Your financial personality influences how you spend and interact with money. Are you a “Soft Life Strategist” or “Budget Luxury Enthusiast”? Or maybe you’re an “Awoof Chaser”? There’s only one way to find out.

Take the quiz:

[ad]

Your financial personality influences how you spend and interact with money. Are you a “Soft Life Strategist” or “Budget Luxury Enthusiast”? Or maybe you’re an “Awoof Chaser”? There’s only one way to find out.

Take the quiz:

[ad]

The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

A little over six months. We started officially dating early this year.

You could say that. Brian and I are coworkers, and for the first two or three months after we met in early 2024, we mostly just hooked up. It was an office fling; we didn’t really talk about it or try to hang out outside work at first.

But we got closer and discovered our similar tastes in music and books. We’d send each other books and read to each other over the phone. Brian was very easy to rant to and banter with. Towards mid-2024, we moved from hooking up at work to visiting each other at home to just enjoy each other’s company.

By the end of the year, Brian asked that we become exclusive. I’d already developed feelings then, but I turned him down.

I’m five years older, and I initially found it weird. I knew he was younger when we started fooling around, but the thrill of forbidden office romance didn’t allow the age thing to sink in my head. But when dating entered the picture, I had to think about it well.

I’ve always dated men a few years older than me or my age mate, so it was new territory. It took me a few months to wrestle with the idea and convince myself no one would beat me for dating someone I love just because he’s a few years younger than me. It’s not like I groomed him or anything.

So, I eventually agreed to see how it goes. It’s been over six months, and it’s been great. We haven’t told our friends, though, and we don’t act like a couple at work. Dating is against the rules. Plus, Brian is quite junior to me at work, so even if dating were allowed, it’d be weird to date a junior staff member openly.

Yes, it does. But I don’t just mean salary; the difference in our salaries is a little over ₦100k. Brian’s career path is more lucrative, and I’m sure that, in a few years, he’ll probably earn more than I do.

I think our age difference is more pronounced in how we think about money and careers in the long term. We’re in very different stages of life. While I’ve been in the professional space for about seven years, Brian is just two years in. I’m not sure how to explain it, but we don’t treat work the same.

For example, my experience has helped me learn to deal with office politics with diplomacy, but Brian doesn’t have time for all that. He doesn’t understand that being careful not to step on toes or avoiding being unnecessarily argumentative doesn’t mean you’re unaware of your rights.

Also, I’m more financially stable. I like to track my expenses, plan for savings and emergency funds, and all that, but Brian is more, “We’ll figure it out as we go.” This might not be due to his age — God, I sound ancient — but I feel like as you grow older, you learn financial planning. Brian doesn’t have that foresight yet.

Not really. I actually just started noticing these differences about a month ago. Maybe it was me snapping out of the honeymoon phase. Don’t get me wrong; my feelings for him haven’t changed. Maybe it’s that thing where you stop seeing someone as a perfect angel and accept they actually have small commas like everyone else.

Back to your question: I’ve raised some of the differences I’ve noticed with Brian, and we’ve talked about them. It’s not like, “Oya, change how you do this today today.” It was more like trying to make him see that there are better ways to do certain things. There’s also a thin line between advising him to do certain things and trying to change him into what I expect him to be. I don’t want him to feel like I’m trying to influence him.

Thankfully, talking is our strength. We communicate our feelings and concerns really well, so there haven’t been any major misunderstandings.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

It’s mostly me talking to him about the importance of saving and planning. He lives alone, and his salary hardly lasts a month between rent, living expenses and the occasional outing. Mine doesn’t do much either, but I put something aside for savings and investments before budgeting for expenses.

Not exactly. We hardly go on outdoor dates since we’re still keeping things lowkey. The last time we went out was about a month ago, and I paid because the date was my idea. We watched a movie at the cinema, and tickets, snacks and drinks cost me ₦25k.

We mostly do indoor dates, and Brian usually cooks or orders food. The most he has gifted me are free e-books and playlists. I randomly buy him cute things, like sunglasses and polo shirts.

I think this is another aspect of an age-gap relationship I didn’t prepare for. I’m used to receiving gifts from partners and them treating me to dates. I don’t expect Brian to do all that because of his current financial level, but sometimes I wish it were possible. I mean, I’m not dating for money, but I also miss being spoiled. Who doesn’t like to be taken care of?

It’s still very modest. I have ₦1.7m in total: ₦300k in emergency funds, ₦1m in savings and ₦400k in investments. I’m not sure I can rest until I have at least ₦10m in my portfolio.

I forced him to save at least ₦20k monthly in his Piggyvest, and last I asked, he had about ₦80k in it. It’s nowhere near a safety net, but it’s a work in progress.

That future can’t be in Nigeria. Brian has been talking about japa a lot recently, and we’re hoping he’ll go through the work visa or permanent residency route. He’ll try the graduate study route if those don’t work out.

I’m not sure we can consider a future together if we’re still in Nigeria. Our culture is still very judgmental about the lady being older than the guy. So, beyond wanting to relocate for better opportunities, I think leaving Nigeria is necessary for us to be together.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: The Undergraduate Dating on a ₦60k Monthly Allowance

[ad]

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

GrabrFi gives Nigerians access to open a US checking account, receive USD payments, spend globally with an international Mastercard, and convert funds to naira—all with no hidden fees. Built for remote workers, freelancers, and creators earning globally. Start here.

Two events come to mind. When I was around 10, I started helping my dad keep stock records at his factory, and he paid me ₦20 or ₦50. I can’t remember how much exactly; I just know it was a very small amount of money.

The second event is also within the same period. My dad sat my brother and me down and gave us a book he titled “Be wise.” Then, he taught us about the Book of Proverbs and how to manage money. I think he saw how I was blowing money anyhow, and wanted me to be more intentional about how I spent. He talked a lot about saving. To be honest, I didn’t really care.

Well, it did a little. At least, in secondary school, I saved for weeks to get my first phone: a Tecno L3 for ₦13500. I remember printing out the picture of the phone and putting it on my locker so I could see it when I woke up every day. I saved all my ₦1k/week pocket money and any extra money I got from relatives to get that phone.

Saving for the phone may have been an isolated event, though. After secondary school in 2014, I got a job working for my cousin. She was in a different state and needed someone to follow up on her clients for some training programs she organised. My job was basically to call the clients and schedule the training.

She paid me ₦10k/month and recharge card. I did that for three months and blew all the money on parties and other random things. See why my dad was trying to get me to make better financial choices?

Yeah. He made and supplied fragrance across the country. It was like our family business; my mum worked there, too. I was a nepo baby growing up. There was no stress about money or anything like that.

At some point after secondary school, things changed a bit. The insurgency in the north — apparently, northerners buy fragrance the most — and the fluctuating exchange rate affected business. My dad had to switch business models, and our living standards reduced slightly. But it was nothing major. We moved from about 17 cars (including personal and commercial) to about four.

I did the job for three months and didn’t do anything again for money until 2016. By then, I was in 200 level at uni. Does this classify as working for money, though? That was when MMM and its cousins were popping, and I used most of my ₦60k allowance to get in on the action too.

I actually made a lot of money in those Ponzi schemes. Money flowed in, and I lavished it on clothes, food, outings, and my babe. She was in Ireland, and I’d regularly send her money in Bitcoin. I had no plan for the money, so I didn’t even take note of how much I was making and spending. After the schemes crashed that year, I still had about ₦200k. I spent that one, too.

In 2018, I started getting a little serious about money. I was in 400 level, and decided to try some businesses with my friends.

The first one we tried was importing electronic shisha pens from China. I told my parents, and my religious mum wanted to lose her mind. But my dad said, “Abeg, let’s run this thing.” He gave me the initial capital I used to import the first set of goods.

The profit was high. Each pen cost ₦500 and we sold it at ₦5k – ₦8k. It would’ve been great, but we sold too many on credit and getting paid became a hassle. Plus, shisha doesn’t hit like weed does. It’s just like puffing flavoured smoke. So, the pens weren’t too popular. Overall, we had a lot of operational inefficiency, and the business didn’t kick off. We did it for six months.

The next business I tried was a total failure.

I went to school in a state that isn’t as developed as Lagos, and my business idea was that people could pay me a percentage to get them gadgets from Lagos. The first client I got wanted an iPhone 6.

He gave me ₦40k, and I found someone willing to sell me the phone on an online marketplace. I paid the person and never saw the phone. Long story short, I had to pay off the ₦40k gbese. That’s how the business ended.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

No abeg. After uni in 2019, I returned to Lagos and chilled for a bit. I felt NYSC was a waste of time, so I didn’t go immediately. Instead, I took advantage of Buhari’s N-Power scheme to learn mixology. I didn’t pay for it; they still paid me ₦10k/month. My dad also supported me with pocket money that year.

To finish the training, I did a three-week internship at a hotel. I suffered in that hotel, sha. Imagine standing for hours to fold towels. I just kept thinking, “So people actually do this?” It was really depressing. It took me going to NYSC camp in November and blowing all the money I’d gathered — about ₦100k — for me to leave that depressive state. So, if you’re ever in a shitty head space, the key to recovery may be to blow money away.

