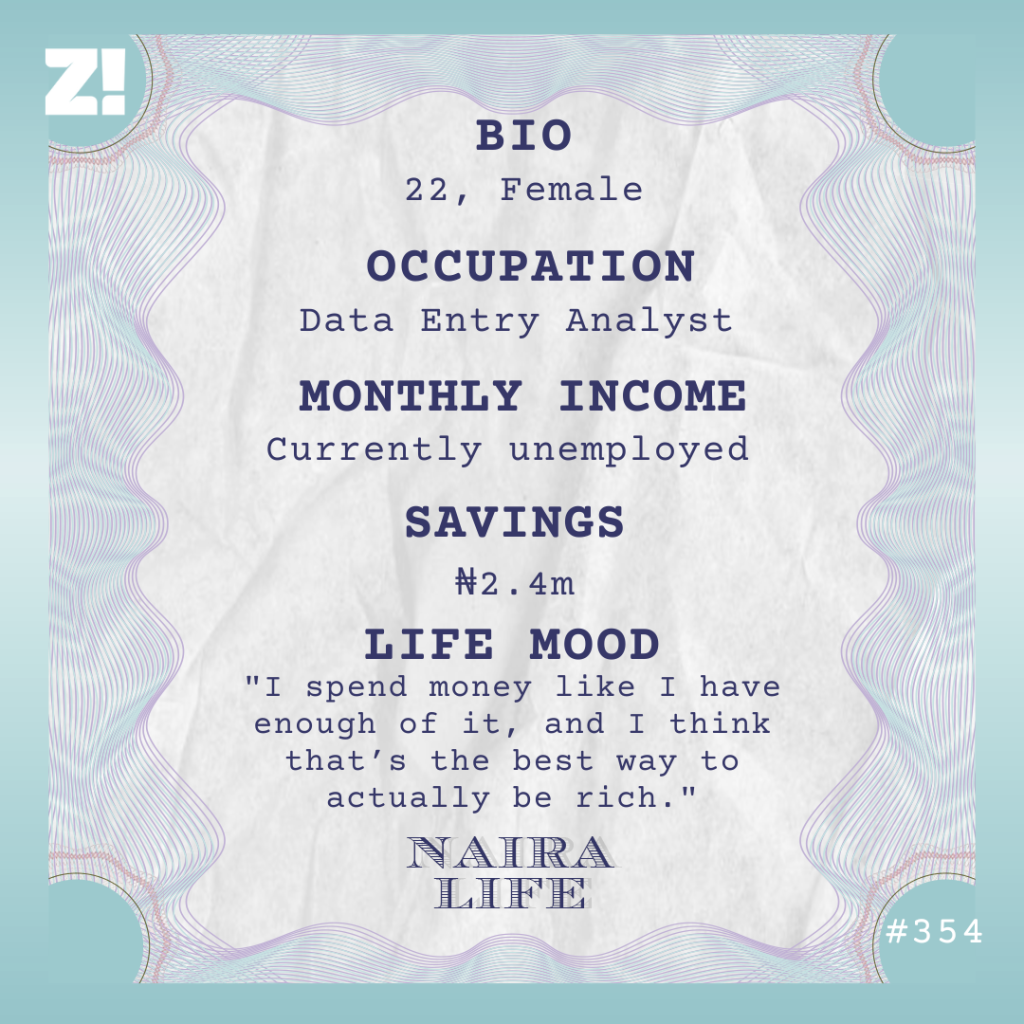

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

In 2019, my brother and I moved to the UK for university. Six months later, my dad stopped our allowance. He paid rent and tuition, but left us to handle whatever else we needed. I was 16 and suddenly couldn’t depend on my dad for money anymore. It was the first time I had truly felt broke.

Thankfully, my other brother (who was our guardian in the UK) was over 18, so he worked and used his income to support us. I lived on his goodwill until I turned 18 and got my own job.

Why did your dad stop giving you money? Were there financial problems?

Not at all. On the contrary, my parents are very comfortable lawyers. You could even call them wealthy. They had a mansion, and all my siblings went to the UK at some point.

