The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

How long have you been with your partner?

It’ll be four years in December.

How did you meet?

Tunde and I met at uni. I was in my final year, and Tunde worked with my project supervisor. He had graduated for a few years, but the lecturer kept him around as a teaching assistant. So, I often sent my chapters and received feedback through Tunde.

I didn’t even know he liked me until he told me over WhatsApp after my project defence. He later told me he didn’t tell me earlier because he didn’t want me to feel pressured because of his influence over my project. I found that really sweet.

I can’t even remember how we started dating. I just know he’d come to my hostel almost every night with suya, and we’d drink garri and gist. Before I knew it, we were calling each other “babe” and chatting for hours. Now that I think about it, this man didn’t even toast me. Wow. He scammed me.

Scrim. What were the early days of the relationship like?

It felt like I was in a romance novel. Tunde was so sweet with words — He still is. I sometimes joke that he used sweet mouth to blind me to the fact that he was broke. To be honest, we were both broke.

I was a broke fresh graduate preparing for NYSC, and he didn’t have a real salary. He made small money here and there from the lecturer. So, we didn’t go on dates like new couples usually do. But I didn’t really feel it because Tunde has always been so intentional.

His first birthday gift to me was a pencil-drawn image of my favourite picture at the time. He didn’t have money, but somehow, he got his friend to draw it, and he put the drawing in a frame. I still have the frame.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

That’s so sweet.

Things got better in 2022. I went for service, and allawee was enough to provide my basic needs. I served at a school that paid ₦5k extra and provided accommodation, so it was manageable.

On the other hand, Tunde started a printing business in school. He also wrote projects, assignments, and presentations — basically anything students needed. It wasn’t big money, but he could afford to visit me once every two months where I served.

Who handled the bills for these trips?

Tunde paid his transport fare, but I took care of the food. He stayed weekends whenever he visited, so I only had to cook two or three times for the duration of the visit. Sometimes, I supported his transport with ₦2k or ₦3k.

I finished NYSC in 2023 and moved in with Tunde. We thought it’d be a waste of money to rent another place. Also, our families knew we were together, and we both knew we wanted to get married, so it made sense to live together and get to know each other’s daily habits better.

How did that turn out?

Honestly, I wasn’t expecting any friction since we’d already been together for two years. Omo, we had several misunderstandings. I’m not a morning person, and I don’t like people talking to me immediately after I wake up. But Tunde is the complete opposite, so there were a few arguments on that. He didn’t understand why I’d just be squeezing face early in the morning.

We also had some issues around financial expectations. A few months after I moved in, I got a receptionist job at a microfinance bank, and Tunde started expecting me to handle bills. He’d only drop ₦5k for food weekly and expect me to handle the rest.

Initially, I supplemented whatever he gave me with my money without complaining. But after a while, I noticed I was struggling.

My salary was ₦80k, and transport already took over ₦15k. By the time I removed ₦5k here and there almost every week for food money and settled my personal needs, I’d be broke before the end of the month. To make it worse, whenever I turned to Tunde for extra money, he’d say, “You need to manage your money well. What are you spending on?”

At some point, I got angry and complained about him leaving the food expenses to me. He didn’t understand my point and thought I was complaining about contributing to our expenses. It caused a huge fight, and we didn’t talk to each other for three days. It took the intervention of a mutual friend to settle that issue.

We discussed and understood that it was a communication issue. He didn’t know I was spending so much on food and thought I could handle it. While I thought he was leaving everything to me.

How did you both handle expenses after that?

It mostly became a joint effort. Tunde handled things like rent and NEPA bills while I handled food, but we often chipped in for whatever expense, depending on how much either of us had.

We also became more transparent about our income. It’s not like we hid money from each other, but we started talking more about how much we had at a time so we could work with our pockets. Tunde also started sending extra money to me because I’m better at saving money. He started doing that last year to save for our wedding, but I got pregnant, and we had to pause wedding plans.

Oh. Why, though?

My dad’s church doesn’t allow weddings when the bride is pregnant. So, the only option was to wait until I gave birth. It’s not like we even had the money for a wedding anyway. We’d only saved about ₦300k, so we used it to buy baby things.

Right now, it’s not looking like a wedding can happen anytime soon. I had to quit my job when I was heavy because my employer didn’t have any allowance for maternity leave. They even told me they’d hire someone else when I gave birth. I had my baby in January and only just got another job as a teacher in June. Tunde also got an NGO job in April, which relocated him to the North.

I’m not excited that he moved away, but it’s a good opportunity. His business in school wasn’t doing well, and this new job pays ₦350k/month. We need the money. My own salary is just ₦55k, but I had to take it because I can take my child to work and leave him in the school’s daycare.

