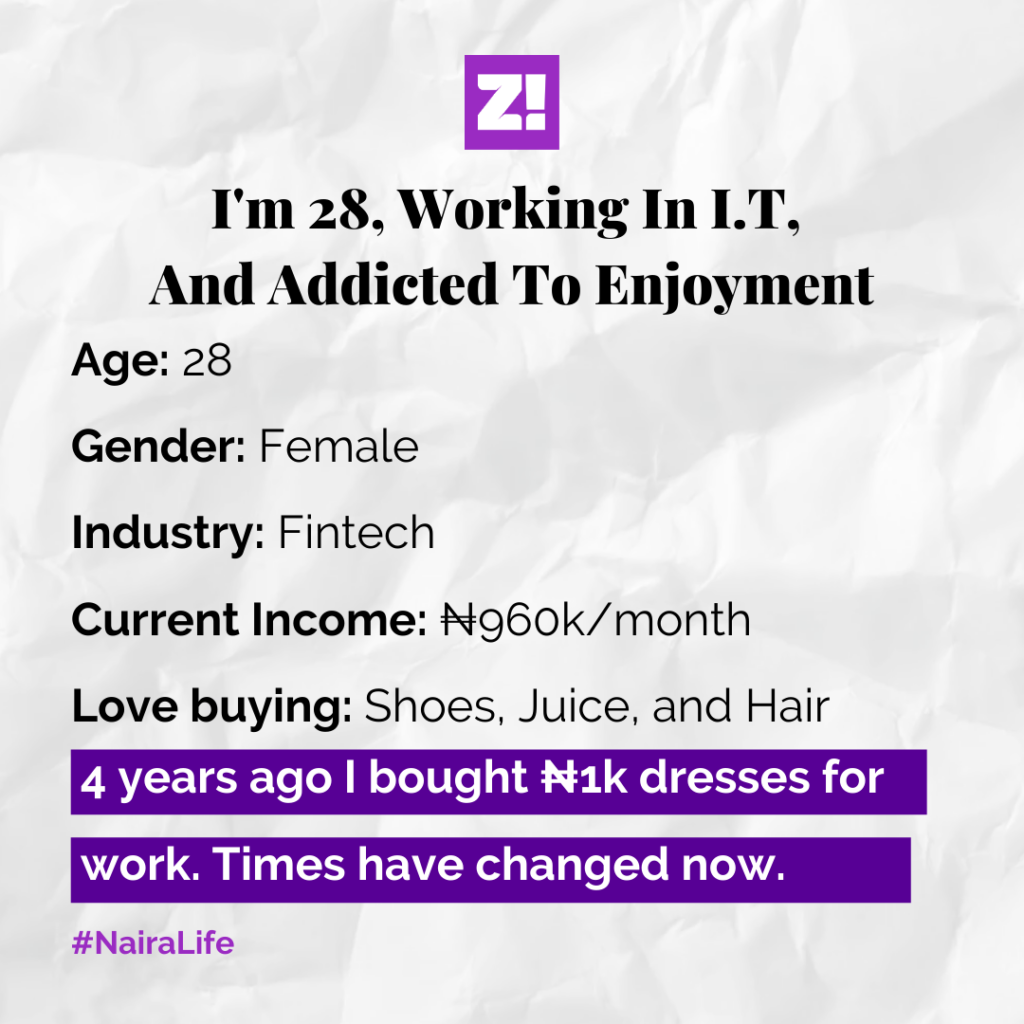

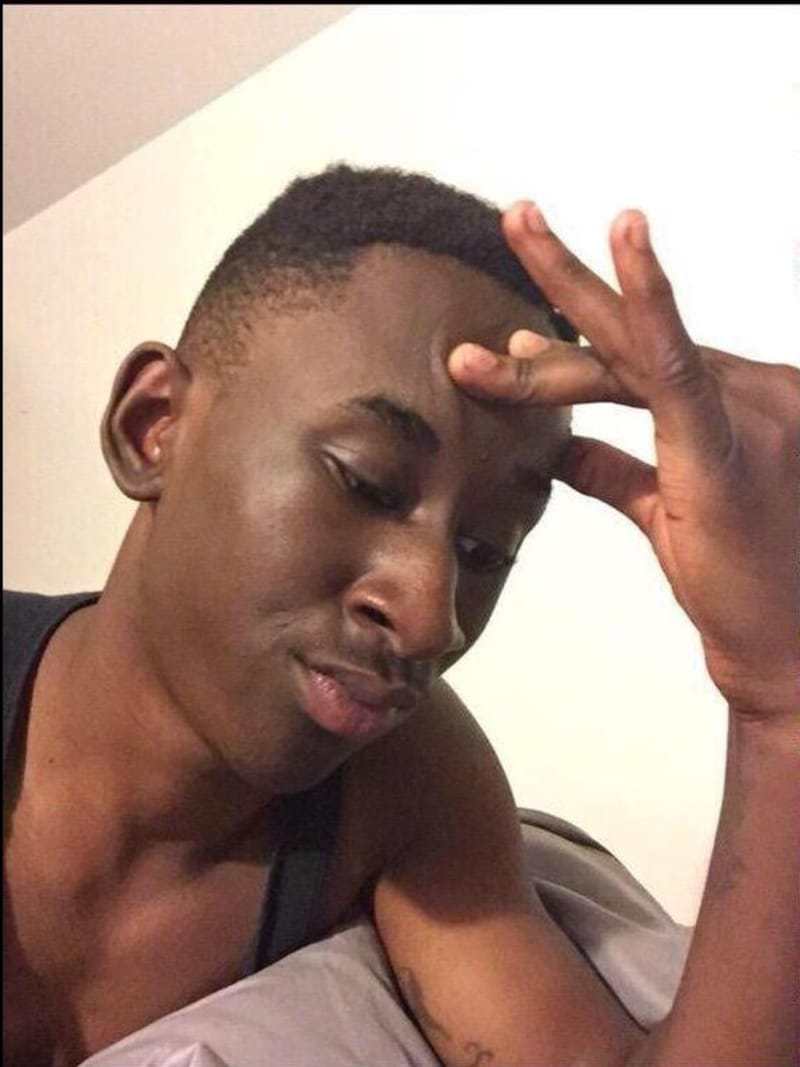

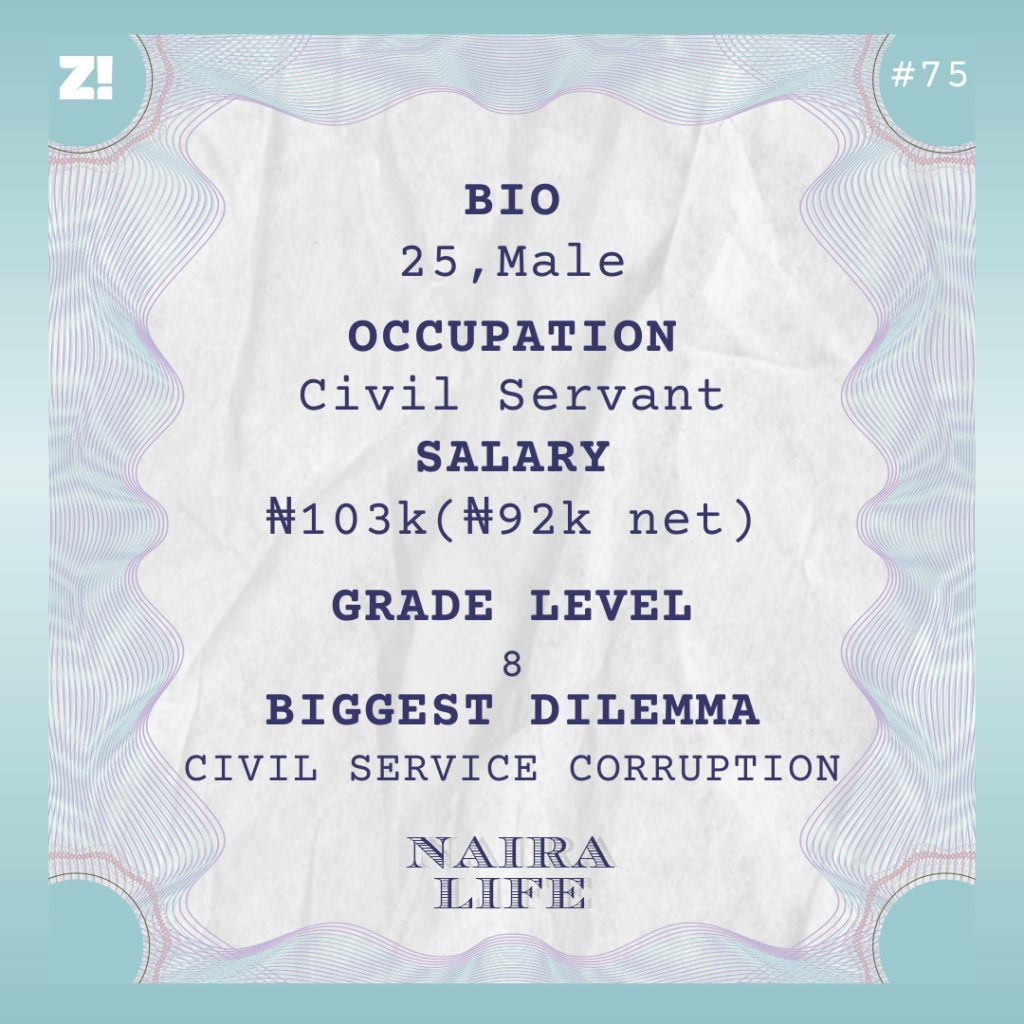

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Tell me about what it was like growing up.

I was born in ‘95 in Lagos. My dad was Director of Finance in a government agency at the time. He became DG in ‘99 when Obasanjo came into office. So life was really good. I had everything I needed growing up.

We, the smaller kids had a car and a driver attached to us, we mostly just needed permission from mumsy to go chilling.

Mad o. What level do you have to be to become a director?

Level 16 in most places. I think 1-3 have been eliminated. You come in at level 4 if your highest qualification is an SSCE and you max out at 7 unless you bring extra qualification. Degree holders start at 8, MSc holders at 9, PhD/ICAN at 10.

There’s 3 years between each level up until 14. There’s no level 11.

Why?

To be honest I don’t know. At GL 12, you’re a Principal Officer; at 13 a Chief; 14 you’re an Assistant Director; and 15, Deputy Director. You can still be a Deputy Director on 16 if there’s no vacancy in the organization.

Tell me about your mum.

She was a teacher before they moved to Lagos in ‘92. That was also the year my dad became Director. She stopped working since then. My dad died in the mid-2000s. She became a businesswoman afterwards; poultry farming, buying stuff from Dubai and reselling.

Sorry about your loss man. How was it for her?

She was devastated but had to worry about us. I remember when she started the poultry. We had just moved houses in ‘07. The farm was my dad’s but it had no structures. So she built the structures and put the chickens in it. It became huge in two years but we kept having issues with the farm manager. It was always chickens dying or the eggs not adding up.

Ah, farm managers and eggs.

Sha, she sold the farm in 2011 because she said she was running at loss for like 2 years. She got around ₦15m for it.

That was when she started trading fabrics from Dubai. That lasted for about three trips over like 2 years. Since then she hasn’t really been into any business, apart from a few catering contracts from senior government relatives here and there.

How’s she been getting by?

Rental properties. We all work apart from my younger brother, the last born – he’s in his third year – so we all chip in at the end of every month. We’re 7 kids; 4 of them are now married; 1 man, 3 women; and the remaining of us, 3 boys, are at home.

7 kids. Your mum raised 7 kids?

I swear down. Big ups to her.

I’m curious about your dad’s inheritance.

