, I still needed security. What if the affiliate marketing job stopped working?

Did it stop working?

I doubled down and started running ads to reach more people. I also added a new strategy — if you bought the course from me, I would coach you by showing a few tips and tricks for free. It made more people refer me, so sales kept coming in at an impressive rate.

By 2021, the volume of my sales slightly reduced because I wasn’t putting as much effort into selling.

Data analysis caught up?

LOL, no. My attention became divided. I was struggling with balancing my Data analysis job, and then I started coaching a lot more because people who didn’t buy the book from me had started reaching out for me to coach them for a fee. The more people I accepted, the more people came, so I split them into general students, cohorts and one-on-one mentees.

Wait, how much do you make on an average month?

Since 2021, I’d say over ₦1 million. I quit the data analysis job in October 2021, because I wasn’t giving it as much attention.

What’s your monthly spend breakdown like?

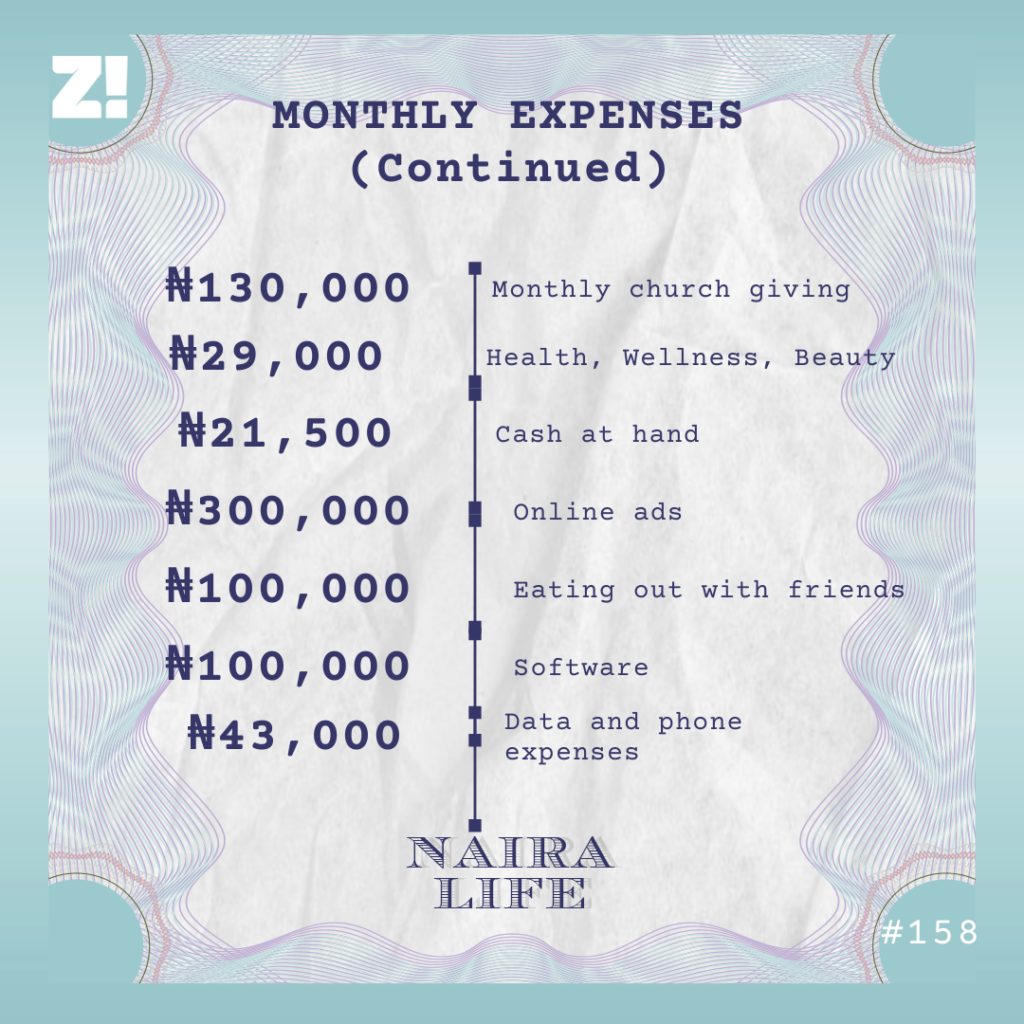

I’ve been terrible with my finances since I started this business. Because the money doesn’t come in bulk, keeping track of where it goes has been a problem for me. Last month, I met with a mentor who shared an excel spreadsheet for me to track my spending so I can be more financially responsible. Before last month though, I spent most of my money heavily investing in crypto. The rest was for eating out, paying for workstations, running ads fixing car issues, and giving in church.

And last month?

What kinds of software do you pay for?

Some are for email marketing, others are for hosting and selling courses.

How has making this much money changed your view on selling?

Immediately I started making money, I realised that selling isn’t about making people buy a product but making a product so attractive people believe they need it. I don’t say, “Come and do this course. It’ll teach you how to sell.” Rather, I say, “See how much this course has given me. You should absolutely do it.”

Nice—

Oh, and in October last year, I published my own course. It started at ₦5,500 for pre-order, then went to ₦7,500, then ₦19,500, and now it’s at ₦22,000. I’ve sold over 600 copies and made over ₦5 million in sales.

Maybe I should consider sales. What do you want but can’t afford right now?

Maybe a house. My own house.

And your financial happiness on a scale of 1-10?

I’d put it at a 9 — not because I’m making good money, but because I’m doing it on my own time and terms. I have sales skills I can never lose, I have a sizeable audience of people who trust me online, I can drive traffic and can make people buy things. If I stop selling courses, I’ll always be able to sell other things that’ll make me good money online. Always. My goal is to make $1 million in the next three years.