Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

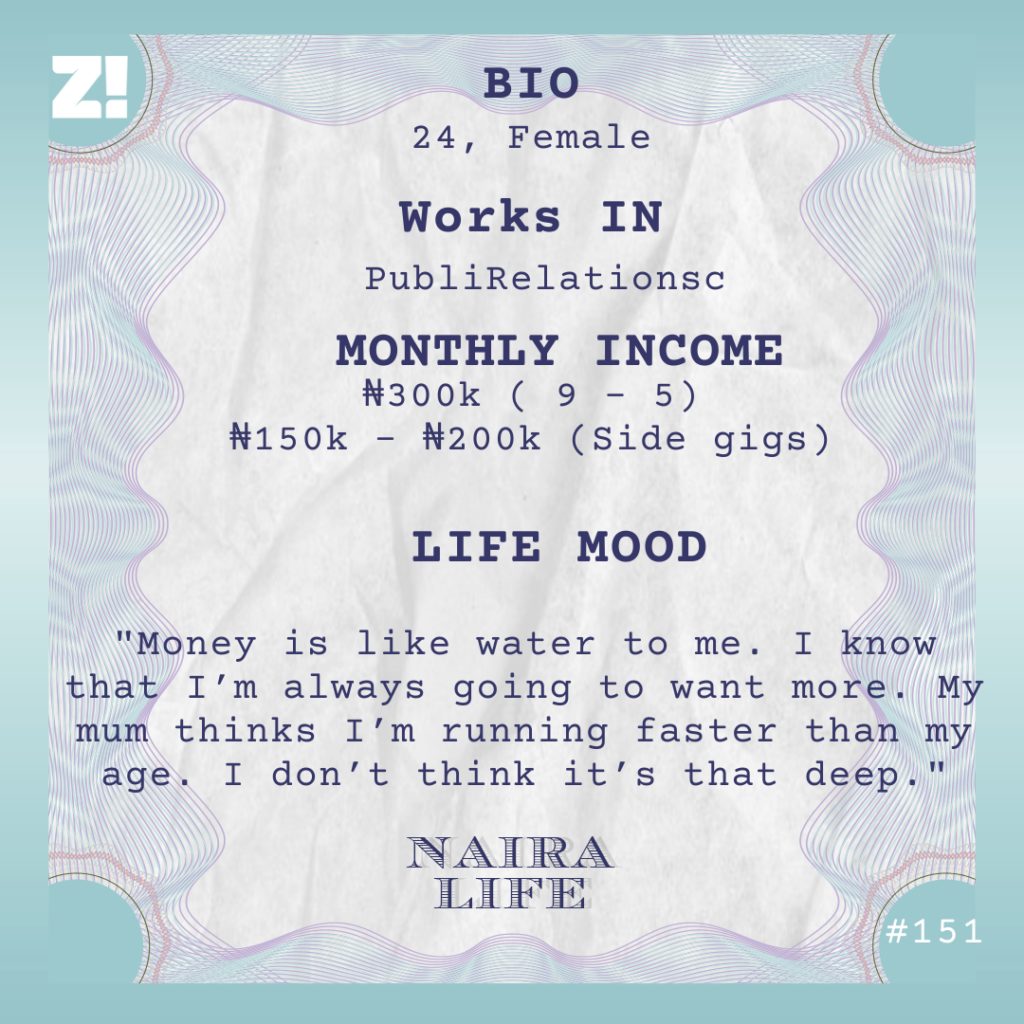

As much as the 24-year-old in this #NairaLife is a big fan of financial literacy, she’s also made her fair share of money mistakes, culminating in a loss of more than ₦2m in 2020. If there’s anything she’d like to hack, it’s how to grow her wealth.

What’s your oldest memory of money?

My mum had a thing against borrowing money or relying on anyone for finance, so she saved religiously. The way she saw it, if you weren’t saving money, then you were wasting it. I took that habit from her at a very young age.

At eight years old, I started putting some structure to saving money. I bought a piggy bank and most of the money I got — usually my pocket money and money gifts from relatives — went into it. My mum was also involved and opened a joint bank account for both of us. She deposited money from my piggy bank and her own money into the account.

That’s so cool. Did you have something you were saving money towards at the time though?

Not exactly. I just thought it was proper to save money. We still save money into the account to date. At the right time, we will figure out what we want to do with it.

