History of Money In Nigeria- The Naira (₦) is the official currency of Nigeria, but did you know that Nigerians didn’t start using Naira until 13 years after independence?

In this article, we’ll tell you five things you probably didn’t know, but need to know about the history of money in Nigeria.

1. Nigerians haven’t always had money.

Before the colonial era, Nigerians traded differently. Value was exchanged through systems like trade by barter where people exchanged goods and services for other goods and services. If you wanted a slave, for example, you had to have something valuable like ivory or cotton to give in exchange. People also traded things like fish, gin, beads, tobacco and salt for whatever they wanted.

As time went on, the concept of currencies became more stable, as people relied mainly on cowries, beads and manilla currency.

2. The British introduced the first currency in Nigeria.

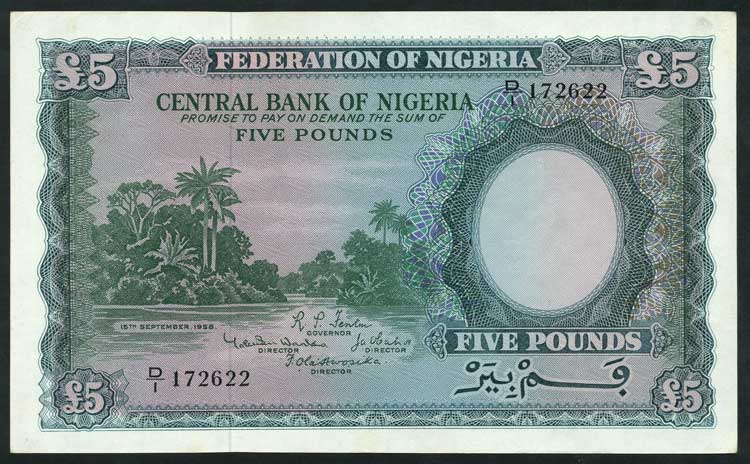

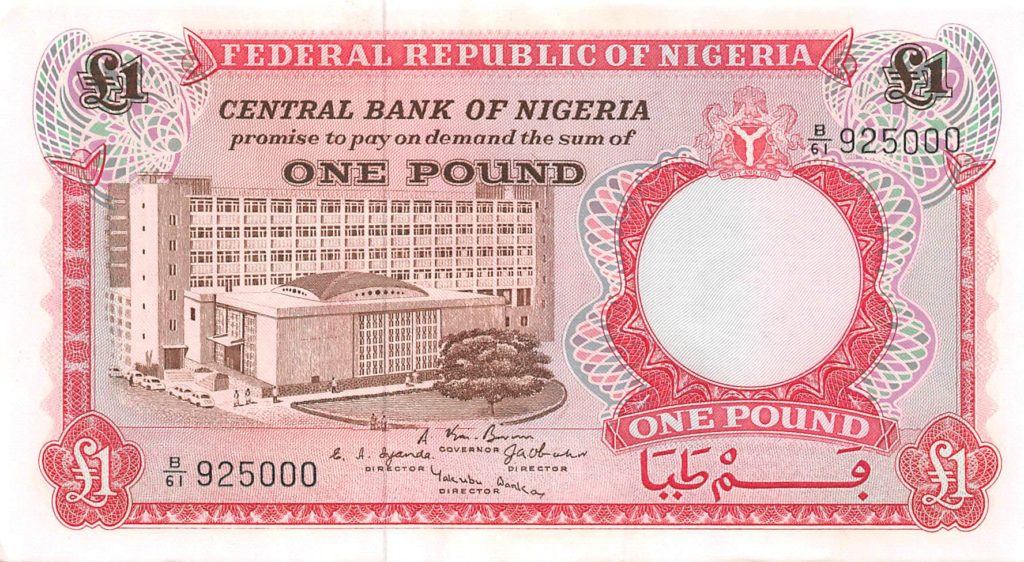

