Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s the first thing you did for money?

When I was eight years old, my mum brought home some pages of Minnie Mouse stickers from a trip she’d gone on. I went to school with some of these stickers, and my classmates liked them. I’m not sure where it came from, but I told them they could have a sticker for ₦20. Surprisingly, they agreed and kept coming back for more. I sold all five pages of stickers in two weeks.

But I had to hide the money because I couldn’t let my mum see it.

Why not?

My parents didn’t think kids should keep any money. My mum didn’t even like strangers giving us money gifts if she wasn’t present. I don’t know why they felt this way, and I’ve never asked.

I suspect I took the chance to sell the stickers because I wanted to know what it felt like to have my own money. I stashed everything I made — I don’t remember how much — inside a flower vase in my parent’s room, and that’s how I got caught.

My mum treated me like I’d committed a crime, and I was heavily reprimanded. Because of that, I didn’t think about money again until I was in university.

When was uni?

2013. I got into the law programme at a private university in the southwest. During my first year, I lived on my monthly allowance of ₦10k. When I was in my second year, however, I took an opportunity to make extra money.

My school had a work and study programme, and I applied to work at the Horticulture and Gardening department and got in. For ₦15k/month, I was now a gardener, which wasn’t bad for a 17-year-old second-year student. But I quit the job the next school year.

Haha. Why?

My work started at 5:30 a.m. I didn’t mind the early hours until I watched an episode of Criminal Minds and got paranoid about working alone so early. In my mind, I was putting myself at risk of being murdered. Thinking about it now, it was such a silly and irrational fear.

Omo. That’s not morbid at all

Haha. I moved on to the next thing I found. My mum’s day job was in a bank, and she also had a clothing business on the side. I offered to work in her shop for ₦10k/month, and she agreed to it. But she paid me the bulk amount of ₦30k when I was returning to school. This was the point I started thinking about saving money, but there was a little problem.

What?

My mum opened an account for me in the bank she worked. Because of this, she had access to how money was moving in and out of my account. If I had enough money in my account at the end of the month, she’d just tell me to use it as my allowance for the next month. If the money in my account wasn’t up to ₦10k, she’d send me the difference.

Fascinating. Do you know why she did this?

The only explanation I got was, “But you have money in your account na.”

I needed to figure out how to work around that, so the moment I turned 18 in 2015, I opened another bank account. Subsequently, I started moving small sums of money into the new account — ₦2k here and there. By my fourth year in university, I had about ₦40k saved up. But I spent everything in one night on Black Friday deals.

This was pretty much how I managed money until I graduated from uni; I’d save for a bit, then splurge on something — usually fashion and makeup products — in one go.

When did you leave uni?

