Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Did you know that 900,000+ Nigerians are buying and selling Bitcoin on Yellow Card? You can buy as little as 2,000 NGN worth of BTC.

Yellow Card is very easy to use and has the best rates on the market, low fees, and top-notch security. Join Now!

When did you first realise the importance of money?

Secondary school, and it was in the context of how people treat each other. I went to an international school, a typical rich kid setting, and the students used money as a popularity yardstick. It was like, “Why should I talk to you if you can’t afford to buy XYZ?”

It was the first time I saw something like that, and it seemed brutal. I didn’t understand why it mattered that people couldn’t afford certain things.

Did you also fall into this category? I mean, not being as rich as the others?

Oh no. I grew up comfortable. My parents are civil servants who own businesses on the side, and we’ve vacationed abroad at least once a year since I was in primary school. Money was never a problem, but I consider myself naturally empathetic, so my classmates’ attitude bothered me.

Plus, my parents didn’t teach me to look down on people based on what they could or couldn’t afford. They’re firm believers of moderation and humility, so my sister and I knew early that mummy and daddy would never throw money at you. They provided the basics. If I needed extra money, I worked for it.

It’s safe to assume you started working early for money then?

Yes, I made money for the first time in primary 4. My sister and I learnt how to make beaded bracelets by watching videos on the internet, and we convinced our parents to buy us the beads and other materials we needed. Initially, we only made bracelets for each other. But we wore them to school, and our classmates liked them, so we decided to sell them.

Each bracelet cost about ₦150 to make, and I sold them for ₦300 – ₦350, depending on the style and whether or not I included charms. My aunty lived with us, so she helped us keep money aside for the materials. My sister and I shared whatever profit remained. We did that business for about a year. By then, almost everyone in our classes had a bracelet, so there was no market anymore.

Oh wait, I just remembered I had a month-long stint reselling snacks in my class before the bracelets thing. I noticed some people came to school with money instead of food, and there was this big shop close to my house that sold snacks. So, I bought snacks from the shop and sold them in class for a ₦50 profit.

I’m trying and failing to picture a 9-year-old logging around snacks

Haha. I always went to the shop with my aunty, and she helped with the buying. The snacks were popular with my classmates because they cost a little less than the ones sold in the school shops, but the ₦50 profit was small. So, I stopped and moved on to the bracelets instead.

Why the need to try businesses so early though?

I liked the idea of having my own money. The bracelet thing was basically turning a skill into a money-making opportunity. My parents are also business-oriented, so they encouraged my sister and me to explore as much as possible.

I entered secondary school in 2014 and resumed the snacks business. Unlike me, most of my classmates were boarding students, and the tuck shop didn’t have much variety. My parents gave me a ₦1500 weekly allowance, so I used part of that to buy snacks from home and sell them in school.

My profit margin was greater this time around, and I made at least ₦150 on every item. In a week, I could make up to ₦2k in profit, and I spent my money on food and gifts for family and friends. I did the business between JSS 2 and SS 1, then I stopped because the school banned boarding students from buying food outside the tuck shop.

I graduated from secondary school in 2020, but I was forced to remain at home for two years due to the pandemic and plenty ASUU strikes. So, while I waited for school, I sold tote bags and other accessories.

How did that work?

I opened an Instagram page and began advertising the tote bags, scrunches, and pillowcases I made myself. I took a sewing class once in secondary school, and I’m quite creative, so it wasn’t that difficult to learn. YouTube also helped a lot.

However, sales weren’t regular. I only sold to a few of my friends and some people online. I can’t even remember what the profit was like because I could sell something once a month and then go weeks without selling anything. I eventually stopped the business in 100 level. My parents gave me a ₦40k monthly allowance, so I just relied on that.