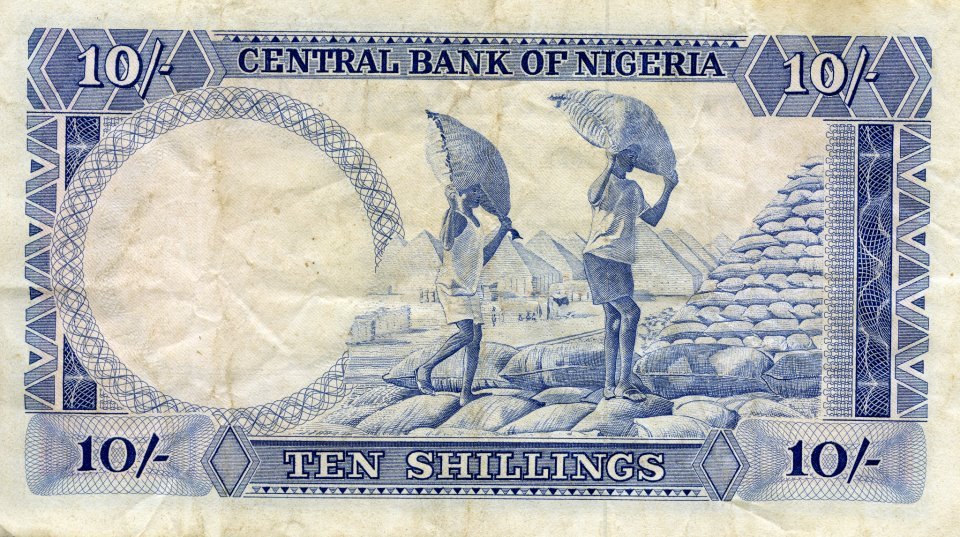

During Britain’s colonisation of Nigeria, the concept of money was introduced. Nigerians used Pounds, Pence and Shillings.

Fun fact: Nigeria used Pound Sterling until 1973

Even though the Central Bank of Nigeria was established in 1958, Nigeria continued to use the Pound Sterling for 13 years after she gained independence. Nigeria was the last country to abandon this system among the British colonised Countries. In 1973, Nigeria started using the Naira.

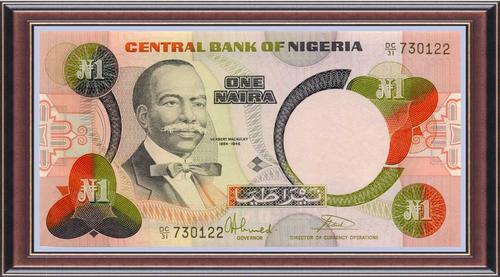

3. The Naira was introduced in 1973.

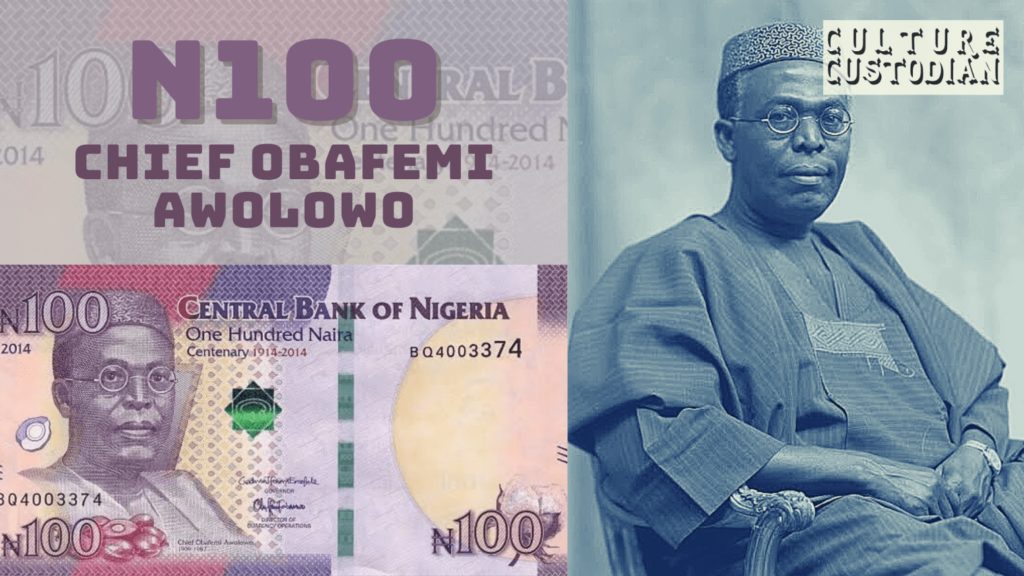

On January 1, 1973, Nigeria started using its own currency. It was named naira by Chief Obafemi Awolowo. This was the real beginning of the history of money in Nigeria. Naira and kobo was rolled into the Nigerian economy with bank noted and coins. The central bank of Nigeria is in charge of distributing the Naira. It controls how much money flows into the economy. The official currency code for Naira is NGN.

