Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This weeks’ #Nairalife was made possible by FCMB’s promise of quality medical care from the comfort of your home.

Do you remember the first time someone called you rich and you were extremely triggered?

My cousins in London. For some reason, their step mum painted an exaggerated version of our family to them. They genuinely thought we were “living in a mansion, driving the latest Benz” life. It was so annoying because I only had £40 in my account and someone was stressing me that I was rich, hahaha.

It was 2012, and I was 17.

What was the real picture of what life was like?

We definitely were not poor or suffering, but we weren’t rich either. It’s like my dad spent all his money on educating all his kids.

I remember asking for things and he would just say, sorry I can’t give you this because I need to pay your brother’s school fees or you can’t travel to so and so place. So, while we weren’t suffering, all the money went to our schooling.

The drive.

My dad is obsessed with education, it’s what helped him get to where he is in life. It gave him a second chance because he had it rough growing up. So, he made sure to get us the best education possible. If you looked at our family from that lens, you’d be like oh wow these guys are rich. But he was taking loans to do this, saving like crazy and investing a shit load, for us.

How rough? Paint a picture.

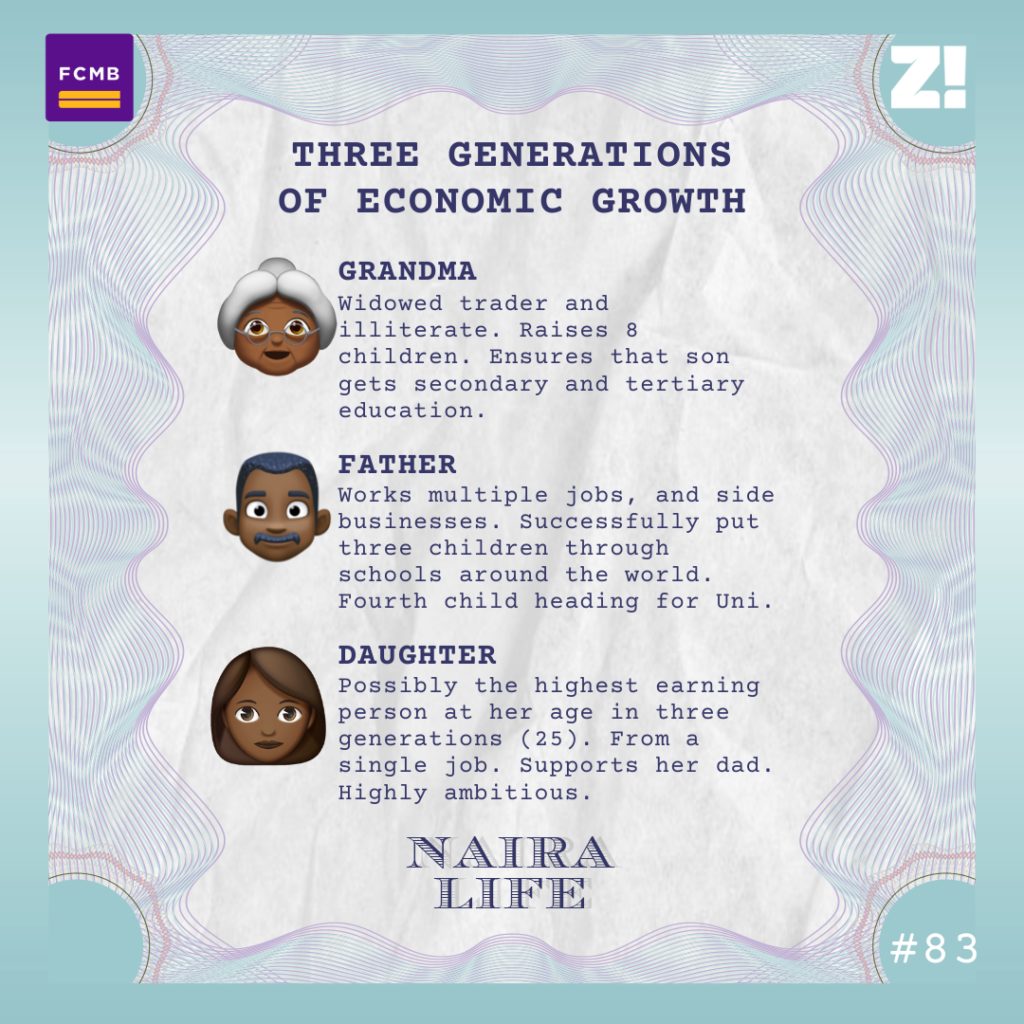

I don’t know, but he doesn’t talk much about it. His dad died when he was pretty young. His mum was a trader. When his dad died, his mum did her best to send all her children to primary school. She was illiterate but learned from her brothers that education was the next best thing. She’s the one that got him obsessed with going to school. Anyway, she had 8 children so, at some point, she couldn’t pay for school for him anymore.

Woah.

She had so many responsibilities and things. So, my dad had to live with someone else, to make space in his mother’s house for his other siblings. He used to sell groundnut in the streets, at some point he started DJ’ing in clubs in secondary school to earn money. He was the ultimate hustler.

Anyway, his mum paid for his secondary school and university, against all odds.

This was quite the game-changer, wasn’t it?

Well, of course. I mean he still had to do sell a thing or two in school, like buying and selling milk to his coursemates for extra cash. But it was definitely a game-changer. He wouldn’t have been able to go to the quality schools if she didn’t go to great length.