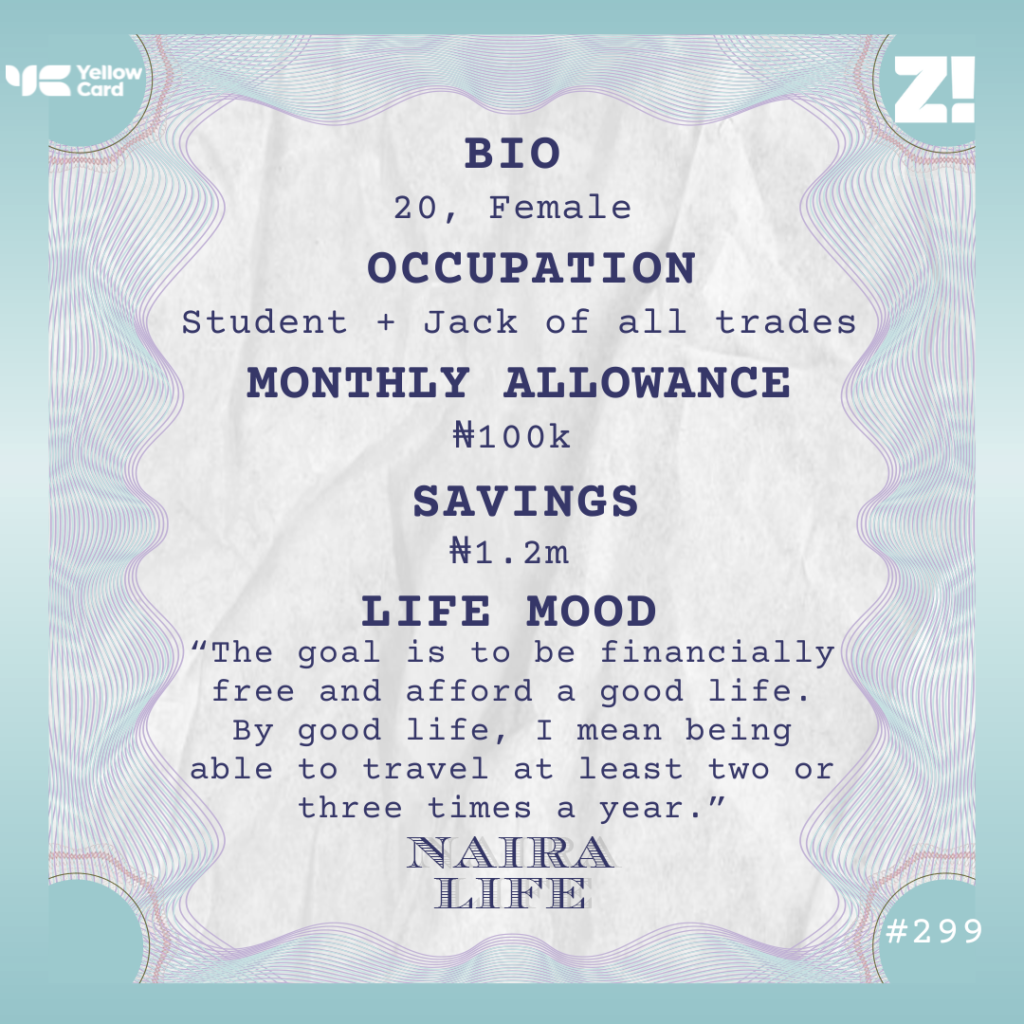

In 200 level, my allowance increased to ₦100k, and I decided it was time to take my finances seriously. The inspiration to get serious with money came from an Instagram financial influencer. She talked a lot about investments and financial management, so I followed her and took a bunch of financial courses she recommended. Most were free, and they were about understanding the stock market and other investment channels.

I’ve always been about making money, but this influencer’s page motivated me to think more about my finances and how to attain financial stability and independence rather than just making quick money. So, since 2023, I’ve been saving half of my allowance and investing some of it in stocks.

What kind of stocks?

US and Nigerian stocks, and sometimes I invest in dollars. Before I bought my first stocks, I tested the waters with a dollar investment. I put $10 in a fintech app and sold it two months later when the exchange rate increased. I made a ₦15k profit on that.

Then, I moved to a brokerage service and put $20 on low-risk stocks because I was wary of losing money. My parents didn’t even support my investment plans — an uncle once lost money to the MMM scam, and I guess they assumed it meant all investments weren’t trustworthy.

