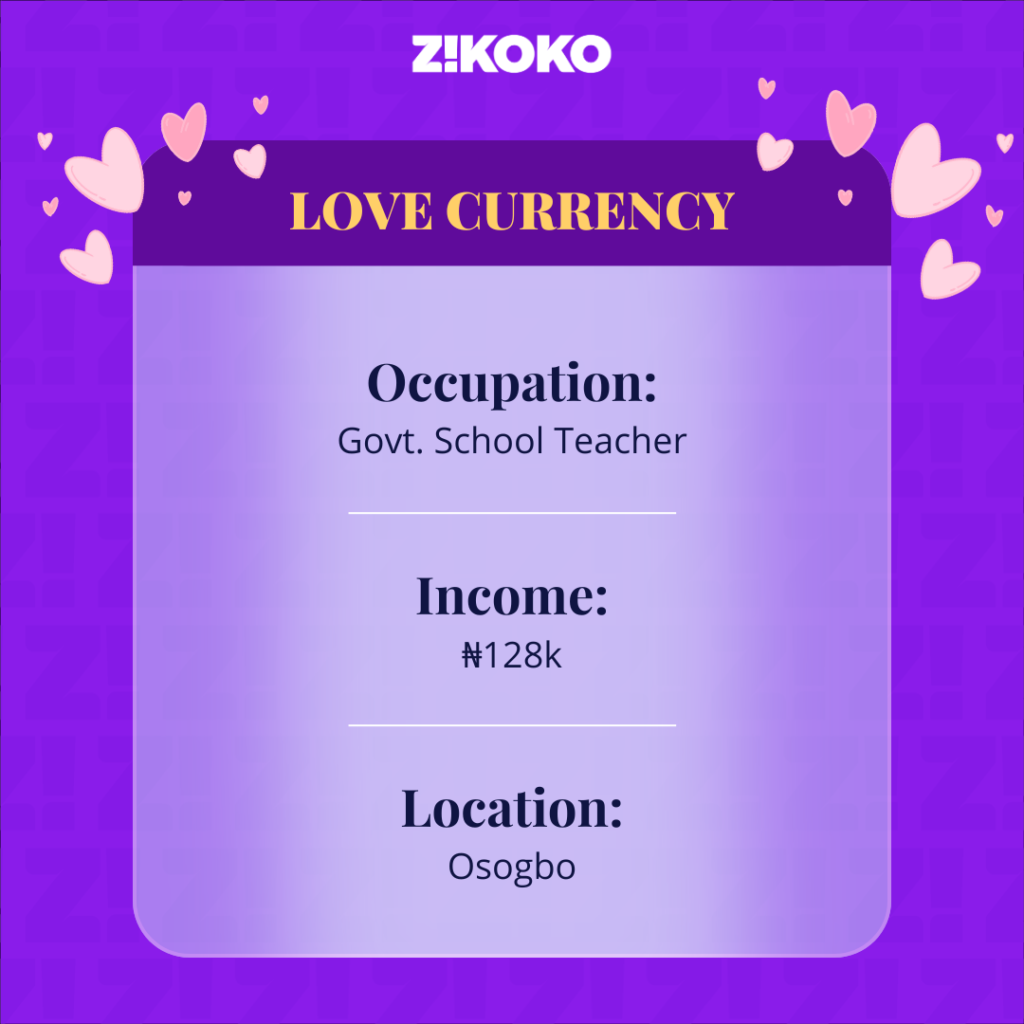

The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

How long have you been with your partner?

I’ve been married for 8 years, but Flora and I dated for two years before we got married. That’s 10 years altogether.

How did you and Flora meet?

We met at the university in 2015. I was a final-year student, and Flora just got in through direct entry. We weren’t in the same department, but I noticed she attended the same all-night class with me. I thought she was pretty, so I drew close and became friends.

After we became friends, she revealed the real reason she attended the all-night classes: she had no accommodation. I offered to let her squat with me and my roommate, and she agreed. A few weeks into the arrangement, feelings entered, and we started dating.

My roommate moved out when we graduated later that year, and Flora and I continued living together.

What was cohabiting like so early in the relationship?

It was quite smooth. I’m the eldest child and have six sisters, so I understand how to live with women and manage their small wahala. Flora doesn’t even have wahala like that. She’s always been an understanding woman.

She knew I didn’t have money, and we were happy with whatever I gave her to cook. When I had money to take her out, we went out — mostly to Chicken Republic, the beach or the cinema. When I didn’t have money, we stayed home and looked at each other.

Were the “no money” situations regular?

In the beginning, yes. Flora didn’t earn anything; the expenses were on me. As a student, I made money by running errands for an older family friend. He worked with the federal government, and I wanted to get a government job through his connections, so I hung around his office.

I survived on the random ₦5k or ₦10k he gave me for errands, which included taking his car to the mechanic, sorting out hotel rooms for his girlfriends or driving them around at midnight. My hard work eventually paid off because I can trace my career path to the man’s help.

