Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

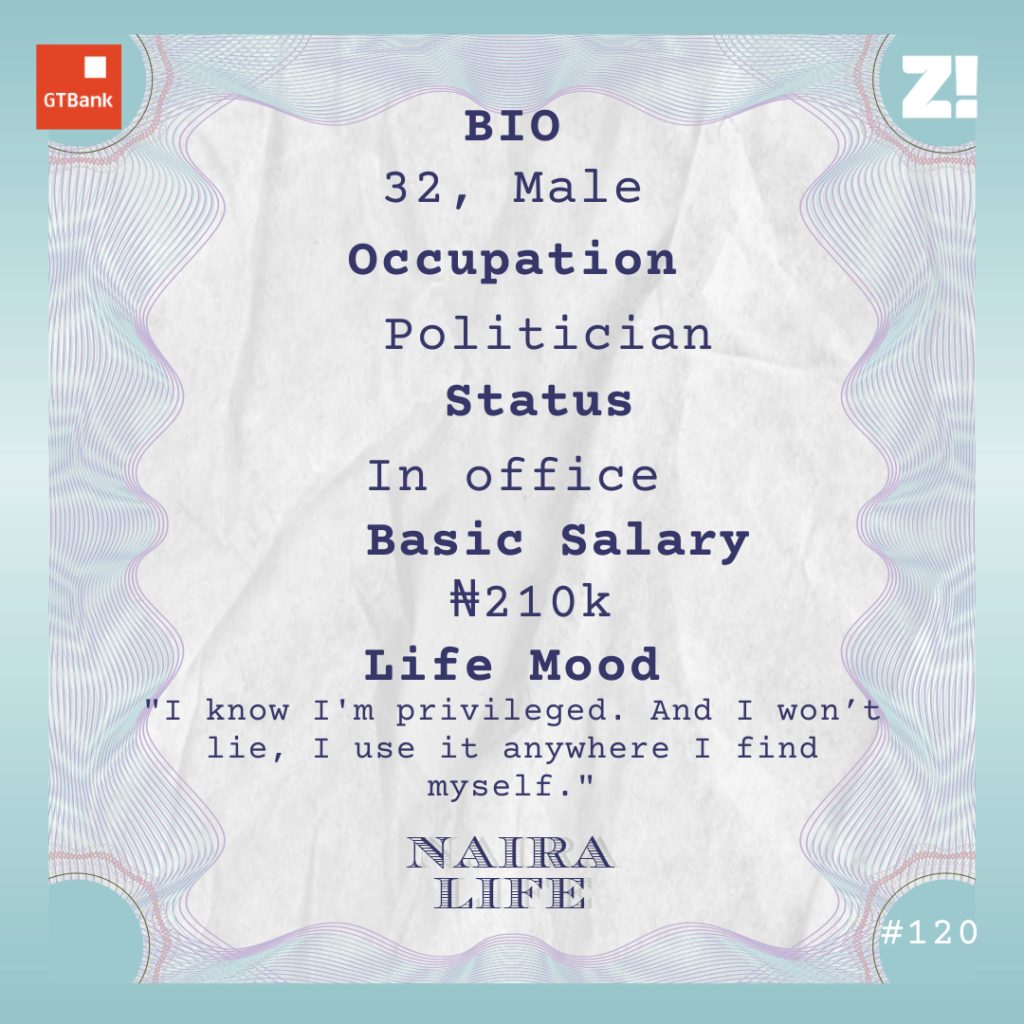

The 32-year-old politician in this story ran for office in 2018 after years of being a businessman. Now he’s the vice chairman of his local government. He shares details of how his monthly allowance is barely enough to cater for his needs and how his privilege and network is keeping him afloat.

Let’s take back a little. What’s your oldest memory of money?

In 1992, during sallah, my uncles gave me money. I was four, but I remember that I made close to N2500.

What could ₦2500 do for a four-year-old kid in 1992?