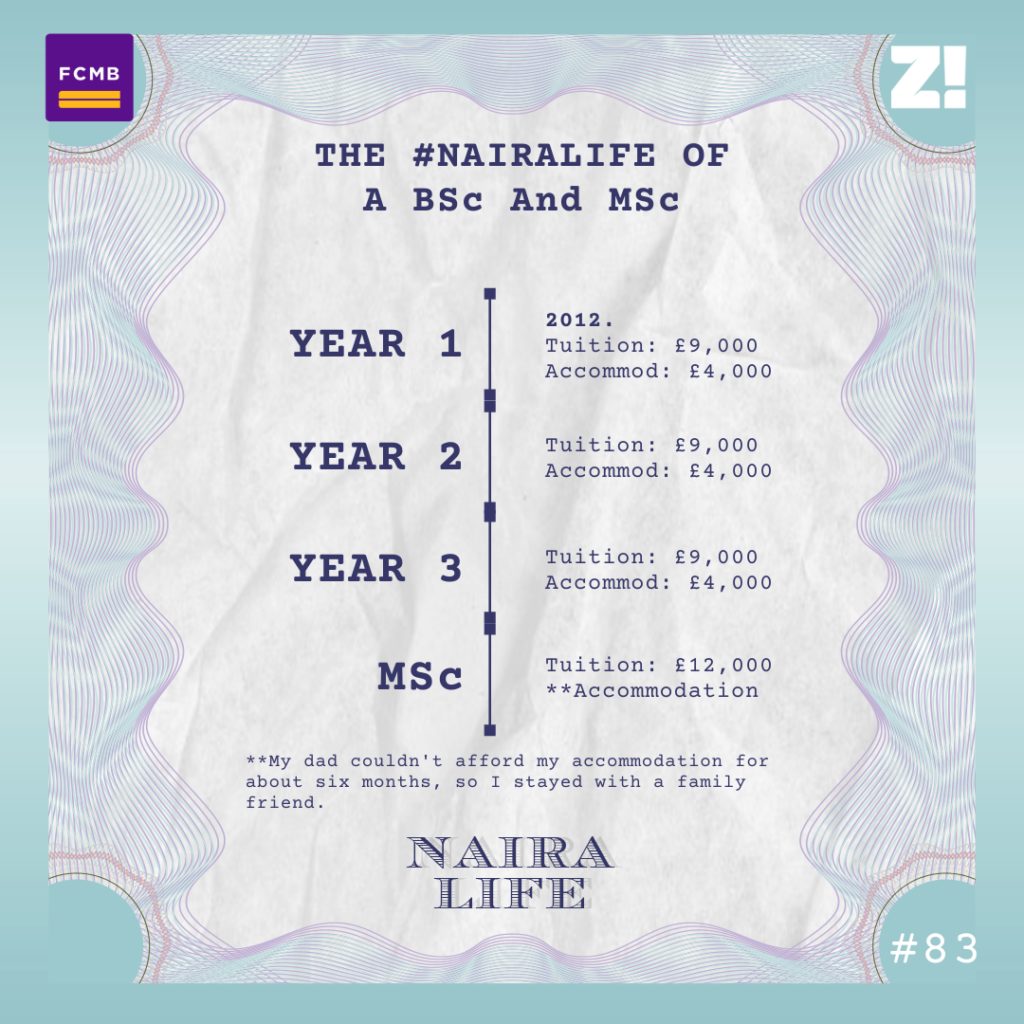

Your dad managed to fund your school fees. Let’s do the math.

I got a scholarship but I can’t remember how much.

