If you’ve been reading this every Monday, you know the drill at this point. If you haven’t, now you know that Zikoko talks to anonymous people every week about their relationship with the Naira.

Sometimes, it will be boujee, other times, it will be struggle-ish. But all the time–it’ll be revealing.

What you should know about the lady in this story: She started off as a hobby, Social Media and writing, and followed through till this day.

When was the first time you made money?

There are stories of me winning essay competitions in Primary and Secondary school, but I have no memory of those days.

Anyway, I found out early that I’m not a “buying and selling of goods” person. I’m more of a services person.

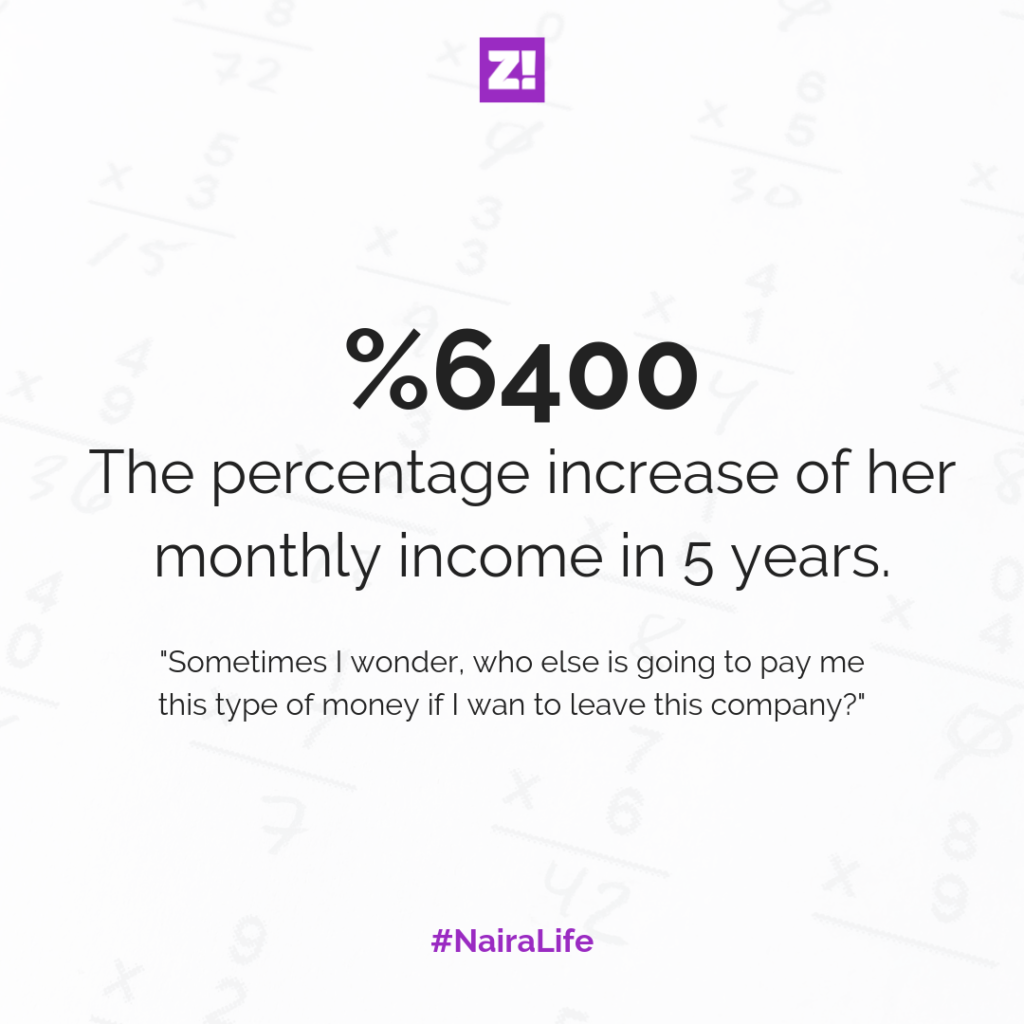

But the first time I remember making money after secondary school, was right before I gained admission into Uni – a writing gig that paid 20k. 2013. I did that for like 3 months.

After that, I did a lot of social media work, just helping businesses manage their social accounts. The 10k’s here, and the 20k’s there for a few months at a time. But the solid and consistent one was like 25k for 2 years.

Then I got to a point where I was like, I can’t be collecting exposure money anymore – the 10k gigs that is. So I quit all the little ones and focused on the 25k one. This was, by this time, late into my first year in Uni.

By the end of my first year though, I was making 50-70k on a monthly basis, including pocket money.

So in the second year, I didn’t take on extra projects. So I switched to social media and started writing for blogs. 3rd year, peg it at 50k a month.

How did you know what was good money or what wasn’t?

I feel like I’m a proud person. The first gig, I collected 10k because I had no experience. But after doing it for 9 months, I already had a good sense of the value I was adding. It’s subjective, but when people starting reaching out to me to do work, I knew I couldn’t be collecting exposure money. In all though, 50k a month in work was okay for me.

Then in my final year, I got a proper job close to school. That’s when I became a proper big girl. The net salary was like 60k. I did that for about a year, until HR came to me one day and said, oh your services are no longer required. Come and be going.

Ehn?

I dunno how I survived for two months. At this time, I had already stopped receiving pocket money from home – this one stopped in 300-level. So I started looking for freelance work that paid good money here and there. One even paid 200k.

Then I got hired in an established company, still working with digital skills. The offer was 200k, and I was like, ‘oh this is not bad’. Next thing, time for salary and 170k entered my account, And I was like what the fuck?