I loved Coca-Cola and the 25cl bottle was sold for ₦2. There was this balloon game I played a lot too — where you attempt to win the biggest balloon — and a round was ₦1.

₦2500 was a lot of money and it would have gotten me a long way. Of course, my mum took all of it.

Speaking of parents, what did yours do for money?

My mother was a full housewife. My father was the quintessential Nigerian businessman. He did everything and took advantage of government policies at different times. He started as a tailor, then he sold textile materials. He made some money at a young age and that gave him the opportunity to mingle and build relationships with the aristocratic kids. They helped him later in life. People might call it nepotism, and I agree, but it worked because he was only trying to be enterprising and turn a profit. He acquired a controlling stake in a construction company much later, and that became his main gig.

I grew up with money and privilege. I understood what privilege meant very early on. It was a polygamous home though — my father had 15 kids, so there was a bit of competition too. The privilege didn’t mean I wasn’t humbled a few times.

What do you mean?

Living in a polygamous family meant everyone had their favourites. I wasn’t our driver’s favourite. He left me at school once or twice when I was in primary two, and I had to trek home. He claimed he didn’t notice that I wasn’t in the car which was bullshit. But it got me thinking about how privilege shouldn’t be an excuse for naivete. It was a good lesson to learn.

Hmm. When did you start working for money?

2004. I had just finished secondary school and tried going to the Nigerian Defence Academy, but it didn’t work out. Then I decided to go to Finland for uni because they offered free tuition at the time. But the thing is, my father paid for our education, but he would never give you a penny if you wanted to go to school out of Nigeria. I really wanted to go to school abroad, so I was determined to figure it out myself.

While this was going on, I needed a job and I got one in 2005. Our next door neighbor and a friend of the family owned a domestic airline. I approached him and he offered me a job as a ticketing officer. My salary was ₦11k. I worked there for a year before I travelled to England.

England?

Finland didn’t work out either. One of my cousins who was living in England reached out and asked me to consider a diploma course in England. I did the whole process myself and was offered admission to a college affiliated with a major university in the UK. My father was just looking at me like I was a mad man. My mother sold some of her jewelry to pay for my flight. In January 2007, I left and had only $500 in my pockets.

How did you figure things like tuition out?

First, my tuition was £1950 per semester. I negotiated a payment plan with the school and they allowed me to pay £190 a month. I got a job at a warehouse as soon as I settled in and was paid £720 each month. The job paid for my tuition and rent. I sent about £100 home to my mother every month too. Man, every penny had to be calculated to do all of this.

Was that the only job you had in the UK?

No, I got a customer service job after that. It paid better and it wasn’t as stressful. The first customer service job I got paid me £800 per month. After a year, I got a second customer service job and my monthly earnings increased to about £1600. When I stopped working in my final year to focus on my dissertation, I had about £3500 in savings. My father finally realised I was serious and paid my tuition in my last year.

Haha. When did you finish your programme?

July 2010. I returned to Nigeria a day after I wrote my final exam. My parents had divorced a month prior so I wanted to come back as soon as possible. My mother was a housewife when she was with my father and was trying to restart her life, so I had to be there for her.

When I got back to Nigeria, I started importing cars from the UK.

Interesting.

My father had sold cars in the past, so this gave me a head start because I knew a couple of people in his network. I hit them up and told them about cars I think would sell. The numbers made sense and they signed on. We began shipping cars in and making a healthy sum. Man, it was some quick money. Nigerians still had money to spend at the time, so we sold these cars in record time.

Talk to me about the numbers.

A Peugeot 406 car cost £1000. The shipping fee was £700. We spent an additional ₦180k (~£256) to clear a car at the port. After settling all this and changing the driving system to left-hand drive, everything would have run into ₦900k. After that, we would sell the car to a car dealer at a profit of ₦300k. That was it.

I started with one or two cars. But when people started chipping in money, I increased the volume to five cars a month. I don’t suppose cars sell as fast anymore because the pull has greatly reduced. More people are selling cars and less people are buying.