In 1973, we had ½, 1, 5, 10 and 25 kobo coins, and 50kobo ₦1, ₦5 and ₦10 bank notes. The ½ and 1 kobo coins were made with bronze and the higher denominations in cupro-nickel. ₦1 is 100 kobo

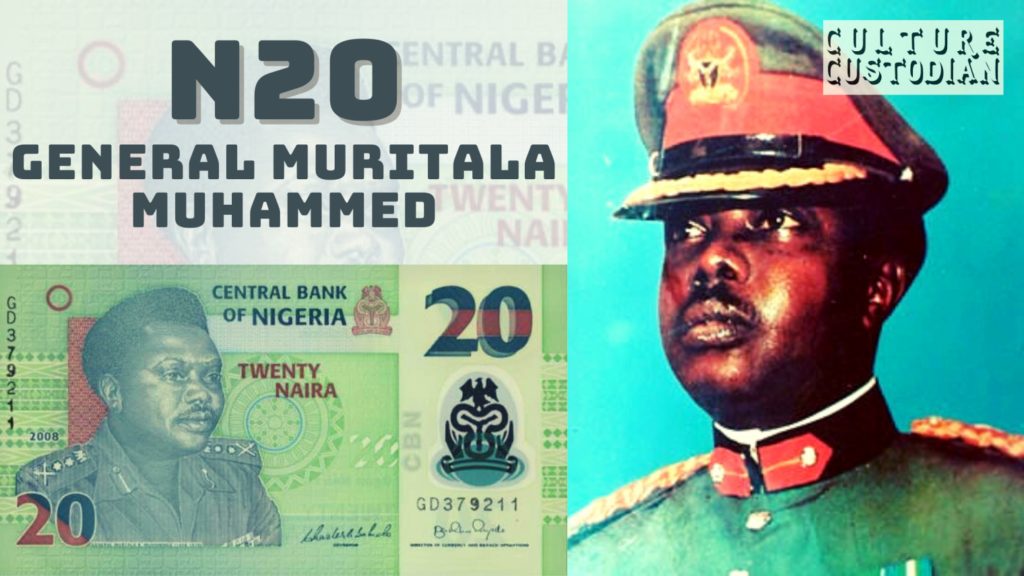

In 1977, the ₦20 was introduced.

Fun fact: Till today, the ₦20 is called “Muri” in some parts of Nigeria because it has a picture of Late General Murtala Muhammed

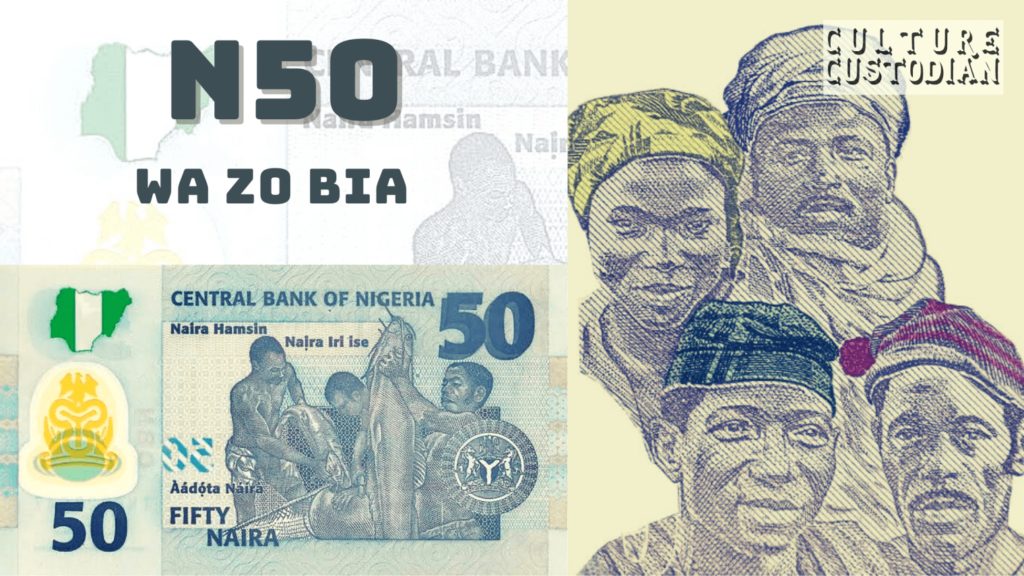

In 1989, the 5 kobo and 10 kobo coins removed from circulation, and in 1991, the ₦50 note was introduced. In 1991, the 50 kobo and ₦1 notes were changed to coins.

Fun fact: The ₦50 carries an illustration of people from different parts of the country to promote unity. That’s why it’s called “Waso”, which is a short form for “Wazobia”.

