Khalid, 26, quit his job to chase the startup dream. His fintech scaled fast, raised hundreds of thousands of dollars, and served thousands of Nigerian businesses looking for easier payment options. It looked like he had cracked the code, but when the cracks began to show up, the very system he was trying to disrupt swallowed his company. What could have been a success story turned into a brutal lesson in how unforgiving the startup game can be.

As told to Aisha Bello

I remember the day Stripe announced its acquisition of Paystack in October 2020. I was hunched over a desk in Abuja, scrolling through my feed like everybody else.

The Fintech had just been bought for $200 million.

That figure glowed back at me, and my chest tightened.

At the time, I was earning ₦120k as a contract engineer at a smaller fintech, with only a Facebook Messenger bot I’d built to my name. About thirty people, mostly friends, used it to buy airtime or data.

But in that moment, I couldn’t stop thinking: If Paystack could make it, why can’t I?

The next morning, I typed my resignation letter, handed it in and walked away.

I was barely 21.

Early Ambitions & First Pivot

In 2016, I thought I’d be an electrical engineer. A few years later, I entered a polytechnic to study computer engineering, but I felt disconnected from the courses. I was restless, and by 2019, I dropped out.

My real education happened in a café where I worked as an operator and was paid ₦15k. With constant internet access, I taught myself HTML and CSS and contributed to open-source projects. By early 2020, the effort paid off, and I landed a ₦120k contract role through a partner company with Paga Technologies. It was my first real step into software engineering.

Then October 2020 happened. Stripe acquired Paystack for $200 million.

Something in me shifted that day, fueling a restless urge to build. After serving out my three weeks’ notice, I left the job and went all in on my little Messenger bot. I didn’t overthink it. All I knew was that I wanted to build something of my own.

Also Read: I’m a Nigerian Tech Startup Founder Who Survived a Kidnapping and Hustled My Way to America

From Bot to Startup

After staying up late for months, iterating and tweaking features, I converted the bot into a web app called Gistabyte.

Then I got the first win. In early 2021, I stumbled on an ad for Union Bank’s accelerator programme on Facebook. Out of curiosity, I applied. Out of hundreds of applications, my startup got in.

This was my first taste of validation.

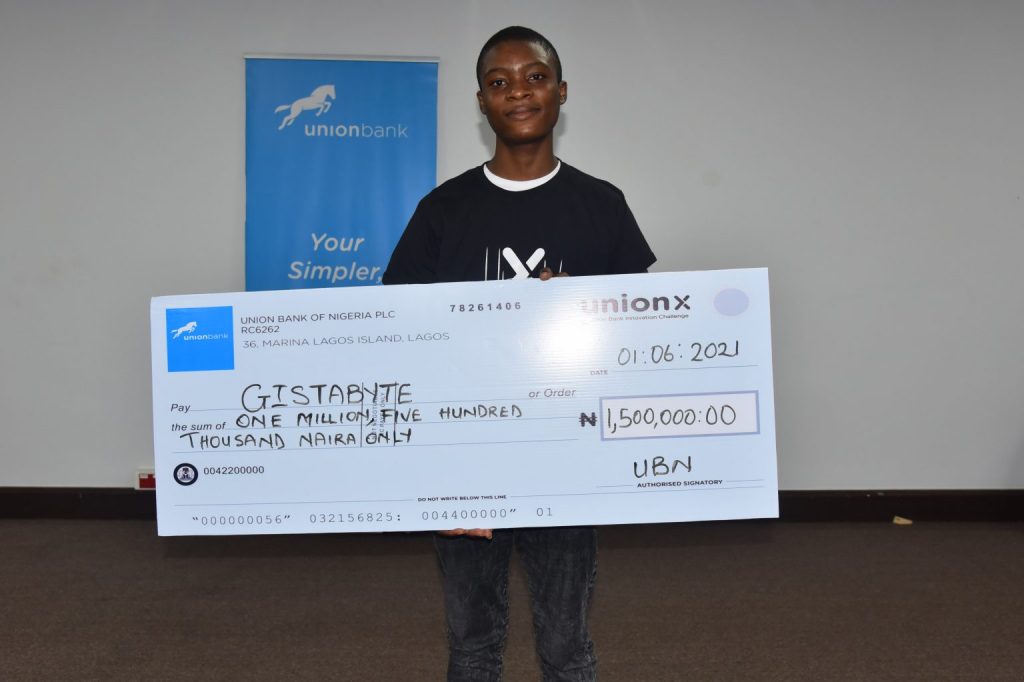

Around the same time, a mutual friend introduced me to someone who eventually became my co-founder. He’d seen what I was building and believed in it enough to join forces. By the end of the accelerator, Gistabyte, our scrappy little product, won ₦1.5 million in funding.