I didn’t want to return to the hotel, so I called my cousin and told her I wanted to do digital marketing. I first learned about digital marketing in university when I attended a seminar on the topic. I liked its flexibility, and I continued gathering bits of knowledge about it over the years.

So, when it came to looking for a PPA, I knew that’s what I wanted to do. My cousin helped me land a ₦25k/month social media management internship with a design agency. This was in addition to NYSC’s ₦19800 stipend and the ₦10k from N-Power. The N-Power payments lasted a year. After about two months, the NYSC stipend also increased to ₦33k, bringing my total income to almost ₦70k.

It was. I didn’t have major expenses; I lived with my parents and drove to work. My dad also paid for fuel, so my life was chill.

Things changed when COVID hit. My job slashed my salary to ₦20k, and the lockdown affected my dad’s business. By then, he’d switched from producing fragrance to running event centres, and no one was going to events. No money entered that house during that period. Omo, I touched suffer. For the first time in my life, my brother and I had to contribute money to support the home’s expenses.

Thankfully, things looked up towards the end of 2020. I got my first big boy job as an account executive at a marketing agency.

₦150k/month. I deployed paid media ads for national and international brands. It was a huge deal, but it was also stressful. At least the money made up for the stress. My family’s situation had improved, so I didn’t have to pick up bills. I was just sending money on outings and food.

Yes, and it gets better. My brother is an ethical hacker, and he managed to find a loophole in the betting system.

I can’t really break it down, but it involved depositing naira and withdrawing the higher dollar equivalent before converting again at the black market rate. The exchange rate meant we made far more than we put in. We also kept the money in USDT and Bitcoin. Essentially, we were betting without losing money. In a day, we could make up to ₦500k.

See, there was money. We balled for five months before the loophole closed. We’d go for long drives, stock the fridge with chocolate and do whatever we wanted. My brother was the brains of the operation, so he had a higher share of the loot. While he used his money to buy lands, I was just balling mine.

I had a girlfriend, and we could just wake up on a random day and decide to chill at hotels. I still saved a little sha. I had ₦1.2m saved when the operation finally crashed. Losing that income source pained me, but it is what it is. I also quit my job. This was in 2021.

The job stressed me too much. Agency work is a lot. My blood pressure consistently spiked, and it was too much for me. So, I quit and crashed at my friend’s place.

For about two months, my routine was to wake up, smoke, spend the day lying down on my friend’s couch, and eat noodles. After I got that out of my system, I turned to freelancing. I figured it’d give me more control over my time, and I could still do digital marketing without an agency breathing down my neck.

I had a good start. A friend I’d made at the agency called and offered me a gig. It was for a brand I’d worked with before, so the campaign went well. The downside to freelancing was the pay, which is based on the campaign budget.

For instance, the campaign budget could be ₦10m for a quarter. The agency takes 10%, which is ₦1m. Out of that ₦1m, my pay is 30%, which is ₦300k, and that’s it for the quarter. Sometimes the agency won’t even pay on time and pile up payments for months.

On a good month, I was averaging ₦75k – ₦100k/month. Other months, I was poor as they come. I had the time I wanted, but money? That was another story. After freelancing for about 10 months, I decided it was enough. I applied for my current job at a government-owned agency and got the role.

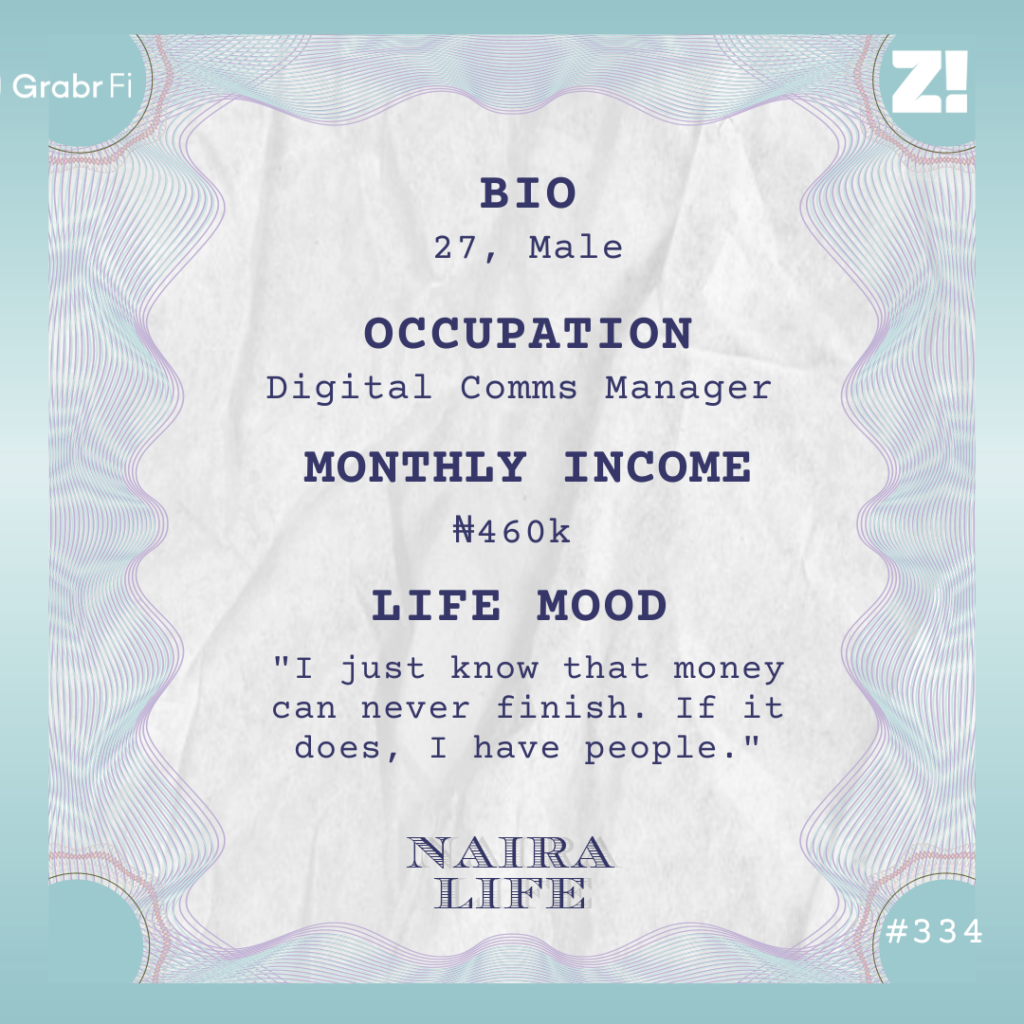

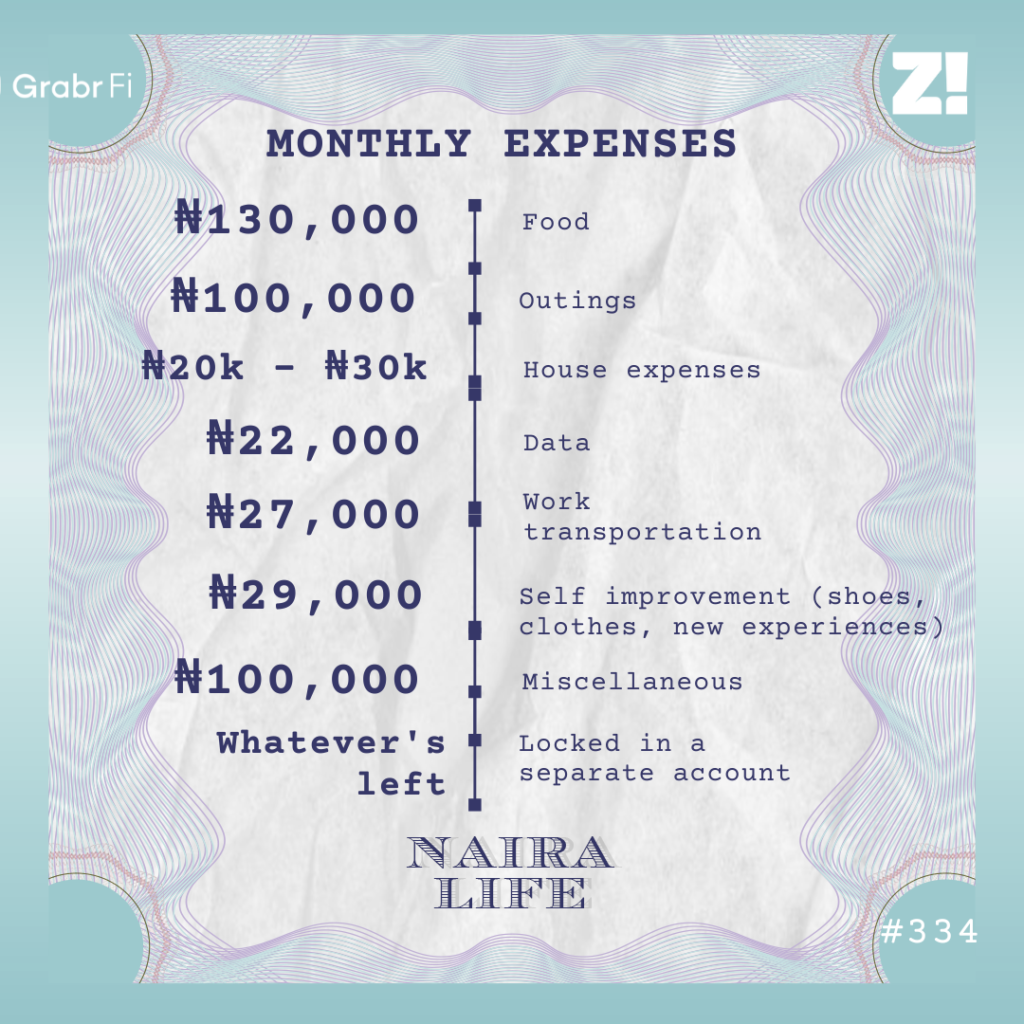

Digital communications manager. When I joined in 2022, my net salary was ₦350k with allowances as high as ₦100k/month. I just got promoted this year, and my net salary has increased to ₦460k. Allowances are an extra ₦140k-ish monthly, but it’s paid in bulk at the beginning of the year. This windfall is around ₦1.6m/year.