Wa-zo-bia is made up of three words, each of which means ‘come’ in Yoruba (wa), Hausa (zo) and Igbo (bia), Nigeria’s three largest linguistics groups

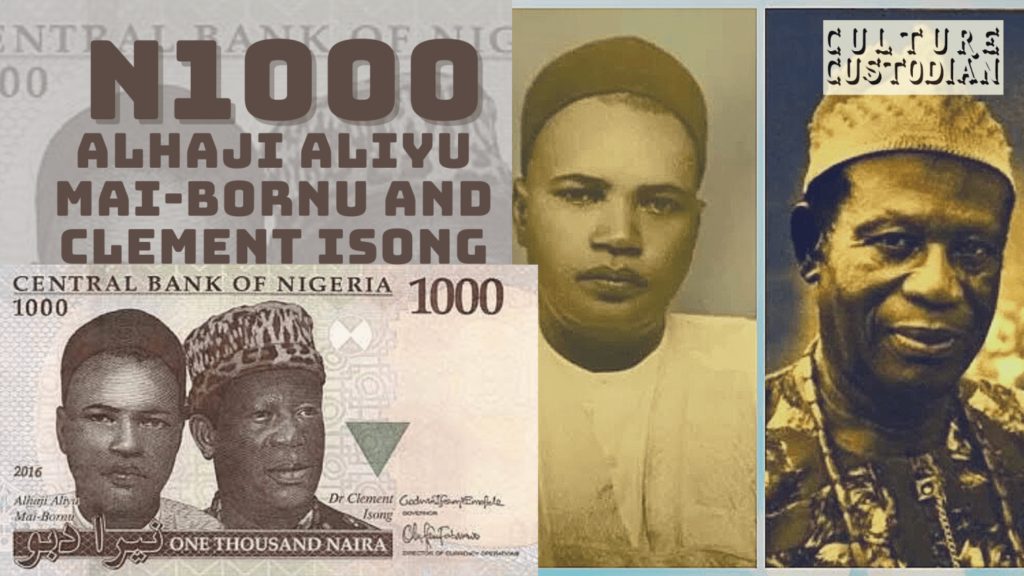

In 1999, the ₦100 note was introduced, in 2000. ₦200 was introduced. ₦500 was introduced in 2001 and ₦1000 in 2005.

₦1000 is the largest Nigerian denomination in circulation.

