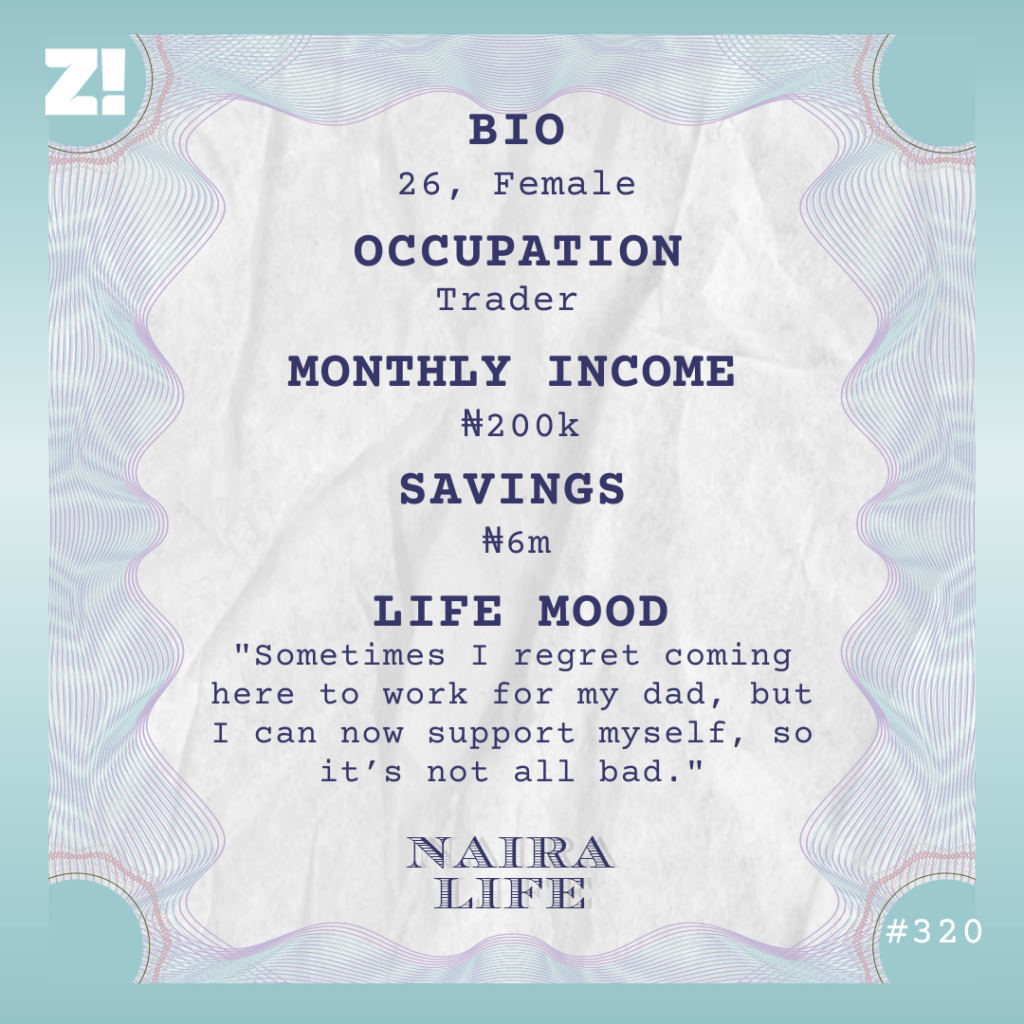

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I remember my dad visiting us and giving me money gifts, usually ₦100. I was around 6 or 7, so ₦100 was big money. It was extra special because my mum didn’t give my siblings or me money. So, I looked forward to my dad coming home.

Your dad didn’t live with your family?

He didn’t. My dad was a trader who often travelled to Niger Republic for business. It was mostly just my mum, my siblings, and me at home. As a child, I associated my dad’s coming home with the opportunity to get money, which was fun.

But as I got older, I realised he was abusive, and my mum preferred it when he wasn’t around. He beat her and barely provided for anything besides rent and school fees. Once, I heard my mum complain to someone that all my dad dropped in four months was ₦20k.