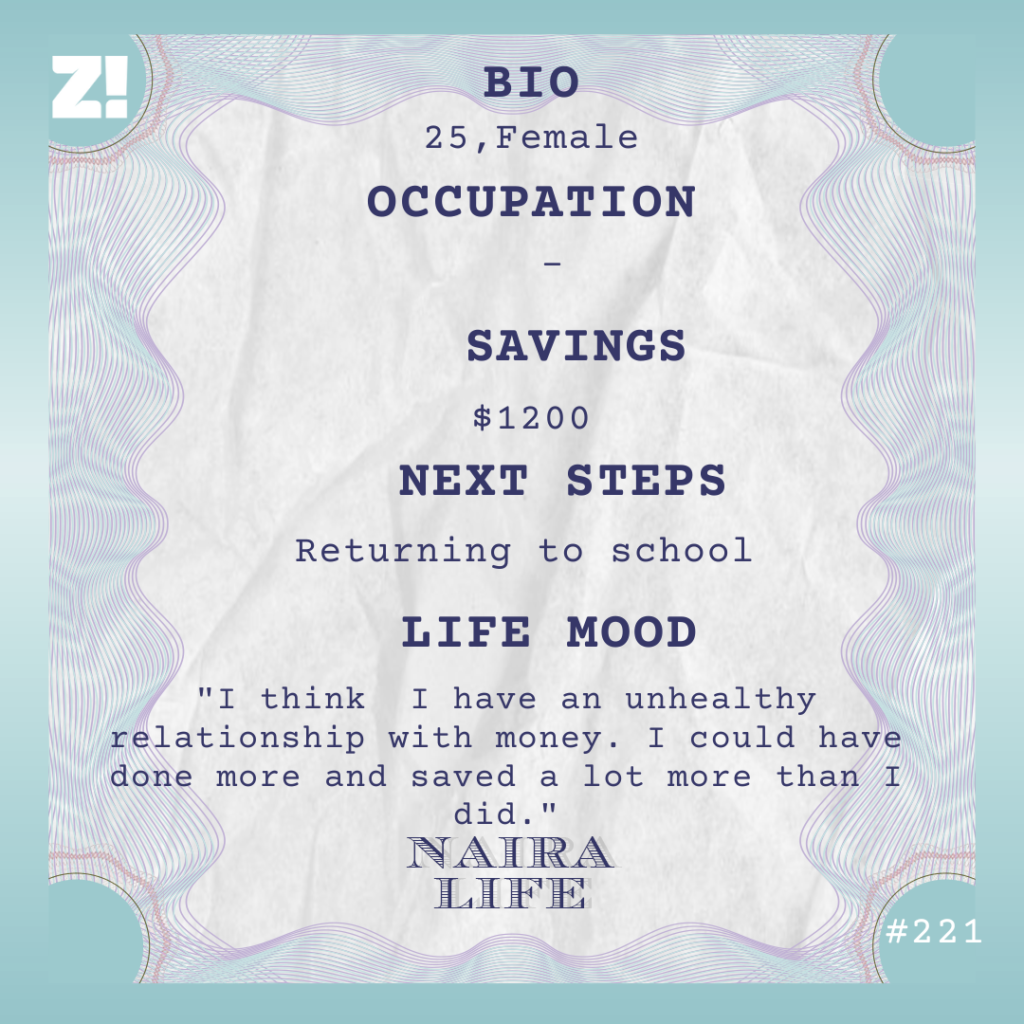

2018. By the way, I fell out of love with getting a law degree in my second year and made peace with the fact that I wouldn’t practice. When I told my parents, we agreed that I’d get my degree first, then travel abroad for school for what I was now interested in — Human Resources.

So tell me why I got the degree and my parents insisted that I had to go to law school and do NYSC first before we could revisit the conversation. With no other options, I begrudgingly went to law school. The whole year was a blur because I didn’t want to be there. The only thing I remember was that I was on a ₦10k weekly allowance, but I didn’t care about saving anything. I left law school flat-out broke in 2019.

NYSC?