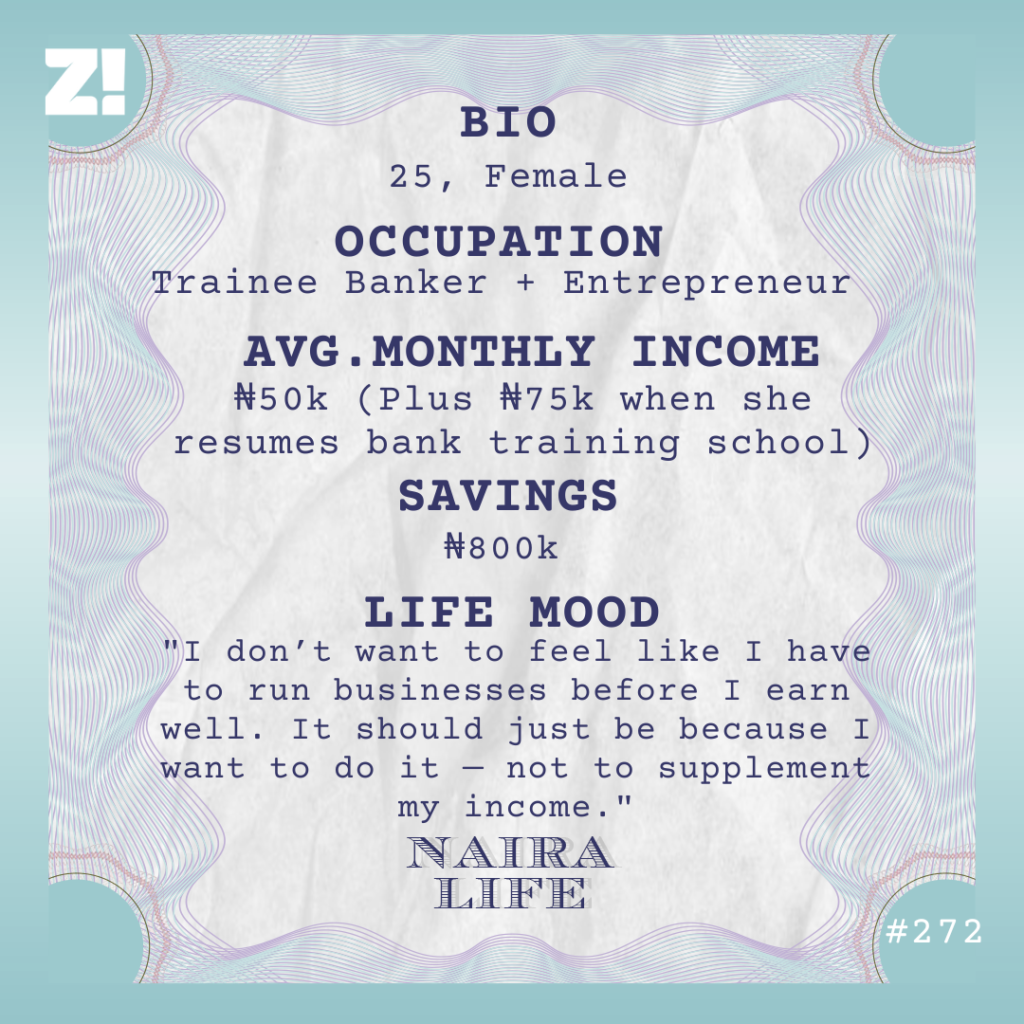

I still continued sha. I have about $120 in stocks right now, but that value increases and decreases depending on market conditions. I’m thinking about the stocks as long-term investments, so I’m leaving my profit to accumulate. I also save in savings apps. Currently, my savings and investment portfolio is worth ₦1.2m.

Not bad. Do you still live on allowances?

For the most part, yes. I’m in 200 level, but I also do a bunch of different things to make money. One of them is personal shopping, which I started early this year. My classmates always complimented my fashion taste and asked where I got my pieces, so I decided to make a business out of it.

So, I help people buy clothes — either what they ask me to get something specific or I just buy if I see anything nice and resell it to them. Sometimes, I outsource styles to a tailor and sell the outfits to my clients. I made at least a ₦1500 profit on clothes I buy from the market and resell.

I don’t really have a steady client base yet, but people come to me occasionally, and I make some money here and there.

I also make money from makeup modelling gigs. I started in 2020 after secondary school and worked with an agency. I left the agency in 2022 because of the bad pay. I got ₦5k per gig, and after removing the agent’s commission and my transportation costs, I was often left with ₦1500 as profit. It didn’t make sense, so I went freelance. It’s been a while since I got gigs, sha.

Voiceover gigs are my most recent venture. A friend needed someone to read two scripts a few months ago, so I did that and got paid ₦6k. I also do a bit of scriptwriting and content creation for a little extra cash here and there.

Seems like you’re bent on trying everything

I just want to build wealth as early as possible. I believe the earlier I start, the faster I can build something like a business empire. The goal is to be financially free and afford a good life. By good life, I mean being able to travel at least two or three times a year. I plan to keep saving and investing till I can do that.

Is it safe to assume the plan after uni is to start working on that empire?

Exactly. I intend to start businesses tailored to my various interests. My friends tease me about being a jack of all trades and never sitting down in one place. But if I’m good at many things, shouldn’t I just do everything?

That said, I like fashion, so I’ll most likely work towards creating a fashion brand where I’ll provide styling services, clothing, and accessories. I also love cooking, so I might start a cooking business, too. I’m always scouring YouTube for recipes and recreating them. I’ll probably end up doing both fashion and food and creating content for both brands.

But short term, I plan to buy land with my savings next year and start a maize farm. I’m thinking of maize because it’s such a versatile crop, and from my findings, it’s also profitable. I’m still working out how it’ll run though. Of course, I’ll have to hire a trusted person to manage it on my behalf, as school won’t let me be more hands-on.

I’m not really focused on a 9-5 job because I see how hard my parents still work at their businesses, even while employed. So, I’m not thinking about making money only within the confines of a job. I’ll still run a business even if I’m employed.

Let’s talk about your current monthly expenses

I plan my expenses using my allowance. Anything extra I get from side gigs is just a plus. So, my allowance typically goes like this:

Savings – ₦50k

Data, food and other personal needs – ₦50k

I split my monthly savings into investments and a savings app. ₦25k goes into stocks and dollars, and I save the remaining ₦25k. I don’t have a budget for transportation —my parents bought me a car last semester to make my commute easier, and they pay for the fuel.

How would you describe your relationship with money?

I think I have two extremes with my finances. Sometimes, I spend aggressively, and other times, I save aggressively. But whenever I’m in that spending state, I make sure not to touch my savings.

What was your last “aggressive” purchase?

I swapped my iPhone 13 for an iPhone 16 and got some new clothes for content. To be fair, I only paid for the clothes. The phone swap cost ₦1.2m, and my dad paid that.

Is there anything you want right now but can’t afford?

A bigger ring light and tripod for content creation. I’m still trying to justify whether I actually need to get new ones since I already have a small tripod and ring light. So I haven’t looked at the prices yet.

How would you rate your financial happiness on a scale of 1-10?

7.5. I’m okay right now, but I can do so much better. I’m on the right path.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]