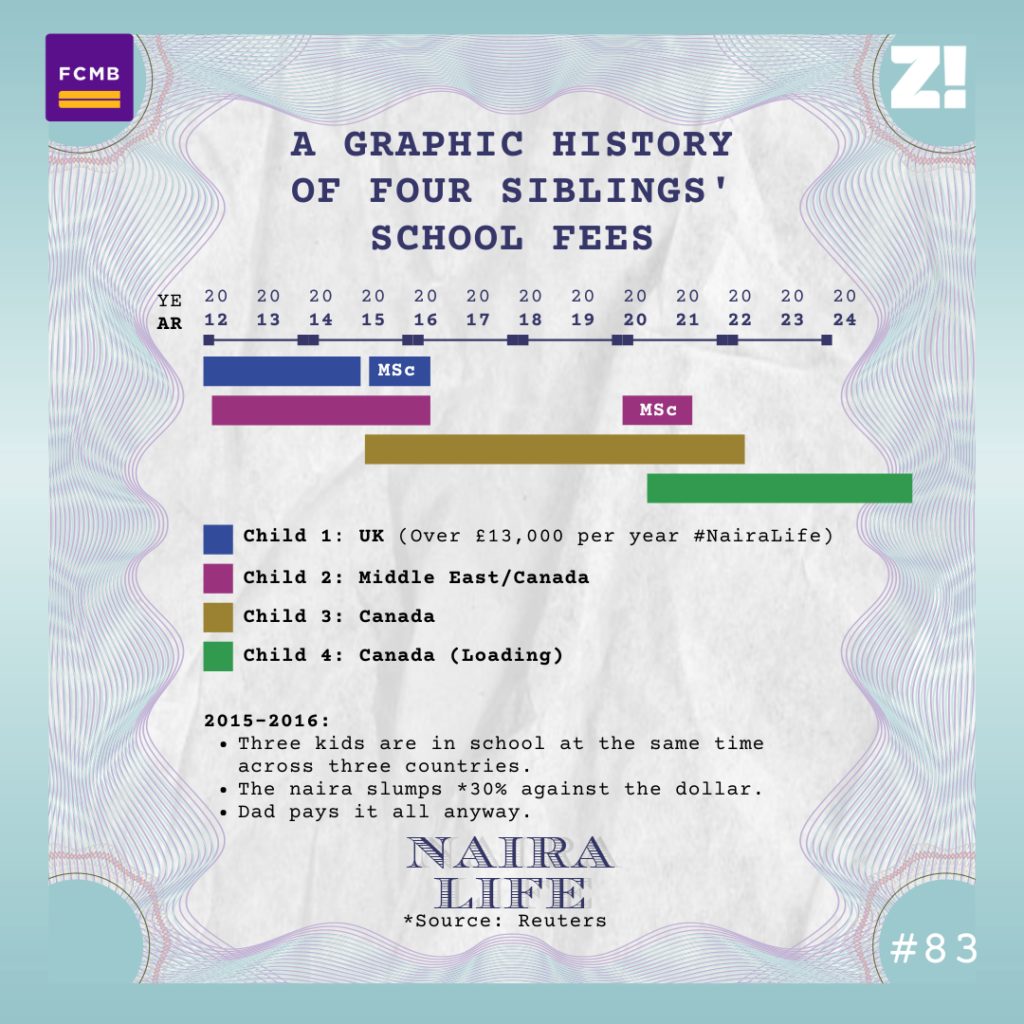

Remember that he had other children abroad while paying this; Canada and the United Arab Emirates.

Plus he used to send me £200 every month, except in my 2nd year when I worked. That one was so expensive he couldn’t afford the accommodation at first. I stayed with a relative for the first 6 months.

One sibling started in 2015, and won’t be done till 2022. Another started in 2012 and is currently doing Masters.

The last-born has gained admission in Canada already. It is COVID that delayed everything. At some point my dad was so broke he considered letting the last born school in Nigeria. Then one day he just came and said, “Canada it is. I will figure it out.”

How does one even pay for all of this?

Loans. And lots of savings. Because I know damn well he doesn’t have the money sitting somewhere. He runs a full-time job, does two things part-time, and tried to start a business that COVID said no to.

Also, stop obsessing about my dad, hahaha.

Fair, because I was just about to segue. So, what do you do?