I won’t even lie; I live a comfortable life. I mean, I still want far more than what I currently have. I want to drive a Mercedes-Benz and travel to Casablanca. But I have the basics. I live in a shared apartment and pay ₦450k for rent. My transportation costs aren’t too crazy.

I also don’t have any black tax nonsense. I still get financial support from my dad and brother. For instance, they just increased my house rent, and I’ll probably have to leave. I know I can rely on my dad and brother for support. He also readily sponsors my personal development plans.

I’m a part of the Toastmasters community, and my dad paid the initial ₦145k fee for me to join. He also sent me ₦100k for my birthday. My dad randomly sends money to my brother and me. We don’t ask, but he does it. Who am I to reject free money?

Very chaotic. I just know that money can never finish. If it does, I have people. I believe in borrowing money from friends to make considerably large purchases. So, instead of using 100% of my funds, I can borrow like 50%. That way, I don’t stretch my account too thin and can easily pay it back. I can’t spend my money and then start soaking garri. That’s nonsense.

I started this “strategy” when I was freelancing. When I noticed I could make money this month and make nothing the next, I borrowed. The money would help me guide until money came again. I also stretched the repayment plan so I could afford to repay without stress.

I don’t borrow often, only strategically, and my creditworthiness is very high. People know I always pay back, so they don’t have problems loaning me money. I recently borrowed ₦600k from a friend to buy an iPhone. I spaced the repayment into three months, and paying back was easy.

Also, still on my relationship with money, I’m the worst at keeping track of my expenses. I’ve tried, but it’s not working. So, I don’t overthink it. Once I’ve paid for a few necessary things, I lock my money in a separate account and keep it as a backup for rent or emergencies. It’s not really savings because I still take from it, if necessary.

Tracking isn’t my strength, but I’ll try.

I want to be better at managing it and having a tracking system so I know where my money is going.

Maybe I shouldn’t have gotten a 9-5 job. Freelancing would have given me more self-control because I’d know I don’t have a set amount of money coming every month.

Besides that, I don’t have any regrets. I’m comfortable. It can be a softer life, but I dey okay.

₦4.5m/month. I’m not necessarily expecting that from a salary. I’m thinking more in terms of starting my own business or joining the family business. I have a few ideas in mind, but I’ll wait for them to happen first before I share. But I definitely want to go into business. Let me have some free time and money to loaf around and allow the devil to use me small.

A Toyota Camry. I haven’t even checked the price.

7. I’m doing pretty well for myself. I don’t lack or want anything. I’m single, so no Nigerian babe to give me unnecessary expenses. I can be better, but I’m doing okay right now.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]

There’s almost nothing as satisfying as hanging out with your friends after a long week or finally taking that group trip out of the group chat. But after the excitement dies out, the numbers begin to come into focus: Who pays for what?

Money is a sensitive topic for many Nigerians, even more so in friendships. From unspoken rules to awkward moments and wild expectations, these Nigerians share how they navigate the complexities of shared expenses with their friends.

We’re three girls in my friend group, but we also have a few other mutual friends, and everyone often hangs out together as a group.

Our hangouts usually happen at restaurants and are centred around birthdays or other special occasions. When we hang out like that, we choose one person to settle the entire bill. The next time we go out, someone else picks up the bill. We’ve been doing that for about a year. I can’t even remember whose idea it was to start it, but I think it’s pretty stupid.

I’ve picked up the bill thrice since we started the “strategy”, and I often feel cheated. For instance, if Bisi* paid the last time, she knows she won’t pay next month, so she’ll order things she wouldn’t typically order. Or it can be Dorcas’* turn to pay, and her boyfriend will choose to pay on her behalf. Other times, some people don’t show up, and the person paying pays for fewer people, which may not be the case the next time.

The last time I paid, I spent around ₦160k for five people. It was excessive, but I couldn’t complain because I had eaten other people’s money too. My closest friend and I both agree this payment strategy doesn’t make sense, but there’s not much we can do. Everyone else seems fine with it, and if only two people keep complaining, it’d be like we’re trying to avoid paying. The only other option is to stop hanging out with my friends, and that’s not an option.

I share a two-bedroom flat with my guy, and we share the bills equally: rent, groceries, fuel and utilities. We’ve lived together for two years.

It’s a good arrangement because I spend only a fraction of what I’d spend if I lived alone. Plus, we’ve never had any money issues. We both know what we’re supposed to pay for. The only challenge is that my friend is richer and has more expensive tastes.

For instance, he runs the generator immediately NEPA takes light and keeps it on until electricity comes back. We both work remotely, so I understand we need light. But it’s expensive, and I don’t think the generator should be on 24/7. We spend ₦50k weekly on fuel, and I must pay half. I’ve mentioned it to him, but he just jokes about it. The cost doesn’t dent his wallet because he earns ₦1.2m/month, but my own salary is just ₦500k. We’re not on the same level at all.

It’s not just fuel. Sometimes he wants to buy more expensive groceries, and I joke that I can’t afford his taste. We don’t argue about money, but I sometimes feel awkward about explaining why we can’t get certain things. I know he doesn’t mind picking up expenses alone, but I don’t want to be a burden.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

It’s an unspoken rule in my friend group that everyone pays for what they get when we go out. However, we don’t pay separately. If it’s a restaurant, we’ll get the bill and send our share to a designated person.

If the restaurant has a service charge, we add a little extra to the amount we’re sending the person so it can cover it. We don’t calculate that part, though. We just round it up. For instance, instead of paying ₦18k as my share, I send ₦20k.

We also do the same thing for Uber rides. If we’re all going to the same place, we share the money. But most times, only one person pays the fare when we’re returning home.

For instance, if Bolaji* lives in Yaba, people who live along the route enter his Uber so they can drop off along the way. No one needs to pay Bolaji for that.

My friends like to be outside. We’re always meeting up in clubs and bars. I love hanging out with them, but I’ve started avoiding these outings because I don’t know how to mention money.

Here’s how a typical outing with my friends goes: One of them calls and is like, “Moses, we dey XYZ place. You go show?” When I get there, we drink and eat. When the bill comes, sometimes the person who invited me pays. Most times, I have to contribute something.

One time, the bill came to ₦80k, and my guy transferred ₦30k. The other guy with us transferred ₦20k, automatically meaning I had to transfer the balance, which I did.

There have also been times when I’ll arrive at the location and my friends will jokingly say I’m the one paying that day. Of course, I won’t want to fall hands, so I just pay.

I’ve started ignoring these invitations because I never know what they mean for my account. I’m not rich enough to have habits like that, and the worst thing is, I can’t even bring it up. How do you start a “How are we sharing the money?” conversation with your guys? It’s just weird. It’s better not to go unless I’m sure I can afford anything that comes up.

I’ve been friends with Jade* since 2014, and we’ve been transparent with our earnings since we started working in 2020.

My salary has always been slightly higher than hers, usually a ₦30k – ₦100k difference, but it has translated to me automatically taking the bigger share of expenses. I think she actually expects it.

We can be talking about getting a friend a gift now, and Jade will be like, “The gift costs ₦50k. Bring ₦35k, I’ll handle the rest.” One time, we planned a staycation and the cost came down to ₦150k. I handled the payments for the trip, and we agreed that Jade would just send me her share. She only sent me ₦50k and said, “You know you’re my sponsor.”

I feel like my money is just another way to show love to my friend, so I don’t mind paying more. However, I sometimes wonder if that’s how everyone does it. Am I being a mugu, or is it not a big deal?

*Names have been changed for anonymity.

NEXT READ: I Took Loans to Sponsor My Sister’s Education. Now I’m Fighting Addiction and Resentment

[ad]

The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

It’ll be a year in September.

