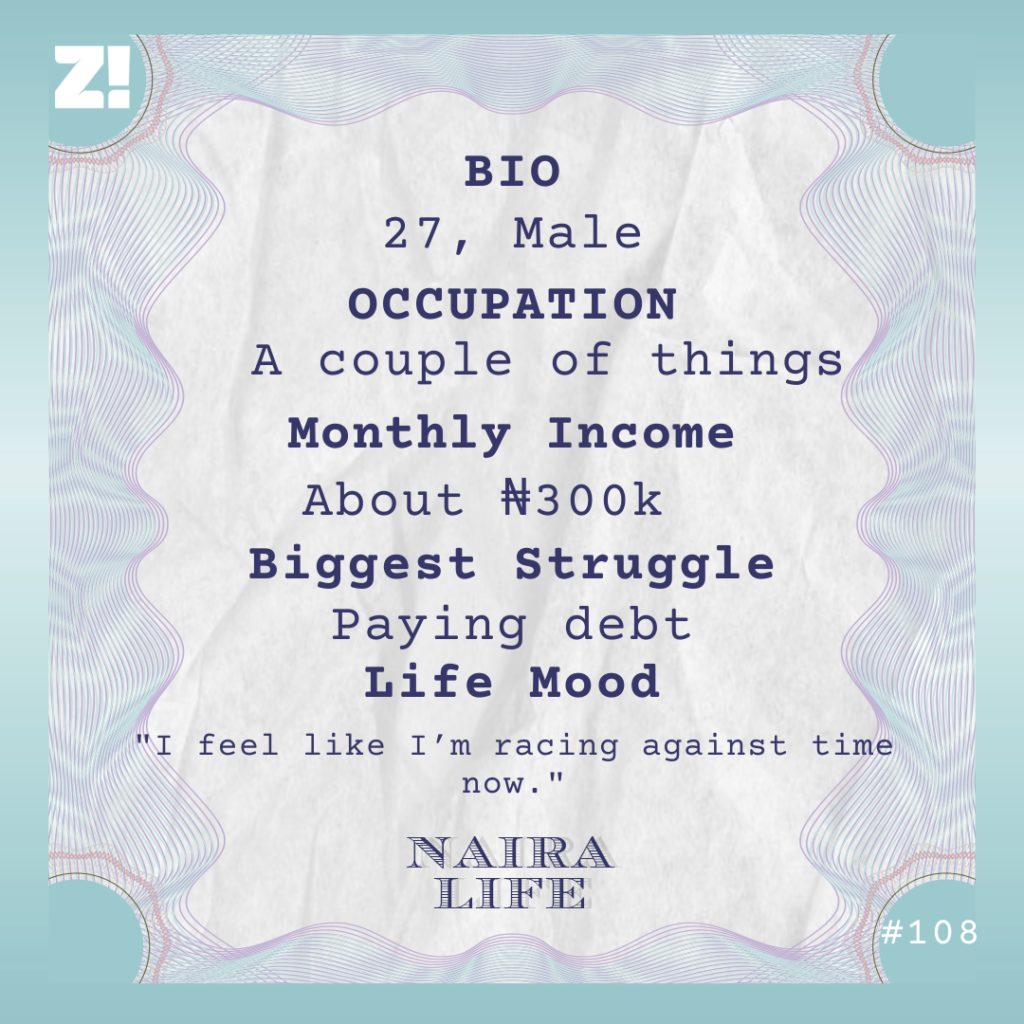

In 1998, this 53-year-old retiree took charge of her financial freedom with small, consistent investments. Over the years, she strategically grew her assets and positioned herself for an early, comfortable retirement.

This is how she made it work in Nigeria.

As Told To Aisha Bello

Model not affiliated with the story. Actual subject is anonymous.

I spent my entire career as an accountant in an insurance company, helping people plan for retirement. During my active years, I saw firsthand what happens when people don’t prepare early enough — the anxiety, the regrets, and the desperate attempts to stretch out insufficient pensions.

I was 26 when I received my first paycheck, and I never wanted that to be me.

Also, I didn’t grow up rich. From a young age, I understood that if I wanted financial security when I was older, I had to build it myself. So, while most people were thinking about how to spend their salary, I was thinking about my retirement plans.

That’s why, from my first paycheck, I made a non-negotiable rule: save and invest 40% of my income, no matter what.

27 years later, I retired at 53 as a director, with a portfolio worth over ₦1 billion spread across real estate, stocks, bonds, forex, and fixed deposits. Over the next 20 years, I’ll also receive a monthly pension of ₦500,000.