I didn’t know what ₦20k could do, but the way she lamented, it was clear it wasn’t enough. She had to handle every other expense with her ₦8k/month teacher salary. Throughout my secondary school years, I had to join the school bus before dawn because my mum had persuaded the driver to carry my siblings and me for free, and that was the only time that worked for him.

Phew. That must have been tough

One time, I went to a neighbour’s house to beg for food because my mum was crying in the room about the lack of food. I told the neighbour my mum was crying, and she gave me a tuber of yam.

But when I returned home and showed my mum the yam, she was furious. She was like, “Who sent you?”

We truly had nothing, but she preferred to pretend. Another time, she fainted at our compound gate because of stress. Things were really hard.

However, despite our situation, my mum refused to let me work. It was always, “Focus on your studies”. Even in uni, I didn’t do anything until my final year. And it wasn’t as if I was receiving one big allowance.

At that point, my mum had stopped teaching and was in the process of starting her own school, so I had to go to my dad for money. Once he sent me ₦5k/month for pocket money, it was a struggle to get any more money from him.

How did you manage to survive in uni then?

Thank God for my boyfriend. I probably would’ve starved if he weren’t there.

My dad’s major concerns were my school and accommodation fees. I was basically on my own for the rest. Omo, I managed so much in the first two years in uni. I couldn’t afford clothes or even make my hair.

The first time I braided my hair with an attachment was in 200 level, and it happened because a hairdresser I knew saw me walking around with my rough hair and was like, “Ah. What’s this? Just buy one attachment and come, let me braid your hair for free.”

I didn’t know students could have money until I accidentally saw my friend’s account balance, and it had about ₦80k. I asked her how she had all that money, and she put me on.

I’m listening

She advised me to add extra money to the cost of the school expenses I shared with my dad. Since he only attended to those requests, it was the only way I could make money.

So, I started adding ₦10k to ₦20k to anything school-related, and he paid it. My mum was aware of my arrangement, and sometimes I sent her the extra money because I knew my dad didn’t give her anything.

You mentioned finally working for money in your final year. How did that happen?

There was a brief ASUU strike in 2019, so I found a job in a factory that produced baby wool. I worked there for a month and earned ₦25k.

I graduated from uni that same year and went for NYSC. The state government paid me ₦5k/month, and the federal government paid me the ₦33k NYSC stipend. It wasn’t great money, but I was posted to a village and didn’t have major expenses. In fact, I didn’t touch a kobo from the stipends. I’d graduated from uni with about ₦300k in my savings — money I’d gathered from my dad and boyfriend — which was more than enough for service year.

What happened after service year?

I tried to get a government job, but the man everyone said could help me wanted me to sleep with him. That wasn’t an option, so I decided to try a business while I waited to find a job.

I bought bags of rice from a neighbouring community and brought them to the state capital to sell. I did that for the remaining months of 2020 and made a ₦30k profit on 100kg bags of rice. At the same time, my dad suffered a stroke and had to return to Nigeria. He also tried to connect me with people to help me find a job, but nothing worked.

Then, in February 2021, my mum called to complain that my dad intended to take my younger brother to Niger to manage his tailoring materials business. My dad needed an eye in Niger to monitor the operations and apprentices.

Why was your mum unhappy about that?

My brother had just finished secondary school, and going to Niger meant he wouldn’t return to school anytime soon. My mum wanted him to go to uni, so she wasn’t on board. In the end, we decided I’d be the one to go to Niger to oversee my dad’s business.

I was supposed to spend a year while my dad recovered, but it’s been four years now, and I’m still here. He’s now used to staying in Nigeria.

Do you get paid to manage your dad’s business?