Felicia and I are in the same department, so we’ve known each other since 100 level. We started talking consistently in 200 level because of a group project. Then I started liking her, but I wasn’t sure about approaching her because Felicia is reserved and gives everyone this “don’t come near me” vibe.

Another thing that held me back was my financial status. I’m a student who fully depends on pocket money from my parents and the occasional ₦10k from my brother. A relationship really wasn’t my priority.

But somehow, I found myself making efforts to get closer to Felicia. I eventually asked her out after half a semester of pretending I just wanted to be her friend. She said yes, and here we are today.

Omo, I don’t even know. I guess the heart wants what it wants. I liked her and just decided to give it a try. Fortunately, a relationship hasn’t been as financially consuming as I thought it’d be.

My guys used to tell me ladies only wanted men who could spend on them, but Felicia isn’t like that. At least, she doesn’t bill me. She’s a freelance writer and gets gigs from time to time in addition to pocket money. So, it’s not like she needs money. I’m even the one spending money on her because I feel like I have to.

It’s mostly food. Our uni provides meals for students, but I don’t always like the food. So, sometimes, I buy food and when I do, I buy for Felicia too. That’s about ₦5k – ₦10k weekly on feeding. The only other expense is sending her airtime, and that happens once in a while.

A few months ago, I bought a cake and paid for her photoshoot for her birthday. That cost me ₦55k, and I had to take out some of the emergency money I saved in my Piggyvest to pay for this. This was during semester break, and there was no pocket money, so I didn’t really have money like that.

We also went on a beach date/picnic with some of our friends during that period, and I paid the ₦5k per person fee for both of us. Our friends handled the food and snacks.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

Money? Do girls give guys money? I don’t expect her to give me money. She gives me gifts, though. She got a gift set for my birthday: belt, cufflinks and body spray. She also gave me a card and body spray for Valentine’s Day.

Oh, I forgot to mention that I bought her flowers for Valentine’s Day. That cost me ₦25k.

Felicia is the financially savvy person in our relationship. She’s the saver, and I’m clearly the spender. It’s good we have that balance.

She introduced me to savings apps last year after I sold a phone my aunt sent me and had extra cash. I think I sold the phone for ₦250k. Felicia suggested I keep the money so I wouldn’t spend it unless in an emergency. That’s the money I eventually took from to settle her birthday bills.

Felicia also put me on to mutual funds sometime this year, and while I haven’t started investing in it, it’s definitely on my mind for when I start working.

My safety nets are my parents and the ₦100k+ in my Piggyvest. I know Felicia has savings, but I’m not sure how much she has. She’s very prudent, though, so I guess it’ll be a reasonable amount. I can’t exactly ask. The last time I jokingly referred to her money, it almost caused an issue.

We were having a conversation about a movie. I’m not sure how we got to talking about money, but I said something like, “I don’t mind being a house husband. I know you have money to take care of me.”

She took offence at that, and we had a small fight. I was just joking, but she said, “So you’re the type of guy who will let a woman feed him?” I was just like, “As how?”

We shouted at each other a bit and didn’t talk for a day, but we eventually settled.

I later understood she reacted like that because of her family’s situation. Her mum is the breadwinner, and it causes issues at home. Felicia doesn’t want to be in her mum’s shoes, so my joke struck a nerve. That’s understandable. I don’t think any girl wants to feel like she’ll be the one spending money on a guy. I don’t even want that.

I want to learn a skill before I graduate from school next year. I’ve started learning to code and hope to start making money from it soon. Felicia has also been trying to get dollar-paying writing gigs, and I hope that happens for her soon. I just want both of us to be successful in our respective fields.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: The Community Manager Dating an Abuja Big Boy on a ₦200k Salary

[ad]

Dinah* (29) had to step up financially after her dad’s income loss and eventual death worsened her family’s financial situation. In this story, she talks about turning to loans to fill the income gap. Although she’s grateful she can support her family, she also resents that her sister has it easier.

As a firstborn daughter, I started subconsciously putting my two sisters’ needs ahead of my own from a young age.

At first, it was the small things, like sometimes giving them my snacks when they begged after eating theirs. It was also the occasional big things, like when I was 13 and allowed my 11-year-old sister to wear my Christmas clothes because she was upset that my dad had accidentally burnt hers.

I don’t remember my parents pressuring me to do those things. The most they did was encourage me to be a good example to my sisters. They didn’t explicitly say, “Put them first,” but I took the “be a good example” advice to mean that as well.

I started giving my sisters money when I was in uni. My youngest sister was in JSS 1, and she asked for money the most. It wasn’t serious money, though. Whenever we talked, she’d ask me to buy her something, and I’d send ₦2k or ₦3k through my mum or my second sister.

In 2020, just as I completed NYSC, my father ran into money problems. The lockdown affected his import business, and then he made a bad investment choice that wiped out his savings. My mum stepped in, but her salary as a teacher struggled to fill the gap my dad’s income loss left. We were broke.

To make matters worse, my immediate younger sister was in a private uni, and my youngest sister was just about to enter. The financial burden was a lot, and even though my parents tried their hardest to provide, I could tell they were struggling.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

My mum sold her car, and she stopped attending parties. My mum is the biggest owambe Nigerian aunty ever, and her inability to buy aso-ebi and souvenirs to attend her parties was the biggest indicator that everything wasn’t okay.

Fortunately, I got my first job almost immediately after NYSC. My ₦180k salary wasn’t huge, but it gave me some independence. I didn’t have to add to the financial burden at home; more importantly, I could support my family.

I started chipping in for expenses at home: food, gas, electricity and utility bills. Things weren’t back to normal, but we were surviving.

Then, in 2021, my dad died.

We had to deal with two different types of grief: grief from losing my dad, and grief from relatives who swooped in like vultures to reap where they didn’t sow. The main bone of contention was our house.

My dad had built it before he married my mum, and his brother (my uncle) had contributed financially to the building. My uncle even had some of the land documents, and after my dad died, he attempted to take ownership. When the wahala became too much, my mum decided to leave the house for him.

Our financial responsibilities increased from just trying to survive and pay school fees to paying rent. My mum took on extra after-school tutorials to make more money, but it wasn’t enough.

My two sisters’ private university tuition ran into millions. My immediate younger sister worked several jobs in school to support herself, but my youngest sister didn’t have that advantage. She relied on whatever she got from home.

In 2022, I took a loan for the first time to pay part of my youngest sister’s school fees. Her university allowed us to pay the tuition fees in instalments, but at that point, we were owing ₦300k, and exams were close.

My mum couldn’t find money anywhere, and out of the blue, my bank sent me an email that I was eligible for a quick loan. I took out ₦310k and repaid it in six months. But before I finished repaying that one, I took another “quick” ₦100k loan from a loan app. Why? The repayment schedule from my bank reduced my monthly income to about ₦100k, which hardly covered my transportation and living expenses.

That’s where the loan cycle started. The loans were supposed to be emergency options until my salary came, but I was drowning in a sea of interest rates and repayments. I was taking loans from one place to repay another loan. At my lowest, I was owing seven different loan apps a total of ₦800k and fielding harassment calls from their loan collectors.

Things didn’t improve even after I changed jobs in 2024 and started earning ₦300k. My mum also had to take it easy at work because of a lingering wound from a domestic accident — she has diabetes, which affected the wound healing process— so I became the de facto breadwinner.

I often feel like my youngest sister doesn’t fully appreciate the extent to which my mum and I went to secure her education. This babe called me early this year for ₦350k for final year week celebrations. She wanted to buy a dinner gown, do her hair, and take pictures. She knows I complain about loans, but somehow, she just expects me to come through for her.

She has finally graduated, and I’m glad to be free of the financial burden. However, I’m still stuck in a loan cycle. I owe two different loan apps a total of ₦408k, and I borrow from another at least once a month. I think it’s an addiction because I literally can’t do without loans. My salary doesn’t last two weeks, and I must borrow money to stay afloat.

I’ve tried to mentally calculate how I can afford to be debt-free and not have to take loans anymore, but the only way that’ll work is if I can double my income to ₦600k or ₦700k. With the level I am now, it’s not possible.

I can’t really blame anyone for my financial situation. No one forced me to take the responsibility, and I’m grateful I could support my mum and siblings. That said, I can’t help feeling some sort of resentment towards my youngest sister. She got to live a soft life and will probably never have to worry about providing for any sibling.

Why didn’t I also have the luck of coming as a lastborn? Why did my dad have to die? Did I do too much for my family? Will I ever make sense of my finances?

I’ll probably never have answers to these questions, so it’s best not to dwell on them. I just have to focus on trying to live for myself now and see what my life can be without black tax lurking in the shadows.

*Name has been changed for the sake of anonymity.

NEXT READ: I Spent ₦1.6m Serving Bridesmaid Duties 8 Times in 11 Months

[ad]

The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

Eight months. We started dating at the end of 2024.

I met Farouk at a mutual friend’s family function. I thought he was handsome, so I shot my shot.

Yes. My friends say I’m weird, but I’ve always spoken to guys I like first. I just went up to Farouk and complimented his smile. He thanked me and we talked for a bit. We exchanged numbers and mostly just did the talking stage for the first few weeks.

