Investing sounds simple: put your money somewhere and watch it grow. But if you’re a Muslim, it’s not that straightforward.

Many investment options in Nigeria aren’t always halal-compliant. But it doesn’t mean you can’t invest; there are ethical and profitable ways to grow your money without compromising your faith.

We spoke to an Islamic Finance professional and two Nigerian Muslims who are actively into Halal investments. Here’s a breakdown of what they told us about navigating Halal investments in Nigeria.

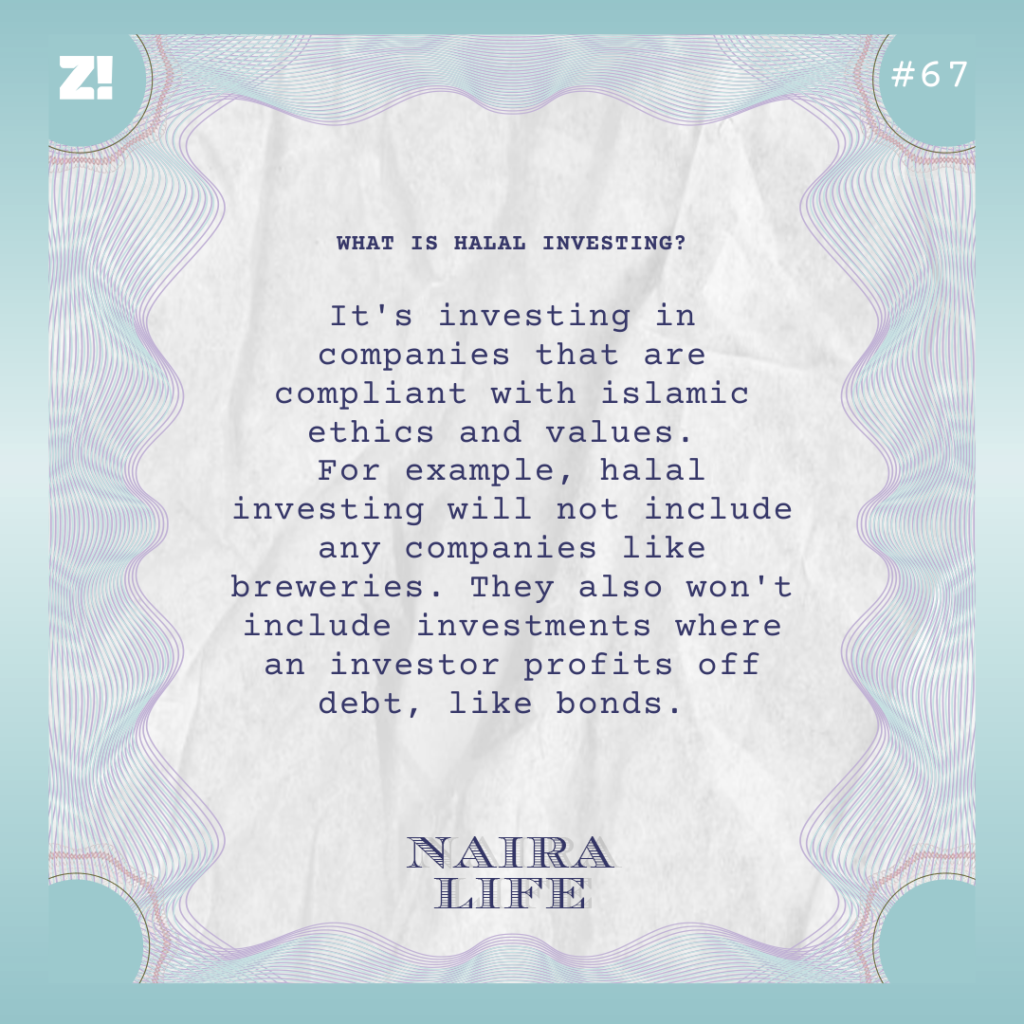

What is Halal Investing?

With conventional investments, you deposit money in a bank, earn interest, and move on. You don’t ask if they’re using your money to fund breweries, adult entertainment or pork businesses. You just collect your returns.

But Halal investments don’t work that way. They’re built on moral ethics, social responsibility and transparency. When you invest through Islamic banks, you know exactly where your money is going. Your funds are invested in actual businesses, and the profit is shared fairly. And if the business fails to make profits, the depositor takes the loss, just like in a real business.

In Halal investing, money cannot generate profit on its own or be used as a lending tool to earn interest. Instead, it must be invested ethically in businesses or assets that generate profit through permissible means.

