Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

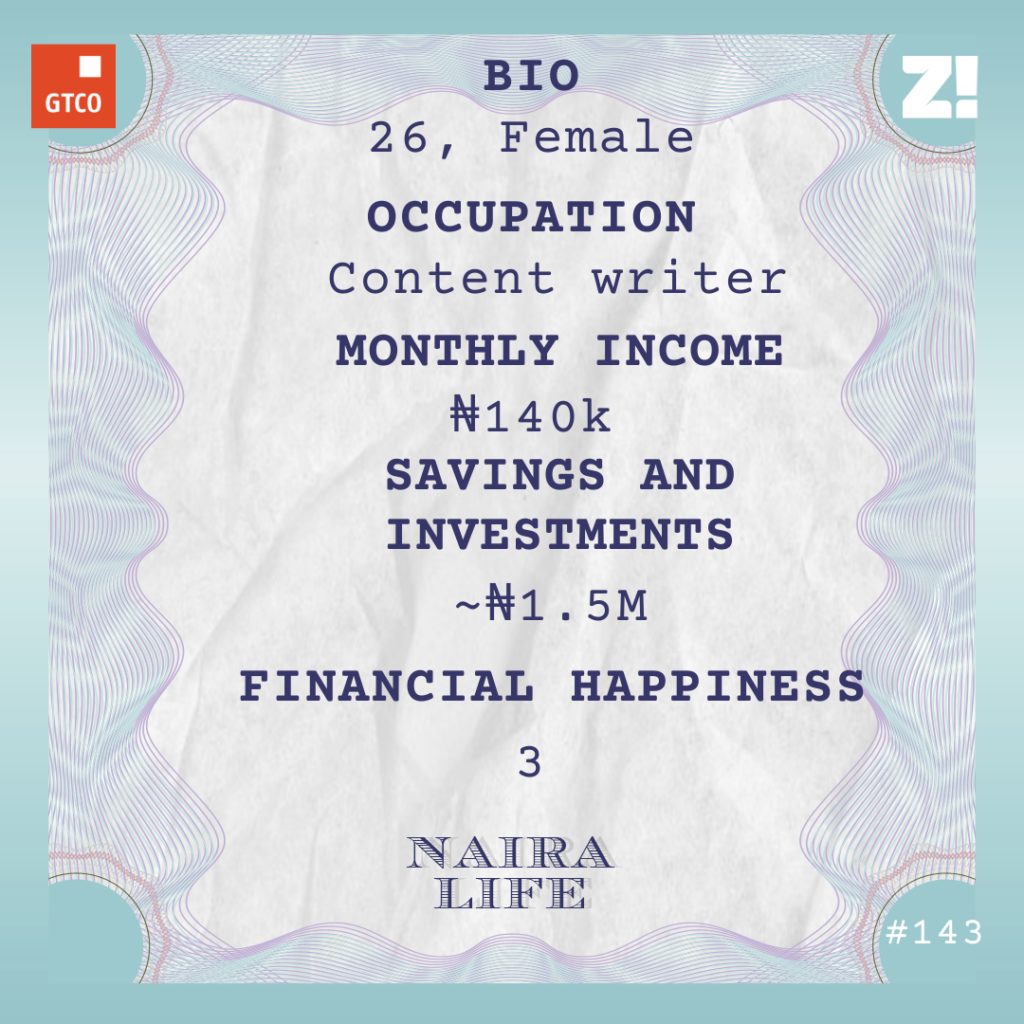

For the 26-year-old content writer in this story, saving reigns supreme. She would know: her longest unemployment stretch was two years. Guess what gave her a soft landing?

What’s your oldest memory of money?

I started out saving a lot of the monetary gifts I got growing up. They went into my “kolo” — a wooden piggy bank. By the time I was 13, my family and the people from church knew they could trust me with money, and I was in charge of the church library. Not sure how much it was anymore, but I made quite a bit of money for the church from renting out books to the congregation.

Although I have two older brothers, my mum trusted me with some things very early and her business was one of them. In 2009, she put me in charge of her store where she sold thrift clothes. I was 15. This could count as my first job because I made some money from it.

How?

The goods were shipped in bulk and when we took stock of the inventory, I kept some of it for myself to sell. Also, if I thought a shoe or a bag was too good for the price my mum asked me to sell it, I added a markup price — usually ₦1k — and that was also mine. In the good months, I made between ₦10k and ₦15k. December was my favourite month because people shopped more and I could make double that.

Eyes on the bag. What was it like growing up though?

My dad was a risk-taker. Probably more than he should have been, and this affected the family a lot. He was one to put his last penny to finance an idea he thought would do well. These projects always failed. My mum had more success in her business dealings, so things weren’t as bad as they probably would have been.