So, you both are doing long-distance now

Yes. I can’t move to join him because we’re concerned about insecurity. The plan is for Tunde to work and save for at least two years so he can quit and return home. Then, we can start thinking about a wedding.

How does romance work in a long-distance situation and with a baby?

We do video calls a lot. Because of the cost and distance, we might not do frequent visits like that this time. So, maybe we’ll do trips once every four or five months. We’ve not seen each other physically since he left in April.

I’m mostly doing childcare alone. Tunde sends ₦50k monthly to support, and his sister comes over twice or thrice a week to help, but it’s mostly just me. It gets hard sometimes, but I know we have a plan to work towards, making it easier.

You mentioned Tunde’s savings plan. How’s that safety net looking?

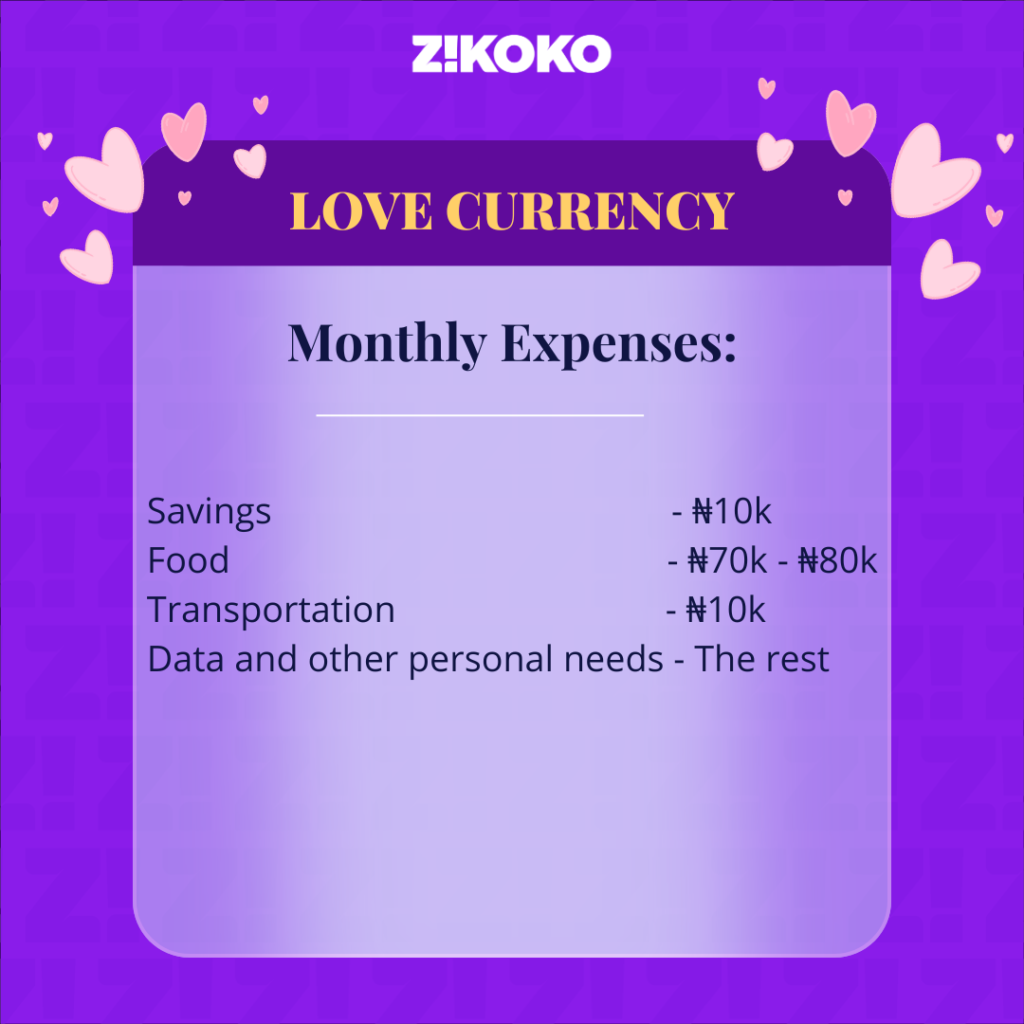

Since April, he’s been sending me ₦200k monthly to save for him. I use a savings app, so I lock the money there. I also try to save ₦10k monthly. Currently, we have ₦630k saved.

To be honest, that’s enough for a tiny wedding, but I sincerely want a big one, or at least a moderate one. It’s a once-in-a-lifetime occasion, and I don’t want to look back at my wedding pictures in regret. There’s still time. I can wait.

What’s your ideal financial future as a couple?

To comfortably afford everything we want. Owning a house feels impossible with this economy, but I’d like that for us one day.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: This Shop Assistant Is Tired of Her Boyfriend’s Lack of Financial Ambition