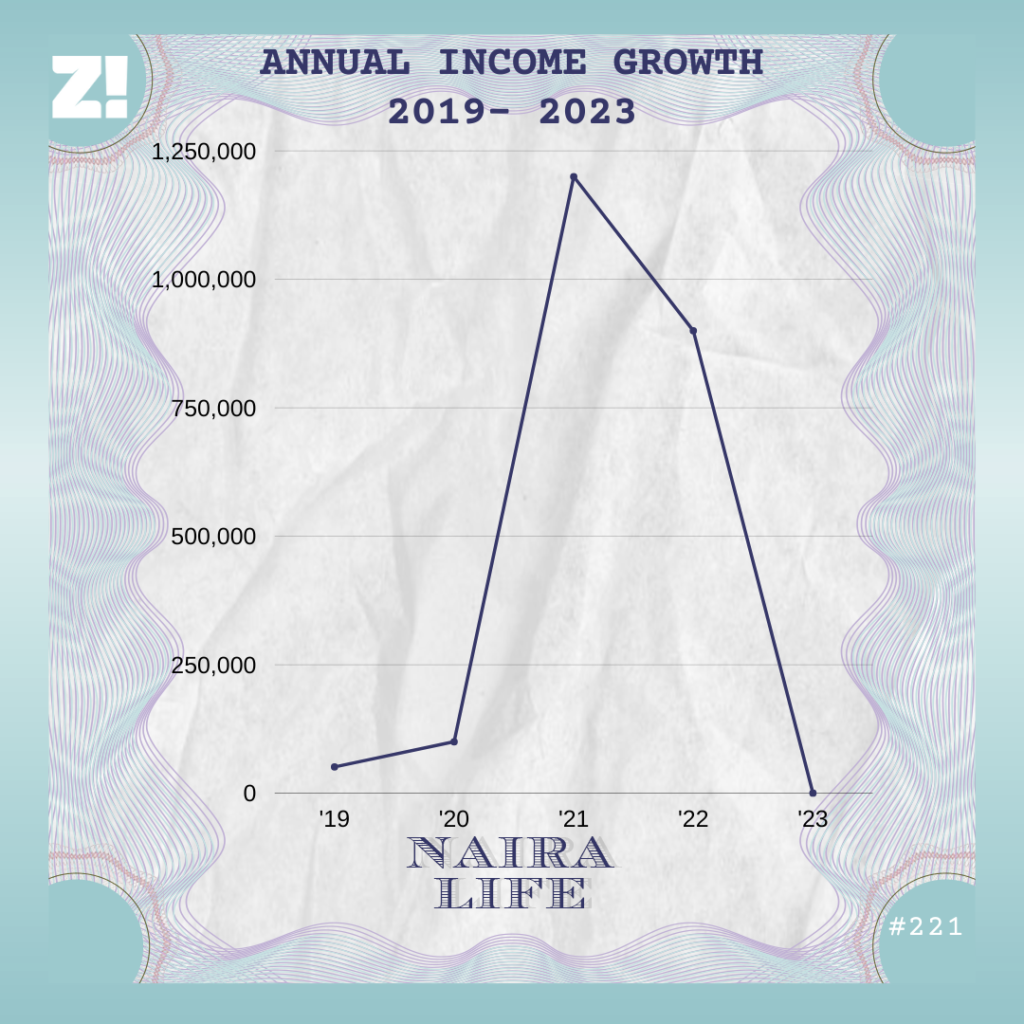

By the time I went for my NYSC in 2019, I’d gotten over the disappointment of not leaving the country, so I was a bit more present. The federal government allowance was ₦33k, and I also worked in an insurance company that paid me ₦18k/month. I was saving at least ₦5k/month and had ₦55k in my savings when I finished NYSC in 2020.

Luckily, I didn’t have to look for another job for long. Two months after NYSC, I got an internship at a merchant bank.

How did this happen?

One of my mum’s networks reached out to me when the bank was hiring. I sent my CV, wrote the exam and did the interview. Within two months, they came back to me with an offer. This was January 2021.

How much?

The actual salary was ₦70k, but there was an extra ₦30k stipend for lunch. I started the job in February.

Lit. What did this mean for you?

It meant I could save ₦70k/month and live on ₦30k. My average spend every day was less than ₦1k, thanks to my privilege. My dad drove me to work daily and an ex drove me back home. Sometimes, I even packed lunch for work.

Since I was consistently saving, I thought it was time to save up and leave my parent’s house. The cheapest option I found was a 200k/year self-contained apartment. So I decided to double the amount before I made any move.

I hit my savings target of ₦400k in August 2021, but I had a falling out with my boss in the same month — he yelled at me over something that wasn’t my fault — I decided to leave the place.

Oof

Everyone thought I was mad because I didn’t have a job lined up. But I’d thought it out and figured that the worst-case scenario was ditching my plans to get my own place. I went ahead and sent in my resignation. My boss offered to add ₦30k to my salary, but I rejected the raise. I was done.

Fortunately, I ran into a bit of luck during my notice period.

At a party, I saw an acquaintance who worked in the customer service department of an American B2B software company, and we talked for a bit. Naturally, our conversations touched on our jobs and I told them I’d just quit mine. It turned out that their company was hiring for a media analyst position, and they encouraged me to apply and told me how I could get in.

How?

Like most remote roles, the key was to optimise my Linkedin profile. In addition, I was advised to study the GMAT

I applied for the role, and I was invited to take a test. Two more tests followed before I got an interview. In November 2021, I got an offer letter and the pay was $20k/year.