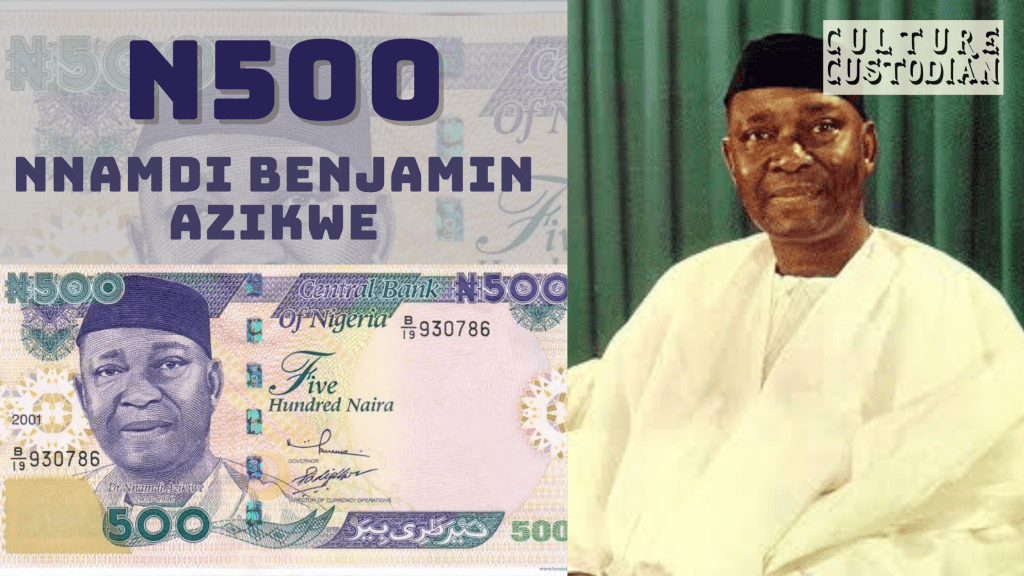

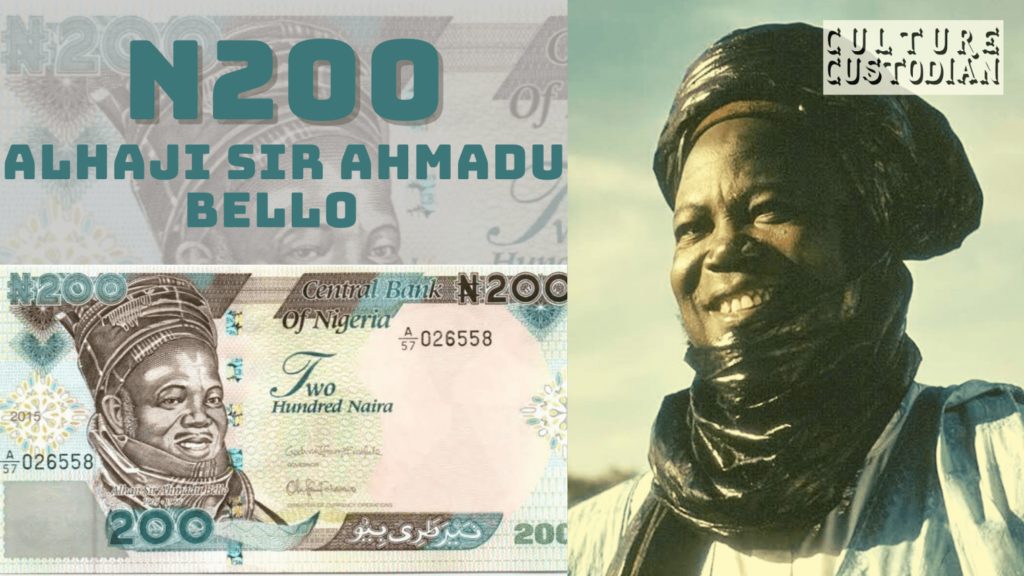

4. Who are the people on the Naira notes?

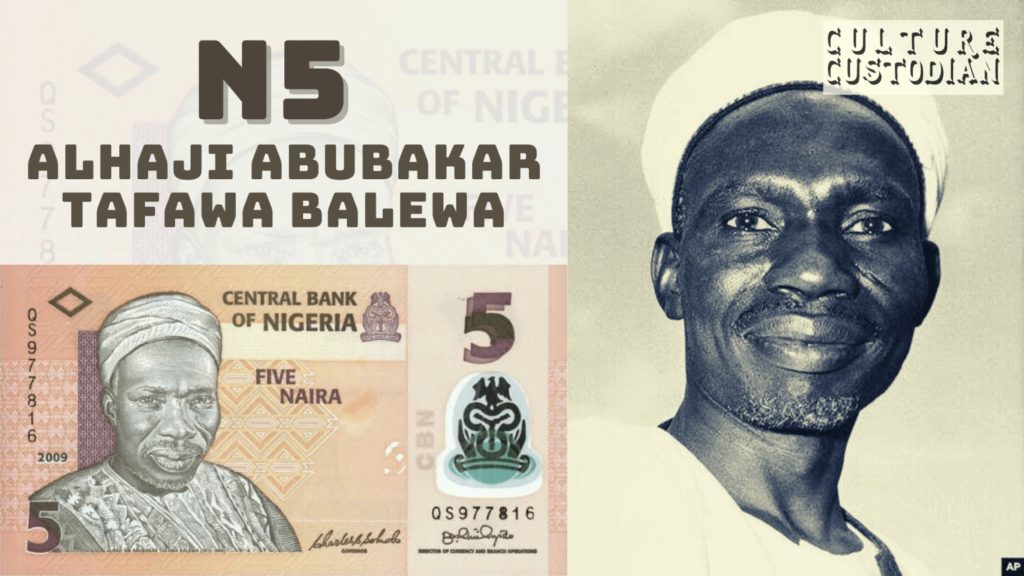

The ₦5 has former Prime Minister Abubakar Tafawa Balewa, ₦10 has educationist, activist and politician, Alvan Ikoku, General Muritala Mohammed is on ₦20, and ₦50 carries an illustration of Nigerians from varying tribes.

₦100 has Obafemi Awolowo, ₦200 has a picture of Sir Ahmadu Bello, ₦500 carries the first persident of Nigeria, Nnamdi Azikiwe and ₦1000 has former CBN governors, Alhaji Aliyu Mai-Bornu and Clement Nyong Isong.

5. The naira wasn’t always this bad.

Today, the naira exchanges at $1 to 413 NGN. It hasn’t always been like that. Over the years, the naira has depleted in value because of economic problems in Nigeria, and inflation.

In fact, we interviewed someone who left Nigeria in 1979 with ₦700, and got it changed to $1000 when he got to the US. His flight to the US cost 280 NGN.

This Wikipedia table shows the history of the exchange rates between the Naira and the Dollar.

How did we get here?

QUIZ: Which Currency Should You Be Paid In?