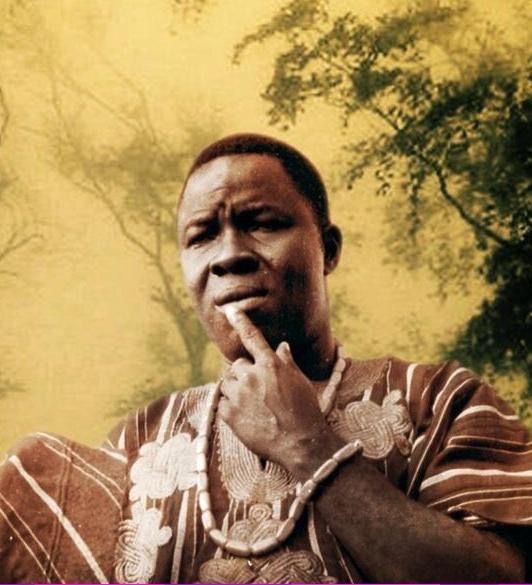

From what I can remember right now; a house and 3 plots of land in Abuja, a farm in Niger State, three houses and two plots in the Northwest. I loved snooping around since I was a kid and I can remember seeing cash figures of about 70 million before they divided it. We also got $100k death insurance. It was actually the airline that paid us – he died in a plane crash.

Eish. So sorry man. What were the first things that changed financially when your dad died?

No more pocket money obviously. Our cars went from 8 to 4 – official cars were returned. We could no longer sustain 24 hours light and only used the generator overnight. Along the line, we started turning it off at 11 pm.

We had to move houses and get a smaller one – I think it was because of maintenance. The initial house was a 7 bedroom with a study and 3 sitting rooms, huge boys quarters also. We moved to a 4 bedroom with boys quarters.

Two of my siblings got married, so we didn’t need that much space.

How did it change you, personally?

Devastating. I feel I was the closest to my dad and it wrecked me emotionally even at that age. I kept wishing it was me instead of him. Financially, I didn’t feel much of the difference because my mum made sure I had all I needed.

Obviously not sleeping with gen was annoying, not getting any money weekly when I was home from boarding school was tough too. But I was quite similar to a lot of my friends so I couldn’t really complain.

My dad used to buy a lot of gifts because he travelled a lot, all of that stopped.

I was in one African country in January to collect a posthumous award on his behalf and I couldn’t hold back the tears fam. I cried on like three different occasions.

*Hug*. Let’s digress, what’s the first thing you ever did for money?

