When Ore Akinde, 25, picked up a crochet hook in university, she didn’t set out to build a fashion empire. It started as a creative outlet, a way to craft and experiment. But within a few years, what began as a side hustle has become a thriving fashion business with customers across Nigeria, the US, Canada, and Europe. Now, Ore is focused on building a sustainable ecosystem and redefining how Nigerians see handmade fashion.

Where It All Started

For Ore, crocheting started as a creative experiment. “I crocheted for fun,” she says. “But even from the start, I took it seriously.”

Her first piece was a humble collaboration with a photographer friend in 2017, styling a model in one of her handmade designs. “The photos never even made it out,” she laughs. “But that was the first time I imagined crochet as fashion, not just a primary school craft.”

Back then, crochet wasn’t the trend it is now. Nigerians still saw it as a home economics project, a pastime for school girls, not a wardrobe essential. “People didn’t wear crochet on their skin,” Ore explains. “They thought of it as bags or thick knitted sweaters. Knitting isn’t even the same thing. I had to introduce crochet as fashion.”

Ore’s edge was simple: she wore her brand everywhere. “I carried it on my head,” she says. “Everywhere I went, I wore crochet. Bags, tops, anything. People had to see it to understand it.” She became a walking billboard for a style no one believed in yet.

But crochet wasn’t her first venture. She tried selling Ankara. Then hairdressing. “Ankara was capital-intensive, and hairdressing was just too much labour for too little pay.” Crochet, however, clicked as she neared the end of her first year in university. Two years later, she landed her first major order — ₦100,000, a small fortune for a student. “That’s when I realised this wasn’t just a hobby. It could be something big.”

The Internship That Pushed Her to Bet on Herself

In her third year at the University, Ore interned at a chaotic radio station. The hours were brutal, salaries were delayed, and the experience was borderline exploitative. “I worked from 7 a.m. to 7 p.m., pouring myself into tasks that yielded no income. Even after I left, my boss reached out to ask for a loan.”

That internship became a turning point. “It was clear that this environment wasn’t for me. My crochet side hustle was already making enough to pay my boss’s salary. So why wasn’t I doubling down on what was already working?”

At this time, Ore’s business was averaging ₦400k per month. But when the lockdown hit, everything changed. With the world stuck at home and shopping online, her revenue jumped to ₦700k, and the business began to take off.

To reach more international customers, she set up an Etsy store. It worked at first, but by 2021, the platform became unsustainable for her business. “Etsy was a great starting point,” she says, “but the fees and restrictions were holding us back. We needed to build our own website — a digital home that truly reflected the brand and made payments easier for our customers.”

That year, Ore’s monthly revenue climbed to ₦1 million, hiring five staff members across logistics and production to keep up with growing demand.

When she graduated in 2022, she had a choice: chase a 9–5 she didn’t believe in, or bet fully on the business that had financed her life in university: paying her school fees, rent, and even salaries for a small team of interns. It was time to bet on herself.

“I was scared,” she admits. “I’d never worked a proper job before, and running a company is different from running a one-woman hustle.” But she packed her bags, moved to Abuja, and leapt. “I did it afraid. I remember almost crying at the airport. My parents wanted me to finish NYSC and settle down first. But I knew if I didn’t start now, I might never.”

New Beginnings, and a Multi-Million Naira Revenue

Relocating to Abuja allowed Ore to focus on the business full-time, free from the demands of being a student. With more time and headspace, she could scale operations, taking on larger orders and running the business from her apartment. That same 2022, she hit her first ₦2–₦3 million in months. “One customer placed a ₦1.6 million order,” she recalls. “That motivated me.”

At this point, the business still ran like a side hustle. Interns were unofficial, and operations were fluid. “I was learning on the job,” Ore says. “Hiring people who didn’t meet expectations, not communicating because I didn’t want to hurt their feelings. I’d prioritise their comfort over the business. That caused resentment.”

Another mistake she made was saying no out of fear. “I turned down so many opportunities because I didn’t feel ready. When the Oyo State government invited me to train women on crochet, I was young and thought, ‘What do I know?’ They reached out multiple times. I just ghosted them.”

It wasn’t until 2023 that Ore realised she needed to sit up and truly understand the business side of things. Until then, she had been winging it — no bookkeeping, structured operations, or clear financial systems. “I hadn’t properly understudied how real businesses worked,” she admits. “If I wanted to scale beyond a side hustle, I needed to do better.” That year, she began taking business operations and management courses, determined to transform her passion project into a structured, scalable brand.

Ore officially registered her company in Nigeria in 2023 and completed its US registration the following year.

2024: The Year She Rebuilt Her Business

By 2024, Ore had learned the hard lessons. She restructured the business from the ground up, drafting proper contracts for her staff, hiring an executive assistant, and expanding her team to 10 people, including a creative director, social media manager, lawyer, and a full production unit.

She also doubled down on marketing and operations, determined to move from a one-woman hustle to a well-rounded fashion company.

That year, she launched her first official collection: the First of Fall. “It was my attempt to move from being just a designer to a full-fledged fashion brand with seasonal collections,” she says. The launch was a success. Six outfits, gender-inclusive designs, bags, bikinis, and caps. “It was the first time I worked with an official photographer, models of different body types, and it paid off.”

But 2024 wasn’t all wins. Ore made a ₦5 million gamble on a girls’ collection that didn’t launch as planned. “We overshot. We spent so much on production, but the release was delayed for months. Sales didn’t come in as expected. It set us back.”