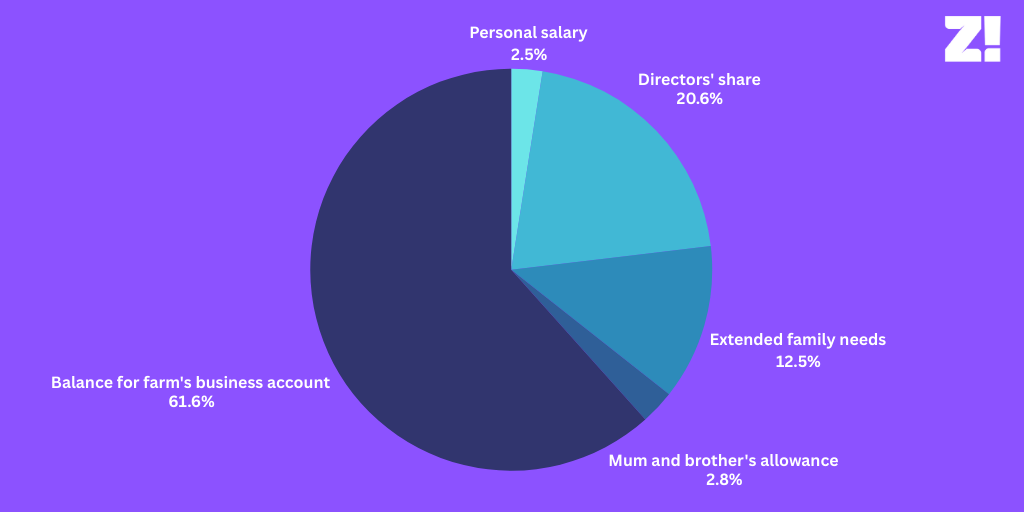

He initially said he’d pay me, but when I didn’t see any money, I started paying myself. I manage the money, so I pay myself a portion of our monthly profits.

The money isn’t set in stone, since we don’t make the same profit every month, but I get an average of ₦200k. I don’t get as much as that on most months — the economy has significantly dipped since the military took over Niger in 2023. Before this happened, it wasn’t unusual to make ₦200k profit in one day.

I notice you keep talking about money in naira even though you’re in Niger

I’ve been thinking in naira since 2023, which is a result of the economic changes here and Nigeria’s currency devaluation.

Before 2023, the naira had a higher value than the CFA. However, now 1000cf is approximately ₦2700, and the exchange rate is often subject to change. I don’t have a bank account here, so I still keep my money in my Nigerian account. It’s just easier to think about everything in naira.

The business should ideally make me think in CFA, but I convert business money to naira. I used to deposit CFA into the business account here in Niger, but I stopped a few years ago when my dad visited and withdrew all the funds. He said he needed it to fence his land, but my mum confirmed he didn’t do anything.

Since then, I’ve converted business funds and kept them in my account, so I have some control over them. But that doesn’t mean I don’t send money to my dad when he asks for it, which is often.

How often?

Very often. He’s a major reason my salary is irregular. My dad is constantly demanding money from the business. I mean, as often as twice a week, and I have no choice but to give him money whenever he calls.

At first, I tried to caution him about his spending, but he’d scream about how it was none of my business. It’s his business, and he can do whatever he wants. After a while, I grew tired of the money disputes and let him do as he pleased. At least whenever he complains about the business not doing well, there’s an account book to show the role he plays in that.

I don’t even know where or how he spends his money because he still doesn’t give my mum money. I know he has a knack for buying drinks for people and dashing them money, but he shouldn’t be burning through cash as quickly as he does. He still takes money from the business for things like school fees and house expenses, so I don’t know what he’s spending on.

I occasionally sneakily send money to my mum from the business. He has explicitly asked me not to send his money to my mum or siblings. But that one is his own. I can’t be suffering in this extremely hot weather and not be able to help my family.

What quality of life would you say your income affords you?

I save far more than I spend, and I have minimal expenses, so I’d say life is quite good. Sometimes I regret coming here to work for my dad, but I can now support myself, so it’s not all bad. At least I can buy what I want without waiting on anyone.

Recently, I purchased some land in Nigeria for ₦2m. The money came from my savings, and I still have approximately ₦6 million saved.

Do you have plans for your savings?

For now, it’s a safety net. Sometimes, when my dad starts ranting about how the business is his, he makes comments like, “I can throw you out anytime.” So, if he does throw me out, I’ll have something to fall back on.