When I noticed he wasn’t moving things along, I asked him, “Do you want to date me or not? I don’t have time.” He laughed and said, “I thought we were already dating?” I insisted he had to ask me officially, so he took me out to a restaurant and got the kitchen to write “Will you be my girlfriend?” on my dessert plate. That’s how we started dating.

I initially worried that Farouk was indecisive, seeing as I had to push him to make things official, but it’s been almost a year, and I haven’t noticed him dragging out decisions or actions. He’s actually a go-getter, and that’s one of the things I love about him. I also don’t mind that he’s rich and stupidly handsome.

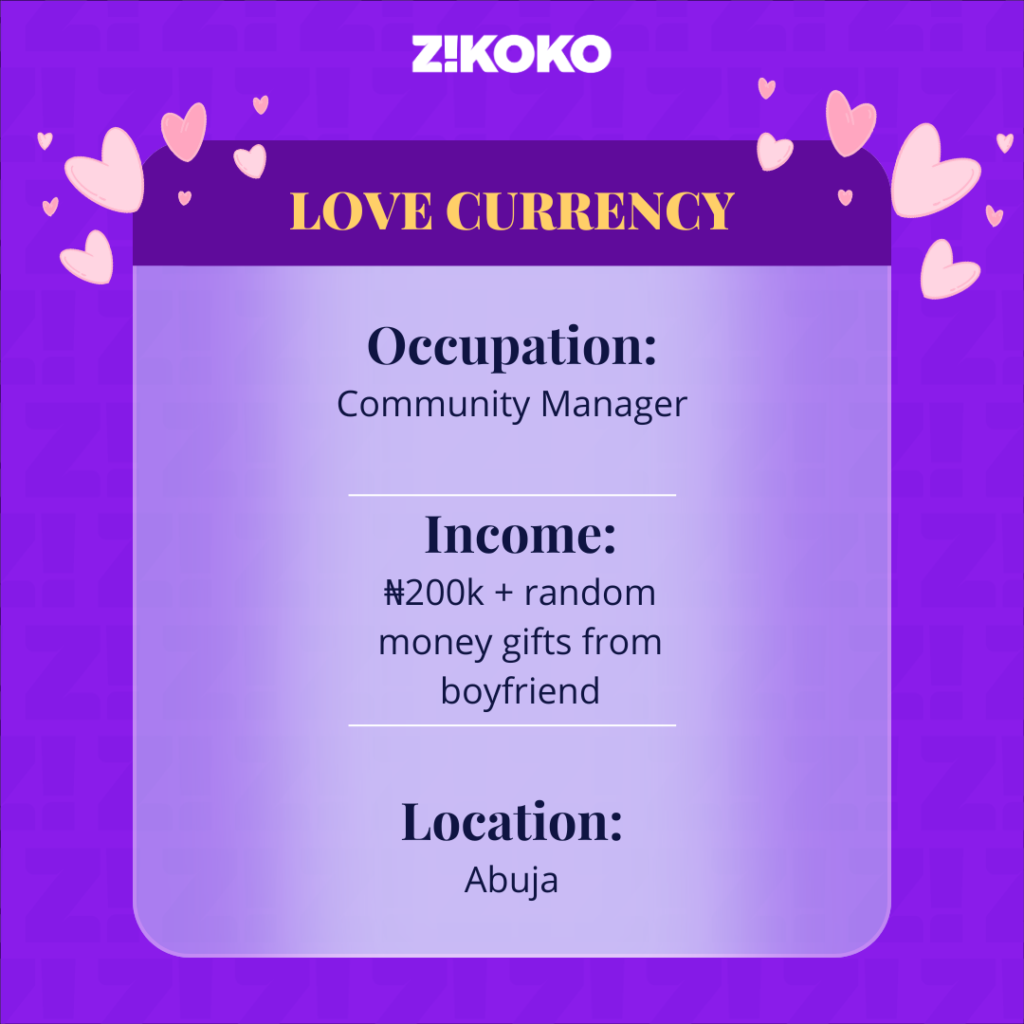

He’s a director in his dad’s company. His family is old money, so he’s not really hands-on with the business. But he has other interests that bring him money; mostly real estate and automobiles. I’m not sure exactly how much he earns, but I know there’s money. He’s constantly taking me out on dates and getting me cute stuff.

For my birthday a few months ago, he got me a designer bag, bracelets, and two pairs of shoes. He must have spent a couple of thousand dollars on that. He also gets me gold jewellery often. He knows I’m obsessed with gold.

Yes, but definitely not as often as he does. I’m a poor 9-5er, please. My gifts to him are mostly perfumes because he’s not much of a perfume person. So, whether it’s an ₦18k perfume or ₦25k, he doesn’t really know the difference. Or maybe he just pretends not to know to make me feel better. I can’t get him things like shoes or watches because I see what he wears, and my power hasn’t reached that level.

Sometimes, I caution Farouk about his spending, but he just looks at me like I’m making a big deal out of nothing. Once, we went to the club, and the bill was around ₦700k. I thought it was too much, but Farouk was like, “Calm down.” I think the thing is, I underestimate how much money he has, so I just try to look away when he spends.

He also sends me money randomly; ₦50k today, ₦100k next week. He doesn’t send me money every week, though. Sometimes twice or thrice a month. I don’t ask. He just does that.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

We go on dates almost every week, and Farouk pays for them. Our dates are typically at restaurants; there is nothing else to try. We don’t hang out at each other’s houses because I live with friends, while Farouk lives with his family. His parents are very conservative. Bringing a girl home is one sin. Bringing one they don’t like is another greater sin.

Well, not me personally. Farouk already told me they’d never accept someone who isn’t a northener, and they have a personal dislike for people from my place. So, the disapproval is already set in place like a stone. I don’t even think he’s allowed to date. An arranged marriage is probably in his future.

That’s not a problem for me, though. I’m not deceiving myself with any marriage imaginations or dreams of a future with him, so that’s fine. I don’t think dating has to lead to marriage. We love each other, and if it ends one day — which it likely will — I’ll be glad I enjoyed my time with him.

I save 10% of my salary monthly, but even I know that’s not a serious number. I plan to increase my savings as I earn more. I currently have ₦180k in my savings. On the bright side, if I’m ever in urgent need, I can sell any of the gold jewellery Farouk has gifted me.

I want to be one of those rich alhaji wives who post “Get Ready With Me” content on social media and just sit pretty while my husband brings money from wherever he’s finding it.

Okay, let me be serious. If we’re thinking in future terms, I’d love us to have joint investments and own property around the world.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: The Husband Who Feels Limited by His ₦220k/Month Salary

[ad]

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Grow your wealth in both dollar and naira, earning up to 15% in USD and 25% in naira. With flexible rates that move with the market, you can switch between wallets anytime to match your financial goals. Start here.

There was no money growing up. For example, I started using glasses in Primary Three to manage short-sightedness, and I remember the series of beatings I got when I lost them in Primary Five. My mum kept saying, “Do you know how much I bought those glasses? I’m not getting you another one.”

I didn’t get another pair of glasses until I was in JSS1, and when I did, the lenses were too strong for me. After I complained, the ophthalmologist retrieved the glasses, but my mum didn’t have money to get me another pair, so I went without glasses for four years. I didn’t get another pair until I was in SS 2.

I’d sit close to the board, yet strain my eyes to make out what’s on it. Other times, I copied notes from classmates.

Once, we were doing class work, and I asked a friend to dictate what was on the board to me. When we all lined up to submit, I went closer to the board to read the questions. It turned out my friend had dictated rubbish to me. Luckily, I still had time to correct my answers, but I felt bad. Someone I considered a friend actually wanted me to fail.

Besides having to rely on people, I also had to endure headaches and watery eyes due to the strain. It was a lot, but I had no choice but to live with it. My parents were civil servants, but my mum handled most of the financial responsibilities and always complained about the economy.

That’s why I started thinking about making money immediately after I finished secondary school in 1999. I didn’t want to depend on my parents or have to explain why I needed something. At least if I made my own money, I could spend it however I wanted.

I started assisting my hairdresser aunt in braiding her clients’ hair. At the time, the “one million braids” hairstyle was popular, and hairdressers always needed assistants to complete it. So, I’d join my aunt, and we’d take about two days to finish one person’s hair. Then she’d pay me ₦400 – ₦600.

This was the 90s, so ₦400 wasn’t bad. Helping my aunt braid two people’s hair meant I could make enough money to go to Underbridge Oshodi and get a body hug top and Lycra trousers, which went for ₦1k.

I was admitted to university in 2000, and I used the first year to explore the environment and see what I could sell. By the time I resumed for my second year, I’d found a business opportunity: selling undies to the ladies in the hostels. I can’t remember exactly how much the business brought me, but I know I no longer depended on my ₦4k/month pocket money.

I ran the business for a year until I completely lost my sight in 2003, when I was in my third year of school.