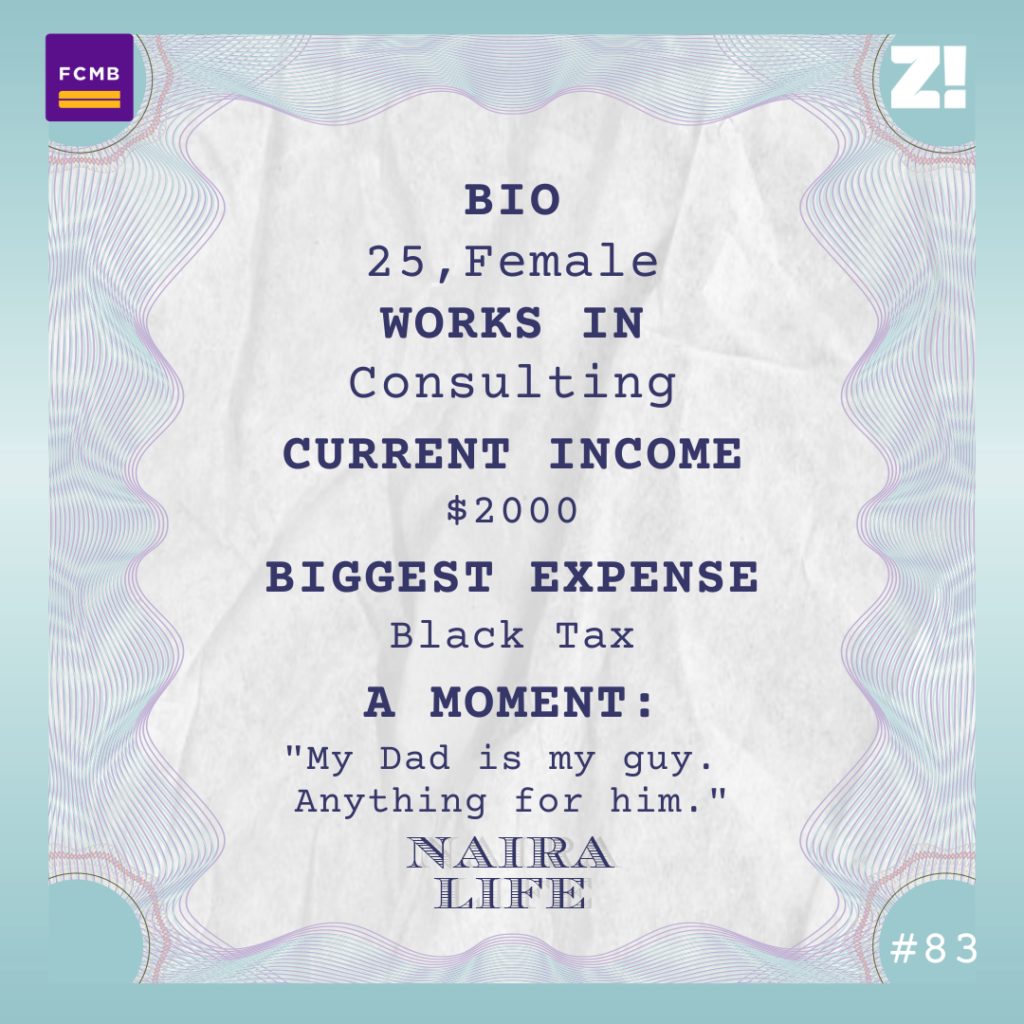

I’m a consultant at a global media agency based in Nigeria.

Hmmm. Global. Is the money global too?

