When 20-year-old Layla* created a YouTube channel in January 2025, it was going to be a side hustle for the occasional extra cash. Instead, she found early success — really fast. Seven months in, she’s steadily raking millions monthly from her faceless YouTube channel. Here’s how she did it.

As Told To Boluwatife

My YouTube “career” started as a barely-thought-out idea. I use “career” loosely because I’m nowhere close to being an expert. I’m a 400-level medical student who just wanted a side hustle. Somehow, I got monetised in three months, made ₦6m in the following three and now earn at least ₦1m/month.

How I Started

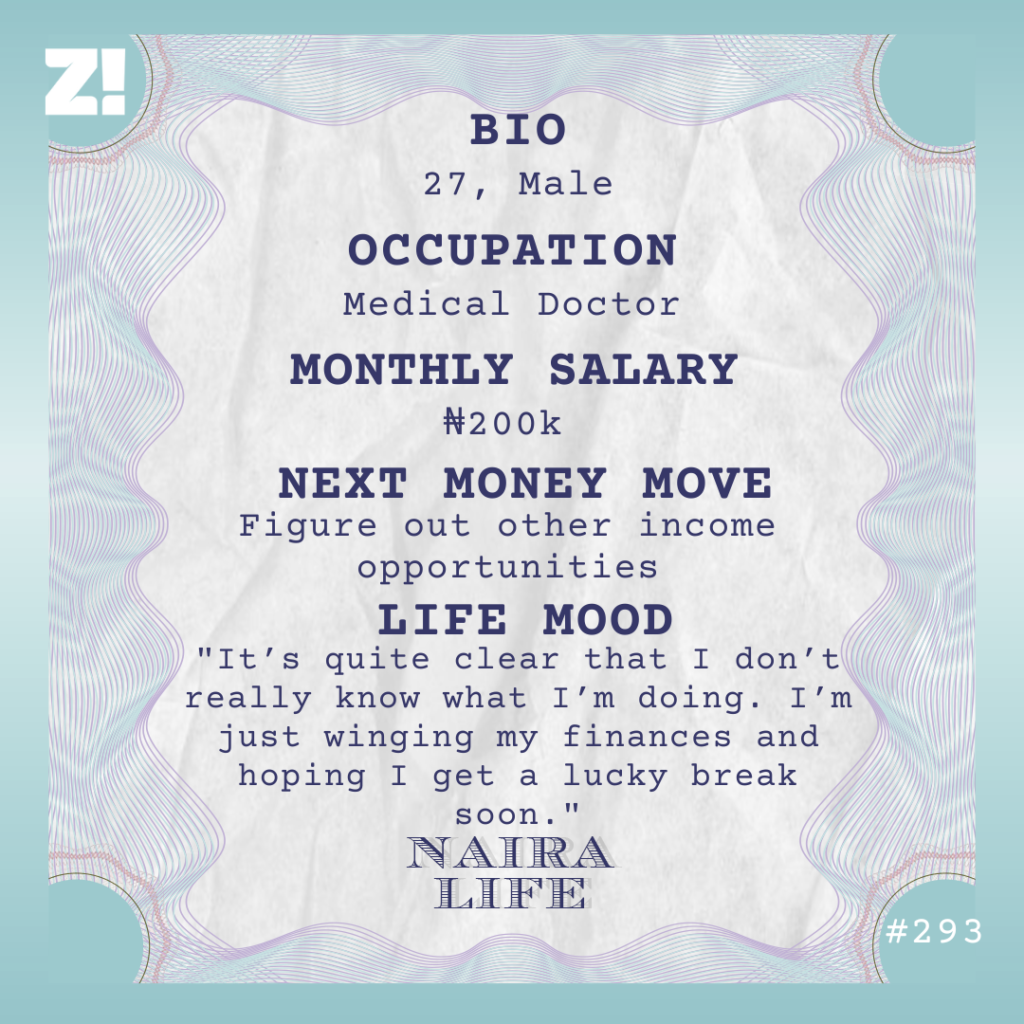

In late 2024, I started considering doing something extra besides my regular school schedule. This “ginger” came from reading Naira Life stories about other medical students making money from side hustles. I wasn’t the best person at tech or business, but their stories challenged me, and I began searching for options that could work for me.

I found one on Facebook.

One day, while doomscrolling on the app — yes, I’m that Gen Z who still uses Facebook unapologetically — I found a video of someone talking about creating on YouTube. Over the next two months, Facebook’s algorithm recommended similar videos. I also joined a YouTubers’ community where creators discussed their channels, content and growth.

In January 2025, I decided to try YouTube content myself. While I hadn’t decided on a niche, I knew I wanted a faceless channel. I love to talk, but showing my face or doing voiceovers required filming and editing, and medical school wouldn’t give me that time.

I already knew how to edit videos with CapCut, and many people online were creating storytelling-type content. They’d script, then create images and voice-overs with AI, edit the clips, and post. I could do that with CapCut.

The first niche I tried out was motivational storytelling. My first video had 81 views in two days, which wasn’t a flop. But most of the views came from Indians, which was bad. Participating in the YouTuber community taught me that channels with predominantly Indian and Nigerian viewers made less money than those with viewers from countries like the US, UK, and Australia.

I hadn’t even told anyone I’d created a channel because I wanted the YouTube algorithm to do its thing. See, I’d learned that, as a creator, you don’t want your audience to be your family members or friends.

The algorithm brings your audience to you if you use the right keywords and hashtags and provide value. It’s better that way because you have an engaged audience. So, I didn’t need to beg people around me to view my content to boost my numbers. Everything I’d seen from the community pointed to one thing: It’s better to trust the algorithm and optimise for an audience from the right countries.

In other words, I had to try another niche. I abandoned that channel, took a break and opened another one in February.

Trying Out A Different Content Direction

For the new channel, I explored other genres of storytelling. I studied different content types: billionaire stories, family stories, and even stories about black people.

I settled on revenge stories.

Writing comes easily to me, and I felt like I wouldn’t have problems finding revenge plots to write about.

After picking out the niche, I began to research. I used tools like TubeBuddy and vidIQ to research popular keywords and hashtags for revenge stories on YouTube. Then, I studied similar creators to observe their style, patterns, how they created their videos, posting schedules, everything.

I didn’t focus on big channels. This group already has an established audience, so they don’t need to do much to get views. Instead, I focused on medium-sized channels and creators with between 1000 and 10,000 subscribers.

The idea wasn’t to copy them. I just needed to figure out why people watched their content. And I did. I noticed that a big part of the “draw” came from their thumbnails and titles, so I implemented that in my own content.

My first video did 600 views in about four days. It was so wild to me. I didn’t tell anyone about my channel, yet 600 people I didn’t know were watching and commenting. It was a confirmation that I was on the right track.

I was writing my professional exams around this time, but I made time to post at least once daily. Scripting the stories was the most taxing part, but editing was straightforward. I’d just create AI images for the footage and have CapCut read the script with the AI voice.

Sometimes, it was difficult to keep to my schedule, but my views kept increasing daily, and the progress was consistent. I had no choice but to be consistent.

ALSO READ: 55 Ways To Make Money Online, Offline and from Home as a Nigerian

Getting Monetised

I started the channel in February, and by the first week in May, I had reached the 1000 subscribers and 4000 watch hours threshold to get monetised. Reaching the watch hour threshold was very easy; it was the subscriber condition that even took me that long. I know people who spent years trying to hit the monetisation milestone, and I got there in less than three months.

Monetisation wasn’t entirely seamless, though. YouTubers get paid through Google Adsense, and to set up my account, I needed to verify my identity. I didn’t have a government ID, and apparently, YouTube doesn’t recognise NIN slips. I heard some people who tried to verify with NIN had their accounts banned, so I didn’t even try it.

I tried to get a voter’s card, but the INEC office I visited told me they only print cards during election season. The workers there even laughed at me and said, “Even if you go to Abuja, you won’t get anything.” I still wonder what the staff do when there are no elections.

In the end, I used my dad’s driver’s license to verify my account so I wouldn’t miss the 20-day deadline YouTube gave for the verification. So, technically, it’s his channel; the money only enters my account.

This is how I make money: YouTube pays based on the number of people who watch my videos. They determine this via two metrics: CPM, which is what advertisers pay, and RPM, which is what YouTube pays after removing their cut. I think YouTube collects 45%, but they don’t show how they split this on the backend.

After YouTube monetised my channel, I noticed I could see my earnings update daily. I remember seeing that I made $20 (about ₦30k) in one day and excitedly estimating I’d make about ₦900k by the end of May.

The thing about YouTube payments being dependent on views is that, you can’t exactly estimate how much you’ll actually make. By the end of May, I made over ₦1.5m.

It was surreal. I told my mum, “Put some respect on my name. You can’t be telling me to wash plates. I earn six figures now.”

In June, I made ₦1.7m, and then around ₦2.8m in July. It’s safe to say a minimum of ₦1m is the baseline, and I’ve never done anything to promote my channel. I just research keywords, write my stories, and post them at least once a day. Some of my videos now do over 200,000 views.

Future Plans

YouTube is very much in my future. I’m considering starting a new channel in addition to this one, most likely with my face. My challenge with that is, no matter the niche I choose, my audience will most likely be Nigerian because of my face and voice.

It might be depressing to compare how much lower the income from that channel will be, especially since I’m used to earning from American viewers, but I may just do it for the love of yapping.

I’ll be in medical school until 2029 — I’m already so over it — so it’ll take a lot of deliberate effort to create content around my schedule, but I honestly love it.

No matter how stressed I get from presenting patients and collecting unnecessary insults, it all just melts away when I pick up my phone to edit. Even when I get creative blocks, I only need to see what others are doing or log on to YouTube Studio for content inspiration.

It also doesn’t hurt that YouTube pays well. I’ve gone from being overly frugal to spontaneously treating myself to things I enjoy. I hang out with friends more, and I treat my family too. I still save more than I spend, though. I currently have about ₦2.9m in savings and am also working towards building a dollar savings portfolio.

I also want to get into investments, but the more I read about options, the more confused I get. I’m also a bit of a scaredy-cat. I’ll literally cry if I put my money in anything and it crashes.

Right now, I’m taking things one day at a time, and I like my progress. I love what I do, and I know what my future career path looks like. I’ll most likely end up working in media or as an on-air personality while having my YouTube channels on the side.

I can say for sure, though: A hospital is nowhere in the future I envision.

*Subject’s name has been changed to protect her identity.

NEXT READ: How I Built a £100K Stock Market Portfolio 2 Years After Moving to the UK

[ad]