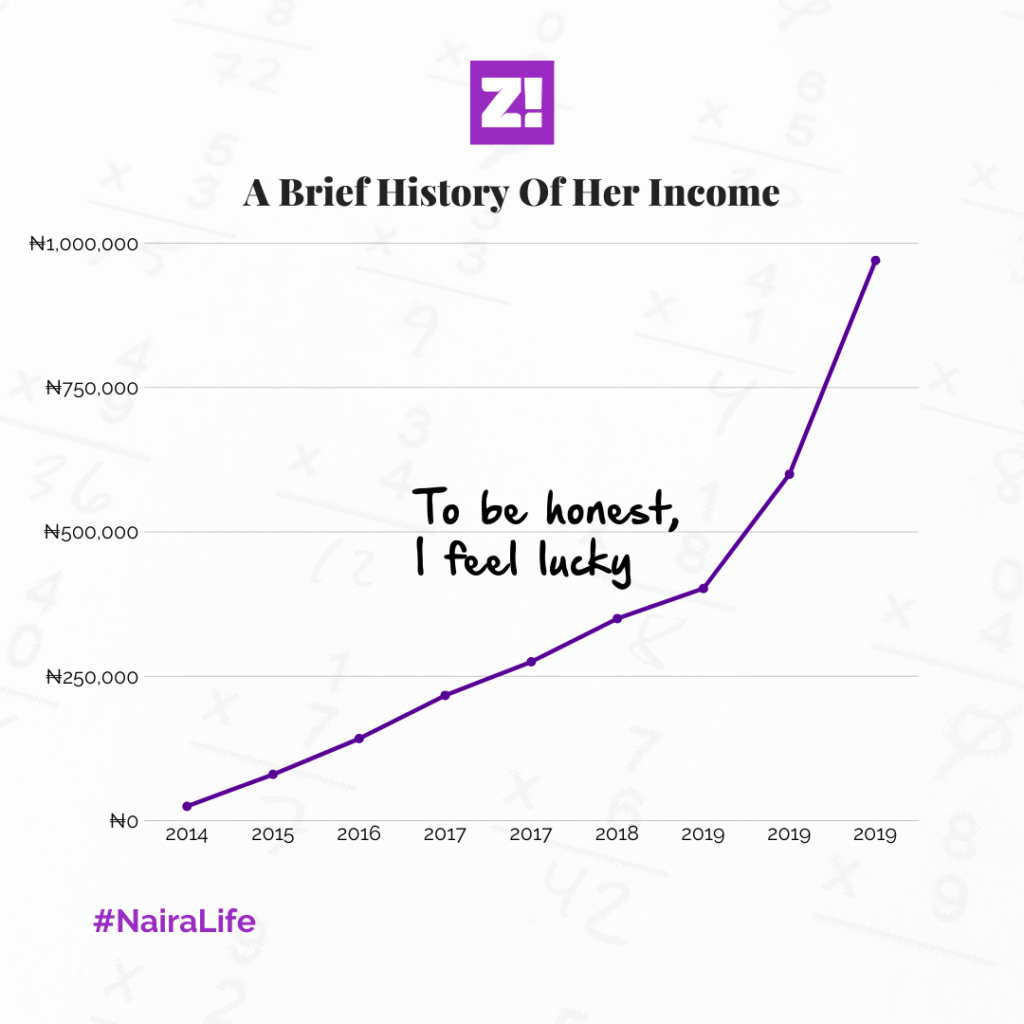

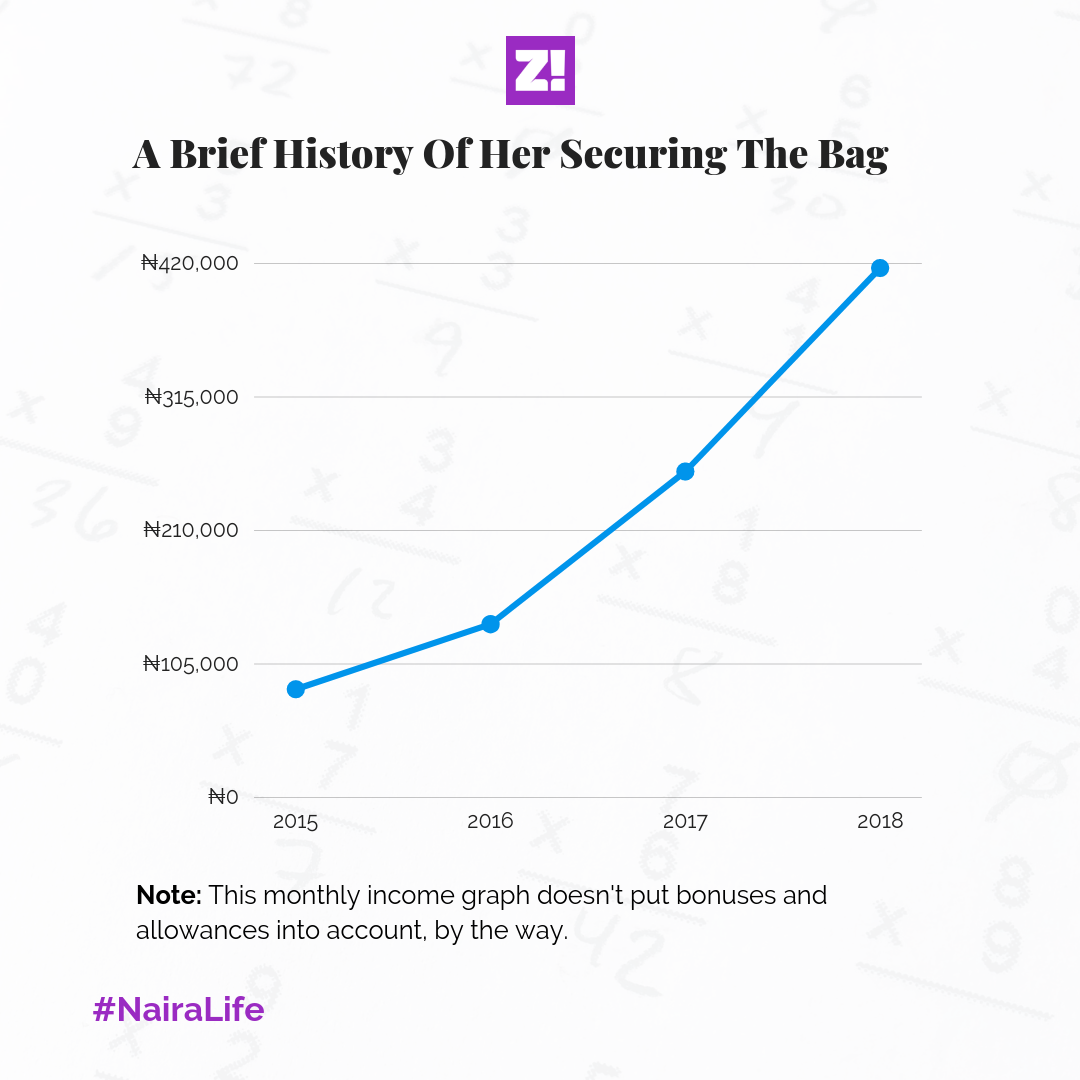

NYSC; January ’17. I was an Office Assistant in the finance department of a government parastatal. It prepared me for getting retained. I now became an accountant in the budget section. While serving, I didn’t do much work and I felt like the whole place was just dead. But when I became a staff, my boss switched up on me and work became really serious.

Buhahahaha

I dey tell you. It’s a small parastatal that feels redundant but they have revenues topping ₦7 billion per annum since 2017, so there’s a lot of work in finance. Expenditure equaling revenue as well.

So basically, no profit?

The difference is usually less than ₦20 million.

Abeg wetin dey chop this 7 billion abeg? Abeg.

The largest expenditure for the agency is transportation. And that is at the heart of the agency.

Logistics is a crazy businessman.

It takes about ₦1.5 billion. Also, there are offices in every local government. Over 1,000 in total. So fueling of vehicles and weekend allowances.

Then there’s money for Ogas too; international travel gulps over ₦100 million. Local over ₦150 million, that’s for all staff sha.

So basically, the Ogas who make up probably less than 5% are spending more than the entire workforce.

More or less. A minister used to send some of his international travel bills too.

How does this even work?

The thing was crazy o. Sometimes, letterhead approval will just come from the ministry saying the conference or whatever they’re going to relates to our parastatal. And as such, we had to cover the cost.

OLUWA WETIN DEY HAPPEN?

Guy, hahaha. This Naija ehn. I saw things and I learnt a lot while there – I benefited also. I got to save enough money to buy a car. Although my mum had to give me money from my inheritance to complete it sha.

Hold up. Tell me what you learned, and of course what you benefited.

I learned how government accounting works. I learned how approvals are passed from Director-General to Director of Finance to Deputy Director and me or my colleagues.

Any kobo to be paid has to pass through about 4 or 5 offices. Directors’ approval limit was ₦2.1m I think and the DG was ₦4m if I can remember.

What were your expectations about the civil service, and what were your realities?

I expected a dysfunctional system without accountability. Civil servants were supposed to be the same, and couldn’t care less about their jobs. I came to find out that the civil service actually works. Also, what I mean by accountability is systems like the Treasury Single Account and some internal checks. Everything that has been done can be tracked, except you don’t go looking for it.

There is just so much redundancy. Selfish people want to cheat the system all the time. For example, the accounting model doesn’t allow for any payment to be made without checks and balances but everybody along the line is ‘settled’ and thus looks the other way. External auditors come and they’re automatically expecting the same treatment too.

