Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Enjoy a December to Remember with Yellow Card this Christmas!

Trade at least 35,000 Naira on Yellow Card today for a chance to win $50 in Yellow Card’s $4000 Christmas giveaway. Don’t miss out on your chance to win!

When did you first realise the importance of money?

That was in JSS 1, and I’d just moved back in with my dad. I’d previously lived with my aunt and didn’t lack anything with her. There was food at home, and she gave me ₦50 to school daily, too.

But we struggled to eat or do other basic things at my dad’s. The ₦50 reduced to ₦20, then the ₦20 stopped coming. It made me hyper-aware of what a lack of money could do.

Why were you living with your aunt?

My mum passed away when I was four, and my dad shipped me off to live with my aunt. He was a builder who had periods of plenty money and then no money at all. I think my mum was the one who managed his money when she was alive. When she passed, he started blowing money on alcohol, cigarettes and whatever else he wanted.

My aunt often complained about my dad not sending money for my care when I lived with her. It was when I went back to live with him that I saw the extent of the situation. It’s safe to say I saw shege. I wouldn’t eat all day and developed an ulcer in less than a year. At some point, I used firewood to cook.

I couldn’t even buy detergent to wash my school uniform, and people stared pitifully because I wore dirty clothes. I had to start boiling my uniforms in water so they’d look a bit presentable. But that made them look rough and wear out quickly. I also owed school fees a lot. It was all embarrassing.

I was likely traumatised too, because I went back to live with my aunt for a year and ate so much I became obese. When I returned to live with my dad again in JSS 3, I began thinking about ways to make money because the financial situation was still terrible.

I’m sorry you went through all that. Did you find a way to make money?

Yeah, I started a reading club in school. My aunt introduced me to novels when I lived with her, and I had quite a number of them — mostly romance. I was also part of a VIP system at a bookstore where I got free access to even more novels.

So, I started renting them out to schoolmates for ₦10 – ₦20 per book. I also sold sweets and made at least ₦600 weekly from both businesses. I did that until SS 1 and stopped after someone reported me to the school authorities.

It’s giving bad belle

Right? I didn’t do anything else for money until I finished secondary school in 2012. Then, I got a job at a school teaching the primary three and four classes. My salary was only ₦6k, but they owed the first month and delayed payment in the second month.

One of the school teachers hired me to coach her child for after-school lessons, but she found it difficult to pay the ₦4k/month we agreed on. After three months, I left the job and moved on to another school that paid ₦15k/month.

The new school also owed salaries, but I stuck with them longer because I had about four students whose parents paid me ₦2k/month for extra lessons. In a good month, my total income was around ₦20k. I was balling.

Tell me about that

I mostly spent my money on food. Whenever my dad had money, he bought a bag of rice, garri, palm oil and dry pepper. The only way I could eat something more interesting was if I bought it myself.

I stayed at the school for over a year and left after they owed three months’ salary at a stretch. My next job was as a sales girl for a woman who sold groceries. My salary was ₦10k, but we agreed she would hold ₦6k for me and only pay me ₦4k monthly.

Why?

I was about to write GCE and JAMB — WAEC banned my result for some reason — and I needed money for the forms and textbooks, as well as to process uni admission. Also, I trusted the person who introduced me to her, so I knew my money was safe.

I got the GCE and JAMB forms for about ₦30k. My elder sister also pitched in even though she was sponsoring herself through school. I couldn’t afford hostel accommodation when I got to uni in 2015, and I spent the first few weeks commuting from my house to school. Even that one sef, I had to beg my sister for the ₦1k daily transport fare.

I realised that wasn’t sustainable, so I started sleeping in class instead. That didn’t last a month because a guy I was reading with in class decided to feel me up while I slept.

Yikes. Sorry about that

It was such a nasty experience. Fortunately, a friend called me around the same time the incident happened and noticed I wasn’t fine. He pressed to know what happened, and I shared my accommodation issue. He sent ₦40k, and I used the money to secure a hostel. He even sent me extra for food later. It was just miraculous timing.

How about your dad? Was he supporting you?

My dad was drunk the whole time I was in uni and didn’t even know when I graduated. I survived in uni by doing a bunch of things.

In year one, I sold puff-puff with my hostel roommate. We pulled money together and I woke up at 4:30 a.m. to mix the dough and fry it before class, while my roommate sold them in school for ₦5 apiece. We did that for less than a semester and made ₦15k in profit before everything scattered.

How did it scatter?

We agreed that I’d keep all our earnings, put it back in the business and wait until the end of the semester to share the money. But she started crying to our other roommates that I’d stolen her money. I was so pissed that I gave her the whole profit and buckets and every other item we’d bought for the business.

After I gave her everything, I remembered I was broke and didn’t have a dime. I lost so much weight because I wasn’t eating. My dad also fell sick, and we had to sell some of his properties to pay his hospital bills.

Fortunately, I met someone in church who took on a spiritual mother role over me. She learned about my situation and was like, “You’re industrious, but you don’t like asking for money.” She eventually loaned me ₦10k, and when I resumed school for year two, I used it to start a supermarket in my room. I sold everything you can think of in that room — from spaghetti to tomatoes.

Was it profitable?

I was a big girl. Gas cookers and stoves were contraband in the hostel, but I bribed the porters to keep one. I cooked soups and ate well. I did very well.

But I fell sick at the end of the year and had to go home. When I returned, my roommate had started selling the same exact things. I didn’t even confront her. I just quietly stopped my own business.

I’d saved up to ₦60k, so I got two other roommates to rent an off-campus room. From there, I started my next hustle as a house agent. I can’t even remember how I got into it; I just did.

How did pay work as an agent?

I reposted room-to-let ads from other agents on my WhatsApp status, and I made at least ₦4k on every person who asked to inspect the house. But I trekked so much during that period, taking people from house to house. I also got a small percentage of the agent fee if they eventually rented the house.

Around 2018, a bike-hailing company launched in Nigeria, and I landed an activation gig with them. My job was to go around telling people about the app and convincing them to download it with my activation code. At first, I made around ₦300 per download, but the company kept reducing the bonus until it was about ₦150.

I moved on to their competitors in 2019, and those ones paid between ₦350 – ₦400 per download. I was still doing the house agent thing, and my income from all the hustles came to ₦40k – ₦80k monthly.

The only downside was that I wasn’t saving a lot. I was pretty much eating whatever I wanted, spoiling myself, and even buying a phone.

To be fair, though, my project took a lot of my money. My supervisor only reviewed printed work, and I had to constantly reprint to reflect the corrections. Anyway, I graduated from university in 2019.

Yay. What did you do next?

I had the brief panic feeling most people get when they finish uni: What do I do next? How do I survive?

So, I applied to jobs everywhere. I even fell for one of those network marketing scams where they gather job applicants and “train” them to become their own bosses. I moved back in with my dad because my apartment had flooding issues. That turned out to be a mistake.

My dad was the kind of person who attributed one’s worth to money. He saw me sitting at home as lazy. On several occasions, he sent me to buy him drugs, and when I asked for transport fare, he said, “Why can’t you trek? What are you doing with your strength anyway? Are you making any impact on society?”

Hmmm

I knew I couldn’t stay home. One day, I walked into a random real estate company and told them I wanted to work. They insisted they weren’t hiring, but I was like, “Don’t worry. Don’t hire me. I’ll just stay here and assist the receptionist.”

That’s how I started hanging around assisting everyone and tagging along whenever they went for site inspections. After some of those inspections, they’d give me ₦4k for transport. The random stipends came weeks apart, so my income was very irregular. But I made sure to be as useful as possible so they wouldn’t think, “What’s the point of keeping this person around?”

A few months later, my spiritual mother introduced me to someone who worked at a mall. They put me in the accounting department, but I did everything from supervising the kitchen to handling the books. My salary was ₦70k/month. This was in January 2020.

Then the lockdown happened, and I had to stop working.

Phew. What did you do with the free time?

I had started learning Excel at the job because I wanted to make myself useful. So, when the lockdown happened, I decided to start offering online “How to do accounting for your business” training sessions on WhatsApp.

I taught small business owners and vendors how to determine the selling price for their business, calculate profit, etc. I charged ₦5k, but I mostly sold the training at a ₦2k early bird price. I know I made ₦20k one time after posting excessively on my WhatsApp.

I also did some dropshipping—mostly gym shoes—on the side, but my main income source during the lockdown was the training sessions. My then-boyfriend (now my husband) encouraged me to learn data analysis since I knew a few things about Excel. So, I took a course on Udemy, which helped me get my next job at an e-commerce company. This time, my salary was ₦60k/month.

My dad also passed away at the end of 2020, and several people gave me and my sister money to help with the funeral. In the end, we had about ₦120k left after we buried him, so we used it to rent an apartment.

Sorry about your dad

Thank you. The new apartment was closer to my job, which reduced my transportation costs. I spent two years at the company, and during that time, I did so many certifications I thought my head would spin.

By the time I left in 2022, my salary had only increased to ₦80k, but my data analysis skills had more than tripled. I’d also started a perfume oil business at some point while employed there and made at least ₦30k/month in profits.

After I resigned, I decided to register for NYSC and get it over with. I took 150 pieces of my ₦1k perfume oil to orientation camp and sold it all in less than three weeks. That was possible because the camp soldiers seized everyone’s big perfume bottles as contraband. My oil bottles were tiny, so they allowed me to take them in. You won’t believe I spent the entire ₦150k I made in camp.

You say?

The lure of the mammy market worked its magic. I was just buying shawarma, grilled fish, grilled chicken, you name it.

Post-camp, my Place of Primary Assignment (PPA) was a tech company — I got the connection through a friend — and my official role was customer success intern. It was a bit weird to be at intern level, considering all my years of work experience, but that was the only role the company had for corps members. They paid ₦50k/month, and with the NYSC stipend, my income was ₦83k/month. The company retained me after I finished my service in 2023, and I got a salary bump to ₦150k. Later that year, after people complained, they reviewed salaries, and I got another bump to ₦250k. But my eyes were already on bigger things.

Customer success is heavily data-reliant, and as the only data analyst on the team, I was doing my normal customer success manager work and data analysis for the entire team. I knew I could get better opportunities. So, I began applying all I’d learnt on the job, talking to people about customer success and putting myself out there on LinkedIn.

[ad]

Did job offers come?

Oh, they did. I was even selecting the ones I wanted. At that point, I worked mostly remotely — only one day at the office —but most Nigerian companies wanted a hybrid situation where employees would work from the office thrice a week. I didn’t want that, so I set my sights on foreign companies.

I eventually landed a customer success manager role with a Ghanaian company early this year. That’s my current role. But I really shot myself in the foot when negotiating my salary.

Ooof. You didn’t ask for enough?

I asked for less than they offered. They gave me a ₦400k – ₦800k range for the role, and I went and picked ₦650k because I was scared of picking the highest.

Only for me to enter the company and realise that other people picked the highest figure and even negotiated to like ₦900k or ₦1m. It’s painful, but I’m trying to work up the courage to ask for a raise.

I also run two businesses. One is with my husband — we got married last year — and it’s a virtual tutoring company where we teach people coding, maths and English. My role is admin-related: I sort out the students, assign them to tutors, handle payments and the rest. I get 17% of the profits monthly, and right now, that’s about ₦200k/month.

The second business is a CV-writing service, and I have a virtual assistant who helps me with the social media page and anything else I want to do outside work. I pay the assistant ₦50k and get an average of ₦50k/month in profit.

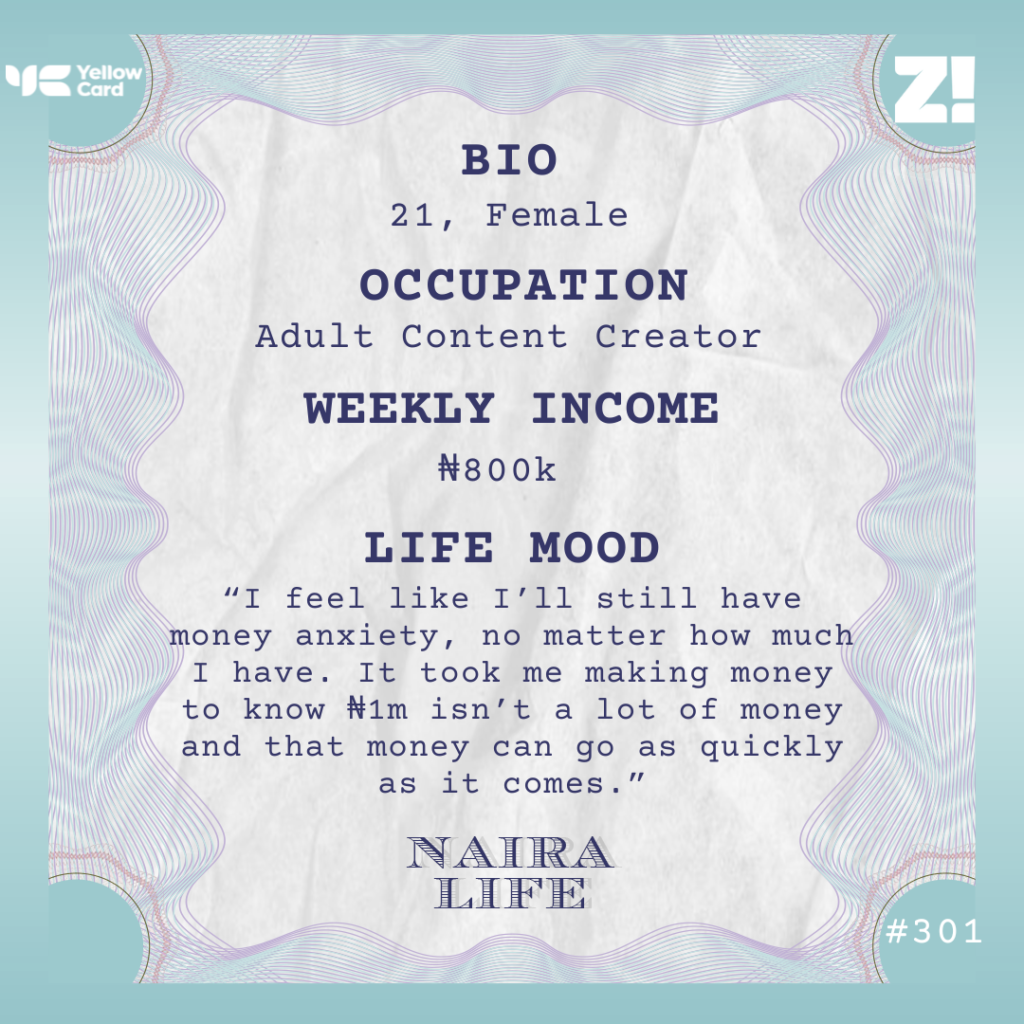

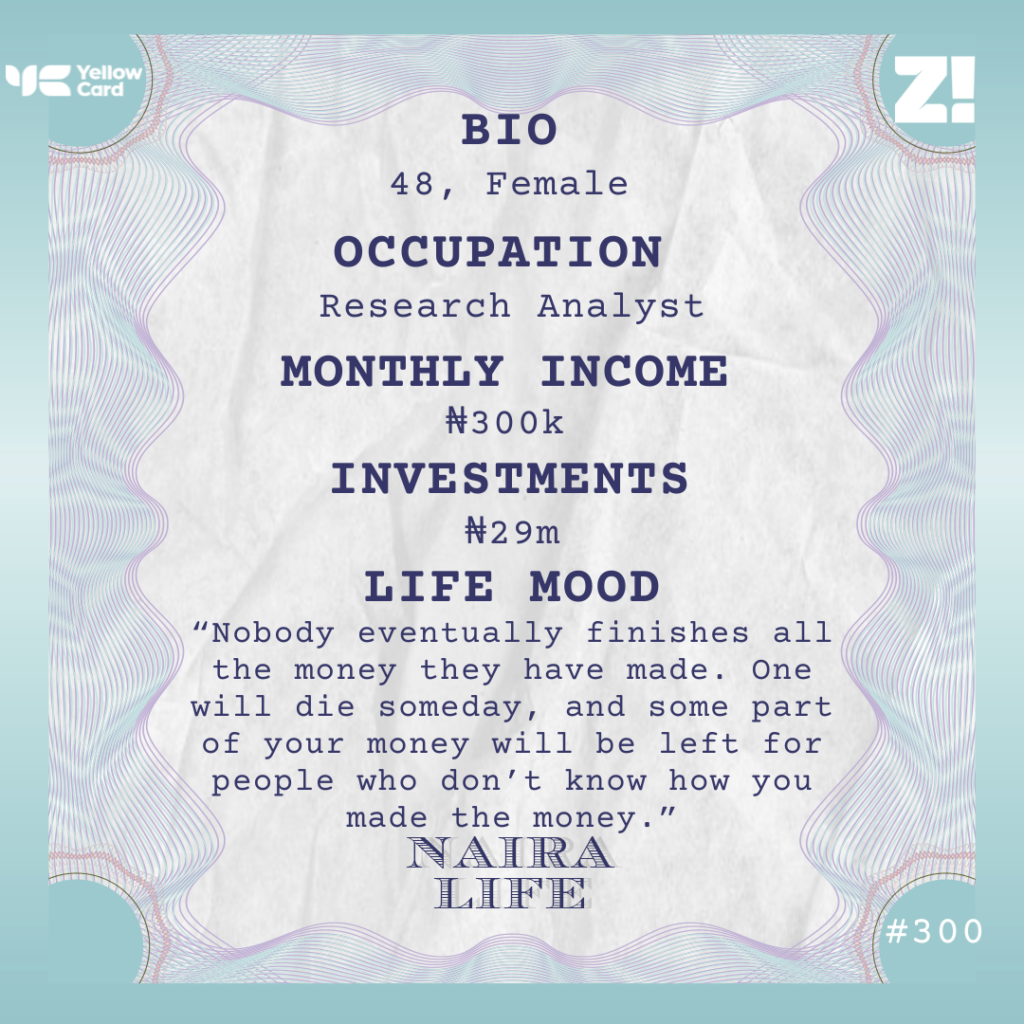

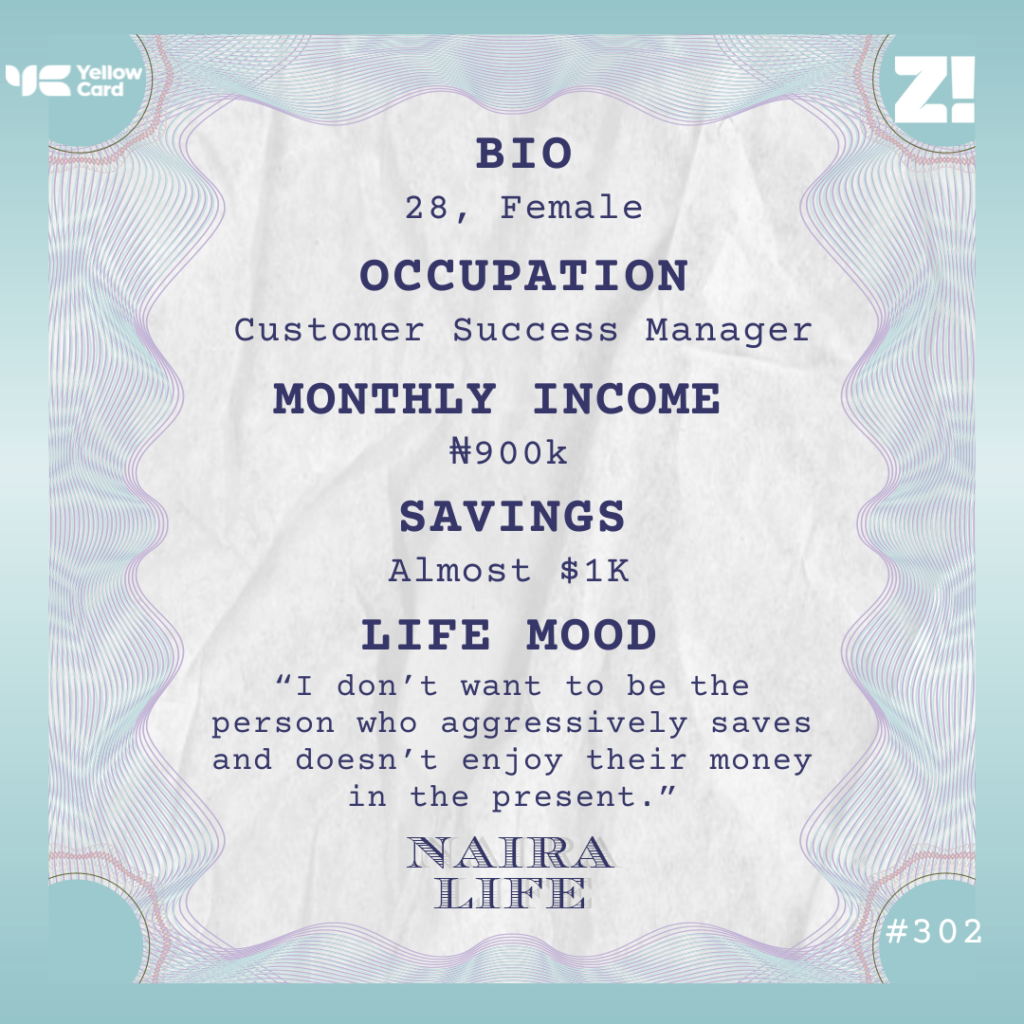

All together, my monthly income is at least ₦900k.

What kind of life does ₦900k/month afford you?

I still feel broke. If someone had told younger me that I’d be earning almost a million and still have to calculate so much before doing things, or not be able to do some things at all, I’d have said it was impossible.

I bought a $300 course recently and I had to save for a few months to afford it. I also want to buy a laptop, but do you know how much that costs now? I feel like I shouldn’t be calculating as much as I do, or thinking about starting a business for extra income. ₦900k should make my life easier, but it doesn’t.

Is there an ideal amount you think would help?

The starting point is earning in dollars. I don’t even mind earning $1k and going up from there. I don’t want to earn in naira anymore.

When I got my job, ₦650k was about $600, but now it’s not up to $400. What happens next year? Will it be $200? What happens when I need to pay for another course? There are several courses I can’t do yet because I have to plan and plan.

I recently got a $2k – $3k offer, though. But the company has several red flags on Glassdoor. I’m currently contemplating if I should sacrifice my mental health for money.

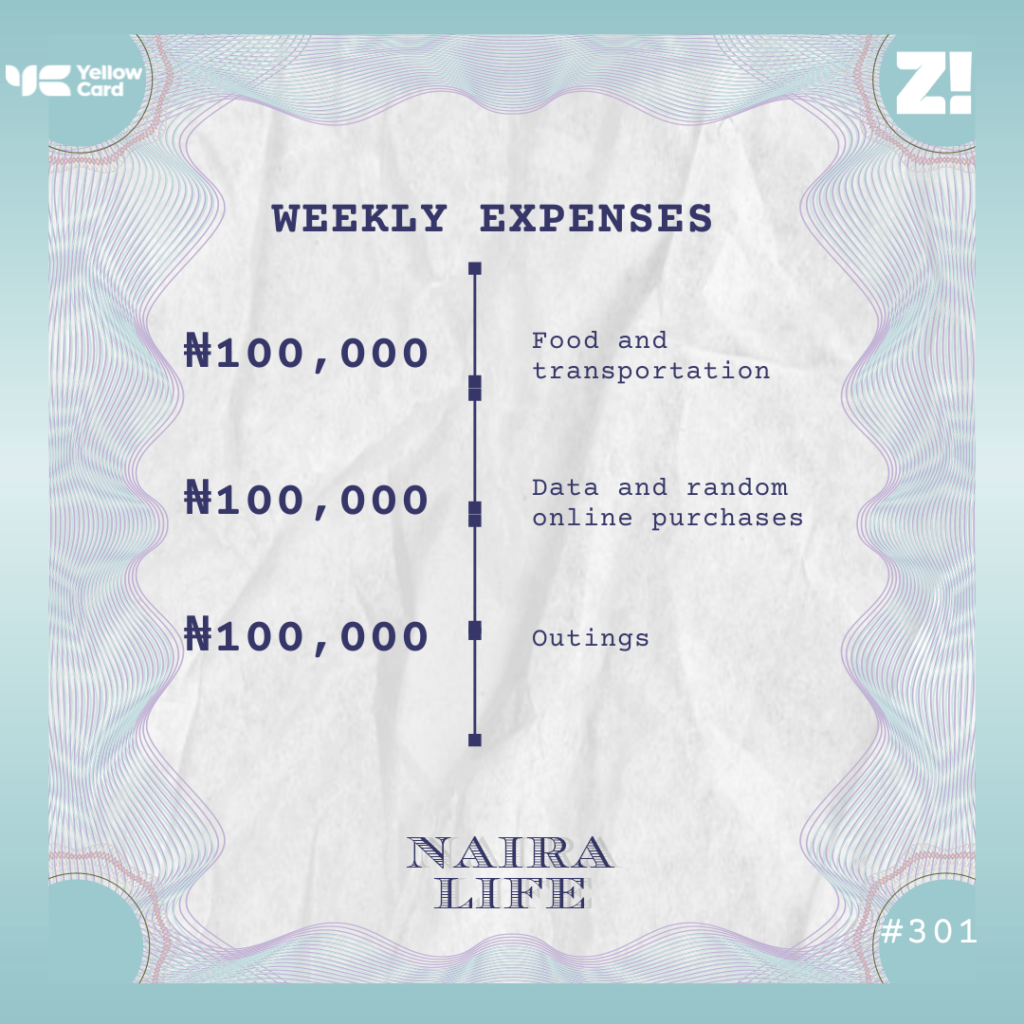

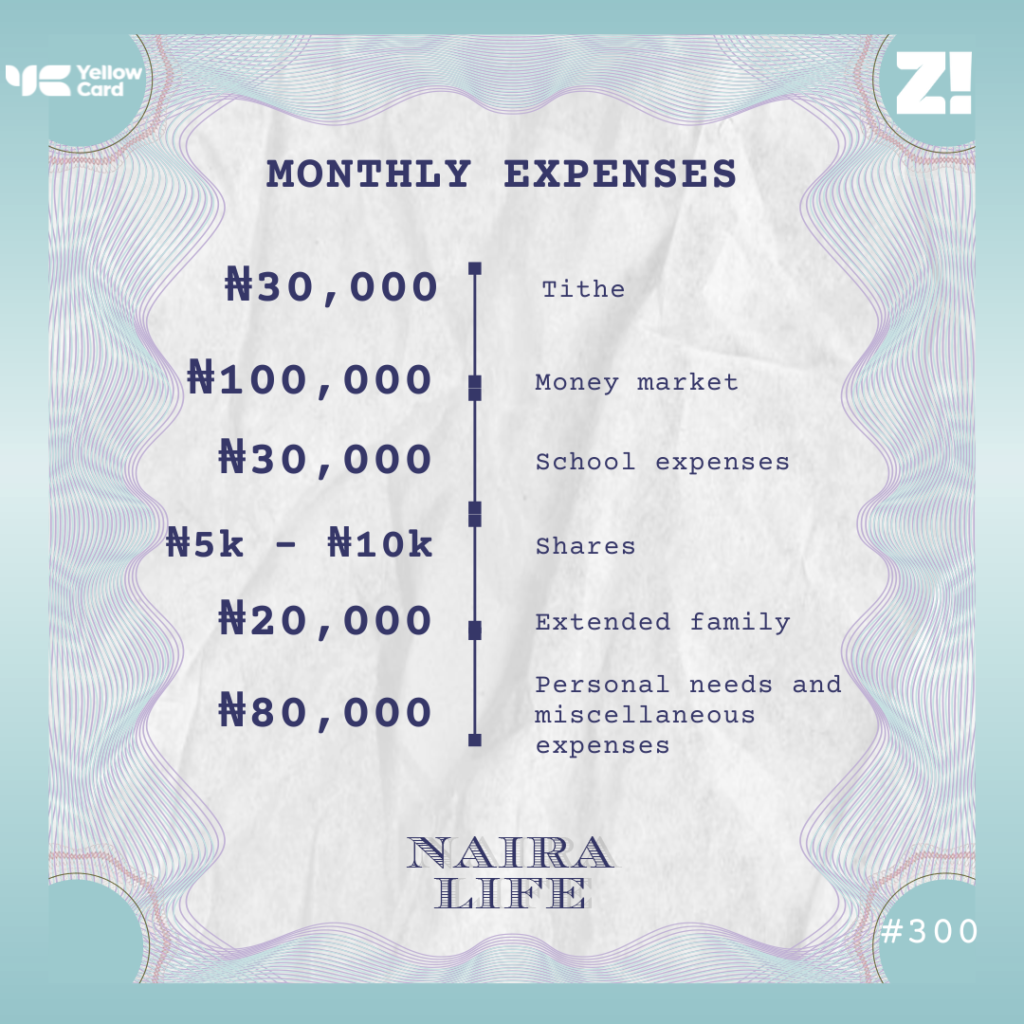

I’m screaming. Let’s break down your monthly expenses

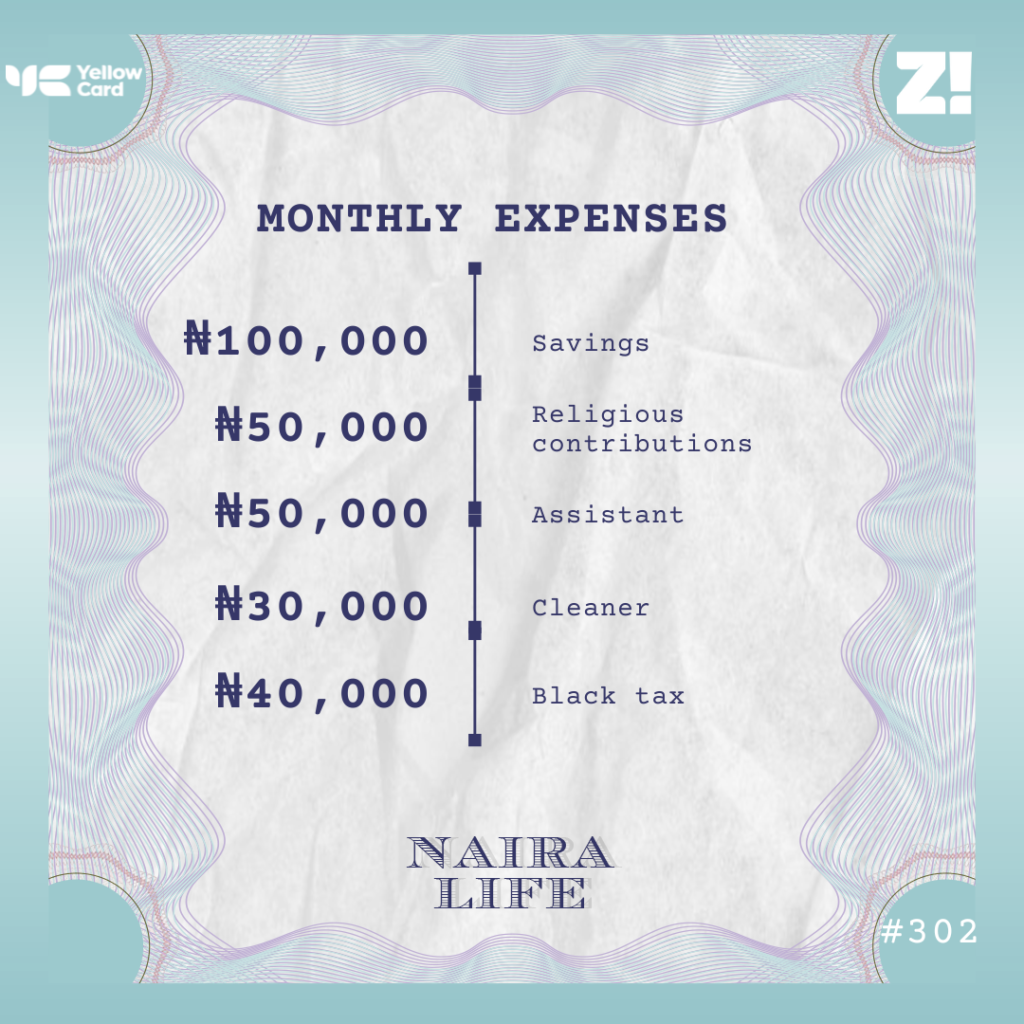

These are my recurring expenses. I often spend more than this, but it depends on the month. For instance, I’m currently renovating my kitchen, and I’ve spent about ₦600k. Sometimes, I contribute to the home’s expenses, but that’s only when I want to assist my husband; he pays for everything.

I regularly take a lot of courses, but there’s no set monthly budget for that. My last course was a two-level professional certification for customer success managers, and I paid over $300 for each level. For savings, I invest my money in stocks.

How much is your stocks portfolio worth now?

It’s a little below $1k now, but it fluctuates regularly because of the stock market and exchange rate. I’m not worried about it, though. The plan is to just forget the money there and let it grow.

I should mention I recently started a master’s degree program, so that’s another thing taking my money. My husband paid the ₦300k registration fee, but I handled the almost ₦400k payment for my first semester.

What part of your finances do you think you could be better at?

I can definitely do better at saving money. ₦100k monthly is pretty small, considering my income and limited responsibilities. But I also don’t want to be the person who aggressively saves and doesn’t enjoy their money in the present.

Is there anything you want right now but can’t afford?

An international MBA. I’ve noticed recruiters for global companies want to see that talents have gone past their immediate environment to gain international experience. I’ve seen relatively cheap MBA options I can do with $300/month, but it’s still expensive because I earn in naira.

Secondly, I’d like to be able to relocate someday. But before this happens, I want to visit these countries and see what they’re like before uprooting my life. I can’t do any of those yet because my income is still too low, but hopefully, that’ll happen soon.

How would you rate your financial happiness on a scale of 1-10?

7 or 8. I’m not where I want to be, but it’s a huge improvement from where I was. It’s like, I know I’m not squandering money, but I also feel like I’m not saving enough.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.