The topic of how young Nigerians navigate romantic relationships with their earnings is a minefield of hot takes. In Love Currency, we get into what relationships across income brackets look like in different cities.

How long have you been with your partner?

I’ve been with my boyfriend, David, for a little over a year. We met in November 2023.

Tell me more about how you met

A mutual friend, who worked with David, set us up on a blind date. They were like, “Oh, I have a friend you should meet.” I had nothing to lose, so I accepted the invitation. David and I exchanged Instagram handles, had conversations for about a week, and met up for an ice cream date.

Interestingly, I didn’t even know what he looked like. He’d seen my pictures on my Instagram, but his profile was empty. So, I saw him for the first time during our date.

Ermm. Weren’t you scared?

The thing is, I don’t like asking men for their photos — they are often terrible and don’t do them justice, so it’s better to see them in person. When I saw David, I thought, “Thank God. He’s not ugly.”

It was a good first date, even though I arrived an hour late because I had the wrong directions. We had a good conversation, and I let my guard down. I didn’t want to get my hopes up before I met him. But after our conversation, I decided to be more open.

We went on a second date the following week, then he asked me to be his girlfriend. I liked him, but I told him to calm down. I thought it was too early to take that step because we’d only been talking for three weeks. To be fair, we’d discussed some important topics even before our second date. But I wanted us to know each other for at least a month before starting an official relationship.

I’m curious about the kind of topics you discussed

One was our finances. David said, “Let’s just be honest and tell each other how much we earn.” This was new to me because I didn’t discuss my earnings with previous partners. I also didn’t ask them. But I saw he really wanted to be open in that aspect, so I told him exactly how much I earned, and he did the same.

At the time, I earned ₦150k – ₦200k as a freelance social media manager. He’s a tech bro and made about ₦400k/month. We started dating a month later. This was in December 2023.

How has the relationship been so far?

It’s been really good. I’ve never been in a relationship with this kind of openness before. David and I share everything.

When we argue, it’s mostly due to our different approaches to things. I want to address an issue immediately and get it over with, but he prefers to bring things up later. When he does that, I often feel blindsided. Like, you were pretending everything was alright while you had this thing on your mind?

This was a source of friction. I thought I was a chill person until we started dating. So, it surprised me how intense I could get in arguments. I’d have to physically stop myself to ask, “Why am I so angry?” But we’re adjusting better now. Sometimes, we just laugh at each other during arguments. Like, why are we acting like this?

Our different spending habits have also been subjects of these arguments.

How so?

I’m always like, “You shouldn’t be spending money this way.”

I’m the saver in the relationship. I grew up with a “need to save” mindset, and it worried me that David had zero savings even though he earned so much money. Who does that?

So, I raised that with him a few times, and he’s seen the light. Now, he saves 40% of his monthly income with me and thinks twice about his spending.