My dad stopped giving me money because he and my mum had some issues, and he felt we kids were on her side. He didn’t admit that cutting us off was supposed to be punishment, but it was pretty clear. Before he cut us off, our allowance was about £500/month.

So, I had to make a few changes when pocket money stopped coming. I couldn’t afford to buy clothes, so I had to learn to do my own hair. I was managing a lot, at least until I got my first job in 2021.

What was the job?

I worked as a warehouse operative for a grocery delivery company. My pay was £11/hour, and I worked 20 hours/week when school was in session. Other times, I racked up as many extra hours as possible.

Six months later, I left to work as a hospitality staff with an agency. Here’s how it worked: the agency could ship me to work with a restaurant today, a hotel tomorrow and another random event the following day. My pay depended on where I worked, but it ranged between £10 and £14/hour.

I worked there up until I graduated in 2022 and for a few weeks in 2023 before I started my braiding business.

What informed the decision to become a braider?

I’ve known how to braid hair since I was in secondary school, and my mum and brother kept encouraging me to pursue it as a business in the UK. I was reluctant at first because I wasn’t sure I’d do well as a business owner. It was interesting because, even before I launched a full business, I received a few customers here and there through word-of-mouth referrals.

I eventually took my family’s advice and became a full-time braider. I created an Instagram account, and the business took off. I started getting fully booked less than a month into launch. I’d even get bookings a whole month ahead. I braided my clients’ hair in my room. I even designed a small section for them with a mirror and snack packs.

What was your income like?

I tried to keep my pricing as affordable as possible. I charged between £40 – £50 for big braids and £60 – £65 for smaller ones. I took on clients seven days a week and made a little over £1k in the first month. I consistently made around that figure and more in the subsequent months.

I didn’t pay rent or have any major responsibilities, so this was good money. I even saved up to pay £2k in less than two months for a visa. My student visa had expired in 2022, and my father refused to pay for my graduate visa. So, I just paid it myself.

So, you were a full-time braider. How long did this last?

I ran the business for about a year until I returned to Nigeria in September 2024. I came back because my visa was about to expire, and I wasn’t really keen on staying in the UK. It’s a very gloomy place, especially when you don’t have community and support.

Plus, my dad was always giving us hell. He could support rent payments for one month and do nothing for the next two months. So, I was overworking myself, trying to make as much money as possible. The whole thing took a toll on me, and my mental health deteriorated. I had a mental health crisis once and was under medical supervision. Returning to Nigeria was a welcome move.

Sorry you went through that. Did you have a plan for the return move?

I didn’t have a plan. I’d been stressed out working so much; I just wanted to come home, rest and then think of what to do. I returned to Nigeria with over £3k, approximately ₦6 million, in savings. I moved back in with my parents, which meant I only had to worry about my personal expenses; my savings came in handy for that.

I started applying for jobs in February 2025 and got two job offers within a few weeks of each other. One was an unpaid writing internship with a news network, and the second was a student recruitment officer role at an educational consultancy agency that paid ₦70k/month.

How did you juggle both jobs?

The writing job was remote and didn’t require me to be hands-on 24/7. The recruitment role was supposed to be hybrid, but I found myself needing to come into the office every day.

My commute cost me ₦7k daily. I took cabs because I didn’t know how to navigate the public transport system, but it wasn’t sustainable. When I finally started using public transport, it scared me so much that I began having panic attacks. I quit the job after two months.

The writing internship was a three-month contract, so by June, I was right back to unemployment.

What did you do next?

For a while, nothing. My mental health was declining again, so I was at the “I don’t care about anything anymore” phase.

I returned to living on my savings, and the money was a good distraction from everything that was going on. My parents were going through a messy divorce (they still are), and having money allowed me to leave the house, hang out with friends and do whatever I wanted.

By July, I’d spent a huge chunk of my savings and had about ₦2.4m left. To avoid spending more, I locked the balance in a savings account for one year, hoping I’d get another job soon. That hasn’t really happened since.

Have you been unemployed since then?