I did start saving money for a purpose when I got into senior secondary school and moved to the school hostel. My monthly allowance was ₦10k and the thrill of having that much money made me develop a taste for luxury, especially wristwatches. I always put money aside so I could buy any wristwatch that caught my fancy. Nothing major happened until I got into uni.

What happened in uni?

I studied communication studies at a private university in the southwest. 2013 was the year I got in and my monthly allowance was ₦30k. I was still in my first year at university when I tried to invest money for the first time. It was one of those things where they’d tell you to put in a certain amount of money, bring five people in, then get your money and interest back.

A pyramid scheme?

Yes, those. I put in ₦10k and got about ₦15k back. In my head, I’d cashed out. I doubled my investment, told my friends about it and convinced them to try it out. We all lost our money. That was when I learned that it’s not wise to put money in any investment opportunity that doesn’t have a well-defined structure. That didn’t stop me from putting money in the next thing I found though.

What was that?

A friend’s business. In my defence, I thought I was supporting a friend and making money while at it. They were going to organise an event in school, and I put ₦100k in it. The plan was that I’d get my capital back and an extra 30% in profit. Unfortunately, the event flopped. My money hung in the air for two years, and I had to fight before I got some of it back. This time, I was done with anything that didn’t involve banks or financial institutions, a rule I stuck with for a while.

What do you mean?

In my third year, I talked to an uncle about investment opportunities and he told me about mutual funds. He knew someone at a bank who could help me open an account, so he hooked us up. My first deposit into the account was ₦50k. From there, I started putting in small amounts — anything between ₦2k and ₦10k. I stuck with it until I graduated from university in 2017. Sadly, I had to liquidate the account shortly before I graduated.

Why?

I was driving a friend’s car when I ran into someone else’s car, and the damage to both cars was extensive. It happened at the wrongest time. There I was, about to finish school and start my life properly. I freaked out and didn’t tell my mum. I liquidated my mutual funds account and other savings I had — about ₦200k — and used everything to fix the situation. In the end, I had to come clean to my mum because what I had wasn’t enough to fix the cars. It wasn’t the best time of my life.

I’m sorry about that.

I felt like I was back to square one. The only thing that comforted me was that I had just gotten a job at a PR company, which meant I could easily start all over.

That’s exciting. How did you get the job?

