Take the quiz:

[ad]

Take the quiz:

[ad]

We stand in the year of our Lord 2024, in the age of modernisation and electric cars, but still, some Nigerians insist on drawing us back with archaic gender arguments every three market days.

Can we petition to leave these arguments in 2024?

I’m not exactly sure how keeping the house you also live in clean constitutes “helping.” Sweeping and washing isn’t a gendered role, people.

Did the government ban restaurants? They exist to satisfy cravings, so by all means, patronise them. Let’s resist the urge to see women as permanent fixtures in the kitchen.

Anyone can. No constitution says the man should make more money. In fact, when women have money, they’re more likely to spend it on family, loved ones and community.

That’s like saying you don’t want to see a woman in power because your distant relative’s long-lost neighbour once had a wicked boss who happened to be female. Let that stereotype go, please.

People often use this argument to try to deny women access to equal opportunities or make them feel unreasonable in an argument. Men are emotional too, and the “logic” part isn’t missing in women’s brains, dears.

Wouldn’t you be proud of yourself if you overcame societal barriers to gain access to education and financial resources and earned the means to make better decisions for yourself and your family?

Anyway, there are more important things to discuss. Join the #HerMoneyHerPower campaign with BellaNaija and The She Tank to champion important conversations about women’s economic power in Nigeria.

Follow @bellanaija and @theshetank on all platforms for more information.

[ad]

Love Life is a Zikoko weekly series about love, relationships, situationships, entanglements and everything in between.

Joke: I knew Makin from a distance during our university days. He was in a different department and two years ahead of me, but I usually saw him at a popular study hub close to school.

Makin held mathematics tutorials for fellow students, and he continued even after he graduated. I had to retake a maths course in 300 level, and that’s how I became one of his students in 2017.

Makin: I noticed Joke because she was easily one of my smartest students — and beautiful, of course — and I was curious about how she got a carryover. We started talking, and our conversations moved from academics to general life. It became a tradition for her to wait for me after class so we could talk as I walked her to her hostel.

She retook the course and passed, but we remained friends.

Makin: The following year, I got a job at an offshore company in another state and couldn’t talk to Joke during the first two weeks because there was no network signal on the rig. I didn’t get myself throughout that period. I missed her so much.

Joke: It was the longest we’d gone without talking to each other. I missed him, but I didn’t want to think about it too much. He hadn’t hinted at anything beyond friendship, and I didn’t want to start catching feelings. But that changed when he returned from the rig.

Makin: I went straight to her hostel the moment I landed back in the state. I didn’t even go home to change. Two weeks away from her made me realise what I felt was more than friendship, and I had to tell her immediately.

Joke: I was pleasantly surprised but also really excited. I hadn’t let myself consider the possibility of us being together, but there he was, energetically confessing his feelings. He asked me to be his girlfriend, we kissed, and the relationship officially started.

Joke: Makin was very intentional. Whenever he wasn’t on the rig, he spent time with me. We talked a lot about our future, went out on dates, and he wrote me little love notes. When NYSC sent me to the North in 2018, he took quarterly flights to come and be with me.

That’s why it was a huge surprise when I found out he cheated.

Makin: I made a mistake, Joke. It wasn’t exactly cheating.

Joke: Really?

Joke: We were discussing an investment scheme someone had told him about on one of his visits to my base. The lady had sent some of the information to his WhatsApp, so he gave me his phone to read it. Out of curiosity, I scrolled up to see what his communication with this lady was like, and I saw that they’d been sexting.

Makin: It happened only once with her. The lady and I had a fling years before I met Joke, but it fizzled out, and we remained casual friends. The sexting thing happened because Joke and I were going through a rough patch, and I lost my head for a bit. But it’s not an excuse for what I did.

Makin: Joke is a very opinionated woman, and I’m more traditional. I expect that while a couple can have different views, the man should ultimately make the final decision. This doesn’t always sit well with Joke.

During that period, we’d argued over what would happen if she didn’t get a job in the state where we lived or where I worked. I argued that it made more sense for her to move to the state where I worked, but she didn’t think we had to settle there because it wouldn’t exactly make the distance shorter. I’d still travel to the rig for weeks at a time.

It became an issue, and we didn’t talk for a whole day. That’s another issue with Joke —when she’s angry, she becomes withdrawn.

Joke: So, I guess the solution was running to another woman?

Makin: I’m sorry.

Help Shape Nigeria’s Biggest Love Report! We’re asking Nigerians about relationships, marriage, sex, money, and everything in between. Your anonymous answers will become a landmark report on modern Nigerian love. Click here to take the survey. It’s 100% anonymous.

Joke: He begged for days, swore it’d never happen again and even involved my mum. We both come from closely-knit families, and our parents knew about us almost as soon as we started dating. Makin is especially close to my mum, so he called and asked her to beg me. He didn’t tell her what he did, though.

I forgave him after a week. I considered it a first-time slip-up and thought I shouldn’t let it destroy what we had. He was still kind and loving and appeared truly sorry.

Makin: I was truly sorry. Since those first two weeks on the rig, I’ve known I want to spend the rest of my life with Joke, and I couldn’t afford to lose her. Thankfully, we moved past it and got married in 2019.

Joke: A mistake.

Makin: I haven’t been the best husband, but I love Joke and want to make things right.

Joke: We’ve had several misunderstandings due to our slightly different views on gender roles. Makin thinks he should have the final say, but I think I should be allowed to disagree. I expect him to offer to help with chores when he’s home — emphasis on “offer” because I’ll likely tell him not to bother. It’s just the thought that counts. But he doesn’t think I should expect that of him.

Makin: I don’t have a problem with helping out. It’s the tone of her voice when she makes these complaints. She often makes it seem like I’m sitting doing nothing and just watching her do all the chores, but I chip in sometimes. Plus, she works remotely, and I’m not always home. Surely, she shouldn’t mind catering to me for the weeks we’re together.

Joke: I hear that, and over the years, I’ve deliberately tried to reduce the complaints. Of course, we still clashed a few times, but I think that’s normal in a marriage. Couples will always have minor misunderstandings. But that’s not why I think marrying Makin was a mistake; it’s because of the cheating.

Joke: More like episodes. I caught him sexting two more people at different points over the years. The first one happened six months into our marriage. The second one was just after we celebrated our third anniversary. Each time, he promised it’d never happen again.

Makin: I really wanted to tell Joke before she found the chats on my phone. I know I have a weakness for women, which becomes worse whenever my wife and I aren’t on good terms.

Both cases were stupid lapses in judgment, and I didn’t clear the chats because I wanted to come clean. But I was scared of telling Joke; I didn’t want her to leave me. I know now that was a foolish justification because I had no one to talk to when my weakness almost destroyed my marriage.

Makin: I had an affair with someone from work last year.

Joke: Let me give you the gory details. Makin slept with a subordinate at work for seven months and only stopped when a colleague caught them going at it in the office.

Joke: He came clean when he got fired a week later. I was heartbroken. I couldn’t believe Makin would actually go that far. His begging and grovelling only made me angrier, so I packed out of the house and moved in with my mum.

Makin: I’ll forever be sorry for hurting Joke. She doesn’t believe me, but I never intended to break her heart and trust that way. I desperately tried to end the affair several times and even avoided the lady, but somehow, I kept going back.

Joke: It was that good, abi?

Makin: No, babe. I was just stupid, please. I’m really sorry.

Joke: Yes. I returned home after three months. I’d already started looking for a divorce lawyer, but Makin and my mum kept pleading with me. Honestly, my mum is the only reason we’re still together. She’s hypertensive, and she was constantly worrying about her only daughter being a divorcee. I didn’t want anything to affect her health negatively.

Makin: I have no choice but to accept it. But I also see an opportunity to rebuild Joke’s love and trust. She has every reason to hate me, but I just want her to see that I’m a new man. The whole ordeal with my workplace led me to God, and I’ve rededicated my life to Christ. I want to build a home that both God and my wife are proud of. I don’t mind how long it takes.

Joke: This isn’t the first time I’ve heard this, though the God part is new. Every time it happens, he claims he’s a changed man and swears on his life that it’ll never happen again. Yet he somehow does something worse after.

I honestly feel I’ll regret coming back. Apart from my mum, you’re the only person I’ve told about this. Because how do I tell people I let a man play in my face, not once or twice?

Joke: I didn’t even share how learning about the affair drove me to depression. I kept wondering if I wasn’t enough. I contributed equally to home expenses and even bought him his car— the same one he used to carry his little girlfriend around. I never denied this man sex. Wasn’t I doing it well enough for him?

Or, is it because we still don’t have a child? The doctor said Makin was the problem, but was an affair his way of trying his luck somewhere else? I kept wishing I could rewind time so I’d have left the first time he cheated. Anything to stop this mistake of a marriage from happening in the first place.

It took several months before I came to terms with the fact that I couldn’t blame myself for his actions. I’m still pained, but it was his decision to do what he did. My focus now is on myself and my career. I may still be in this marriage, but I can’t pretend that the love is still here.

[ad]

Makin: I suggested it when Joke first returned home, but I was unemployed, and Joke wasn’t interested in paying for it. However, I got a new job a few months ago and I’m trying to convince Joke to let us talk to a counsellor.

Joke: I think it will be a waste of time. Talking about the affairs for an extended period of time will only bring back the pain. Plus, counselling is like saying we want to work to rebuild our union. I don’t want to dedicate my efforts and emotions to repairing our connection because it’ll only hurt more when he cheats again.

Makin: Believe me, babe. It’ll never happen again.

Joke: Right.

Joke: We’re basically roommates who have sex with each other. Makin has been trying to be more helpful around the house and buys me things to win my love back. It works sometimes and for a few days, I like him again. But then I remember and it hurts all over again. I can’t afford to love or trust him because it won’t end well for me.

Makin: Things are still very up and down right now, but I see it as me needing to put in more work to get Joke back. I can’t live without her, and I’ll keep trying until she believes I’ll never hurt her again.

Joke: 2. This wasn’t the life I envisioned in marriage, and I would be long gone if not for my mum.

Makin: 4. We’re a work in progress. I know I messed things up, but I believe we can still be happy again.

Check back every Thursday by 9 AM for new Love Life stories here. The stories will also be a part of the Ships newsletter, so sign up here.

Help Shape Nigeria’s Biggest Love Report! We’re asking Nigerians about relationships, marriage, sex, money, and everything in between. Your anonymous answers will become a landmark report on modern Nigerian love. Click here to take the survey. It’s 100% anonymous.

Folu* (27) went through the better part of his life believing he had the “AA” genotype. He talks about only finding out he had a different genotype after falling in love and why he blames Nigeria for the heartbreak he’s currently navigating.

Image: Canva AI

I fantasise about leaving Nigeria, but the state of the economy isn’t what fuels my japa dreams. It’s because Nigeria and the system’s “anyhowness” cost me the love of my life, and I know my story would’ve been different if I wasn’t in this country.

Secondary school was my first introduction to genotypes and sickle cell. My biology teacher painted a horror picture of sickle cell complications and why people with the AS genotypes needed to steer clear of each other. Thinking about it now, it must’ve been weird for Mariam*, the only sickle cell patient in our class.

Before that biology class, I didn’t really have reasons to pay attention to sickle cell. Sure, I was mildly curious about how often Mariam missed school and the fact that she carried an ID card that exempted her from doing any school chores. But we weren’t close, and I couldn’t ask her about it.

When I returned from school that day, I asked my parents about my genotype, and they said I had the “AA” genotype. I was happy to hear this and saw no need to think about genotypes again. My teacher said “AA” was the best, so I felt lucky.

When I got into uni, genotypes became a recurring topic of discussion. I often heard stories of people who broke up with their significant others because they were both of the “AS” genotype and couldn’t risk the lifetime of pain and medical expenses that having a child with the “SS” genotype would bring.

I even joined others to loudly share my disapproval whenever a story popped up online about couples who went ahead to marry without making the necessary genotype findings and eventually gave birth to sickle cell children. It’s the 20th century; surely everyone knows to confirm their genotypes, right?

I didn’t bother to confirm my own genotype until 2021, and I only got tested because of Layo*. I met Layo during NYSC orientation camp and fell head over heels in love with her. The way I fell in love is still a wonder to me because I always thought people who went to camp and fell in love were unserious. Like, can’t you stay three weeks without pursuing love?

But I saw Layo’s smile from across the studio, where we both volunteered with the Orientation Broadcasting Service (OBS) for NYSC camp, and I lost all rational thought. Layo is breathtakingly beautiful.

Working together made me realise Layo’s brain and heart were even more beautiful, and I fell harder. The icing on the cake? She was attracted to me, too. I’m sure other corps members in camp would’ve noticed the two lovebirds who always walked hand-in-hand to Mammy market like love-sick fools.

I’m not sure when we officially got into a relationship, but we became closer after camp. Our PPAs weren’t too far apart, so we were always in each other’s spaces. After work, I’d take a keke to Layo’s workplace because she closed much later than me. I’d wait in her office, and then we’d walk to her lodge when she closed from work.

Sometimes, we ended up at my lodge, and we’d just talk and talk for hours. Other times, we just cuddled in silence. But we talked a lot. It was like we wanted to know as much about the other person as possible.

During one of our talking sessions, Layo told me she had the “AS” genotype, and I replied, “I don’t even care. I’m AA.” We didn’t discuss genotypes again until about four months into our relationship.

Layo saw a Twitter post about someone who got a false genotype result at a lab in Lagos and joked about how false results could be the reason church people believe their genotypes or HIV statuses “miraculously” changed after prayers. At one point, the conversation changed to how people needed to ensure they use standard labs for tests, and Layo asked where I did my genotype test. I confessed I’d actually never checked it myself; I just followed what my parents said.

Layo thought that was weird and insisted I do my test. So, I went to what I assumed was a standard lab in Ibadan and got tested— the result confirmed my “AA” genotype. I didn’t expect anything different because my parents already told me years ago. I also didn’t expect that my world would crash a year later.

I volunteered to donate blood to a blood drive in 2023, and as part of the preliminary tests, the organisation also tested for genotype. I remember being so shocked when they gave me my result slip, and I saw “AS” under genotype. I told Layo about it, and we decided it was probably an error.

We repeated the test at three different hospitals in Lagos and got “AS” every time. Confused, I asked my parents if they actually tested my genotype, and they insisted they did. They confirmed that they did the test for both me and my sister after birth, and we were both “AA”. We re-tested everyone in my family, and it turned out that my parents were “AA” and “AS”, and only my sister was “AA”.

It took a while for the reality of what was happening to kick in. Layo was with me through the whole re-testing period, but after it was all over, we had to face the fact that it’d affect our relationship.

We cried for a long time and briefly considered breaking up. But we both lost our resolve after not speaking to each other for only one day. That’s when we agreed that we’d just adopt after marriage. We loved each other too much to end things after almost two years because of a false result. It wasn’t like we knowingly built a life together knowing we were “AS”. Nigeria had deceived both of us, and we didn’t have to suffer for it.

We also decided not to tell our parents to avoid them pressuring us to separate. That settled, we began planning to get married in late 2024. We were so confident that our genotypes were the least of our worries.

Then Layo accidentally got pregnant towards the end of 2023, and we made the difficult decision to abort. We couldn’t risk the possibility that our child would have sickle cell.

That abortion broke our relationship. Layo never recovered from the trauma of losing a baby, and I couldn’t get through to her. We stopped talking and cuddling. It was like she wanted to be as far away from me as possible.

Three weeks after the abortion, Layo told me she wanted to break up. Pregnancy and losing the baby had made her realise she actually wanted to have her own child and wasn’t sure she wouldn’t one day resent me for taking that choice away from her.

There’s nothing I didn’t use to beg Layo. I cried, pleaded and grovelled, but nothing worked. I even agreed we could have at least one biological child and promised to raise money to do a bone marrow transplant if the child turned out to have sickle cell, but Layo said it wasn’t realistic.

It’s been almost a year since Layo ended things between us, and it feels like the pain will never go away. Some days, I don’t even want to wake up. My friends have suggested therapy and even held interventions, but I’ve lost interest in everything. I see Layo everywhere I go. Everything reminds me of her. I see her in my dreams.

I don’t know if I’ll ever move on. I don’t even know if I want to. I still stalk her every day and wonder how she could move on so quickly. I dread the day I find out she’s with someone else.

Maybe the pain would’ve been easier to manage if the first genotype result had been accurate. We were just four months into the relationship, and I might have moved on easily. Now, I just want to curl up somewhere and cry all day.

*Some names have been changed for the sake of anonymity.

NEXT READ: Losing My Cousin to Sickle Cell Changed Everything I Thought About Family

[ad]

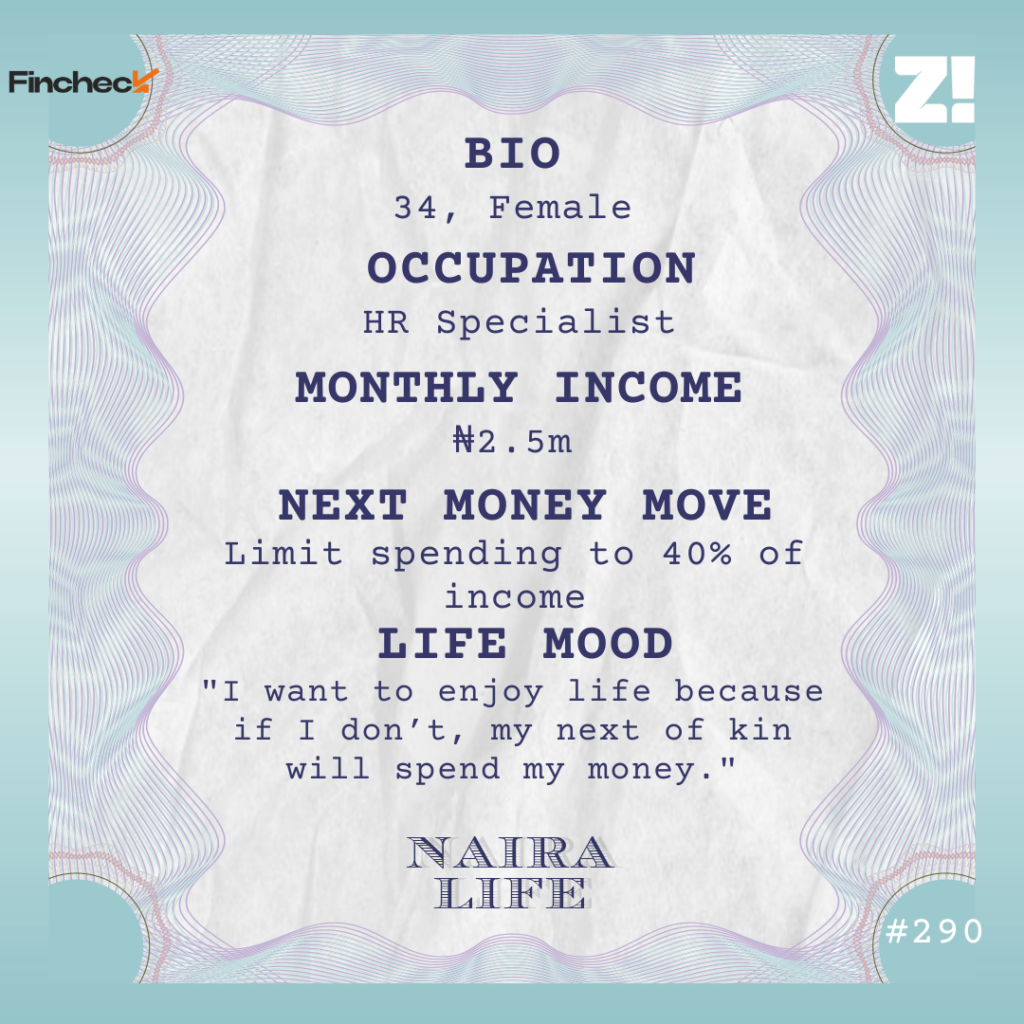

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Oya, time to face your money wahala! Are you a baller or just full of grammar? Take the Leadway Fincheck quiz and find out if your pocket is hot or your village people are working overtime. It’s time for Check Up. Are you an Odogwu or a brokie? Let’s find out.

It has to be when I transitioned to boarding school in primary three, and my classmates started treating me differently. Boarding students paid more than day students, and my school saw boarders as being on a different, higher level.

I realised money creates a level of classism, if that makes sense. Money wasn’t really something we talked about at home, probably because I come from a broken home. My dad only came around to drop food and clothes and pay school fees.

I’m the first child, and my earliest memories of my parents were their fights. Their marriage was pretty toxic, and they eventually separated when I was in primary school. My dad moved to another state but visited every three to four months. He spent the weekend with my siblings and me during those visits.

He remained the breadwinner even after the separation; his job with the federal government meant he earned more than my teacher-mum. My siblings and I went to the best schools and didn’t really lack anything.

But my parents weren’t the ones to care about their children’s emotions. My dad’s own was to make sure we were well-fed and in school, while my mum took out her aggression and annoyance with my dad on us— mostly me because I’m the first. Even though we lived together, my mum and I didn’t have much of a relationship. I was closer to my dad because he was financially responsible for us.

After I graduated from secondary school in 2008, I moved in with my dad and got first-hand experience of how hard he worked. He constantly picked up different side gigs and quickly moved up the corporate ladder. Watching him influenced my work ethic; how I saw money and the importance of working for it. I appreciated those lessons more when I started working for money.

2012. I moved to the UK to study law, and to sort my feeding expenses, I first worked as a customer service rep at a McDonald’s. My pay was £7/hour, and I worked 20-hour shifts every weekend for a whole month to make £450 after tax.

It was a wake-up call to notice just how much my dad sacrificed for me and my siblings. My school fees was £17k/year plus another £700/month for accommodation, and he was also putting my two siblings through school abroad and paying for their accommodation as well.

This is random, but my dad has a saying, “I’m not waiting for the fruits of my labour on my children. I’ll eat my fruits now.” I grew up knowing that while my dad would provide for us, his money or properties weren’t mine. I’d have to work hard for what I wanted because my dad didn’t expect me to bank on him for anything besides the basics. Moving to the UK made that extremely clear.

Not really. I worked there until my second year in uni. Then, a friend introduced me to care work with the NHS (National Health Service). I got a job as a healthcare assistant, and my salary was around £800 – £1k/month. During the summer, I earned more because I could work up to 40 – 60 hours/week. I was with the NHS until I finished my degree and the extra year it took to get my master’s degree.

My salary was enough to cover my living expenses and short summer trips to European countries with my friends. I also started sending money home to my mum during this period. She didn’t earn much as a teacher, and I thought I had to support her. I even helped her change apartments and contributed to her getting a car.

I finished my master’s in 2017 and returned to Nigeria the following year to start my professional career.

I didn’t want to, but my dad wanted me to go to law school so I’d be licensed to practise in Nigeria.

However, working in the NHS made me realise I enjoyed administrative work and speaking to patients. With the help of one of my uni professors, I decided that the best career path for me was human resources. After that, I did an 18-month online CIPD certification and became a certified human resource personnel in the UK. This was in 2017.

He didn’t understand why I’d get a law master’s degree and decide not to practise.

Thankfully, an uncle intervened, and we came to a compromise: I’d intern with a law firm in Nigeria to figure out if I wanted to work as a lawyer.

I interned for four months, and the firm paid me ₦40k/month. Two months into the internship, the firm’s partner told me plainly that I wasn’t built to be a lawyer. It was obvious my mind wasn’t there.

I told her about my HR career aspirations and she advised me to attend law school because a good HR personnel needed to understand the labour implications of the profession.

So, I went to law school in 2018 and got called to the bar in 2019. My dad sustained me through law school with a ₦70k/month allowance. I had about ₦500k in my savings but I didn’t have to touch it because of the allowance, not until I left home in 2019.

My dad wanted me to take a legal personnel job at his workplace, and I didn’t want it. We butted heads over it, and it was clear I couldn’t remain in his house and disobey him. So, I moved in with a friend and planned to live on my savings till I found a job.

Fortunately, I found one as an intern at a management consulting firm. They paid me ₦50k/month because of my master’s degree. Apparently, they paid interns ₦40k.

The money wasn’t great, but I had no major responsibilities. I still stayed with my friend, and while I pitched in, it wasn’t a financial burden.

But the work? It was hectic. I had to figure out many things myself. I was also super intentional about building relationships, and I attended every single HR event and was in the LinkedIn DMs of every senior HR person. I was determined to build a solid HR career.

I got my next job with a stroke of luck and faith. Towards the end of 2019, someone referred me for an executive assistant role that offered ₦200k/month, but I rejected it because I’d be a glorified errand girl. Everyone thought I was mad.

But then, a week later, I applied to a multinational company. In January 2020, I was employed as a human resources officer, and the salary was also ₦200k/month. After the three-month probation period, my salary increased to ₦300k and then to ₦400k after six months.

I know, right? And I still didn’t have to pay rent. My friend who accommodated me relocated in April 2020, but a mentor offered me a space in her home so I could save my money.

I didn’t pay rent until 2022, when I got a ₦1.8m/year shared apartment. From 2020 to 2022, I comfortably saved ₦200k/month.

Most of my savings went into crypto and stocks.

I was just flipping the coins. If I bought ₦100k worth of coins and found out it was worth ₦150k the next day, I’d remove the ₦50k, spend it as free money, and buy more coins.

I didn’t really touch my stocks, though. I also saved a small percentage in a savings app. At the end of the year, I’d gather my savings to travel for a holiday in the UK.

When I left the multinational in 2022, my salary had grown to ₦525k/month.

An international company poached me and offered me double my salary. My new salary was ₦1.2m with stock options, and I could work remotely. It was a no-brainer.

But you know how they say, “The more money you earn, the more your problems,” right?

It did. I moved to a ₦2.5m/year apartment, excluding service charges and other dues. There were other small lifestyle changes, too — spending a little more here and buying a few more things there.

Then, the 2022 crypto crash happened, and I lost about ₦2m worth of my crypto investment. I also invested ₦1.6m in an agric company that folded up. In 2023 again, I took a ₦4.5m loan to help an ex raise the proof of funds he needed to japa. He blocked me after relocation, and I’m still repaying that loan.

It’s my biggest financial regret till date. I pay ₦410k monthly and should be done in November this year.

I haven’t really felt the impact of the loan deductions because I got an extra income source in November 2022. My job had started to feel monotonous, so I took up a part-time HR consultant role that pays me an extra ₦1m monthly.

But my salary from my 9-5 has reduced. The company hit a rough patch early this year and laid off staff. I didn’t lose my job, but they cut my hours to 20 weekly, and my employment is now on a contract basis. My salary went down to ₦930k/month, and I get a quarterly ₦1.8m bonus.

I also get occasional small recruitment and startup advisory side gigs that bring roughly ₦500k/month.

Right now, I’m sure of at least ₦2.5m monthly from my jobs and side gigs.

[ad]

I can afford most of what I want. But am I comfortable? Nope. I don’t think that’s even possible in this country. I want to earn more, and I’m looking to get a foreign-currency paying job, so I can hedge against inflation. For instance, I can’t travel to the UK this year for holiday because I can’t afford it any more. I could afford it in 2020, and I wasn’t earning as much as I do now. Maybe I’ll make do with Ghana.

Black tax is also at an all-time high. I have ₦1m in naira savings, because I spent roughly ₦5m on my brother’s wedding a few months ago — as per first child.

My mum is also really entitled. I give her a ₦100k monthly allowance and also pay her ₦500k rent, but she’s constantly asking for more money. Sometimes, she sends her bank statements to show she’s broke so I can cough out money. I recently installed solar electricity at her house, bought a generator and bigger TV, but the expenses never end.

I’m definitely not. We never had much of a relationship, and she was never financially responsible for me, so most of the time, I feel like my mum doesn’t deserve my money. I’m not happy about it. I just give her because I have a conscience.

My dad and I got back on talking terms after I got the international job. I prefer to spend my money on him, but he has no use for it. I try to make up for it by buying him stuff when I travel or for his birthday.

But my mum? Nah. She doesn’t deserve it. In fact, what I do now is block her after sending her monthly allowance so she doesn’t call for more money. Then, I unblock her when I’m ready to send her more money. That’s basically our relationship now.

Asides my regular savings, I religiously save my quarterly bonuses from work. My savings portfolio is spread around stocks, dollars and naira in a savings app.

Oh, I got a car last year, which explains my car expenses. Funny story about that car actually. It’s a 2016 Toyota Corolla worth ₦16m in 2023, but I only spent ₦4m on it. My dad added the remaining money.

I’d say it’s a give-and-take situation. I believe my money is supposed to work for me. I won’t say I’m not touching my salary because I want to be prudent. I work hard for my money, so I should be able to use it to take care of myself. I want to enjoy life because if I don’t, my next of kin will spend my money. That’s why I’m always looking to earn more.

At least ₦4m-₦5m, and if it’s in dollars, $5k. That’s when I can confidently claim to be comfortable. I’ve told my boyfriend I need to earn that before marriage because I want a certain lifestyle for myself and my family. I know people earn that much in Nigeria, and I’m sure I can get that, too.

I want to buy a house with my boyfriend because marriage can happen soon. But I also know there’s no way we can afford ₦80m – ₦100m for a house with our current incomes. So, I’m considering mortgage options. It’s not set in stone, but we’ll probably go through the National Housing Fund (NHF) route because bank loan interest rates are crazy right now. The NHF gives loans based on the individual’s income and repayment can take up to 20 years or more. I should be able to get about ₦20m based on my income.

Impulse spending. I’d be happy if I could limit my spending to less than 40% of my income. Last month, I spent about ₦500k on perfumes alone, and online shopping doesn’t help. There’s always one vendor selling stuff at discount prices, and it feels like a deal I shouldn’t miss. Before I know it, those expenses accumulate. I’ve muted all my Instagram vendors and hope to avoid online shopping for this month, at least.

7. I’m not living paycheck to paycheck, but I can do much better.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Ese* (26) has been responsible for 80% of her family of seven’s needs since her parents left the police force a year ago, and it hasn’t been a walk in the park.

She talks about how her parents’ pension and gratuity payment delays have contributed to her family’s financial situation, sacrificing her needs and taking loans to meet demands at home, and how money has strained her relationship with her mum and sister.

Image: Canva AI

I’m my parents’ second child, but I’ve supported them and my siblings financially since I started making some money.

I graduated from the university in 2020 and almost immediately started working for an older coursemate who had a POS business. She had a chain of POS machines and didn’t trust her staff to transfer money to clients without diverting some of it, so my job was to do those transactions for ₦10k/month.

From that ₦10k, I started contributing to sort home expenses. My parents were police officers who didn’t make much money — they each earned less than ₦150k/month — and had five children to feed. My elder sister wasn’t working, so I had to pick up small expenses like utility bills and gas. I even dropped half my salary once to buy my mum a birthday cake. Still, the financial load was bearable until my parents retired from the force.

My dad retired first in May 2023. He retired as an Assistant Superintendent of Police (ASP) after 35 years of service. I didn’t imagine the lack of a salary would immediately worsen our financial situation. My dad said he was entitled to a cooperative association payout, gratuity, and monthly pension, so we all expected to get a tangible cash inflow soon. It didn’t exactly happen like that.

First, my dad’s cooperative payout was only ₦600k. I expected it’d be more than that since it was supposed to be a portion of his salary for the whole 35 years he worked, but he may have withdrawn certain amounts at different times.

My dad decided to invest the payout in a fish farming business even though the family warned against it. Fish farming was a new business, and we weren’t sure there was enough capital. We suggested investing it in my mum’s small poultry business instead.

He refused, and as we predicted, the business folded up in six months. After building the pond, the remaining balance wasn’t enough to feed the fish regularly, and my dad ended up selling the fish at a loss.

For the gratuity and pension, it’s been over a year, and we still don’t know when the government will process either. The gratuity is supposed to be a lump sum of ₦1m+. However, my dad knows police officers who retired a year before him and still don’t know when gratuity will come because of the unnecessary bureaucracy in the Nigerian system.

My mum also retired early this year and has joined the queue of expectant retirees. She’s expecting a bit more gratuity and pension because she retired as a Deputy Superintendent of Police (DSP), but as of right now, she and my dad are in the same shoes.

With both my parents retired, I became the de facto breadwinner. Fortunately, I landed an account officer position at a bank in September 2023, and my ₦324k/month salary seemed more than enough to provide for my family.

My first mistake was letting my family know how much I earn, though I don’t see how I’d have avoided that. My parents asked about my salary after I returned from training school, and I don’t lie, so I told them.

Also, my local church is very small and almost entirely made up of my family. We have a tithe card system in the church, where members write the amount they pay as tithe. My family would’ve seen that my tithe had increased to ₦32k and would’ve easily added two and two together.

It’s not that I don’t want to help out. Earning more made it easy to fill the gaps my parents’ retirement caused, but the rising cost of everything due to inflation and increasing expectations at home have turned my salary into almost nothing.

By the time I remove ₦125k for ajo, sort out my lunch and transportation to work, food, utilities, school fees for my brother in secondary school and lend my parents money to do one thing or the other, I’m completely broke. I have to take quick loans from loan apps every other month to stay afloat.

A few months ago, I had to take a ₦230k loan to support my brother through police training school. Then I took another ₦50k loan for my mum to feed her birds at the poultry and pay me back after she sold them off— she never paid me back. These loan deductions have brought my salary to about ₦250k/month, but I have no choice but to keep handling 80% of my family’s needs.

The other 20% is my undergraduate younger sister, who fends for herself in uni, and my elder sister, who works at a school now but hardly makes enough to transport herself to work, let alone contribute to the home.

It’s exhausting being a breadwinner at 26. I’m constantly anxious about inflation and being unable to save for an emergency or even invest in property. I have about ₦300k saved up now, but it’s nowhere close to the ₦1m I need to buy land in my area or hold as emergency savings.

I’m constantly worried that one health emergency will come and drain me financially. My dad is diabetic, and my health insurance only covers me. He has NHIS, but that doesn’t get him standard treatment. I need to find a way to get him regular care at a private facility. Anyone else in my family can suddenly fall ill too. What do I do then?

The ajo I mentioned earlier was supposed to get me my own apartment, but since I can’t support two households, I used my share to update my work wardrobe, set money aside for my brother’s school fees and spent the rest on my family.

Aside from my concerns about savings and health, being breadwinner also means I constantly struggle with resentment toward and from my family.

My younger siblings don’t know how to manage with little, and they regularly ask for money. One could just go, “Can you give me ₦10k?” without giving reasons for why they need the money. Even me who’s making the money can’t make expenses like that.

I also expect them to pick up small expenses like soap or gas, but everyone just keeps whatever money they get because they know I’ll handle everything. I resent that a lot. It’s like they think I have a magic tree where I just make money appear.

On the other hand, I’m positive my mum and elder sister resent me because of this same breadwinner matter.

My mum isn’t used to not having her own money, so she often lashes out because of frustration. When I have extra money, I try to give my parents around ₦10k – ₦20k just so they can hold it as pocket money, but it doesn’t always help with my mum.

Whenever I complain about my siblings wasting food, my mum often throws shade. She says things like, “Some people complain too much just because they’re the ones who bought something.” Sometimes, she’s supportive, but most times, she’s annoyed with me. I never know what version of her to expect daily.

For my elder sister, I think the resentment is because culture expects that everyone runs to the firstborn for financial help, and she feels bad that I’m the one in that “firstborn” position. Sometimes, she acts off towards me, and our relationship is often tense. Other times, she’s sympathetic and tells me she appreciates my sacrifices. Just like with my mum, I never know what to expect from my sister.

At least I don’t have to face that with my dad. He’s always appreciative and constantly praying for me.

Still, I’m grateful that I can help my family. It’s difficult most of the time, but it’s my duty. My friends and colleagues assume I have no use for money because I live with my parents and get offended when I say I can’t join an asoebi wedding group or lend them money. How many people do I want to tell about my situation?

I know things will get easier when my parents receive their gratuity and start receiving pensions. My mum would start a business again and no longer need to depend on me. If my siblings also get good jobs, they’ll be able to contribute to the living expenses. That hope is the one thing keeping me going right now.

*Name has been changed for the sake of anonymity.

NEXT READ: I Fear That My Husband Will Bankrupt Us One Day

[ad]

Wani’s* (23) boyfriend is 21 years older than her, but that’s not the problem with her relationship. The problem is other people.

She talks about dealing with people’s perceptions of their relationship and why she isn’t concerned about their future.

Image: Canva AI

I’ve been dating my boyfriend, Adeolu*, for two years, but my closest friends still don’t know exactly how we met because I know I’ll get weird looks. It also doesn’t help that Adeolu is 21 years older than me.

I met Adeolu in 2022 while hospitalised for severe stomach pain that turned into an emergency appendectomy. Adeolu was my anesthesiologist, and he’d been the one to calm me down when I started freaking out in the operating theatre.

After the surgery, Adeolu came to check on me twice before the hospital discharged me a week later. He joked about how I needed to focus on getting better so I could eat the hospital canteen’s famous amala and gbegiri. When I saw him again two weeks later during a follow-up appointment, I insisted I was well enough to eat the famous amala, and he took me for lunch. Things pretty much took off from there.

We talked so much during that canteen visit that we just had to exchange numbers to keep the conversation going on WhatsApp. I was surprised by how much he knew about what older people would call “Gen Z things”. Slangs like “E choke” and “Lori iro” were still in everyone’s mouth in 2022, and Adeolu knew them all.

When he finally asked me on a date a month later, I said, “Aren’t you like 50 with a wife at home?” That’s when he told me he was actually 42 and had never been married. I said yes to that date, and we became an item. Honestly, I already liked him, and I’m not sure knowing he had a wife would’ve stopped me from dating him.

I’ve dated two people before Adeolu, but he’s the first much older man I’ve been with. I didn’t even imagine I’d ever date someone that old, but Adeolu is different. He’s hella attractive, with a sexy sprinkle of white hair on his goatee. He looks his age but doesn’t look ancient if that makes sense. He’s also so funny.

Adeolu and I have been together for two years, and I’ve never been happier. He treats me like a princess and provides all I need — both emotionally and financially. He tells me I’m beautiful, and I feel beautiful when I’m with him. He’s also a very considerate lover.

Adeolu has made my life better in so many ways. When I struggled with a course in school, he drew up a study schedule for me and regularly called me at a particular time daily to make sure I was reading. He’s also made me promise to get a master’s degree after uni. He’s constantly telling me how much he believes in me, and I love him for it.

The only downside to our relationship is how people react when they find out we’re together. Twice, restaurant servers have assumed Adeolu is my older brother. Maybe I also make it worse by never letting it slide. I’m quick to correct sibling assumptions, and the person involved either gives a weird look or a knowing smile. As if they’re saying, “Anything for the bag, girl.”

One time, Adeolu and I attended an owambe together, and one of the ushers came to where we sat to ask Adeolu to come and re-park his car. Adeolu had gone to the toilet then, and this usher said, “Excuse me, please, what about that your uncle that sat down here before?” I told her, “You mean my boyfriend?” and she apologised, but I could tell she was surprised.

I still don’t understand why people quickly assume he’s a relative. I know I’m petite and have a baby face, but still, it’s too bad.

The sugar daddy assumptions are what I hate most. Whenever Adeolu calls me in the hostel, and my friends see his name on my phone, they go, “Your sugar daddy is calling o.” I had to tell them I met Adeolu online because they’d either think he took advantage of his position as my doctor or that I agreed to date him because I wanted a sugar daddy.

However, they still think we’re in a transactional relationship because of the age difference. It’s so annoying. Adeolu isn’t even that rich, and I don’t ask him for money. He just buys me things and sends me money monthly like a regular boyfriend.

I haven’t told my parents about Adeolu because they’d never understand. Only my sister knows, and she doesn’t even support the relationship. She keeps saying Adeolu is just using me for sex and will soon dump me. But this same man has introduced me to his friends and neighbours. I’m almost always at his house and know everything about him. How else should he show he’s serious?

I’m tired of defending my relationship, so I’ve chosen to quietly enjoy what I have with Adeolu. I can’t say for sure if marriage is in the cards for us because Adeolu has said he doesn’t believe in marriage, but I don’t even care.

I’d rather not think about what the future will bring and if we can even be together. I’m happy with what we have for now. We love each other, and that’s all that matters.

*Names have been changed for the sake of anonymity.

NEXT READ: I Love My Best Friend, but I Don’t Want to Date Him

[ad]

Okeoghene (32) knows how difficult it is to rebuild after losing everything.

He shares how he found a rewarding career in art and graphic design despite his parents’ disapproval, becoming successful, and hitting a creative wall after losing ₦17m. Now, he’s trying to start over.

Image: Okeoghene Efeludu

I loved cartoons as a child. The late 90s and early 2000s Cartoon Network raised me, and I loved recreating the characters I loved — Samurai Jack, Dexter’s Lab and Courage the Cowardly Dog.

My drawings were just a fun hobby. But I stopped drawing when my dad saw a Justice League-inspired comic I drew in JSS 2 and tore it up. For him, drawing had become a distraction and prevented me from improving my studies.

I didn’t draw again for a long time. Instead, I focused on doing what my parents expected of me.

First, it was sports. I ran track and played basketball in secondary school. I was on the path to getting a basketball scholarship to a university in the US when a drunk driver hit me and broke both legs. I was 16, and that was the end of any dreams of a sporting career.

Since I couldn’t pursue a US university admission anymore — my barely middle-class family couldn’t afford it without financial aid — I focused on getting into a Nigerian university. That took three years of trying out different things my parents wanted.

Between 2009 and 2012, I was admitted into three different universities to study courses ranging from computer engineering to even almost getting recruited into the Nigerian Defence Academy. I wasn’t interested in them.

I wanted to study archaeology, but like typical Nigerian parents, my parents weren’t having it.

I eventually studied computer engineering, networking, and cybersecurity at NIIT, a talent development institution. By 2015, I was working in tech support, fixing laptops, and working on telecommunication masts.

In the same year, I had a wake-up call. I asked myself, “What do I really want to do?” I’d spent all these years doing different things, but when would I eventually do something for myself?

At that time, I was a fan of the Hip-hop culture, and graphic T-shirts were a big part of it. However, the 2015 graphic T-shirts had phrases like “Ama Kip Kip” and “My money grows like grass.” I hated those shirts, and I wanted to create something better.

There was a problem: I’d stopped drawing for so long that I wasn’t sure how to start. My cousin, Precious, was an artist, so I called him. We agreed that I’d describe what I wanted to draw, and he’d make it happen.

But there was another problem: How would I convert these drawings on paper to something digital I could print on shirts?

I knew a graphic designer at a cyber cafe I frequented, and when I asked how much it’d cost to turn the drawings into digital designs, I decided I was going to learn graphic design.

I bought Corel Draw tutorial CDs and began teaching myself. It looked like sorcery at first, but I soon got the hang of it. My sister’s boyfriend gave me my first gig, paying me ₦2k to design a small flyer.

My parents were pissed when they realised I was spending all my time with graphic design. It took an uncle’s intervention for them to tolerate the fact that I’d abandoned everything to pursue a career in graphic design.

I also got my first graphic design job in 2015, making ₦10k/month at a printing press. Asides making me a better designer, that job taught me a lot about the T-shirt business.

After a few months, I left the job and began designing my own T-shirts. I borrowed ₦20k from my sister and printed my first samples; then, I got a gig to supply T-shirts for a street jam party. It didn’t take long before people knew me as the “T-shirt guy.”

In 2016, I started posting my graphic designs on social media and got a few freelance gigs here and there. Of course, I made some of the obligatory rookie mistakes most new freelancers make.

I remember not negotiating for a branding gig because I got it through a friend. After I completed the gig, they asked for my fee, and I said ₦20k. They laughed and sent me ₦5k. Another client told me they got someone else for the job after I’d already gone halfway through the project.

These experiences taught me to treat design as a business. So, I learned to draw up guidelines and collect part payments before working on any project.

Things took off from there. I got regular jobs, and with them came the confidence boost that came with being really good at what you did. I even went viral in 2018 for doing a photo manipulation with King Kong and the UBA building at Marina, Lagos. It was just a random design, but UBA reposted it, and I got tons of followers and even more gigs.

Digital art gave me my first big break in 2018. Someone contacted me on Instagram and requested a canvas print for her boyfriend. I randomly charged ₦300k, and she negotiated to ₦280k. I honestly thought the most I’d get was ₦50k.

After I completed the job and got paid, I used about ₦120k to go on a mini vacation to Ghana. It was my way of coming to terms with the fact that I could live a good life and make good money from design.

And I did make good money between 2019 and 2021.

My designs caught attention online because I had a thing for mixing Afrocentric and urban designs with pop culture. I got a job with a US creative firm that paid six figures and collaborated with several national and international brands.

Image: Okeoghene Efeludu

I was on a financial high, and while I initially just spent money as it came, I decided to become serious with my finances and began consistently saving in 2020. That turned out to be helpful because 2020 was a slow year due to the pandemic and some health issues. I quit my 9-5 and went fully freelance.

However, things picked back up in 2021. I secured a collaboration with an international drink brand and was on retainer for about five other brands. I even formed a small company and got a few young designers to work on the projects I couldn’t take on because of time constraints. I was a proper creative director.

Then, 2022 came, and that’s when my problems started.

I invested some of my money in a friend’s delivery business. One day in February, one of our bikes developed a fault, and the rider got into an issue with area boys. I was close by, so I decided to go there to sort it out. However, rather than de-escalating the issue, a fight broke out when I arrived, and my phone got stolen in the scuffle.

I wasn’t bothered by the theft at first. I called my network provider and asked them to block my line. The bank account linked to the line was my main savings account, so I also called my bank and deactivated my ATM card — basically everything I was supposed to do after losing my phone.

I couldn’t retrieve my SIM for about two months because of the NIN wahala. I eventually retrieved it without going to my network provider’s office. It turned out you could just meet a regular person on the street, and they’d link your line to a new SIM card. I was shocked that was possible, but I guess it explains how the people who got my stolen SIM were able to impersonate me.

When I put the new SIM card into my phone, I started receiving strange debit alerts. Almost immediately, random people began calling and accusing me of defaulting on loans. I didn’t know what was happening.

I found out that blocking my SIM card didn’t prevent it from receiving text messages. The thieves could still use USSD codes on the SIM, and they cleared my entire ₦17m savings. I didn’t realise earlier because I never touched the money in that account — I had a separate account for everyday use.

They also used USSD to find my BVN and collected loans—about ₦300k in total. I thought the loan companies disturbing me was the worst part until the Economic Financial Crime Commission (EFCC) flagged my bank account and summoned me.

Apparently, the thieves had sold my SIM card to a 419 syndicate, and those ones used my details to open different accounts. The next few months involved multiple police station and court visits to sign statements and swear affidavits that I’d actually lost my phone and SIM card. I also had to secure a court cease and desist order and involved the FCCPC to get the loan companies off my back.

When I eventually sorted that out, I had to face the reality that I’d lost everything. I was in a very wild state of mind. I was suicidal, mentally unavailable and couldn’t work. I couldn’t do anything from June to November except sleep and wake up.

In 2023, I decided to throw myself into work and try to make all the money I’d lost. It worked out for a bit — I got several gigs, averaging ₦400k – ₦500k monthly. I even got another 9-5 in October.

But I gradually realised I hadn’t properly processed all that had happened in 2022. I was spending so much because I was scared of saving and losing my money again. I’d also taken that job because I was trying to make money quickly again, but I was mentally drained due to the toxic environment. I was losing my creativity and starting to hate design.

I quit my job about two months ago and spoke to a therapist to process everything that’s happened. It doesn’t help that I’m trying to rebuild my life and finances at a time when the country isn’t even balanced. Inflation is literally making it impossible for me to build a safety net again.

It’s extra difficult because money plays an important role in my creativity. For instance, I like doing passion projects — murals, visual art pieces, and art recreations on the side. Those cost a lot of money, but they help me explore my creativity and create art I love. Sometimes, I sell these pieces, but it’s difficult to take that risk now because I don’t know where the money will come from.

I’m now focusing on rediscovering myself as a creative person and figuring out how to love design without relying on a financial safety net. It hasn’t been spectacular, but I’m in a better place mentally, and I’ve learned to separate the money from the art.

I’m reminding myself that I don’t make art because of the money I want to make from it or what I hope to get. I create and design because I love it. It’s my life, and it shouldn’t stop because I lost everything.

NEXT READ: I Failed Out of Medical School After 5 Years, but I Don’t Regret It

[ad]

On Tuesday, September 3, 2024, the Nigerian National Petroleum Company Limited (NNPCL) officially increased the petrol pump price from ₦617/litre to ₦855 – ₦897/litre (depending on the location) effective immediately. The fuel price has now been increased thrice since the subsidy was first removed in May 2023.

Image: This Day

According to NNPC spokesman Olufemi Soneye on September 1, 2024, the state oil company claimed it was burdened by the high cost of supplying petrol to Nigerians and a $6.8bn debt to international suppliers.

The NNPC also confirmed that the financial strain was making petrol supply to depots difficult, resulting in scarcity across Nigeria and posing a threat to the sustainability of fuel supply.

The new price adjustment is expected to reflect the rising costs of supply. While this isn’t exactly a surprise to independent fuel marketers and many Nigerians, some had held out hope that petrol production from the Port-Harcourt and Dangote refineries would make fuel supply more affordable.

Image: Arise News

On Tuesday, Aliko Dangote, chairman of the Dangote Group, released official petrol samples from his refinery. He declared that the product could enter the Nigerian market in 48 hours, depending on how soon he reached an agreement with the Federal Government. He also assured that the local sale of the fuel would help stabilise the naira and make scarcity a thing of the past.

However, it is unclear whether Dangote’s fuel will be a cheaper alternative. Dangote says the price will be determined through an agreement between his company and the federal government.

Several experts have predicted that the upward review in the petrol pump price would further plunge Nigerians into poverty and worsen the country’s inflation levels.

The Director-General of the Nigeria Employers Consultative Association (NECA), Mr Adewale-Smatt Oyerinde, also expressed concerns about the new development. According to him, “This new pump price could be seen as making Nigerians pay for the crass inefficiency in the NNPCL.”

He remarked that he’d expected the planned commencement of operations from the refineries to progressively reduce the petrol pump price, but this does not seem to be the case.

Nigeria currently owns four refineries, and while billions of dollars have been spent on turnaround maintenance within the past year, none of them have been able to meet production deadlines.

Currently, Nigeria’s fuel supply is almost entirely dependent on fuel imports, and it looks like the pump price hike is here to stay. And unless petrol depots receive more cargo in the coming weeks, the fuel queues may be here indefinitely, too.

NEXT READ: What Does Another Fuel Price Increment Mean for These Nigerians?

[ad]