Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

If you’re looking for the best place in Nigeria to trade stablecoins like USDT and USDC, use Yellow Card.

Yellow Card is very easy to use and usually has the best rates on the market, low fees, and top-notch security. Join Now!

Let’s start from the beginning. What’s your earliest memory of money?

I come from an entrepreneurial family — my dad owned a printing press, and my mum was a petty trader — so money conversations were regular. It wasn’t strange to overhear questions about where our next meal could come from. So, I can’t remember a time when I wasn’t thinking about making money. One that comes to mind was when I sold biscuits for extra income in secondary school.

Tell me about that

I attended a boarding school, and when I got into the senior class, my parents started giving me a ₦10k allowance per term for feeding and other minor expenses. I’m a natural saver, so I managed my allowance to meet my needs. If I ever ran out of money, I’d call home.

Then, during exams in SS 3, I noticed my classmates were selling biscuits and other snacks. The snacks were popular among students who didn’t want to walk all the way to the canteen at break time and those who got hungry at night when everywhere was closed.

I spoke to a friend whose mum also sold snacks at the school canteen, and we made an arrangement: I’d pay for cartons of biscuits and keep them at their house. Then, I’d take a few cartons at a time to the hostel to sell.

How did that go?

It was very profitable. I can’t recall the actual figures because this was in 2016/2017, but I made enough to afford to recruit my friend’s sister and some junior students to sell my biscuits in their classes for a small commission.

The business lasted two terms, and I stopped because my hostel warden wasn’t a fan of students doing business. He tried to report me to the principal and housemaster several times, but I always escaped. I think I just decided on my own that I didn’t want to do it anymore.

My next hustle happened during the waiting period between secondary school graduation and university admission.

Another business?

Something like that. I almost started selling natural health products in 2018. A friend introduced me to it, and I thought it wouldn’t hurt to try since admission hadn’t come — I was pursuing medicine and wasn’t making any money at my dad’s printing press.

That business didn’t kick off because I couldn’t raise the ₦20k I needed for registration. However, I found digital marketing. My elder brother noticed I had a knack for writing, so he suggested starting an Instagram blog to grow an audience and possibly monetise it in the future.

Before then, I only posted my pieces on WhatsApp and Twitter. I started the blog as he suggested and began seeing how the foreign guys did digital marketing. They talked about graphic and brand design, email marketing, social media marketing and management. I read all they had to say, researched, and even took some courses.

I involved my brother in my progress, and he helped me get my first social media management job with his friend, who owned a laundry company. This was in 2019.

Was it a paid job?

Oh yes. The guy paid me ₦20k/month, and we worked together for six months. His business slowed during the 2020 pandemic because his clients had nowhere to go and didn’t wear as many clothes. So, he had to let me go.

I also got admission to study medical lab science that period, but the combination of COVID and ASUU strike meant I couldn’t resume until the following year. I took advantage of my free time to hone my skills. I built a brand online as a social media manager and digital marketer, learnt graphic design and became a stronger content writer.

In September 2020, I got my next gig as an engagement specialist with a digital marketer in the UK. He created most of the content, and my job was basically to engage his social media community and respond to comments and enquiries. The pay was £4/hour, and it was my first big break. I worked at least two hours a day, and my pay at the end of the month was usually ₦250k.

Not bad

It wasn’t bad at all. I worked with him on and off until January 2023 — sometimes, we worked together for three consecutive months and stopped when he didn’t have money. Then, we’d resume a month or two later. Towards the end of 2022, he introduced me to two of his friends, and I had a two-month stint working with them at the same £4/hour rate.

My income comes in very handy for school. I think my dad only paid my first-year school fees. I paid my ₦180k/year accommodation myself and didn’t bother calling home for allowances because I knew their financial situation depended on when my dad got a major printing job. I even started sending money home to help with emergencies or if my mum needed extra money to cook for the weekend.

But how are you managing school and the multiple gigs?

A lot of scheduling and sacrificing my free time, but I just have to manage. When I stopped working with the UK guy, I briefly worked with someone who needed help with the content strategy for two brands for a non-profit she wanted to start.

We agreed on ₦45k/month for a three-month contract, and I persuaded her to pay me for all three months at once; I had to move to the uni’s medical campus that year and needed money. While working with her, I took on another three-month digital marketing gig that paid $250/month — approximately ₦300k after conversion.

By the time the three months elapsed, I had about ₦800k saved from my different gigs. So, I decided to stop taking on gigs to focus on school for a while. The coursework was a lot that semester, and I needed to study. I survived on my savings for the next six months and only took another job in October 2023.

What job, and how did you get it?

Social media management. I got it via referral from a friend, and payment was per task completed. For instance, I got $50 to set up an ads account for TikTok and Instagram. The arrangement lasted three months, and I made a total of $200.