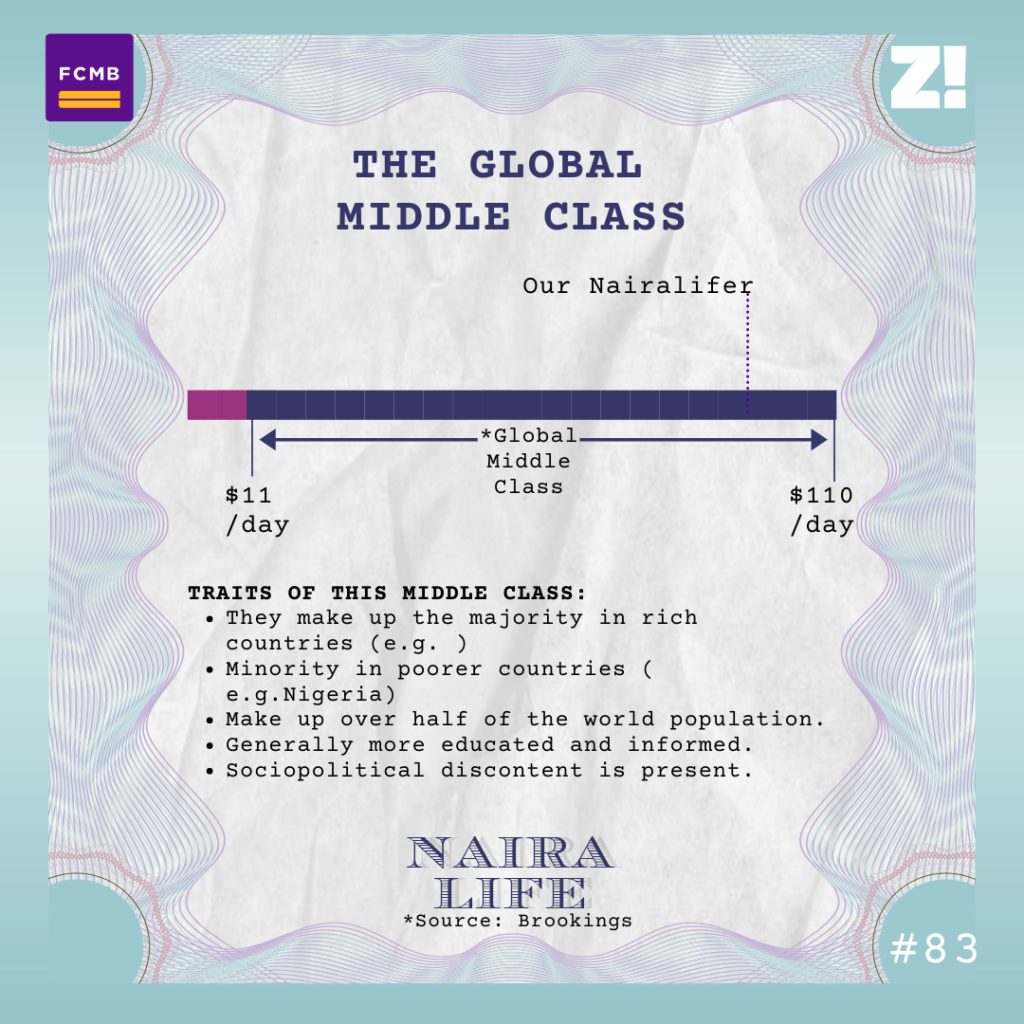

Well, it’s $2,000 a month – $1980 if you remove bank charges.

This puts you in the upper strata of the supposed global middle class.

Hahaha. Wow. This money that I’m managing.

Hmmm. Managing. Tell me how you manage every month.

It changes every month, but this is what an ideal month looks like.

₦10k goes to fuel. ₦20k goes to internet subscriptions. Rent? Zero, hahaha. ₦150k goes to just spending; I’m always buying food for myself or bae. Or taking my friends. ₦20k is for toiletries and random things for my body and bathroom.

The rest almost always goes to my dad. He thinks I’m borrowing him but I’ve dashed him.

That’s interesting, that last part. Tell me about the first time it happened.

It was 2019, and he didn’t have the money to pay for one of my sibling’s accommodation. I could tell it was stressing him out. And I had $4000 sitting on my account, I was saving it but I didn’t have any immediate use for it. So, I was like here you go, Daddy. He was so grateful for it.

Because I don’t pay rent, health insurance, and transport, I always have money. So, it’s easy to give him. He’s saying he’ll pay me back. But for me I’ve dashed him. It’s happened all the time since then.

How have these experiences shaped your perspective on money?

I don’t really know. I have never thought about it. I think one thing I’m certain of is that I want to have bastard money. There’s always something to spend on, someone’s school fees to pay, someone’s book fees to help out with. I want to have enough money to cover those expenses, not even for myself. For them.

I hope you get it. Looking at what you currently earn, how much do you think you should be earning?

I know I should be earning at least $3000 for my current level. I didn’t negotiate properly when I was just starting out. I was coming from a salary of about $600 to $2000, so the difference seemed a lot to me. But based on industry standards, definitely $3000.