I don’t know. I was on my way to get new glasses. One lens had gotten lost two weeks earlier, and my mum had just given me ₦4k to replace it. I was walking when my vision suddenly went blurry. I could make out reflections and rays, but couldn’t see people. Like, the imagery wasn’t forming.

I thought it was a joke and kept rubbing my eyes, hoping my sight would “reset”. I’d sometimes deal with blurry sight if a car’s headlight shone into my eyes. This one was different. I managed to get a bike to a friend’s place and begged her to take me to an optician. When we got there, the doctor said there was water retention in my eyes. I was like, “How did water enter my eyes?”

He gave me some medications and said he’d recommend surgery if there was no improvement. I took the medication for days, but nothing changed. My mum and I sought different opinions at eye clinics and did multiple scans. At some point, someone recommended an eye foundation to us, and those ones told me there was no guarantee surgery would bring my sight back. They didn’t even explain the test results; they just said they didn’t see any ray of light. It was LUTH who told us it was retina detachment, and there was no fix, so I had to learn to live with it.

In the beginning, I was hopeful. I kept hoping we’d find a solution. After the doctors told us there was no hope, my mum and I turned to religion and spiritual houses.

We went from prophets to alfas, and spent a whole lot of money. My mum would drop ₦15k here, ₦17k there. One time, we killed a ram. I think we spent ₦30k on that. All of them promised I’d regain my sight in a few days. Nothing changed.

This went on for about five years. Also, my mum handled all these expenses; there was no support from anywhere. Besides her civil service job, my mum had a fabrics and jewellery business, and everything she made went into trying to find a solution for me.

As each spiritualist promised and failed, I went from feeling hopeful to feeling lost and agitated. I felt rejected. Would I have to depend on people all my life? Would I turn out to be a beggar? Every bad thing you can imagine, I thought about it. I attempted suicide twice. Each time I woke up, I asked God why he had to return me to life. I was so overwhelmed.

Thanks. In 2008, someone introduced my mum to blind education. I applied and was accepted into a rehab school. I think it was ₦50k for the year I spent there, but the school changed my outlook on life.

They taught me how to live with my new reality, how to move and navigate my environment with my white cane, how to use a typewriter and computer, how to read and write Braille, and general life and hygiene skills. They also taught me vocational skills, like how to make bags and shoes.

While in school, I took JAMB again and got admitted to study guidance and counselling in 2009.

I might not have even applied if people hadn’t encouraged me to try. I kept thinking, “How do I return to school without my sight?” But I had support. I’d just started dating my husband then, and he’d take me to and from school for registrations.

When I moved into the hostel, I made friends with classmates who helped me navigate attending classes and returning safely to my room. I had one friend who never let me just sit in the hostel. She dragged me along when she went out for shows, campus activities, or just to have fun. I think when you’re good to people, you attract good people too. My friends helped me record notes with my midget recorder so I could listen and use the recordings to read.

During exams, I either went with a reader to read out the questions for me, or the school provided one while I typed out the answers with a typewriter. I should also note that I had to provide everything I needed to study: typing sheets, a recorder, and even my typewriter. The university didn’t owe me anything. As usual, my mum was my main source of financial support.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

I started job-hunting after I graduated in 2014. I reasoned that it’d be better for me to find government employment. I specifically wanted to teach, so I applied to government schools and the Ministry of Education. When nothing positive came after a few months, I decided to apply for a master’s degree instead of just sitting at home.

I got an admission offer in 2015, but it came with a major challenge: how to fund it. My mum didn’t have the capacity to support me anymore, so I turned to people for help. It took a couple of close calls, but I raised the almost ₦140k I needed for admission acceptance and tuition fees. A lecturer even paid my ₦44k hostel fee. God and people really came through for me that year. A fellow student also befriended me and took all my expenses on her head, from food to clothing.

Towards the end of my master’s program, I saw an advertisement for state government teachers. I applied and got employed as a Level 8 teacher in 2016. My salary was around ₦52k/month after deductions.

I can’t even describe how I felt. I knew people around me who, despite their sight, couldn’t get an education or a job. But there I was, with two degrees and a government job just like that. I felt so many emotions: fulfilment, happiness, joy and gratitude.