That period became her toughest, the “brokest” the business had ever been. Yet, it forced her to reevaluate. “I had to learn it’s okay to fail, to make mistakes, and to communicate better with my customers. That collection didn’t go as planned, but it became one of my most important learning experiences.”

Peak Moments and Ongoing Battles

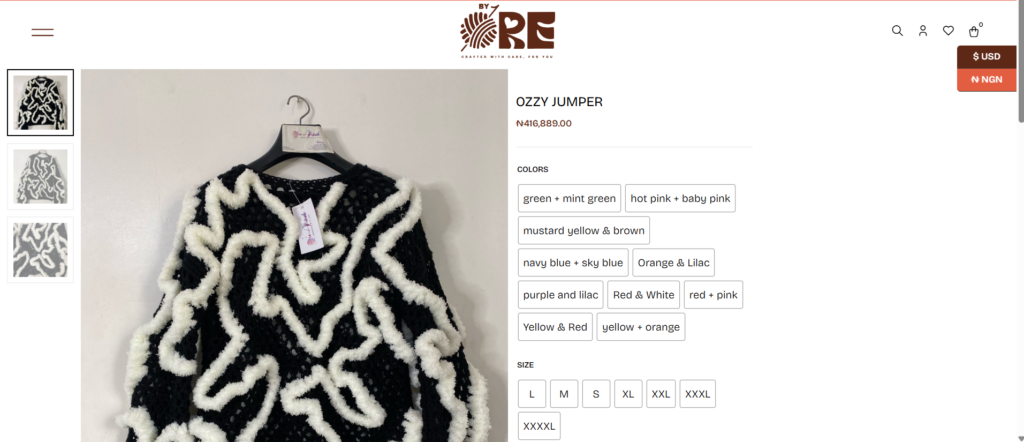

By the end of 2024, Ore’s brand peaked with the Ozzy Jumper, a collaborative piece with fashion icon Ozzy Etomi. “It became our bestseller,” she says. “Over 200–300 orders. One was sold for ₦416K.” That piece was a breakthrough into new customer segments. “Ozzy is a trend setter.”

But beyond aesthetics, Ore’s real business pivot came with infrastructure. Registering in the US, integrating Stripe for payments, and setting up systems that allowed global customers to buy seamlessly. “Before, it was a struggle with PayPal, CashApp, Venmo. Now, we’re accessible in 190 countries.”

About 50% of her customers are in the US and Canada, 25% in Nigeria, and the rest are scattered across Europe and the UK. But growth hasn’t been linear. “In 2024, there were months we did ₦5 million, others ₦10 million. And sometimes orders dip, and we have to push harder.”

In hindsight, Ore wishes she had spent more time understanding business operations before diving in. “I was crocheting and learning as I went. It would’ve been helpful to understudy a real system.” Still, she’s making up for lost ground. Plans for a business MBA in Fashion Communication are in motion.

Expanding Beyond Fashion: Ruggings and New Frontiers

Beyond fashion, Ore is diversifying. She recently launched a second franchise, Ruggings, which she aims to firmly establish within Nigeria’s interior design space. Their first collection, a line of plushies, was released in July 2025, marking Ruggings’ official debut.

What’s Next for Ore Akinde?

Ore plans to release a new collection this summer, a key driver for 2025’s revenue. But beyond custom orders and viral jumpers, she’s focused on building a sustainable crochet fashion brand.

“In the next four to five years, I want my business to produce 100 to 200 orders a month,” she says. “We’ll have our own atelier, not just a small store, but a space that feels like a home for creativity. A place where outfits are made, yarns are designed, and rugs are crafted. It’ll be big enough to hold all my people working at once, and it’ll be busy because the business itself is thriving.”

Ore’s vision isn’t just about fashion; it’s about owning the supply chain. She plans to import her own yarn and eventually create custom yarn lines for other creatives. “I don’t want to just be a retailer. I want to be a producer.”

In the immediate future, she’s gearing up for pop-up events in Lagos and Ghana, her first venture into physical retail after years of made-to-order sales. “We’re taking it one step at a time. Walking too fast while carrying something heavy? You’ll fall. I don’t want that.”

But she’s also painfully aware of the cultural disconnect around handmade products in Nigeria. “People here don’t understand the effort. They think handmade should be cheap. So you have to find your people, the customers who get it. Branding and constant visibility are key. Always put your work out there.”

What keeps her grounded through entrepreneurship’s unpredictable highs and lows is simple: choice. “Every time it gets difficult, I remind myself I chose this. Business is wild. When it’s high, it’s very high. When it’s low, it’s low. But I’ve learned not to let the lows crush me or let the highs carry me away. It’s all about balance.”

Creativity, she’s learned, can’t be forced. “When my brain feels foggy, I don’t push. I let it rest. Ideas come back when they’re ready. Sometimes I even get them in my dreams, I wake up and jot them down before they run away.”

The atelier isn’t here yet. The studio and the in-house yarn production are still in the works. But for Ore, that’s the beauty of it. “I don’t just want a store. I want an ecosystem. A space where everything we create comes to life in its full expression. I’m carrying it carefully, one steady step at a time. There’s no point rushing to build something that can’t stand tall.

We’re focused on growing without compromising our production quality, prioritising quality over quantity, and staying true to handmade craftsmanship,” she says.

For Ore, what started as a personal hobby is now evolving into a hub where creativity, commerce, and craftsmanship co-exist.

Next Read: Nigerians Say My ₦250k Crochet Slippers Are Too Expensive. But I’m Building a Luxury Brand Like Dior

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

[ad]