That money was everything.

Before then, I was running on fumes: vibes, my mum’s support, and stubborn faith. But with the grant, we could finally hire people, keep the lights on, and think beyond survival. It gave us hope and the courage to take the startup to the next level, and imagine it as more than a side project — the seed of what would eventually become Byte.

The Big Breakthrough

With that small financial cushion, I could travel to pitch and network. Many investors said no, and honestly, half the time we didn’t fully know what we were doing. However, one of our employees’ brothers believed in us enough to invest $10,000. A founder-friend added $5,000; later, an accelerator invested $50,000. Bit by bit, we raised around $300,000 by 2023. This runway helped us stay alive and scale.

The product itself went through several iterations. We started out as an airtime app. Then we tried to replicate everything Abeg (now Pocket) was doing — free and peer-to-peer transfers using just an email, phone number, and password, along with other features that had proven successful.

We made all transactions free and generated profit through airtime sales. We grew to about 5,000 users in no time, but the model proved unsustainable. On a good month, we made ₦1.5 million, but spent nearly ₦3 million just to stay afloat. We were growing, but bleeding cash.

The turning point happened in 2023, when we pivoted to business banking. I realised how difficult it was for Nigerian entrepreneurs to open business accounts or collect payments, especially without CAC registration. Traditional banks made the process hell with endless documentation, references, and delays. But we figured out a faster way: by integrating with partner banks, we could open a business account in five minutes, not two days.

This pivot changed everything. Byte grew to over 20 employees, serving more than 20,000 businesses. Beyond accounts, we rolled out POS terminals, tools to help businesses scale, and access to loans. For the first time, we were building something that could last.

Most of our clients were Nigerian businesses transacting in naira, but because Byte was a Delaware-registered company, we reported in dollars for investors. At our peak, the platform handled transaction volumes worth millions of dollars monthly, while actual revenue hovered around $10k.

The Collapse

The model didn’t survive. Everything started to unravel in the last quarter of 2024.

On the surface, demand was strong; clients wanted what we had built. But scale came with compliance challenges and fraud. We were growing fast, burning through money, and attracting bad actors.

Some misrepresented themselves as legitimate businesses and used our platform to defraud others. For example, a fraudster might set up a fake company profile, process large transactions to appear credible, and then disappear with the customer’s funds. Others went further, registering with us using counterfeit documents and polished websites that appeared entirely legitimate, only to exploit our system for fake trades or payments that never reached consumers.

Whichever form it took, the fallout was the same: the responsibility and the financial hit came back to us. It became a crushing burden for a young company still trying to grow.

Fraud mitigation and compliance became our Achilles’ heel. And once it caught up with us, it was too late. By late 2024, we had no choice but to shut down the company’s operations.

All we could do was help the team we’d built find opportunities elsewhere, while I tried to figure out what came next.

I stepped back and went into a state of hibernation.

Nothing could mask how tough that season was. I’d poured everything into the startup, and when it collapsed, I was back at zero. As a founder, you mostly don’t have a salary to fall back on; your bet is the company itself.

The Bounce Back

After the shutdown, I needed space to breathe and search for clarity. I wasn’t sure what came next, so I leaned on my network. Friends who knew my skills in building technology pulled me into small consulting gigs. One opportunity led to another, and within a few months, I was already consulting for several tech companies.

I can’t put an exact figure on it, but my monthly income from consulting has ranged between ₦1.5m and ₦3m over time. I’m not yet where I want to be, but the progress is clear.

From that period of consulting emerged a new idea. If I were to build again, I wouldn’t want to repeat old mistakes or put all my eggs in one basket. So, in August, I started a lab with some friends. It’s a service-led agency on the surface, helping founders with technology and product development. But underneath, the real goal is experimentation. We build and test different product ideas together as a team. Not all of them will succeed, but it only takes one winner to cover the rest.

For now, the agency funds the lab. However, in the next year or two, we expect some of these products to gain traction. My vision is that we’ll grow into one of the biggest product labs, known for consistently creating solutions that scale.

To me, success won’t just be measured in money. Finance will come naturally if the product is strong. What will truly make me feel accomplished is seeing something we built reach millions, maybe even hundreds of millions of people. That kind of impact is what drives me.

If there’s one lesson I’ve taken from this journey, it’s the importance of pausing. It’s easy to get caught up in competing with others, trying to build just to outpace someone else. But sometimes, the best move is to stop, reflect, and reset. Taking a pause gave me clarity, and it’s a discipline I carry with me into every new chapter.