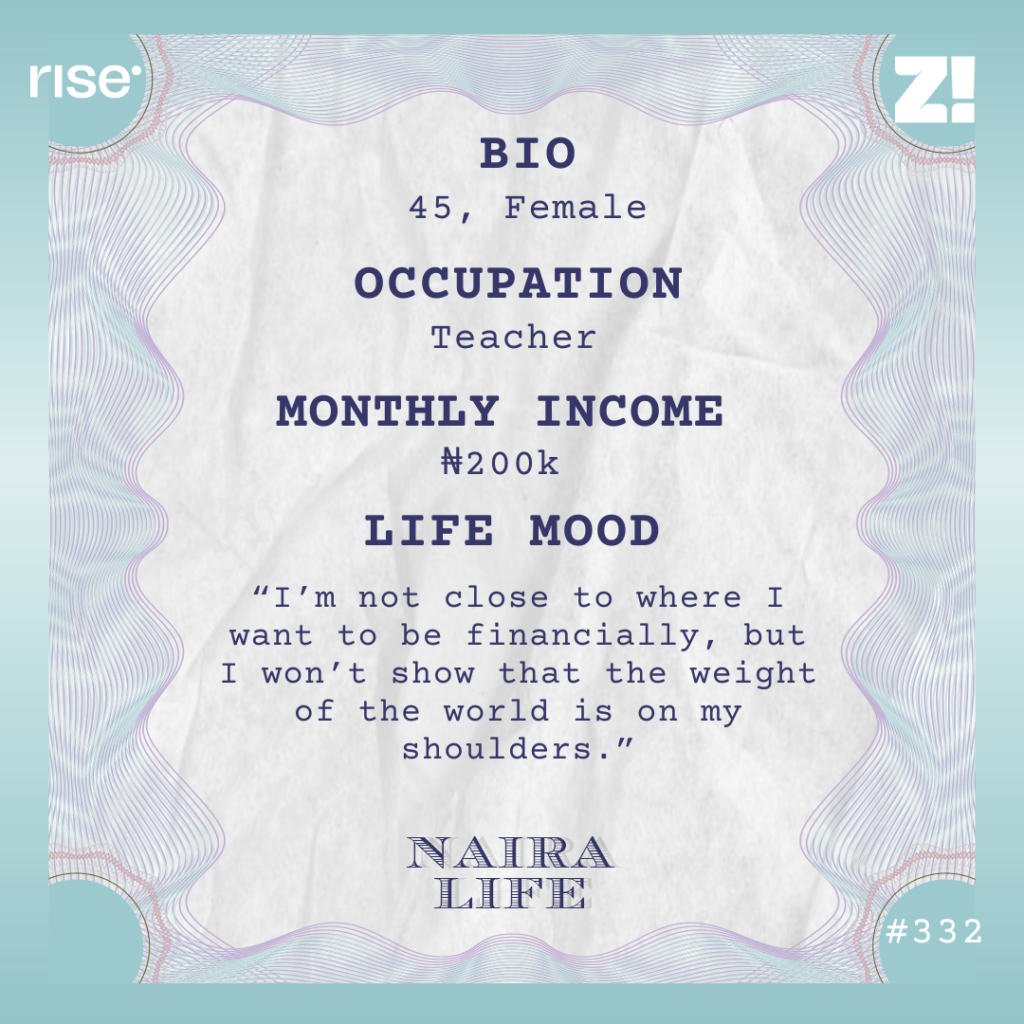

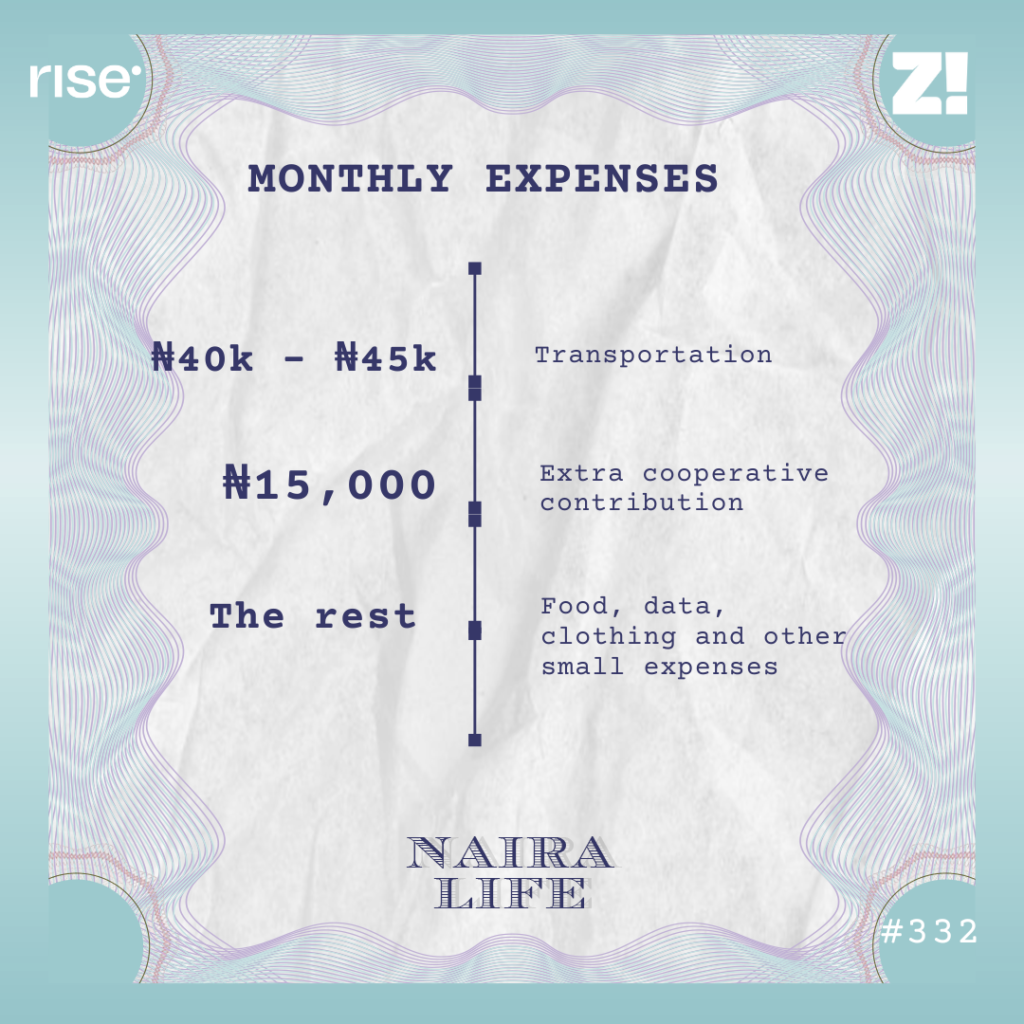

I’m now a Level 12 teacher, and my salary has grown to ₦200k/month. It should be slightly more than that, but I’m part of three cooperatives, and they deduct my monthly contributions from the source.

I’m surviving and can take care of my family to some extent. It’s good to have something consistent, but with the economy, my salary is barely enough. Plus, my expenses are higher than the average person’s. My husband isn’t always comfortable with me using public transportation alone for security reasons.

So, when he can’t go with me or I can’t go alone, I often have to travel with someone. This is especially necessary when I’m at work or need to go for documentation. Of course, I have to pay for their transportation and also feed them that day. So, while someone else is spending ₦1k/day on fare, I’m spending ₦5k-₦10k.

If I could, I’d have explored side hustles like my colleagues, but I don’t have that luxury. During my undergraduate days, I had a stint selling provisions, but someone cheated me, and I stopped.

I used to arrange different cash denominations in a particular way so I could handle transactions. Then, one day, a girl came to buy an egg and handed me what she said was ₦50.

I gave her ₦20 change, but my instincts told me she didn’t give me ₦50, so I kept her money aside. When my roommate returned, I asked her to confirm the note, and it was actually ₦20. So, she essentially bought the egg for free and collected her money back. I decided I couldn’t continue doing business if people would just keep cheating me.

So, even while I want to explore other income opportunities, I’m still limited. I once told someone that I wished I could borrow money from my cooperative to buy a keke so I could ride it and make my money. I’d make enough to support my husband and child. But of course, I can’t do that. I also can’t consider anything involving sales because people will take advantage of my condition.

The cooperative contribution on this list is different from the three that get taken out at source. I just make these two additional contributions personally. I participate in so many cooperatives because they’re the only way I can save and prepare for the future. When I retire, I can have something to keep me before gratuity comes in.

I can’t say there’s an ideal amount. If my salary increases to ₦1m tomorrow, my expenses will grow to match it. A higher income will definitely help my family live better, but I don’t have a particular figure in mind.

Teaching is actually much easier now. The state has an online platform where teachers can download their materials. So, I use a text-to-speech app on my phone to read the materials.

Before, we mostly had printed textbooks, and I had to get someone to snap the pages before my app could read them to me. Whenever I need to use a print material, I can get someone around me to help take photos of the notes. Also, my students are sighted, but I don’t have problems managing them.

A two-storey building.

It’s actually a childhood dream. Growing up, we lived on the ground floor, and the landlord’s family, who lived upstairs, kept throwing things at us. That’s when I decided that if I ever built my own house, it had to be a two-storey building — not to intimidate my neighbours, but to be on top of my building and just enjoy the environment.

I equipped my kitchen with things to make my life easier. I love pounded yam, but I can’t pound. Other people with visual impairments can do it o, I just can’t. I also don’t like frying because of the hot oil. So, I bought an air fryer for ₦35k and a yam pounder for ₦22k.

7.5. I’m a happy person, and I don’t allow things to get to me. I’ve grown past the point of wallowing in my condition. It has happened, and life moves on. I’m not close to where I want to be financially, but I won’t show that the weight of the world is on my shoulders. Also, can I say something to people reading this?

Please, don’t run away from people with disabilities. When you see people standing by the road with their white canes, they probably need help crossing the road or a bridge. It doesn’t hurt to offer help. I’ve had people run away from me when I call out for help. Disability isn’t communicable, and the stigma doesn’t help. There are many of us out here, and we need as much assistance and financial help as possible.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]

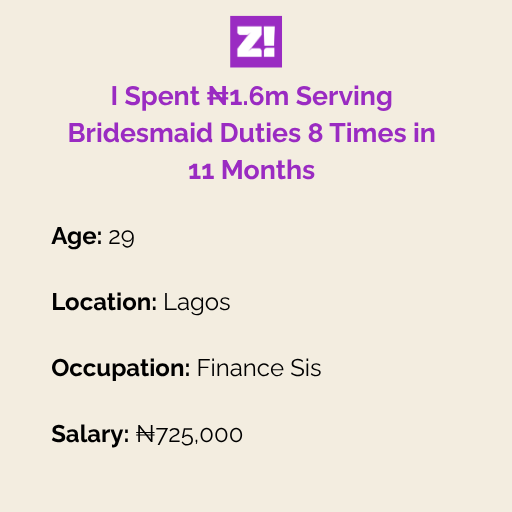

I’m a social butterfly. I make friends everywhere I go, and while that’s usually a good thing, I’ve noticed some disadvantages in the past year: the damage to my bank account. Between August 2024 and July 2025, I attended 12 weddings and was an aso-ebi girl for 8 of them.

For context, an aso-ebi girl is a bridesmaid who wears coordinated outfits with the other ladies/bridesmaids on the bridal train to signify their close ties with the bride. It’s a standard in Nigerian Yoruba weddings. I wasn’t close friends with all 8 brides, but everyone knows you don’t have to be super close to someone before you can ask them to join your bridal party.

As a Yoruba babe, the larger your entourage of aso-ebi girls, the more colourful your wedding. Plus, you get more people to create TikTok content with and have a lit reception entrance. Most of the aso-ebi invitations were from friends, mutual friends, church members and work colleagues. I like to show up for people. I like turning up at weddings and parties even more, but I might have gone overboard with the “turning up” this past year.

I want to make better financial decisions, so I may not take up all the invitations I receive moving forward. But first, let’s go over the damage of the past 8 weddings.

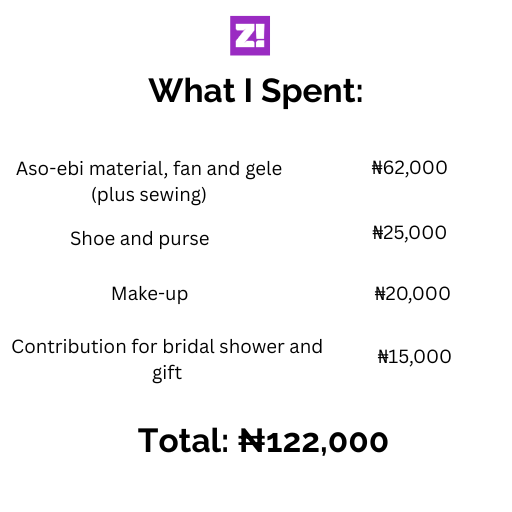

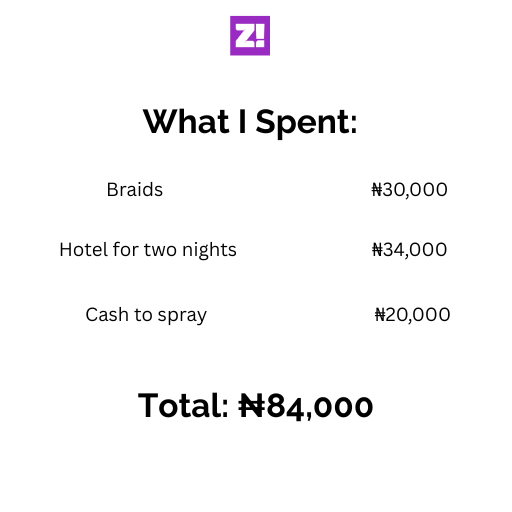

This was my best friend’s wedding, and it was so important to me. I’d been part of their love story since uni, so I took their union personally.