This didn’t happen by luck. It was the result of deliberate decisions, smart investments, and some hard lessons along the way.

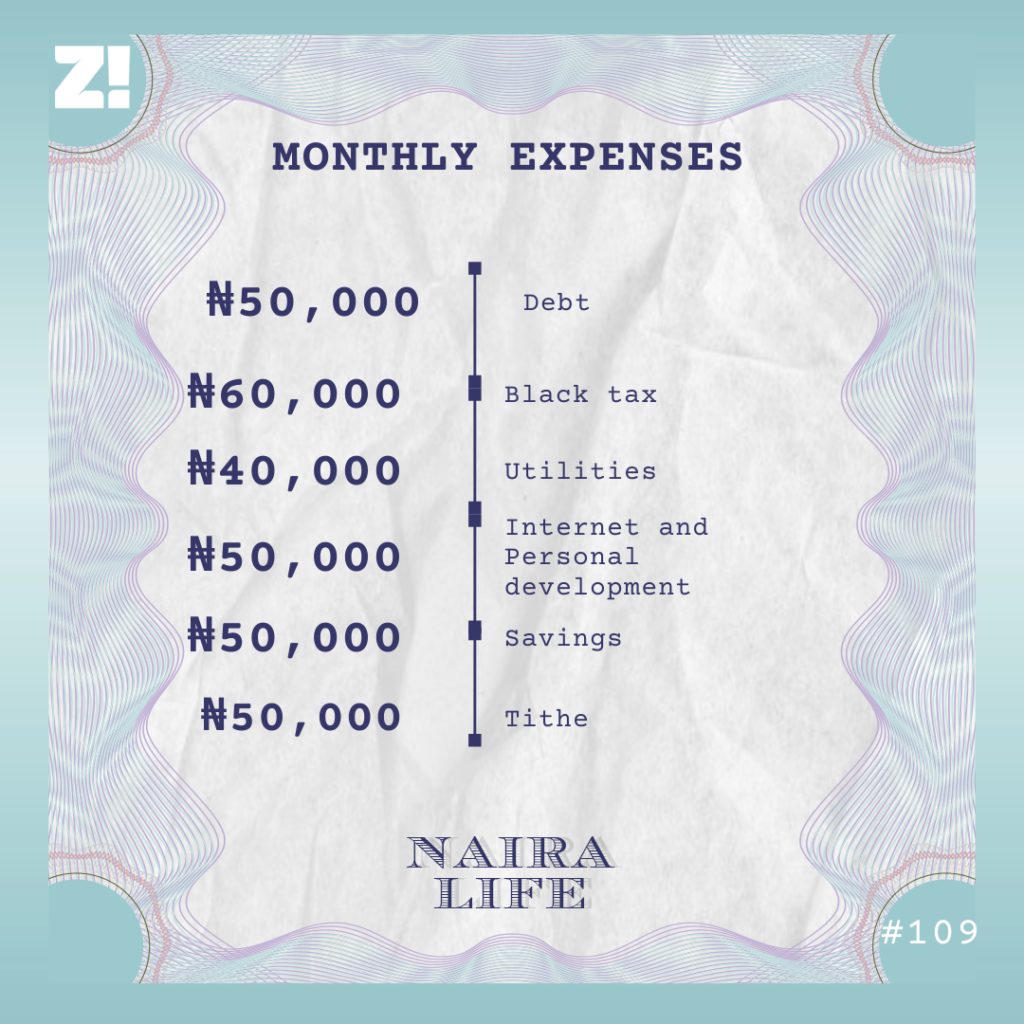

Breaking down my Retirement Portfolio

Here’s what my assets look like today:

Now, let’s talk about how I built each of these.

Fixed Deposit: The early money move that made a difference (₦65M)

In 1997, I started my career as an entry-level accountant, earning ₦16,000 per month. At this point, the Nigerian minimum wage was ₦450 before President Olusegun Obasanjo passed a new wage bill to give workers ₦5,500 in 2000.

At the time, I wasn’t investing; I was just saving aggressively. But everything changed when a friend at National Bank introduced me to fixed deposits.

That small decision laid the foundation for the rest of my financial journey.

My organisation had a unique payment structure: I received a portion of my salary monthly, while the rest was paid upfront at the beginning of the year. My basic salary (₦16,000) accounted for 60% of my total income (₦26,000 per month), while the remaining 40%, which covered housing and furniture allowances, was paid in bulk annually.