Anybody that doesn’t tow this line is quickly turned against and a witch-hunt starts almost immediately; I saw this first hand with a senior member of staff. She became unwilling at some point to approve the multiple payments and she claimed to have something on all of the top management.

They swung into action to find something on her and they did. At that point my morality had been so affected too that I was against her, I’m probably just realising this now.

Fascinating, your realisation that is.

Well, what can I say? She was frustrating my boss and his boss and the way it was conditioned, I couldn’t help but support them. Disloyalty is rewarded with an immediate transfer.

There are people that still manage to go home with money that is clearly not their salary, where do those come from?

So many ways o. For the big bosses, most of their illegal money comes from inflated contracts and collecting kickbacks from contractors. A 2015 Prado for example, will be bought in 2018 for ₦75 million. A car that would most likely not have cost above ₦25m.

For that to be possible, the DG, Director of Finance, Head of Audit and Head of Procurement all have to be in on it. Then the money will trickle down to the lower boys, and that makes you complicit. And in a place that spends ₦7 billion a year, you can imagine the number of inflated contracts a year.

Then we had Duty Tour Allowance or estacode as the case may be. There’s already a budget before the start of the year stating the amount to be spent on local travels and international travels. The organisation makes sure every kobo is spent, no matter how frivolous the trip. In some cases, you don’t even need to travel, as long as your boss – usually a Director – signs off that you indeed were supposed to travel. You’ll be paid without stepping out of the office.

This has happened to my face countless times.

That is crazy.

If you have something important that needs to be passed, you’ll go office by office and drop something for the boys so your paper can be passed till it gets to the appropriate office.

During internal budget defense week, I got ₦30k just for being there.

“Thank you for coming” money?

Exactly. But we were about four in my grade range. I don’t even have any idea what my bosses would get.

Tell me about the first time this thing ever happened.

During NYSC, my boss asked to see me. I went to see him that day but couldn’t because he was so busy. The next morning, an elderly colleague asked if I had seen Oga, I told him no, he said: “Ehn Oga dey find you, you no wait for am, this boy you don’t know good things.”

When I went to see him, Oga gave me ₦20k just like that. I received this about 15 times during my 2-year stay at the agency.

Crazy. How did that make you feel?

I went to tell my colleague, a level 9 staff at the time. And he said, Oga gave everyone in the division.

“Is this frequent, what is it for?” He said Oga understands salary cannot be enough and because of his benevolent nature, he helps his boys out whenever something comes in.

I reflected on whether it was right or wrong for a while until I forgot about it.

That’s heavy.

I know for a fact that it is wrong and contributes to whatever rot we’re seeing in this country. But maybe I’m saying this because I’m not eating anymore. These things are extremely hard to stop when you’re a part of them.

I had a colleague who was a very devoted Christian. She came when I was there sometime within my first year. I told her how people get money and she told me that she’d never collect money whose source she has no clue about.

Then one time, our Oga gave her 20k, but she didn’t say anything. The next day, I asked her about the money, and she was like, “how did you know?”

I told her, remember that time you said you’d never collect money whose source you don’t know?

Has there ever been anyone who’s gone into this system and completely resisted?

Not a single person I know of. It actually made me start thinking twice about my dad and all of my friends’ parents in govt. Everyone I spoke to always found a way to justify it. I always come to the conclusion that my dad was a good person in office. Bad people are usually discarded after death. My friends’ parents, if you see the balling they do, it’s hard to imagine a government official getting it legit.

What level did you start with, and what level are you in now?

8, officially started in December 2017. Left the agency and went to another one from April 19 to start afresh from 8 again. The transfer process is cumbersome. So I was advised to resign and take up a new appointment. So I’ll be due for promotion 2022.

It was quite disappointing, but I did start afresh.

I still want a career in govt though, somewhere that fits my interest and skills like the Central Bank, NSIA, NDIC etc.

I’ve always had an interest in governance and I would like to contribute my skills and ideas to improve this country.

