Since the Nigerian government announced the new ₦70,000 minimum wage, I’ve been curious: can anyone actually live on that amount for a full month in this economy?

I earn ₦250k monthly as an IT support specialist, and while it might sound okay on paper, it runs out faster than fuel during a subsidy rumour.

Typically, I spend 60% of my salary and stash the remaining 40% — ₦150k goes out most months, but sometimes my spending hits 70%. This April, I want to try something different: I’m limiting myself to spending just ₦70,000 for the entire month. Basically, I’m trying to live like someone earning minimum wage.

Can I make it through the month if I stick to a plan? That’s the question.

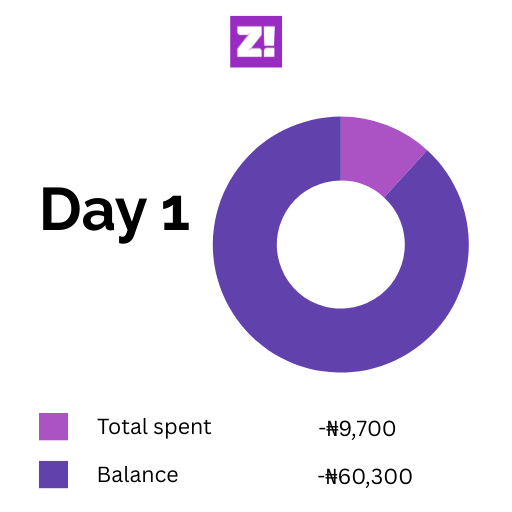

Day 1

It’s April 1st, and it’s the Eid-el-Fitr public holiday, so I’m not working. I stay at home to avoid spending unnecessarily. Then reality sets in — my new laptop is en route from Ibadan, and I need to pay the delivery driver.

I top up ₦1,500 for airtime, call the driver, and track my parcel. After confirming he’s close, I head to a POS near the bus park to get some cash. That’s another unexpected cost. The POS attendant tells me they charge ₦100 for every ₦5,000. I roll my eyes and hand over my card.

I withdraw ₦5,000 first, then later go back for another ₦3,000 to keep. That’s ₦8,200 gone in total and ₦200 of it is just for POS charges.

I pay the bus driver ₦5,000 to sort the waybill.

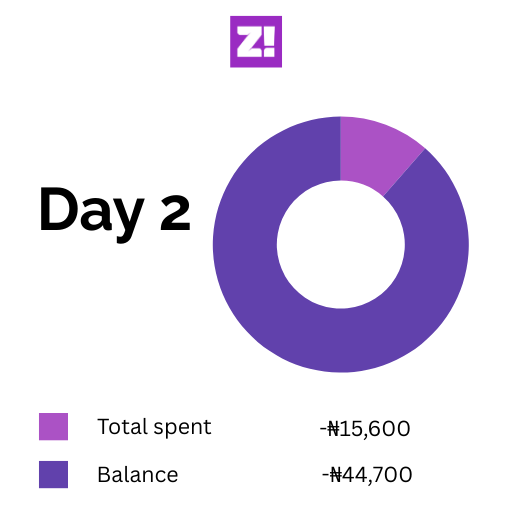

Day 2

I work remotely and only have to visit the office once a month, so I plan my days to avoid unnecessary spending. I rarely ever step out.

I keep my fridge stocked, line up my calls back-to-back so I’m not tempted to leave the house, and stay glued to the internet. It’s a simple formula: the less I step out, the less I spend.

After work, I withdraw ₦3,100 from a POS nearby for a bike ride to a supermarket, where I spend ₦10,500 on skincare essentials — Nivea body cream and Dove soap.

By 8:30, Barça is playing Madrid. They score, and Cowrywise yanks ₦1,000 from my account. It’s part of their “goal-based savings challenge” — an automated feature that deducts money every time my team scores. I signed up for it, and it stings, but it’s a disciplined kind of pain. They also take another ₦1,000 for my regular weekly savings plan.

The money is locked until January, so I can’t touch it. Since I never know how many goals Barça will score, I never really know how much I’ll end up saving. But so far, it’s worked.

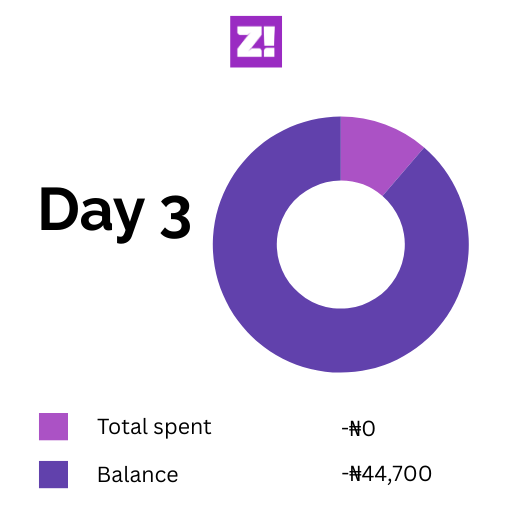

Day 3

I didn’t spend a single kobo today.

There’s food in the kitchen, and I’m not going anywhere. I have a router set up, so data isn’t a problem either. I just sit at my desk, work, eat, and mind my business — a peaceful, no-spend kind of day.

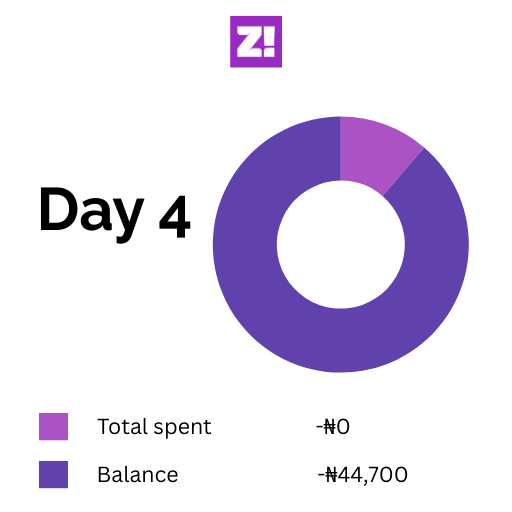

Day 4

Same as yesterday — indoors, no spending. I’m starting to feel proud of myself.

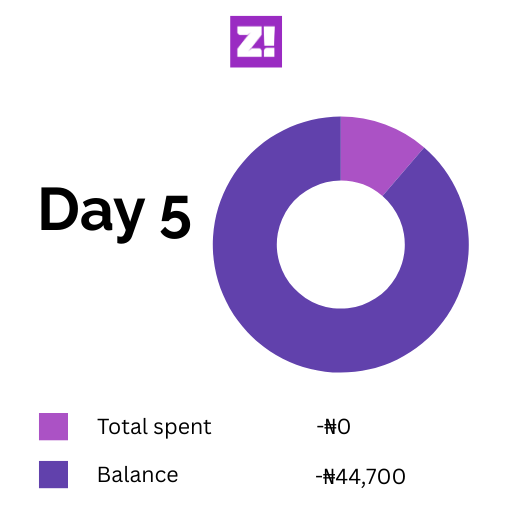

Day 5

No movement again. No money spent. This might work.

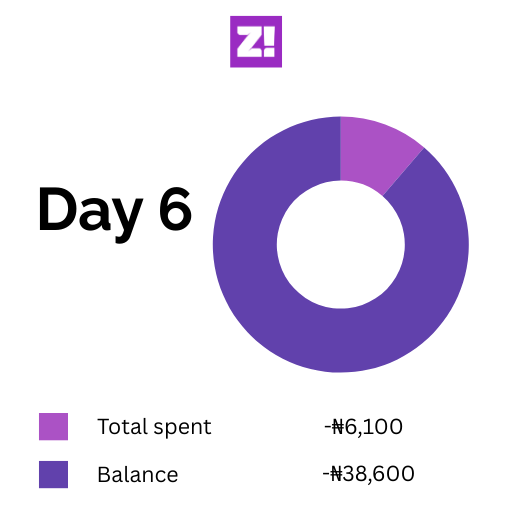

Day 6

It’s Saturday, and I figure a quick haircut and a snack won’t break the bank — it should cost me ₦6,000 or less.

I recharge ₦500 airtime, withdraw ₦2,100 for transport, and head to the barbershop. A clean cut costs me ₦1,500, and I treat myself to two meat pies for ₦2,000.

I spend ₦6,100. The three-day no-spending streak is over.

Day 7

No movement = no spending. Simple math.

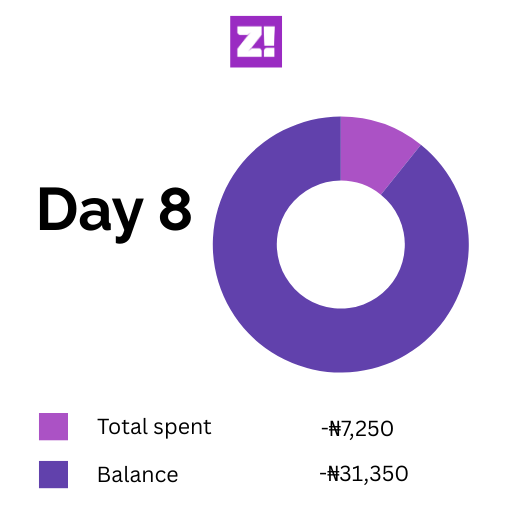

Day 8

I’m tired of home food. I order pounded yam with ogbono and fish. It slaps, but it also costs ₦7,250.

Day 9

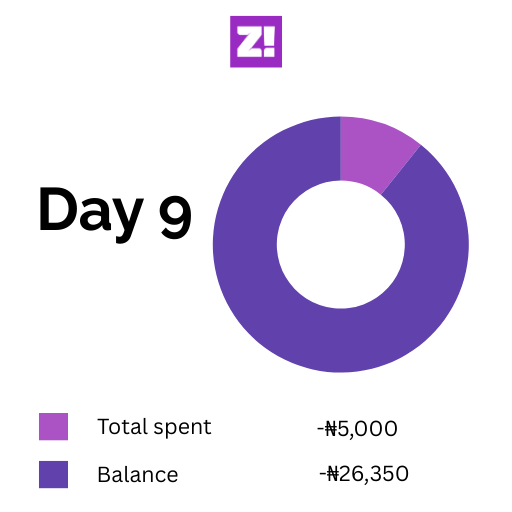

Barça strikes again: four goals, and that’s ₦4,000 straight into my savings wallet. My regular weekly ₦1,000 savings hits too.

I know I’m not making it to the end of the month on ₦70k.

Day 10

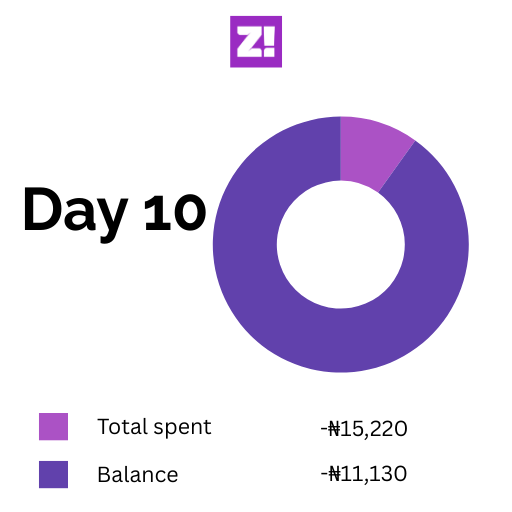

It’s time for my monthly in-office appearance.

I book a business class train from Abeokuta to Lagos for ₦4,720. I also load ₦2,500 data for my MiFi and withdraw ₦5,000 cash to hold me.

I order a cab from Mobolaji Johnson Station in Yaba to my hotel in Surulere. It costs ₦3,000.

Luckily, my company covers food and accommodation for the next few days.

Day 11

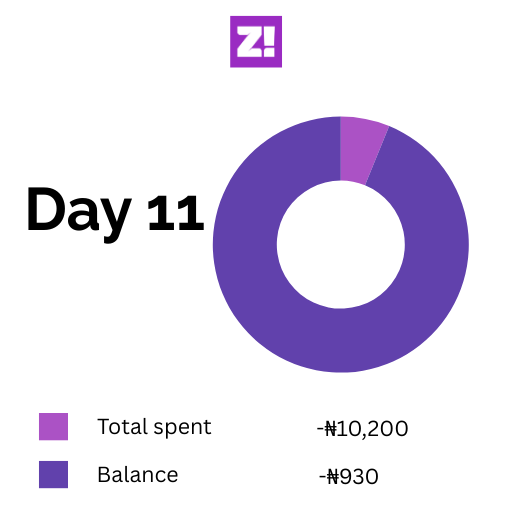

I take another cab to work in Surulere for ₦2,200. I find out I could have trekked the distance. SMH.

I buy shawarma for ₦7,000 in the evening and recharge ₦1,000 airtime.

Day 12

No spending.

I stay in the office all day and enjoy free breakfast, lunch, and dinner. But I know I’m not on track anymore. I’ve already burnt through most of the ₦70k. At this point, I’m just trying to delay the inevitable.

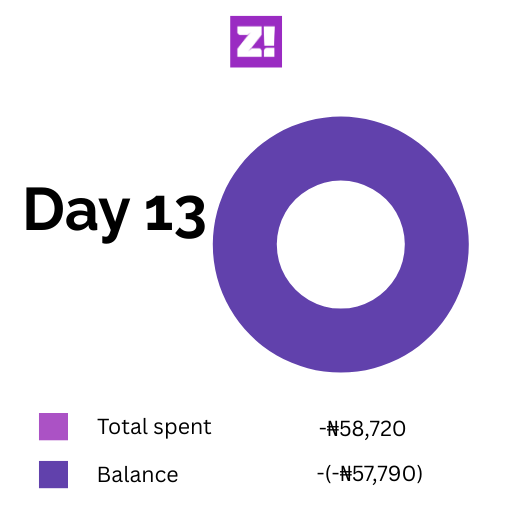

Day 13

Sunday: the beginning of the end.

I miss my 4 p.m. train back to Ogun. I take a bus back to the hotel, which costs me ₦2,500. I also pay ₦48,000 to extend my stay for the night, and this isn’t covered by the company.

After I settled in, I book another train ticket for ₦4,720.

Barça scores again, which means another ₦1,000 deduction. Then, I renew my ₦2,500 weekly MiFi plan.

Day 14

I hail a cab to the station — it costs me ₦3,200. I catch the morning train this time, and once onboard, hunger kicks in. I spend ₦1,800 on meat pie and sausage rolls.

By 9:49 a.m., I arrive in Ogun and hop on a bike for the last stretch home. That’s another ₦500 gone.

Bottom Line

It’s just the 14th day of the month, and I’ve already blown way past the ₦70k minimum wage — and more than half my salary, too. If I were commuting to the office daily, I’d have spent much more.

I thought I could survive the month on Nigeria’s new minimum wage if I planned well enough. But in reality, even someone who earns ₦250k monthly can barely stretch that far.

Living in Nigeria right now isn’t just hard; it’s a full-time survival game.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.