In 1998, I decided to take a risk with my annual upfront salary, which was about ₦128,000.

Subsequently, I saved my annual upfronts in fixed deposits with the National Bank until the bank failed to meet the Central Bank of Nigeria’s capital requirement in 2002. The CBN took control, and three years later, the bank was acquired by Wema Bank. Afterwards, I made fixed deposits with different banks to grow my savings.

Today, I no longer use banks for fixed deposits — except for VFD Microfinance Bank, where I’m a shareholder. Instead, I invest through asset management companies like Vetiva, FSDH and Anchoria because of their higher interest rates.

For instance, GT Bank’s fixed deposit rate is 5.25% per year, and FSDH’s returns can be up to 10% per annum, depending on the investment amount.

Right now, I have ₦65 million in fixed deposits and earn fixed interest annually.

Real Estate: My biggest asset class (₦500M)

I’ve always believed that owning property is key to financial security in Nigeria.

In 2001, I bought my first property in Isolo, Lagos, for ₦7 million. When I sold it in 2008, its value had appreciated to ₦100 million, a 1328% increase.

In 2009, I bought a plot of land in Ajah for ₦3 million. Seven years later, I sold it for ₦45 million. The value skyrocketed because of rapid development in the area; new housing projects were being built, and the road network improved significantly, driving more people to rent homes there.

I currently own three properties in Lagos worth a combined ₦500 million and earn ₦10 million in rental income from each property annually.

FGN Bonds: My safety net (₦300M)

I prioritise security, so Federal Government of Nigeria (FGN) bonds have always been part of my plan. And as an accountant, I’ve always known about them.

FGN bonds are managed by the Debt Management Office (DMO), which allows the government to borrow money from citizens in exchange for interest payments.

Regular FGN bonds require a minimum of ₦50 million, and these predominantly long-term investments range from three to fifty years.

FGN Savings Bonds, which are short-term, offer a more accessible option. They have a minimum subscription of ₦5,000 and a two- to three-year term. Once the bond matures, the principal is returned.

With FGN Savings Bonds, I receive quarterly interest (coupon payments), while longer-term FGN bonds pay interest twice a year. At the beginning of every month, the government issues savings bonds for those who want to buy; the most recent interest rate was around 18%.

My children also have FGN Savings Bonds, and they’re already earning passive income, with quarterly interest payments deposited into their accounts. Since they don’t need the funds, I reinvest their earnings to compound their wealth over time.

To get FGN bonds, you need an agent. I have bought through GT Bank, FSDH, and Vetiva in the past, but I currently use Afrinvest. I reviewed their financials while working, so I knew it was safe to go through them.

I hold both short- and long-term FGN bonds worth ₦300 million.