I had the car business on lock but I was also a fashion designer. I would buy yards of materials at the market and make them into outfits. A trip usually cost me about ₦100k-₦200k but I made up to 1000 per cent in profit.

HOW?

I was a big boy designer, so I sold my outfits to high-end users. I did a couple of other things too — bought iphones in Dubai and resold here; bought onions during their on-season and sold them during the off-seasons. Pretty much everything. However, I stopped all of these things in 2018.

Why?

I entered politics. I grew up around politics enthusiasts, so the interest has been there for as long as I can remember. Before my dad passed away in 2012, he was a treasurer and major financier of a political party. Also, one of my adopted brothers ran for political office in the 90s.

In 2018, I came out looking to be elected as the chairman of my local government. My privilege played a role here. I won’t lie, I use it anywhere I find myself.

That’s very honest.

I put in the work too. I wanted to run for a councillorship seat in 2011 but I didn’t get it. I chinned up and continued politicking. In 2015, I was too up in my businesses to run for anything but I was involved in local politics. When the talk of local government elections came up in 2018, I presented myself.

How did it go?

Well, I created my team and started my campaign. But it didn’t work out. Privilege and connections are good, but sometimes, there’s only so much they can do. The powers that be didn’t think I was the most politically-acceptable candidate. And to be honest, I wasn’t.

Why?

I was relatively new to the race. I started my campaign 12 weeks before the primaries and there were people who had begun their campaign two years earlier. I hadn’t done the rounds or built a solid base.

Anyway, the stakeholders held a meeting a few days before the primaries and told me I wasn’t the best candidate the party could present in the polls. However, they told me to run as the vice-chairman. By that time, I had spent about ₦10m on my campaign but I agreed to it.

Omo. Do you remember what that ₦10m went into?

Consultation with stakeholders: ₦5m

Ticket:₦ 650k

Publicity: ₦3m

Team logistics:₦1.5m

I guess your political party won the local government elections.

Yes. I’m currently the vice chairman of my local government.

I have so many questions. But first, how much do you earn as the vice-chairman?

Well, there’s the basic salary and there are allowances, which are mostly the running cost of the statutory committees and projects I manage as the vice chairman. My salary is ₦210k after tax. But when you add up the allowances, it runs into about ₦750k per month.

However, I received the allowances for only eight months after I resumed office.

Ah, why?

The chairman and I fell out. Our working relationship was borne out of a political marriage of convenience. We had different ideas on how things should be and he probably thought I was trying to undermine his authority or trying too hard to be popular.

Uh-oh.

When this happened and our relationship wasn’t as good anymore, the local government council started paying me my basic salary only. And this was a problem because if I wanted to have at least a 50% approval rating in the local government, I needed to spend at least ₦300k for my constituency needs — from mini infrastructure and development projects to other welfare stuff. Before I fell out with the chairman, I had enough money to cater for these needs.

How are you navigating this?

At first, I dipped into my savings. But now, it’s donations. I rely on my family and friends to find the money to fund these projects.

Back to this in a bit. How does money move in a local government?

Most of it comes from the federal government. There is a Federal Allocation Account Committee (FAC) meeting every month, and that’s where Nigeria’s money is shared among the states. At the state level, there is the Joint Account Allocation Committee meeting and that’s where each local government council knows how much is due to them. Typically, my local government gets ₦220m every month.

Unfortunately, we don’t generate a lot of Internally Generated Revenue. So what we get from the federal government is hardly enough. We pay about 1900 teachers, 240 staff at the local government secretariat, 400 healthcare workers at the primary care centre. After everything, we end up with a deficit of about ₦20m. The state government clears that for us.

I’m very concerned about how we’re not tapping into the IGR potential in the local government. That alone could bring us an additional ₦100m every month, but the chairman doesn’t want to see it. That’s one of the reasons we fell out.

Sounds hectic. What about your businesses, anything coming from those?

No. Everything is on hold. The law doesn’t allow me to run a business while in office. And yes, that has affected my lifestyle. I’ve gone from being a top boy to begging for alms from my friends and family. I used to go on vacation at least once a year, but I can’t afford to do that anymore. I’m living a spartan life.

How do you reconcile with that?

Man, I see my job as a service and a privilege. I know it sounds like bullshit coming from a politician, and I understand that. It is what it is. I have gone through life to understand that I love having money but I get most of my satisfaction from looking back at how I’ve made people’s lives better.

Tell me more about this.

Sometimes, it’s the ₦500,000 spent to drill a borehole for a community of 2000 people; to the culvert or drainage system you construct to make a road passable for a community of more than 1000 people. There are also the annual JAMB and WAEC fees for over 200 students to give them a shot at tertiary institutions.

This is the sort of satisfaction I’m talking about. It’s the whole reason I’m in this politics business in the first place. I believe politics is the biggest tool for social change. Also, I know that the privilege I have is a responsibility and I need to give something back to the society in the best way I can.

Interesting. This is a good place to talk about your monthly running costs.

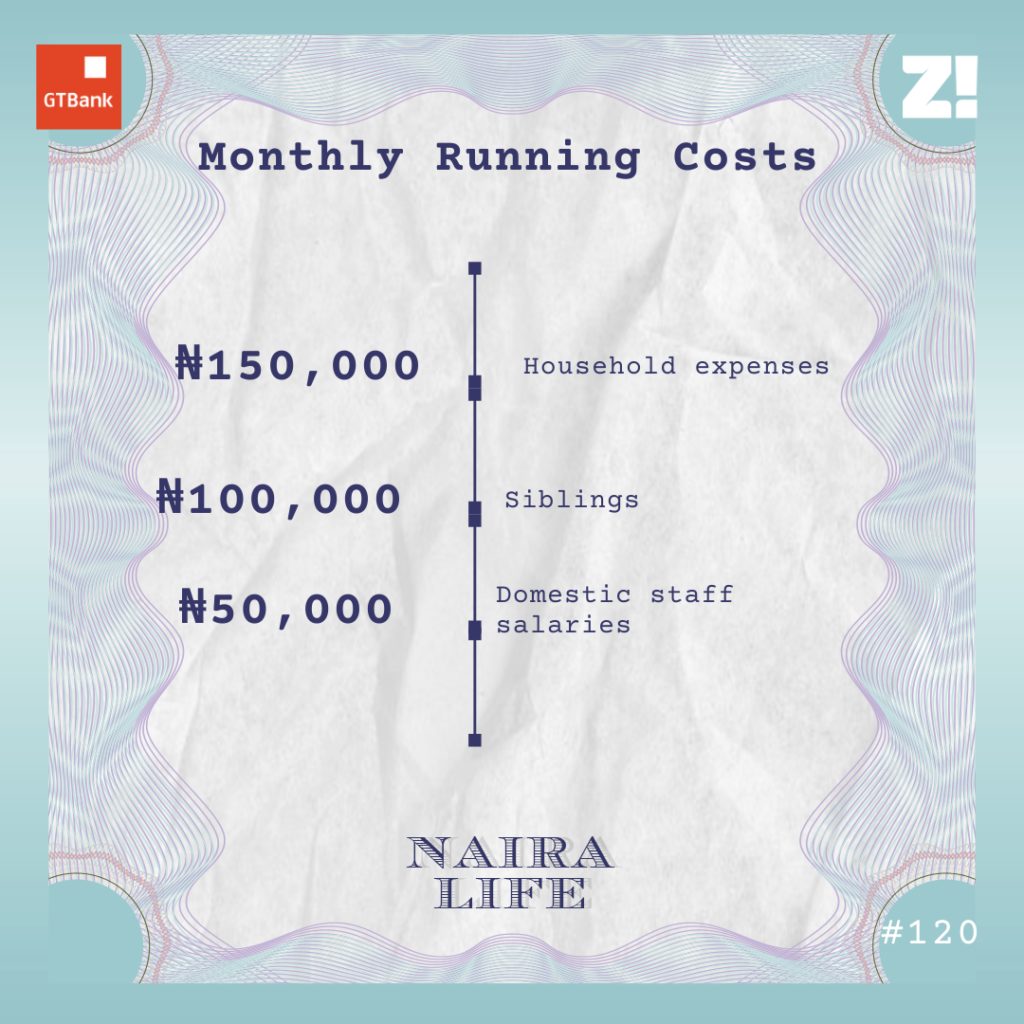

Haha. I spend about ₦300k on my immediate needs and family. My basic household expenses, including feeding, cable subscriptions, and other utilities cost about ₦150k. I support two of my siblings and send them ₦50k each per month. My security guard and my kids’ nanny salaries take another ₦50k.

On the political front, at least ₦300k gets me through each month. I talked about what the money goes into earlier.

Your monthly outflow is about ₦600k but your income is ₦210k, how does that work?

I know people I can always count on, and they’ve not stopped helping. I’m not really the person currently funding my life. Sometimes I don’t even ask, I just get a credit alert.

Mad. So how much do you have in your savings now?

₦70k

Huh?

Since I’ve gotten into office, I haven’t had more than ₦200k in my account for a long period of time. The money that comes in goes out almost as quickly. Also, we just finished the primary elections in my party. I’m vying for the chairman of the local government this time.

That’s going to cost money.

Yes. But I’ll be fine; donations will keep me afloat. I’ve received a significant amount already.

How much?

I wouldn’t want to say disclose that at the moment because it’s an ongoing process. I’ll tell you something though.

I’m listening.

If you want to run a robust citizen-focused campaign for this office, from the primaries up to the general elections, you may have to spend about ₦50m. Politics is a people and numbers game — who you know and how much you can raise through them matters a lot.