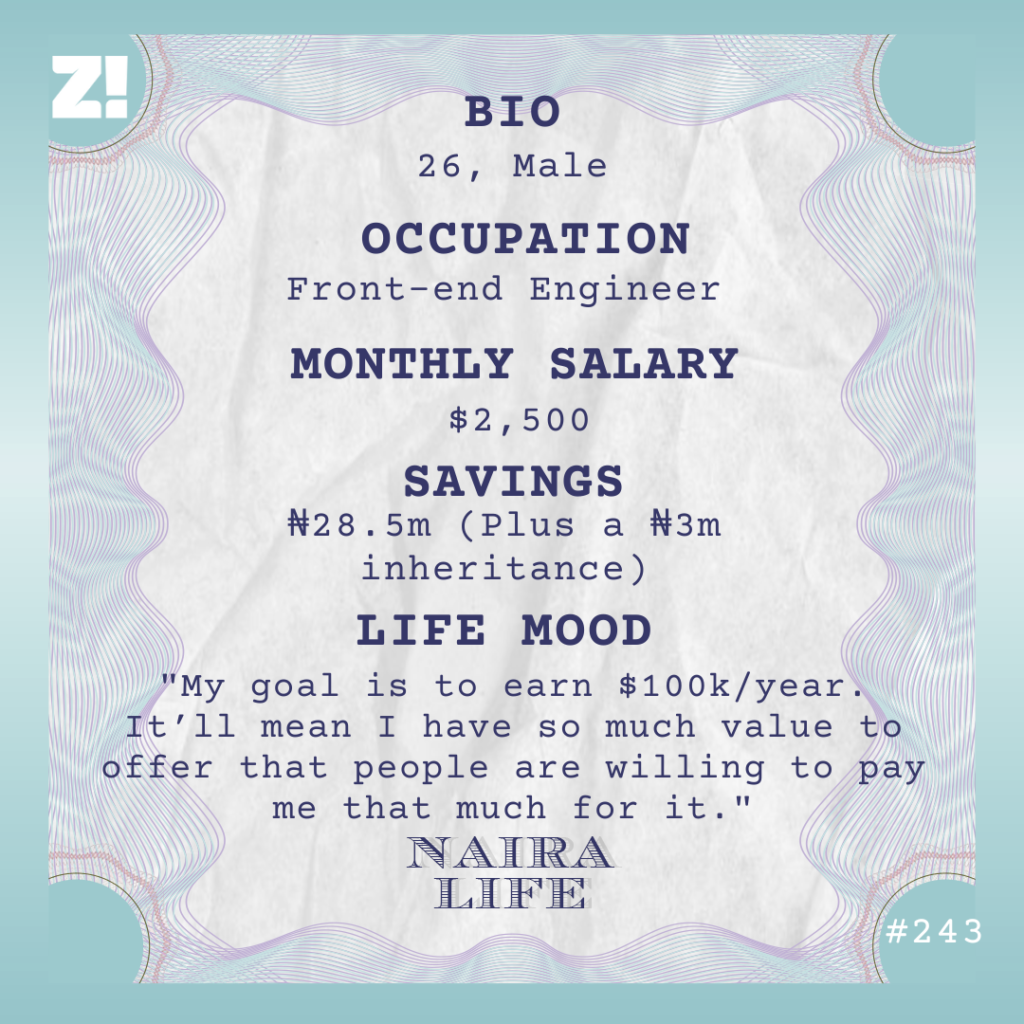

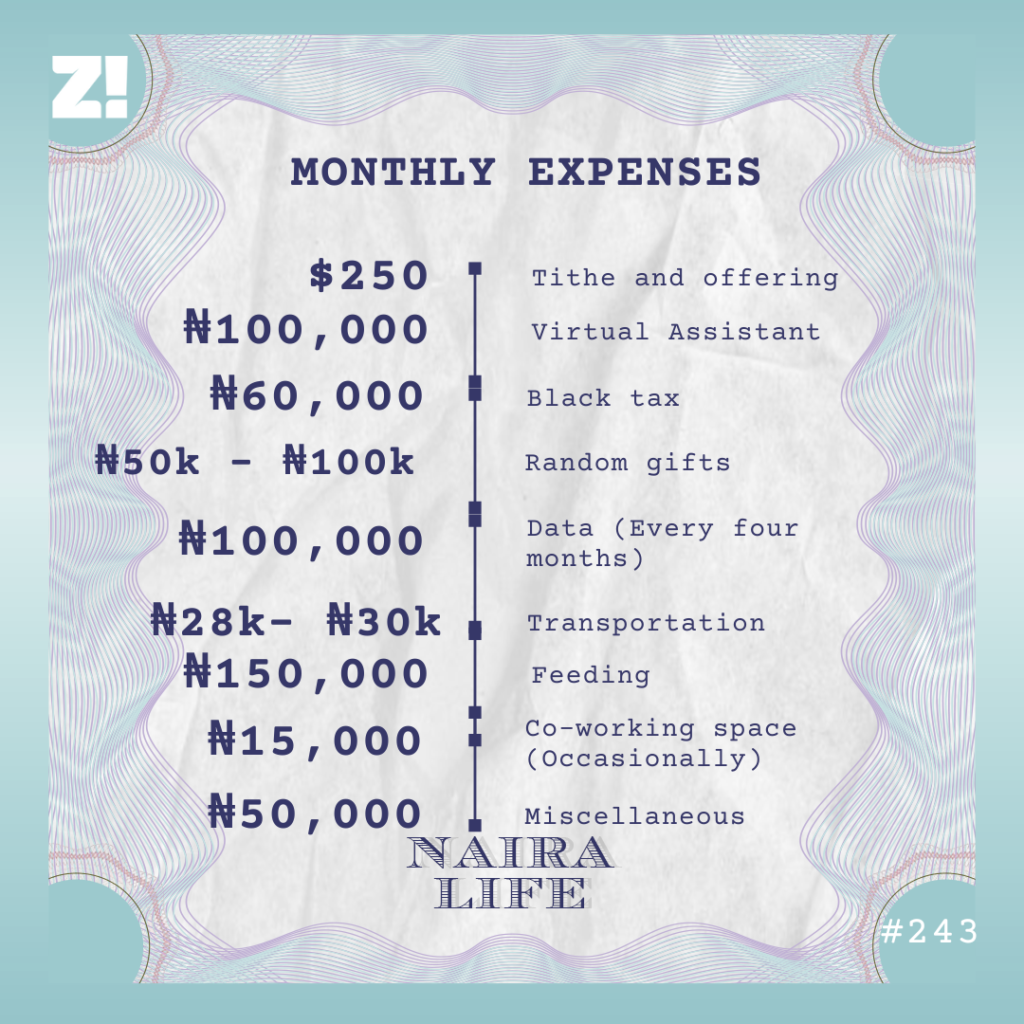

At the moment, David works for a foreign company and earns £3k/month (about ₦6m), and 40% of that is about ₦2m. There’s another £300 he sends to me monthly.

I know people might think it’s crazy that he keeps his money with me, but no one should worry. I won’t run away with his money.

I’m screaming. Is the £300 a girlfriend allowance?

Something like that. This is how it started: During my NYSC in February 2024, I found a Place of Primary Assignment (PPA) that would pay me ₦60k/month. When I told David about it, he thought I didn’t need it. My remote freelance job guaranteed up to ₦200k/month. The ₦60k job was on Lagos Island, but I live on the mainland, and commuting was going to be stressful and expensive.

I reasoned I should just try the 9-5 life, but David insisted that he didn’t think I should do it because of the stress. So, I joked that I’d quit if he paid me ₦500k/month. Two months later, he got his current role and brought up the joke.

I didn’t quit, though. I didn’t want a situation where someone controlled my decisions because of money. I stuck with the job for another three months before I decided the 9-5 life wasn’t for me. After I left, he started sending me £300 every month. This has happened for six months now.

You mentioned he saves his money with you. Is it toward a particular goal?

A safety net. We just want to have something saved for when we need it. For example, he used his savings to buy a ₦5m car and move into a ₦1.9m apartment in 2024. Then, some more money to furnish and set up the place. All these were possible because of the safety net.

I have my own savings, too. Sometimes, I use it for our dates or joint expenses. My housewarming gift to him was most of the equipment in his kitchen, and the whole set cost me almost ₦400k.

What’s your financial situation like right now?

On average, I make around ₦450k – ₦500k/month, depending on how many gigs I get. From this, I save at least ₦100k.

I haven’t touched the £300 allowance David sends me monthly and haven’t even converted it. I’m keeping it as rent money. I currently live with family members, but I’ll probably get my own place in March, so it will come in handy.