That’s a huge jump from ₦100k. But what was your role exactly?

I know right! I was analysing media information for the industries and companies the business served and wrote reports based on my findings.

A lot happened after I took the job.

I’m listening

The first thing was lifestyle inflation. One minute, I was living conveniently on ₦30k/month, then I started earning more and the number rose to ₦200k – ₦250k/month.

Hold up. Break it down, please

The thing is, my parents heard how much I was making and decided that I’d be paying for the house’s internet, power and diesel. Internet was ₦20k/month and power unit was an average of ₦50k/month. Also, we used ₦25k worth of diesel every five days, so that was about ₦100k/month. To be honest, I was happy to do this. Besides, I needed these things for work.

At some point, though, I sat down and figured that I might be spending less money if I got my own apartment. In March 2022, I paid ₦1.1m for a one-bedroom apartment and moved in.

What happened after?

I was laid off from my job in October.

Whoa. That came out of nowhere

That’s exactly how I felt. I’d just returned from a one-month trip to Rwanda that cost me $1500 when I got the email. The company was shutting down my unit, and that was it. Thankfully, I had $4300 in my savings, so I knew I’d be good for three months while I figured out my next step.

On a whim, I decided that it was time to return to school, and I applied to a school in Canada. The application cost C$250.

While this was going on, I was also looking for other analyst roles, but none of them was remote. I didn’t find any lead until January 2023 when an analyst role opened in another unit in the company that laid me off. I applied with bated breaths, and I was hired again. However, the salary this time was $15k/year.

How did you feel about the pay cut?

A win is a win. Also, my savings were down to $2500 and my rent was almost due. Between January and March, I saved up $1400 and got my savings up to $3900.B ut I suddenly had a decision to make.

What do you mean?

Two days before I planned to renew my rent, the Canadian university I applied to offered me a spot in their Graduate Certificate Degree in Human Resources program. The first step was to pay the C$5k acceptance fee, which was about $3700.

I ran back to my parents, and they agreed to pay the tuition if I sorted out my acceptance fee, so I closed my eyes and paid it. Now, I had $200 to my name, which meant I couldn’t make rent. I took the only option I had — I moved back in with my parents in March. All my energy since that time had been going into how to leave for school later this year.

How much do you imagine it will cost?

It’s a 2-year programme and tuition is about C$14k – C$24k, depending on how many credits I take. My parents are paying for that and will also pay for my flight — I don’t know how much that will be yet.

I’m paying for my accommodation, and I need C$2k for my first and last month’s rent. Then there’s my visa application fee, the visa itself, medicals and background check. The $1200 I have in my savings is going to all of this.

But I’m glad that I decided to go back to school.

Why?

I got laid off from my job again this month. It was also the same script: they shut down the unit I was working in and let everyone go. As it stands, I’ve lost two jobs in less than a year and neither one was because I was bad at my job. I’m not going to lie, it sucks a little.

Man, sorry

Well, thank God for my emergency plans – my parents.

Tell me, what’s your current mindset about money?

First, I understand that money is fickle. But I also think that I have an unhealthy relationship with money. I could have done more and saved a lot more than I did. I’ve moved on fairly quickly from the layoffs and planning my next steps, and I have my privilege to thank for that. If I didn’t have my parents, this wouldn’t have been possible. If I start making decent money again, the first thing I’m taking is a financial management course.

Do you know how much you’ll like to make in your next role?

I’m hoping for nothing less than $120k/year. Last year, I was interviewing with a company for a research role and they would have paid me $60k/year if it’d worked out. I’m using this experience as my reference now. If I can make $60k/year in Nigeria, there’s a chance to make at least double that outside. I’m counting on that.

On a scale of 1-10, where would you place your financial happiness?

2. I like to think about money in the context of what I can do with it, and I can’t do much conveniently right now. I’m thinking about how to pay for my visa and sort out my accommodation and the other expenses that’d come up when I travel for school. I know I have my parents, but I’d like to carry the financial weight as much as possible by myself.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Yes, I want to do a Naira Life

Find all the past Naira Life stories here.