The wedding was a three-day affair: registry, traditional, and church. I wasn’t just an aso-ebi girl; I also doubled as the chief bridesmaid for the church wedding.

This is honestly what I can remember because I sprayed money at the wedding. I must have spent a fortune on transportation to and fro Balogun market, helping my friend with purchases and looking for materials. I also bought her a bridal crown and some accessories for her bridal shower, but I don’t remember the cost. In the end, it was worth it. My friend had a good time, and I did, too.

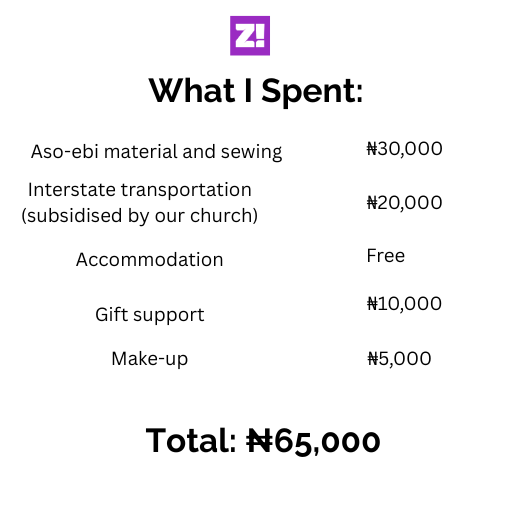

How I became an aso-ebi girl at this wedding was quite interesting. The bride was one of the aso-ebi girls at my best friend’s wedding. I knew her from a distance in uni, but we never interacted until we both joined the bridesmaids’ WhatsApp group. We met a few times to help my best friend with the market runs and the surprise bridal shower plan, so we became cordial. From there, we started commenting on each other’s status updates and chatting occasionally.

A few weeks after my best friend’s wedding, this bride sent me her wedding invitation. I called to congratulate her, and she chipped in that she’d like me to be one of her aso-ebi girls. Apparently, she liked my energy at my best friend’s wedding and wanted me to be part of her big day. I thought, “Why not?” At least the clothes I’d buy would be mine. Plus, I’d get to have fun. So, I agreed.

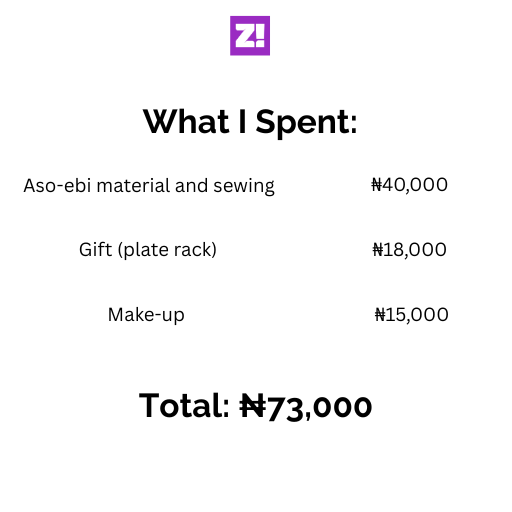

Thankfully, her wedding was low-key, so I didn’t have to spend much.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

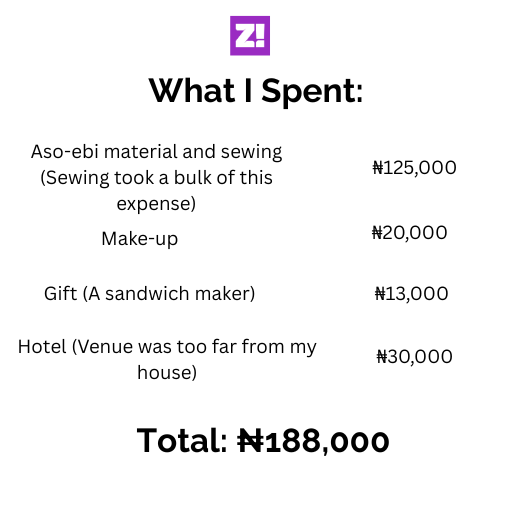

This was my office bestie’s wedding. I don’t think she officially asked me to join her aso-ebi girls. You know how friends comment, “We have a wedding to plan!” after their friend posts proposal pictures online? That’s how it happened. Instead of just office gist, we started gisting about her wedding plans.

One day, the gist extended to the colours she was considering for the day, and she said, “What do you think of pink? You’ll be wearing pink as part of the aso-ebi.” That’s how I became an aso-ebi girl again.

I also sprayed money at this wedding, but I can’t remember how much. On the plus side, the bride’s uncle sprayed me $200, so I recouped my money in a way.

I didn’t enjoy the aso-ebi girl experience at this wedding for several reasons. First off, the other ladies on the bridal train were really somehow. I kept wondering if they were the bride’s friends because they dragged everything on the bridesmaids group: from the style of lace to how much each person was willing to part with. One lady even said, “Must we buy gele? I don’t have money for gele.” Like, which aso-ebi girl doesn’t wear gele?

That aside, I was broke. It was a church member’s wedding, and I’d been aware of the wedding for months (even before weddings 2 and 3). However, my phone had issues around this time, and my account was red. But I’d already agreed to be a bridesmaid, and I couldn’t back out. I ended up borrowing ₦60k from a friend to meet up. I really hated resorting to a loan, but I had no choice.

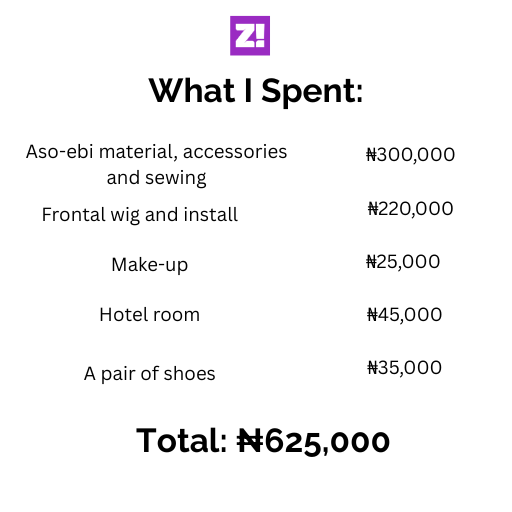

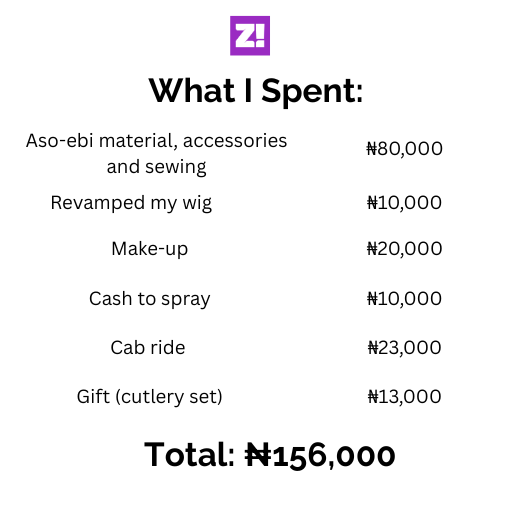

I’ll admit I overdid myself at this wedding. A mutual friend was getting married to a big name in society, and I volunteered to join the aso-ebi because I wanted to experience the paparazzi.

I also work in asset management, and I thought the event would help me meet richer people and expand my network. I may also have been hoping to find a sugar daddy, but I digress.

At this point, I was in an average of two bridesmaids’ WhatsApp groups simultaneously and wondered how I got myself into that mess. The only way I can explain it is that I’m now at an age where almost everyone I know is getting married. Will I take that as a sign? Heck no.

Anyway, this was another work colleague’s wedding. What can I say? I’m popular at my office.

This was my cousin’s wedding, and I spent less than usual because the aso-ebi material was free, and my aunt helped me sew it. My other cousin did my makeup for free, and I received a selfie light as a souvenir for this wedding. It might have been my favourite wedding all year.

The craziest thing about this wedding was that the couple added me to a “Friends of the couple” group. The group’s purpose was to raise money to support them. I thought that was wild because I’m already on your bridal train.

I didn’t contribute any money, and the bride has been acting coldly. The wedding happened some weeks ago, so I’ll just assume she’s still on her honeymoon. Let me wait before jumping to conclusions.

Bottom Line

In total, I spent ₦1,689,000 on eight weddings. I know I spent a lot, but seeing the cold, hard fact is really humbling. The worst part is, there are hidden costs I can’t remember. The silver lining is I always rewear my aso-ebi outfits to church during Thanksgiving Sundays, so I didn’t completely waste money.

Will I stop accepting aso-ebi girl invitations? Probably not. But I intend to reduce it to the bare minimum: only close friends.

I also have a plan to help me become more financially conscious. When I get an invite, I’ll estimate how much the aso-ebi would likely cost and put the money in a savings app instead. It’ll be difficult to enforce because I still love going outside, but I’ll have to try. It’s time to be serious.

NEXT READ: I Tried to Survive on Nigeria’s ₦70k Minimum Wage for a Month. I Only Lasted 14 days

[ad]