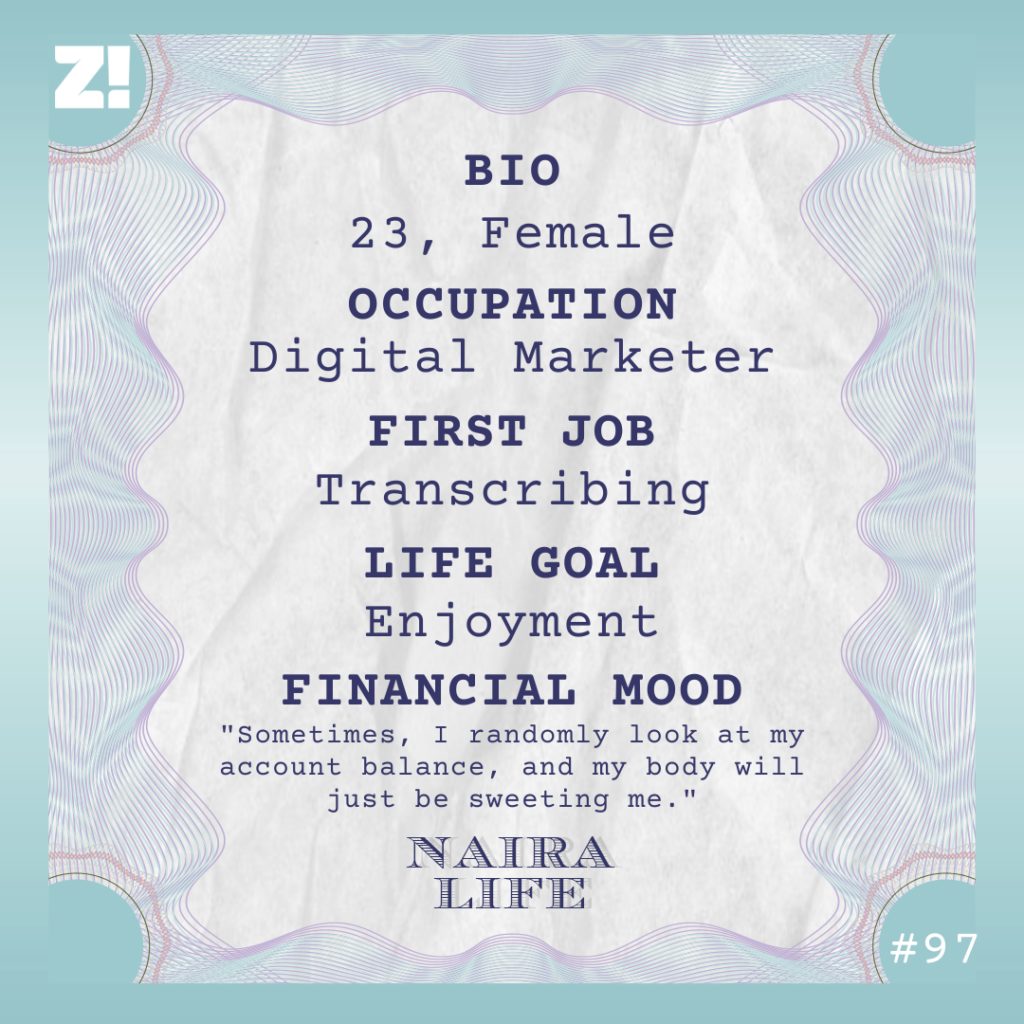

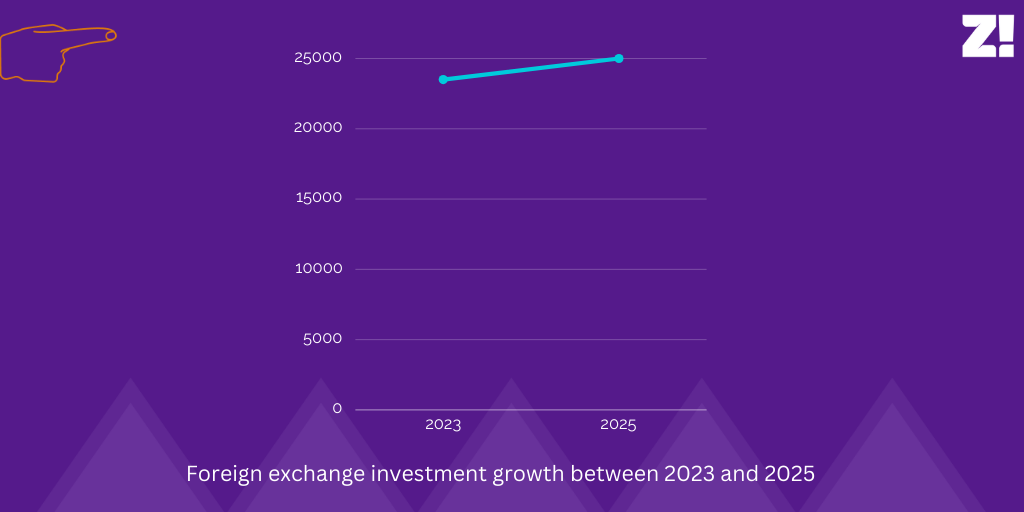

Foreign Exchange Investment: Beating inflation with hard currency ($25,000)

For foreign exchange investments, I use Zenith Bank and FSDH for fixed deposits and Vetiva for my Eurobond investments. This is different from online forex trading, where people actively buy and sell various currencies to make a profit. Forex trading is high-risk and requires active monitoring.

I focus on foreign currency investments by depositing dollars in fixed-income instruments like Eurobonds and dollar-denominated fixed deposits. This protects my money from naira devaluation while earning a stable return.

I started investing in forex two years ago when the naira started losing value. My initial investment of $23,500 has since grown by 6%.

Stocks: Slow and steady growth (₦22M)

I invested heavily in stocks until the 2008 stock market crash changed everything. The market dropped by at least 70%, and people lost their lives over the financial ruin. At the time, I had invested ₦500,000 and later bought rights issues worth ₦4 million to increase my shares. Rights issues allow existing shareholders to buy more shares when a company wants to raise capital.