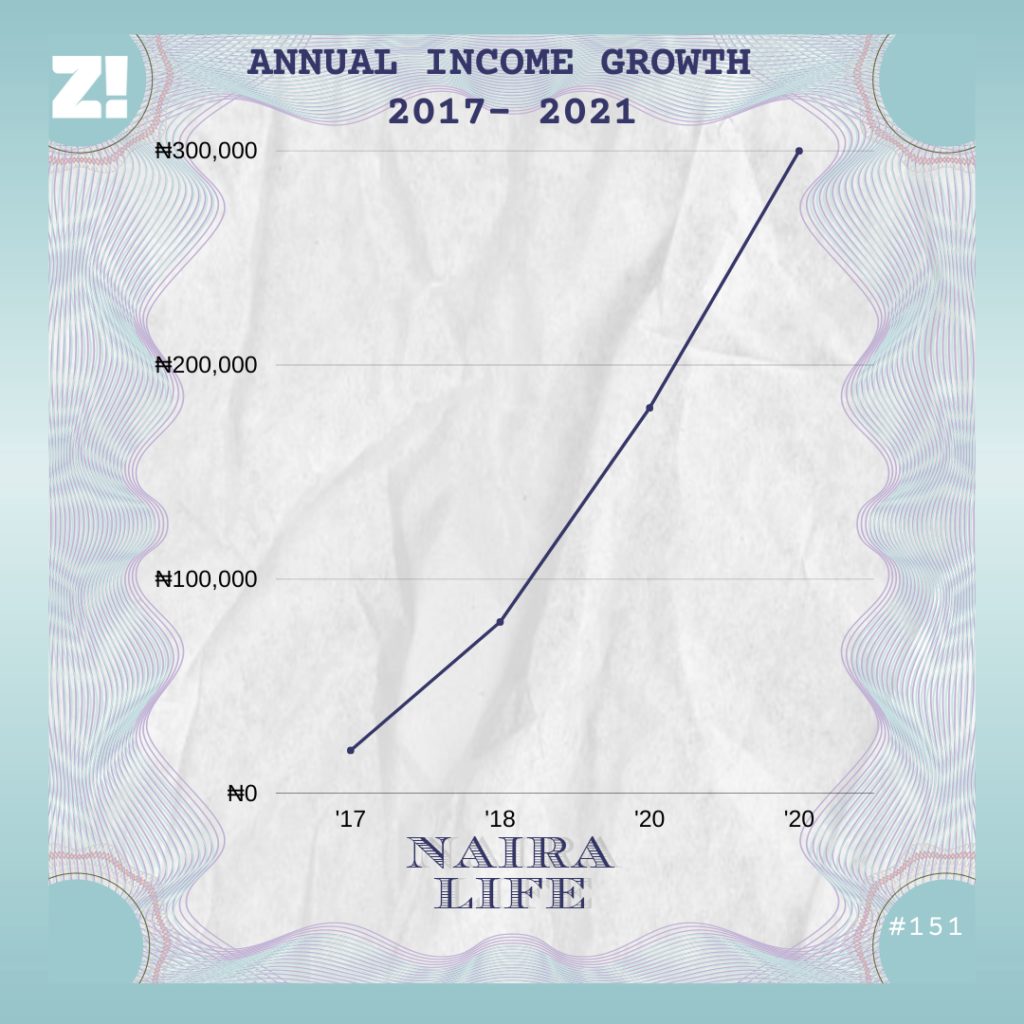

I met the owner of the company at an event in 2017, and I was eager to talk to him because they had worked on a project that piqued my interest. We had a conversation, he gave me his email address, then I sent him my CV. I interviewed with the company a day before my final exam. Before the month was over, I got an email from them — it was an offer to start as an intern. I took it. The pay was ₦20k.

I was earning less than my allowance in the university, so there was no major change in my lifestyle. I did manage to find another source of income.

I’m listening.

My uncle — the same one that helped me open my mutual funds account — had opened a family account on Uber and added me to it. I’m not sure where the idea came from, but I thought it would be great to book Uber for people in my office and charge them for it. It was almost like my uncle was dashing me money. The only thing was that he didn’t know about it.

Wild. I’m curious about how much you were making from this.

About ₦10k – ₦15k every week. Add that to my salary and I was netting ₦60k to ₦70k every month and saving about 70% every month. My savings strategy changed when I was mobilised for NYSC later in 2017.

How so?

I decided to save the entire ₦19,800 for the whole year and live on my salary and the Uber thing for the next couple of months. I had a few responsibilities: tithe and send money to a second cousin every month, so I still had enough left to cover my monthly costs and do something nice for myself.

I got my first promotion in July 2018, and my salary increased to ₦80k. Shortly after I got the raise, my uncle stopped paying for the Uber family plan — he couldn’t figure out why he had to pay so much for it. I didn’t need the money anymore, so nothing changed.

Nice. What happened after?

Well, I finished NYSC with about ₦237k in savings. I had opened a PiggyVest account at that point, so I put the money in it. Subsequently, I started putting ₦1k in PiggyVest every week, which I increased to ₦2k at some point.

Then in 2019, I travelled to the UK to study for my masters.

Interesting. How much did it cost to do this?

My tuition was £18k and my monthly living allowance was £600. I lived with my cousin for the entire time, so I didn’t pay for rent.

Gotcha. How did it go in the UK?

It wasn’t bad. I continued saving whatever I could. Somewhere down the line, I did some jobs to make extra money. I bartended for a while. I also took up some menial jobs I don’t like to talk about. The money wasn’t great either — £1.50 an hour, and I worked a minimum of seven hours on the days I worked.

So yeah, there wasn’t much to do in the UK. I just focused on saving money until it was time to return to Nigeria in October 2020.

How much had you saved up until that point?

More than £3k. One of the first things I did after I returned was to open a mutual fund account with another bank. My first deposit was ₦1m.

Why did you return to mutual funds?

It was just about balancing my portfolio and putting money into some long-term investment. I wasn’t in a rush, and that’s exactly why my next moves didn’t make sense.

Oh?

A childhood friend approached me in June 2020, asking me to invest in forex with her. In her words, she wanted us to make money together. I wasn’t sold, but I took out of my pounds savings and gave her the equivalent of $1k. She promised that my investment would increase by 10% every month. At the end of the month, she showed me my portfolio, and I liked what I saw. In July, I gave her another $1k. Then another $1k in August. The plan was to keep the funds locked away with her until February 2021. I got pretty excited about it and told a friend about it. He wasn’t convinced but decided to go along with it because he saw how invested I was about the whole thing. He dropped $1k after a stern warning — he would hold me responsible for whatever happened to his money.

Ah. And you went through with it?

I did o. Nothing funny happened for the first few months. He opted to collect his ROI every month, and it happened until December — which was the last month he signed up for. The friend I was investing with was living in Russia and came into Nigeria on December 16 and cut communication lines for the rest of the month. On January 1, 2021, I eventually heard from her but it was to tell me that she was having troubles accessing the funds.

Did you believe her?

Strangely enough, I did. I couldn’t call my friend who I convinced to put money into the scheme though. And I couldn’t pay him off either because I didn’t have enough liquid cash. By February, I still hadn’t gotten my money or his. I wasn’t comfortable owing him money anymore, so I sold my iPad and got a loan from a loan company to pay him.

That sucks.

Oh, that’s not all of it. I had also put money into another scheme in 2020. I guess I had not truly learned my lesson about money doubling arrangements.

You were running two FX schemes concurrently?

Yes oh. I started the second one with ₦200k when I returned in October 2020. It was supposed to run for 12 months with monthly returns of ₦26k. I had no idea something was wrong with that one too.

Back to my friend: she stopped answering my calls in March. I was frustrated and told my mum. Somehow, I got her home address, which was somewhere in the south-south and my mum travelled there. Unfortunately, she didn’t live there but the house belongs to her dad. My mum managed to get the dad’s number, and we reached out to him. After a series of back and forth, the dad paid me the money — $4k, which was about ₦1.9 million.

Phew.

That was just my capital. I didn’t get any of the returns I had been promised.

Omo. We move. What about the second investment scheme you were in?

Oh. By May 2021, I had put in ₦2,070,000, which included some of the money I got back from my friend’s dad. The cycle was also supposed to end in October 2021. They went cold in June 2021 and I haven’t heard from them since that time.

I’m curious about something, how were you funding all of this?

I went back to my old job when I returned to Nigeria because they had given me a study leave. My salary jumped from ₦80k to ₦180k, then to ₦300k in December 2020. Also, I had a couple of side hustles I was getting from people in the UK. That was creative work, and it brought in £100 here, £600 there at least once a month. I didn’t keep a handle on these, so I didn’t track how the money was coming in. But it always came.

Must be nice. Back to June 2020?

Well, my money was gone and there was nothing I could do about it. It was just best to move on. I went back to mutual funds and started buying some stocks on Bamboo. The major thing I’ve been into since that time is crypto. Here’s the thing: as much as I like to put money into many things, I don’t know what I’m doing sometimes. And the way I navigate is constantly reminding myself that I need to take risks to grow my finances.

Interesting stuff.

I mean, I believe that crypto is the future but I have to mostly rely on conversations about crypto on the internet before I figure out what coin to put money in. Somehow, it has paid off. I bought my first coin in August 2020 when Ethereum was about £300 — I think about money in pounds these days. Now, the value of one Ethereum is over £3k. A little over a year later, I’m holding 18 coins and my portfolio is worth £9,479.

That’s impressive.

Oh, and I still have some naira savings — about ₦1.9m. That’s about it.

How do you manage all of this on a ₦300k salary?

The side jobs I got after I returned to Nigeria helped a lot, especially because I wasn’t getting paid in naira. I don’t make as much money from side hustle anymore. On average, I make between ₦150k – ₦200k monthly these days. But it’s still nice because my monthly bills wipe out my entire salary.

Wait, how?