I had a two-month stint working with a UK firm on market research. They’d just ask me a bunch of questions, ranging from being an international student to questions about the apps I used. They paid me between £30 and £60 whenever I helped them with research.

After that opportunity had elapsed, I turned to data entry around October. I’d started learning about it early in 2025, but hadn’t taken it seriously. However, with my financial decline and a bad breakup, I began to seriously consider what I wanted to do.

Data entry aligns with my skills and experience at the educational consultancy agency, so I’m currently focusing on upskilling and searching for remote jobs or freelance work in this area. I don’t want to work for a Nigerian company, though. It has to be a foreign company.

Any reason why it has to be a foreign employer?

I mentioned a bad breakup earlier. It happened a few months ago and opened my eyes to see that I’d really lost myself in the relationship. I wasn’t focusing on myself, and I need to fix that.

I really want to make something out of myself, and a big part of that involves working at a job that makes me feel fulfilled. I don’t think any job in Nigeria can give me that sense of accomplishment.

That’s fair. How’s the job search going?

There are bad days and good days. I get a lot of scam emails as well. But somehow, my spirit isn’t broken. I know it’s easy for me to fall back into a depressive state, but just imagining the kind of life a foreign, remote job would give me keeps me going.

My journey so far has been interesting. I have no money, and my primary safety net is locked away until July 2026, but I don’t feel scared or anxious. Most of the time, I’m almost nonchalant about it. I mean, worry creeps up on me sometimes, but I’m really lucky that I have my brothers. From time to time, they give me money for data, and I have food to eat.

What’s it like having to depend on them?

It feels very weird. I haven’t been this broke in a while, and sometimes it’s a surprise, reminding me that I can’t do certain things for myself. It’s almost dehumanising, but I feel very hopeful that I’ll get a job soon, and this won’t last long.

That’s the only thing distracting me from the fact that I don’t have a source of income. I suppose you could say I’m optimistic or even delusional. I don’t look at my current circumstances and see it as my life. I don’t believe that this is my life.

Somewhere in my head, I’m living a life where I have my own apartment, and I’m working a job that gives me financial freedom. That’s the reality that I’m currently living in, so my circumstances don’t upset me as much.

Rooting for you. Is there an ideal amount of money you think a foreign job would pay you?

Anywhere from $2k/month. I know that’s possible because many Nigerians are working for foreign companies and earn around that price range. It even sounds small, but at least $2k would be ideal.

How would you describe your relationship with money?

I’m not scared of money. I spend it freely and don’t let the fear of money hold me back. Since I left the UK, I stopped depriving myself of things, and it’s really improved my relationship with money. I spend money like I have enough of it, and I think that’s the best way to actually be rich. When you aren’t scared of money and act like it won’t be an issue for you, money will never be an issue.

Interesting. I know you don’t have a specific income right now, but could you walk me through your non-negotiable monthly expenses?

I no longer have a budget. I just work with any money I see these days, but the constant is data. I spend about ₦20k – ₦25k on data monthly, and that’s because it’s the only thing that’ll help me apply for jobs.

Other non-negotiables used to be my nails, hair, lashes and waxing, but I haven’t done that for about three months. I can’t afford them.

I’m curious. Have you considered making money with your braiding skills?

I don’t think I would ever braid hair in Nigeria. The earning disparity from braiding in the UK and Nigeria is very different. No one is going to pay me £90 to braid hair here, and most Nigerians aren’t willing to pay up to ₦40k or ₦50k. I would never stress myself and stand for 6-8 hours to earn ₦30k. I’d just go back into depression.

Is there anything you want right now but can’t afford?

I’d like to move out and get my own apartment. This is one of the most difficult parts of my current financial situation. I feel like I’m in jail in this house; I can’t go anywhere because I don’t have money. I don’t like being indoors all the time, but I can’t even afford an escape.

Phew. I can imagine. How would you rate your financial happiness on a scale of 1-10?

0.5. I feel like I’ve lost my freedom. In hindsight, I should’ve probably used my savings to get my own place, but it’s okay. I’m manifesting a new job and a better financial situation before March.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.