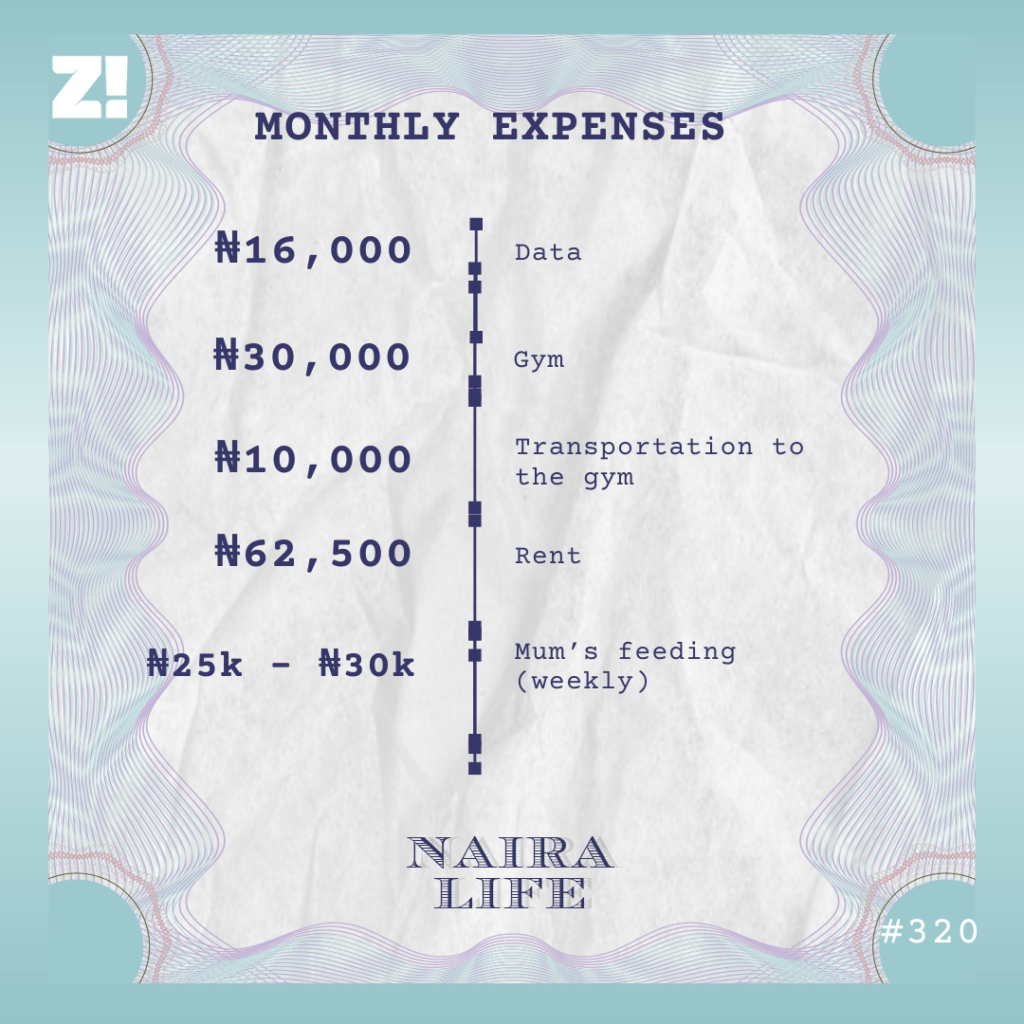

Let’s talk about your expenses. What do they look like in a typical month?

I live with three boys, so my feeding budget is nonexistent; we just constantly buy food. I do a lot of bulk food shopping when I visit Nigeria, but I don’t even have a range of how much I spend. The budget for my mum’s feeding comes from the business.

Out of curiosity, do you plan to manage your dad’s business in the long term?

I don’t have another plan at the moment. It’s like my brain has been clouded since I came to this place, and I feel stuck. I wasn’t like this before. I once considered pursuing a master’s degree and finding employment. But since I got here, the only thing I think about is the day-to-day of the business. I’m stuck in the routine of going from the house to the shop and back.

I often wish I hadn’t come here in the first place because managing my dad and the business is really overwhelming. He wouldn’t be constantly calling me for money if I weren’t working for him.

Maybe I’d have gotten a government job back in Nigeria, and my life would’ve been different. The salary might not be as high as what I make here, but I would have peace and feel like I’m making progress. On some days, I can’t even gather myself to go to the shop and just lie in bed all day. It’s exhausting.

I hope everything becomes clearer soon. How would you rate your financial happiness on a scale of 1-10?

9. I don’t have a money problem anymore, so at least I’m happy on that front.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

[ad]