I’m sure that if I had been saving for rent from my income, I wouldn’t have the same level of financial freedom I enjoy now. Because I have this safety net, I can comfortably shop and eat what I want without overthinking expenses. I’m grateful for that.

Do you both have a monthly budget for romance stuff and dates?

We spend about ₦100k on dates and do this at least once a month. Other times, we stay indoors and order food, which costs anything between ₦20k and ₦30k.

David pays for these dates. From his salary, we decided that ₦1m is for him to spend on whatever he wants, and the money for dates comes from there. On the rare occasion that he finishes the ₦1m, I send him like ₦100k. That said, I also ask him for money if I’ve spent more than I planned for and only have my savings left. We try not to dip into our savings at all. If we do, we always return what we take.

How about gifts?

We often exchange random gifts, and don’t wait till special occasions. I get him jerseys and clothes. Sometimes, I just send him money. The most expensive gift he’s bought for me was my iPhone 14 Pro last year. It cost ₦1.5m, so that was massive.

How are you both thinking about future plans for your relationship?

I’m definitely team japa, but David doesn’t want to leave unless he has solid options abroad. I understand him — £3k can’t do much outside Nigeria. Even in Nigeria, £3k should make him super comfortable, but it doesn’t. In the long term, we’ll definitely leave because this country won’t get better.

For now, we’re just focusing on our relationship and trying not to let the pressures of adulting and work affect us. We also plan to go on vacation by the end of the year.

What’s your ideal financial future as a couple?

I want to earn millions so I can match his energy, and we won’t have to think deeply when we want to go on vacation. Let it be that we both worked hard for our money and can afford to rest. I’d also like a future where we can afford to live in nicer places, and we don’t spend all the money we make just living day to day.

Interested in talking about how money moves in your relationship? If yes, click here.

*Names have been changed for the sake of anonymity.

NEXT READ: This Osogbo Teacher Doesn’t Need Her Husband to Be the Sole Provider

[ad]