In Nigeria, regulators like the Securities and Exchange Commission (SEC), the advisory committee of experts, and the Central Bank of Nigeria’s Islamic Regulatory Advisory Committee ensure that non-interest banks operate within Islamic finance principles.

What makes an investment halal?

1. No Interest (Riba) – Money Shouldn’t Make Money by Itself

Interest-based earnings like fixed deposit savings are considered haram. Your money should be actively invested in real businesses to generate profits.

2. No Haram Industries – If You Can’t Eat It or Do It, Don’t Invest in It

Any business involved in alcohol, gambling, adult content, pork or practices Islam considers unethical is off-limits. Your money should only fund enterprises that align with Islamic values.

3. No Excessive Risk or Speculation (Gharar) – No Gambling with Your Money

Investments should be transparent and low-risk. Anything that involves uncertainty and betting on price swings, like forex trading, is considered haram.

Crypto sits in a grey area in halal investing. Some Islamic scholars consider Bitcoin halal because it functions like digital gold—it has real value, operates transparently, and doesn’t involve interest. However, many other cryptocurrencies are deemed haram due to their speculative nature, lack of intrinsic value, and resemblance to scams or Ponzi schemes.

4. Ethical and Social Responsibility – Your Money Should Actually Do Good

Halal investing supports businesses that positively impact society, like healthcare, education, sustainable energy, and ethical banking.

5. Risk and Profit Sharing – Everyone Wins (or Loses) Together

Instead of guaranteed, fixed-interest returns, halal investments operate on profit-sharing models. You make money when the business makes money and share losses if it doesn’t—just like real business partners.

Where Can You Invest The Halal Way?

Islamic Finance professional Oluwafemi Oyelehin breaks down some of the halal investment options available in Nigeria:

1. Real Estate

Real estate is one of the safest and most popular halal investment options because it is tied to tangible assets (physical land and buildings). You can legitimately generate income from renting as long as the property is used for halal purposes. But not all real estate investments are automatically Halal —how you finance or use the property matters.

How to invest in Real Estate:

- Buying property outright: If you can afford to pay the full price at once, this is the simplest way to acquire property. It grants you immediate ownership, but it’s crucial to ensure it’s used for permissible purposes.

- Islamic financing options: Loans that include interest are not permissible. If you need financial assistance, non-interest Islamic banks like Jaiz offer Halal alternatives to traditional mortgages (property loans).

Here’s how they work:

Musharakah (Joint Ownership):

- You and the bank co-own the property and share profits.

- Over time, you gradually buy out their share until the property is 100% yours.

- There is no interest, just shared investments.

Ijarah (Islamic Leasing) – Rent-to-Own, the Halal Way:

- The bank fully owns the property and leases it to you

- You make agreed payments over time until you fully own the property.

- Essentially, you’re paying rent while you use the property, and at the end of the lease, you ultimately gain full ownership.

- There is no interest, no hidden fees, just a structured way to own property over time.

2. Halal Compliant Stocks

Investing in stocks is Halal, but only if you know where your money is going.

Think of it this way: You wouldn’t want your money funding weapons manufacturing or a brewery, right? That’s why not all stocks are Halal. Before investing, you need to double-check what the company does.

How to Invest in Halal Stocks:

- Avoid companies involved in interest-based finance (banks), gambling, alcohol, or unethical industries.

- Islamic bank stocks are a safer option. These operate under Shariah principles, ensuring compliance with Halal investment rules.

- Check where your money goes. Stocks like MTN, Tesla, Google, and Nestlé are generally Halal Investment options because they provide essential goods and services.

- Halal stocks earn through profit-sharing, not interest. Your returns come from business growth and profits, not lending money at fixed interest rates.

- Easier options include the Halal Mutual Fund, such as the FSDH Halal Fund, Lotus Capital Halal Investment Fund and the Cordros fixed income fund. They pool funds from multiple individuals to invest in a diversified portfolio of halal-compliant stocks and other asset-backed halal investments. Instead of researching individual stocks yourself, the fund managers handle the halal screening for you.

At its core, investing in Halal stocks is like providing venture capital for ethical businesses. You’re good to go as long as their operations align with Islamic principles.

3. Commodity Trading

Commodity trading is one of the oldest and simplest ways to grow your money the Halal way. Instead of earning interest, you profit by buying and selling authentic, tangible goods.

Here’s how it works:

- Buy low, sell higher, and profit fairly: For example, buy a stereo for ₦25,000 and sell it for ₦30,000. Both you and the buyer benefit.

- Trade real, valuable assets: Invest in oil, wheat, or agricultural products, as long as they’re ethically sourced.