But there were periods when the family was barely getting by. My time in the university was a struggle because of this.

Do you want to talk about it?

I got into university in 2011 and my mum borrowed money to raise my tuition. During my first two years in uni, my allowance was ₦2500 per week. Sometimes it was ₦4000 for two weeks, and I learned how to manage it.

My third year and final year were the worst. I hardly got any money from home. And when it came, I couldn’t do a lot with it. I had a boyfriend, and he was there whenever he could. But I learned to do a lot of things myself.

Perhaps, the most important thing I learned was how to be frugal because I didn’t know when the next money would come. It’s a miracle I survived university.

I’m sorry about that.

It’s fine. When I graduated from university in 2015 and went for my service year, the only thing I was optimising for was income growth. I kept rejecting the PPAs I was assigned to because they didn’t want to pay. I finally found a school that was open to paying me ₦10k per month to supplement the allowance I got from the government, and that was the offer I accepted.

However, I didn’t have access to the federal government allowance for six months.

What happened?

BVN issues. Very frustrating, but I just chalked it up to me saving money. I planned my expenses around the ₦10k I got at my PPA. I should add that I earned some more money from teaching some kids during the holidays, and the total I made from this was ₦14k.

It was easier to plan my finances during my service year because I knew to expect something at the end of each month. It worked out well, and at the end of my service year, I had about ₦200k saved up. It took some restraint to hit that number — I mostly lived on what I got from my PPA, but again, saving money has always been easy for me.

I finished NYSC in February 2017 and started job hunting immediately.

When did you get a job?

In the same month, and it was for this guy who had a website. I’d always known that I liked to write, so I figured I had nothing to lose if I applied for the job. I did, and I got it. The salary was ₦30k.

How did the job go?

Not well. For starters, my KPI was 15 articles daily. I had to leave home at 5:15 a.m. every day to beat the traffic and get to work before 6 a.m. to start working. When my boss saw how fast I worked, he asked me to start writing for another website he owned, promising to compensate me for the extra work. He didn’t.

It was a struggle before he even paid my salary. When he didn’t pay my first salary at the end of the month, I stopped going to work in March. After some back and forth, he paid me ₦15k, and that was it. I was out of a job again.

I wouldn’t find another job until October 2017.

What happened in between?

In April 2017, I took a loan of ₦80k from a microfinance bank, bought female clothes and travelled to a federal university in the southwest. I had a friend there who took me in. The plan seemed simple: university ladies loved good clothes, and I had an eye for them, so there had to be a market for me.

At the end of my first week, I had sold nothing and had only ₦100 left on me. I sold a blouse for ₦1400 — ₦300 less than the cost price in the second week. Later that week, I sold something worth ₦6500. The lady paid ₦3k and promised to send the rest later. She didn’t.

I realised that the business wasn’t going to work. I used the money I made to transport myself back home to Lagos.

With a loan hanging around your neck…

This didn’t hit me until I returned home. I cried my eyes out. I had agreed to a weekly repayment plan: ₦2700 every week, I think. My mum took it up and started paying it off gradually. Also, My boyfriend from university had travelled out of the country but we were still in touch. He sent some money so I could offset the debt too. Eventually, I paid about ₦42k myself spread over a couple of months.

How did this happen?

I got a freelance writing gig in May 2017. I was writing five articles a day for ₦10k monthly.

Omo.

I was desperate for a job and had a loan to pay off, so I took it. I did that for only two months though — I realised that the money was too little for the effort and the lady I worked for never paid on time. If it wasn’t a token issue, it was some network problem.

I got another job in August at a women-focused website. The pay was ₦50k plus a ₦5k internet allowance. After my first three months, my basic salary was increased to ₦60k. Around the same time, I got a writing gig on the side that paid me ₦25k.

Now you were averaging ₦85k monthly, what did that mean for you?

See, I started thinking about getting my own apartment. I had wanted to move out of my parents’ since 2017 but I didn’t have the means. I found a mini-flat in February 2018 and it cost ₦265k, which I split with a friend.

Ah, nice. Back to your job. How long did you spend there?

Nine months. I left for purely sentimental reasons. In May 2018, another website I had always liked and had even done some free work reached out to me and asked if I was interested in a full-time position. I took a ₦5k pay cut to join them. Not the best decision. During negotiations, my boss said that she couldn’t pay me the ₦80k I asked for because the company wasn’t making money. I joined and found out that the company was indeed making money.

Ouch.