You’re living a version of the Nigerian dream; earn global, spend local. What’s something you didn’t expect to be a source of stress for you, that is now?

Black tax. I knew it would come eventually, but not on this scale. I barely save except, except for my current moving-out fund. All my savings go to someone’s school fees or something. I’d have had millions of naira in my account if not for that. I could have gotten a house.

Hence, the trigger when people say you’re rich.

Oh my God, yes. It’s so annoying. I mean I’m definitely not poor, I’ve never had to beg for money. If I’m begging it’s from my friends and I always pay them back. But for some reason, people always make jokes about me having money.

And what makes it triggering is not saying I’m rich or asking for money, it is the timing of it. It always comes when my account is empty or almost empty. Imagine someone continuously making rich jokes when you have just ₦10k in your account.

Your spending power feels relatively small compared to what you earn.

On average I spend about $400. I don’t have external expenses like rent or medical bills, so it makes it easy to spend less.

The big project savings only happens occasionally, everything else goes to the family. So, like $1400 goes to the family. My dad never ever asks me for this money, by the way. It’s just that I always feel some sort of guilt seeing him hustle so much.

Imagine your dad struggling to pay school fees and you have a shitload of money in your account doing nothing? It just makes sense giving him instead of having the money sleep there. And he always accepts it, so that means he needs it. Even though he won’t ask when I don’t show up. He doesn’t rely on me or anyone else. He always finds away. But I’m always happy to help him. Until I no longer can.