- Bank-backed trading: You invest in a car purchase, the buyer pays over time, and you share a pre-agreed profit with the bank.

There is no interest, no hidden fees, just transparent, ethical transactions.

4. Gold

Gold is a real, tangible asset, making it 100% Halal if bought and traded correctly. Unlike regular currencies that can be devalued by inflation, gold holds its intrinsic value and has been used as a store of wealth for centuries.

5. Islamic Insurance (Takaful)

Traditional insurance can be problematic in Islam because it often involves interest, uncertainty, and gambling (Maisir). That’s where Takaful comes in: a fair, ethical, and Halal alternative.

How Takaful Works:

- Community-based protection: Members pool their money into a shared fund to support anyone who experiences a loss (medical bills, car damage, or life insurance payouts).

- No Interest or gambling: Unlike conventional insurance, Takaful avoids unethical investments and speculative risks.

- Fair and transparent: If nothing happens to you, your money isn’t lost; it stays in the fund or is distributed fairly among members.

- It covers everything: Health, life, car, and business insurance—all in a Halal way.

Islamic insurance companies like Noor Takaful offer this ethical insurance option in Nigeria. It’s a win-win: financial protection without compromising your faith.

6. Islamic Bonds Sukuk

Traditional bonds like the Federal Government of Nigeria (FGN Bonds) are considered Haram because they pay an interest rate; you lend the government money and earn fixed returns.

How Sukuk Works:

- No Interest, just profit-sharing: Investors own a share of an actual project and profit from its success.

- Full transparency: You know exactly where your money is going, whether it’s funding roads, hospitals, or schools.

- Backed by tangible assets: Unlike regular bonds, Sukuk investments are tied to real projects, making them safer and more ethical.

- Ever seen a green signboard with “Sukuk Funded Section” or “Sukuk III, IV or V” on Nigerian roads? If you’re in Lagos, there’s one in Victoria Island and Marina. These roads were built with Sukuk funds, and investors received returns from their use.

Sukuk can be issued by Corporate entities such as Family Homes Funds Limited, Family Homes Sukuk Issuance Program Plc, Taj Bank, etc. Federal and state governments, as well as multilateral agencies, can also issue Sukuk, but only with approval from the Securities and Exchange Commission (SEC) of Nigeria.

7. Profit Sharing Savings Account

Unlike regular savings accounts that earn interest (Riba), a Mudarabah (profit-sharing) savings account helps you grow your money the Halal way.

How It Works:

- You deposit money, and the bank invests it in Halal businesses like real estate and ethical industries.

- Profits are shared between you and the bank based on an agreed ratio.

- No fixed returns: if the business invested in makes a loss, the depositor bears it.

In Nigeria, options include Jaiz Bank’s Mudarabah Savings Account and Taj Bank’s Profit-Sharing Investment Account. It’s a transparent, ethical, and Shariah-compliant way to grow your savings without interest.

Two Muslim Nigerians Share Their Halal Investment Journey

Amina* (31, Medical Doctor)

I started thinking about investing when I earned my first income during my medical internship in 2019. At first, I considered treasury bills, but a Muslim colleague told me they weren’t Halal. I kept saving my money since I knew no other halal investment options and couldn’t afford real estate.

By 2021, I gave my savings to a friend trading crypto and got decent returns, but I wasn’t sure if it was Halal. Later, in early 2022, another friend recommended Risevest. They had different investment options, but my Muslim friend advised me to stick with their real estate plan.

I invest naira every month, which they convert to dollars. Once my plan matures, I can withdraw with returns. This is considered Halal because my funds are pooled and used to purchase a property in the U.S., which is then rented out and managed by experts to generate rental returns for me. It’s a medium-risk investment, and I earn between 12% and 15% returns annually.

Ahmed* (32, Business owner)

I started a Halal investment group five years ago when I realised many Muslims like me wanted to grow their money the right way. Today, we’re a community of 70 investors pooling funds into ethical stocks, tech startups, and agricultural commodities (Halal mutual fund), with an investment portfolio now worth $200,000.

If I can’t easily confirm that a company’s operations are Halal, I simply don’t invest.

Bottom Line

Halal investments are about building wealth correctly while staying true to your faith. Whether you’re investing in real estate, Islamic bonds, gold, or halal-compliant stocks, the goal is ethical growth, zero interest, and financial security.

The best part? You can have both; you don’t have to compromise between faith and financial success. So before your next investment, ask yourself: “Is my money working for me in a halal way?” If the answer is yes, you’re already winning.

NEXT READ: I Retired at 53 With Over ₦1 Billion in Assets — Here’s How I Did It

[ad]