The Nigerian stock market has only recently regained some stability. After the 2008 crash, I stopped actively investing in stocks, though I held the ones I already owned. I still receive annual dividends from solid companies like GTB, First Bank, Flour Mills, Nestlé, and Transcorp Hotels. At this point, I’ve already gotten my initial investment and continue to earn from them.

The only new stock I’ve bought recently is VFD Microfinance because I trust the company’s growth potential. I initially invested ₦5 million, then bought their rights issue for ₦8 million.

Today, my stock portfolio is valued at ₦22 million.

Anyone interested in stocks can’t just walk into the Nigerian Stock Exchange (NGX) building on Lagos Island to buy shares; you need a licensed stockbroker. They handle buying and selling on your behalf. I used to use Meristem but now work with FSL Capital Limited.

Pension: The passive income that gives me peace of mind (₦500K/Month)

In 2004, the federal government introduced a new pension scheme that required me to contribute 8% and my employer 10% of my salary towards retirement.

I also had the option for voluntary pension contributions, which I locked into because it meant more pension income. Before this, we had a fixed system where every employee had to pay ₦4 monthly, while the employer added ₦10. That didn’t do anything, but the new scheme meant my pension was directly proportional to what I earned in service.

When it comes to pensions in Nigeria, you can either choose Programmed Withdrawal (PW) or Annuity. With Programmed Withdrawal, you receive a set amount of money for a set period, say 10 or 20 years, after which the payments stop.

An annuity, on the other hand, is paid for life. When you opt for an annuity, your money is transferred to a life insurance company that administers income until you die. This type of pension is for life but can be transferable to living family members based on the specific terms of the contract.

I opted for Programmed Withdrawal because, as an accountant, I prefer to have control over my finances. With an annuity, I’d need to transfer my entire balance to an insurance company and receive fixed payments for life. I don’t need any company to manage my money; I have the experience. With Programmed Withdrawal, my funds remain invested, and I can still benefit from returns.

I now receive a monthly pension of ₦500,000 and will continue to receive that for the next twenty years.

In addition, I bought a personal pension plan from the insurance company where I worked. A year before retiring, I stopped the plan, took my money, and invested it in other assets.

Investment Diversification: Not all eggs in one basket

If a project requires funding, I liquidate some of my investments to finance it. Then, when I have more funds available, I’ll reinvest.

But the rules are different with government bonds. If I invest in a two- or three-year bond, I wait until maturity to access my funds. Although I can sell the bond, it’s not a liquid asset, and I won’t get my money back immediately.

In contrast, fixed deposits with banks are more flexible. If I invest in a one-month fixed deposit, I can withdraw my funds at the end of the month or even before that if needed.

I’ve had real estate projects that required funding, so I terminated some investments to finance them. Then, when I generated returns, I reinvested what I took out.

I believe in diversifying my investments, so I don’t put all my eggs in one basket. I mix fixed deposits, government savings bonds, real estate, and shares. I’m also into foreign exchange investments. If I decide to run a business now and invest some funds, that’s diversification.

This way, I can rely on others for support if anything happens in one sector.

My Two Cents on Investing For The Future

Economic challenges are constant – inflation, downturns, market volatility, and instability have always existed and won’t stop. Regardless of any economic downturn, you must plan and invest towards your retirement to ensure a secure financial future. My two cents:

- Start early, no matter how small.

- The best time to start investing is with your first paycheck.

- Prioritise investments over saving. Think of savings as money you can access anytime, but it doesn’t grow much. And investments as money locked for a period, earning higher interest.

- When you save, your money sits in the bank, earning minimal interest, but when you invest, you put your money to work.

- Don’t worry if the interest seems small at first; consistency is key.

- Increase your investments as your income grows.

- Aim to save at least 30% of your salary.

- If 30% is too much, start lower and increase it gradually.

- Remember to make voluntary pension contributions. I recommend using a pension fund administrator (PFA) like Stanbic IBTC Pension Manager because they reinvest your contributions, allowing your pension balance to grow with the added interest or returns.

Bottom Line

Don’t be greedy about earning high interest rates. Explore low-risk investments, start investing early, be consistent, and aim to invest at least 30% of your income.

Editor’s note: This subject chose to keep her legal name and information confidential for privacy reasons, and Zikoko has verified her assets and earnings via income statements and necessary documentation.

ALSO READ: I’m 22, and This Is How I Grew My Money by 29% in 2024

[ad]