That’s heavy.

Haha. My dad is my guy. Anything for him.

Where does your mum sit in the context of money and household income?

Interesting question. She doesn’t contribute much, barely actually. She works but all the money goes back into her business which has been recently tested by COVID 19. It’s such a struggle that sometimes we hand her money for rent and other business-related expenses.

You said “no longer can” earlier, and I’m curious about that.

I’m moving out soon, it means I’ll have additional expenses of my own to worry about. I’ll have to worry about rent and my own personal expenses. So, there will be less to contribute unless I get a raise or a better job.

What are the things that need to happen for you to unlock your next level of income?

I already have the skillset needed to get a raise but I’m not sure the place I work is interested in giving me a raise since I’m a consultant, not full-time staff. I have to either find a better paying job or stick there till a miracle happens.

Stick there? Do you ever get the sense of feeling trapped?

I’m getting there. When I feel like I can no longer take it, I’ll move on. For now, there are still some benefits of sticking there. I am picking up other unrelated skills that will help me moving forward. For now, it’s keeping me occupied. I’m also building a fantastic global network. It helps to know many people in high places haha.

How much do you think you’ll be earning in, say 5 years?

$10,000 a month. Or more. But in 5 years, I don’t know if I’ll be doing the same thing or in the same industry so it’s hard to say.

What’s something you want right now but can’t afford?

A house. Always a good investment.

What’s something you wish you could be better at, financially?

I don’t know shit about investment. I know I don’t have enough to invest but I haven’t taken the time out to learn my options at least. I need to fix that.

Financial regrets?

I wish I didn’t buy a car haha. I love driving but I hate driving because of mad people. I almost always Uber because of the traffic and because I need to work in transit. So, sometimes I think of what I could have done with that car money instead. It cost nearly $6,000.

You don’t even think in naira. Why all this?

Naira is setting me back, my dear. I’m thinking for the future when I move outside the country. Also, I earn in dollars so it’s easier to calculate my expenses in the currency I earn in.

Did I just hear you say japa?

I’m not a fan of migration or the Canada hype. But I know that for the type of opportunities I want, there is very little Nigeria can give me. At some point, the UK or the US will come calling.

I can’t work with local agencies or media companies. They can’t afford to pay me, and they can’t offer me the type of environment or network I’m looking for. So, inevitably I’ll bounce outside the country.

On a scale of 1-10, financial happiness?

8. I’m very happy because I’m not suffering or poor. I could be saving and earning more but I’m definitely okay.

One last question.

Shoot.

Your dad giving you the best quality of education means that you actually went to school with rich people. What was that like for you?

It was such a weird change that started from secondary school – it was an expensive private school here in Nigeria. I was coming from a background that you can call razz, and I got bullied for it and called ‘local’ a lot.

Their pocket money was like ₦20k every month and I was getting like ₦3 – ₦5k. I’d never travelled abroad or even entered a plane at the time. Whenever we travelled, it was by road.

So, having rich schoolmates was such an experience. I wasn’t poor but my family couldn’t compete financially and socially with all those guys there. But I tell you it shaped me.

On some days, it hurt to be dragged but for the most part, I was fine. I experienced different sides of the coin, I guess. And by the time I finished secondary school, I had a network of friends outside my family status.

It turned out to be a blessing.

It’s Okay To Be Too Busy For Your Doctor’s Appointment. Weekdays are for work, weekends frankly should be for resting. To suit your busy lifestyle, FCMB has a promise: from the convenience of your home, workplace or even on the go, you can connect with 30 qualified medical doctors across a broad range of specialities, get access to free and up-to-date health resources on key medical conditions, and lots more.

No stress, no judge-zone! Easy-peasy, right? What’s more, as an FCMB customer, your first 30-minute consultation with a doctor is FREE!

Click here to get started