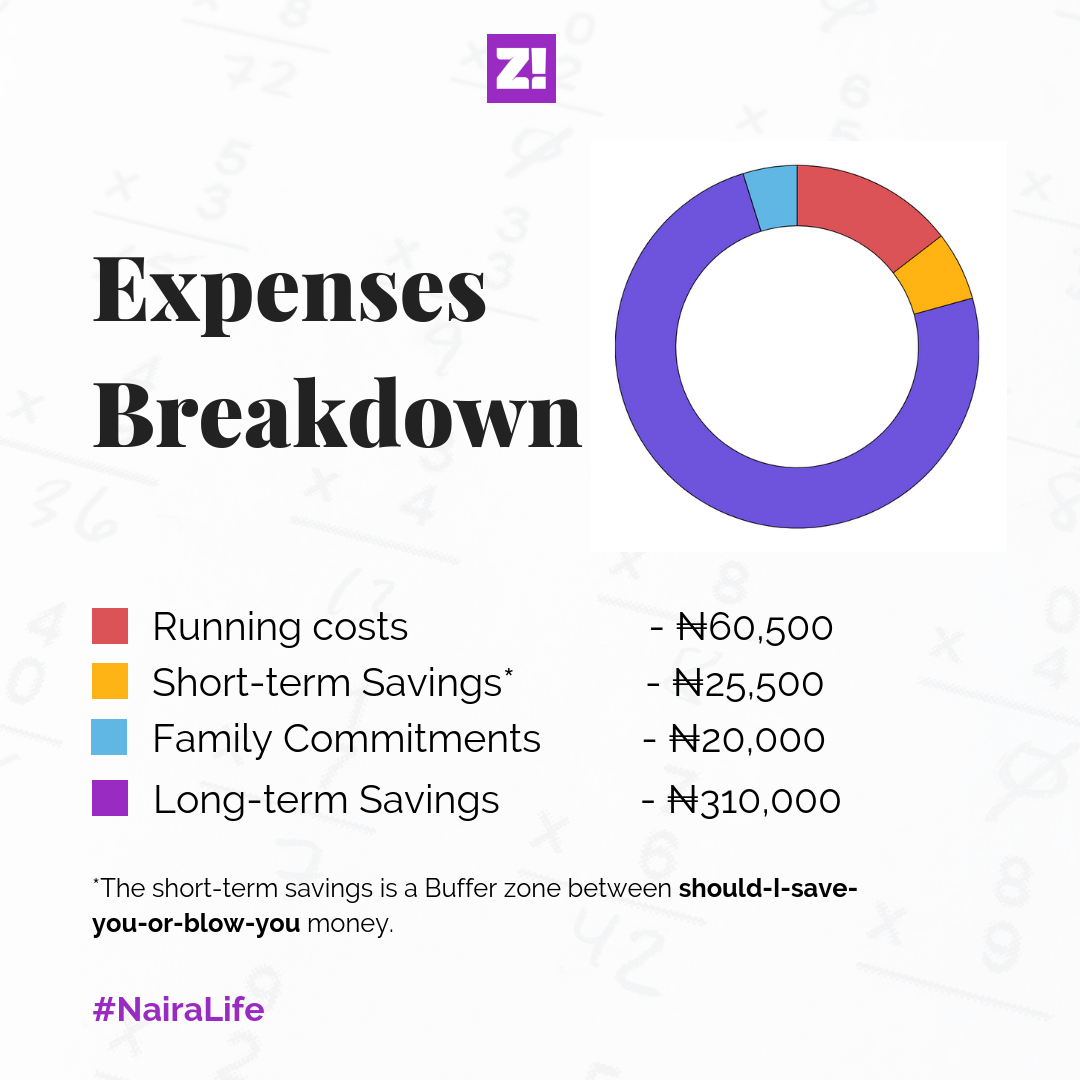

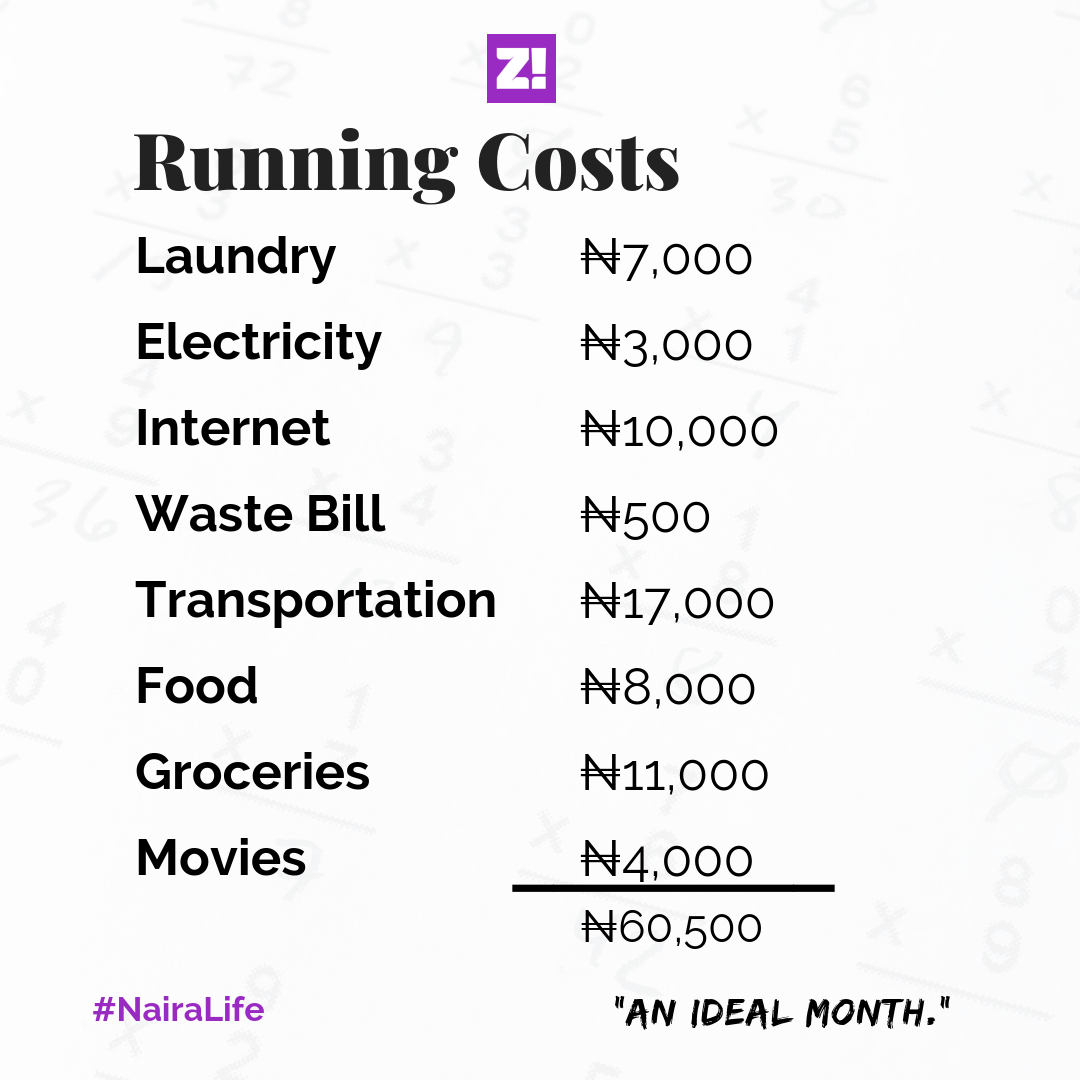

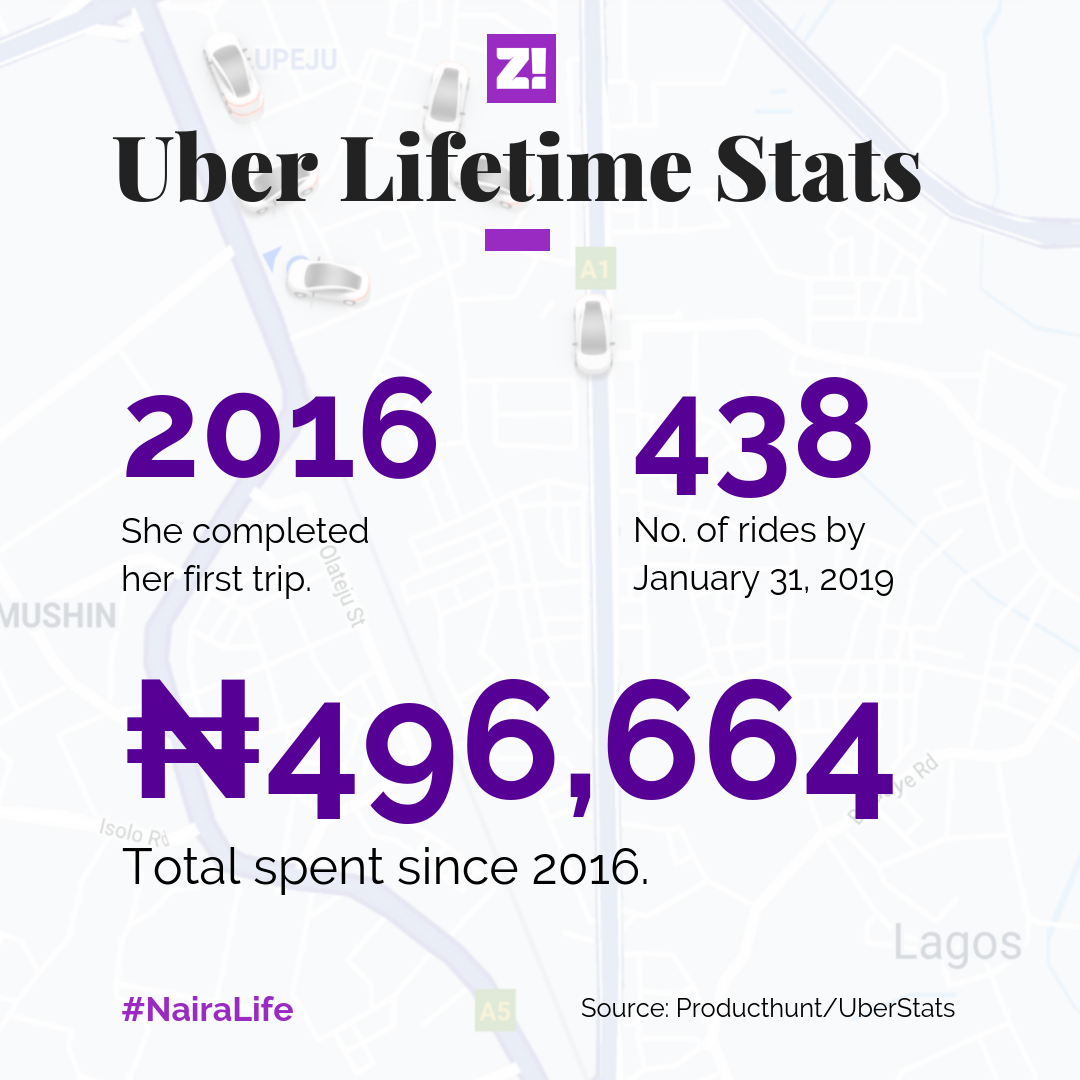

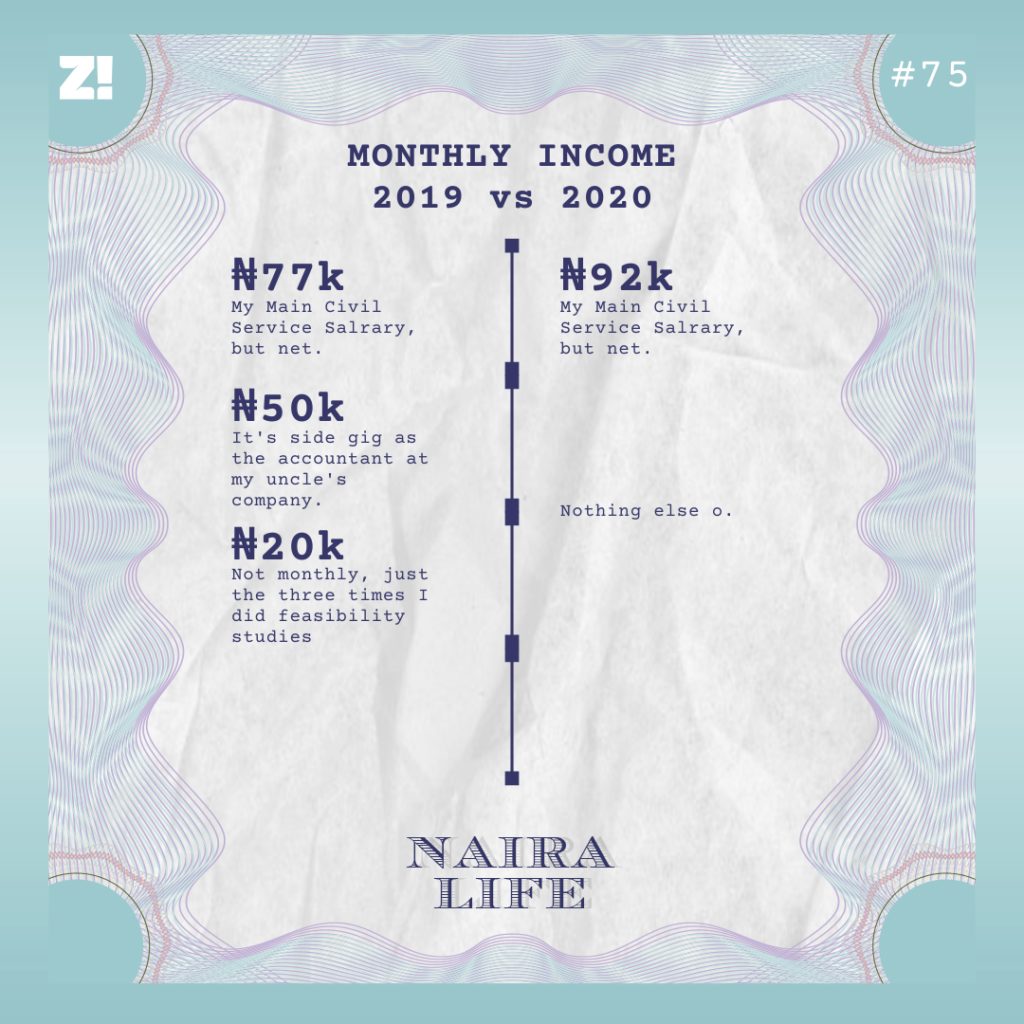

Now’s the time to breakdown your monthly income. Every dime. Where does it go, where does it come from?.

Also, what do you spend your money on monthly?

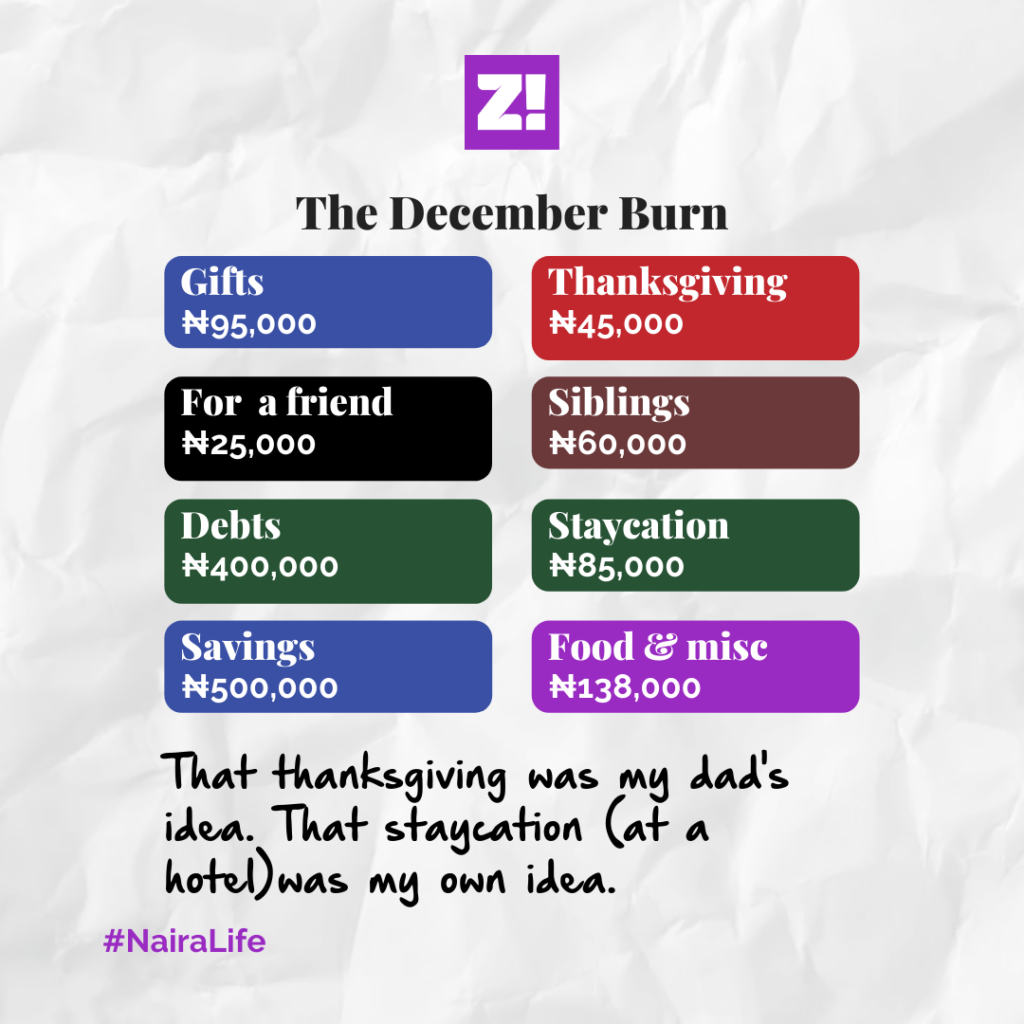

- Fuel: ₦20k

- Eating out (office and otherwise): ₦25k

- Data: ₦9k

- Miscellaneous: ₦8k (Laundry, car repairs and other stuff)

- Savings: ₦30k

Do you have a monthly savings target?

2019; ₦40k. 2020; ₦30k. I’ve not missed a naira. The pandemic has helped a lot though.

How much is in your savings chest?

About ₦1.4m, $1k and the rest naira. I’m scared of putting everything in one place. Even the $ are in different forms.

Do you have insurance, pension and all of that?

I have NHIS as my health insurance, doesn’t cover everything but it’s not bad. I have a pension as well. And it’s growing nicely, love checking it every quarter. I forgot to mention, I also receive roughly ₦200k every year from rent.

From your dad’s property?

My property now.

ENERGY.

Hahaha.

What’s something you really wish you could be better at?

Making money off intellectual property. Financial consulting so to say. That’s what led me to write feasibility studies.

How would you rate your happiness levels on a scale of 1-10?

4 TBH. Alhamdulillah for what I currently have but I feel like I should be earning roughly 220 net a month at this stage. I’m still far off from that.

I would have been earning the same but my promotion would have been due December this year so technically early next year.

What’s something you want right now, but can’t afford?

In the short term, a new car. Long term; a Masters’ from a school worth going to (Salford, LSE, INSEAD etc.). In the long run when I’m vying for a management position they definitely help. There’s also the fact that I want to learn from the best. I saw my dad’s CV and I found out he had 5 international appointments. I want something like that; being good enough to hold those positions and titles.