Also, we agreed that my closing time would be 4 p.m. if I resumed work at 6 a.m. I kept my end of the deal but my boss didn’t. After five months, I decided the job wasn’t worth it anymore, so I resigned. I didn’t even have any plan. I just knew I would lose my mind if I continued working at the job. My safety net was my savings — I had gotten it up to ₦220k.

Sweet. When did you get your next job?

About two months later. In January 2019, I casually applied for another content job, and I got it. The offer was ₦100k. Omo, it felt like a big break but all the excitement went into the air after I was owed salaries at a stretch. My editor was also hard to work with.

It was easy to resign from this one when I got another offer in May. I hadn’t even been paid for two months at the time, but I was determined to get it. I went to the office one day and informed HR that I wouldn’t leave until I got my paycheck. They paid a month’s salary that day. The balance was paid three months later.

Energy. What about the new role?

I was hired as a creative writer at an enterprise business. The company had a couple of brands under its name, and I wrote for all of them. The salary was ₦160k and I loved the work I did here.

My salary was a big deal to me. I saw money in a new light and even started giving my parents an allowance. I was also saving a lot more than I had ever saved up until that point. ₦40k went into my savings every month. This was non-negotiable. After settling my bills and savings, I still had quite a bit left to spend on clothes.

However, the work culture was toxic. People were fined or fired for the most basic reasons. I knew it was a matter of time before I got fired too.

And that happened?

It did. On September 1 2019, I was handed a sack letter. I didn’t even do anything, but they said the company needed to downsize.

That’s brutal. I’m sorry.

I was relieved they let me go. I had started thinking about leaving too. My savings, again, gave me a soft landing. I had about ₦500k and wasn’t in debt, so I figured I could live on it until I got a new job. I had some interviews lined up, and I was confident that I’d get an offer from one of them. I didn’t find another job for two years.

Hay God!

See, I didn’t see that coming. I aced the interviews but for some reason, they didn’t go with me. Two months after I got fired from my last job, I started getting restless. I decided to start a clothing business again and opened an Instagram store. The focus this time was on corporate clothing items, and all my clients came from Instagram. I didn’t make any sales until December 2019 though.

Omo.

Thankfully, it started picking up after that. It got me through the pandemic in 2020, and I saved my first million before the year was over. God, I saved like crazy.

In the first three months of 2021, I saved another million. At this time, I was averaging at least ₦300k monthly in profit. I probably would have saved more if there wasn’t one bill or the other I had to settle at home. The last bill within that period was this ₦350k I loaned my mum.

Ah, I see. I’m curious: Were you still looking for a job?

I never stopped job hunting, although the momentum dropped at some point. I didn’t see the need to rush since I had my clothing business.

Fast forward to October, I finally got another offer as content lead at a startup.

Yay.

The salary was ₦140k. Less than what I earned at my last job.

But you took it. Why?

I needed to start leaving my house. I won’t lie, it was a relief. Shortly after I started working there, I got another offer. It was double my current pay, but I turned it down.

Oh?

I felt bad about leaving the place I’m currently at without a replacement. So yes, I stayed.

Sales are bad this time of the year, so I’m currently making between ₦60k and ₦80k from my business.