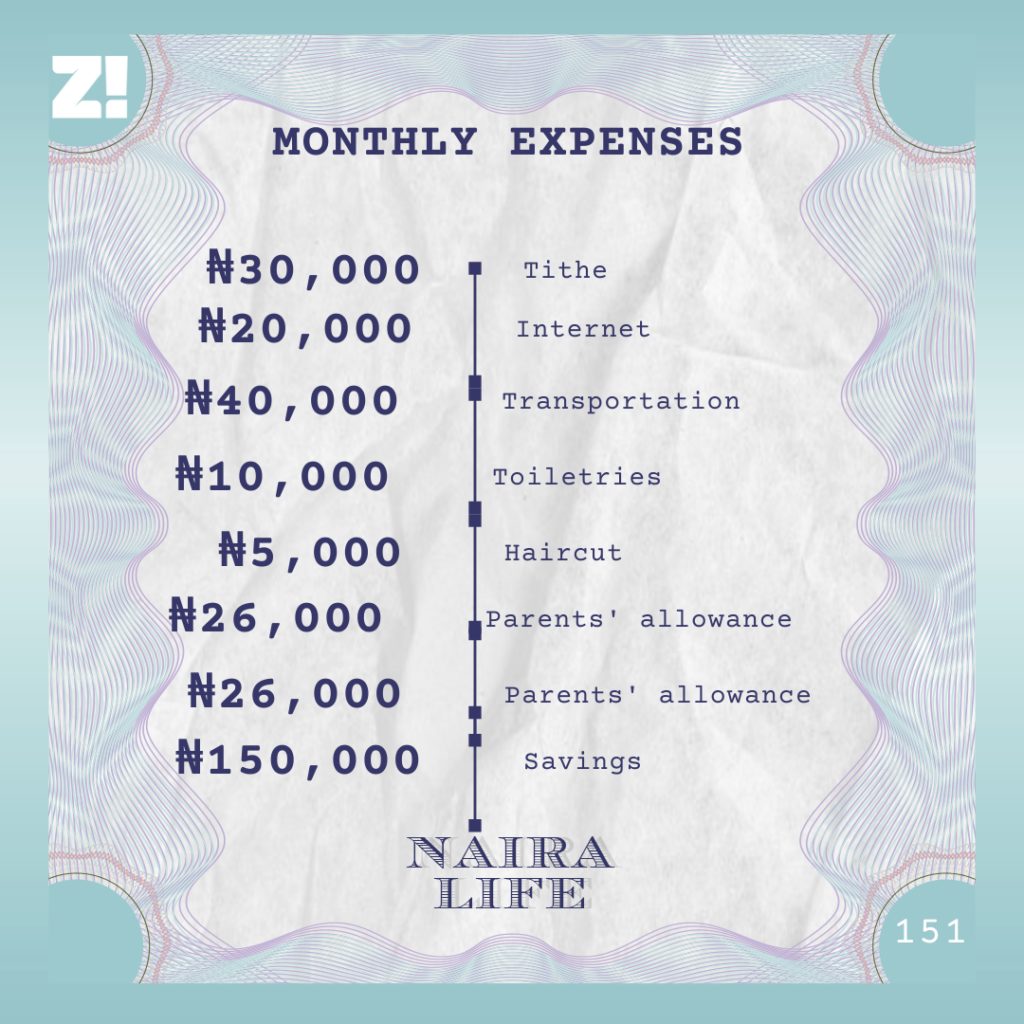

Let me break it down.

I also sponsor a child in an East African country, and I pay ₦18,700 into the foundation’s account every month. So yeah, I don’t live on my salary. It’s a good thing something also pops up on the side.

I agree. I want to know how someone like you thinks about money.

Money is like water to me. I know that I’m always going to want more. I have big plans for the future. I don’t want to just leave something for my kids and grandkids; I want my great-grandkids to benefit from the moves I’m making now and the ones I’ll make in the future.

I also believe money is hard to come by, and that’s why I don’t look down on it. I think I try too hard to look for money sometimes. My mum thinks I’m running faster than my age. I don’t think it’s that deep; I don’t want to suffer. I can’t afford to suffer.

Amen. How much do you feel like you should be earning now?

₦750k is the first number that comes to mind, so I’m going to stick to it. I feel like I’ve put in a lot of effort at work and should have grown more than I have. I deserve that money. I know I do.

I mean, that’s very relatable. Based on what you currently earn and your investment portfolio, is there anything you want but can’t afford?

A car. My transportation budget every month is ₦40k, and it’s always a struggle not to go above it. I feel like a car would make it cheaper. I can scrape enough money together to buy a car, but it’s not a priority right now and that tells me that I don’t have enough money for it.

What part of your finances do you think you could be better at?

Investments. For example, I’m putting money into crypto even though I don’t understand it. The same thing happens with stocks — I buy companies whose names I like. It would be great to actually have an in-depth knowledge of these things and not just go in blindly.

Rooting for you there. On a scale of 1-10, how would you rate your financial happiness?

I would give it a four. If I lose my job today and don’t get anything in three to four months, I might be back to square one. I’m not satisfied with what I have across the board because it’s simply not enough. I believe it could be more. If my crypto portfolio explodes, this number will go up. But until then, I’ll continue to try and improve my financial knowledge and hopefully achieve financial savviness at some point. I’d love to stop making mistakes and falling for silly schemes. That would be growth in my books.