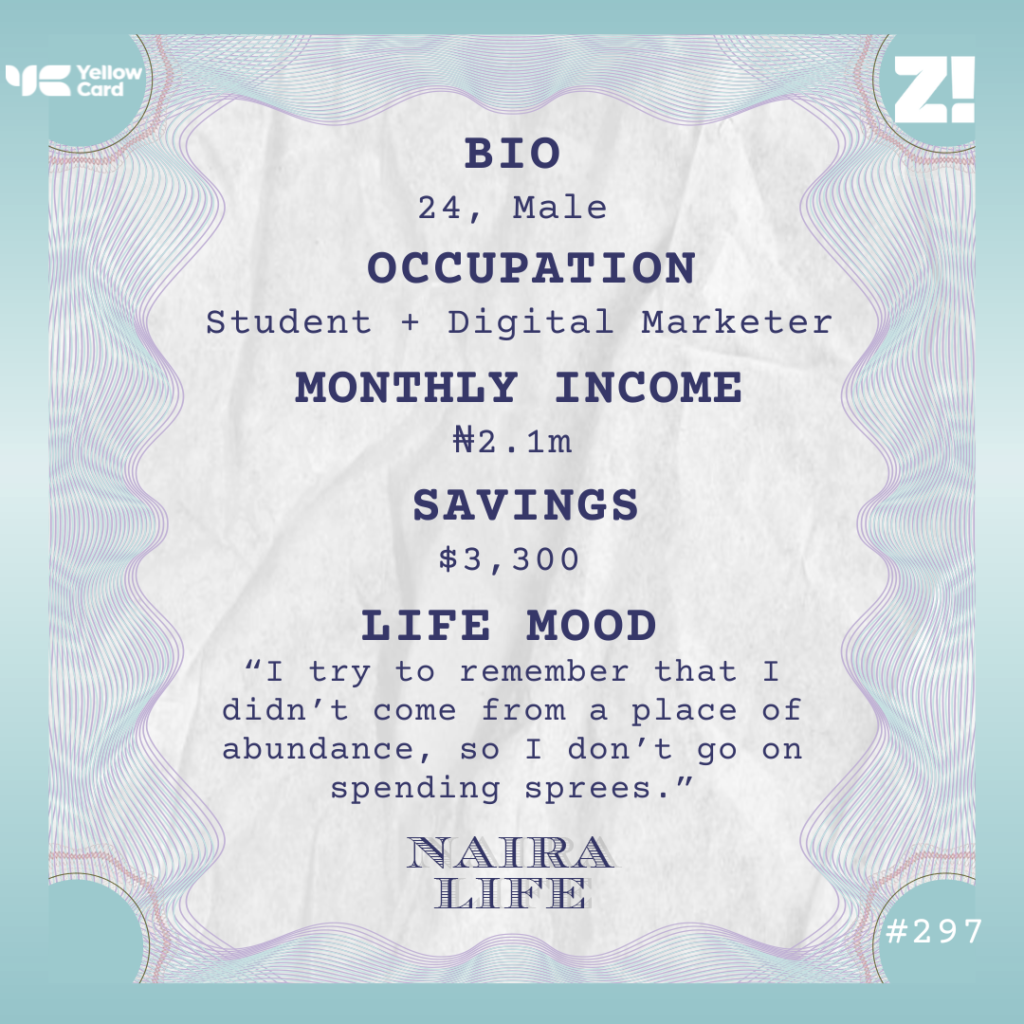

After that, I took another brief break for school before I got my current job on Upwork in July 2024. I work with an editing firm as a book editor. My pay structure was initially an hourly arrangement of $7/hour, which came up to about $1,120 in a month. But I got confirmed after my first month and now earn approximately $1250/month, including bonuses. That’s around ₦2.1m after conversion.

That’s wildly impressive. And you’re still in school?

Yup. I’m currently in 400 level. It’s been very interesting managing school and work. Sometimes, I skip classes. Sometimes, I juggle work and exams. So far, my work hasn’t adversely affected my academic performance.

Two months ago, I employed someone and delegated some of my work to him. We agreed on $25 per book edited, but he’s not a professional yet, and his work rate was really slow. My workplace gives me a week to edit each book, and it just wasn’t working out with him. We worked together on three books before we had to part ways.

I think I’ve pretty much worked out a reliable schedule for work and school. For instance, I know I won’t always have time to cook, so I just accept that I’ll need to order food most of the time.

You’ve had impressive income growth over the years. How does this impact your perspective on money?

I consciously try to remember that I didn’t come from a place of abundance, so I don’t go on spending sprees. Even though I have enough to afford almost anything I want now, I don’t see the need to spend on luxuries or things that won’t impact my life.

I appreciate that I have more financial freedom, but I feel it’s just an opportunity to save more and provide financial leeway for my family. Without worrying, I can now afford to spend ₦100k on my parents’ medical bills or send ₦150k for food. In addition to the money gifts, my family can also come to me for loans, and I’m happy to help out.

You mentioned saving. How does that work?

I live very much below my means and save far more than I spend. I don’t send money to my family every time, so I’m constantly saving. I have about $3,300 in savings now, and I save in dollars to protect my money from inflation and the falling naira.

I’m also considering investments, but I’m being careful about that. I once lost over $500 in 2021 trading crypto. I did both futures and spot trading then, but I was new to it and lost that money because I didn’t properly weigh the risks. I plan to return to crypto one day since I have the experience now. About 53% of my savings are actually in a crypto wallet.

But before that time, I might consider getting a financial advisor or expert to help me select the best investment options to diversify my funds. I have money right now, but I know anything can happen in the future, and I need a healthy safety net that I can fall back on. So, I definitely need to pay attention to how I handle my finances.

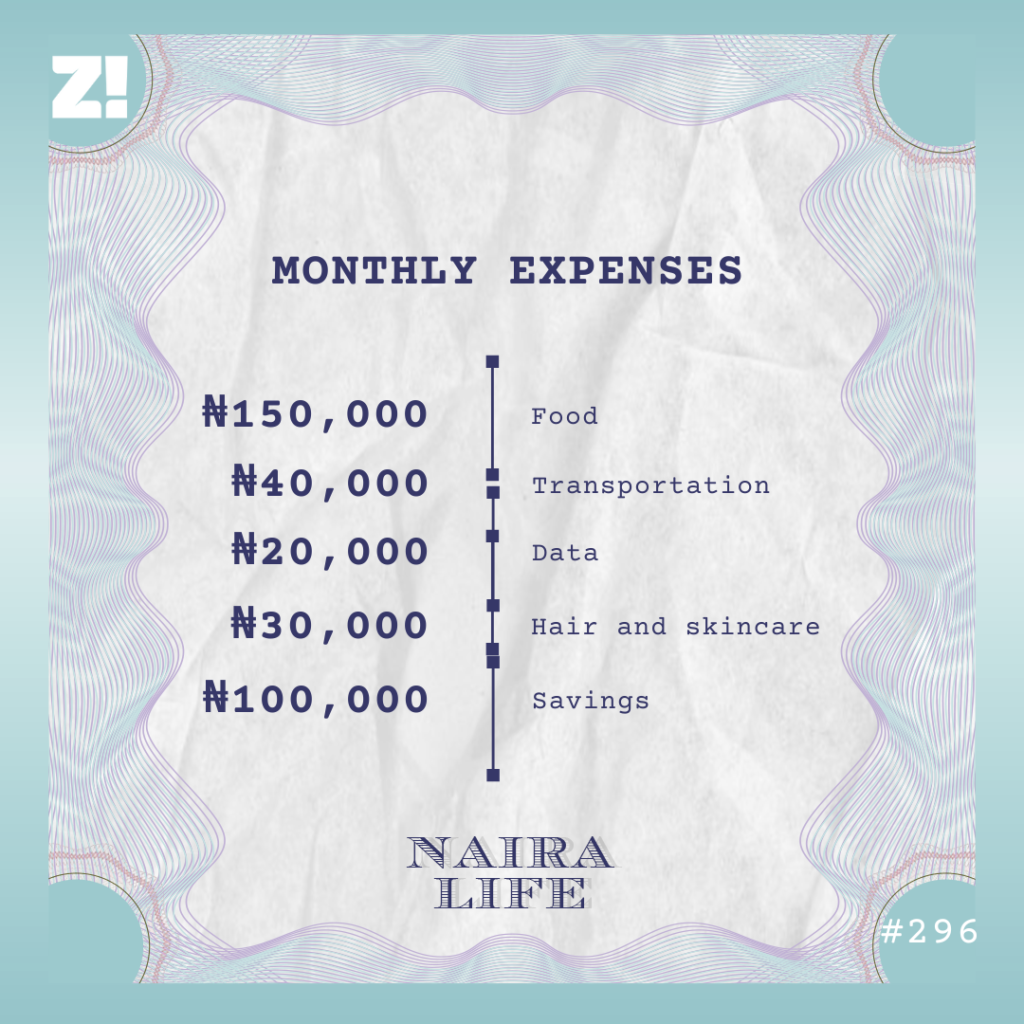

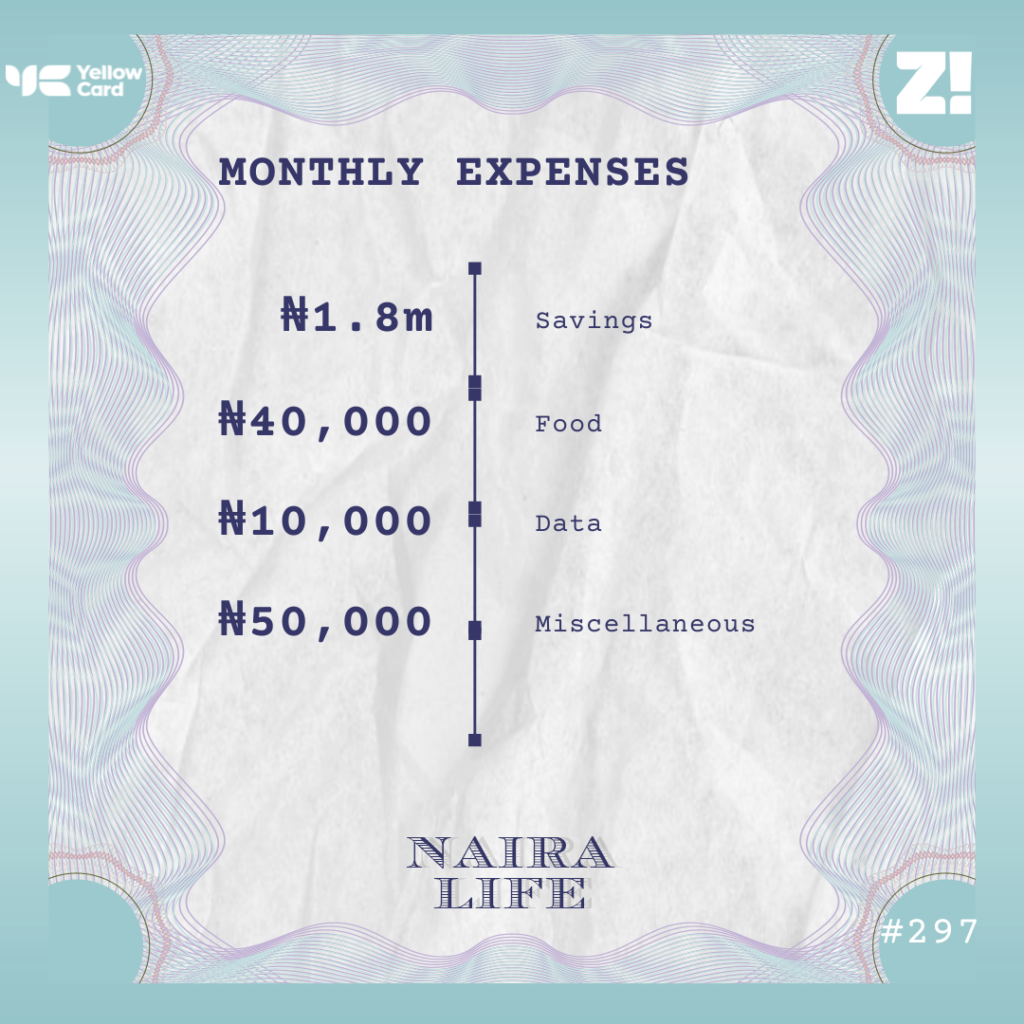

Speaking of, let’s break down how much you typically spend in a month

I pay a yearly rent of ₦100k. That’s not a monthly expense, but I feel like I should mention it.