Many of us learn net from gross after the first alert.

What was your first personal encounter with the difference between net income and gross income?

— Fu’ad. (@FuadXIV) May 19, 2019

Need y’all to help me take the poll and retweet this #NairaLife.

Thanks.

Thennnnn, I got another job – an international tech company – and next thing you know, I received alert at the end of the month. 600k. This was in 2018. It was actually in dollars, but when you convert it to naira, that’s what it comes to.

I’m assuming you’d never seen big alert before then.

Never. When it hit my account, I was like yooooooooooooooooo. I was just looking at it in disbelief. My first disbelief was actually why I was paying so much in taxes. Like, I called my mum to help me calculate to make sure they didn’t scam me.

When my mum heard how much it was, she was like YOU NEED TO SAVE. YOU CAN LIVE ON 10% OF THIS.

10k to 650k in 5 years, how did that happen?

Hopping jobs. Because how else will you get a raise if you’re not hopping jobs? People say if you hop around, it’s bad for your career.

But I’m doing okay if I say so myself.

My major driver, in general, is that I don’t like to be broke. I like to have money. It’s not even so I can buy expensive things. I just want to have that safety that money provides. My folks aren’t poor, but I’ve seen them struggle. And I need it to end with me. Also, I don’t want kids; because fuck them kids.

It’s nice to be able to eat out, but having money as a safety net is even better. Right now though, I’m very broke, which makes no sense–

–talking about being broke;

I had major expenses. In January, I had over a million in my account and I was like wow, first million sitting in the bank. It’ll probably never happen again because I have a lot of expenses lined up. I bought land in January. Then I bought some gear for work, a computer actually.

Okay, let’s break down your monthly spending properly.

First thing, when my salary enters, I let it just sit for like 2 days. Then I dive in.

“No matter how much you earn, make sure you save” is a scam. Saving became easier as I earned more. Also, I have two types of savings. There’s the touchables; small ones I can quickly liquidate. Then there’s the untouchable, which goes up to 80k per month.

I rarely spend on food and transport. The company takes care of that. Also, I go out only twice a month. Relationships are expensive so date nights indoors, please. Then I buy gifts for my friends. Everything else is as e dey hot.

Okay, but how much do you feel like you should be earning though?

Honestly, my money is okay. But if I want to demand more, 1 million to be honest. There are many things I need to do, and money will help me do it faster. But I even feel like if I get that much money, I’ll just be dashing people.

How did you arrive at 1 million?

Omo, I dunno, I just plucked that money from the air. I don’t pay rent, I’m not paying school fees. The only reason I still do some freelance work is that I’m very ambitious and I need more money to achieve some things.

How much do you imagine you’ll be earning in 5 years?

I don’t want to be in this country – let’s start from there. I don’t care about being extremely wealthy. I just need comfort and security. And then whatever is slightly above average in whatever country I’m living in. Whether I go to Spain or Switzerland, or Cuba, as long as I’m comfortable enough to pay my bills, go on holiday once a year, and take care of myself, I’m fine.

It can’t be in Nigeria where you’re one health disaster away from poverty.

I feel like being extremely wealthy has its own pressures, so neh. I just don’t want to have to balance sheets every time to make basic financial decisions.

What’s something you want right now but can’t afford?

I would have said a car, but I’m not sure I want a car. I’m just saying it because it feels like the thing I’m supposed to say. A trip, I guess. I dunno. I don’t really want a lot, just comfort. Unless someone gives me a Glucose Guardian that doesn’t want glucose and just wants me to succeed in life.

I really just want to make money and be alright. It’s why I started working when I was much younger – I didn’t want to wait for my father to stop giving me handouts before I figured it out.

Oh yes – I know what I want but can’t afford. I want to buy a house.

What’s the last thing you bought that required serious planning?

Land – I bought it for 800k. Add documentation to that, and everything cost about a million. Fencing is lined up as my next major expense. I don’t really know what I want to use it for sef. I dunno whether I’ll build on it or something. I dunno. It just felt like a sensible investment channel.

What other investments do you have?

Mutual funds. Online investment platforms. I want to try all those Agric platforms too – ThriveAgric and Farmcrowdy – but I haven’t gotten around to checking them out. I’m a very low-risk person, so I like to know things thoroughly before I put my money on them.

What’s your “One sickness away from poverty” safety net?

I have HMO, I have doctor family friends. In fact, I didn’t bother with HMO because our family doctors used to give heavy discounts. Also, my pension is almost a million. Last-last, make God dey protect person.

Happiness Levels?

A solid 7.5. The remaining 2.5 is because I’m not yet collecting bastard money. I guess if I have 1.5 million naira net, my happiness will land on 10. Beyond the money, I have the things I wanty in life; a great support system, good health, so just give me more money.

Oh, and take me out of this country.

I consider myself lucky because I never imagined I’d be doing what I’m currently doing, earning a living off Digital skills.

I’m generally a go-with-the-flow person. I’ve just been lucky to be at the right place, at the right time, with the right people. I definitely work hard, but it’s like 40% luck. I could be working hard in one corner and still be earningn my 20k.

What’s–

–Actually, it’s not luck. It’s 100% hard work and my mother’s prayers. You were saying?

I was going to ask you if there’s something you wanted me to ask that I didn’t already ask.

I dunno, my account number?

Thank you very much. How old are you again?

20.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people.

But, if you want to get the next story before everyone else, with extra sauce and ‘deleted scenes’, just subscribe here. It only takes a minute.

Also, you can find every story in this series here.