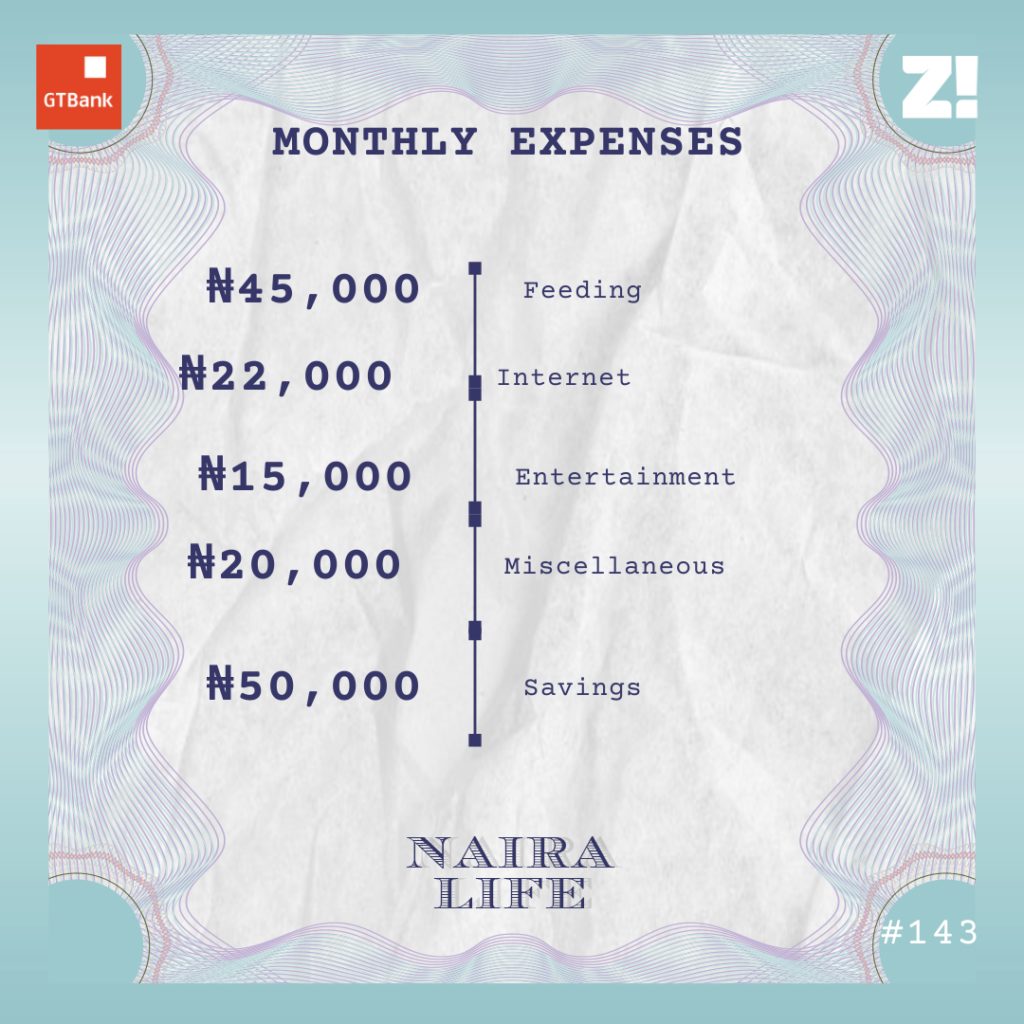

Fascinating. So, what’s eating your money these days

You’ve always been big on savings, how do you approach it these days?

The thought of being broke throws me into a panic. ₦50k goes into my savings every month. No compromises. Whatever I have left after settling my monthly bills goes into a separate savings account. So do the occasional money gifts I get.

I know one thing: I’m on my own and there may be no one to run to if I run into trouble, so saving money makes me feel safe. I save as little as ₦200 sometimes. A trickle eventually becomes a lot. But I’ve also realised that saving money is not always enough, so I started some investments in April.

What investment options are you in?

I started with crypto. I’m still learning how this works, but I haven’t made any significant losses. Also, I have a RiseVest account and they invest in stocks for me. That works for me.

What’s the value of your savings and investments the last time you checked?

Core savings — ₦427k

Crypto — ₦660k

RiseVest — ₦360k

I’m glad I have developed a savings habit, but I wish I could save more every month. ₦150k would be great and I know I can do it if I’m earning more.

This feels like a good place for a segue: how much do you think you should be earning?

₦600k from all my income streams would be great right now. ₦400k from a 9-5 job and the rest from my business. I have a feeling this will happen next year.

Energy. How would you say your experiences over the years have shaped your perception of money?

Money makes me safe, which is why I take savings seriously. My worst fear is having to rely on people for money. I saw my parents go broke a number of times, and it scared me. I never want my children to go through that or have to depend on others.

I also know that saving religiously is not enough, and that’s why I’m trying to figure out a way around making the right investments.

Fair enough. What was the last thing you bought that required serious planning?

My MacBook. In August 2020, I realised I needed a computer, so I started saving heavily for a Mac. Luckily, someone I know wanted to sell theirs and what I had saved for five months was enough to buy it off them. It cost ₦325k.

Nice. But I wonder if there’s anything you want right now but can’t afford?

A car. I move around a lot but I’d probably spend less if I had my own car. I imagine I’ll need ₦2.5m for a Camry that works.

I started saving for a car already but I’m nowhere close. Rent is coming up, and I need ₦600k for that. After I make rent, I’ll restructure my savings to accommodate my car needs.

What part of your finances do you think you could be better at?

Investments! I need to figure that out as soon as I can. Sticking to a budget is something else I need to start doing. I made an impulse purchase recently and splurged ₦80k on some skincare products. They stopped working after a month. I’m still very upset about it.

Sorry. On a scale of 1-10, how would you rate your financial happiness?

It’s 3 at the moment.

I didn’t see this coming.

Let me explain. I know my finances are in much better shape than it was two years ago, and I wouldn’t call myself broke. However, I’m not close to where I want to be. I have a high taste. I’d rather not have an item than spend less and compromise on quality. This means I have to continuously earn more than I could spend. This hasn’t happened yet.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld