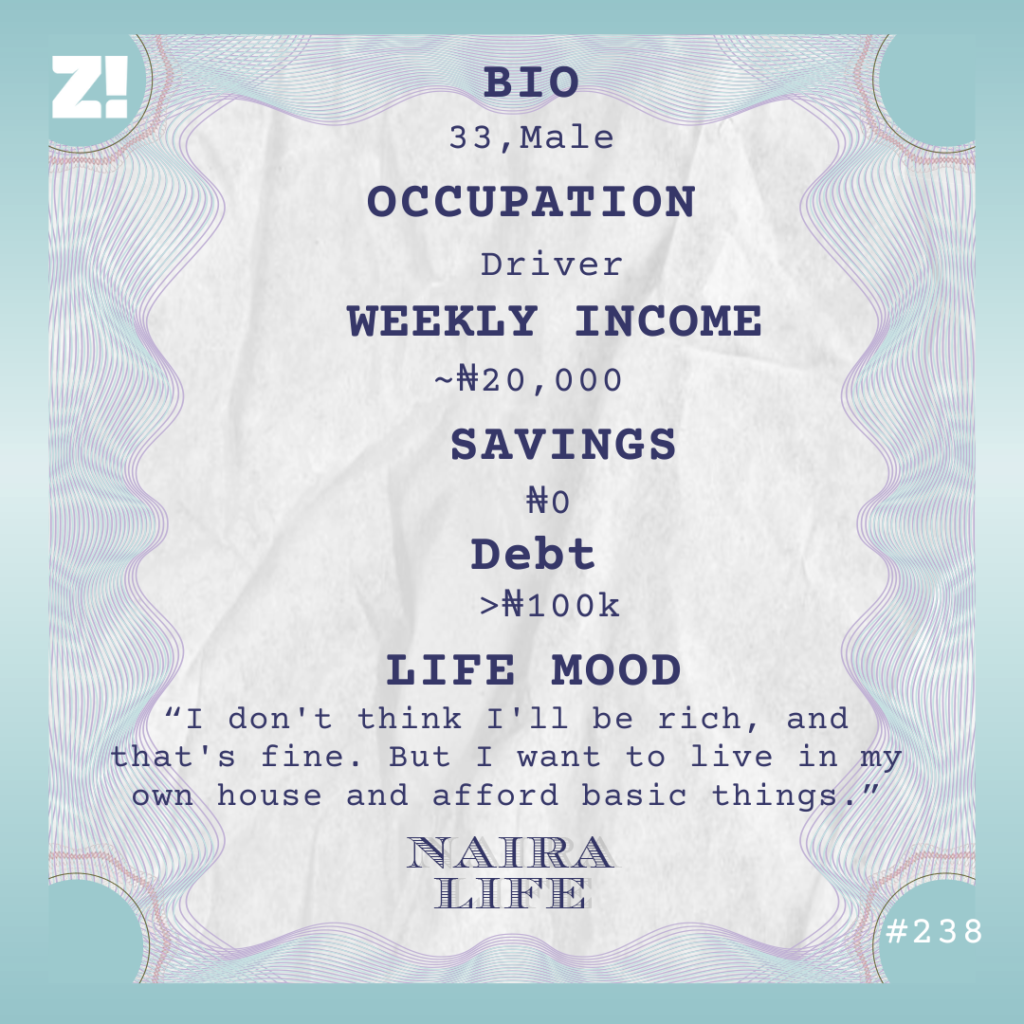

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When did the hustle start for you?

The moment I entered secondary school in 2001.

I’m the 14th of my parents’ 15 children. My dad was a retired soldier and a pastor. The church didn’t pay him, and his government pension wasn’t enough to care for our large family. My mum spent most of her time in church and only did petty trading.

My dad used the little money he had to pay our school fees. We always knew we needed to get out there and make things happen for ourselves. Everybody in our house knew if you needed money, you had to work to get it.

What’s the first thing you did for money?

My friends and I hung around a block factory. When people bought blocks, we’d help move them in a wheelbarrow to where they needed them. We got paid ₦3 per six-inch block and ₦5 per nine-inch block. If we moved 200 units of nine-inch blocks, we’d make ₦1k and split it between ourselves. I was 12 years old and this was big money then.

How frequently did you do this?

Every day after school and on the weekends. But people didn’t buy blocks every day, so I combined this with other hustles during my six years in secondary school.

What other hustles?

I fixed shoes for people and worked for a man who rented bicycles out. I also taught myself how to play the keyboard, so I played in churches most weeks and got paid about ₦1k per session.

What happened after you finished secondary school?

In SS 2, one of my older sisters died.

The company where she worked paid her life insurance — about ₦300k. My dad used the money to buy land in Badagry and built a small house.

But Badagry was too far from my school. Luckily, a policeman who lived close to my school took me in because he liked how I played the keyboard. I lived there until I graduated in 2007.

After that, I lived with one of my brothers in Ikorodu. That was the beginning of the real hustle.

I’m listening

My brother drove okada commercially. Through him, I got an okada on hire-purchase. I was to pay ₦80k back over two years, so I was delivering about ₦4k/week.

How did that go?

The first two years were all right. One litre of fuel was about ₦65, and ₦200 worth of fuel was enough to take me for a day. I don’t remember how much I made weekly, but I never missed a payment. I even had enough left to cover feeding and other small expenses. Also, I lived with my brother, so I didn’t worry about rent.

Once I made the weekly payments, I was fine for that week. But I had several girlfriends, which came with a cost, so I made extra money from playing the keyboard at different churches every week. They paid me ₦2k each time.

I finished paying for the okada in 2009.

Did anything change after you completed the payments?

I became lazy and only worked when I needed money. Soon, I though about returning to school, but what I made from driving an okada couldn’t cover that. I needed to find something more lucrative.

In 2010, I got a security job at a school.

How much?

₦18k/month. In the evenings, I’d start my okada and work for two to three hours to make extra money. I worked there for about eight months. I have a funny story about how I learnt to drive vehicles from there.

I’m listening

The school had eight buses parked in its compound, and I had the keys. After everyone left for the day, I’d start one of the buses and practise what I’d seen other drivers do.

But this didn’t always go smoothly. I once hit a part of the school fence and lied about it. Then one night, my boss came to school and caught me driving the bus. I thought she was going to fire me on the spot.

She didn’t?

No. I’ll never forget what she said: “If you wanted to learn, you could have come to me, and I’d ask a driver to teach you.”

After that, she spoke with the senior driver, and that’s how I started my lessons.

Mad

I applied for a driver’s licence and resigned from the job after I got it.

What did you do next?

I dropped a job application to be a bus driver at another school, passed the driving test and got hired.

This was still in 2010. I’ve been driving since that time.

How much did they pay?

₦25k/month. I got my first apartment while I was at the job.

I also met my first real girlfriend there. She worked as an attendant on another bus. She helped improve my money habits. After getting my salary, I’d send everything to her to keep for me, then I only asked for what I needed. I was still playing the keyboard at churches, so I still got the extra ₦1k – ₦2k weekly.

What about your okada?

At that point, I only used it to transport myself to work. It was old and had started giving me issues. One night, the police stopped me and asked for my papers. They’d expired, and I hadn’t renewed them. That’s how they seized the keys and took the okada to their office. That was the last time I saw it. I never went back for it.

I’m screaming

Back to my apartment. I got a one-room apartment in Ikorodu for ₦40k/year in 2012. Sadly, my dad died around the same time. So I had to use all my savings to pay rent, furnish the apartment and settle part of my dad’s funeral expenses.

Sorry about your dad. Did you continue saving with your girlfriend after that?

No. She broke my heart not long after. She already had someone she wanted to marry, back in her state, and I never knew about it. Although we dated for two years, she never brought it up.

One day, she just called me while she was on the road, to tell me she was returning to the East and I shouldn’t expect her back. She never came back.

Omo

The heartbreak was mad. But I picked the pieces and moved on. After I started feeling like myself again, I quit my job at the school after working there for a year and a few months. My next job was as a private driver — I made the switch because I wanted something different.

Tell me more about that

My first employer was a microfinance bank manager. I left him after two months because he kept owing me. My salary was supposed to be ₦25k per month, but he paid me ₦15k. He said ₦10k was for pension. I didn’t have enough money to spend in the present, and he was talking about pension.

After him, I worked with a lady who owned an insurance brokerage firm. My salary was ₦30k, and I worked with her for about a year before I left and started working with interstate transport companies.

The first was in Calabar, and my routes were Calabar to Lagos, Lagos to Abuja and Abuja to Calabar. My basic salary was ₦40k. But I made a lot of money through other means.

Like what?

The company gave me ₦12k for fuel per trip. After buying the fuel for the journey, I always had some money left. Also, the bus wasn’t always full when I left the park, so there was room to pick up passengers on the road. Depending on how many, I could make up to ₦20k extra on a trip.

Fascinating

But during my second year at the job, I had an accident. My bus hit something and somersaulted a few times in the air. Nobody on the bus died, but I landed in the hospital. My company didn’t pay a visit once. The police had towed their vehicle and wanted them to show up before they could release me and the bus. After a week, I knew they weren’t coming, so one afternoon, I told the attending nurse I was coming and just left the hospital. I had ₦6k in my pocket, which I used to find my way back to Lagos.

You didn’t save any money from the job?

I could’ve done better with money. I’m ashamed about it now, but I spent most of the money I made in the two years on women. I rented and furnished apartments for my girlfriends in Lagos, Abuja and Calabar. I didn’t save or do anything except buy a small generator. Those two years were a waste.

But I moved on again. In 2015, I decided to return to school. With some family members’ help, I enrolled into a polytechnic in the South-West to study business administration. Tuition was ₦60k/session. Two years later, I got my ND.

Did you do anything for money in those two years?

Music was now my primary source of income. I stopped driving and went deeply into playing the keyboard. Every weekend, I had a show to play at and made about ₦10k – ₦15k. This was apart from the ₦4k I made from performing at churches on Sundays.

It was enough to keep body and soul together but nothing compared to what I started making after I got my ND.By the way, I returned to school because I just wanted to have a degree; I had no plan of working in an office.

Did you return to driving?

Yes. My next employer was another transport company. This time, my route was Lagos to Benin and Asaba. While my basic salary was ₦6k, they paid another ₦200 per trip. At the end of the month, they’d calculate the number of trips I made and add the money to my basic salary.

On average, I made 20 to 30 trips every month, so I always got about ₦4k – ₦6k extra. I didn’t mind the ridiculous amount they paid because the salary wasn’t where the money was.

Fuel money and extra passengers, eh?

Yes. Waybills, too — if someone wanted to send a package to someone else in another state, I’d agree to get it to the receiver for a fee. So yes, I always made more money than the company paid me.

I was there until 2018, before I switched to another transport company. At ₦2k – ₦3k per trip, this one paid the most, and I made ₦60k – ₦90k/month in salary alone. The fuel allowance was ₦25k, but I never spent more than ₦10k on any trip I made.

However, I only spent three months there. The company overworked us drivers, and we had no off-days. It was so severe that it was common for drivers to fall asleep on the steering wheel and get into accidents.

On one trip to Abuja, I got to the park at around 2 a.m., and they started loading my bus to go to Lagos at 4:30 a.m. It wasn’t safe.

Omo

On the bright side, I was more careful with money. It helped that I was in a serious relationship.

We met at the polytechnic in 2015 and got married in 2019. I wanted a small wedding, but she’s her parents’ first daughter, and they wanted to make a statement. We ended up spending close to ₦1m on the wedding.

I spent most of what I had saved up.

Did you have another job by then?

No. I had a plan. I didn’t want to drive interstate anymore, because of my wife. So I’d decided I would enter the cab and e-hailing market. I got a car and agreed with the owner to deliver ₦35k/week. When I started, I was making about ₦60k/week. After paying my weekly target, I still had about ₦25k left. It was an easy time.

Can you break it down?

I made at least ₦3k per trip, and there was high patronage because there were more passengers than drivers on the platforms.

Also, a litre of fuel was ₦145. I didn’t need to buy more than ₦3k worth of fuel per day, and I only needed ₦10k to fill the tank.

In February 2020, I got a car on hire-purchase. It cost ₦3.6m, and the plan was to pay for it over three years at ₦30k/week. A month later, COVID hit, and I couldn’t work.

What was that period like?

We lived on the little I had saved, and when that finished, we lived from hand to mouth. It was a little tricky because my wife was heavily pregnant. Our son came in April 2020.

Thankfully, the lockdown started to ease up in May, and I was back to work. But I worked fewer hours because of the curfews. On average, I made ₦30k/week. I couldn’t make my car payments during the lockdown, but when I returned to the road, I started paying ₦10k/week, then ₦15k to ₦20k. We eventually landed at ₦25k when things opened up in September 2020.

I’ve been paying ₦25k/week since then.

Did you ever return to making as much money as before the pandemic?

By January 2021, it was possible to make up to ₦60k/week again after removing fuel and other expenses. There were times I even made up to ₦100k in one week. But as more drivers joined the platforms, the competition became fiercer.

Now, it’s almost impossible to make that much money.

Since when exactly?

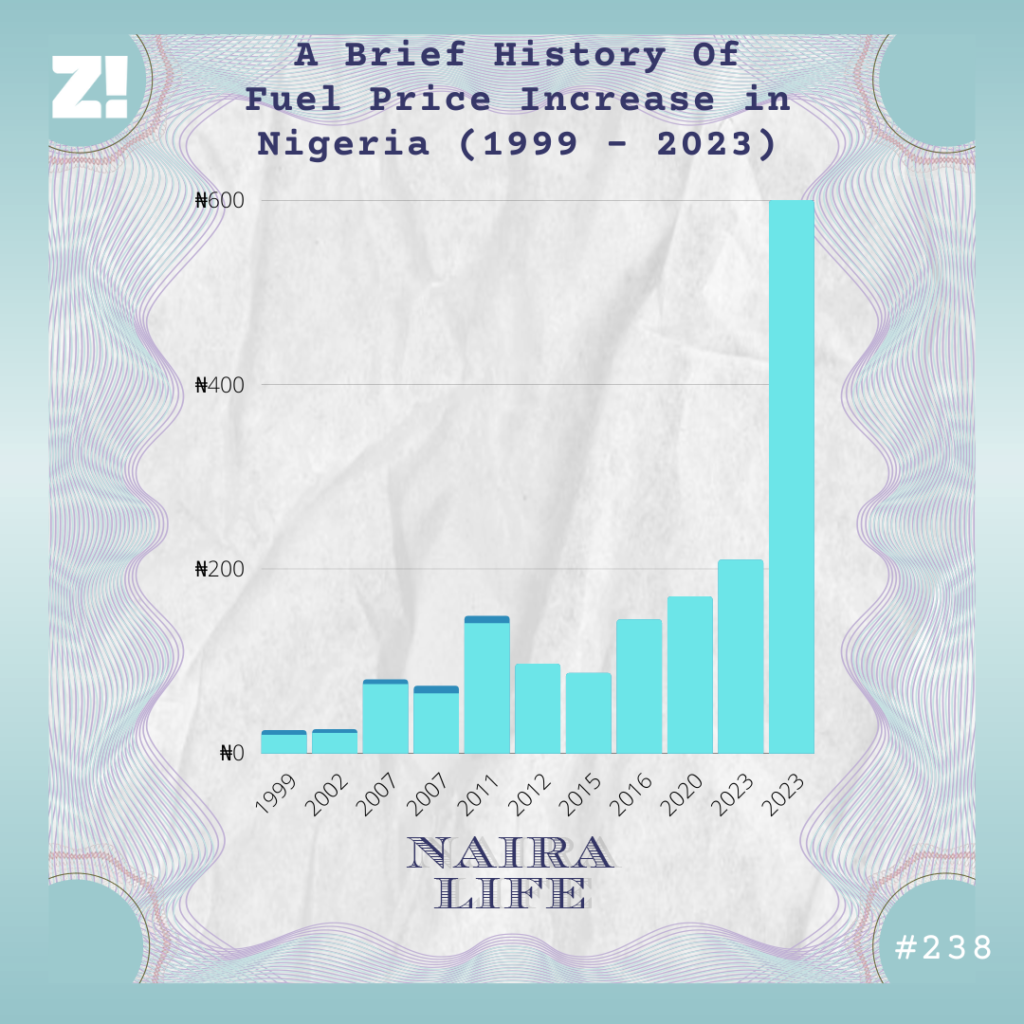

Since that man announced the fuel subsidy removal.

Do you mean the president?

Yes. The business died the day he was sworn in.

Please, explain

The fuel price increased by almost 400%, but cab fares stayed the same in the first two months. It used to cost me about ₦10k to fill up my car. When the government removed the subsidy, it jumped to ₦45k.

Omo

For a month, I didn’t work. When I looked at how much fuel I needed to work and what I’d potentially make, I decided it was better to sit at home.

What did you do in the meantime?

I turned to gambling.

I’ve always placed bets because I love football, not because I needed it to survive. But in June 2023, things changed for me. I started staking ₦100 – ₦500 on games. Once, I gambled ₦64k on a match and won ₦220k. That said, my average winnings were between ₦30k and ₦50k. But I also lost almost as much in other matches.

This was how I kept up payments for my car and ran the family.

I started losing money from staking on football friendlies when the football season ended in June. Before long, I was back to zero.

In July, I returned to driving.

What do the numbers look like now?

After the drivers protested, the major e-hailing platforms increased fares by 20%. It didn’t make much impact. I know many people who sold their cars because of this. Nobody doing this work right now is smiling.

Before, ₦5k worth of fuel would fetch me ₦30k. Now, I can’t make more than ₦20k for every ₦10k worth of fuel I buy. Also, fewer passengers are requesting rides because of the increased cab fares. It’s a miracle if I make more than ₦20k in a week now.

I haven’t been able to turn in the weekly ₦25k for my car for two weeks. The owner can even confiscate the vehicle. We agreed they had the right to take the car if I defaulted on payment for two consecutive weeks. The last payment I made was after I took a ₦100k loan. I never thought I’d need loans to sort out my bills, but here we are.

Let me even tell you something.

I’m listening

I had no orders when I was leaving the house the other day. So I just hit the road and picked up four passengers, charging them ₦500 each. When I dropped the last one, I finally got a ride and made ₦3k from that. Then my car developed a fault, and the mechanic charged me ₦5k to fix it. I gave him everything I’d made. I didn’t get another order for the rest of the day.

Damn

I’m on a negative balance now. I wish I had finished paying for my car so I could sell it. But that won’t happen until October. The plan is to sell it immediately, buy a Sienna and return to driving interstate.

I have seven more years to sort out my financial future before I turn 40. I don’t want to still be driving or chasing money like this at that age.

How much is good money for you now?

₦200k/month. I can’t do anything if I’m making less than that.

What do you spend money on every month?

Food — ₦50k

Data — ₦6k

Car payment – ₦100k

I try to give my wife ₦3k daily for the utilities. My son is also in school, and his fees are ₦60k/term, then another ₦15k for stationery.

What do you see when you think about your financial future?

I don’t think I’ll be rich, and that’s fine. But I want to live in my own house and afford basic things. I don’t want to repeat what my father did — he couldn’t leave anything for his kids when he died. I don’t want my children to hustle like I did. So, beyond sending them to school, I want to provide a suitable space to grow. If I can do this, I’ve hit financial freedom. This interstate driving plan is my last chance to do that.

I’m rooting for you. What’s the last thing you spent money on that required planning?

My house rent — which is ₦200k/year for a mini flat in Ikorodu. My next project is to get a piece of land in the area.

How would you rate your financial happiness on a scale of 1-10?

1. I wish you had asked me this question last year because my answer would’ve been different. But now, my account is red and I’m in a few loan debts even though I work harder than ever.

My wife is pregnant again, and our daughter will arrive soon. I want to give her ₦100k to shop for baby clothes.

And the sad thing is, I don’t have it.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

We’re bringing you a meat festival! Here’s all you need to know about Burning Ram.