Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

The money gifts I received from visiting relatives when I was younger. Then my mum would say, “Bring the money. I’ll keep it for you or use it to buy you something later.” I never saw the money again.

Haha. Typical Nigerian parents. What was money like growing up?

We were comfortable, but started to struggle when I entered secondary school. My accountant dad moved to a different state for work, and joining him meant my mum had to leave her previous teaching job to start looking for another.

Things weren’t bad, per se; we just had to make some adjustments. For instance, I attended a boarding school, and we had to reduce some of my provisions. When I’d usually get both cornflakes and Golden Morn, I now had to choose between them. It was a slight inconvenience.

What was the first thing you did to earn money?

Fresh out of secondary school in 2014, I got a job teaching at a school for the ridiculous salary of ₦5k/month. I worked there for a couple of months before leaving to work with my mum, who had now opened her own school.

I feel like I already know the answer to this, but did she pay you?

Haha. There wasn’t a solid payment structure. My younger sister also worked there at some point, and I don’t think we ever received an actual salary.

My mum was paying the other teachers, but, of course, as her children, she only gave us random pocket money. We never actually had the salary conversation. You know how it is, she was feeding us, so how do you ask for a salary?

Right. How long did you work with her?

I worked there for about two years before leaving for university in 2016. In uni, I received a ₦25k – ₦40k monthly allowance. It wasn’t specific, as I could just call home if I ran out of money.

In my second year, I began exploring ways to earn money part-time without solely relying on an allowance. I wanted something that wouldn’t require a lot of my time or interfere with my studies. My roommate was actively doing ushering jobs, so I got her to help me get started as well.

What was the pay like?

It was usually ₦5k per event. In rare cases, payment could be as high as ₦6k – ₦7k. I didn’t always get a lot of gigs, though. I’m not very tall, so my options were limited. That said, I secured at least one or two ushering gigs monthly.

I did this throughout my time in university, taking on these random gigs until 2022. I left uni in 2020, but we officially graduated in 2022.

What did you do between that time?

I was home when COVID happened. The pandemic led to my dad getting laid off at work, which affected our finances. I needed to find a way to support myself and my siblings, so I started actively seeking opportunities.

I found a boot camp for young professionals on Twitter, which came with a scholarship to attend for free. Towards the end of the boot camp, one of the partners said they needed a virtual assistant to manage social media and customer service for their fitness brand.

I applied and got the job even though I didn’t have virtual assistance experience. I did have some social media management experience from the time I helped a coursemate with their brand. I’d also taken a handful of courses on design and content creation, so I believe those helped.

My salary was ₦35k/month. I did that for a few months and realised I couldn’t survive on that amount.

I’m the firstborn, and I had two younger siblings in uni. By the time I bought data and shared money with my siblings, I was back to zero. I needed another source of income. While I held onto my job, I continued to seek out new opportunities.

How did that go?

In a matter of weeks, I saw an opening for a social media assistant on a Telegram career board, applied, and was hired at ₦25k/month.

Someone at church who knew I was into social media also offered me a role, and I collected that too, juggling all three jobs together. The pay was also ₦25k, which wasn’t great, but at least I was gathering all the salaries together to make a reasonable income.

I held onto two of those jobs for a year, until one laid me off and the other closed down. This was around 2021. I still had the virtual assistant job, and they even increased my salary to ₦45k/month. I worked there for two more years before eventually leaving in 2023.

My uni’s convocation delay contributed to my staying that long. Also, my employer travelled, and I kept waiting for her to return, only to learn she actually relocated.

I’m screaming

I should also mention that I began my journey into video editing while working as a virtual assistant. Actually, I picked up the skill while working with the church member who employed me.

I was supposed to manage their social media, but somehow my job also involved editing videos. I realised I enjoyed it, so I kept at it even after losing the job. I was in the social media department of my church, so I’d shoot content, edit and post on the church’s social media pages.

In 2023, just before I left my VA job, I applied to work as a creative assistant for someone who needed one during her time in Nigeria. She lives abroad and needed someone to help with shooting, editing, and creating behind-the-scenes clips while she was in the country.

It was a 10-day visit, and in my application, I even said she didn’t have to pay me. I just wanted the experience. She picked me up, and although there was no pay, she covered my transportation. I actually learnt a lot from her, and she must have liked my work, because she gave me a shoutout on her Instagram story after the project.

The shoutout helped me land a booking to cover a baby shower, marking the beginning of my foray into mobile videography. I began taking on small jobs here and there. When the first lady I worked with got married a few months later, I was the mobile videographer for the event, which brought me visibility and more bookings.

Love it. How much were you making from these bookings?

See, I might have a problem with knowing how to charge for my services. When I got my first baby shower gig, the client asked for my rates, and I didn’t know what to say.

Mobile videography was still relatively new, and I didn’t have anyone doing something similar whom I could ask. I ended up charging the client ₦25k.

Ah

I learnt after that incident sha. I think the next fee I charged was ₦40k. Then I started considering transportation costs and the value of my time in my rates, and gradually increased them to ₦60k, then ₦80k, and later ₦100k.

Fast forward to 2024, and I was finally called up for NYSC. I served at a government agency that paid me ₦25k/month — too many people have paid me ₦25k in this life — in addition to the ₦33k stipend from NYSC.

I didn’t do much at the agency, so I still actively took on mobile videography gigs during this period. I did everything from proposals and birthday dinners to weddings and corporate events. By now, my pay was a standardised ₦100k – ₦150k.

How often were these gigs coming?

I averaged five to seven gigs monthly, but my main problem was that I didn’t keep track of my income. I’m not proud of it, but I was terrible with my finances and spent money anyhow.

Suddenly, I no longer understood the concept of public transportation. I took cabs everywhere, bought junk food and skincare and regularly sent money to my siblings. I didn’t have many expenses, but I just couldn’t track how my money was disappearing.

It was only two months ago that I sat myself down and decided to try to be intentional about my finances.

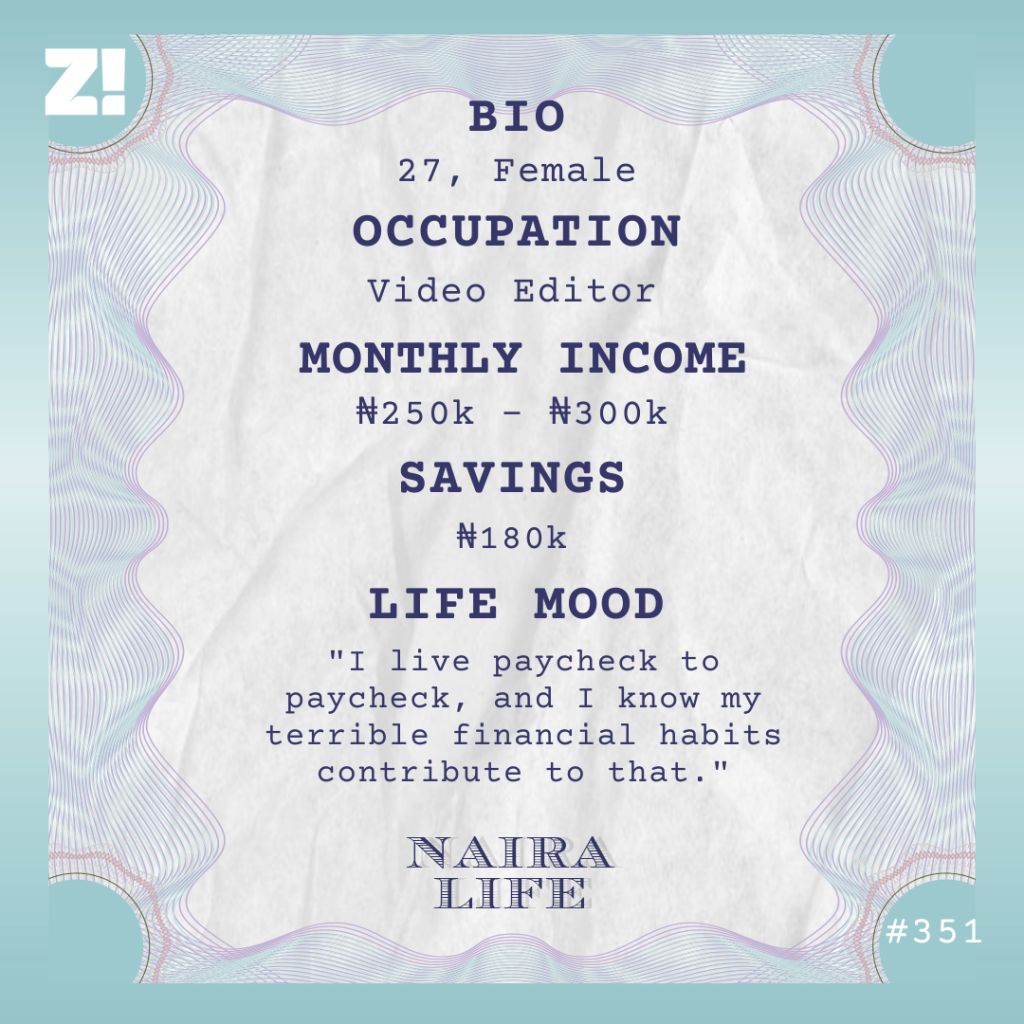

What’s your income like these days?

I’m a full-time freelance video editor, so my income isn’t very stable. I make an average of ₦250k – ₦300k monthly. In really good months, I can make up to ₦500k or ₦600k. In very bad months, I make nothing.

Remember the lady who hired me as a creative assistant? We currently have a monthly retainer arrangement, and she pays me ₦150k/month to edit videos and develop content ideas and strategy. Our work relationship is now more personal than strictly employer-employee. So, I’m sure of at least ₦150k even if I don’t get any video editing gigs.

I’m also in film school. I started in September, and I applied because I felt stuck at some point in the year. I wanted something concrete, more knowledge than what I already knew. Thankfully, the film school is sponsored by the state government, so it’s free. My long-term goal is to become a film editor. I realised I loved the editing part of my job more than shooting, so I’m currently studying visual post-production.

I noticed you didn’t mention virtual assistance or social media management anymore

Yeah. I made a decision at the end of 2024 to stop them. I just felt like I didn’t know what I was doing, and that I wasn’t good at it. I think it was just a step on the journey of figuring out what I want to do in life.

It’s interesting because I earned dollars for the first time last year through virtual assistance and social media, but I just didn’t see myself doing that anymore. It was time to move on.

Wait. Tell me more about that dollars part

Around March 2024, just after NYSC orientation camp, my boss (the one I work with as a creative assistant) linked me up with a talent recruitment agency that connects talents with clients in the UK, Canada and the US.

The talent doesn’t discuss payment with the client; the agency just tells you XYZ person needs you and is willing to pay a certain amount. I’m sure they get their percentage or a commission. I got two clients through them; one paid $175/month and the other paid $195.

The contract for both gigs lasted about six to seven months. I finished the last one in December. Then I informed the agency that I was pivoting to video editing and was open to roles in that field. Maybe they don’t have many clients who need video editors, as I haven’t received a client from them since then.

What kind of lifestyle does your income afford you?

I live paycheck to paycheck, and I know my terrible financial habits contribute to that. At least, I can afford my basic needs. I live with my siblings in a family house, so thankfully I don’t pay rent. That’s my saving grace.

How would you describe your relationship with money?

It’s very touchy. Before 2024, I liked the idea of hoarding money, but then I started to convince myself to let money go. I believed I should be a channel through which money flowed, rather than just keeping it somewhere.

So, I started to get comfortable spending money. Unfortunately, I took it to the extreme. I’d use my last money to order food online and be doing, “If I perish, I perish.” I’m just now trying to find a balance and taking financial literacy seriously.

How are you doing that?

For one, I’m trying to reduce the amount of food I order, which is difficult, especially since I’m almost always in school. I also use an Excel sheet to track my income and expenses. I haven’t seen much active change yet, but it’s a gradual process.

Another thing I recently did was to register my business (which cost me ₦13k) and open a business account. The idea is that I can separate business expenses from my personal expenses. I haven’t figured out how to do that yet, but my younger sister, who is an accountant, suggests paying myself a salary so I can use that to fund my expenses and have money specifically set aside for scaling my work.

Speaking of my work, I want to get better at my pricing. I think I don’t have the greatest appetite when it comes to charging my worth. I need to work on my mindset to accept that I deserve to be paid more. I also need to build systems to make my business solid and reputable.

All in all, I think I’m making progress. I used to call myself a spendthrift, but now I see myself as someone taking intentional steps to improve my finances and do better.

I’m curious. What informs how you currently charge for your services?

I charge by the hour, as I mostly work with events. My lowest offering is three hours for ₦120k, and the price increases with the number of hours I spend. My highest rate is about ₦300k for 12 hours.

I believe I should be charging more, maybe at least ₦350k – ₦400k. However, I’m also self-aware. I’ll probably need to change my phone or get a new gadget so I can produce higher-quality videos if I hope to increase my rates.

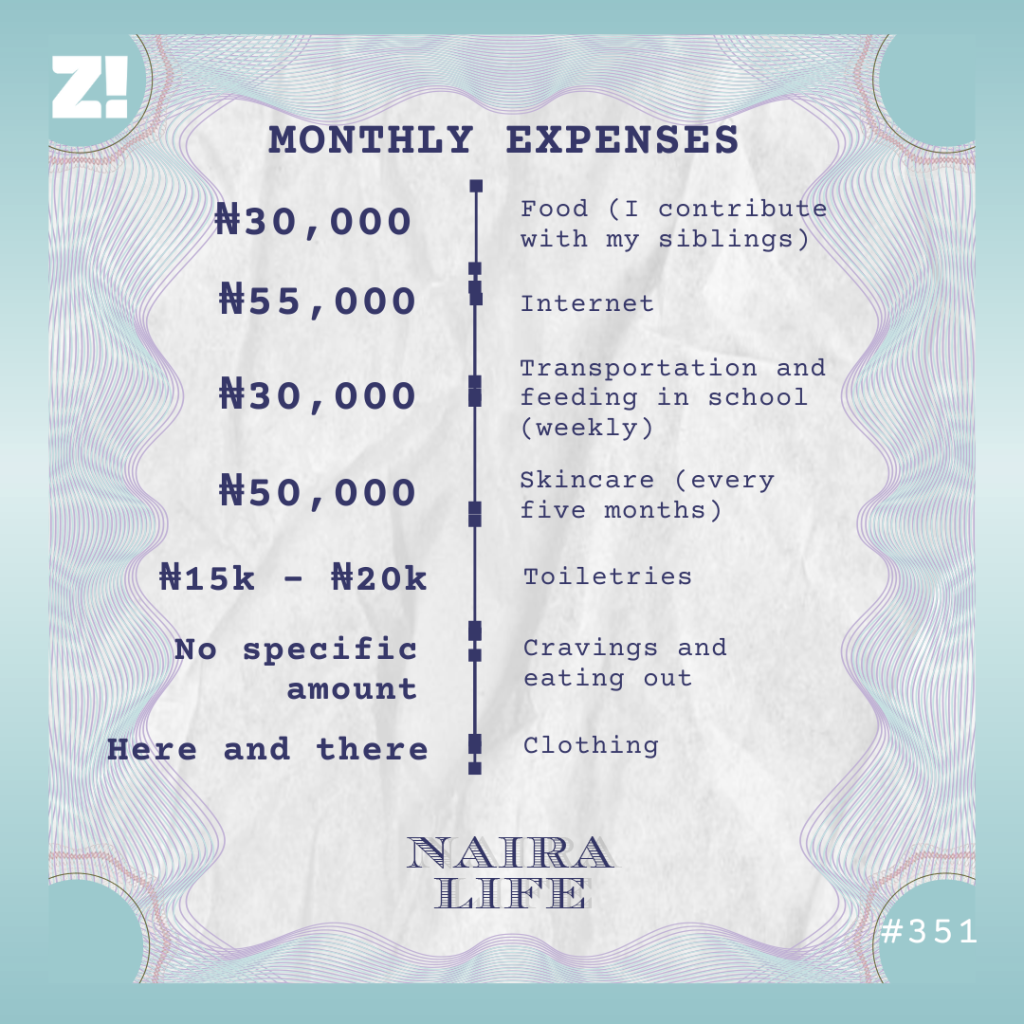

Let’s break down your typical monthly expenses

Since I decided to take my finances seriously, I’ve been doing a thing where I try to save ₦10k or ₦20k from every new gig. I currently have about ₦60k in my savings, and another ₦120k in a locked account.

What’s an ideal amount you think you should be earning now?

I should be able to average ₦2.5m/month if I take my life seriously, upskill and put in the work. I suspect I hit ₦1m or ₦1.5m a couple of times last year, but I didn’t exactly track my money, so I can’t say for sure.

That said, ₦2.5m feels possible. I mentioned my business earlier. I’m trying to put together a video editing agency. I already have video editors who work with me, and I pay them per video. With an agency, I can put more structures in place and expand my income sources to include hosting video editing classes. This all depends on me putting in the work. Film school will end in a couple of weeks, so I need to get my act together.

Rooting for you. What’s one thing you want but can’t afford right now?

An iPhone 17 for my business, but that’s almost ₦3m.

How about the last thing you bought that made you happy?

It was my brother’s birthday a few weeks ago, and I bought him a ₦35k Kaftan two-piece. I loved being able to do that for him.

How would you rate your financial happiness on a scale of 1-10?

2. My financial habits got me to where I am right now. I should’ve done better with my finances, but there’s room for improvement.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]