I’m curious. Have you thought about future plans after school?

I honestly think crypto trading and social media sales offer the highest earning potential and will continue to pay the highest in the next 10 years. If I can hone my trading skills and continue leveraging what I know about social media ads and marketing strategies, I can earn a lot. My short-term goal is to earn $5k/month by 2025 or 2026. Long term, I hope to earn $10k/month.

There’s still the question of what I’ll do with my medical lab certificate, but I like that it gives me another option if the others don’t work. I may even consider opening a medical laboratory strictly for business purposes. Whatever the case, I intend to keep saving so I have enough of a safety net for whatever dream I want to pursue.

How much do you consider a good safety net?

Maybe $15k, and it’d be fantastic if I could save that by the end of next year. With a safety net like that, I wouldn’t feel too pressured if I didn’t start earning immediately after I left school, and it’d give me room to pursue whatever dream comes to mind.

What’s one thing you want but can’t afford?

Nothing.

You know what? I rate it. How would you rate your financial happiness on a scale of 1-10?

9. I’d like more financial freedom so I can take more risks. I think I’ll get there in time, especially with my current income and attitude to savings.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Get more stories like this and the inside gist on all the fun things that happen at Zikoko straight to your inbox when you subscribe to the Zikoko Daily newsletter. Do it now!

[ad]