Interesting. Where do you see all of this in five years?

I’ve gotten the ticket to represent my party at the polls for the chairman seat. We’ll see what happens after that. I don’t know if I’ll be in a political office in five years, but I’d like to be one of the people that will decide who will govern my state. I’m not an Abuja guy. I just want to be involved in the local politics of my state as much as possible.

Back to your personal finances. If you weren’t in office, how much do you imagine you will be earning per month?

Nothing less than ₦3m. Also, I know I would have started a couple of other businesses. But it is what it is.

What part of your finances do you think you could be better at?

Maybe not letting my emotions dictate how I spend money. I do that a lot, and it’s not helping me. I could see people in trouble and go all out to spend money to fix whatever it is without giving it much thought.

What do you want right now but can’t afford?

I want to go for Hajj. It’s high up on my bucket list but I can’t afford to right now. I would need about ₦2.5m – ₦3m on that. Another thing I could use right now is a bigger house because I have two kids now and my family is growing.

Speaking of family, how does your wife deal with your irregular finances?

My wife is a businesswoman with her own money. She understands where I’m at. Sometimes, she chips in and supports me financially too.

Lit. What’s something you bought recently that improved the quality of your life?

I bought an iPhone 12 Pro Max about three months ago. It cost about ₦700k and the money was even a gift. This is a good place to add that these gifts don’t come from people who have financial dealings in the local government.

Ah, I see. I find it interesting that you live on donations and gifts. How has this shaped your perspective about money?

See, I’ve learned that the greatest source of wealth is from a network. It’s not how much you own personally because things change quickly and that can affect what you can and can’t afford. However, with a network of reasonable and successful people, you can afford everything without actually having the money.

On the other hand, I shudder at the amount of wealth inequality in the country, and it’s a time bomb. But I see more young people becoming more interested in politics and coming into the system. I can be optimistic that this will start to change things.

Fingers crossed on that. How will you rate your financial happiness on a scale of 1-10?

7. I’m very content with what I spend my money on. The problem is I always have to rely on other people to raise most of it. I will probably move to a 10 If I’m on an improved salary.

Last question. How much is a good salary to you right now?

₦800k.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld