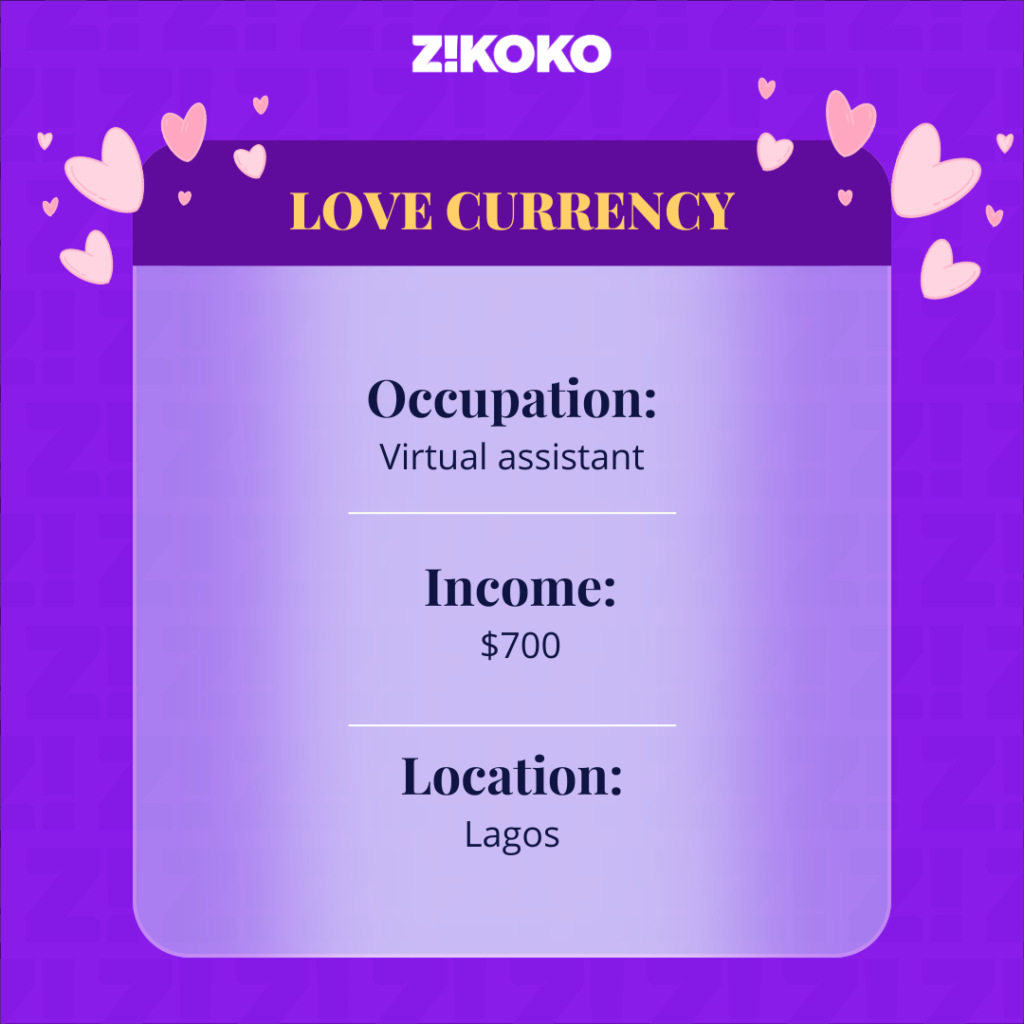

The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

Interested in talking about how money moves in your relationship? If yes, click here.

How long have you been with your partner?

We started dating in 2013 and got married in 2021. That’s 12 years in total.

How did you meet?

We were in the same faculty at uni, and I used to see her around. She was my spec: slim and dark skin. I liked her, but I didn’t approach her. Instead, I asked a friend who stayed in her hostel to send me her Twitter handle. I started following her, but didn’t initiate a conversation until a few weeks later.

She already knew I liked her at this point because I’d already told mutual friends, and they kept hinting at it. One time, during a general course lecture, Fiyin sat beside my friend, and I sat beside them. I started telling the guy about my feelings for her, you know, just to make him aware. The guy literally tapped her, pointed to me and said, “My guy likes you.” I just bent my head.

I’m screaming

Fiyin complained about my many “hints” to a mutual friend. Thankfully, the friend encouraged her not to cancel me just yet. I finally reached out to her on Twitter and asked for her BBM pin (BlackBerrys were still trending in 2012), and we started chatting.

We got along pretty quickly. We’d go for walks in the faculty, and she’d laugh at my dry jokes. All my friends loved her. It was great. I formally asked her out a few months later in 2013, just to make things official. We were both in 300 level at this time.

Here for the undergraduate love. What was your financial situation, though?

We both lived on pocket money. I got mine from my dad, but it wasn’t stable. Sometimes he’d send ₦5k, other days, he’d send ₦20k. Fiyin got pocket money from both her mum and dad. I’m not sure how much, though.

That said, we didn’t pressure each other to buy stuff or go on dates. Fiyin wasn’t billing me or anything like that. I did go all out on her birthdays, though. For her last birthday in uni, I bought a huge card for ₦1,500 and got all her friends to write on it. I also bought her a cake for ₦5k and a pair of flat shoes for ₦5k.

We graduated in 2014 and served the NYSC year in neighbouring states. It wasn’t long-distance, though, because she always visited on the weekends. I was sharing an apartment with a cousin then, so Fiyin would just stay over.

Who paid for these trips?

Fiyin paid for them herself. It took me about a year to land my first real job after NYSC. To be honest, the delay was because of me. I was very picky about where I wanted to work. I eventually picked a contract role at a telecoms company for ₦97k/month in 2016. I was on that salary for about four years. At one point, it even reduced to ₦85k.

My relationship with Fiyin was going great, but I didn’t feel financially stable enough to progress beyond dating. Fiyin wasn’t pressuring me either. Plus, our incomes were similar. Between 2016 and 2018, she earned ₦60k. Then she got a bank job and moved to around ₦90k.

Our financial situation started to improve in 2019. I got a permanent role at my job, and my salary increased to ₦437k. Fiyin also got a promotion and a salary bump to ₦195k. By 2021, when we finally felt ready for marriage, we earned ₦600k and ₦256k, respectively.

How did you both handle wedding expenses?

It was a joint effort, but I took on more of the expenses since I earned more. Before the wedding, I lived with my parents, which helped me save a whole lot. I was just investing my money in mutual funds and Risevest.

We also got a lot of financial support from friends. Our wedding cost us about ₦14m, but only ₦4m of that amount was our own money. It was surprising because we didn’t even actively ask people for support.

Then we got our three-bedroom apartment for ₦2.850m (₦2m/year without the agent fees). Interestingly, we only got the place two weeks before our wedding and didn’t move in until a few weeks after, because, between 2020 and 2021, Fiyin lived with me in my parents’ house. Her own parents left the country, so she had to stay with me. My parents are liberal, and they didn’t have a problem with that. So, there was a point after our wedding when we had to return to my parents’ house because our apartment wasn’t ready.

Back to the present day. How do you both run your home’s finances?

Our rent has doubled since then — it’s now ₦4m — but our income has also increased. Fiyin joined my workplace in 2023 and now earns ₦1.2m/month, while I earn ₦1.7m. We also have a child now.

I pay rent, and Fiyin pays the ₦600k/year service charge. Once salary enters, we immediately take out our savings — ₦1m for me and ₦500k – ₦700k for her — convert them to dollars immediately and leave them in a Risevest account.

Then we use the rest to sort out bills and home expenses. Sometimes I pay when we go shopping, and other times she pays. I fuel the car, she fuels the car too. We just handle everything together.

What kind of money conversations do you both have?

We often discuss personal development. For instance, when Fiyin worked at the bank, I noticed she couldn’t keep up with her savings because she didn’t earn much. So, I started helping her apply for roles in my company because I knew they’d pay her more. It took a couple of tries, but she eventually got in, and our finances and savings have improved jointly.

Speaking of savings, we also discuss our plans for saving and investing. We’re both prudent savers, so it’s easy for us to be on the same page. I should also mention that we’re in the middle of a Canada relocation process, and our joint savings played a big role in making that happen.

Oh. Tell me more about the relocation bit

We went through the Express Entry route and got Permanent Residency early this year. We didn’t actually think japa would happen so soon. We had it in mind, and I had done IELTS and WES, but it wasn’t exactly top of mind until someone told my wife about a category-based selection for people who worked in transport.

My wife works in finance, and transport is under finance. She had experience interacting with suppliers and other transport guys, so we entered the Entry Pool with that and got the Invitation to Apply (ITA) in a month. It was quite shocking.

Anyway, we travelled in July for a soft landing, spent a month, and are now back to prepare to relocate fully next year.

Congrats! What’s “soft landing,” though?

So, when you get your Permanent Residency (PR), Canada gives you a specific number of days to land in the country, or else they’ll revoke the PR status. A “Soft landing” is when you travel within that period to complete the necessary documentation, get the PR card, open bank accounts, and spend some money to increase your credit score before you’re actually ready to relocate.

So, that’s what we did. I honestly can’t remember all we spent on the whole process because it was a lot of random bills. However, I can estimate we spent around ₦5m for the applications and WES evaluations and gathered 34,000 CAD (around ₦38m) for our proof of funds. We dipped into the proof of funds for the soft landing trip and spent about $5,000 on the trip and other expenses, including a $1,000 gift to the relative we lived with for the month we spent there.

All this came from your joint savings?

Yes. Everything.

Safe to say it was a case of “opportunity meets preparation”?

It was exactly that.

Nice. You both seem to run like a well-oiled engine. Do you even have money-related conflicts?

Haha. Not really. There’s the occasional complaint when I borrow money from Fiyin and don’t return it quickly or at all. It’s more banter than conflict sha.

Do you still have a safety net? Considering you’re using your savings for the proof of funds

Well, we’re still saving. We’re moving for good next year, so we’ll still save our salaries, leave allowances and bonuses, and sell our cars and some property in our house to top up what we already have.

I estimate we’ll travel to Canada with at least $65k. That should keep us afloat in case there are any delays in finding jobs. I applied for some jobs (and got some rejections) while we were in Canada just to get a sense of how they worked. I intend to begin serious applications about three or four months before our move. I’m positive we’ll find something before we move.

Rooting for you. What’s your ideal financial future as a couple?

I’m not greedy; I just want us to have a $5m net worth. If we have that in S&P 500 stocks and consistently receive 14% returns, that’s about $700k in yearly interest, which is essentially extra money. We won’t even need that much to survive in a year.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: The Mechanic Cohabiting With His Common Law Partner on a ₦70k/Month Income

[ad]