He connected me to the company where I did my NYSC, and I’ve worked with them since 2015. The job also contributed to us getting married in 2017.

How so?

Flora got pregnant, and her parents said their family members couldn’t have children out of wedlock. They wanted us to marry before she gave birth. If I didn’t have a job, I’d have pushed back because how would I even care for a family?

But I was earning ₦55k/month, and I figured we’d make it work. So, we had a small traditional wedding. Our families also supported us, and after the wedding, we had enough to move out of my one-room student hostel into a ₦100k/year room and parlour apartment.

Flora was rounding up her final year, so I paid ₦60k for her to learn hairdressing to make money and support our home. There was no point looking for a job because it’d be difficult to juggle it with a child when she gave birth. My job often took me out of town, so she needed a flexible job.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

Did you both discuss how you’d split the home’s expenses?

We did, but it wasn’t much of a split. She made small money here and there from braiding, which was enough to handle some personal needs like toiletries. I handled rent and feeding.

We’ve maintained the same arrangement over the years. However, our dynamic changed slightly in 2023 when my company transferred me to Edo state. Flora stayed back in Asaba, so travel costs have joined our expenses. We travel to see each other at least twice a month.

Flora now has a hair salon, so she pays for food and her transportation when she visits. I send money for school fees and pay the ₦400k rent for our apartment in Asaba.

Out of curiosity, is travelling back and forth cheaper than living together in the same city?

It’s not. The thing is, my two youngest sisters live with me in Edo. In 2023, we lost our family house to some family issues, and since my company provided accommodation, I told my sisters to join me. The plan was for Flora to rent out her salon in a few months and move to join me, but when she heard my sisters had moved in, she refused to come.

Why?

She said she didn’t want to live with her in-laws. If there’s one thing Flora and I hardly agree on, it’s my sisters. Since I started earning a bit more money, I’ve been financially supporting my sisters, and Flora doesn’t like it. She can’t stop me, but she murmurs.

I’ve tried to explain that I can’t watch my sisters suffer without helping them, but I don’t think she understands. She says I shouldn’t always respond to their billing. Whichever way, it’s my money, and no one can dictate what I do with it. But I’m deliberately not pushing on this living-apart issue.

I understand my wife’s concerns about living with her in-laws, and I know it won’t be fair to force her to agree. But I can’t send my sisters packing or afford to rent an apartment for them. They’re almost done with uni, so I know they’ll leave sooner or later.

Right

Also, I’m not paying for my apartment here, so we’re not incurring double expenses. I don’t give Flora food money because I’ve told her I can’t pay for food here and in Asaba. She can come here if she knows she can’t handle the bills alone. At least I pay school fees and rent.

I’m considering not paying this year’s rent because it’s a waste of money. Maybe I’ve been too understanding. It’s already been almost two years since we started living apart. I need to put my foot down and stop this child’s play we’re doing.

Hm. I hope that chat goes well. Speaking of, what kind of money conversations do you both have?

They’re mostly about what our two children need or things to fix in the house. Sometimes, when her business isn’t good, we discuss it, and I support her financially. But that doesn’t happen all the time.

Flora knows how to manage, so money is not a big issue. She can even settle bills around the house without asking me. The only comma is when she complains about me giving my sisters money. But I think she’s learning to keep her concerns to herself.

How do you both plan for romance while living apart?

We don’t do that much anymore because of the distance, work, and the children. Sometimes, when the children are on holiday, we visit malls or playgrounds. I can’t remember the last time Flora and I went out alone. But sometimes, she calls and tells me she’s craving one kind of food, and I send her money if I have it. That’s usually around ₦10k.

What about gifts for special occasions?

We don’t do gifts. If I ask my wife what she wants for her birthday, she’ll say money, so I don’t bother to ask. I’ll just send her ₦15k or ₦20k or buy her data on her birthday or maybe Valentine’s Day. She does the same for me.

Do you both have safety nets?

She’s a woman, so I know she’ll have savings. Women are always keeping money for one thing or another. Plus, my wife isn’t the spending type. She can manage for Africa, so I’m sure she has backup savings somewhere.

I have so many responsibilities that there is no space for savings. I’m always broke by the middle of the month. Most times, loans from friends and loan apps take me through the month. I also gamble sometimes, and I make extra money here and there.

Also, I do small procurement runs under the table at work, which gives me around ₦150k extra monthly. I know I make money, but responsibilities carry everything.

What’s your ideal financial future as a couple?

We’d like to relocate. Another reason I want her to move in with me is so she can take advantage of my sisters’ presence to go to nursing school. At least they can watch the children while she focuses on school. Then we can work on her finding a nursing job abroad so we can all japa together.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: The Second Wife Who’s Pursuing Financial Independence on a ₦280k/Month Income

[ad]